Académique Documents

Professionnel Documents

Culture Documents

S & P VV August 2017 Market Report

Transféré par

VinodDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

S & P VV August 2017 Market Report

Transféré par

VinodDroits d'auteur :

Formats disponibles

MONTHLY MARKET OVERVIEW

1st — 31st August 2017

SUMMARY OF CONTENT

• Value analysis

• Second hand S&P activity

• Newbuilding activity

• Demolition activity

• Charter rate analysis

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

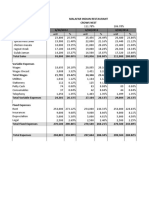

BULKER VALUES THROUGH AUGUST 2017

BULKERS Bulker values have firmed for all vessel types.

This table shows the monthly % change in value from 1 st to the 31 st August 2017

for Bulker vessels, by year of build.

YEAR

OF BUILD CAPE PMAX SUPRA HANDY

D WT DWT DWT DWT

+5.0% +1.4% +0.8% +0.1%

2017

180k 80k 60k 30k

+4.8% +1.4% +1.1% +0.6%

2016

180k 80k 60k 30k

+4.7% +1.5% +1.4% +1.2%

2015

180k 80k 60k 30k

+4.5% +1.5% +1.7% +1.7%

2014

180k 80k 60k 30k

+4.3% +1.5% +2.0% +2.3%

2013

180k 80k 60k 30k

+4.2% +1.4% +2.4% +3.1%

2012

180k 80k 60k 30k

+4.0% +1.5% +2.8% +3.7%

2011

180k 80k 60k 30k

+3.9% +1.5% +3.3% +4.5%

2010

180k 80k 55k 30k

+3.8% +1.5% +3.8% +5.1%

2009

180k 80k 55k 30k

+3.7% +1.6% +4.2% +5.2%

2008

180k 80k 55k 30k

+3.6% +2.3% +4.8% +5.3%

2007

180k 75k 55k 30k

+3.6% +2.3% +4.4% +5.4%

2006

180k 75k 55k 30k

+3.6% +2.4% +4.0% +5.4%

2005

180k 75k 55k 30k

+3.6% +2.4% +4.5% +5.3%

2004

180k 75k 55k 30k

+3.2% +2.4% +4.7% +5.3%

2003

175k 75k 50k 30k

+3.3% +2.5% +5.0% +5.1%

2002

175k 75k 50k 30k

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

BULKER VALUES THROUGH AUGUST 2017

Capesize Values have firmed throughout August.

3 sales have been confirmed this month.

2 Valemax Shandong Da De (402,300 DWT, Sep 2011, Daewoo) and Shandong Da Cheng

(402,300 DWT, May 2012, Daewoo) sold including charter to Bank of Communications for an en

bloc price of USD 178 mil.

Asterix (179,400 DWT, Jul 2010, HHI) sold for USD 29.5 mil in a part shares part cash deal to

Navios Maritime, VV value USD 27.5 mil.

Panamax Values have firmed throughout August.

10 sales have taken place this month.

United World (82,000 DWT, Oct 2013, Tsuneishi Zosen) sold for USD 21.5 mil, VV value USD 21.6 to

JP Morgan.

Harbor Hirose (83,500 DWT, Oct 2011, Sanoyas) sold for USD 19.3 mil to Songa Bulk, VV value USD

19.25 mil.

ABY Diva (76,600 DWT, Apr 2007, Imabari) sold for USD 12.7 mil, VV value USD 12.56 mil.

Levantes (76,000 DWT, Sep 2001, Tadotusu Tsuneishi) sold for USD 8.2 mil, VV value USD 7.81 mil.

Supramax Values have firmed a small amount this month.

15 sales have taken place.

An en bloc deal of 4 Tiger Ultramaxs’ Tiger Zheijiang, Tianjin, Hongking and Beijing

(63,600 DWT, 2015, Chengxi) sold for USD 80 mil, VV value USD 74.65 mil.

Ocean Leader (56,100 DWT, Jan 2010, Mitsui Ichihara) sold for USD 14.5 mil, VV value USD

14.26 mil.

Chrina (52,800 DWT, May 2001, Onomichi) sold for USD 7.2 mil, VV value USD 7.15 mil.

Handy Values have firmed most significantly for older tonnage.

4 sales have taken place this month.

2 resale vessels have been bought by Oldendorff Shipbuilding Hull 1058 and 1059 (35,700

DWT, Dec 2018, Samjin) for USD 15 mil each, VV value USD 15.07 mil each.

Voula Seas (28,500 DWT, Jun 2002, Kanda) sold for USD 5.3 mil, VV value USD 4.28 mil.

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

TANKER VALUES THROUGH AUGUST 2017

TANKERS Tanker values have varied this month. Aframax and LR1 values have

firmed.

