Académique Documents

Professionnel Documents

Culture Documents

Corporate Taxpayer

Transféré par

JP JimenezDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Corporate Taxpayer

Transféré par

JP JimenezDroits d'auteur :

Formats disponibles

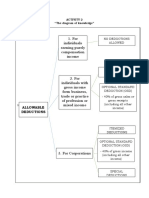

4.

Corporate Taxpayer

TAX ON CORPORATIONS

Itemized

Income Taxpayer Tax Rates Exemptions OSD Inter-Corporate Dividend MCIT IAET BPRT

Deductions

Personal Additional

50K 25K

1. Normal Corporate Income Tax (NCIT) = 30% on the taxable income

GEN RULE: 10%

2. MCIT = 2% Gross Income

Exp: IAET shall NOT apply to:

EXCEPT: income exempt from income tax and income subject to Final Withholding Tax (FWT)

1. Publicly-held Corporations

2. Banks and other non bank financial

3. 15% of Gross Income if the following conditions are met: (as of 2018 NOT YET IMPLEMENTED)

intermediaries (leasing, factoring, and

a) tax effort ratio of 20% of Gross National Product (GNP) YES if taxed

b) ratio of 40% of Income Tax collection to total tax revenues

YES if taxed venture capital companies, pension funds,

under NCIT. insurance companies, and mutual funds)

1. Domestic Corporations (DC) c) VAT tax effort of 4% of GNP; and NOT APPLICABLE TO under NCIT. 2% of Gross Income

d) 0.9% ratio of the Consolidated Public Sector Financial Position to GNP (this last one has yet to be implemented)

Otherwise, EXEMPT 3. Insurance Companies N/A

-W/N and W/O CORPORATE TAXPAYERS Otherwise, (p94 Ingles) 4. Taxable Partnerships

NOTE: Option to be taxed based on Gross Income shall be available only to firms whose ratio of cost of sales to gross sales or receipts from all sources does not exceed NO

55%.

NO 5. General Professional Partnerships

[p191] Dividends received 6. Non Taxable Joint Ventures

7. Enterprises registered with Philippine

4. Capital Gains Tax by a DC or RFC from

Economic Zone Authority (PEZA), Bases

another DC are Conversion and Development Authority

5. Final Tax on Passive Income (same rules as that of Individuals)

EXEMPT since the (BCDA), or other special economic zones.

6. IAET - 10% on Improperly Accumulated Taxable Income (in addition to other taxes) law assumes that

the dividends

1. Normal Corporate Income Tax (NCIT) = 30% on the taxable income received will be

injected to the

2. MCIT = 2% Gross Income

EXCEPT: income exempt from income tax and income subject to Final Withholding Tax (FWT)

CAPITAL which will 15% based on the

eventually be taxed total profits applied

3. 15% of Gross Income if the following conditions are met: (as of 2018 NOT YET IMPLEMENTED) when the or earmarked for

a) tax effort ratio of 20% of Gross National Product (GNP)

b) ratio of 40% of Income Tax collection to total tax revenues

YES if taxed YES if taxed corporation gets 2% of Gross Income remittance without

2. Resident Foreign Corporation

c) VAT tax effort of 4% of GNP; and NOT APPLICABLE TO under NCIT. under NCIT. income from the (p95 Ingles for list any deduction for

(RFC) p96 N/A

d) 0.9% ratio of the Consolidated Public Sector Financial Position to GNP (this last one has yet to be implemented) CORPORATE TAXPAYERS Otherwise, Otherwise, use of such capital. of RFCs that are the tax component

- W/N only NOTE: Option to be taxed based on Gross Income shall be available only to firms whose ratio of cost of sales to gross sales or receipts from all sources does not exceed

55%.

NO NO EXEMPT from MCIT) thereof [except

those registered

4. Capital Gains Tax with PEZA](P103

5. Final Tax on Passive Income (same rules as that of Individuals)

Ingles)

6. Branch Profit Remitance Tax (BPRT): 15% of total profit applied or earmarked for remittance without any deduction for tax component thereof

1. 30% Final Tax on Gross Income

3. Non-Resident Foreign 15% - With Tax

NOT APPLICABLE TO

Corporation (NRFC) p 105 2. Capital Gains Tax on Sale or Disposition of Shares of Stock N/A N/A Sparing; 30% - N/A N/A N/A

Except CGT on Sale or Disposition of Real Property CORPORATE TAXPAYERS

- W/N only Without Tax Sparing

(NRFC Cannot acquire Real Property)

