Académique Documents

Professionnel Documents

Culture Documents

Trust Receipts Law PD 115 Notes

Transféré par

Juris Renier Mendoza0 évaluation0% ont trouvé ce document utile (0 vote)

309 vues39 pagesThis document summarizes key aspects of Philippine trust receipts law under Presidential Decree No. 115. It defines a trust receipt as a written agreement signed by an entrustee in favor of an entruster regarding goods, documents, or instruments. The law aims to encourage financing of imports and purchases by allowing banks to release goods to buyers (entrustees), who agree to hold them in trust, dispose of the proceeds to the bank, and return the goods if unsold. The entrustee's violation of the trust receipt terms, such as by misappropriating goods or funds, constitutes estafa and can result in criminal penalties under the decree.

Description originale:

ok

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThis document summarizes key aspects of Philippine trust receipts law under Presidential Decree No. 115. It defines a trust receipt as a written agreement signed by an entrustee in favor of an entruster regarding goods, documents, or instruments. The law aims to encourage financing of imports and purchases by allowing banks to release goods to buyers (entrustees), who agree to hold them in trust, dispose of the proceeds to the bank, and return the goods if unsold. The entrustee's violation of the trust receipt terms, such as by misappropriating goods or funds, constitutes estafa and can result in criminal penalties under the decree.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

309 vues39 pagesTrust Receipts Law PD 115 Notes

Transféré par

Juris Renier MendozaThis document summarizes key aspects of Philippine trust receipts law under Presidential Decree No. 115. It defines a trust receipt as a written agreement signed by an entrustee in favor of an entruster regarding goods, documents, or instruments. The law aims to encourage financing of imports and purchases by allowing banks to release goods to buyers (entrustees), who agree to hold them in trust, dispose of the proceeds to the bank, and return the goods if unsold. The entrustee's violation of the trust receipt terms, such as by misappropriating goods or funds, constitutes estafa and can result in criminal penalties under the decree.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 39

Trust Receipts Law

(P.D. No. 115)

Origin of Trust Receipts

• The device first came into general use in

importing transactions, where goods were

consigned directly to a bank which paid a

draft for the price on the credit of the

intended buyer who engaged to repay the

bank’s advances

Policy Objectives/Purpose

1.To encourage and promote the use of

trust receipts.

2.To provide for the regulation of trust

receipt transactions

3.To penalize violations as a criminal

offense (Sec. 2)

Definition

What is a ‘Trust Receipt’?

• It is a written or printed document signed by

the entrustee in favor of the entruster

containing terms and conditions

substantially complying with the provisions

of the Trust Receipts Law. (Sec. 3, cf. Sec. 4)

• Ruth wants to buy ingredients and supplies for

her new restaurant.

• But she doesn't have enough money as she is

only starting.

• Her friend Trina tells her: "You can borrow

money from the bank!“

• Ruth applies for a letter of credit the bank.

• The bank finance Ruth’s purchases of supplies.

• Ruth receives the ingredients.

• Ruth executes a Trust receipt in favor of the

bank.

How does it work?

Trust Receipts Letters of Credit

bank releases the bank substitutes its

goods to the entrustee, promise to pay for the

who promises to promise of a customer

deliver the proceeds or who in turn promises

return the goods to the to pay the bank.

bank.

South City Homes v. BA Finance

• A trust receipt is a security transaction

intended to aid in financing importers and

retail dealers who do not have sufficient

funds or resources to finance the importation

or purchase of merchandise, and who may

not be able to acquire credit except through

utilization, as collateral, of the merchandise

imported or purchased.

South City Homes v. BA Finance

• In the event of default by the entrustee on his

obligations under the trust receipt agreement, it

is not absolutely necessary that the entruster

cancel the trust and take possession of the goods

to be able to enforce his rights thereunder.

• Entruster has the discretion to avail of such right

or seek any alternative action, such as a third

party claim or a separate civil action which it

deems best to protect its right, at any time upon

default or failure of the entrustee to comply with

any of the terms and conditions of the trust

agreement.”

