Académique Documents

Professionnel Documents

Culture Documents

B1 Income From Salary / Pension (Ensure To Fill SCH TDS1) 1

Transféré par

Varun GuptaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

B1 Income From Salary / Pension (Ensure To Fill SCH TDS1) 1

Transféré par

Varun GuptaDroits d'auteur :

Formats disponibles

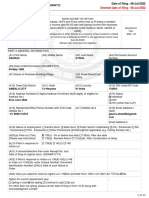

A1. First Name A2. Middle Name A3. Last Name A4.

PAN

VARUN AJAY GUPTA BNVPG8460K

A5. Sex A6. Date of Birth (YYYY/MM/DD) A7. Income Tax Ward/Circle

Male 1993-05-13 WARD 2(2)(5) GHAZIABAD

INFORMATION

A8. Flat / Door / Building A9. Name of Premises / Building / Village A10. Road / Street

PERSONAL

II-A 23 NEHRUNAGAR

A11. Area / Locality A12. Town / City / District A13. State

NEAR HOLY CHILD CHOWK GHAZIABAD UTTAR PRADESH

A14. Country A15. Pincode Status

91- INDIA 201001 Individual

A16. Email Address A17. Residential/Office Mobile No. 1 A18. Mobile No. 2

Phone No. with STD

Code

varunajaygupta45@gmail.com ( 120 ) - 4129038 9654008793

A19 Employer Category OTH

A20 Tax Status Nil Tax Balance

A21 Residential Status RES- Resident

A22 Return filed under section 11- On or Before Due Dat

e 139(1)

A23 Whether Person governed by Portuguese Civil Code under section 5A No

A24 If A23 is applicable, PAN of the Spouse

FILING STATUS

Whether original or revised return? Original

A25 If under section: 139(5) - revised return:

Original Acknowledgement Number

Date of filing of Original Return(DD/MM/YYYY)

If under section: 139(9) - return in response to defective return notice:

Original Acknowledgment Number

Date of filing of Original Return (DD/MM/YYYY)

Notice Number.

A26 If filed in response to notice u/s 139(9)/142(1)/148/153A/153C,enter the date of such notice

A27 Whether you have Aadhaar Number ? No

A28 If A27 is Yes, please provide

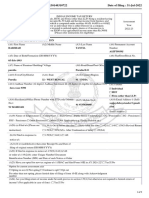

B1 Income from Salary / Pension(Ensure to fill Sch TDS1) 1 482796

B2 Type of House Property

Income from one House Property 0

B3 Income from Other Sources (Ensure to fill Sch TDS2) 3982

B4 Gross Total Income (B1+B2+B3) 4 486778

C Deductions under chapter VI A (Section)

C1 80C 150000 150000C11 80G 0 0

C2 80CCC 0 0C12 80GG 0 0

INCOME & DEDUCTIONS

C3 80 CCD (1) 0 0C13 80GGA 0 0

(Employees /

Self Employed

Contribution)

C4 80CCD(1B) 0 0C14 80GGC 0 0

C5 80CCD (2) 0 0C15 80RRB 0 0

(Employers

Contribution)

C6 80CCG 0 0C16 80QQB 0 0

C7 80D 0 0C17 80TTA 3982 3982

C8 80DD 0 0C18 80U 0 0

C9 80DDB 0 0

C1080E 0 0

C19 Total Deductions (Total of C1 to C18) C19 153982

C20 Taxable Total Income (B4 - C19) C20 332800

D1 Tax Payable on Total Income (C20) D1 8280

D2 Rebate u/s 87A D2 2000

D3 Tax Payable after Rebate (D1-D2) D3 6280

D4 Surcharge, if C20 exceeds 1 crore D4 0

COMPUTATION

D5 Cess on (D3+D4) D5 189

D6 Total Tax, Surcharge & Cess (D3+D4+D5) D6 6469

TAX

D7 Relief u/s 89 D7 0

D8 Balance Tax After Relief (D6 - D7) D8 6469

D9 Total Interest u/s 234A D9 0

D10 Total Interest u/s 234B D10 0

D11 Total Interest u/s 234C D11 0

Total Interest Payable (D9 + D10 + D11) 0

D12 Total Tax and Interest (D8 + D9 + D10 + D11) D12 6469

Taxes Paid

D13 Total Advance Tax Paid D13 0

TAXES PAID

D14 Total Self Assessment Tax Paid D14 0

D15 Total TDS Claimed D15 6468

D16 Total TCS Collected D16 0

D17 Total Taxes Paid(D13 + D14 + D15 + D16) D17 6468

D18 Tax Payable(D12 - D17, if D12 > D17) D18 0

D19 Refund(D17 - D12, if D17 > D12) D19 0

D20 Exempt income only for reporting purposes D20 2175

D21 Details of all Bank Accounts (excluding dormant accounts) held in India at any time during the previous year (Mandatory

irrespective of refund due or not)