This table shows the monthly % change in value from 1 st to the 31 st August 2017

for Tanker vessels, by year of build.

YEAR

OF BUILD VLCC SUEZ AFRA LR1 MR

D WT DWT DWT DWT DWT

+1.2% +0.2% +3.9% +3.7% +3.5%

2017

320k 160k 110k 75k 50k

+1.1% +0.1% +3.9% +3.7% +3.4%

2016

320k 160k 110k 75k 50k

+1.1% -0.0% +4.0% +3.8% +3.2%

2015

320k 160k 110k 75k 50k

+1.0% -0.3% +4.2% +3.9% +2.9%

2014

320k 160k 110k 75k 50k

+1.0% -0.5% +4.5% +4.2% +2.6%

2013

320k 160k 110k 75k 50k

+1.0% -0.9% +4.7% +4.4% +2.2%

2012

310k 160k 110k 75k 50k

+0.9% -1.3% +5.0% +4.7% +1.7%

2011

310k 160k 110k 75k 50k

+0.8% -1.7% +5.2% +5.0% +1.2%

2010

310k 160k 110k 75k 50k

+0.7% -2.1% +5.4% +5.1% +0.6%

2009

310k 160k 110k 75k 50k

+0.8% -2.5% +5.4% +5.2% -0.1%

2008

310k 160k 110k 75k 50k

+0.5% -3.0% +5.4% +5.2% -0.7%

2007

310k 160k 110k 75k 50k

+0.3% -3.5% +5.3% +5.0% -1.3%

2006

310k 160k 110k 70k 45k

-0.0% -3.5% +5.1% +4.7% -0.4%

2005

310k 160k 110k 70k 45k

-0.3% -3.2% +4.7% +4.4% -2.8%

2004

305k 155k 105k 70k 45k

-0.5% -3.1% +4.3% +4.0% -3.6%

2003

305k 155k 105k 70k 45k

-0.8% -3.0% +3.6% +3.2% -4.3%

2002

305k 155k 105k 70k 45k

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

TANKER VALUES THROUGH AUGUST 2017

VLCC Values have remained stable this month.

1 sale has been concluded this month.

Nichinori (298,400 DWT, Nov 2002, Hitachi) sold SS Due for USD 21 mil, VV value USD

22.67 mil to Sinokor Merchant.

Suezmax Values have remained stable this month.

There have been no sales this month for Suezmax vessels.

Aframax Values have firmed slightly this month.

3 Aframax Tankers and 2 Panamax Dirty Tankers have been sold this month.

Phoenix Light (105,600 DWT, Jan 2009, HHI) was sold by Phoenix Tankers to Great Eastern

Shipping for USD 23.25 mil, VV value USD 21.55 mil.

Gener8 Pericles (105,700 DWT, Feb 2003, Sumitomo) sold SS Due for USD 10.3 mil, VV value

USD 11.4 mil.

The two Dirty Panamax Tankers Jill and Tanja Jacob (73,000 DWT, Jan 2003, Samsung) sold

for USD 20 mil en bloc, VV value USD 19.92 mil.

LR1 Values have softened in older tonnage.

No LR1 vessels have been sold this month.

MR Values have softened a small amount.

5 sales have taken place this month.

Atlantic Falcon and Guard (50,000 DWT, Sep 2017, Hyundai Mipo) was bought by Torm for

USD 32.5 mil each, VV value USD 32.4 mil each.

Box (50,500 DWT, Dec 2009, SPP) sold for 19.2 mil, VV value 19.4 mil.

Torm Fox (37,000 DWT, May 2005, Hyundai Mipo) sold for USD 11 mil, VV value USD 11.71 mil.

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

CONTAINER VALUES THROUGH AUGUST 2017

CONTAINERS Container values have firmed for Post Panamax Container vessels

and Panamax Container vessels. Handy and Feedermax values have

remained stable.

This table shows the monthly % change in value from 1 st to the 31 st August 2017

for Container vessels, by year of build.

