Académique Documents

Professionnel Documents

Culture Documents

PM Reyes Flowchart of Tax Remedies

Transféré par

Jason Certeza0 évaluation0% ont trouvé ce document utile (0 vote)

152 vues12 pages2016 version

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce document2016 version

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

152 vues12 pagesPM Reyes Flowchart of Tax Remedies

Transféré par

Jason Certeza2016 version

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 12

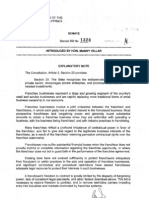

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes Page 1 of 12

1, REMEDIES UNDER THE NATIONAL INTERNAL REVENUE CODE

A. Assessments (Section 228, NIRC) OPTIONS OF TAXPAYER

IF RECONSIDERATION 1. HAIR denies Protest:

1 ays

180 day Sides

pot

15 days 30 days @—_——® See ee

Period within CIR or a

Authorized Representative :

vov v todecide FODA

!

108 || PAN FLD/

Ma NOTE: Taxpayer may file a Motion for Reconsideration with the CIR but it shal not

tollthe 20-day period to appeal tothe CTA.

IF REINVESTIGATION

60 days 180 days 2. If authorized representative denies Protest:

eee ee

i 30.doy soda

| Documents ! to deci

x0 decide Se eo

FDDA | MRwith CIR | | Petition for Review with |

= | CTA Division }

3. IfCIR or authorized representative does not act within the 180-day

2. File a Petition for Review within 30 days; or

30 days

Lapse of 180-day period | | petition for Review with |

(deemed denial | cTADivision !

b. Await for FDDA

Follow procedure in either I(A)(2) or (A)(2)

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes

B. Recovery of Erroneously or Illegally Collected Taxes and/or Penalties (Section 229, NIRC)

2years

a

v

NOTE: Both the administrative and the judicial

- = =1 —claimmustbe fled within the two-year period

Date of Payment Petition for | " year Pe

or Withholding of Review with |

Tax CTADWision |

File Administrative

Claim with CIR,

(before Judicial

Claim}

C. VAT Refund/Credit (Section 112, NIRC) GETIONS OF TAXPAYER:

1. If CIR or authorized Representative denies claim:

30 days

2 years 120 days

ot e—--®

(considered a denial)

v Period to [peni| re “1

| Petition for |

Close of the | File | Review with |

Taxable Quarter | Administrative pom Division

when de | Claim with CIR !

\ and submit | 2

relevant sales M comneles |

were made, ee 1

ia | documents | eee cece

a eo e

NOTE: Only the administrative claim must be v v

filed within the two-year period. ooh

Lapse of 120-day period | Petition for

| Review with |

'

t

CTA Division |

Page 2 of 12

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes Page 3 of 12

I, REMEDIES UNDER THE LOCAL GOVERNMENT CODE

A. Local Business Tax

1, Assessment

1. If $ P300,000 (or < P400,000 for Metro Manila)

60 days 60 days

1 15 days 15 days 30 days

a > > >

o—_e—e___—-©

J L___, ronoso 7 7

5 1

Notice of | | Protest to | decide '

Assessment | | Local ! Denial by | Appeal | ‘Appeal

| Treasurer iT or | tomrc | ini

- Lapse of a

60 days

2. If > P300,000 (or > P400,000 for Metro Manila)

NOTE: The period to appeal shall be Interrupted by a timely motion for new trial

tn 30 days ‘or reconsideration. In any case, ifthe motion is denied, the movant has a fresh

ase m period of 15 days from receipt or notice of arder denying or dismissing the

eee motion for reconsideration within whieh to file the appeal. (Neypes Doctrine]

Denial by Petition

Toor tor

Lapse of Review

ee to the

iid cma

Division

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Civ Oblicon DigestsDocument49 pagesCiv Oblicon DigestsCattleya90% (10)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- BIR Ruling No 455-93 DigestDocument2 pagesBIR Ruling No 455-93 DigestJason CertezaPas encore d'évaluation

- Legal Forms in Civil CasesDocument34 pagesLegal Forms in Civil CasesJason Certeza100% (2)

- Judicial Affidavit Rule A.M. No. 12-8-8-SCDocument7 pagesJudicial Affidavit Rule A.M. No. 12-8-8-SCjason_escuderoPas encore d'évaluation

- StatCon Latin MaximsDocument3 pagesStatCon Latin MaximsJason CertezaPas encore d'évaluation

- Accession Chart in PropertyDocument3 pagesAccession Chart in PropertyKelsey Olivar Mendoza100% (2)

- 3C Evidence Part 1Document136 pages3C Evidence Part 1Jason CertezaPas encore d'évaluation

- AGENCY - 2D '13 Class Digest - CompleteDocument41 pagesAGENCY - 2D '13 Class Digest - CompleteJason Certeza100% (4)

- SB 1328Document19 pagesSB 1328Jason CertezaPas encore d'évaluation

- Bir Ruling 044-10Document4 pagesBir Ruling 044-10Jason CertezaPas encore d'évaluation

- A Road Map To The New FTC Franchise RuleDocument7 pagesA Road Map To The New FTC Franchise RuleFranquicias para hispanosPas encore d'évaluation

- Conflicts Philippine CasesDocument19 pagesConflicts Philippine CasesJason CertezaPas encore d'évaluation

- Nego Case Digests - Sec. 1Document5 pagesNego Case Digests - Sec. 1Jason CertezaPas encore d'évaluation

- Torts - August 22Document6 pagesTorts - August 22Jason CertezaPas encore d'évaluation

- Second Division: Petitioners, PresentDocument127 pagesSecond Division: Petitioners, PresentJason CertezaPas encore d'évaluation