Académique Documents

Professionnel Documents

Culture Documents

Tariff List: Category Tariff Products Category Tariff

Transféré par

srajkrishna0 évaluation0% ont trouvé ce document utile (0 vote)

31 vues1 pageSchedule of Tariffs

Titre original

Schedule of Tariffs

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentSchedule of Tariffs

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

31 vues1 pageTariff List: Category Tariff Products Category Tariff

Transféré par

srajkrishnaSchedule of Tariffs

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

TARIFF LIST

CATEGORY TARIFF CATEGORY TARIFF

PRODUCTS GCCNet cash withdrawal Bz. 800

1 . Current Account (All Segments) Balance inquiry through GCCnet Bz. 300

Service charges for active current accounts Cash withdrawal through VisaNet OMR 2.000 per transaction

If balance < OMR 200 p.m. (recovered by system) Bz. 500 per month OmanNet cash withdrawal Bz. 100

Service charges for dormant current account: OmanNet balance enquiry Bz. 50

If balance < min as above (recovered by system) OMR 2.000 per annum OmanNet mini statement Bz. 50

Closure of account: OmanNet Customer account transfer Bz. 50

Within one year of opening account OMR 3.000 OmanNet Account to account transfer (Sender) Bz. 100

After one year of opening account NIL OmanNet POS transaction NIL

Cheque book charges: 8. Business Card (Debit Card)

Cheque book 25 leaves (personal) OMR 2.000 Annual debit card OMR 10.000

Cheque book 50 leaves (corporate) OMR 3.000 9. Credit Cards

1.1 Other Charges: Platinum Card (Master Card)

Cheque returned charges (no funds) OMR 15.000 Principal card OMR 70.000

Cheque returned charges (other reasons) OMR 5.000 Supplementary card OMR 40.000

Stop payment Late payment fees OMR 7.000

OMR 5.000

(either single cheque or bunch of serially numbered cheques)

Over limit fees OMR 5.000

Special clearing OMR 10.00 for all

18% per annum or 1.5% per month 20% per

Photocopies of cheques/vouchers: up to 1 year OMR 2.000 per cheque Interest rate

annum against other security

Photocopies of cheques/vouchers: more than 1 year OMR 3.000 per cheque Card replacement OMR 15.000

Processing of requests for removal of customer name from CBO caution list OMR 10.000 Pin reissuance OMR 5.000

(individual account)

Gold Credit Card (Visa or MasterCard)

Processing of requests for removal of customer name from CBO caution list OMR 20.000

(business account) Principal card OMR 50.000 per annum

2. Savings Account Supplementary card OMR 35.000 per annum

Minimum balance for account opening OMR 5.000 Late payment fees OMR 7.000

Rate of interest: Over limit fees OMR 5.000

Intereste rate up to 3%, subject to change as 18% per annum or 1.5% per month 20% per

High yield savings Interest rate

per bank policy annum against other security

Al Heson Savings NIL Card replacement OMR 15.000

Service charges – high yield deposit account: PIN reissuance OMR 5.000

If balance < OMR 100 p.m. (recovered by system) Bz. 500 per month Classic Card (Visa or MasterCard)

Service charges – active savings accounts: Principal card OMR 30.000 per annum

If balance < OMR 100 p.m. Bz. 500 per month Supplementary card OMR 20.000 per annum

Service charges – dormant savings account: Late payment fees OMR 7.000

If balance < OMR 100 OMR 2.000 per annum Over limit fees OMR 5.000

Closure of account: 18% per annum or 1.5% per

Interest rate

Within one year of opening account OMR 3.000 month 20% per annum against other security

After one year of opening account NIL Card replacement OMR 15.000

Withdrawals in foreign currency notes 1% (Min OMR 5/- per transaction) PIN reissuance OMR 5.000

Withdrawals across the counter in OMR NIL Cash advance fee (as percentage of total amount) The higher of 3% or OMR 3.000 (per transaction)

3. Recurring Deposit Internet Card (eComcard)

Interest rate up to 4% subject to change as per Rate of interest 18% per annum or 1.5% per month

Interest rate Membership fee OMR 10.000 per annum

bank policy

Minimum deposit OMR 50 Late payment fee OMR 7.000

Period of deposit Minimum 6 months – Maximum 60 months Over limit fees OMR 5.000

Penalty for early withdrawal Card replacement OMR 5.000

If break/closed the deposit before end of the period and the deposit rate above 1% 1% will be charged on the total deposit Interest NIL Card (Al Noor)