YEAR

OF BUILD POST PMAX PMAX HANDY FMAX

TE U TEU TEU TEU

+3.2% +7.6% +0.4% +0.4%

2017

7000 4250 1750 1100

+3.1% +7.4% +0.3% +0.4%

2016

7000 4250 1750 1100

+2.9% +7.2% +0.2% +0.3%

2015

7000 4250 1750 1100

+2.6% +6.9% +0.1% +0.2%

2014

7000 4250 1750 1100

+2.3% +6.5% +0.0% +0.1%

2013

7000 4250 1750 1100

+1.8% +6.1% -0.1% +0.0%

2012

7000 4250 1750 1100

+1.4% +5.6% -0.1% -0.1%

2011

7000 4250 1750 1100

+0.8% +5.0% -0.2% -0.3%

2010

7000 4250 1750 1100

+0.3% +4.5% -0.2% -0.4%

2009

7000 4250 1750 1100

+0.3% +4.0% -0.3% -0.4%

2008

7000 4250 1750 1100

+0.2% +9.6% -0.3% -0.6%

2007

7000 4250 1750 1100

+0.1% +9.5% +2.7% -0.2%

2006

7000 4250 1750 1100

+0.1% +9.6% +2.9% -0.0%

2005

7000 4250 1750 1100

+1.3% +9.6% +3.1% -0.3%

2004

7000 4250 1750 1100

+9.6% +9.6% +3.1% -0.0%

2003

6500 4000 1750 1100

+9.6% +9.6% +3.3% -0.4%

2002

6500 4000 1750 1100

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

CONTAINER VALUES THROUGH AUGUST 2017

Post PMax Values have firmed most significantly for older tonnage due to scrap rates.

There has been 1 sale this month.

Ever Charming (8,084 TEU, Sep 2005, Samsung) sold for USD 22 mil, VV value USD

22.03 mil.

Panamax Values have firmed throughout the month particularly for older tonnage due to scrap rates.

17 sales have taken place this month.

4 Seaspan Panamax containers have been sold Seaspan Kenya, Alps, Grouse and Mourne (4,275

TEU, Oct 2008, Feb, Mar and May 2009, Samsung) sold for USD 38.8 mil en bloc, VV value USD

37.85 mil.

Pinehurst Kontor (5,060 TEU, Aug 2004, HHI) sold for USD 6.85 mil, VV value USD 7.03 mil.

Handy Values have remained stable this month.

2 Handy sales have taken place this month.

Hansa Nordburg (1,740 TEU, Jun 2002, CSSC OME) sold for USD 3.5 mil, VV value USD 3.99 mil.

Feedermax Values have remained stable this month.

1 sale have been confirmed this month.

Shippan Island (1,118 TEU, Oct 2005, Jiangdong) sold for USD 4.8 mil, VV value USD 5.11 mil.

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

LPG VALUES THROUGH AUGUST 2017

LPG LPG values have remained stable across all vessel types.

This table shows the monthly % change in value from 1 st to the 31 st August 2017

for LPG vessels, by year of build.

YEAR SP FR SP FR FULL

OF BUILD VLGC LGC MGC LARGE SMALL PRESS LEG

CBM CBM C BM C BM C BM C BM C BM

+0.4% +0.9% -1.5% -4.2% -2.5% -1.5% -1.4%

2017

84k 60k 38k 20k 6.5k 3.5k 12k

+0.3% +0.8% -1.5% -4.1% -2.5% -1.5% -1.5%

2016

84k 60k 38k 20k 6.5k 3.5k 12k

+0.2% +0.7% -1.5% -4.1% -2.4% -1.4% -1.5%

2015

84k 60k 38k 20k 6.5k 3.5k 12k

+0.1% +0.6% -1.6% -3.9% -2.3% -1.6% -1.5%

2014

84k 60k 38k 20k 6.5k 3.5k 12k

+0.0% +0.5% -1.6% -3.8% -2.1% -1.5% -1.6%

2013

82k 60k 35k 20k 6.5k 3.5k 12k

-0.1% +0.4% -1.6% -3.6% -1.9% -1.6% -1.6%

2012

82k 60k 35k 20k 6.5k 3.5k 9k

-0.2% +0.3% -1.6% -3.4% -1.7% -1.6% -1.6%

2011

82k 60k 35k 20k 6.5k 3.5k 9k

-0.2% +0.3% -1.6% -3.1% -1.5% -1.7% -1.7%

2010

82k 60k 35k 20k 6.5k 3.5k 9k

-0.3% +0.2% -1.6% -3.0% -1.3% -1.8% -1.7%

2009

82k 60k 35k 20k 6.5k 3.5k 9k

-0.3% +0.2% -1.7% -2.8% -1.1% -1.7% -1.7%

2008

82k 60k 35k 20k 6.5k 3.5k 9k

-0.3% +0.1% -1.7% -2.7% -1.0% -1.7% -1.7%

2007

82k 60k 35k 20k 6.5k 3.5k 8k

-0.4% +0.1% +1.1% -2.7% -1.0% -0.7% -1.1%

2006

82k 60k 35k 20k 6.5k 3.5k 8k

-0.3% +0.1% +1.1% -2.7% -1.0% -0.8% -1.2%

2005

78k 60k 35k 20k 6.5k 3.5k 8k

-0.3% +0.2% +1.1% -2.8% -1.1% -0.9% -1.3%

2004

78k 60k 35k 20k 6.5k 3.5k 8k

-0.2% +0.2% +1.1% -3.0% -1.3% -1.1% -1.4%

2003

78k 60k 35k 20k 6.5k 3.5k 8k

-0.2% +0.3% +1.0% -3.3% -1.5% -1.2% -1.8%

2002

78k 57k 35k 20k 6.5k 3.5k 8k

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

LPG VALUES THROUGH AUGUST 2017

VLGC Values have remained stable this month.

