Académique Documents

Professionnel Documents

Culture Documents

Highnoon-Oct14 10

Transféré par

sanjeev77Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Highnoon-Oct14 10

Transféré par

sanjeev77Droits d'auteur :

Formats disponibles

Visit us at www.sharekhan.

com October 14, 2010 13:00 noon IST

Punter’s Call

Support @ 6200

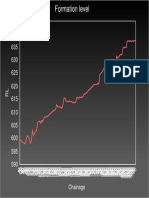

The Nifty has given a negative close on the hourly charts run. Market breadth is positive with 716 advances and 674

indicating that the rally, which started from 6057, has declines.

taken a halt. Now till today’s high is not taken off i.e.

6284 Nifty may still be sideways. On the lower side 6200 Of the 30 stocks of the Sensex Larsen and Toubro (down

is a crucial support which is 38.2% retracement of the 2.24%) and NTPC (down 1.25%) are the top losers, whereas,

rise from 6057 to 6284. The daily momentum indicators Wipro (up 2.54%) and Tata Steel (up 2.42%) are the top

still remain in sell mode which is showing some negative gainers.

divergence on Nifty. So, now one should buy above 6284

or on dips at 6200 to match the ideal risk-reward in the Updated at 12:00 noon

short term. The Nifty is getting closer and closer to its all Advance Decline

time high and we continue to maintain our short term BSE 1,453 1,454

bias up for the target of 6350. NSE 728 666

Moving Average (hourly)

On hourly charts, KST momentum indicator has given a

buy crossover and is trading above the zero line. The 20(S) 6143 100 (S) 6102

Nifty is trading above its 20HMA and 40HMA, i.e. 6143 40(S) 6141 200 (S) 5937

and 6147 respectively, which are supports in the short S: Simple Moving Average

- NSE50 [NIFTY] (6,224.75, 6,240.85, 6,222.35, 6,235.30, +10.7500) 6350

6300

6250

6200

6150

6100

6050

6000

5950

5900

5850

5800

5750

5700

5650

5600

5550

5500

5450

5400

5350

5300

KST (1.63983) 2.5

2.0

1.5

1.0

0.5

0.0

-0.5

-1.0

25 26 27 30 31 1 2 3 6 7 8 9 13 14 15 16 17 20 21 22 23 24 27 28 29 30 1 4 5 6 7 8 11 12 13 14 15

September October

For Private Circulation only

Short Term Trend

Target Trend Reversal Support/Resistance

Sensex 21200

u Down below 20107 20107 / 21200

Nifty 6350 u Down below 6057 6057 / 6350

Medium Term

Medium Term Trend

Trend

Target Trend Reversal Support/Resistance

Sensex 22500 u Down below 19100 19100 / 22500

Nifty 6700 u Down below 5740 5740 / 6700

Icon guide

u

u Up Down Downswing matures Upswing matures

CTFT Calls

Carry today for tomorrow

Stock Action Stop loss Price Closing price Target

Praj Industries Buy 74.1 74.8 74.9 76/77

Punjab National Bank Buy 1,334.0 1,347.8 1,349.1 1,362/1,375

High noon 2 October 14, 2010 Home

Smart Charts

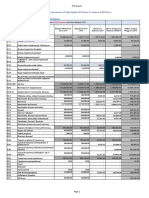

Date Recommendation Action Stop Loss/ Stop Loss/ Buy/Sell Closing Potential % Targets

Reversal Reversal Price Price P/L at

(Intra-day) DCL (CMP) CMP

13-10-10 Gujarat NRE Coke Buy - 66.0 68.1 68.0 -0.1% 73.5-78

13-10-10 United Phosphorus Buy - 184.5 194.0 191.2 -1.4% 205-210

13-10-10 Punj Lloyd Buy - 131.0 136.8 135.6 -0.9% 145-155

12-10-10 Apollo Tyres Buy - 79.9 84.0 84.4 0.5% 88.5-91

11-10-10 Essar Oil Buy - 135.0 141.7 140.8 -0.6% 149-154

6-10-10 Prism Cement Buy - 59.0 62.5 62.4 -0.2% 66-72

6-10-10 Peninsula Land Buy - 66.0 70.7 67.7 -4.2% 78-85

5-10-10 Hindustan Oil Buy - 236.0 254.6 243.7 -4.3% 275-300

05-10-10 TTML Buy - 21.9 23.4 23.9 2.1% 26-29

24-09-10 Reliance Industries Buy - 1,007.9 1,007.4 1,072.0 6.4% 1085-1170

NOTE: Kindly note that all stop losses in Smart Charts Calls are on closing basis unless specified.