Total number of savings and current bank accounts held by you at any time during the previous year (excluding 2

dormant accounts)

a) Bank Account in which refund, if any, shall be credited

S.No.IFS Code of the bank Name of the Bank Account Number Bank Account Type

1 YESB0000014 YES BANK 001491900020211 Savings

b) Other Bank account details

S.No.IFS Code of the bank Name of the Bank Account Number Bank Account Type

2 UTIB0001082 AXIS BANK 914010017006632 Savings

SCH TDS1-Details of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)]

SI.NO Tax Deduction Name of the Employer Income Tax Deducted

Account Number Under Salary

(TAN) of the

Employer

1 PTLN12115F NOVOINVENT SOFTWARE PRIVATE LIMITED 17000 2156

2 PTLN12115F NOVOINVENT SOFTWARE PRIVATE LIMITED 292999 4312

Total 6468

Schedule Asset and Liability at the end of the year (Applicable in a case where total income exceeds Rs. 50 lakh)

AL

A Particulars of Asset Amount (Cost)

(Rs.)

1 Immovable Asset

a Land

b Building

2 Movable Asset

a Cash in hand

b Jewellery, bullion etc.

c Vehicles, yachts, boats and aircrafts

3 Total

B Liability in relation to Assets at A

VERIFICATION

xyz

I, VARUN AJAY GUPTA, son/daughter of, AJAY KUMAR GUPTA, solemnly declare that to the best of my knowledge and belief,

the information given in the return is correct and complete and that the amount of total income and other particulars shown therein are

truly stated and are in accordance with the provisions of the Income- tax Act 1961, in respect of income chargeable to Income-tax for the

previous year relevant to the Assessment Year 2016-17.

Place GHAZIABAD Date 2016-07-21 PAN BNVPG8460K

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

TRP PIN [10 Digit] Name of the TRP TRP Signature

Amount to be paid to TRP

Vous aimerez peut-être aussi

- NY CA 01-01-1953 9984 TXPRDocument98 pagesNY CA 01-01-1953 9984 TXPRAdmin OfficePas encore d'évaluation

- Sample PDFDocument2 pagesSample PDFkorean languagePas encore d'évaluation

- Taxation On PartnershipDocument28 pagesTaxation On PartnershipEvie Marionette100% (1)

- GST Act, 2017-SorDocument6 pagesGST Act, 2017-SorMohit NagarPas encore d'évaluation

- Presentation On GST: (Goods and Services Tax)Document11 pagesPresentation On GST: (Goods and Services Tax)tpplantPas encore d'évaluation

- 2019 10 20 11 13 28 743 - Cixpm4133k - 2016Document3 pages2019 10 20 11 13 28 743 - Cixpm4133k - 2016tarun mathurPas encore d'évaluation

- Form PDF Year 2015-16Document3 pagesForm PDF Year 2015-16HARISH CHANDRA MISHRAPas encore d'évaluation

- B1 Income From Salary / Pension (Ensure To Fill SCH TDS1) 1Document3 pagesB1 Income From Salary / Pension (Ensure To Fill SCH TDS1) 1santoshkumarPas encore d'évaluation

- Form PDF 758837930310815Document2 pagesForm PDF 758837930310815deepkaryan1988Pas encore d'évaluation

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnDc InnovatorsPas encore d'évaluation

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturngrafikeysPas encore d'évaluation

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnAman AnandPas encore d'évaluation

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnramnik20098676Pas encore d'évaluation

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnImpactianRajenderPas encore d'évaluation

- DocumentDocument5 pagesDocumentAkshay KumarPas encore d'évaluation

- Itr-1 Sahaj: Individual Income Tax ReturnDocument7 pagesItr-1 Sahaj: Individual Income Tax ReturnRinku SoraishamPas encore d'évaluation

- PDF From XMLDocument5 pagesPDF From XMLNirbhay KumarPas encore d'évaluation

- Form PDF 278241510300722Document68 pagesForm PDF 278241510300722jawedPas encore d'évaluation

- Form PDF 957530660230722Document68 pagesForm PDF 957530660230722kmuditkPas encore d'évaluation

- Form PDF 501225711170922Document71 pagesForm PDF 501225711170922Kundan SharmaPas encore d'évaluation

- ITR 4 Sugam Form For Assessment Year 2018 19Document9 pagesITR 4 Sugam Form For Assessment Year 2018 19sureshstipl sureshPas encore d'évaluation

- Form PDF 630396840101022Document38 pagesForm PDF 630396840101022RahamTullaPas encore d'évaluation