IAET: The provision discouraged tax avoidance through corporate surplus accumulation. When corporations do not declare dividends, income taxes are not paid on the undeclared

dividends received by the shareholders. The tax on improper accumulation of surplus is essentially a penalty tax designed to compel corporations to distribute earnings so that the said

earnings by shareholders could, in turn, be taxed. p113

Vous aimerez peut-être aussi

- Instructions To Use Tax CalculatorDocument5 pagesInstructions To Use Tax Calculatormadhuri priyankaPas encore d'évaluation

- Labor Cases - AppealsDocument7 pagesLabor Cases - AppealsJP JimenezPas encore d'évaluation

- 2 Create RR 5-2021 - IT - FullDocument51 pages2 Create RR 5-2021 - IT - FullTreb LemPas encore d'évaluation

- CREATE Law InfographicDocument20 pagesCREATE Law InfographicVennice Castaneda100% (3)

- Guideline in The Transfer of Titles of Real PropertyDocument4 pagesGuideline in The Transfer of Titles of Real PropertyLeolaida AragonPas encore d'évaluation

- Remedial Law Review Suppletory NotesDocument3 pagesRemedial Law Review Suppletory NotesJP JimenezPas encore d'évaluation

- MCQ - Taxation Law ReviewDocument24 pagesMCQ - Taxation Law ReviewphiongskiPas encore d'évaluation

- Idt Notes June Dec 22Document232 pagesIdt Notes June Dec 22Sam SamPas encore d'évaluation

- 121 Pilmico-Mauri Foods Corp Vs CIRDocument2 pages121 Pilmico-Mauri Foods Corp Vs CIRJJ Val100% (2)

- 4A Special DCDocument1 page4A Special DCJP JimenezPas encore d'évaluation

- Advance Taxation (P6) Summary of NoteDocument31 pagesAdvance Taxation (P6) Summary of NoteYivon TeoPas encore d'évaluation

- 7 Understanding Taxation in Indonesia 1 PDFDocument13 pages7 Understanding Taxation in Indonesia 1 PDFYlaine Gonzales-PanisPas encore d'évaluation

- Taxes in A Nutshell 2021: For Estonia, Latvia, Lithuania and BelarusDocument19 pagesTaxes in A Nutshell 2021: For Estonia, Latvia, Lithuania and BelarusRegita Kusumaning PutriPas encore d'évaluation

- CREATE Law - MANA, Karen Mariz B.Document3 pagesCREATE Law - MANA, Karen Mariz B.karen mariz manaPas encore d'évaluation

- Status Update: Features of CREATEDocument18 pagesStatus Update: Features of CREATEMarkie GrabilloPas encore d'évaluation

- Regular Income TaxationDocument6 pagesRegular Income TaxationAnabel Lajara AngelesPas encore d'évaluation

- Corporate Tax Concept Map LARADocument1 pageCorporate Tax Concept Map LARAWinnie LaraPas encore d'évaluation

- KPMG Foreign Taxation India - 2018-v2Document38 pagesKPMG Foreign Taxation India - 2018-v2Sai Kiran ReddyPas encore d'évaluation

- Facts On Malaysian IRB During MCODocument9 pagesFacts On Malaysian IRB During MCOshah7592Pas encore d'évaluation

- Salient Features: Company-Confidential 26.02.2010Document9 pagesSalient Features: Company-Confidential 26.02.2010Coolvishal AgnihotriPas encore d'évaluation

- TDS Rate Chart For FY 2023-24 (AY 2024-25)Document70 pagesTDS Rate Chart For FY 2023-24 (AY 2024-25)DRK FrOsTeRPas encore d'évaluation

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashPas encore d'évaluation

- For Individuals Earning Purely Compensation Income: Allowable DeductionsDocument4 pagesFor Individuals Earning Purely Compensation Income: Allowable DeductionsJAN FEVRIER OLETEPas encore d'évaluation

- Fiscal System in PortugalDocument24 pagesFiscal System in PortugaldriPas encore d'évaluation

- (Year) : Amendments Vide Finance Act, 2010 On "Direct Tax"Document16 pages(Year) : Amendments Vide Finance Act, 2010 On "Direct Tax"peyala_sudhirPas encore d'évaluation

- CREATE Bill RA No. 11534 Final VersionDocument8 pagesCREATE Bill RA No. 11534 Final Versionericka maePas encore d'évaluation

- ERG TAX 7.0 CorporationDocument22 pagesERG TAX 7.0 CorporationRiyo Mae MagnoPas encore d'évaluation

- On MAT and AMT WRO0533356 - FinalDocument25 pagesOn MAT and AMT WRO0533356 - FinalOffensive SeriesPas encore d'évaluation