TPB: Trailing profit booked

Momentum Calls

For the short term—1 to 5 days

Stock Action Action Stop loss Price Closing Potential % Target1 Target2

Date price P/L at CMP

Tata Comm Buy 14-10-10 329.0 336.4 335.0 -0.4% 343.0 347.0

Prism Cement Buy 13-10-10 Book Profit 62.2 65.5 5.3% 64.0 65.5

RPower Buy 13-10-10 163.4 165.1 164.4 -0.4% 169.0 173.0

Tech Mahindra Buy 13-10-10 778.0 783.0 789.0 0.8% 802.0 813.0

Dr. Reddy’s Lab Buy 13-10-10 1,584.0 1,582.0 1,594.0 0.8% 1,612.0 1,640.0

BPCL Buy 13-10-10 Stopped Out 754.0 739.0 -2.0% 769.2 784.2

TCS Buy 13-10-10 Book Profit 958.0 979.0 2.2% 978.0 997.0

Praj Industries Buy 13-10-10 72.5 74.8 75.1 0.4% 76.5 78.0

ICICI Bank Buy 11-10-10 Book Profit 1,142.5 1,166.0 2.1% 1,165.5 1,188.5

NOTE: Kindly note that all stop losses in Momentum Calls are on an intra-day basis.

TPB: Trailing profit bookeds

NOTE : Action taken after market hours will be highlited in blue colour.

Home

To know more about our products and services click here.

Disclaimer

“This document has been prepared by Sharekhan Ltd. This Document is subject to changes without prior notice and is intended only for the person or entity to which it is addressed to and may contain confidential and/or privileged material and is not for any type of circulation. Any review, retransmission, or

any other use is prohibited. Kindly note that this document does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is from publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies, their directors and employees (“SHAREKHAN and affiliates”)

are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. We do not represent that information contained herein is accurate or complete and it should not be relied

upon as such. This document is prepared for assistance only and is not intended to be and must not alone betaken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such investigations

as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed

or views expressed may not be suitable for all investors. We do not undertake to advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject

SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves

of and to observe such restriction.

High Noon 3 October 14, 2010 Home

SHAREKHAN & affiliates may have used the information set forth herein before publication and may have positions in, may from time to time purchase or sell or may be materially interested in any of the securities mentioned or related securities. SHAREKHAN may from time to time solicit from, or

perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of

any kind. Any comments or statements made herein are those of the analyst and do not necessarily reflect those of SHAREKHAN.”

Vous aimerez peut-être aussi

- Characteristics of Winning Traders - John Pocorobba 10-14-19Document65 pagesCharacteristics of Winning Traders - John Pocorobba 10-14-19danhPas encore d'évaluation

- Essential Oils Business PlanDocument35 pagesEssential Oils Business PlanSwagat R Pyakurel73% (15)

- Test BankDocument197 pagesTest BankJomar100% (1)

- Depository System in IndiaDocument10 pagesDepository System in Indiababloorabidwolverine100% (2)

- Atlas Budget TemplateDocument13 pagesAtlas Budget Templateapi-3701155100% (1)

- Financial Modelling 2016Document25 pagesFinancial Modelling 2016SukumarPas encore d'évaluation

- Black Book 07Document57 pagesBlack Book 07akshat50% (2)

- Weekly Report-South Region - WK36Document3 pagesWeekly Report-South Region - WK36Adil MuradPas encore d'évaluation

