Académique Documents

Professionnel Documents

Culture Documents

Tugas CH 1, 2 Dan 4 Inter I Sepr 17

Transféré par

dheyaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tugas CH 1, 2 Dan 4 Inter I Sepr 17

Transféré par

dheyaDroits d'auteur :

Formats disponibles

NPM :_ NAME :__________________________

Write down the answer : true or false, along with the reason

The major financial statements used under IFRS include the statement of changes in

financial position and the statement of stockholders’ equity.

The International Accounting Standards Board issues IFRS.

The 2nd level of the IASB’s conceptual framework provides the qualitative characteristics

that make accounting information useful and the elements of financial statement.

The first level of the conceptual framework identifies the recognition and measurement

concepts used in establishing accounting standards.

Cross (x) on the most correct answer

Accrual accounting is used because

a. cash flows are considered less important.

b. it provides a better indication of ability to generate cash flows than the cash basis.

c. it recognizes revenues when cash is received and expenses when cash is paid.

d. none of the above.

The major financial statements include all of the following except:

a. Statement of financial position. c Statement of comprehensive income

b. Statement of changes in financial position d Statement of stockholers equity

Which of these statements regarding the IFRS and U.S. GAAP is correct?

a. U.S. GAAP is considered to be "principles-based" and more detailed than IFRS.

b. U.S. GAAP is considered to be "rules-based" and less detailed than IFRS.

c. IFRS is considered to be "principles-based" and less detailed than U.S. GAAP

d. Both U.S. GAAP and IFRS are considered to be "rules-based", but U.S. GAAP tends

to be more complex.

What is the quality of information that enables users to better forecast future operations?

a. Reliability. c Comparability

b. Materiality. d Relevance

Expensing the cost of a simple calculator when it is acquired is an example of which

constraint?

a. Materiality. C Conservatism

b. Cost-benefit. D Industry Practices

Essay

Income statement and retained earnings statement.

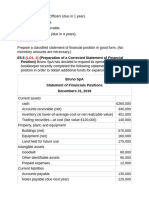

Wooble Corporation's capital structure consists of 50,000 ordinary shares. At December 31,

2016 an analysis of the accounts and discussions with company officials revealed the following

information:

Sales ¥1,200,000

Purchase discounts 18,000

Purchases 642,000

Loss on discontinued operations (net of tax) 42,000

Selling expenses 128,000

Cash 60,000

Accounts receivable 90,000

Share capital 200,000

Accumulated depreciation 180,000

Dividend revenue 8,000

Inventory, January 1, 2011 152,000

Inventory, December 31, 2011 125,000

Unearned service revenue 4,400

Accrued interest payable 1,000

Land 370,000

Patents 100,000

Retained earnings, January 1, 2011 290,000

Interest expense 17,000

General and administrative expenses 150,000

Dividends declared 29,000

Allowance for doubtful accounts 5,000

Notes payable (maturity 7/1/14) 200,000

Machinery and equipment 450,000

Materials and supplies 40,000

Accounts payable 60,000

The amount of income taxes applicable to ordinary income was ¥48,600, excluding the tax

effect of the discontinued operations loss which amounted to ¥18,000.

Instructions

(a) Prepare an income statement up to gross profit line

(b) Prepare an income statement up to income from operations

(c) Prepare an income statement up to income from continuing operations

(d) Prepare an income statement up to net income along with earning per share presentation

(e) Prepare a retained earning statement

Vous aimerez peut-être aussi

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4Pas encore d'évaluation

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooPas encore d'évaluation

- Akuntansi Keuangan 1Document15 pagesAkuntansi Keuangan 1Vincenttio le CloudPas encore d'évaluation

- Application 1 (Basic Steps in Accounting)Document2 pagesApplication 1 (Basic Steps in Accounting)Maria Nezka Advincula86% (7)

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- TP1-W2-S3-R0 Sri Annisa KatariDocument3 pagesTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariPas encore d'évaluation

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioPas encore d'évaluation

- Accounting AssignmentDocument2 pagesAccounting Assignmentsadif sayeed100% (2)

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosPas encore d'évaluation

- Acctg1205 - Chapter 8Document48 pagesAcctg1205 - Chapter 8Elj Grace BaronPas encore d'évaluation

- Chap14 The Calculation & Interpretation of Accounting RatiosDocument6 pagesChap14 The Calculation & Interpretation of Accounting RatiosSaiful AliPas encore d'évaluation

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIEPas encore d'évaluation

- Financial Analysis Test 2Document8 pagesFinancial Analysis Test 2Alaitz GPas encore d'évaluation

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenPas encore d'évaluation

- ch04 PDFDocument5 pagesch04 PDFĐào Quốc Anh100% (1)

- MAY 2017 EXAM CHIEF EXAMINER'S REPORTDocument27 pagesMAY 2017 EXAM CHIEF EXAMINER'S REPORTAnna MwitaPas encore d'évaluation

- Group Assignment On Fundamentals of Accounting IDocument6 pagesGroup Assignment On Fundamentals of Accounting IKaleab ShimelsPas encore d'évaluation