Ching v. CA

• A trust receipt is a document in which is

expressed a security transaction where

under the lender, having no prior title in

the goods on which the lien is to be given

and not having possession which remains

in the borrower, lends his money to the

borrower on security of the goods which

the borrower is privileged to sell clear of

the lien with an agreement to pay all or

part of the proceeds of the sale to the

lender.

Ching v. CA

• It is a security agreement pursuant to which a

bank acquires a "security interest" in the

goods. It secures an indebtedness and there can

be no such thing as security interest that

secures no obligation.

• It could never be a mere additional or side

document as alleged by petitioner. Otherwise, a

party to a trust receipt agreement could easily

renege on its obligations thereunder, thus

undermining the importance and defeating with

impunity the purpose of such an indispensable

tool in commercial transactions.

• Form and Content

• No particular form required but it must substantially

contain:

(1) a description

(2) the total invoice value of the goods and the amount

of the draft to be paid by the entrustee

(3) an undertaking or a commitment of the entrustee

to:

- hold in trust for the entruster

- dispose of them in the manner provided for in

the TR and

- to turn over the proceeds (Sec. 5)

• Subjects of a Trust Receipt Transaction

• Goods, Documents or Instruments

Parties

Entruster – person holding title over the

goods, documents or instruments

Entrustee – person having or taking

possession of goods, documents or

instruments (Sec. 3)

Concept of Trust Receipt Transaction

• a real security transaction where a person

who owns or holds absolute title or security

interests over certain specified goods,

documents or instruments releases the same

to the possession of another person who

binds himself to hold the goods etc in trust

and to sell or otherwise dispose of the same

with the obligation to turn over the proceeds

thereof (Sec 4)

Two Features of a Trust Receipt

Transaction

1. Loan Feature

- Entruster financed the importation or

purchase.

2. Security Feature

- Secure the performance of an

obligation of the entrustee or of some

other third persons in favor of the

entruster.

Nacu v. CA

• A letter of credit-trust receipt arrangement is

endowed with its own distinctive features and

characteristics. Under that set-up, a bank

extends a loan covered by the letter of credit,

with the trust receipt as a security for the

loan. In other words, the transaction involved

a loan feature represented by the letter of

credit, and security feature which is in the

covering trust receipt. .

Ownership of the Goods, Documents and

Instruments under a Trust Receipt

• Who holds title?

• The entruster takes the full title to the goods at the very

beginning—as soon as goods are bought and paid by

him.

• Who holds the goods?

• Entrustee is factual owner.

• Entruster’s ownership is merely legal fiction. (Abad vs.

CA)

• Who has better right?

• Entruster v. Creditor of Entrustee /Innocent Purchasers

for Value

Robles v. CA

• In the case at bar, the acts of petitioner which

were complained of were committed between

19 November 1976 and 9 March 1977, that is,

long after the beginning date of effectivity of

Presidential Decree No. 115.

• Does the penal provision of PD 115 (Trust

Receipts Law) apply when the goods

covered by a Trust Receipt do not form

part of the finished products which are

ultimately sold but are instead,

utilized/used up in the operation of the

equipment and machineries of the

entrustee-manufacturer or use in the

construction of communication towers?

Allied v. Ordonez

• The trust receipts, there is an obligation to repay

the entruster. Their terms are to be interpreted

in accordance with the general rules on

contracts, the law being alert in all cases to

prevent fraud on the part of either party to the

transaction. The entrustee binds himself to sell or

otherwise dispose of the entrusted goods with

the obligation to turn over to the entruster the

proceeds if sold, or return the goods if unsold or

not otherwise disposed of, in accordance with the

terms and conditions specified in the trust

receipt. A violation of this undertaking

constitutes estafa under Sec. 13, PD 115.

Ng v. People of the Philippines

• It must be remembered that petitioner was transparent to

Asiatrust from the very beginning that the subject goods were

not being held for sale but were to be used for the fabrication

of steel communication towers in accordance with his

contracts with Islacom, Smart, and Infocom. In these

contracts, he was commissioned to build, out of the

materials received, steel communication towers, not to sell

them.