No sales have been concluded this month.

SPFR Values have remained stable this month.

Maple 3 (20,700 CBM, Feb 1993, HHI) sold for an undisclosed price, VV value USD 8.42 mil.

Fully Values have softened this month.

Pressurised

Lady Mathilde (3,515 CBM, Feb 2001, Shitanoe Zosen) sold for an undisclosed price,

VV value USD 3.75 mil.

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

OFFSHORE VALUES THROUGH AUGUST 2017

OSV Values have remained stable in both the AHTS/AHT and PSV sector

this month.

This table shows the monthly % change in value from 1 st to the 31 st August 2017

for OSV vessels, by year of build.

YEAR LARGE MEDIUM SMALL SUPER MEDIUM SMALL

OF BUILD PSV PSV PSV AHTS AHTS AHTS

D WT D WT DWT BHP BHP BHP

+1.8% +1.8% +1.8% +1.4% +2.2% +2.2%

2017

5.2k 3.6k 1.7k 24k 8.2k 5.5k

+1.8% +1.8% +1.9% +1.4% +1.9% +1.8%

2016

5.2k 3.6k 1.7k 24k 8k 5.2k

+1.7% +1.6% +1.6% +1.4% +1.3% +1.3%

2015

5.2k 3.6k 1.7k 24k 8k 5.2k

+1.6% +1.5% +1.5% +1.3% +0.9% +0.9%

2014

5.2k 3.4k 1.7k 24k 8k 5.2k

+1.4% +1.5% +1.5% +1.3% +0.4% +0.6%

2013

5.1k 3.3k 1.7k 24k 8k 5.2k

+1.4% +1.4% +1.4% +1.3% +0.3% +0.0%

2012

4.8k 3.3k 1.7k 24k 8k 5.2k

+1.3% +1.3% +1.3% +1.3% +0.0% +0.0%

2011

4.8k 3.3k 1.6k 24k 8k 5.2k

+1.2% +1.2% +1.2% +1.2% +0.0% +0.0%

2010

4.8k 3.3k 1.6k 24k 8k 5.1k

+1.1% +1.2% +1.0% +1.2% +0.0% +0.0%

2009

4.8k 3.3k 1.6k 24k 8k 5.1k

+1.0% +1.0% +1.2% +1.2% +0.0% +0.0%

2008

4.8k 3.3k 1.6k 24k 8k 5.1k

+1.0% +1.0% +0.9% +1.2% +0.0% +0.0%

2007

4.8k 3.3k 1.6k 24k 8k 5.1k

+1.0% +0.9% +1.0% +1.1% +0.0% +0.0%

2006

4.8k 3.3k 1.6k 24k 8k 5.1k

+1.0% +0.8% +1.2% +1.3% +0.0% +0.0%

2005

4.8k 3.3k 1.6k 24k 8k 5k

+1.0% +0.9% +1.4% +1.2% +0.0% +5.0%

2004

4.8k 3.3k 1.6k 24k 8k 5k

+0.9% +0.7% +0.8% +1.2% +0.0% +0.0%

2003

4.8k 3.3k 1.6k 24k 8k 5k

+0.8% +0.8% +0.9% +1.2% +0.0% +0.0%

2002

4.7k 3.3k 1.6k 24k 8k 5k

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

OFFSHORE VALUES THROUGH AUGUST 2017

PSV Values remained stable this month.

No PSV sales have taken place this month.

AHTS Values remained stable this month.

& AHT

1 small AHT sale has taken place this month.

Lydia D (3,872 BHP, Nov 2011, Neptune Shipyard) sold for an undisclosed price, VV value

USD 2.11 mil.

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

2ND HAND S&P ACTIVITY AUGUST 2017

S&P $ Value of 2nd hand sales in August 2017 vs August 2016.

Aug 2017

700 $629

Aug 2016

600

$490 $492

500

Value (M USD)

400

300

$226

$201

200

$120

$90

100

$6 N/A $14

0

Bulker Tanker Container Gas OSV

Total transaction values are only USD 200 mil lower for August 2016 compared to August 2017.

Bulker transaction values are firmer by 20% for August 2016 compared to August 2017.

Tanker transaction values are more than half the value for August 2017 compared to August

2016.

Container transaction values are half the value for August 2017 compared to August 2016.

2 LNG vessels Gallina and Galea were sold mid August by Shell for USD 45 mil each.

S&P No. Number of 2nd hand sales taken place in August 2017 vs August 2016.