- CA Inter Income Tax Basic ConceptDocument16 pagesCA Inter Income Tax Basic Concepttauseefalam917Pas encore d'évaluation

- Financial Act 2Document1 pageFinancial Act 2Kashif AliPas encore d'évaluation

- Regular Income TaxationDocument6 pagesRegular Income TaxationAnabel Lajara Angeles0% (1)

- KPMG Brief On Finance Bill 2023Document37 pagesKPMG Brief On Finance Bill 2023Ayan NoorPas encore d'évaluation

- Lecture 3 - Income Taxation (Corporate)Document5 pagesLecture 3 - Income Taxation (Corporate)Paula MerrilesPas encore d'évaluation

- Regular Income Taxation - Regular CorporationDocument9 pagesRegular Income Taxation - Regular Corporationdelacruzrojohn600Pas encore d'évaluation

- Personal Income Tax: Tax Rates in VietnamDocument1 pagePersonal Income Tax: Tax Rates in Vietnamhằng phạmPas encore d'évaluation

- Unit Iii:: Income Tax ON CorporationsDocument35 pagesUnit Iii:: Income Tax ON CorporationsEllePas encore d'évaluation

- Atx MT 1Document3 pagesAtx MT 1contact.xinannePas encore d'évaluation

- CH 2 TAXATION ON INDIVIDUALS Slide 43 71Document8 pagesCH 2 TAXATION ON INDIVIDUALS Slide 43 71Casandra Nicole AldecoaPas encore d'évaluation

- BLT Business Income OnwardsDocument16 pagesBLT Business Income OnwardsAybern BawtistaPas encore d'évaluation

- RR 12-2007Document9 pagesRR 12-2007Aris Basco DuroyPas encore d'évaluation

- Acco 20133 - Unit Iii & Iv - CreateDocument35 pagesAcco 20133 - Unit Iii & Iv - CreateHarvey AguilarPas encore d'évaluation

- PLBC FY2022 AmendedDocument4 pagesPLBC FY2022 AmendedstillwinmsPas encore d'évaluation

- MODIFIED - TIMTA Annexes For CREATE FAs of 20 June 2021Document14 pagesMODIFIED - TIMTA Annexes For CREATE FAs of 20 June 2021Sunshine PaglinawanPas encore d'évaluation

- Cannot Be Used by Nra-Etb & Taxpayers Mandated To Use Itemized DeductionsDocument3 pagesCannot Be Used by Nra-Etb & Taxpayers Mandated To Use Itemized DeductionsAreel GalvanPas encore d'évaluation

- 8.special Tax Rates of Companies & MATDocument22 pages8.special Tax Rates of Companies & MATMuthu nayagamPas encore d'évaluation

- Irect Axes Ypes: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 116Document3 pagesIrect Axes Ypes: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 116Washim Alam50CPas encore d'évaluation

- Income Tax On PartnershipsDocument3 pagesIncome Tax On PartnershipsNadine SantosPas encore d'évaluation

- Tax LawsDocument7 pagesTax Lawsbesong marlonPas encore d'évaluation

- Budget Highlights KE 2020Document14 pagesBudget Highlights KE 2020h3493061Pas encore d'évaluation

- Audit Report 2020-2021Document10 pagesAudit Report 2020-2021Mirza AsadPas encore d'évaluation

- OECD Publishing OECD Tax Policy Studies No.16 Fundamental Reform of Corporate Income Tax Oecd Tax Policy Studies-HalamaDocument32 pagesOECD Publishing OECD Tax Policy Studies No.16 Fundamental Reform of Corporate Income Tax Oecd Tax Policy Studies-Halamaasderrg ,xxnnhsjwasssddkPas encore d'évaluation

- Recent Tax and Expenditure Reforms in IndiaDocument18 pagesRecent Tax and Expenditure Reforms in IndiaSatyam KanwarPas encore d'évaluation

- Corporatetaxation NewDocument32 pagesCorporatetaxation NewGayatri SinghPas encore d'évaluation

- REVIEWER-NI-LOVE HeheDocument6 pagesREVIEWER-NI-LOVE HeheSteph GonzagaPas encore d'évaluation

- Cameroon - Country Key FeaturesDocument5 pagesCameroon - Country Key FeaturesTheo HendricksPas encore d'évaluation

- Assignment - TaxDocument6 pagesAssignment - TaxsuriPas encore d'évaluation

- Regular Income TaxationDocument12 pagesRegular Income TaxationMa. Alessandra BautistaPas encore d'évaluation