• The true nature of a trust receipt transaction can be found in

the "whereas" clause of PD 115 which states that a trust

receipt is to be utilized "as a convenient business device to

assist importers and merchants solve their financing

problems." Obviously, the State, in enacting the law, sought to

find a way to assist importers and merchants in their financing

in order to encourage commerce in the Philippines.

Rights of the Entruster

• The entruster shall be entitled:

–Proceeds

–Return

–Enforce all other rights, sell the goods

with at least 5 days notice

–Cancel and take possession upon

default

Obligations of the Entrustee

• hold the goods in trust

• dispose of them strictly in accordance with TR's

terms and conditions

• receive the proceeds in trust

• turn over the proceeds to enstruster

• insure the goods for their total value against fire,

theft, pilferage or other casualties

• keep the goods or proceeds separate and

capable of identification as property of entruster

• return in the event of non-sale or upon demand

• observe all other terms and conditions of the TR

Disposition of the Proceeds

1. Expenses of the sale,

2. Expenses derived from re-taking,

keeping and storing the goods,

documents and instruments, and

3. Principal obligation

What if there is deficiency? Excess?

Remedies Available

• Entrustee always bound to pay loan.

– Sec. 7, PD 115 expressly provides that

entrustee shall be liable to entruster for any

deficiency.

• No Option to Abandon Goods to Set-off Loan

– Entrustee-borrower cannot be relieved of

his obligation to pay the loan simply by

abandoning property with bank.

Penalty for Breach of Entrustee

• Entrustor may File Estafa Charges Against Entrustee

• Art. 315 Revised Penal Code

1. With unfaithfulness or abuse of confidence, namely:

…

• (b) By misappropriating or converting, to the

prejudice of another, money, goods, or any other

personal property received by the offender in trust or

on commission, or for administration, or under any

other obligation involving the duty to make delivery of

or to return the same, even though such obligation be

totally or partially guaranteed by a bond; or by

denying having received such money, goods, or other

property.

• Sec. 13, PD 115 imposes penalty upon “directors, officers,

employees or other officials or persons therein

responsible for the offense , without prejudice to the civil

liabilities arising from the criminal offense.”

• Damage to entruster need not be proven.

• Pilipinas Bank v. Ong: when no dishonor or abuse of

confidence can be attributed to the corporate officers

charged because evidence showed that the corporate-

entrustee failed to comply with its obligations upon

maturity of the trust receipts due to serious liquidity

problems that necessitated the filing of the petition for

rehabilitation, especially when demands made by the

entrustor were made in the time corporate-entrustee was

already under a management committee, which took

custody of the covered goods, the corporate officers

cannot be held criminally liable.

• Exception to: Nemo Dat Quod Non Habet

– Although the entrustee is not the owner of

the goods, anyone who acquires the goods

from the entrustee acquires good title over

the goods.

• Exception to: Res Perit Domino

– Although the entrustee is not the owner of

the goods covered by a trust receipt, should

the goods be lost while in his possession,

entrustee will bear the loss.

Prudential v. IAC

• Although it is true that the petitioner

commenced a criminal action for the violation of

the Trust Receipts Law, no legal obstacle

prevented it from enforcing the civil liability

arising out of the trust receipt in a separate civil

action.

• Under Article 33 of the Civil Code, a civil action

for damages, entirely separate and distinct from

the criminal action, may be brought by the

injured party in cases of defamation, fraud and

physical injuries. Estafa falls under fraud.

Colinares v. CA and People

• A thorough examination of the facts obtaining

in the case at bar reveals that the transaction

intended by the parties was a simple loan,

not a trust receipt agreement .

• The Trust Receipts Law does not seek to

enforce payment of the loan, rather it

punishes the dishonesty and abuse of

confidence in the handling of money or

goods to the prejudice of another regardless

of whether the latter is the owner.

Tiomico v. CA

• The Court has repeatedly upheld the validity of

the Trust Receipts Law and consistently declared

that the said law does not violate the

constitutional proscription against

imprisonment for non-payment of debts.

