Académique Documents

Professionnel Documents

Culture Documents

Fundamentals and Technical Analysis of Equity Derivatives: A Project Report ON

Transféré par

tarun nemalipuriDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fundamentals and Technical Analysis of Equity Derivatives: A Project Report ON

Transféré par

tarun nemalipuriDroits d'auteur :

Formats disponibles

J WINGS MANIFEST WEALTH

A PROJECT REPORT

ON

FUNDAMENTALS AND TECHNICAL ANALYSIS OF

EQUITY DERIVATIVES

BY

SREELEKHA BABYSANKAR

17BSPHH01C1100

AT

J WINGS MANIFEST WEALTH

IBS-J wings Manifest Wealth 1|Page

J WINGS MANIFEST WEALTH

A PROJECT REPORT

ON

FUNDAMENTALS AND TECHNICAL ANALYSIS OF

EQUITY DERIVATIVES

BY

SREELEKHA BABYSANKAR

17BSPHH01C1100

IBS HYDERABAD

AT

J WINGS MANIFEST WEALTH

A REPORT SUBMITTED IN PARTIAL FULFILLMENT OF THE

REQUIREMENTS OF MBA PROGRAM OF

IBS HYDERABAD

DISTRIBUTION LIST:

FACULTY GUIDE COMPANY GUIDE

PROF. DR D SREENIVASACHARY MR GOPALA KRISHNA

DATE OF SUBMISSION

9th MAY 2018

IBS-J wings Manifest Wealth 2|Page

J WINGS MANIFEST WEALTH

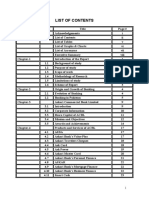

TABLE OF CONTENTS

SL NO. TITLE PAGE NO.

1 Authorization 6

2 Acknowledgement 7

3 Abstract 8

4 1.Introduction 10

5 1.1 About The Company 10

6 2 About The Project 10

7 2.1 Objectives 10

8 2.2 Methodology 11

9 2.3 Limitations 11

10 3. Forex Market 12

11 4 Indian Derivatives 12

12 4.1 History 13

13 4.2 Exchange Traded Markets 14

14 4.3 Over The Counter Markets 15

15 4.4 Financial Derivatives 15

16 4.5 Equity Derivatives 16

17 4.6 Commodity Derivatives 16

18 4.7 Participants In Derivative Market 17

19 4.8 Derivative Instruments 18

20 5. Forwards Contract 19

21 5.1 Pay Offs From Forward Contracts 21

22 5.2 Limitation Of Forward Contracts 21

23 6. Options Contract 22

24 6.1 Options Terminology 23

25 7. Futures Contract 26

26 7.1 Features Of Futures Contract 26

27 7.2 Futures Terminology 27

28 7.3 Kinds Of Transactions In Futures Contract 28

29 7.4 Currency Futures 29

30 7.5 Speculation Using Futures 30

IBS-J wings Manifest Wealth 3|Page

J WINGS MANIFEST WEALTH

SL NO TOPIC PAGE NO.

31 7.6 Operation Of Margin Account 31

32 7.7 Leverage 33

33 7.8 Pay Off Structure 35

34 7.9 Hedging With Futures 37

35 7.10 Open Interest 40

36 7.11 Delivery 41

37 7.12 Cash Settlement 42

38 8. Technical Analysis 43

39 8.1 Japanese Candle Sticks 44

40 8.2 Single Candle Stick Patterns 44

41 8.2.1 Marubozu 45

42 8.2.2 Spinning Top 45

43 8.2.3 Doji 46

44 8.2.4 Hammer 47

45 8.2.5 Hanging Man 48

46 8.2.6 Inverted Hammer 49

47 8.2.7 Shooting Star 50

48 8.3 Multiple Candle Stick Patterns 51

49 8.3.1 Engulfing Pattern 51

50 8.3.2 Piercing Pattern 51

51 8.3.3 Dark Cloud Cover Pattern 52

52 8.3.4 Harami Pattern 53

53 8.4 Triple Candle Stick Patterns 54

54 8.4.1 The Evening Star 54

55 8.4.2 The Morning Star 55

56 9. Technical Indicators 56

57 9.1 Relative Strength Index 57

58 9.2 Moving Averages 60

59 9.3 Fibonacci Retracement 61

60 9.4 Stochastic Oscillator 62

61 9.5 Bollinger Bands 65

62 10 Limitations 69

63 11 Conclusion 70

64 12. Reference 71

IBS-J wings Manifest Wealth 4|Page

J WINGS MANIFEST WEALTH

LIST OF FIGURES

SL. NO TOPIC PAGE

NO.

Fig 1 Market Participants 17

Fig 2 Pay Off From Forwards 21

Fig 3 Option Chain 23

Fig 4 Stock Options 25

Fig 5 Stock Futures 29

Fig 6 Long Futures 36

Fig7 Short Futures 37

Fig 8 Hedging With Futures 38

Fig 9 Open Interest 40

Fig 10 Technical Analysis 43

Fig 11 Marubozu 45

Fig 12 Spinning Top 45

Fig 13 Doji 46

Fig 14 Paper Umbrella 47

Fig 15 Hammer 48

Fig 16 Hanging Man 48

Fig 17 Inverted Hammer 49

Fig 18 Shooting Star 50

Fig 19 Engulfing Pattern 51

Fig 20 Piercing Pattern 52

Fig 21 Dark Cloud Cover Pattern 52

Fig 22 Harami Pattern 53

Fig 23 Evening Star 54

Fig 24 Morning Star 55

Fig 25 Triple Candle Stick Pattern 56

Fig 26 Technical Indicators 57

Fig 27 Relative Strength Index 58

Fig 28 Relative Strength Index 59

Fig 29 Moving Averages 61

Fig 30 Fibonacci Retracement 62

Fig 31 Stochastic Oscillator 63

Fig 32 Bollinger Bands 65

Fig 33 W Bottoms 66

Fig 34 M Tops 67

Fig 35 Walking The Band Signal 68

IBS-J wings Manifest Wealth 5|Page

J WINGS MANIFEST WEALTH

AUTHORIZATION

I, Sreelekha B hereby declare that the project entitled “STUDY ON THE FUNDAMENTALS

AND TECHNICAL ANALYSIS OF EQUITY DERIVATIVES” has been prepared under the

guidance of Dr D Sreenivasachary, Professor , ICFAI Business School, Hyderabad in partial

fulfillment of the requirement for the fulfillment of MBA Program (2017-19) of IBS Hyderabad.

I also declare that this is a bona fide record of research work done by me during the course of our

study and no part of it has been submitted for any other degree, fellowship or other similar title of

recognition.

SREELEKHA B

17BSPHH01C1100

MBA(2017-2019)

IBS-J wings Manifest Wealth 6|Page

J WINGS MANIFEST WEALTH

ACKNOWLEDGEMENT

The journey of Summer Internship On a rare topic which is “A Study on the Fundamentals of

Indian Derivatives market with special focus on Equity derivatives” for the last one and half

Months sounds very interesting. This of course would not have been possible without the support

and guidance of certain people.

To start with, I would like to thank J wings Manifest Wealth for providing me the chance to

undertake this internship study and allowing me to explore the areas of derivative market and

forex market which will greatly add to my experience in the field of finance.

I express my gratitude to my college guide, Dr. D Sreenivasachary Professor, ICFAI Business

School, Hyderabad, for helping me in each and every stage of this project.

I would also like to thank Rev. Mr. Megesh M, Managing Director of J wings Manifest Wealth

for his valuable guidance throughout the completion of this work. His continuous support and

encouragement was highly instrumental in making this report in its present form.

I would like to express my deep sense of gratitude to Mr Gopala Krishna, Business Head, J

wings Manifest Wealth for his valuable guidance throughout the work. His advice, support and

feedback has helped a lot.

I also appreciate the encouragement and constructive criticism that I have received from my

Friends and family which went long way to make this project a satisfying experience to me.