4. Call Deposits Rate of interest NIL

Minimum opening Balance OMR 1,000/- Membership fee OMR 40.000 per annum

If balance < OMR 100 p.m. (recovered by system) Bz. 500 per month Late payment fee OMR 10.000

5. Fixed Deposit Over limit fees OMR 10.000

Minimum Opening Balance OMR 1,000/- Supplementary card OMR 20.000

No deduction from principal, Interest payment Commission 9.75% sales trans 12.75% cash trans

Penalty for early withdrawal may be reduced by 1% p.a. for the

period run. Card replacement OMR 15.000

6. Foreign Currency Accounts PIN re-issuance OMR 5.000

Service charges – FCY Current Accounts: Excess credit limit OMR 5.000

If balance < equivalent of OMR 200 p.m. (recovered by system) Bz. 500 per month Copy of previous statement OMR 5.000

Service charges – FCY Savings Accounts: Copy of sales voucher OMR 4.000

If balance < equivalent of OMR 100 p.m. (recovered by system) Bz. 500 per month Student Credit Card

FCY Call Deposit: minimum opening balance OMR 1000/- equivalent Card replacement OMR 15.000

If balance < equivalent of OMR 100 p.m. (Recovered by system) Bz. 500 per month PIN regeneration OMR 5.000

FCY Fixed Deposit: minimum opening balance OMR 1000/- equivalent 3% of the withdrawal or OMR 3

Cash withdrawal fee

whichever is higher

Penalty for early withdrawal No deduction from principal, Interest payment

may be reduced by 1% p.a. for the period run. Late payment NIL

7. Visa Electron Cards (Debit Cards) Over limit OMR 5 per month

New Card OMR 1.000 10. Loans

Annual debit card fees OMR 1.000 Deferment of loan installment (at customers request) OMR 5.000 / request

Supplementary card OMR 2.000 Top Up or rescheduling of existing loan OMR 5.000

Replacement card (due to loss/physical card damage) OMR 2.000 Pre-payment or pre -closure of loan before maturity (before actual due date) 1% of the prepaid or foreclosed amount

Balance Enquiry NIL 0.05% of the loan amount,

Insurance fees

Mini statement NIL Min OMR 5.000, Max OMR 75.000

Using customer account transfer (inward) NIL No objection certificate (NOC) OMR 2.000

Using the Card through POS NIL Housing Loan processing fee OMR 50.000

Using the Card through GCCNet POS NIL Personal Loan processing fee OMR 25.000

Account to account transfer (outward) Bz. 200 Education Loan processing fee OMR 25.000

Using ATMs within GCC Countries NIL Car Loan processing fee OMR 25.000

CATEGORY TARIFF CATEGORY TARIFF

SERVICES Cancellation of Demand Draft – non-account holder At Bank’s buying rate + OMR 5.000

1. Duplicate Statement Stop Payment of Demand Draft / TT OMR 3.000 + Telex + Correspondent’s charges

Up to past 6 months OMR 1.000 Purchase of Foreign Demand Draft / TT OMR 3.000 + Courier charges

6 months – 1 year OMR 3.000 6.2 Telex Charges

Beyond 1 year OMR 5.000 Inland Oman – customers (ACH/RTGS) OMR 1.750

2. Other Charges Inland Oman – non-customers (ACH/RTGS) OMR 1.750

Credit reports (given) local OMR 10.000 GCC Countries – customers (GCC transfer) OMR 5.000

Credit reports (obtained) local OMR 10.000 GCC Countries – non-customers (GCC transfer) OMR 5.000

Credit reports foreign USD 25.000 Other Countries – customers (overseas transfer) OMR 5.000

Utility bill payment – customers Bz 500 Other Countries – non-customers (overseas transfer) OMR 5.000

Utility bill payment – non-customers OMR 1.000

Standing instructions (internal – to third party) OMR 1.000

In case the charges are borne on the applicant, i.e. OUR in the Swift messages, the following are the foreign banks’ charges which

Standing Instructions (paid) per transaction (local & foreign currency will need to be debited (manually) upfront at the time of remittance, this is in addition to BankDhofar’s charges mentioned above,

OMR 2.000 + PO / DD / TT fee

accounts) as this is the foreign bank’s charges.