• PD 115 is a declaration by the legislative

authority that, as a matter of public policy, the

failure of a person to turn over the proceeds of

the sale of goods covered by a trust receipt or to

return said goods if not sold is a public nuisance

to be abated by the imposition of penal

sanctions.

Phil. Blooming v. CA

• The entruster may cancel the trust and take

possession of the goods, documents or

instruments subject of the trust or of the proceeds

realized therefrom at any time upon default or

failure of the entrustee to comply with any of the

terms and conditions of the trust receipt or any

other agreement between the entruster and the

entrustee, XXXXXXXX.

• Thus, even though TRB took possession of the

goods covered by the trust receipts, PBM and

Ching remained liable for the entire amount of the

loans covered by the trust receipts.

Sarmiento Jr. v. CA

• This breach of obligation is separate and distinct

from any criminal liability for “misuse and/or

misappropriation of goods or proceeds realized

from the sale of goods, documents or instruments

released under trust receipts”, punishable under

Section 13 of the Trust Receipts Law(P.D. 115) in

relation to Article 315(1), (b) of the Revised Penal

Code.

• Being based on an obligation ex contractu and not

ex delicto , the civil action may proceed

independently of the criminal proceedings

instituted against petitioners regardless of the

result of the latter.

Rizal Commercial Banking Corporation v. Alfa RTW

Manufacturing Corp.

• A trust receipt transaction is one wherein a

bank extends to a borrower a loan covered

by the letter of credit, with the trust receipt

as security of the loan.

• In contracts contracted in trust receipts, the

contracting parties may establish agreements,

terms and conditions they may deem

advisable, provided they are not contrary to

law, morals or public order.

Nature of Trust Receipts

• In a certain manner, a trust receipt partakes

of the nature of a conditional sale as

provided in the Chattel Mortgage Law, i.e.,

the importer becomes absolute owner of the

imported merchandise as soon as he has

paid its price.

TR vs. Chattel Mortgage

• It is not a chattel mortgage because:

- it does not require the formalities set forth in

the Chattel Mortgage Law, such as the

affidavit and oath (Secs. 3(j) and 5, cf. Sec. 5,

Act 1508)

- it does not have to be registered with the

Register of Deeds (Sec. 3(j), cf. Sec. 198,

Admin. Code)

TR vs. Conditional Sale

• It is not a conditional sale per se because:

• - the entruster is not a seller as contemplated

by law. He does not take on the obligations

and warranties of a seller (Sec. 8, cf. Arts.

1495-1581, Civil Code)

• - the transaction between the entruster and

the entrustee is more akin to a credit

transaction than a sale.

TR vs. Pledge

• It is not a pledge because:

- the entrustee/debtor is not the absolute

owner of the goods (cf. Art. 2085)

- the entrustee/debtor does not deliver the

possession of the goods to the

entruster/creditor (cf. Art. 2093)

TR vs. Consignment

• It is different from consignment because

the entrustee is the real owner of the

goods and not a mere dealer/agent

• Note: But if the consignment is evidenced by a

delivery trust receipt, it will fall under the Trust

Receipts Law (Robles vs. CA)

Vous aimerez peut-être aussi

- Trust Receipts LawDocument5 pagesTrust Receipts LawGenevieve BermudoPas encore d'évaluation

- Important Provisions Under RA 9139Document2 pagesImportant Provisions Under RA 9139Myn Mirafuentes Sta Ana0% (1)

- BSB vs. Sally GoDocument4 pagesBSB vs. Sally GoJustinJalandoniPas encore d'évaluation

- QUASI - Judicial PowerDocument100 pagesQUASI - Judicial PowerPauline Eunice Lobigan100% (1)

- CID VsDocument2 pagesCID VsHEART SANTOSPas encore d'évaluation

- Corpo Case Digests 2Document41 pagesCorpo Case Digests 2Marshan GualbertoPas encore d'évaluation

- Concurrence and Preference of CreditsDocument1 pageConcurrence and Preference of CreditsHenry LPas encore d'évaluation