- Study Id35480 Coworking Spaces Statista DossierDocument69 pagesStudy Id35480 Coworking Spaces Statista DossierManpriya JainPas encore d'évaluation

- Portfolio Management in Kotak SecuritesDocument92 pagesPortfolio Management in Kotak SecuritesGunda Abhishek0% (1)

- (Equities) : Cracks All OverDocument7 pages(Equities) : Cracks All OverMahesh PhalePas encore d'évaluation

- NIFTY Outlook 11th AprilDocument3 pagesNIFTY Outlook 11th AprilAnkit GuptaPas encore d'évaluation

- Phuluc (Lan 17)Document141 pagesPhuluc (Lan 17)longhoang75Pas encore d'évaluation

- EagleEye-Apr01 11 (E)Document4 pagesEagleEye-Apr01 11 (E)Rem MaliPas encore d'évaluation

- Rollover Analysis: HighlightsDocument7 pagesRollover Analysis: HighlightsBhavya ShivakumarPas encore d'évaluation

- Express AM5Document5 pagesExpress AM5Алёна БартязоваPas encore d'évaluation

- Baasii Galii Keessoo 2015ADocument2 pagesBaasii Galii Keessoo 2015AAddisuPas encore d'évaluation

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimPas encore d'évaluation

- 0 1.5 3 4.5 6 0.75 Miles: LegendDocument1 page0 1.5 3 4.5 6 0.75 Miles: Legendnaem julkerPas encore d'évaluation

- Cartridge Selection Poster EnglishDocument1 pageCartridge Selection Poster EnglisharitharenPas encore d'évaluation

- Intelsat 34Document1 pageIntelsat 34Hugo CrespoPas encore d'évaluation

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueJhonli Aji KasioPas encore d'évaluation

- Gsat 10Document1 pageGsat 10carliemorsey9Pas encore d'évaluation

- HTTPSWWW - Idx.co - Idmedia0ykgvw11wr230401 e PDFDocument2 pagesHTTPSWWW - Idx.co - Idmedia0ykgvw11wr230401 e PDFAkbar GaleriPas encore d'évaluation

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimPas encore d'évaluation

- Bsais 4JDocument18 pagesBsais 4JArjay DeausenPas encore d'évaluation

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimPas encore d'évaluation

- Fee Structure 2022 23Document1 pageFee Structure 2022 23Mukul RaiPas encore d'évaluation

- Technical Analysis - Charts, Trends & Patterns: Presented by Jayanthi Premkumar 0991014Document26 pagesTechnical Analysis - Charts, Trends & Patterns: Presented by Jayanthi Premkumar 0991014ruckumaaluPas encore d'évaluation

- 1001-155-CIV-DWG-BARA-002 Drawing For Foundation Acid 1600 KL (155-TK-17 & 155-TK-18) (R) 08122023Document1 page1001-155-CIV-DWG-BARA-002 Drawing For Foundation Acid 1600 KL (155-TK-17 & 155-TK-18) (R) 08122023mhajaraswadi2023Pas encore d'évaluation

- Latihan Perpetual PT CEMERLANGDocument28 pagesLatihan Perpetual PT CEMERLANGSamsul PangestuPas encore d'évaluation

- Tugas Kelompok StatprobDocument19 pagesTugas Kelompok StatprobAzkha AvicenaPas encore d'évaluation

- Change ID: CRQ000000581352: Requestor Information ClassificationDocument2 pagesChange ID: CRQ000000581352: Requestor Information ClassificationAlamgeer Abdul RazzaquePas encore d'évaluation

- Mr. Anshar Ahmad,: Page 1 of 4Document5 pagesMr. Anshar Ahmad,: Page 1 of 4manashvi mishraPas encore d'évaluation

- El CallaoRegional Geology PDFDocument1 pageEl CallaoRegional Geology PDFJoanMontillaPas encore d'évaluation

- EagleEye May21 13 (E)Document5 pagesEagleEye May21 13 (E)Harshit Raj KarnaniPas encore d'évaluation