Standing instruction (unpaid) (local & foreign currency accounts) OMR 1.000 per occasion

Balance certificate OMR 2.000

No liability certificate OMR 2.000 Destined Country

Confirmation of balance to auditors OMR 2.000 Currency / Foreign Charges per item

3. Travellers Cheque Correspondent Bank

USD Wells Fargo • 5.50 USD

Buying travellers cheques OMR 2.000 / Transaction

Payment on Banks • EUR 6.00 for any amount less than EUR 2,500

4. Inward Clean Collection in Germany – • EUR 12.00 if amounts are less than EUR 12,500

EUR

Commission Bz 250 Through Commerz • EUR 25.00 if amounts are less than EUR 50,000

Bank • EUR 75.00 if amounts are more than EUR 50,000

Cheque returned NIL

Version 2.0 Last updated on 01 May 2017

• GBP 6 if amounts are less than GBP 150

5. Outward Clean Collection GBP Llyods

• GBP 12 if amounts are more than GBP 150

To GCC countries OMR 3.750 INR ICICI • INR 100 per item

Outside GCC countries OMR 3.750 Abu Dhabi

AED • AED 40 per item

Post-dated cheques OMR 3.000 / Cheque Commercial Bank

6. Remittances SAR Saudi Hollandi Bank • SAR 25 per item

6.1 Demand Drafts /Payment Orders Charges

Demand Drafts – account holders OMR 2.000 7. Safe Deposit Lockers

Small size – rent per year OMR 30.000

Demand Drafts – non-account holders OMR 2.000

Medium size – rent per year OMR 40.000

Payment Orders – account holders OMR 2.000

Large size – rent per year OMR 60.000

Payment Orders – non-account holders OMR 2.000 Refundable Deposit – all sizes OMR 40.000

Cancellation of Demand Draft – account holder At Bank’s buying rate + OMR 2.000 Replacement of locks for lost key OMR 100.000

Vous aimerez peut-être aussi

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CAPas encore d'évaluation

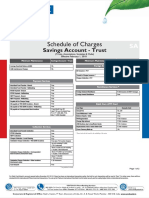

- SOC Savings AdityaDocument2 pagesSOC Savings AdityaDenny PjPas encore d'évaluation

- Minimum Disclosure of Bank Fees and Charges 2021Document1 pageMinimum Disclosure of Bank Fees and Charges 2021Bahati RaphaelPas encore d'évaluation

- KCB Kenya Tariff Guide 2019Document1 pageKCB Kenya Tariff Guide 2019clement muriithiPas encore d'évaluation

- Tariffs and Charges: HBON Commercial Banking & Global BankingDocument15 pagesTariffs and Charges: HBON Commercial Banking & Global BankingMoneycomePas encore d'évaluation

- Updated MD TARRIFS A2 Amendments March 24thDocument1 pageUpdated MD TARRIFS A2 Amendments March 24thjustas kombaPas encore d'évaluation

- Key Facts Sheet Asaan Digital Account (Ada) Islamic CurrentDocument3 pagesKey Facts Sheet Asaan Digital Account (Ada) Islamic CurrentAmira AslamPas encore d'évaluation

- Myworld Pricing 2021Document3 pagesMyworld Pricing 2021carinaPas encore d'évaluation

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurPas encore d'évaluation

- Tariff Eng BookDocument16 pagesTariff Eng BookRahul T HPas encore d'évaluation

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiPas encore d'évaluation

- 2601 Tariffs Review May 2022Document1 page2601 Tariffs Review May 2022Willard ShamuPas encore d'évaluation

- Tariff Guide 2022 Access BankDocument1 pageTariff Guide 2022 Access Bankkefiyalew BPas encore d'évaluation

- MCB Young Key Fact SheetDocument3 pagesMCB Young Key Fact SheetFahad MagsiPas encore d'évaluation

- Schedule of Charges 2015Document10 pagesSchedule of Charges 2015HASIB RUPUPas encore d'évaluation

- Bassein Catholic Co-Op. Bank LTD.: Service Charges W.E.F. 1 May, 2019Document17 pagesBassein Catholic Co-Op. Bank LTD.: Service Charges W.E.F. 1 May, 2019OUTDOOR WILDERNESS AND LEARNINGPas encore d'évaluation

- Key Fact Sheet For Islamic Digital AccountDocument7 pagesKey Fact Sheet For Islamic Digital Accountwaqas wattooPas encore d'évaluation

- SOC Next Gen Savings AccountDocument2 pagesSOC Next Gen Savings AccountSUBHRAKANTA DASPas encore d'évaluation

- 1193940000-October 2020Document1 page1193940000-October 2020Ronald AranhaPas encore d'évaluation