Aug 2017

70

61 Aug 2016

60

50

No. Vessels

40

33

30 25

20 15 7

13

8

10 5

1 1

0

Bulker Tanker Container Gas OSV

Total sales by number count are 67% lower for August 2017 at a total of 67 compared to

a total of 112 sales for August 2016.

Bulker sales are down by 90% for this August.

Tanker sales are just over half the number this August at 13 sales compared to last

August with 25 sales.

Both Container and Gas sales are higher for August 2017 compared to August 2016.

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

NEWBUILDING ACTIVITY AUGUST 2017 VS 2016

Newbuilding Number of newbuilding orders taken place in August 2017 vs August 2016.

No.

38 Aug 2017

40

Aug 2016

35

30

No. New Buildings

25 23 22

20

15

10 8

5

5 2 2

0 0 0

0

Bulker Tanker Container Gas OSV

38 Bulker NB orders have been placed for August 2017. 3 x 180,000 DWT, delivery 2019,

Jiangsu New Yangzijiang Capesize vessels were ordered for an undisclosed price.

33 Panamax vessels have been ordered with 19 of these vessels 81,600 DWT, Tsuneishi Cebu.

Both Tanker and Container NB orders are a considerable lower for August 2017 compared to

August 2016.

SITC has ordered 2+2 Feedermax Containers (1,006 TEU, Delivery 2018 +2 2019, Dae Sun) for

USD 17 mil each.

No Gas or OSV NB orders have been placed.

Newbuilding Total number of newbuild orders from 1st August 2016 to 31st August 2017.

Total No.

300

243

250

200

No. Vessels

145

150

100

58

50 25

9

0

Bulker Tanker Container Gas OSV

The total number of NB orders from last August through to this August is considerably

higher for Tankers compared to other vessel types. The majority of these orders took place

in the latter half of 2016 and early 2017.

Total Bulker NB orders by number are c.100 less than Tankers. Few orders were placed in

the last half of 2016 however 71 orders have already been placed in the 3rd Quarter of 2017.

Container orders have stayed low with only 12 vessels being ordered in the first half on 2017

compared to 34 vessels in the latter half of 2016.

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

DEMOLITION ACTIVITY AUGUST 2017 VS 2016

Demolition Number of demolition sales per ship type, taken place in August 2017 vs August 2016.

No.

Aug 2017

25

21 Aug 2016

19

20

17

16

No. Demo sales

15

10

6

4

5 3

2 2

1

0

Bulker Tanker Container Gas OSV

It has been a relatively active month for demolition with total demolition sales across all

ship types in August 2017 higher by 22% compared to August 2016 due to the increased

scrap rate.

8 Panamax vessels have been scrapped in the Bulker sector, all roughly 17 years old.

Pakistan remains the favourable option of delivery for Bulkers.

5 VLCC vessels have been scrapped this August along with various other larger tonnage,

with main deliveries being Bangladesh for Tankers.

For the first time in a while Container scrap numbers are lower this month.

Demolition Demolition price trend for Tanker Price India from August 2016 - August 2017.

Trend

Tanker scrap price

450

400

No. Vessels

350

300

250

200

Oct 2016 Jan 2016 Apr 2016 Jul 2017

Demolition price USD/LDT over the past year has fluctuated however over the course of

July and August 2017 a significant increase in price was seen, also confirmed by the

number of sales for this year, especially within the Tanker sector.

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

CHARTER RATES

Dry Baltic Exchange daily market spot rates for Capesize, Panamax, Supramax and

Handy Bulkers from 1st August 2016 - 31st August 2017. Source: Baltic Exchange

Capesize

Panamax

25,000

Supramax

Handy

20,000

(USD per day)

15,000

10,000

5,000

0

Oct 2016 Jan 2016 Apr 2016 Jul 2017

Capesize rates have firmed a considerable amount this month. Rates peaked mid

month with levels as high as USD 18,451/day, a c.70% increase on last year’s rates which

were fluctuating round the USD 4,000/day figure.

Panamax rates also firmed at the beginning of the month with rates reaching over USD

10,800/day which is the highest we have seen since earlier this year in April.

Both Supramax and Handysize rates have also firmed a small amount showing an

active month.

Wet Baltic Exchange daily market spot rates for VLCC, Suezmax and Aframax Tankers

from 1st August 2016 - 31st August 2017. Source: Baltic Exchange

VLCC

Suezmax

60,000

Aframax

50,000

(USD per day)

40,000

30,000

20,000

10,000

0

Oct 2016 Jan 2016 Apr 2016 Jul 2017

VLCC rates have softened a considerable amount this month, at the end of August rates

were as low as USD 487/day. There is much availability and little enquiry which is

supressing rates.

Suezmax rates have firmed throughout the month, rates at the end of the month

reached USD 7,765/day showing reduced tonnage and higher rates.

Aframax rates have also firmed from USD 1,671/day to USD 4,940/day.