Above all I thank God Almighty for providing me the right atmosphere and mental strength to

Work and for showering all blessings for the successful execution of this project.

SREELEKHA B

17BSPHH01C1100

MBA (2017-2019)

IBS-J wings Manifest Wealth 7|Page

J WINGS MANIFEST WEALTH

ABSTRACT

Briefly speaking the project started on a positive note with a discussion with company mentor on

selection of the topic. After considering various factors like growing fields of financial

instruments, growing demand of various financial options ,global and international investment and

trading trends, future relevance and scope to research and explore more ,I have selected the topic

“A study on the fundamentals and technical analysis of equity derivatives” with special focus on

futures.

An equity derivative is a derivative instrument whose value is derived from underlying assets

based on equity securities. An equity derivative's value will fluctuate with changes in its underlying

asset's equity, which is usually measured by share price. The major types of equity derivatives are

futures and options. A future contract is an agreement between two parties to buy or sell an asset

at a certain time in the future at a certain price. Options are contracts that grant the right, but not

the obligation to buy or sell an underlying asset at a set price on or before a certain date. The right

to buy is call option and the right to sell is put option. Derivatives like futures, options, etc were

introduced for Hedging and Price discovery, instead retail investors are investing in futures

contracts for Speculative purposes mainly because of the fact that these instruments yield high

returns but of course in trade off with high risk.

The research started with the basics of Indian derivatives market, read and learnt about various

derivative instruments, functions, participants and more about equity derivatives. My focus was

mainly on futures and about its operations. Further the research gave more importance on the actual

operation of futures in derivatives market including the formation of the agreement till settlement.

The research also gave focus on forwards and about their working and operations. Understanding

and learning about the fundamentals of options. The main motive was to understand about the

futures market including the operations of currency futures and to predict their price trend by

analyzing the respective underlying asset with the help of technical indicators.

The study also gave large importance to the technical analysis undertaken to predict the market

trend. The technical analysis helps to identify the trading opportunities using actions of market

participants through charts, indicators and patterns. The concept of technical analysis can be used

to analyze any asset class – equities, foreign exchange, commodities etc. The few key assumptions

of technical analysis are market discounts everything, price moves in trends and history tends to

repeat itself. The types of charts used to analyze trade patterns are bar charts, line charts and

Japanese candle stick charts. The Japanese candle stick charts are the most popular and the widely

used charts to analyze any market. In a Japanese candle stick chart, strength is represented by a

bullish candle and weakness by a bearish candle. Some of the widely used indicators are Relative

strength index, Fibonacci retracement, moving averages, stochastic oscillator, Bollinger bands and

pivot point.

IBS-J wings Manifest Wealth 8|Page

J WINGS MANIFEST WEALTH

As the company’s focus was more onto forex and stock market trade, they gave training on various

widely used technical indicators namely Relative strength index, moving averages ,Pivot points

and Fibonacci retracement. The study stretched to a different perspective when I started analyzing

the charts of various underlying assets with the help of technical indicators. The research gave

importance to the study of candle stick charts as well. Some great market traders always says,

candle stick charts itself are sufficient enough to predict the market trend.

The project started focusing more on the technical analysis part including learning more about

Japanese candle stick charts and various technical indicators. The study also involved comparing

the various strategies of technical indicators .However no one indicator is completely reliable in

market, every indicator has its own pros and cons. Till now the fundamental research on equity

derivatives have been completed along with the understanding of technical analysis and Japanese

candle stick charts. Presently the research is happening on the role of leverage in futures market

and regarding various strategies of technical indicators. Finally the focus would be to understand

the various risks and rewards related to trading on equity derivatives mostly on futures.

Trading in futures market and forex market are highly risky and thus highly profitable as well. The

traders must keep stop losses for every trade in order to limit their losses .It’s always better to

develop a trading plan and make sure it’s followed. Only trade when you feel it’s the right moment

to execute a trade and never trade to compensate for your losses that may end up in a huge failure.

If one is not ready to take small losses, he/she will have to bear mother of losses. There are various

demo accounts available for forex and futures trading .People can try out their new strategies in

these demo accounts and track the effectiveness of their trades.

The whole idea of the project is to learn and understand about futures market and forex market in

detail along with technical analysis, with the help of candle stick charts and indicators. The project

explains about forwards, futures, currency futures and about the various technical indicators used

to predict the trend in the market. Futures are highly leveraged and risky products that can

create lots of wealth if used properly or else it can be a weapon of mass destruction as well.

Forex Derivatives were introduced to eliminate Cross Currency risk or Translational Risk.

Institutions having currency risk can hedge their positions by entering into forex futures.

The research has also focused on the relevance of margin account, role of leverage and hedging

with futures. The research has made use of only secondary data, from various websites, books and

journals.

IBS-J wings Manifest Wealth 9|Page

J WINGS MANIFEST WEALTH

INTRODUCTION

1. ABOUT THE COMPANY

J wings manifest wealth is a financial services and trading company which is mainly into stock

market and forex trading. They provide training services and various financial advisory services

as well. J wings is also into health Insurance and investment planning services .The company has

vast experience and comprehensive understanding in the field of forex trade and technical analysis.

The company offers trading through an online trading platform, under this online trading platform

investors are able to trade through various platforms such as web based terminal, mobile based

trading as well as app based trading. These online platforms enable the investors to trade in forex

market. They update the investors with the market trends and notify them on various fundamental

news regarding various currency pairs. Their office is situated at Horamavu, Bangalore, Karnataka.

2. ABOUT THE PROJECT

2.1 OBJECTIVES

o Understanding the concept of Indian Derivatives market

o To learn more about different derivative instruments and it’s functioning from

formation of the agreement till settlement with special focus on futures.

o To understand and examine the role of leverage and importance of margin account in

futures market

o To learn about the pay off structure and about the various risks and rewards related to

equity derivatives

o To study the technical analysis and critically examine the working of futures in

derivatives market.

o To learn more about the candle stick charts and various technical indicators to analyse

the underlying assets

IBS-J wings Manifest Wealth 10 |

Page

J WINGS MANIFEST WEALTH

2.2 METHODOLOGY:

The present study is purely an exploratory study, dependent on the secondary sources of

data. Secondary data will be the formal and official references of the researcher which

includes annual reports of various institutions and other publications about derivatives

market and equity derivatives, online portals, relevant literature and facts, statistics and data

available on various books, newspapers, websites etc. This project used descriptive and

explanatory research and secondary research based on secondary data.

Descriptive And Explanatory Research

Descriptive study is a fact finding investigation with an adequate interpretation. It is the simplest

type of research and is more specific. In the given project, complete descriptive research has

been adopted where detailed study of the concept was implemented.

Secondary Data

Secondary research was done to know more about the history and working of equity derivatives

including futures and options. Information from various published sources like reports by

National Stock Exchange (NSE) ,books, research papers , online publication etc was taken

2.3 LIMITATIONS

o Limited time period of three months

o Indian Derivatives is a very wide topic thus its unable to concentrate on all the derivative

instruments in this limited time period

o Many are not willing to invest in futures as they are highly leveraged products that

carries high risk

o Mostly investors are not willing/unable to invest large amounts and are risk averse

o Technical indicators may not be completely reliable all the time.

o People have less knowledge regarding derivatives market

IBS-J wings Manifest Wealth 11 |

Page

J WINGS MANIFEST WEALTH

3. FOREX MARKET

Forex market is also known as currency market , where 36 cross pair currencies are traded .The

major and mostly traded six currency pairs are AUS/USD,EUR/USD, GBP/USD,JPY/USD,

USD/CHF and XAU/USD(GOLD).The mostly traded currencies are dollar 84.9 % , Euro 39.1%

and Yen 19 %. One pip movement in currency is equivalent to 10 dollars , in gold one pip

movement is equivalent to 100 dollars and for silver its 50 dollars. Trading in forex is between

various currency pairs. The first currency in any currency pair is called base currency and the

second currency is called the quote currency. The difference in the ask and bid price gives the

spread amount , which goes to the broker as commission.