- Stanbic Mini Diclosure Tarrif GuideDocument2 pagesStanbic Mini Diclosure Tarrif GuideOMARYPas encore d'évaluation

- Card Transaction Report ةقاطبلا تلماعم ريرقت Al Fanan JewelleryDocument1 pageCard Transaction Report ةقاطبلا تلماعم ريرقت Al Fanan Jewellerytexvijay4Pas encore d'évaluation

- Stanbicpricingguide2022 2023Document1 pageStanbicpricingguide2022 2023Yaseen QariPas encore d'évaluation

- Parameter Au Samriddhi Current AccountDocument2 pagesParameter Au Samriddhi Current Accounthiteshmohakar15Pas encore d'évaluation

- Key Fact Statement For Deposit Products: Account Types & Salient FeaturesDocument3 pagesKey Fact Statement For Deposit Products: Account Types & Salient FeaturesHassan AhmadPas encore d'évaluation

- BANK MUSCAT-Tariff Eng BookDocument14 pagesBANK MUSCAT-Tariff Eng BookmujeebmuscatPas encore d'évaluation

- Indus Infotech December292017Document1 pageIndus Infotech December292017Harssh S ShrivastavaPas encore d'évaluation

- Rates and Charges - Fincare Small Finance BankDocument4 pagesRates and Charges - Fincare Small Finance BankkrishnabhasingikPas encore d'évaluation

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03Pas encore d'évaluation

- CABCA - SOC - July 22Document2 pagesCABCA - SOC - July 22anjumPas encore d'évaluation

- Coop Bank Kenya Tariff-GuideDocument1 pageCoop Bank Kenya Tariff-GuideSamuel Kamau100% (1)

- Banking Services: Fees and ChargesDocument46 pagesBanking Services: Fees and ChargesIsaacPas encore d'évaluation

- Indus Freedom February2017Document1 pageIndus Freedom February2017HeartKiller LaxmanPas encore d'évaluation

- SOC Indus Multiplier MaxDocument4 pagesSOC Indus Multiplier Maxmanoj baroka0% (1)

- Tariff Sheet For HDFC Bank Individual Demat AccountDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accountnirvana8791Pas encore d'évaluation

- Schedule-Of-Charges SBM BankDocument14 pagesSchedule-Of-Charges SBM Bankmegha90909Pas encore d'évaluation

- Schedule of Charges Current AccountDocument8 pagesSchedule of Charges Current AccountAshif RejaPas encore d'évaluation

- GSFC Kotak811 Apr17Document1 pageGSFC Kotak811 Apr17karthip08Pas encore d'évaluation

- Soc Conventional 24 07 23Document20 pagesSoc Conventional 24 07 23rahmanredwan468Pas encore d'évaluation

- Tariff Guide: All Tariff Charges Are Exclusive of Applicable TaxesDocument1 pageTariff Guide: All Tariff Charges Are Exclusive of Applicable TaxesSamuel KamauPas encore d'évaluation

- SBL-Schedule of ChargesDocument20 pagesSBL-Schedule of ChargesMd Joinal AbedinPas encore d'évaluation

- QNB Oman - Tariff of Charges-Retail-Version-2ENDocument5 pagesQNB Oman - Tariff of Charges-Retail-Version-2ENshady emadPas encore d'évaluation

- Amount Due: B127 Mahindra Iris CourtDocument4 pagesAmount Due: B127 Mahindra Iris CourtVinod VentoPas encore d'évaluation

- Service Charges - BoB - As On 6.11.17Document63 pagesService Charges - BoB - As On 6.11.17Praneta pandeyPas encore d'évaluation

- Caart PDFDocument2 pagesCaart PDFvinodPas encore d'évaluation

- Service Charges and Fees For Current Account Club 50 Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Club 50 Effective July 01 2022Nitin BPas encore d'évaluation

- Key Fact Sheet (HBL FreedomAccount) - July To DecemberDocument1 pageKey Fact Sheet (HBL FreedomAccount) - July To DecemberAftab AhmedPas encore d'évaluation

- Accounting Cycle of A Service Business: Mr. Jan CupangDocument30 pagesAccounting Cycle of A Service Business: Mr. Jan Cupangbanigx0xPas encore d'évaluation

- Burgundy Fees and Charges As On 2019 09Document7 pagesBurgundy Fees and Charges As On 2019 09Shivanshu SinghPas encore d'évaluation