- Form PDF 860011410060114Document2 pagesForm PDF 860011410060114prakashdebleyPas encore d'évaluation

- ITRForm Arjun 2022Document39 pagesITRForm Arjun 2022Shahrukh Ahmed AnsariPas encore d'évaluation

- Form Itr-4 SugamDocument9 pagesForm Itr-4 SugamAccounting & TaxationPas encore d'évaluation

- Form PDF 858747220180722Document38 pagesForm PDF 858747220180722sonu singhPas encore d'évaluation

- Form PDF 765250410080722Document69 pagesForm PDF 765250410080722Naresh KUMAR GUPTAPas encore d'évaluation

- Deductions Under Chapter VI A (Section) : Date of Filing of Original ReturnDocument2 pagesDeductions Under Chapter VI A (Section) : Date of Filing of Original Returnismailkhan.dbaPas encore d'évaluation

- Form PDF 340519100221221AVTPC0987CDocument8 pagesForm PDF 340519100221221AVTPC0987Csmadvocate049Pas encore d'évaluation

- Form PDF 432385000170822Document9 pagesForm PDF 432385000170822Khan kingPas encore d'évaluation

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnShivam JainPas encore d'évaluation

- Form PDF 114320560260722Document9 pagesForm PDF 114320560260722DeepPas encore d'évaluation

- Form PDF 893006160301222Document9 pagesForm PDF 893006160301222manish.toshniwal1Pas encore d'évaluation

- Form PDF 157539400270722Document41 pagesForm PDF 157539400270722Vidushi JainPas encore d'évaluation

- 2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017Document6 pages2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017ApoorvPas encore d'évaluation

- Form PDF 621098631061022Document68 pagesForm PDF 621098631061022nlr726371Pas encore d'évaluation

- Form PDF 774514440031122Document9 pagesForm PDF 774514440031122krishna salesPas encore d'évaluation

- Form PDF 638844880230723Document8 pagesForm PDF 638844880230723Srikanth Chowdary DarePas encore d'évaluation

- Form PDF 215347070090623Document10 pagesForm PDF 215347070090623m sinhaPas encore d'évaluation

- Form PDF 910494870311222Document9 pagesForm PDF 910494870311222Navin DongrePas encore d'évaluation

- Form PDF 845380590170722Document41 pagesForm PDF 845380590170722cchascashcPas encore d'évaluation

- Indian Income Tax Return Assessment Year 2021 - 22: SugamDocument9 pagesIndian Income Tax Return Assessment Year 2021 - 22: SugamAvnish BhasinPas encore d'évaluation

- Form PDF 804649980151122Document15 pagesForm PDF 804649980151122RAMKISHAN SAHUPas encore d'évaluation

- Form PDF 767221760080722Document13 pagesForm PDF 767221760080722Gaurav AtwalPas encore d'évaluation

- Aman Form FY 21-22Document94 pagesAman Form FY 21-22Shruth ShahPas encore d'évaluation

- Itr2 EnglishDocument34 pagesItr2 Englishniko belicPas encore d'évaluation

- Form PDF 658202480080622Document6 pagesForm PDF 658202480080622Chandrasekhar NandigamPas encore d'évaluation

- Form PDF 720742190260723Document10 pagesForm PDF 720742190260723rishika 61Pas encore d'évaluation

- Sugam: Indian Income Tax Return Assessment Year 2021 - 22Document7 pagesSugam: Indian Income Tax Return Assessment Year 2021 - 22Chetanya VigPas encore d'évaluation

- Form PDF 344575900310722Document38 pagesForm PDF 344575900310722tingu gangPas encore d'évaluation

- Form PDF 308785760300722Document42 pagesForm PDF 308785760300722Rishi KapoorPas encore d'évaluation

- Form PDF 301906800310714Document2 pagesForm PDF 301906800310714deepkaryan1988Pas encore d'évaluation

- Form PDF 360019890310722Document9 pagesForm PDF 360019890310722Sumit SainiPas encore d'évaluation

- Form PDF 383130140310722 PDFDocument9 pagesForm PDF 383130140310722 PDFsandeep kuamr ChoubeyPas encore d'évaluation

- Form PDF 276720890300722Document6 pagesForm PDF 276720890300722atifmd250Pas encore d'évaluation

- Form PDF 240892210050821Document8 pagesForm PDF 240892210050821anushkaenterprises75Pas encore d'évaluation

- Form PDF 284892120220923Document10 pagesForm PDF 284892120220923nishantsahab0786Pas encore d'évaluation

- Form PDF 237268260290722Document9 pagesForm PDF 237268260290722cfaprep040Pas encore d'évaluation