- ACFrOgCJ87XweE1ORK13I2yjbAMpCA3F8IcGcpwOM7Zst d62VpOa - XyXN MuGeegYkBFHwEvDzNOO7UyAo3ZaahtGIUUtsLu9puasYbmvQsTO8CMisioK4V7tRmWf MWfXFiQHjT0hWqlhMM4XDocument8 pagesACFrOgCJ87XweE1ORK13I2yjbAMpCA3F8IcGcpwOM7Zst d62VpOa - XyXN MuGeegYkBFHwEvDzNOO7UyAo3ZaahtGIUUtsLu9puasYbmvQsTO8CMisioK4V7tRmWf MWfXFiQHjT0hWqlhMM4XAngelica PagaduanPas encore d'évaluation

- Taxation HandoutDocument9 pagesTaxation HandoutTricia mae DingsitPas encore d'évaluation

- (A) in General: Sec. 27 - Rates of Income Tax On Domestic CorporationsDocument15 pages(A) in General: Sec. 27 - Rates of Income Tax On Domestic CorporationsdencamsPas encore d'évaluation

- Withholding Tax Card 2020-21Document3 pagesWithholding Tax Card 2020-21Javed MushtaqPas encore d'évaluation

- Income Payment Subject To Creditable Withholding TaxDocument2 pagesIncome Payment Subject To Creditable Withholding TaxChelsea Anne VidalloPas encore d'évaluation

- Revised Direct Tax CodeDocument37 pagesRevised Direct Tax Codepankaj_adv5314Pas encore d'évaluation

- Summary of Changes Under The RA 11534 (CREATE ACT) Atty. Mark Anthony P. TamayoDocument6 pagesSummary of Changes Under The RA 11534 (CREATE ACT) Atty. Mark Anthony P. TamayoNievelita OdasanPas encore d'évaluation

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesD'EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesPas encore d'évaluation

- Political Law Review Questions 4Document3 pagesPolitical Law Review Questions 4JP JimenezPas encore d'évaluation

- Civil Code ContractsDocument1 pageCivil Code ContractsJP JimenezPas encore d'évaluation

- Political Law Aug 12, 2017Document4 pagesPolitical Law Aug 12, 2017JP JimenezPas encore d'évaluation

- SB CrimDocument2 pagesSB CrimJP JimenezPas encore d'évaluation

- Civil Law - State Immunity From SuitDocument6 pagesCivil Law - State Immunity From SuitJP JimenezPas encore d'évaluation

- Notes Civil ProDocument5 pagesNotes Civil ProJP JimenezPas encore d'évaluation

- Notes Civil ProDocument5 pagesNotes Civil ProJP JimenezPas encore d'évaluation

- TABLE 3: Procedure in Criminal CasesDocument1 pageTABLE 3: Procedure in Criminal CasesJP JimenezPas encore d'évaluation

- Civil Code ContractsDocument1 pageCivil Code ContractsJP JimenezPas encore d'évaluation

- Civil Law - State Immunity From SuitDocument6 pagesCivil Law - State Immunity From SuitJP JimenezPas encore d'évaluation

- Commercial Law - JPJDocument8 pagesCommercial Law - JPJJP JimenezPas encore d'évaluation

- 5 Passive IncomeDocument3 pages5 Passive IncomeJP Jimenez100% (1)

- 2018 Tax Bar Exams 2 - JPJDocument3 pages2018 Tax Bar Exams 2 - JPJJP JimenezPas encore d'évaluation

- 5 Passive IncomeDocument3 pages5 Passive IncomeJP Jimenez100% (1)

- Amending Amla.Document3 pagesAmending Amla.Shari ThompsonPas encore d'évaluation

- L/Epublic of Tije Tlbilippines: Tjjaguio LcitpDocument12 pagesL/Epublic of Tije Tlbilippines: Tjjaguio LcitpJP JimenezPas encore d'évaluation

- Sources of Income & 2 Income TaxpayerDocument1 pageSources of Income & 2 Income TaxpayerJP JimenezPas encore d'évaluation

- 4B & 4C Special RFC & NRFCDocument2 pages4B & 4C Special RFC & NRFCJP JimenezPas encore d'évaluation

- Supreme Court: Baguio CityDocument17 pagesSupreme Court: Baguio CityJP JimenezPas encore d'évaluation

- 2018 Tax Bar Exams 2 - JPJDocument3 pages2018 Tax Bar Exams 2 - JPJJP JimenezPas encore d'évaluation

- Supreme Court: Baguio CityDocument17 pagesSupreme Court: Baguio CityJP JimenezPas encore d'évaluation

- Acknowledgment ReceiptDocument1 pageAcknowledgment ReceiptJP JimenezPas encore d'évaluation