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

CHARTER RATES

Container Contex daily time charter rates for Panamax, Handysize and Feedermax Containers

from 1st August 2016 - 31st August 2017. Source: Contex, VHSS

Panamax

Handy

12,000

Feedermax

10,000

(USD per day)

8,000

6,000

4,000

2,000

0

Oct 2016 Jan 2016 Apr 2016 Jul 2017

Panamax rates have begun to soften again over the past few months.

Handy and Feedermax rates have remained stable throughout the month with a slight

firming in value.

LPG Fearnleys weekly market spot rates for VLGC, MGC and LEG Gas ships

from 1st August 2016 - 31st August 2017. Source: Fearnleys

VLGC

MGC

900

LEG

800

(Thousand USD per month)

700

600

500

400

300

200

100

0

Oct 2016 Jan 2016 Apr 2016 Jul 2017

VLGC rates have firmed towards the latter part of the month after the low seen earlier this

month with rates USD 180,000/month.

MGC and LEG rates remain stable throughout August, with MGC rates now dropping below

LEG to USD 420,000/month.

The flooding in Houston caused severe disruption to scheduled loadings and exports from US

Gulf terminals have been suspended, causing uncertainty in the VLGC market. This has helped

keep vessels occupied and encouraged owners to raise their offers higher for September.

+44 (0) 203 026 5555 vesselsvalue.com info@vesselsvalue.com

Vous aimerez peut-être aussi

- Computer Laboratory Maintenance Plan and ScheduleDocument5 pagesComputer Laboratory Maintenance Plan and ScheduleJm Valiente100% (3)

- Walt Disney Company's Slepping Beauty Bond - Student SpreadsheetDocument20 pagesWalt Disney Company's Slepping Beauty Bond - Student SpreadsheetshrabaniPas encore d'évaluation

- To Dmaic or Not To DmaicDocument1 pageTo Dmaic or Not To Dmaicritch99Pas encore d'évaluation

- Reliance Baking Soda - Case ExhibitsDocument5 pagesReliance Baking Soda - Case ExhibitsAnonymous FUZw6z6JN8Pas encore d'évaluation

- Case Study #2 - Ocean CarriersDocument11 pagesCase Study #2 - Ocean CarriersrtrickettPas encore d'évaluation

- Tesla (TSLA) Full Operating Model + Reverse DCFDocument7 pagesTesla (TSLA) Full Operating Model + Reverse DCFDon JuanPas encore d'évaluation

- CFJV00198BDocument360 pagesCFJV00198BCheongPas encore d'évaluation

- 02-Dr Ooi-Design of Jacked-In Piles & Case Studies in SingaporeDocument39 pages02-Dr Ooi-Design of Jacked-In Piles & Case Studies in SingaporefreezefreezePas encore d'évaluation

- Monthly Market Overview: Summary of ContentDocument16 pagesMonthly Market Overview: Summary of ContentJackPas encore d'évaluation

- Monthly Market Overview: Summary of ContentDocument16 pagesMonthly Market Overview: Summary of Contenttelsizci78Pas encore d'évaluation

- Monthly Market Overview: Summary of ContentDocument17 pagesMonthly Market Overview: Summary of ContentMelvin LeongPas encore d'évaluation

- CPG Financial Model and Valuation v2Document10 pagesCPG Financial Model and Valuation v2Mohammed YASEENPas encore d'évaluation

- Rakor HRD 19022Document58 pagesRakor HRD 19022sarPas encore d'évaluation

- Yield MaturityDocument17 pagesYield MaturityLeiidii OlayaPas encore d'évaluation

- The Gordon Model Cost of EquityDocument35 pagesThe Gordon Model Cost of EquityMahmood AhmadPas encore d'évaluation

- World GDT Auction Results - enDocument7 pagesWorld GDT Auction Results - enlyesPas encore d'évaluation

- File 19-Class Wrap-Ups 17Document7 pagesFile 19-Class Wrap-Ups 17alroy dcruzPas encore d'évaluation

- File 19-Class Wrap-Ups 16Document7 pagesFile 19-Class Wrap-Ups 16alroy dcruzPas encore d'évaluation

- Inventario Pasabocas AKB30 14 Oct 20Document15 pagesInventario Pasabocas AKB30 14 Oct 20RosalbaPas encore d'évaluation

- AG Pernod Ricard VF AnDocument144 pagesAG Pernod Ricard VF AnArleneminiPas encore d'évaluation

- Soil Qty CBR15Document12 pagesSoil Qty CBR15Janaka DineshPas encore d'évaluation

- Trade MarketingDocument46 pagesTrade MarketingOriginalo VersionaPas encore d'évaluation

- Ocean CarriersDocument17 pagesOcean CarriersMridula Hari33% (3)