The bid price is actually the price at which the market is prepared to buy a specific currency pair

in the forex market .This is the price at which the trader sells the base currency. The ask price is

the price at which the market is prepared to sell a currency pair in the forex market .At this price

the trader buys the base currency.

For example ,if the quote for eur/usd has been given as bid 1.2815 and ask price as 1.2820 usd.

Here the trader can buy a euro for 1.2820 and can go for a short at 1.2815.

A standard lot is 100,000 units of the base currency, a mini lot represents 10,000 units ,a micro lot

represents 1000 units and a nano lot represents 100 units of the base currency. A pending order

allows the trader to set orders that will be activated once the price reaches a level chosen by the

trader. The most important four types of pending orders are buy limit,sell limit, sell stop and buy

stop. A buy limit order is executed when a buy order is placed below the current market price. A

buy stop order is entered at a stop price above the current market price. A sell limit order is a sell

pending order that is placed above the market price. A sell stop order is an order to sell a stock if

its price falls to a certain predetermined amount .

4. INDIAN DERIVATIVES

Derivatives are financial products whose value is determined from one or more underlying assets

in a contractual manner. The underlying asset can be commodities or financial assets. Derivative

markets are working on the basis of spot price and future price. Derivative market functions

according to the agreements between parties to the contract. Major function of Derivative contracts

is risk management. The common underlying assets for derivatives are equity shares, equity

indices, debt market securities, interest rates, foreign exchange and commodities. The major

derivative exchanges in India include the following:

• Bombay stock exchange(BSE)

• National Commodity and Derivatives Exchange (NCDEX)

• National stock exchange(NSE)

• Multi Commodity Exchange(MCX)

IBS-J wings Manifest Wealth 12 |

Page

J WINGS MANIFEST WEALTH

Derivative is a contract or a product whose value is derived from value of some other asset known

as underlying. Derivatives are based on wide range of underlying assets. These include:

• Metals such as Gold, Silver, Aluminum, Copper, Zinc, Nickel, Tin, Lead

• Energy resources such as Oil and Gas, Coal, Electricity

• Agri commodities such as wheat, Sugar, Coffee, Cotton, Pulses and

• Financial assets such as Shares, Bonds and Foreign Exchange.

The factors driving the growth of equity derivatives are:

• Increased volatility in asset prices in financial markets

• Increased integration of national financial markets with the international markets

• Development of more sophisticated risk management tools, providing economic agents

a wider choice of risk management strategies

• Innovations in the derivatives markets

DERIVATIVES: FINANCIAL WEAPON OF MASS DESTRUCTION

4.1 HISTORY

The origin of derivatives can be linked to the need of the farmers to protect their crops against

the fluctuations in the price of their crop. Earlier, from the time of sowing to the time of crop

harvest, farmers always faces uncertainties regarding the price of the commodity, but with the

introduction of derivative products farmers are in a position to hedge their price risk by locking

in asset prices. These happens on the basis of certain simple contracts between two parties one

can be a farmer and other can be a merchant or any other interested person to the contract. With

the help of these agreements the supplier is in a position to earn more when the prices fall down

because of high supply during harvest period.

The merchant or the second party to the contract also benefits from the derivative contracts. The

merchant is assured with the supply of certain commodities on a pre determined date for a

predetermined price. This helps him to secure himself from paying more amounts of cash for a

certain commodity in case of scarcity or low supply. In this way both the parties to the contract

will be benefitted from derivative contracts.

The concept of derivatives can be tied to the formation of Chicago Board of Trade (CBOT) in

1845 by a group of farmers and merchants with an aim to safeguard the interest of participants of

the board by predetermining the price of commodities with the help of lock in price. They setup

the world’s first commodity exchange under the name of CBOT in the year 1848.

IBS-J wings Manifest Wealth 13 |

Page

J WINGS MANIFEST WEALTH

The concept became very successful for hedging and speculating the price changes of various

commodities traded and in 1925, the first future clearing house came into existence.

Derivatives have been associated with a number of high-profile corporate events that shocked the

global financial markets over the past two decades. To some critics, derivatives have played an

important role in the near collapses or bankruptcies of Barings Bank in 1995, Long-term Capital

Management in 1998, Enron in 2001, Lehman Brothers in and American International

Group (AIG) in 2008 sub-prime crisis etc. Warren Buffet even viewed derivatives as time bombs

for the economic system and called them financial weapons of mass destruction. But derivatives,

if properly handled, can bring substantial economic benefits. These instruments help economic

agents to improve their management of market and credit risks. They also foster financial

innovation and market developments, increasing the market resilience to shocks.

Derivatives can be of two types mainly;

➢ Financial Derivatives

➢ Commodity Derivatives

4.2 EXCHANGE TRADED MARKETS

This is the market where individuals trade with standardized contracts that has been approved by

the exchange. People have been trading in derivatives exchanges since a long time. In 1848

Chicago Board of Trade (CBOT) was established to bring farmers and merchants together. Initially

their main duty was to standardize the quantities and qualities of the grains that were traded. Within

a very few years the first futures contract was developed and came to be known as the to arrive

contract. The speculators found trading in contracts as more attractive than trading in grain itself.

In 1919 Chicago Mercantile Exchange(CME) was established followed by various exchanges all

over the world. The CBE and CBOT were later emerged to form the CME group, which also

includes the Newyork mercantile exchange ,the commodity exchange (COMEX) , and the Kansas

city Board of Trade (KCBT).

The Chicago Board of Options Exchange started trading on call option contracts on 16 stocks in

1973 .Options were even traded prior to 1973 but CBOE could create an orderly market with well

defined contracts. Put options started trading on the exchange in 1977. The CBOE now trades

options on over 2500 stocks and many different stock indices. Traditionally derivative exchanges

have been using the open outcry system, wherein the traders physically meeting on the floor of the

exchange, shouting and by using various hand signals to indicate the trades that they would like to

place .This open outcry system has been largely replaced by the electronic trading .Wherein the

user enters the trade with the help of a computer terminal and places their trade online. Electronic

markets makes use of computer programs to initiate trades and has led to a growth in high

frequency and algorithm trading.

IBS-J wings Manifest Wealth 14 |

Page

J WINGS MANIFEST WEALTH

4.3 OVER -THE COUNTER MARKETS

This is not a physical market place but a collection of brokers and dealers, scattered across the

country. The main participants in OTC derivative markets are large financial institutions, banks,

fund managers and corporations. Once an OTC trade has been agreed, the two parties can either

present it to a central counterparty (ccp) or clear the trade bilaterally. A CCP takes up the role of

an exchange clearing house, it stands between two parties to the transaction so that one party do

not have to bear the risk of default from another party. Usually participants in the OTC market

have contacted each other through phone and email or finds a counter party through an interdealer

broker . OTC market is less regulated as the trades take place between qualified and capable

counterparties , who are supposed to take care of their trades. At the same time exchange traded

contracts are highly standardized contracts ,whose prices are determined by the interaction of

buyers and sellers on an anonymous auction platform. The clearing house guarantees settlement

of transactions. The number of derivatives transactions per year in OTC market is smaller

compared to that in exchange traded markets. But the average size of the transactions in OTC

market is much greater.

4.5 FINANCIAL DERIVATIVES

Section 2(ac) of securities contract Regulation Act (SCRA) 1956 defines Derivative as “a contract

which derives its value from the prices, or index of prices of underlying securities. Financial

Derivatives can be defined as financial instruments whose value is based on the performance of

assets such as stocks, bonds, currency exchange rates etc. The growing instability in the financial

markets helped the financial derivatives in gaining prominence after1970. The growing instability

includes the collapse of the Bretton Woods system of fixed exchange rates in 1971 which increased

the demand for hedging against exchange rate risk. The Chicago Mercantile Exchange allowed

trading in currency futures in the following year. Advancements in options pricing research, most

notably the Nobel-prize winning Black-Scholes options pricing model introduced in the year 1997,

provided a new framework for portfolio managers to manage risks. In recent years, the market for

financial derivatives has grown in terms of the variety of instruments available, as well as their

complexity and turnover. Financial derivatives have changed the world of finance through the

creation of innovative ways to understand , measure, and manage risk.