- Tariff Eng BookDocument15 pagesTariff Eng BookMokhtarPas encore d'évaluation

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95Pas encore d'évaluation

- Minimum Disclosures 23rd January 2023Document1 pageMinimum Disclosures 23rd January 2023alexPas encore d'évaluation

- Abw2209 003 MW Priceupdate Web-99 PDFDocument1 pageAbw2209 003 MW Priceupdate Web-99 PDFBenny BernicePas encore d'évaluation

- Annexure BDocument3 pagesAnnexure BMayapur CommunicationPas encore d'évaluation

- Schedule of Charges - English - July To DecemberDocument15 pagesSchedule of Charges - English - July To DecemberBurairPas encore d'évaluation

- Globe Bill 929104011Document2 pagesGlobe Bill 929104011Mona Victoria B. PonsaranPas encore d'évaluation

- Tariff: Banque Du CaireDocument32 pagesTariff: Banque Du CaireØmar KhaledPas encore d'évaluation

- Class Notes BB9143Document4 pagesClass Notes BB9143BBPas encore d'évaluation

- Standard CharteredDocument2 pagesStandard Charteredsan_sam3Pas encore d'évaluation

- 2918 Stanbic August TarrifsDocument1 page2918 Stanbic August TarrifsNyamutatanga MakombePas encore d'évaluation

- Merge PDFDocument8 pagesMerge PDFsrajkrishnaPas encore d'évaluation

- Road TenderDocument6 pagesRoad TendersrajkrishnaPas encore d'évaluation

- Embedded SIM White PaperDocument7 pagesEmbedded SIM White PapersrajkrishnaPas encore d'évaluation

- Merge PDFDocument8 pagesMerge PDFsrajkrishnaPas encore d'évaluation

- How 5g Will Transform Industrial IotDocument26 pagesHow 5g Will Transform Industrial IotRavi YarrabothuPas encore d'évaluation

- QUALCOMM Internet of ThingsDocument41 pagesQUALCOMM Internet of ThingsrberrospiPas encore d'évaluation

- RVA 2016 Eng PrintDocument93 pagesRVA 2016 Eng PrintsrajkrishnaPas encore d'évaluation

- Electricity Tariff Reform in Uttar Pradesh, India: Challenges & Key Findings May 2018Document13 pagesElectricity Tariff Reform in Uttar Pradesh, India: Challenges & Key Findings May 2018srajkrishnaPas encore d'évaluation

- The Blockchain Standard Infrastructure For Business: WhitepaperDocument71 pagesThe Blockchain Standard Infrastructure For Business: WhitepapersrajkrishnaPas encore d'évaluation

- RVA 2016 Eng PrintDocument93 pagesRVA 2016 Eng PrintsrajkrishnaPas encore d'évaluation

- Tariff Analysis: IES Virtual EnvironmentDocument35 pagesTariff Analysis: IES Virtual EnvironmentsrajkrishnaPas encore d'évaluation

- Electricity Tariff Reform in Uttar Pradesh, India: Challenges & Key Findings May 2018Document13 pagesElectricity Tariff Reform in Uttar Pradesh, India: Challenges & Key Findings May 2018srajkrishnaPas encore d'évaluation

- 2018 Tariff ScheduleDocument7 pages2018 Tariff SchedulesrajkrishnaPas encore d'évaluation

- Draft 2019-2020 TNUoS Tariffs Report PDFDocument68 pagesDraft 2019-2020 TNUoS Tariffs Report PDFsrajkrishnaPas encore d'évaluation

- Renewable Energy Feed in Tariff Strategy: Republic of ZambiaDocument28 pagesRenewable Energy Feed in Tariff Strategy: Republic of ZambiasrajkrishnaPas encore d'évaluation

- IBM Blockchain Course Video Slides PDFDocument57 pagesIBM Blockchain Course Video Slides PDFdsa132132Pas encore d'évaluation

- Schedule of TariffsDocument13 pagesSchedule of TariffssrajkrishnaPas encore d'évaluation

- 03 Imsc PDFDocument10 pages03 Imsc PDFneoPas encore d'évaluation

- Schedule of TariffsDocument13 pagesSchedule of TariffssrajkrishnaPas encore d'évaluation

- 640Document32 pages640srajkrishnaPas encore d'évaluation

- ADP Prospectus For WebsiteDocument29 pagesADP Prospectus For WebsiteAshar KirmaniPas encore d'évaluation

- 90-17 Cpar - Local Government TaxesDocument37 pages90-17 Cpar - Local Government TaxesJellah NavarroPas encore d'évaluation