- 123567-1999-Pacheco v. Court of AppealsDocument10 pages123567-1999-Pacheco v. Court of AppealsMa. Hazel Joy FacoPas encore d'évaluation

- Jader-Manalo vs. CamaisaDocument3 pagesJader-Manalo vs. CamaisastrgrlPas encore d'évaluation

- G.R. No. L-23726 - Villanueva vs. de Leon FactsDocument1 pageG.R. No. L-23726 - Villanueva vs. de Leon FactsChristine MontefalconPas encore d'évaluation

- Credit Transactions (Chattel Mortgage & Antichresis)Document21 pagesCredit Transactions (Chattel Mortgage & Antichresis)Judy Miraflores Dumduma0% (1)

- Warehouse Receipt Law ReviewerDocument6 pagesWarehouse Receipt Law ReviewerRyan UyPas encore d'évaluation

- Diaz V de Leon, 43 Phil 413Document11 pagesDiaz V de Leon, 43 Phil 413angelo6chingPas encore d'évaluation

- GREGORIO DE VERA V CA CASE DIGESTDocument4 pagesGREGORIO DE VERA V CA CASE DIGESTKristanne Louise YuPas encore d'évaluation

- People vs. Angelita DaudDocument4 pagesPeople vs. Angelita DaudCarla January OngPas encore d'évaluation

- BPI v. CA, G.R. 160890, 10 November 2004Document2 pagesBPI v. CA, G.R. 160890, 10 November 2004Deyo Dexter GuillermoPas encore d'évaluation

- Suroza v. HonradoDocument2 pagesSuroza v. HonradoJo DevisPas encore d'évaluation

- Labor Law Bar Q & A ARTS. 37-73: Submitted To: Atty. Voltaire DuanoDocument8 pagesLabor Law Bar Q & A ARTS. 37-73: Submitted To: Atty. Voltaire DuanoJohn Lester TanPas encore d'évaluation

- 1 Letters of Credit DigestDocument22 pages1 Letters of Credit DigestmjpjorePas encore d'évaluation

- ACT NO. 2137 - The Warehouse Receipts LawDocument10 pagesACT NO. 2137 - The Warehouse Receipts LawDanyPas encore d'évaluation

- 117Document1 page117Marry Lasheras0% (1)

- Land Bank of The Philippines V PerezDocument2 pagesLand Bank of The Philippines V PerezIrish AnnPas encore d'évaluation

- Caniza Case and Republic V CADocument3 pagesCaniza Case and Republic V CAEmiaj Francinne MendozaPas encore d'évaluation

- RAMOS - Diaz Vs PeopleDocument5 pagesRAMOS - Diaz Vs PeopleRovi Kennth RamosPas encore d'évaluation

- BSB Group VDocument3 pagesBSB Group VVerne SagunPas encore d'évaluation

- The Warehouse Receipts LawDocument42 pagesThe Warehouse Receipts Lawkeith105100% (1)

- Republic V Pal Fox DigestDocument1 pageRepublic V Pal Fox Digestjimmyfunk56Pas encore d'évaluation

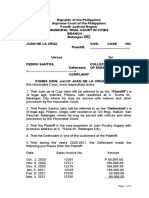

- Complaint - Juan Dela CruzDocument3 pagesComplaint - Juan Dela CruzLaika HernandezPas encore d'évaluation

- The Appellant in His Own Behalf. Franco and Reinoso For AppelleeDocument1 pageThe Appellant in His Own Behalf. Franco and Reinoso For AppelleeCarlyn Belle de GuzmanPas encore d'évaluation

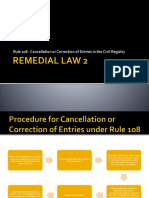

- Nympa - Report REM2 - Rule 108Document14 pagesNympa - Report REM2 - Rule 108RPCO 4B PRDP IREAPPas encore d'évaluation

- Abacus v. Manila Banking Corp., G.R. No. 162270Document2 pagesAbacus v. Manila Banking Corp., G.R. No. 162270xxxaaxxxPas encore d'évaluation

- Table For Art. 447 448 and 546 548Document3 pagesTable For Art. 447 448 and 546 548MOHAMMAD AL-FAYEED BALTPas encore d'évaluation