Applications Of Financial Derivatives

a. Management of risk: Risk management is not the elimination of risk but the

management of risk. Financial derivatives provide a powerful tool for limiting risks that

individuals and organizations face in the ordinary conduct of their business. It requires a

thorough understanding of the basic principles that regulate the pricing of financial

derivatives. Proper and effective use of financial derivatives can save cost and can also

increase returns.

IBS-J wings Manifest Wealth 15 |

Page

J WINGS MANIFEST WEALTH

b. Efficiency in trading : Financial derivatives allow for free trading of risk components

and that leads to improving market efficiency. Traders can use a position in one or more

financial derivatives as a substitute for a position in the underlying instruments.

c. The underlying instruments: In many instances, traders find financial derivatives to be a

more attractive instrument than the underlying security. This is mainly because of the

greater amount of liquidity in the market offered by derivatives as well as the lower

transaction costs associated with trading a financial derivative as compared to the costs of

trading the underlying instrument in cash market.

d. Speculation : Financial derivatives are considered to be highly risky .If not used properly

these can lead to huge financial destruction. But these are powerful instruments for

knowledgeable traders to expose themselves to calculated and well understood risks for

high returns.

e. Price Stabilization function : Derivative market helps to keep a stabilizing influence on

spot prices by reducing the short-term fluctuations.

4.6 EQUITY DERIVATIVES

An equity derivative is a derivative instrument whose value is derived from underlying assets

based on equity securities. An equity derivative's value will fluctuate with changes in its underlying

asset's equity, which is usually measured by share prices in the spot market. The major types of

equity derivatives are forwards, futures and options. A forward contract is a contractual agreement

between two parties to buy and sell asset at a certain time in future , at a price decided on the date

of the contract .A future contract is an agreement between two parties to buy or sell an asset at a

certain time in the future at a certain price. Options are contracts that grant the right, but not the

obligation to buy or sell an underlying asset at a set price on or before a certain date. The right to

buy is call option and the right to sell is put option.

4.7 COMMODITY DERIVATIVES

Derivative contracts where underlying assets are commodities are called as commodity

derivatives. These underlying assets can include precious metals (gold, silver, platinum), agro

products (coffee, wheat, pepper, cotton), energy products ( crude oil, heating oil, natural gas) etc.

They help in future price discovery of underlying commodities. Here the trade is routed through

certain organized mechanisms. The major focus is that presently farmers are deciding the

commodity to be cultivated for next year is based on the price of the commodity in current year.

Ideally this decision should be based on next year’s expected price. This can be obtained with the

help of the price discovery mechanism of commodity market.

IBS-J wings Manifest Wealth 16 |

Page

J WINGS MANIFEST WEALTH

4.8 PARTICIPANTS IN A DERIVATIVE MARKET

The following are the participants in a derivative market;

Fig 1

PARTICIPANTS

HEDGERS SPECULATORS ARBITRAGERS

▪ Hedgers

Hedgers face the risk associated with price of an asset. They use the futures or

options market to reduce or eliminate the risk. Derivative market with the help of

various instruments will transfer risk from person who have them but may not like

them to those who are ready to take it.

▪ Speculators

Speculators are people who bet on the future movement of the price of an asset.

Instruments like futures and options give them more leverage because by keeping a

small amount of money upfront, they can take large positions in the market. Because

of this leverage they increase the potential for large profits and large gains.

▪ Arbitragers

Arbitragers works on the principle of taking the advantage of variations or

discrepancy in prices across markets. They usually take offsetting positions in two

different markets to lock in the profits. It happens when a trader purchases an asset

cheaply in one location and simultaneously arranges to sell it at a higher price in

another location.

IBS-J wings Manifest Wealth 17 |

Page

J WINGS MANIFEST WEALTH

4.9 DERIVATIVE INSTRUMENTS

▪ Forwards

Forward contracts are agreement between two parties who are agreed to buy/sell the

underlying at a future date at today’s predetermined price. Forward contracts are not

regulated by exchange and because of that they take place over the counter. There

are no formal rules for market stability, integrity and for safeguarding the interest of

market participants in these instruments.

▪ Futures

Future contracts are agreements between two parties to buy or sell some underlying

assets at a future date at today’s future price. They are exchange regulated and hence

over the counter transaction is not allowed. Futures are standardized exchange

traded contracts.

▪ Options

There are mainly two types of options;

❖ Call option: A call option gives the buyer the right not the obligation to buy

a given quantity of underlying asset at a given price on or before the due

date.

❖ Put option: A put option gives the seller the right not the obligation to sell a

given quantity of underlying asset at a given price on or before the due date.

▪ Warrants

Option contracts generally have a life time of maximum twelve months. Most of

the option agreements are for nine months. Option contracts which are traded for

more than nine months are called warrants.

▪ Baskets:

Baskets options are options on portfolio of underlying assets. The underlying asset

will be the weighted average of the assets in the basket. Equity index options are a

form of basket options.

▪ Swaps:

Swaps are agreements between two parties to exchange cash flows in the future

according to some prearranged formula. There are mainly two types of swaps

namely interest rate swaps and currency swaps.

• Interest rate swaps : These entail swapping only the interest related cash

flows between the parties in the same currency.

IBS-J wings Manifest Wealth 18 |

Page

J WINGS MANIFEST WEALTH

• Currency swaps: These entail swapping both principal and interest

between the parties, with the cash flows in one direction being in a

different currency than those in the opposite direction

SIGNIFICANCE OF DERIVATIVES

Like other segments of Financial Market, Derivatives Market serves following specific

functions:

• Derivatives market helps in improving price discovery based on actual valuations and

expectations.

• Derivatives market transfers different risks from those who are exposed to risk but have low

risk appetite to participants with high risk appetite. Like hedgers want to give away the risk

where as traders are willing to take risk.

• Derivatives market helps shift of speculative trades from unorganized market to organized

market. Risk management mechanism provides stability to the financial system.

Various risks faced by the participants in derivatives

Market Participants must understand that derivatives, being leveraged instruments, have risks

like

➢ Counterparty risk (default by counterparty)

➢ Price risk (loss on position because of price move)

➢ Liquidity risk (inability to exit from a position)

➢ Legal or regulatory risk (enforceability of contracts)

➢ Operational risk (fraud, inadequate documentation, improper execution, etc.)

5. FORWARD CONTRACTS

It is an agreement made between two parties to buy / sell an asset on a specific date in the future,

at the conditions decided today. Forwards are widely used in equity, interest rate markets,

commodities & foreign exchange. The exchange happens at a specific price on a specific future

date and the price is fixed by both the parties on the day they enter into contract. All the terms of

the contract like price, quantity and quality of underlying, delivery terms like place, settlement

procedure etc. are decided on the day of entering in contract.

To understand better let’s take an example to understand basic difference between spot market and

forwards?

IBS-J wings Manifest Wealth 19 |

Page

J WINGS MANIFEST WEALTH

Assume on April 9, 2018 you wanted to purchase gold from a goldsmith. The market price for

Gold on April 9, 2018 was Rs. 14,425 for 20 gram and goldsmith agrees to sell you gold at market

price. You paid him Rs.14,425 for 20 gram of gold and took gold. This is a cash market transaction

at a price (in this case Rs.14,425) referred to as spot price. Now suppose you do not want to buy

gold on April 9, 2018, but only after 1 month. Goldsmith quotes you Rs.14,450 for 20 grams of

gold. You agree to the forward price for 20 grams of gold and go away. Here, in this example, you

have bought forward or you are long forward, whereas the goldsmith has sold forwards or short

forwards.