- Form PDF 179843840280722Document10 pagesForm PDF 179843840280722rakeshkaydalwarPas encore d'évaluation

- Rktarai DetailDocument9 pagesRktarai DetailDeepak SwainPas encore d'évaluation

- Form PDF 805452110140722Document41 pagesForm PDF 805452110140722SAYAN SARKARPas encore d'évaluation

- Form PDF 317912690300722Document10 pagesForm PDF 317912690300722harendra godaraPas encore d'évaluation

- Form PDF 606473310030522Document9 pagesForm PDF 606473310030522mahayogiconsultancyPas encore d'évaluation

- Form PDF 166180900050823Document8 pagesForm PDF 166180900050823AshokPas encore d'évaluation

- Public Finance.Document15 pagesPublic Finance.Ali Sultan100% (3)

- Taxes in Canada-Final 2010-4-07 Recovered)Document112 pagesTaxes in Canada-Final 2010-4-07 Recovered)DayarayanCanadaPas encore d'évaluation

- AFF's Tax Memorandum On Finance Bill, 2021Document47 pagesAFF's Tax Memorandum On Finance Bill, 2021ahmad muzaffarPas encore d'évaluation

- Pacheco ComplaintDocument8 pagesPacheco ComplaintNew Mexico Political ReportPas encore d'évaluation

- Tax Appeal E026 of 2020Document8 pagesTax Appeal E026 of 2020Meru CityPas encore d'évaluation

- GST ReturnDocument7 pagesGST ReturnJCGCFGCGPas encore d'évaluation

- CARELIFT - BIR Form No. 1604E 2021Document1 pageCARELIFT - BIR Form No. 1604E 2021Jay Mark DimaanoPas encore d'évaluation

- Project Report of MBA On Taxation 309668020Document69 pagesProject Report of MBA On Taxation 309668020GAURAV SINGHPas encore d'évaluation

- Public Finance in Canada Canadian 5Th Edition Rosen Test Bank Full Chapter PDFDocument26 pagesPublic Finance in Canada Canadian 5Th Edition Rosen Test Bank Full Chapter PDFanselmlayla3l3c1100% (4)

- Corporate Tax PlanningDocument18 pagesCorporate Tax PlanningSANDEEP KUMARPas encore d'évaluation

- First Home Super Saver SchemeDocument5 pagesFirst Home Super Saver Schemeishtee894Pas encore d'évaluation

- Guidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnDocument1 pageGuidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnRieland CuevasPas encore d'évaluation

- ACCTAX HW 3Document4 pagesACCTAX HW 3JasperPas encore d'évaluation

- Theory and Precatice of GSTDocument3 pagesTheory and Precatice of GSTakking0146Pas encore d'évaluation

- CLWETAX Finals Module 5 7Document12 pagesCLWETAX Finals Module 5 7johndanielsantosPas encore d'évaluation

- Design & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueDocument1 pageDesign & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueRinjumon RinjuPas encore d'évaluation

- Billing Address: Tax InvoiceDocument1 pageBilling Address: Tax InvoiceHari Sandeep ReddyPas encore d'évaluation

- Victoria Freitas - 1040-FormDocument2 pagesVictoria Freitas - 1040-Formapi-537101018Pas encore d'évaluation

- Seminar On Service Tax Workshop and Latest UpdatesDocument3 pagesSeminar On Service Tax Workshop and Latest UpdatesFiza. MNorPas encore d'évaluation

- Minimum Wage EarnerDocument2 pagesMinimum Wage EarnerdailydoseoflawPas encore d'évaluation

- Chapter 18 Homework: Award: 10.00 PointsDocument4 pagesChapter 18 Homework: Award: 10.00 PointsBreann MorrisPas encore d'évaluation

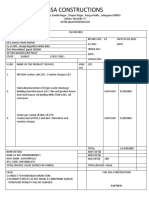

- BSA CONSTRUCTIONS Done1Document1 pageBSA CONSTRUCTIONS Done1Ravi KiranPas encore d'évaluation

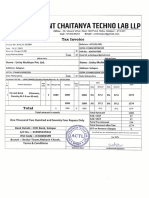

- Anant Chaitanya Techn0 Lab LLP: SalaltaDocument11 pagesAnant Chaitanya Techn0 Lab LLP: SalaltaGiridhari ChandrabansiPas encore d'évaluation

- Desai Brothers LTD 104 20-09-2021Document1 pageDesai Brothers LTD 104 20-09-2021Pragnesh PrajapatiPas encore d'évaluation

- TEST-3 Topic-Government Budget MM-25 Date-26/05/2020Document2 pagesTEST-3 Topic-Government Budget MM-25 Date-26/05/2020harrycrePas encore d'évaluation