- Illegal Recruitment CaseDocument32 pagesIllegal Recruitment CaseJP JimenezPas encore d'évaluation

- List of Accredited Bond Companies For Makati RTCDocument1 pageList of Accredited Bond Companies For Makati RTCJP JimenezPas encore d'évaluation

- Accredited Bonding Company by SC (Civil Cases)Document70 pagesAccredited Bonding Company by SC (Civil Cases)JP JimenezPas encore d'évaluation

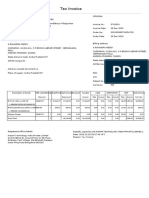

- 23) Invoice No-729697096 DT 21.03.2020 IOCLDocument1 page23) Invoice No-729697096 DT 21.03.2020 IOCLkmuraliPas encore d'évaluation

- Acc 201 Taxation PDFDocument166 pagesAcc 201 Taxation PDFadekunle tosinPas encore d'évaluation

- Tax Invoice: FromDocument1 pageTax Invoice: FromGravindra ReddyPas encore d'évaluation

- Intermediate Accounting III: Pre-Test - Errors and ChangesDocument2 pagesIntermediate Accounting III: Pre-Test - Errors and ChangesMay RamosPas encore d'évaluation

- IDT MTP Oct'20Document16 pagesIDT MTP Oct'20Babu GupthaPas encore d'évaluation

- Commissioner and Internal Revenue, Petitioner. Fortune Tobacco Corporation, RespondentDocument3 pagesCommissioner and Internal Revenue, Petitioner. Fortune Tobacco Corporation, RespondentBeatta RamirezPas encore d'évaluation

- Anti Deferral and Anti Tax Avoidance June 2008Document11 pagesAnti Deferral and Anti Tax Avoidance June 2008Chelsea BorbonPas encore d'évaluation

- TAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsDocument4 pagesTAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsKim Cristian MaañoPas encore d'évaluation

- Income and Business TaxationDocument138 pagesIncome and Business Taxationjustine reine cornico100% (1)

- InvoiceDocument1 pageInvoiceApurva KumarPas encore d'évaluation

- GST/HST Credit: Including Related Provincial and Territorial Credits and BenefitsDocument14 pagesGST/HST Credit: Including Related Provincial and Territorial Credits and BenefitsSarah AliPas encore d'évaluation

- Cagayan Electric Vs CIRDocument4 pagesCagayan Electric Vs CIRRaymond MedinaPas encore d'évaluation

- PIT 2 - 916 Nowy Wzór 2023 PDF ENGDocument3 pagesPIT 2 - 916 Nowy Wzór 2023 PDF ENGСофія РудикPas encore d'évaluation

- FATCADocument1 pageFATCAmuslimnswPas encore d'évaluation

- Govt Acctg 1234Document5 pagesGovt Acctg 1234taylor swiftyyyPas encore d'évaluation

- MCQ - Unit 2Document15 pagesMCQ - Unit 2Niraj PandeyPas encore d'évaluation

- NTN RPL 2015 1st Oct 2015Document78 pagesNTN RPL 2015 1st Oct 2015Pankaj MittalPas encore d'évaluation

- 2004 Act Blue BookDocument345 pages2004 Act Blue BookparooneyPas encore d'évaluation

- RMC No 65-2012 VATDocument3 pagesRMC No 65-2012 VATSpecforcPas encore d'évaluation

- Boat 235V2 Fast Charging Bluetooth Headset: Grand Total 1199.00Document1 pageBoat 235V2 Fast Charging Bluetooth Headset: Grand Total 1199.00AjayPas encore d'évaluation

- Invoice YamahaDocument2 pagesInvoice YamahaAlvin FaqihPas encore d'évaluation

- Accounting For LabourDocument23 pagesAccounting For LabourSujal DabasiaPas encore d'évaluation

- Haygot Services Private Limited: Salary Slip For October - 2019Document1 pageHaygot Services Private Limited: Salary Slip For October - 2019Mohit Sharma0% (1)

- CRS Form For Tax Residency Self CertificationDocument2 pagesCRS Form For Tax Residency Self Certificationcoldbrizze2Pas encore d'évaluation

- 1601 eDocument3 pages1601 eJulius Sangalang100% (1)

- CGST Act 2017Document63 pagesCGST Act 2017Vijai AnandPas encore d'évaluation

- 90,000 40,000 102,000 Correct Answer 110,000 100,000 300,000 312,000 314,000Document11 pages90,000 40,000 102,000 Correct Answer 110,000 100,000 300,000 312,000 314,000Hazel Grace PaguiaPas encore d'évaluation