There is no exchange of money or gold at this point of time. After 30 days, you come back to the

goldsmith pay him Rs. 14,450 and collect your gold.

This is a forward contract, where both the parties are obliged to go with the contract irrespective

of the value of the underlying asset (in this case gold) at the point of delivery.

Essential features of a forward are:

• It is a bilateral contract.

• All terms of the contract like price, quantity and quality of underlying, delivery terms like

place, settlement procedure etc. are decided on the day of entering in contract.

In other words, Forwards are bilateral over-the-counter (OTC) transactions where the terms of the

contract, such as price, quantity, quality, time and place are negotiated between two parties to the

contract. Any changes in the terms of the contract are possible only if both the parties agree to it.

Corporations, traders and investing institutions extensively use OTC transactions to meet their

specific requirements. The main objective of entering into a forward is to cap the price and

subsequently avoid the price risk. Thus, by entering into forwards, one is assured of the price at

which one can buy/sell an underlying asset. In the above-mentioned example, if on May 9, 2018

the gold trades at Rs. 16,500 in the cash market, the forward contract becomes favourable to you

because you can then purchase gold at Rs. 14,450 under the contract and sell in cash market at

Rs. 16,500 i.e. net profit of Rs.2050. Similarly, if the spot price is 13,390 then you incur loss of

Rs. 60 (buy price – sell price).

Forward contracts on foreign exchange are also very popular. Most large banks employ both spot

and forward foreign exchange traders. Forward contracts are highly used to hedge foreign currency

risk .Let’s say, if you are planning to place a trade between GBP( great Britain pound) and USD.

Here GBP is the base currency and USD is the quote currency .Lets consider the spot and forward

quotes for the USD/GBP exchange rate on May 6 2018 as follows. On spot market ,the bid price

was 1.5541 and offer price was 1.5545. For three months forward the bid price is 1.5533 and offer

price is 1.5538. Suppose on May 6 2018 ,the US corporation is liable to pay Euro 10 million in 3

months (august 6) .The corporation will agree to buy euro 10 million 3 months forward at an

exchange rate of 1.5538. The corporation now has a long forward contract on GBP and it has

agreed to buy the sum from the bank for 1.5538 million. Thus the bank now has a short forward

contract on GBP.

IBS-J wings Manifest Wealth 20 |

Page

J WINGS MANIFEST WEALTH

5.1 PAYOFFS FROM FORWARD CONTRACTS

The payoffs can be positive or negative. This gives a better idea about the trader’s total loss and

gain. The payoff from a long position in a forward contract on one unit of an asset is denoted as

Pt-K . Where as the payoff from a short position in a forward contract on one unit is denoted as

K-Pt. where K is the delivery price and Pt denotes the price of asset at contract maturity.

In the above example , the contract obligates the corporation to buy euro 10 million for 1553800

dollars. If the spot exchange rate rose to 1.6000 , the corporation earns a profit of 46200 dollars.

At the same time if the spot exchange rate fell to 1.5000 at the end of 3 months , the forward

contract would give a loss of 53800.This would lead to the corporation paying 53800 more than

the market price.

Fig 2

5.2 MAJOR LIMITATIONS OF FORWARD CONTRACT

Liquidity risk:

As forwards are highly customized contracts i.e. the terms of the contract are according to the

specific requirements of the parties, other market participants may not be interested in these

contracts. The investment bank has to find a person who has an opposite view. The investment

bank does this for a fee.

IBS-J wings Manifest Wealth 21 |

Page

J WINGS MANIFEST WEALTH

Counterparty risk:

Counterparty risk is the risk of an economic loss from the failure of counterparty to fulfil its

contractual obligation.This happens when the counterparty defaults. This is also called as default

risk or counterparty risk.

Regulatory Risk :

The forwards contract agreement is executed by a mutual consent of the parties involved and there

is no regulatory authority governing the agreement .This may increase the incentive to default.

Rigidity:

The rigidity of forward agreement is that they cannot foreclose the agreement halfway through.

Future contracts were then designed to reduce the risk of forward agreements.

6. OPTIONS CONTRACT

Options are traded in the Indian markets for over 15 years, but the real liquidity was available only

since 2006.An option is a tool for protecting your position and reducing risk. An option is a

contract that gives the right but not an obligation, to trade the underlying asset on or before a stated

date/day , at a stated price ,for a price. The party taking a long position i.e entering the option is

called buyer/holder of the option and the party taking a short position i.e selling the option is called

the seller/writer of the option.

A buyer of the call option has the right and the seller has an obligation to make delivery .The

option buyer has the right but not the obligation with regards to buying or selling the underlying

asset, while the option writer has the obligation in the contract.Therefore, option buyer/ holder will

exercise his option only when the situation is favourable to him, but, when he decides to exercise,

option writer would be legally bound to honour the contract. Options may be categorized into two

main types:-

Call Options: Options, which gives buyer a right to buy the underlying asset

Put Options: Options which gives buyer a right to sell the underlying asset

At the time of agreement the option buyer pays a certain amount to the option seller ,this is called

the premium amount. The agreement happens at a pre specified price called the strike price.The

option buyer benefits only if the price of the asset increases higher than the strike price. If the asset

price stays at or below the strike price ,the buyer does not benefit and thus its always advisable to

buy options when you really expect the prices would increase. Options are cash settled in India.

Similar to futures contract, options contract also have an expiry. They expire on the last Thursday

of every month. Option contracts have different expires- the current month, mid month and far

month contracts.

IBS-J wings Manifest Wealth 22 |

Page

J WINGS MANIFEST WEALTH

Buy a put option when you are bearish about the prospects of the underlying and when you are

bullish on the underlying one can either buy a call option or sell a put option. The maximum loss

the buyer of a call option experiences is to the extend of the premium paid. The loss is experienced

as long as the spot price is below the strike price. The call option buyer has the potential to make

unlimited profits provided the spot price moves higher than the strike price.The point at which the

call option buyer completely recovers the premium he has paid that is called the breakeven point.

The call option buyer truly starts making a profit only beyond the break even point. Selling a put

option required you to deposit a margin. When you sell a put option your profit is limited to the

extend of the premium you receive and your loss can potentially be unlimited.

Fig 3

6.1 OPTIONS TERMINOLOGY

a) Index option: Options having index such as Nifty, Sensex, etc. as an underlying asset.

b) Stock option: These options have individual stocks as the underlying asset. For example,

option on ONGC, NTPC etc.

IBS-J wings Manifest Wealth 23 |

Page

J WINGS MANIFEST WEALTH

c) Buyer: Option Buyer is the one who has a right but not the obligation in the contract. For

owning this right, he pays a price to the seller of this right called ‘option premium’.

d) Writer: Option writer is one who receives the option’s premium and is thereby obliged to

sell/buy the asset if the buyer of option exercises his right.

e) Option price/Premium: It is the price which the option buyer pays to the option seller. In

the above screenshot of nifty option, the premium amount is 1207.95.

f) Lot size: Lot size is the number of units of underlying asset in a contract. Lot size of Nifty

option contracts is 50.

g) Expiry Day: It is the day on which a derivative contract expires. It is the last trading

date/day of the contract. In our example, the expiration day of contracts is the last Thursday

of every month i.e. for current month options will expire on 26 April, 2018.

h) Spot price (S): 10404.50 is the spot price for nifty here in the above example. It is the

price at which the underlying asset is traded at the spot market.

i) Strike price or Exercise price (X): strike price for 9200 Call option is 9200. It is the price

per share for which the underlying security may be purchased or sold by the option holder.

j) In the money (ITM) option: This option would give holder a positive cash flow, if it

were exercised immediately. A call option is said to be ITM, when spot price is higher than

strike price. And, a put option is said to be ITM when spot price is lower than strike price.

k) At the money (ATM) option: At the money option would lead to zero cash flow, if it were

exercised immediately. Therefore, for both call and put ATM options, strike price is equal

to spot price.

l) Out of the money (OTM) option: In other words, this option would give the holder a

negative cash flow if it were exercised immediately. A call option is said to be OTM, when

spot price is lower than strike price. And a put option is said to be OTM when spot price is

higher than strike price.

m) Intrinsic value: Option premium, defined above, consists of two components - intrinsic

value and time value. For an option, intrinsic value refers to the amount by which option

is in the money i.e. the amount an option buyer will realize, before adjusting for premium

paid, if he exercises the option instantly.