- Case 2: Vs - Sandiganbayan (Fourth Division), Jose LDocument3 pagesCase 2: Vs - Sandiganbayan (Fourth Division), Jose Lidmu bcpo100% (1)

- Vizconde vs. IACDocument3 pagesVizconde vs. IACJinPas encore d'évaluation

- Polotan Vs CADocument3 pagesPolotan Vs CAMary Ann Isanan100% (1)

- AMA LAND, INC. v. WACK WACK RESIDENTS' ASSOCIATION, INC.Document2 pagesAMA LAND, INC. v. WACK WACK RESIDENTS' ASSOCIATION, INC.Nina Riavel DEOMAMPOPas encore d'évaluation

- 2 Sameer Overseas Placement Agency, Inc., Petitioner, vs. JOY C. CABILES, Respondent. G.R. No. 170139 August 5, 2014Document1 page2 Sameer Overseas Placement Agency, Inc., Petitioner, vs. JOY C. CABILES, Respondent. G.R. No. 170139 August 5, 2014James WilliamPas encore d'évaluation

- Collector of Internal Revenue vs. FisherDocument25 pagesCollector of Internal Revenue vs. Fisherjosiah9_5Pas encore d'évaluation

- ANTHONY NG V PEOPLE OF THE PHILIPPINESDocument1 pageANTHONY NG V PEOPLE OF THE PHILIPPINESRoxanne AvilaPas encore d'évaluation

- Property Cases 093Document13 pagesProperty Cases 093JoyPas encore d'évaluation

- Santiago Case DigestDocument3 pagesSantiago Case Digestlicarl benitoPas encore d'évaluation

- Talento Vs Escalada Jr.Document20 pagesTalento Vs Escalada Jr.Terry FordPas encore d'évaluation

- Macondray V Pinon Case DigestDocument2 pagesMacondray V Pinon Case DigestZirk TanPas encore d'évaluation

- Compiled Cases GuarantyDocument20 pagesCompiled Cases GuarantyJec Luceriaga BiraquitPas encore d'évaluation

- Article 110 of The Labor CodeDocument31 pagesArticle 110 of The Labor CodeErnesto Neri100% (1)

- Fleischer vs. Botica NolascoDocument4 pagesFleischer vs. Botica NolascoBelle PenalosaPas encore d'évaluation

- Civil Law Review 2 - SALESDocument627 pagesCivil Law Review 2 - SALESRio AborkaPas encore d'évaluation

- Villa Vs Garcia BosqueDocument2 pagesVilla Vs Garcia BosqueJohn Michael VidaPas encore d'évaluation

- Resci Cases On TrustDocument10 pagesResci Cases On TrustResci Angelli Rizada-NolascoPas encore d'évaluation

- Civil Actions vs. Special Proceedings 5. Personal Actions and Real ActionsDocument4 pagesCivil Actions vs. Special Proceedings 5. Personal Actions and Real ActionsHazel LunaPas encore d'évaluation

- ROGELIO Florete Vs MARCELINO FloreteDocument4 pagesROGELIO Florete Vs MARCELINO FloreteMaePas encore d'évaluation

- JAVELLANA VS LimDocument2 pagesJAVELLANA VS Limcmv mendozaPas encore d'évaluation

- Kenneth O. Glass The Sum of P37,190.00, Alleged To Be The Agreed Rentals of His Truck, As Well As The Value of Spare PartsDocument2 pagesKenneth O. Glass The Sum of P37,190.00, Alleged To Be The Agreed Rentals of His Truck, As Well As The Value of Spare PartsMary Fatima BerongoyPas encore d'évaluation

- Ruben Austria Eat Al vs. Hon. Andres Reyes GR No. L-23079 Feb 27, 1970 en BancDocument2 pagesRuben Austria Eat Al vs. Hon. Andres Reyes GR No. L-23079 Feb 27, 1970 en BancAdrian CabanaPas encore d'évaluation

- Republic v. EugenioDocument16 pagesRepublic v. EugenioEd Von Fernandez CidPas encore d'évaluation