- საკონსულტაციო შეხვედრაDocument20 pagesსაკონსულტაციო შეხვედრაMakuna NatsvlishviliPas encore d'évaluation

- Price 01122022Document702 pagesPrice 01122022ShivaPas encore d'évaluation

- Utah Housing Numbers (Jan 2023)Document1 pageUtah Housing Numbers (Jan 2023)KUTV 2NewsPas encore d'évaluation

- Nielsen Piata Mezeluri Ian Aug 2014Document15 pagesNielsen Piata Mezeluri Ian Aug 2014Alexandra CioriiaPas encore d'évaluation

- EVALUACION Plaza Jose OlayaDocument140 pagesEVALUACION Plaza Jose OlayaDaNnY VILLACORTAPas encore d'évaluation

- InuseesDocument481 pagesInuseesAkshat TaratePas encore d'évaluation

- Master BudgetDocument23 pagesMaster Budgetdarwin tjoeaPas encore d'évaluation

- Start Startup Financial ModelDocument5 pagesStart Startup Financial ModelRaman TiwariPas encore d'évaluation

- Currency USD USD USD USD USD USD USD: Growth Over Prior Year NA 436.1% 179.3% 55.6% 24.7% 96.3% 36.4%Document29 pagesCurrency USD USD USD USD USD USD USD: Growth Over Prior Year NA 436.1% 179.3% 55.6% 24.7% 96.3% 36.4%raman nandhPas encore d'évaluation

- The Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Document5 pagesThe Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Rohit AggarwalPas encore d'évaluation

- Act 5Document23 pagesAct 5darwin tjoeaPas encore d'évaluation

- Nike Inc - HMDocument8 pagesNike Inc - HMHumphrey OsaigbePas encore d'évaluation

- Phase in FinalDocument2 pagesPhase in FinalRuss LatinoPas encore d'évaluation

- Real Life. Real Answers.: NaborDocument4 pagesReal Life. Real Answers.: Naborapi-26167871Pas encore d'évaluation

- Chair & TableDocument10 pagesChair & TableDushyant PratapPas encore d'évaluation

- Workbook 1Document47 pagesWorkbook 1api-3344203120% (1)

- Round: 0 Dec. 31, 2016: Selected Financial StatisticsDocument13 pagesRound: 0 Dec. 31, 2016: Selected Financial StatisticsHimanshu KriplaniPas encore d'évaluation

- Configuration & Genre: Year To Date 2000 1St QuarterDocument6 pagesConfiguration & Genre: Year To Date 2000 1St QuarterSonyPicsPas encore d'évaluation

- Bakery Project V5Document10 pagesBakery Project V5sajjads100% (1)

- Genzyme DCF PDFDocument5 pagesGenzyme DCF PDFAbinashPas encore d'évaluation

- p3 Selviani Amir 13179129Document13 pagesp3 Selviani Amir 13179129vivi alfionitaPas encore d'évaluation

- FY 19 Budget Overview 3818Document83 pagesFY 19 Budget Overview 3818Chris SwamPas encore d'évaluation

- Recipe 1Document15 pagesRecipe 1bewketPas encore d'évaluation

- PT Cost Rate Total Lit Mileage Total KM ('E) Km/Rev Rev ('E) Net RevenueDocument11 pagesPT Cost Rate Total Lit Mileage Total KM ('E) Km/Rev Rev ('E) Net RevenueagraladnPas encore d'évaluation

- Actual Previous Highes T Lowest Dates Unit Frequency 320.0 0 312.57 320.00 3.71 1960 - 2019 USD Billion Yearly Current USDDocument11 pagesActual Previous Highes T Lowest Dates Unit Frequency 320.0 0 312.57 320.00 3.71 1960 - 2019 USD Billion Yearly Current USDHamza HusnainPas encore d'évaluation

- Strategic Marketing & PlanningDocument30 pagesStrategic Marketing & PlanningsalmansaleemPas encore d'évaluation

- Orwe Oe 2022-07-17Document6 pagesOrwe Oe 2022-07-17BalbaaAmrPas encore d'évaluation

- Q4 2010 Quarterly EarningsDocument15 pagesQ4 2010 Quarterly EarningsAlexia BonatsosPas encore d'évaluation

- SC MLS One-Sheeter 2010-10Document1 pageSC MLS One-Sheeter 2010-10kwillsonPas encore d'évaluation

- Steel Strucure Database - 19 July 2018Document1 pageSteel Strucure Database - 19 July 2018DeeuPas encore d'évaluation

- Equity Advvv.Document5 pagesEquity Advvv.Anmol KapoorPas encore d'évaluation

- Calculations For Investment Detective CaseDocument10 pagesCalculations For Investment Detective CaseCalypso StarsPas encore d'évaluation