IBS-J wings Manifest Wealth 24 |

Page

J WINGS MANIFEST WEALTH

n) Time value: It is the difference between premium and intrinsic value, if any, of an option.

ATM and OTM options will have only time value because the intrinsic value of such

options is zero.

o) Open Interest: As discussed in futures section, open interest is the total number of option

contracts outstanding for an underlying asset. For example 9200 CE has an open interest

of 68475.

The table below shows the list of stock options registered under national stock exchange. The table

also contains the respective underlying asset, expiry date , strike price and also data on open, high,

low, prev close and last price.

Fig 4

IBS-J wings Manifest Wealth 25 |

Page

J WINGS MANIFEST WEALTH

7. FUTURES CONTRACT

Futures markets were innovated to overcome the limitations of forwards. A futures contract is an

agreement made through an organized exchange to buy or sell a fixed amount of a commodity or

a financial asset on a future date at an agreed price. Simply, futures are standardized forward

contracts that are traded on an exchange. The clearinghouse associated with the exchange

guarantees settlement of these trades. A trader, who buys futures contract, takes a long position

and the one, who sells futures, takes a short position. The words buy and sell are figurative only

because no money or underlying asset changes hand, between buyer and seller, when the deal is

signed. Mostly future contracts are cash settled thus there is no worry of moving the asset from

one place to another and there is total transparency in the cash settlement.

The futures agreement inherits the transactional structure of the forwards contract. A futures

agreement derives its value from its corresponding underlying asset in the spot market. For

example TCS futures derives its value from the underlying in the TCS share market. These are

highly standardized contracts whose variables are predetermined- lot size and expiry date.

a) To enter into a futures agreement one has to deposit a margin amount ,which is a certain

percent of the contract value. Margin allows us to deposit a small amount and take exposure

to a large value transaction and hence leveraging on the transaction.

b) When we transact in a futures contract ,we digitally sign the agreement with the counter

party and thus becomes obliged to honor the contract upon expiry.

c) The futures agreement is then tradable, the trader can hold it till the expiry or trade it in

between. The trader can take a long position if he expects the price to go up and can go for

a short if the prices will go down.

d) Equity futures are always cash settled. Future agreements are called zero sum game

because it allows one to transfer money from one pocket to another.

In the futures market ,all the trades are regulated by the exchange .The exchange in return takes

the burden of guaranteeing the settlement of all the trades. The exchange makes sure that the people

who are entitled to profits receive the same and also they ensure that they collect the money from

the party who is supposed to pay up. They do this by collecting the margins and by marking the

daily profits or losses to the market. The futures market in India is regulated by SEBI securities

and exchange board of India.

7.1 FEATURES OF FUTURES CONTRACT

In futures market, exchange decides all the contract terms of the contract other than price.

Accordingly, futures contracts have following features:

• Contract between two parties through Exchange

• Centralised trading platform i.e. exchange

• Price discovery through free interaction of buyers and sellers

IBS-J wings Manifest Wealth 26 |

Page

J WINGS MANIFEST WEALTH

• Margins are payable by both the parties

• Quality decided today (standardized )

• Quantity decided today (standardized)

7.2 FUTURES TERMINOLOGY

a) Underlying asset: An underlying asset is a financial instrument from which a derivative

derives its value.Underlying assets can be metals ,agricultural commodities ,stock, index

etc. The futures price completely mimics the underlying as when the price of underlying

goes up the price of futures also rises. Likewise when the price of underlying goes down

the future price also comes down.

b) Spot price: This is the price at which the asset trades in the regular market or spot market.It

is the current market price.For example if we are talking about gold as an underlying then

the price of gold in spot market is spot price and gold in futures market is called gold

futures.

c) Future Price: The price at which the asset is traded at futures market.

d) Lot Size : Futures is a standardized contract where everything related to the agreement is

predetermined. Lot size is one such parameter. Lot size specifies the minimum quantity

that you will have to transact in a futures contract. Lot size varies from one asset to another.

e) Contract Value : Futures contracts are traded in lots and to arrive at the contract value we

have to multiply the price with contract multiplier or lot size or contract size. Contract

value = Futures price *Lot size.

f) Margin: Margin amount is a percent of contract value that is paid as a token advance in

the beginning. It is paid for entering into the contract. Margin allows investors to deposit a

small amount of money and take exposure to a large value transaction. This initial margin

includes span margin and exposure margin.

a. At the time of initiating the futures position , margins are blocked in one’s trading

account.

b. The margins that get blocked are called the initial margin.

c. The initial margin is made up of span margin and exposure margin

d. Initial margin will be blocked in your trading account for how many ever days the

trader choose to hold the trade.

IBS-J wings Manifest Wealth 27 |

Page

J WINGS MANIFEST WEALTH

g) Expiry :Future contracts are time bound .The expiry date of the futures contract is the date

upto which the agreement is valid. It is the date till which the one can hold the future

agreement. All derivative contracts in India expire on the last Thursday of the month.

h) Open Interest: Open interest is the total number of open or outstanding (not closed or

delivered) options and/or futures contracts that exist on a given day, delivered on a

particular day. It gives an idea of how many contracts are open and live in the market.

i) Hedging: This is a technique to ensure that your position in the market is not affected by

any adverse movements. When a position is hedged it becomes neutral to the overall

market position and thus this will neither make money nor lose money.

j) Bid and Ask prices :Bid prices are those provided by buyers who want to buy shares or

futures .Ask prices are those quoted by sellers who want to sell shares or futures or other

products at these prices, The difference between the ask and bid price is called as the

spread.

k) Mark To Market (M2M) :Marking to market or mark or market is a simple accounting

procedure which involves adjusting the profit or loss you have made for the day.

7.3 KINDS OF TRANSACTIONS IN FUTURES

• Opening buy means creating a long or buy position ,this happens when the investor believes

that the stock prices would rise

• Opening Sell means creating a Short Position .When we believe that the price of stock is

going to decline ,we opt for a short position.

• Closing Buy means offsetting (fully or partly) an earlier Short Position

• Closing Sell means offsetting (fully or partly) an earlier Long Position

Square off is closing an existing futures position. The square off for a buy open position

would be to sell and the square off for for a sell is to go for a long position.

The table below shows the list of stock futures registered under National Stock Exchange. The

table also contains the respective underlying asset, expiry date , strike price and also data on open,

high, low ,previous close and last price.

IBS-J wings Manifest Wealth 28 |

Page

J WINGS MANIFEST WEALTH

Fig 5

7.4 CURRENCY FUTURES

The future contracts on various currency pairs are knows as currency futures. Currently the future

contracts that are available are : USD/INR, EURO/INR, GBP/INR and JPY/INR. These contracts

are allowed to be traded on NSE and MCX. The contracts are very similar in nature and have to

be cash settled .Some of the contract details are as follows :

The symbols are USDINR ,EURINR, GBPINR and JPYINR , respectively. The underlying asset

here is actually the exchange rate of the respective currencies in Indian rupees; It is the exchange

rate for USD 1 in INR , EURO 1 in INR ,GBP 1 in INR and JPY 100 in INR.One unit of trading

in currency futures denotes USD 1000 and the tick size is INR 0.0025(i.e 0.25 paisa ). The contract

can be traded between 9am and 5:00 pm Monday to Friday .The contract trading cycle is a 12

month trading cycle with the last trading day being two working days prior to the last business

day of the expiry month of the contract at 12:00 noon .