- Landl & Co. V. Metrobank G.R. No. 159622 July 30, 2004 FactsDocument3 pagesLandl & Co. V. Metrobank G.R. No. 159622 July 30, 2004 FactsJose MasaratePas encore d'évaluation

- Trust ReceiptsDocument23 pagesTrust ReceiptskarenkierPas encore d'évaluation

- RULE 86 Cases 6 To 9Document8 pagesRULE 86 Cases 6 To 9DennisSaycoPas encore d'évaluation

- Trial Memorandum BuenoDocument3 pagesTrial Memorandum BuenoEfie LumanlanPas encore d'évaluation

- Trust Receipts Law PD 115Document57 pagesTrust Receipts Law PD 115Venice SantibañezPas encore d'évaluation

- Truth in Lending ActDocument7 pagesTruth in Lending ActJuris Renier Mendoza100% (1)

- Bank of Commerce Vs RPN Case DigestDocument2 pagesBank of Commerce Vs RPN Case DigestJuris Renier Mendoza100% (3)

- Diaz Vs VirataDocument1 pageDiaz Vs VirataJuris Renier MendozaPas encore d'évaluation

- Mondragon Vs SolaDocument1 pageMondragon Vs SolaJuris Renier MendozaPas encore d'évaluation

- Case Digests DissolutionDocument10 pagesCase Digests DissolutionJuris Renier MendozaPas encore d'évaluation

- Lao VS lAODocument2 pagesLao VS lAOJuris Renier MendozaPas encore d'évaluation

- Ra 9048Document3 pagesRa 9048Juris Renier MendozaPas encore d'évaluation

- Written Report 5Document11 pagesWritten Report 5Juris Renier MendozaPas encore d'évaluation

- Hala Ka DihaDocument2 pagesHala Ka DihaJuris Renier MendozaPas encore d'évaluation

- Hdata Lee Vs IlaganDocument2 pagesHdata Lee Vs IlaganJuris Renier MendozaPas encore d'évaluation

- Batch 3 CompilationDocument12 pagesBatch 3 CompilationJuris Renier MendozaPas encore d'évaluation

- For ReceivingDocument1 pageFor ReceivingJuris Renier MendozaPas encore d'évaluation

- Negligence in General Full Text CasesDocument39 pagesNegligence in General Full Text CasesJuris Renier MendozaPas encore d'évaluation

- Sec Case No. 1375Document47 pagesSec Case No. 1375Juris Renier MendozaPas encore d'évaluation

- Comparative - Reyes Vs Rosenstock and Bpi Vs ConcepcionDocument3 pagesComparative - Reyes Vs Rosenstock and Bpi Vs ConcepcionJuris Renier MendozaPas encore d'évaluation

- AmazingnessDocument15 pagesAmazingnessJuris Renier MendozaPas encore d'évaluation

- 10 Banco Filipino vs. Monetary Board People vs. InvencionDocument3 pages10 Banco Filipino vs. Monetary Board People vs. InvencionJuris Renier MendozaPas encore d'évaluation

- Bar Exam Question: Iren G. Pepito Certiorari Mendez v. People, 726 SCRA 480Document3 pagesBar Exam Question: Iren G. Pepito Certiorari Mendez v. People, 726 SCRA 480Juris Renier MendozaPas encore d'évaluation

- Huang Vs Philippine HoteliersDocument2 pagesHuang Vs Philippine HoteliersJuris Renier MendozaPas encore d'évaluation

- Cardinal Principles SuccessionDocument2 pagesCardinal Principles SuccessionJuris Renier MendozaPas encore d'évaluation

- HDFC Bank QuestionnaireDocument25 pagesHDFC Bank QuestionnaireIesha GuptaPas encore d'évaluation

- Philippine National Bank v. AmoresDocument6 pagesPhilippine National Bank v. AmoresRoemma Kara Galang PaloPas encore d'évaluation

- Group 1 - Tactical Accounting and Financial Information Systems PDFDocument9 pagesGroup 1 - Tactical Accounting and Financial Information Systems PDFX BorgPas encore d'évaluation