- Statistical Bulletin OF Bangladesh Tea Board: For The Month of February, 2020Document13 pagesStatistical Bulletin OF Bangladesh Tea Board: For The Month of February, 2020Shafin AhmedPas encore d'évaluation

- RV Capital Factsheet 2017-03Document1 pageRV Capital Factsheet 2017-03Rocco HuangPas encore d'évaluation

- Book 1Document10 pagesBook 1AbRam KPas encore d'évaluation

- Proximus Consensus Ahead of q1 2023Document4 pagesProximus Consensus Ahead of q1 2023Laurent MillerPas encore d'évaluation

- 01 - Enero - PatentamientoDocument5 pages01 - Enero - PatentamientoMiguel Leonardo PeirettiPas encore d'évaluation

- Income Statement 1990 1989 Sales $ 34,720 Cost of SalesDocument3 pagesIncome Statement 1990 1989 Sales $ 34,720 Cost of SalesJosué Abanto MasgoPas encore d'évaluation

- 2nd Term Physics ReviewerDocument5 pages2nd Term Physics ReviewerAlfredo L. CariasoPas encore d'évaluation

- Vertical Take Off and LandingDocument126 pagesVertical Take Off and LandingMukesh JindalPas encore d'évaluation

- Metalband SawDocument7 pagesMetalband SawRichard JongPas encore d'évaluation

- 01-19 Diagnostic Trouble Code Table PDFDocument40 pages01-19 Diagnostic Trouble Code Table PDFmefisto06cPas encore d'évaluation

- RT120 ManualDocument161 pagesRT120 ManualPawełPas encore d'évaluation

- 9C606C.64 To 65Document24 pages9C606C.64 To 65SHIRISHA YADAVPas encore d'évaluation

- Droop Vs Iso Control Modes For Gas TurbinesDocument3 pagesDroop Vs Iso Control Modes For Gas TurbinesArdvark100% (1)

- MCB 12V-8A MCB 24V-5A Battery ChargerDocument2 pagesMCB 12V-8A MCB 24V-5A Battery ChargerJosé Wilton AlvesPas encore d'évaluation

- Transfer Action in Sap HRDocument3 pagesTransfer Action in Sap HRKarthi MrvkPas encore d'évaluation

- Molinos VerticalesDocument172 pagesMolinos VerticalesLeonardo RodriguezPas encore d'évaluation

- Api 682Document132 pagesApi 682Raul Gonzalez FernandezPas encore d'évaluation

- MMD 74 XX DR PS 0020 - C03Document1 pageMMD 74 XX DR PS 0020 - C03bramexPas encore d'évaluation

- The Effects of Crankshaft Offset On The Engine FrictionDocument15 pagesThe Effects of Crankshaft Offset On The Engine Frictionqingcaohe100% (1)

- TT2223 Week 12a Z-TransformDocument39 pagesTT2223 Week 12a Z-TransformAjiMaulanaPas encore d'évaluation

- Crisfield - Vol1 - NonLinear Finite Element Analysis of Solids and Structures EssentialsDocument360 pagesCrisfield - Vol1 - NonLinear Finite Element Analysis of Solids and Structures EssentialsAnonymous eCD5ZRPas encore d'évaluation

- App 3.3 Scaffolding Measurement 20200512 FINALDocument15 pagesApp 3.3 Scaffolding Measurement 20200512 FINALharshkumar patelPas encore d'évaluation

- Wri Method FigDocument15 pagesWri Method Figsoumyadeep19478425Pas encore d'évaluation

- CatalogDocument76 pagesCatalogmkpasha55mpPas encore d'évaluation

- Quarter-Wave Impedance TransformerDocument4 pagesQuarter-Wave Impedance TransformerEric SkinnerPas encore d'évaluation

- Elvax 460Document3 pagesElvax 460ingindjorimaPas encore d'évaluation

- Isuzu 4hk1x Sheet HRDocument4 pagesIsuzu 4hk1x Sheet HRMuhammad Haqi Priyono100% (1)

- d9 VolvoDocument57 pagesd9 Volvofranklin972100% (2)

- Data Flow Diagrams PDFDocument9 pagesData Flow Diagrams PDFYasmine2410Pas encore d'évaluation

- CS 303e, Assignment #10: Practice Reading and Fixing Code Due: Sunday, April 14, 2019 Points: 20Document2 pagesCS 303e, Assignment #10: Practice Reading and Fixing Code Due: Sunday, April 14, 2019 Points: 20Anonymous pZ2FXUycPas encore d'évaluation

- MET Till DEC 2018 PDFDocument171 pagesMET Till DEC 2018 PDFt.srinivasanPas encore d'évaluation

- Stainless Steel: Presented By, Dr. Pragati Jain 1 YearDocument68 pagesStainless Steel: Presented By, Dr. Pragati Jain 1 YearSneha JoshiPas encore d'évaluation