IBS-J wings Manifest Wealth 29 |

Page

J WINGS MANIFEST WEALTH

The final settlement day is the last working day (excluding Saturday ) of the expiry month.The

base price is the theoretical price on the first day of the contract ; for all other days it is the daily

settlement price , which is calculated based on the last half an hour weighted average price.The

final settlement price is the Reserve Bank of India reference rate .Also the contract follows a

“T+2” cycle for the final settlement.

The position limits for trading members are as follows :

➢ For USD/INR contracts , the limit is 15% of the toal open position or USD 50 million

whichever is higher

➢ For EUR/INR contracts ,the limit is 15% of the total open position or Euro 25

million,whichever is higher

➢ For GBP/INR contracts ,the limit is 15% of the total open position or GBP 25 million ,

whichever is higher

➢ For JPY/INR contracts , the limit is 15% of the total open position or JPY 1000 million ,

whichever is higher.

The minimum initial margin is based on SPAN and the extreme loss margin is

• 1% of the mark to market value of all open positions for USD/INR

• 0.3% of the mark to market value of all open positions for EUR/INR

• 0.5% of the mark to market value of all open positions for GBP/INR

• 0.7% of the mark to market value of all open positions for JPY/INR

7.5 SPECULATION USING FUTURES

Speculation is basically the act of trading in an asset that has a significant risk of losing money

with the expectation of making a gain. The speculators wishes to take a position in the market. So

speculators will either bet that the price of the asset will go up or they will bet that the price of the

asset will go down.

Lets consider a US speculator who in march thinks that the British pound will strengthen relative

to the US dollar over the next two months and is planning to invest to the extend of 250000 pounds.

One thing the speculator can do is to purchase 250000 pounds in spot market in the hope that the

sterling can be sold at higher prices in the future market. Another alternative is to take a long

position in four CME May futures contracts on sterling. Each futures contract is worth 62500

pounds.

IBS-J wings Manifest Wealth 30 |

Page

J WINGS MANIFEST WEALTH

Buy 250000 pounds Buy 4 futures contracts

Spot price=1.5470 Future price=1.5410

Investment $386750 $20000

Profit if May spot =1.6000 $13250 $14750

Profit if May spot=1.5000 -$11750 -$10250

The above table gives a picture about the profits and losses made on both the alternatives. If the

rate increases to 1.6000 dollars per pound in May, the futures contract alternative enables the

speculator to realize a profit of (1.6000-1.5410) *250000 = $14750.

The spot market alternative leads to 250000 units of an asset being purchased for $ 1.5470 in

March and sold for $1.6000 in April , so that a profit of ( 1.6000-1.5470 )*250000=$13250 would

be made. At the same time consider a situation where the exchange rate falls to 1.5000 dollars per

pound. The futures contract gives rise to a loss of ( 1.5410-1.5000)*250000= $10250 and the spot

market alternative gives rise to a loss of (1.5470-1.5000) =$11750 .Thus it becomes very evident

from the example that the futures alternative is favourable.The initial investment that was made in

the spot market for buying sterlings were 250000*1.5470=$ 386750 .Whereas the investor just had

to deposit a small sum of amount in the margin account. It was $5000 for one contract and thus

$20000 for four futures contract.

7.6 OPERATION OF MARGIN ACCOUNTS

One of the most important role of exchange is to organize trades , so that contract defaults are

avoided .This is where margin accounts comes into picture. Margin allows us to deposit a small

amount of money and takes exposure to a large value of transaction , thereby helping the trader to

leverage on the transaction. The exchanges set the margin levels and are constantly required to

review the rates as per the market volatility. The margin amounts can go up and down as well. The

forwards market doesn’t have a regulator, but all the trades in futures market are routed through

the exchange. The exchange here in return takes the burden of guaranteeing the settlement of all

the trades. The exchange makes sure that the deserving party receives the amount . They ensure

that they collect the money from the right party who is supposed to pay up.

At the time of initiating a futures position, the margins are blocked in the trading account .The

margins that get blocked is called the initial margin .The initial margin is actually a combination

of the Span margin and exposure margin. Initial margin would be blocked in the trading account

for how many ever days you choose to hold the futures trade .Span margin or maintenance margin

is the minimum requisite margins blocked as per the exchange’s mandate .

IBS-J wings Manifest Wealth 31 |

Page

J WINGS MANIFEST WEALTH

Exposure margin is blocked over and above the span to cushion for any mark to market losses.It

is collected as per the broker’s requirement .Both span and exposure are specified by the exchange.

Span margin is more important as not having this in your account may lead to a penalty in the

exchange .As the volatility rises , the span margin also rises. The moment the cash balance falls

below the maintenance margin , they will call you asking you to pump in more money .In the

absence of which they will force close the positions themselves .This call the broker makes

requesting to pump in money is called the margin call. The margins vary from one underlying to

the another.

To illustrate how margin accounts work , we can consider an investor who contacts his broker to

buy two December gold futures contracts.We can take current future price as 1450 per ounce . As

the contract size is 100 ounces, the investor is required to buy a total of 200 ounces at this price.

The broker will require the investor to deposit funds in a margin account .This fund deposited at

the time of entering into the contract is known as initial margin .Let’s suppose thus us 6000 per

contract and 12000 in total here .At the end of each trading day , the margin account is adjusted to

reflect the investor’s gain or loss .This is known as the daily settlement or marking to market .

Suppose at the end of first day the futures price has dropped by $9 from $1450 to $1441. The

investor here will have a loss of $ 1800 (200*9) , because the gold can now only be sold at $1441.

The balance in the margin account will reduce to 10200 from 12000.A trade is first settled at the

close of the day on which it takes place .It is then settled at the close of trading on each subsequent

day.The investor has the full right to withdraw any balance in the margin account in excess of the

initial margin.

The daily settlement is not just an arrangement between broker and client. Whenever there is a

decrease in futures price , the margin account of an investor with long position would be reduced

by that specific amount. In the example given here $1800 would be reduced from the investor’s

account. The investor’s broker has to pay the exchange clearing house $1800 and this money is

passed on to the broker of an investor with a short position. Similarly when there is an increase in

the futures price ,brokers for parties with short positions pay money to the exchange clearing house

and brokers for parties with long positions receive money from the exchange clearing house.

The exchange ensures that the balance in the margin account never becomes negative with the help

of maintenance margin, which would be somewhat lower than the initial margin. At this point

when the balance in the margin account falls below the maintenance margin , the investor receives

a margin call and is expected to top up the margin account to the initial margin level by the end of

the next day.The extra funds deposited are known as a variation margin .If the investor does not

provide variation margin ,the broker closes out the position. Here in the example , closing out the

position involves selling off 200 ounces of gold for delivery in December.

IBS-J wings Manifest Wealth 32 |

Page

J WINGS MANIFEST WEALTH

The table given below illustrates the operation of margin account for one possible sequence of

futures prices.The maintenance margin is assumed to be $4500 per contract or $9000 in total .On

day 7 the balance in the margin account falls $1020 below the maintenance margin level.This

leads to a margin call and the investor is supposed to add up $4020 to bring the account balance

upto the initial margin level of $12000.The investor here provides this margin by the close of

day 8. The contract is entered into on day 1 at $1450 and closed out on Day 16 at $1426.90.The

margin is the only factor that provides confidence to market participants that others will meet the

obligations on time.

