Académique Documents

Professionnel Documents

Culture Documents

Accounts

Transféré par

stommy07Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounts

Transféré par

stommy07Droits d'auteur :

Formats disponibles

forfeiting

method of export trade financing, especially when dealing in capital goods (whic

h have long payment periods) or with high risk countries. In forfeiting, a bank

advances cash to an exporter against invoices or promissory notes guaranteed by

the importer's bank. The amount advanced is always 'without recourse' to the exp

orter, and is less than the invoice or note amount as it is discounted by the ba

nk. The discount rates depends on the terms of the invoice/note and the level of

the associated risk.

investment management

The process of managing money, including investments, budgeting, banking, and ta

xes. also called money management.

letter of credit

L/C. A binding document that a buyer can request from his bank in order to guara

ntee that the payment for goods will be tranferred to the seller. Basically, a l

etter of credit gives the seller reassurance that he will receive the payment fo

r the goods. In order for the payment to occur, the seller has to present the ba

nk with the necessary shipping documents confirming the shipment of goods within

a given time frame. It is often used in international trade to eliminate risks

such as unfamiliarity with the foreign country, customs, or political instabilit

y.

balance of payments

An accounting record of all transactions made by a country over a certain time p

eriod, comparing the amount of foreign currency taken in to the amount of domest

ic currency paid out.

book building

The process of determining the price at which an Initial Public Offering will be

offered. The book is filled with the prices that investors indicate they are wi

lling to pay per share, and when the book is closed, the issue price is determin

ed by an underwriter by analyzing these values.

bought deal

An offering in which the underwriter (or syndicate) buys all the shares and rese

lls them. When the underwriter's) are willing to take this risk it is a sign tha

t they have a high degree of confidence in the issue's success.

green shoe

A provision in an underwriting agreement which allows members of the underwritin

g syndicate to purchase additional shares at the original. This is a useful prov

ision for underwriters in the event of exceptional public demand. The name comes

from the fact that Green Shoe Company was the first to grant such an option to

underwriters. also called overallotment provision.

corporate finance

The division of a company that is concerned with the financial operation of the

company. In most businesses, corporate finance focuses on raising money for vari

ous projects or ventures. For investment banks and similar corporations, corpora

te finance focuses on the analysis of corporate acquisitions and other decisions

.

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Matlab/Simulink Models For Typical Soft Starting Means For A DC MotorDocument6 pagesMatlab/Simulink Models For Typical Soft Starting Means For A DC MotorkensesanPas encore d'évaluation

- EchoDocument11 pagesEchoapi-394733232100% (3)

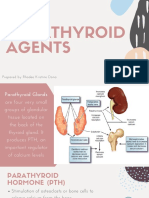

- Parathyroid Agents PDFDocument32 pagesParathyroid Agents PDFRhodee Kristine DoñaPas encore d'évaluation

- Case Digest Labor DisputeDocument5 pagesCase Digest Labor DisputeMysh PDPas encore d'évaluation

- Jurnal Upload DR Selvi PDFDocument8 pagesJurnal Upload DR Selvi PDFRudi ChyprutPas encore d'évaluation

- Mahabharata Reader Volume 1 - 20062023 - Free SampleDocument107 pagesMahabharata Reader Volume 1 - 20062023 - Free SampleDileep GautamPas encore d'évaluation

- Hyrons College Philippines Inc. Sto. Niño, Tukuran, Zamboanga Del Sur SEC. No.: CN200931518 Tel. No.: 945 - 0158Document5 pagesHyrons College Philippines Inc. Sto. Niño, Tukuran, Zamboanga Del Sur SEC. No.: CN200931518 Tel. No.: 945 - 0158Mashelet Villezas VallePas encore d'évaluation

- Anesthesia Considerations in Microlaryngoscopy or Direct LaryngosDocument6 pagesAnesthesia Considerations in Microlaryngoscopy or Direct LaryngosRubén Darío HerediaPas encore d'évaluation

- Case Study Beta Management Company: Raman Dhiman Indian Institute of Management (Iim), ShillongDocument8 pagesCase Study Beta Management Company: Raman Dhiman Indian Institute of Management (Iim), ShillongFabián Fuentes100% (1)

- The Christ of NankingDocument7 pagesThe Christ of NankingCarlos PérezPas encore d'évaluation

- GMAT2111 General Mathematics Long Quiz 2Document2 pagesGMAT2111 General Mathematics Long Quiz 2Mike Danielle AdaurePas encore d'évaluation

- Corporation Essay ChecklistDocument5 pagesCorporation Essay ChecklistCamille2221Pas encore d'évaluation

- Audi A4 Quattro 3.0 Liter 6-Cyl. 5V Fuel Injection & IgnitionDocument259 pagesAudi A4 Quattro 3.0 Liter 6-Cyl. 5V Fuel Injection & IgnitionNPPas encore d'évaluation

- Geoland InProcessingCenterDocument50 pagesGeoland InProcessingCenterjrtnPas encore d'évaluation

- Ritual 2 Turning Attraction Into LoveDocument2 pagesRitual 2 Turning Attraction Into Lovekrlup0% (1)

- Privileged Communications Between Husband and Wife - Extension of PDFDocument7 pagesPrivileged Communications Between Husband and Wife - Extension of PDFKitingPadayhagPas encore d'évaluation

- Basic Statistics For Business AnalyticsDocument15 pagesBasic Statistics For Business AnalyticsNeil Churchill AniñonPas encore d'évaluation

- gtg60 Cervicalcerclage PDFDocument21 pagesgtg60 Cervicalcerclage PDFLijoeliyas100% (1)

- Associate-Shopping in Hyderabad, Telangana Careers at HyderabadDocument1 pageAssociate-Shopping in Hyderabad, Telangana Careers at HyderabadpavanPas encore d'évaluation

- Test Bank For Davis Advantage For Medical-Surgical Nursing: Making Connections To Practice, 2nd Edition, Janice J. Hoffman Nancy J. SullivanDocument36 pagesTest Bank For Davis Advantage For Medical-Surgical Nursing: Making Connections To Practice, 2nd Edition, Janice J. Hoffman Nancy J. Sullivannombril.skelp15v4100% (15)

- All New Keys DictionaryDocument7 pagesAll New Keys DictionaryvishntPas encore d'évaluation

- Keir 1-2Document3 pagesKeir 1-2Keir Joey Taleon CravajalPas encore d'évaluation

- A Palace in TimeDocument6 pagesA Palace in TimeSonkhePas encore d'évaluation

- Revision Notes On Section 1.6 - Belief, Uncertainty & UnbeliefDocument5 pagesRevision Notes On Section 1.6 - Belief, Uncertainty & Unbeliefnisalielisha rodrigoPas encore d'évaluation

- By Nur Fatin Najihah Binti NoruddinDocument7 pagesBy Nur Fatin Najihah Binti NoruddinNajihah NoruddinPas encore d'évaluation

- Review of Related LiteratureDocument5 pagesReview of Related LiteratureRJ PareniaPas encore d'évaluation

- Last Speech of Shri Raghavendra SwamyDocument5 pagesLast Speech of Shri Raghavendra SwamyRavindran RaghavanPas encore d'évaluation

- ADDICTED (The Novel) Book 1 - The Original English TranslationDocument1 788 pagesADDICTED (The Novel) Book 1 - The Original English TranslationMónica M. Giraldo100% (7)

- K Unit 1 SeptemberDocument2 pagesK Unit 1 Septemberapi-169447826Pas encore d'évaluation

- Ethics - FinalsDocument18 pagesEthics - Finalsannie lalangPas encore d'évaluation