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiPas encore d'évaluation

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaPas encore d'évaluation

- SCI Handout 1 PDFDocument4 pagesSCI Handout 1 PDFhairu keyansamPas encore d'évaluation

- Quiz - SFP With AnswersDocument4 pagesQuiz - SFP With Answersjanus lopezPas encore d'évaluation

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaPas encore d'évaluation

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaPas encore d'évaluation

- FAR Activity Feb 19 With AnswersDocument16 pagesFAR Activity Feb 19 With AnswersCybill AiraPas encore d'évaluation

- Presentation and Preparation of FS FINALDocument86 pagesPresentation and Preparation of FS FINALJoen SinamagPas encore d'évaluation

- Assignment 1 AFSDocument14 pagesAssignment 1 AFSSimra SalmanPas encore d'évaluation

- Additional Cash Flow Problems QuestionsDocument3 pagesAdditional Cash Flow Problems QuestionsChelle HullezaPas encore d'évaluation

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Exercise Chap 5Document9 pagesExercise Chap 5JF FPas encore d'évaluation

- FINANCIAL STATEMENT ANALYSIS – FINAL EXAM DECEMBER 16, 2020Document11 pagesFINANCIAL STATEMENT ANALYSIS – FINAL EXAM DECEMBER 16, 2020Alaitz GPas encore d'évaluation

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehPas encore d'évaluation

- MGMT 600 SAMPLE Midterm Exam 1Document9 pagesMGMT 600 SAMPLE Midterm Exam 1Enkhbadral UlaanhuuPas encore d'évaluation

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngPas encore d'évaluation

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- Bus. Finance W3-4 - C5 (Answer)Document5 pagesBus. Finance W3-4 - C5 (Answer)Rory GdLPas encore d'évaluation

- Cases Chapter 5Document2 pagesCases Chapter 5Rifqi FarhanPas encore d'évaluation

- Acctg 601Document2 pagesAcctg 601Maria Regina Javier100% (1)

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Document36 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (27)

- Fm2quizb4 QoDocument10 pagesFm2quizb4 QoYe YongshiPas encore d'évaluation

- Flour Power Financial StatementsDocument9 pagesFlour Power Financial StatementsAshley WoodPas encore d'évaluation

- Soal Tugas Akm Is - ST o FP - CFDocument6 pagesSoal Tugas Akm Is - ST o FP - CFElyssa Fiqri Fauziah0% (1)

- 286practice Questions - AnswerDocument17 pages286practice Questions - Answerma sthaPas encore d'évaluation

- FM 1 Assignment 1Document3 pagesFM 1 Assignment 1Jelly Ann AndresPas encore d'évaluation

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderPas encore d'évaluation

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanPas encore d'évaluation

- 13. Single EntryDocument24 pages13. Single Entrylascona.christinerheaPas encore d'évaluation

- Soal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document9 pagesSoal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudPas encore d'évaluation

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoPas encore d'évaluation

- Comprehensive Income & NcahsDocument6 pagesComprehensive Income & NcahsNuarin JJ67% (3)

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaPas encore d'évaluation

- Cash FlowDocument8 pagesCash FlowTarmak LyonPas encore d'évaluation

- Far First PB 1017Document25 pagesFar First PB 1017Din Rose Gonzales100% (1)

- Far410 Chapter 3 Fin StatementsDocument17 pagesFar410 Chapter 3 Fin Statementsmr.nazir.shahidanPas encore d'évaluation

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManPas encore d'évaluation

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoPas encore d'évaluation

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikPas encore d'évaluation

- TIA FINANCIAL ACCOUNTING EXAMDocument9 pagesTIA FINANCIAL ACCOUNTING EXAMSebastian MlingwaPas encore d'évaluation

- Schaum's Outline of Principles of Accounting I, Fifth EditionD'EverandSchaum's Outline of Principles of Accounting I, Fifth EditionÉvaluation : 5 sur 5 étoiles5/5 (3)

- Equity Valuation: Models from Leading Investment BanksD'EverandEquity Valuation: Models from Leading Investment BanksJan ViebigPas encore d'évaluation

- Tugas CH 1, 2 Dan 4 Inter I Sepr 17Document1 pageTugas CH 1, 2 Dan 4 Inter I Sepr 17dheyaPas encore d'évaluation

- Tugas CH 1, 2 Dan 4 Inter I Sepr 17Document2 pagesTugas CH 1, 2 Dan 4 Inter I Sepr 17dheyaPas encore d'évaluation

- Chapter14 Audit Revenue Cycle INI PDFDocument48 pagesChapter14 Audit Revenue Cycle INI PDFdheyaPas encore d'évaluation

- Consolidated Financial Statement for White Corporation and SubsidiaryDocument1 pageConsolidated Financial Statement for White Corporation and SubsidiarydheyaPas encore d'évaluation

- Ch01 Version1Document52 pagesCh01 Version1An Trần Thị HảiPas encore d'évaluation