- SuperCat - Itinerary Receipt 6Document2 pagesSuperCat - Itinerary Receipt 6Sheena AnonuevoPas encore d'évaluation

- Fedex Ratesheets: Proposal No.: 9819742 1 / 11Document11 pagesFedex Ratesheets: Proposal No.: 9819742 1 / 11nanananacmonPas encore d'évaluation

- Crazy Deal Mauritius - Victoria Beachcomber Resort and Spa (4 Star)Document9 pagesCrazy Deal Mauritius - Victoria Beachcomber Resort and Spa (4 Star)testing2469Pas encore d'évaluation

- 001jan172020 3 PDFDocument4 pages001jan172020 3 PDFSteven EnglishPas encore d'évaluation

- AchieveCard Prepaid MasterCard Cardholder AgreementDocument18 pagesAchieveCard Prepaid MasterCard Cardholder AgreementAchieve CardPas encore d'évaluation

- Barangay BP Forms-FinalDocument32 pagesBarangay BP Forms-FinalMelvs Navarra100% (2)

- Q A English About InsuranceDocument3 pagesQ A English About InsuranceLeHuong7885Pas encore d'évaluation

- Grand Total 17,594.00: Compendia For Criminal Procedure and EvidenceDocument1 pageGrand Total 17,594.00: Compendia For Criminal Procedure and EvidenceJomarie Martir MoralPas encore d'évaluation

- Darden Terms and Conditions - 2017Document5 pagesDarden Terms and Conditions - 2017borgosdPas encore d'évaluation

- Columbia Gas Sample BillDocument2 pagesColumbia Gas Sample BillYoutube Master75% (4)

- Issuance of Dangerous Drugs License (S2-License, Practitioner)Document4 pagesIssuance of Dangerous Drugs License (S2-License, Practitioner)Josselle Sempio CalientaPas encore d'évaluation

- Aakash Medical Prospectus - Pune - Without FeeDocument28 pagesAakash Medical Prospectus - Pune - Without FeeNikPas encore d'évaluation

- Chase-Ashlee James WarfieldDocument5 pagesChase-Ashlee James WarfieldANGELA WALLPas encore d'évaluation

- PAL v. Edu, 164 SCRA 320Document14 pagesPAL v. Edu, 164 SCRA 320citizenPas encore d'évaluation

- Italy Admission Process StepsDocument5 pagesItaly Admission Process StepsTEJASHREE BEDEKARPas encore d'évaluation

- School Transport Policy For Parents 1.1 (A) Initiation of The Transport Facility (Parent)Document6 pagesSchool Transport Policy For Parents 1.1 (A) Initiation of The Transport Facility (Parent)Kashyap MulukutlaPas encore d'évaluation

- Qalco E FormDocument10 pagesQalco E FormAtif AttiquePas encore d'évaluation

- CarloansDocument1 pageCarloansjith82Pas encore d'évaluation

- Thirteen Major Clauses An Interior Design Contract Agreement Document Must ContainDocument13 pagesThirteen Major Clauses An Interior Design Contract Agreement Document Must Containadventure of Jay KhatriPas encore d'évaluation

- Franz ComplaintDocument4 pagesFranz ComplaintFrederick BartlettPas encore d'évaluation

- Loyalist College Program Availability List For JAN - 2023 Intake 240522Document6 pagesLoyalist College Program Availability List For JAN - 2023 Intake 240522Jayrajsinh ParmarPas encore d'évaluation

- Math0301 Review Exercise Set 15Document5 pagesMath0301 Review Exercise Set 15Ever DalePas encore d'évaluation

- Credit Card Assignment PDF WeeblyDocument2 pagesCredit Card Assignment PDF Weeblyapi-371069146Pas encore d'évaluation

- FAB (Current-Accounts)Document3 pagesFAB (Current-Accounts)Amr YehiaPas encore d'évaluation

- Tapawarma Franchise Kit As of Oct 2019Document8 pagesTapawarma Franchise Kit As of Oct 2019Joseph Angelo Evangelista CoronelPas encore d'évaluation

- Eight Kwai Fong Sales Brochure 20210722 PDFDocument79 pagesEight Kwai Fong Sales Brochure 20210722 PDFcody punPas encore d'évaluation

- Lakeshore at Altamonte SpringsDocument2 pagesLakeshore at Altamonte SpringsJose CruzPas encore d'évaluation

- Hotel Voucher 1Document2 pagesHotel Voucher 1nileshPas encore d'évaluation