Table 1

Day Trade Settlement Daily Cumulative Margin Margin

Price Price Gain Gain Account Call

Balance

1 1450 12000

1 1441.00 -1800 -1800 10200

2 1438.30 -540 -2340 9660

3 1444.60 1260 -1080 10920

4 1441.30 -660 -1740 10260

5 1440.10 -240 -1980 10020

6 1436.20 -780 -2760 9240

7 1429.90 -1260 -4020 7980 4020

8 1430.80 180 -3840 12180

9 1425.40 -1080 -4920 11100

10 1428.10 540 -4380 11640

11 1411.00 -3420 -7800 8220 3780

12 1411.00 0 -7800 12000

13 1414.30 660 -7140 12660

14 1416.10 360 -6780 13020

15 1423.00 1380 -5400 14400

16 1426.90 780 -4620 15180

7.7 LEVERAGE

Futures are highly leveraged products , this one factor makes futures more appealing and also a

risky venture. Leverage here in futures trading means that the traders here have to pay only a

small amount to the exchange to control a lot of product. The margin amount is only a small

percentage of the contract value .This small amount facilitate the investors to take exposure for a

large value transaction. The higher the leverage, the higher is the risk and the higher is the profit

potential.

IBS-J wings Manifest Wealth 33 |

Page

J WINGS MANIFEST WEALTH

The higher the leverage the higher is the risk .When leverage is high ,only a small movement in

the underlying is required to wipe out the margin deposit

Let’s understand the role of leverage in a better way with the help of an example considering two

situations. Take for example , Mr M plans to buy shares of Infosys in spot market to the extend of

100000 . On 30th April 2018 , the Infosys share is traded at a price of 1168. Thus Mr M can afford

to buy 86 shares of Infosys.

100000/1168 = 86

Now on May 7th , when Infosys is trading at 1300 .Mr M can square off the position for a profit

of 11800 on investing 100000.

86*1300 =111800 ,

The return percentage would be 11800/100000=.1180 or 11.80 %

A return of 11.80 % on a 7 days time is a great thing. Now lets look at another alternative when

Mr M decides to buy Infosys futures of 100000 worth in futures market .The minimum number of

shares that needs to be bought in Infosys is 125 or in multiples of 12 .Thus the contract value is

the lot size multiplies by the futures price .In this case the futures price is 1168 per share , hence

the contract value becomes

125 *1168=146000. Here he doesn’t have to pay the entire contract value instead he only pays the

margin amount and can enter the trade .The margin amount is a certain percent of contract value

and here when we take a 14% , it happens to be 146000 *14%=20440. Thus Mr M can easily take

4 lots of the contract instead of 1 lot .Thus with 4 lots of Infosys futures the number of shares

would be 500 (125*4)- at the cost of 81760.

Futures contract value at the time of buying =Lot size * number of lots *Futures Buy price

=125*4* Rs 1168

=Rs 584000/-

Margin amount – Rs 81760

Futures Sell price = 1300

Futures contract Value at the time of selling = 125 *4*1300 =Rs 650000

Thus a profit of Rs 66000

Hence the return percent becomes [66000/81760] *100 =80.72%

That’s becomes a large amount of profit from Infosys futures .Thus the investor can earn a return

of 80.72% from investing in futures market . The same person could only earn an approx. 12%

return from investing in the spot market of the same security. Thus by virtue of margins,the

investors can take positions much bigger than the actual capital available , this is called

“Leverage”. Its like a double edged sword, if used in the right spirit and knowledge , it can lead to

the creation of wealth or else can even wipe out your account. The higher the leverage ,the higher

is the risk associated with the trade. When you are trading with a high leverage ,only a small move

in the underlying is required to wipe out the margin deposit.

IBS-J wings Manifest Wealth 34 |

Page

J WINGS MANIFEST WEALTH

LEVERAGE CALCULATION

The leverage calculated as follows :

Leverage =Contract value / Margin

Hence for the above Infosys trade the leverage one lot is

146000/20440 =7.14

This means every Re 1 in the trading account can buy upto Rs7.14 worth of Infosys. This is a very

manageable ratio.However if the leverage increases then the risk also increases. At 7.14 times

leverage , Infosys has to fall by 14% for one to lose all the margin amount ,this is calculated as

follows –

=1/7.14

=14%

Now for a moment assume the margin requirement was just Rs 5000 ,instead of 20440 .In this

case the leverage would be

=146000/5000

=29.2 times

This is clearly a very high leverage ratio ,the investor would lose all his capital if Infosys falls by

1/29.2

=3.4%

Here is this case , a 3.4% move in the underlying is enough to wipe out all your margin

deposit.Alternatively , at 29.2 times leverage one just need a 2.4% move in the underlying to

double your money.Thus the higher the leverage ,the higher is the risk. From the above calculations

its evident that , the more the margin the less would be the leverage associated with it .Whereas

when the margin amount is less , the leverage would be high and thus more risky.

7.8 PAY OFF STRUCTURE

The payoff structure plots a graph of the possible price on the day you bought the share versus the

buyer’s profit and loss. In case of a long position -Any price above the buy price results in a profit

an any price below the buy price results in a loss.If the trader has initiated a short position – then

any price below the short price will result in a profit and any price above the short price lead to a

loss.Since the traders here takes place trades in lots , just one point price movement results in a

gain of (1* lot size ) and the same with a one point negative movement. The proportionality comes

from the basic fact that the money made by the buyer is the loss suffered by the seller. The profit

and loss is a smooth straight line thus its called as a linear pay off instrument.

IBS-J wings Manifest Wealth 35 |

Page

J WINGS MANIFEST WEALTH

The pay off for buyers of futures contract is similar to the pay off for a person who holds an asset.

He has a potentially unlimited upside and downside as well. Consider for example the case of a

speculator who buys a two month Nifty Index futures contrtact when the nifty stands at 1220 .The

underlying asset in this case is the nifty portfolio .When the index moves up , the long futures

position starts giving profits and when the index moves down it starts making losses.

The graph below represents the pay off structure for futures during a long position. If SPm is the

spot price on maturity and PP is the purchase price ,then the pay off on a long position per one

unit of the asset is “SPM-PP”.

Fig 6

The payoff for a person who sells a future contract is similar to the payoff for a person who shorts

an asset .For example take the case of a speculator ,who sells a two month Nifty index futures

contract when the nifty stands at 1290 .The underlying asset in this case is the nifty index. When

the index moves down ,the short futures position start making profits and when the index moves

up , it starts making losses.

If SPm is the spot price on maturity and PP is the purchase price ,Then the pay off on a short

position per one unit of the asset is “PP-SPm “ .

IBS-J wings Manifest Wealth 36 |

Page

J WINGS MANIFEST WEALTH

Fig 7

7.9 HEDGING WITH FUTURES

A majority of the investors in futures market are hedgers . Their main motive is to use futures

markets to reduce a particular risk that they face. Hedging position is undertaken by the investors

inorder to eliminate the risk. When an individual or company chooses to use futures market to

hedge a risk , the objective is to take a position that neutralizes the risk as far as possible .

Lets consider an example where an investor takes an hedging position against a single stock.

Imagine if we bought 250 shares of Infosys at 2300 per share .This works out to be an investment

of 575000. Here the investor is long on Infosys shares in the spot market.

After initiating this position , the investor realize that the quarterly results are expected soon.The

investor is worried that Infosys may announce a not so favorable set of numbers , as a result of

which the stock price may decline considerably .To avoid making a loss in the spot market , the

investor decides to hedge the position.

Thus , in order to hedge the position in spot market , the investor here took a short position in the

futures market for 250 shares at a price of 2301 per share.Thus the contract value becomes 575250

and the lot size is 250 . Now on one hand the investor is long on Infosys in spot market and on the

other hand he is short on Infosys on futures market.Thus the investor could create a neutral position

here.

IBS-J wings Manifest Wealth 37 |

Page

J WINGS MANIFEST WEALTH

Arbitrary price Long on spot Short on Futures Net P & L

P&L P&L

2200 2200-2300= -100 2301-2200= 101 -100+101= 1

2400 2400-2300= 100 2301-2400= -99 100-99= 1

2550 2550-2300= 250 2301-2550 = -249 250-249 =1

Fig 8

In the above figure , the investor has taken a long position in the spot market and a short position

in the futures market. The above example neither make money nor lose money , the overall position