- Nike vs Adidas Performance 2014-40Document5 pagesNike vs Adidas Performance 2014-40SalmaAlnofaliPas encore d'évaluation

- FEIADocument45 pagesFEIAReema DsouzaPas encore d'évaluation

- The Impact of Advertising On Sales Level New 222Document85 pagesThe Impact of Advertising On Sales Level New 222JosephPas encore d'évaluation

- Polycab India LTD AR 2019 20 2 PDFDocument307 pagesPolycab India LTD AR 2019 20 2 PDFSrikanth Reddy SanguPas encore d'évaluation

- Sukriti Project Report NevaDocument51 pagesSukriti Project Report NevaujranchamanPas encore d'évaluation

- Financial Accounting Paper-5 InterDocument944 pagesFinancial Accounting Paper-5 InterShaikh Aftab100% (1)

- Unit Deficit Financing: 14.0 ObjectivesDocument12 pagesUnit Deficit Financing: 14.0 ObjectivesSiddharth DixitPas encore d'évaluation

- Essentials of Accounting For Governmental and Not-For-Profit Organizations 12th Edition Copley Solutions Manual 1Document37 pagesEssentials of Accounting For Governmental and Not-For-Profit Organizations 12th Edition Copley Solutions Manual 1elizabeth100% (33)

- 2020-07-03-CERA - NS-Ambit Capital PVT Lt-Cera Sanitaryware (BUY) Pain Is Inevitable!-89001883Document9 pages2020-07-03-CERA - NS-Ambit Capital PVT Lt-Cera Sanitaryware (BUY) Pain Is Inevitable!-89001883akanksha satijaPas encore d'évaluation

- Timothy Monroe Opened A Law Office On January 1 2017 PDFDocument1 pageTimothy Monroe Opened A Law Office On January 1 2017 PDFAhsan KhanPas encore d'évaluation

- Responsibility Accounting & Transfer Pricing ConceptsDocument5 pagesResponsibility Accounting & Transfer Pricing ConceptsadorableperezPas encore d'évaluation

- Financial Management MCQ QuestionsDocument8 pagesFinancial Management MCQ QuestionsAbhijeet Singh BaghelPas encore d'évaluation

- Week 2 (Principles of Taxation - Part 2)Document48 pagesWeek 2 (Principles of Taxation - Part 2)Beef TestosteronePas encore d'évaluation

- Process of Fundamental Analysis PDFDocument8 pagesProcess of Fundamental Analysis PDFbharti khandelwalPas encore d'évaluation

- Weirich7e CasesDocument18 pagesWeirich7e Casescuwekaza0% (1)

- Barangay Profile AND Development PerspectivesDocument64 pagesBarangay Profile AND Development PerspectivesJamiah Obillo HulipasPas encore d'évaluation

- Ratio Analysis of BMWDocument16 pagesRatio Analysis of BMWRashidsarwar01Pas encore d'évaluation

- Residual Income and Business Unit Profitability AnalysisDocument7 pagesResidual Income and Business Unit Profitability AnalysisLealyn CuestaPas encore d'évaluation

- BBA BIM BBM 2nd Semester Model Question AllDocument22 pagesBBA BIM BBM 2nd Semester Model Question AllGLOBAL I.Q.Pas encore d'évaluation

- Service Revenue and Expenses ReportDocument103 pagesService Revenue and Expenses Reportjescy pauloPas encore d'évaluation

- Ifrs 17 Reinsurance Contract Held ExampleDocument24 pagesIfrs 17 Reinsurance Contract Held ExampleHesham AlabaniPas encore d'évaluation

- Accounting for Trading Organizations ExplainedDocument40 pagesAccounting for Trading Organizations ExplainedMUHAMMAD AMMAD ARSHADPas encore d'évaluation

- Heads of Account in AccountingDocument3 pagesHeads of Account in AccountingammarPas encore d'évaluation

- Wood and Company ANY Security Printing Initation Report 20171215Document36 pagesWood and Company ANY Security Printing Initation Report 20171215Anonymous UPBYhtPas encore d'évaluation

- Supreme Court Decision on Tax Credits for Senior Citizen DiscountsDocument16 pagesSupreme Court Decision on Tax Credits for Senior Citizen DiscountsCharmaine Valientes CayabanPas encore d'évaluation

- Middle East Hotel Market Review 2017: UAE Abu Dhabi Performance Declines 13Document21 pagesMiddle East Hotel Market Review 2017: UAE Abu Dhabi Performance Declines 13Nesty NecesitoPas encore d'évaluation

- Working Capital Management Marathon Electric India Pvt. Ltd.Document63 pagesWorking Capital Management Marathon Electric India Pvt. Ltd.Leo SaimPas encore d'évaluation

- ACCOUNTING STANDARDS GUIDEDocument10 pagesACCOUNTING STANDARDS GUIDEchiragmittal286Pas encore d'évaluation

- Corporate Finance Chapter9Document30 pagesCorporate Finance Chapter9NoniPas encore d'évaluation