- Luigi Balucan Inacc3 Week 2Document12 pagesLuigi Balucan Inacc3 Week 2Luigi Enderez BalucanPas encore d'évaluation

- GCC Listed Banks ReportDocument92 pagesGCC Listed Banks Reportaziz ziaPas encore d'évaluation

- Volvo Truck - Penetrating The US MarketDocument5 pagesVolvo Truck - Penetrating The US MarketKha NguyenPas encore d'évaluation

- What Is Reconstruction?: Need For Internal ReconstructionDocument31 pagesWhat Is Reconstruction?: Need For Internal Reconstructionneeru79200079% (14)

- PHilex Mining Corp Vs CIRDocument15 pagesPHilex Mining Corp Vs CIRNelly HerreraPas encore d'évaluation

- Operations Management: Yenny LegoDocument32 pagesOperations Management: Yenny LegoYenny Dusty PinkPas encore d'évaluation

- Chapter15 Fintech and Government RegulationDocument17 pagesChapter15 Fintech and Government RegulationAllen Uhomist AuPas encore d'évaluation

- CFO or VP of FinanceDocument3 pagesCFO or VP of Financeapi-121633167Pas encore d'évaluation

- 24 Standard Costing and Variance AnalysisDocument12 pages24 Standard Costing and Variance AnalysisSafwan mansuriPas encore d'évaluation

- Natural Commerce SupplementDocument167 pagesNatural Commerce SupplementCristian CambiazoPas encore d'évaluation

- TNEB Online Payment PDFDocument1 pageTNEB Online Payment PDFpavanPas encore d'évaluation

- CH 16 - Staff Loans - Provisions BGVBDocument17 pagesCH 16 - Staff Loans - Provisions BGVBpritt2010Pas encore d'évaluation

- Abandono de PozosDocument60 pagesAbandono de PozosIvan Reyes100% (1)

- Ulc Xix Aimcc Moot PropositionDocument6 pagesUlc Xix Aimcc Moot PropositionRangoliTiwariPas encore d'évaluation

- How To Use Ichimoku Charts in Forex TradingDocument14 pagesHow To Use Ichimoku Charts in Forex Tradinghenrykayode4Pas encore d'évaluation

- RHB-Product Disclosure Sheet-Personal FinancingDocument4 pagesRHB-Product Disclosure Sheet-Personal FinancingMohd Imran NoordinPas encore d'évaluation

- Crisil Sme Connect Dec11Document60 pagesCrisil Sme Connect Dec11Lao ZhuPas encore d'évaluation

- Case Problems in Finance: Twelfth EditionDocument3 pagesCase Problems in Finance: Twelfth EditionAGNES LESTARIPas encore d'évaluation

- UN-Habitat, Slum Upgrading Facility. 2009Document70 pagesUN-Habitat, Slum Upgrading Facility. 2009Marcos BurgosPas encore d'évaluation

- Cnooc LimitedDocument3 pagesCnooc LimitedMahdiPas encore d'évaluation

- International Finance PresentationDocument29 pagesInternational Finance PresentationY.h. TariqPas encore d'évaluation

- Sample PDFDocument2 pagesSample PDFkorean languagePas encore d'évaluation

- Proba Finance Interview QuestionsDocument1 pageProba Finance Interview Questionstheodor_munteanuPas encore d'évaluation

- Ludhiana - Brs Nagar Phone No.: 0161-5066369/70/71: If Paid Within Rebate Effective Rate of InterestDocument2 pagesLudhiana - Brs Nagar Phone No.: 0161-5066369/70/71: If Paid Within Rebate Effective Rate of InterestAneesh kumar0% (1)

- Case Study Olympian Backpacks Inc.Document18 pagesCase Study Olympian Backpacks Inc.Rimuru TempestPas encore d'évaluation

- MC 0920Document16 pagesMC 0920mcchroniclePas encore d'évaluation

- CV Rajesh GuptaDocument3 pagesCV Rajesh GuptaChandrasen GuptaPas encore d'évaluation