- Bulljake 3Document1 pageBulljake 3bparsons215Pas encore d'évaluation

- Tourism Sector Update Sep 2023Document40 pagesTourism Sector Update Sep 2023kvimalPas encore d'évaluation

- MurreeDocument14 pagesMurreeArif KhanPas encore d'évaluation

- Illustration 1.1: Grande Trek: Account Balances 1 October, 2020Document7 pagesIllustration 1.1: Grande Trek: Account Balances 1 October, 2020J DashPas encore d'évaluation

- Profit - Loss - 01 03 2024 - 31 03 2024Document4 pagesProfit - Loss - 01 03 2024 - 31 03 2024pajakptpoinmedikaindonesiaPas encore d'évaluation

- 3m Respirator Cartridge and Filter Selection PosterDocument1 page3m Respirator Cartridge and Filter Selection PosterOh DausPas encore d'évaluation

- 4.1 Director Chair Stelo 2.0Document1 page4.1 Director Chair Stelo 2.0shandaPas encore d'évaluation

- To Pathardi To Navgaon Rajuri: Project TitleDocument23 pagesTo Pathardi To Navgaon Rajuri: Project TitleSumit JainPas encore d'évaluation

- LIC Nav Jeevan Plan - Calculation of Returns (IRR - Example)Document3 pagesLIC Nav Jeevan Plan - Calculation of Returns (IRR - Example)SanjivaniPas encore d'évaluation

- Financial Projection For: Rental Internet & Computer GameDocument6 pagesFinancial Projection For: Rental Internet & Computer Gamemoer76Pas encore d'évaluation

- Chart GoDocument1 pageChart Goshaheed jafarPas encore d'évaluation

- Reliability of Structures 2nd Nowak Solution ManualDocument38 pagesReliability of Structures 2nd Nowak Solution Manualbuddhaunkardly2s100% (13)

- DraftDocument1 pageDraftmahakmathurPas encore d'évaluation

- Creditors Oustanding StatementDocument4 pagesCreditors Oustanding StatementDilan Maduranga Fransisku ArachchiPas encore d'évaluation

- Warehouse Storage Warehouse Storage: Parking AreaDocument1 pageWarehouse Storage Warehouse Storage: Parking AreaVince Bagsit PolicarpioPas encore d'évaluation

- Strategy Name Number of Option Legs Direction: Short Straddle 2 Market NeutralDocument4 pagesStrategy Name Number of Option Legs Direction: Short Straddle 2 Market NeutralGupta JeePas encore d'évaluation

- WORKSHEET (Lembar Jawaban)Document10 pagesWORKSHEET (Lembar Jawaban)I Gede Wahyu krisna DarmaPas encore d'évaluation

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinPas encore d'évaluation

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueMandiri Mesindo PatiPas encore d'évaluation

- Form Neraca Lajur #Document8 pagesForm Neraca Lajur #Anggi Saeful RohmanPas encore d'évaluation

- Report EXCEL - Laporan Produksi Harian (LPH)Document59 pagesReport EXCEL - Laporan Produksi Harian (LPH)HeriPas encore d'évaluation

- Funds Position Report-HorizontalDocument1 pageFunds Position Report-HorizontalZulqarnainPas encore d'évaluation

- Buletin Statistik ASPI SP Q1 2023 UmumDocument13 pagesBuletin Statistik ASPI SP Q1 2023 UmumIndra Wahyu PratamaPas encore d'évaluation

- Option Chain (Equity Derivatives)Document2 pagesOption Chain (Equity Derivatives)The599499Pas encore d'évaluation

- List Barang Urgent FEB 2023Document1 pageList Barang Urgent FEB 2023ujang karbitPas encore d'évaluation

- S-12 FCD Almeda 2 CanopyDocument1 pageS-12 FCD Almeda 2 CanopyAlvin SanvictoresPas encore d'évaluation

- List Barang Urgent MAR 2023Document1 pageList Barang Urgent MAR 2023ujang karbitPas encore d'évaluation

- RAWDocument21 pagesRAWArjay DeausenPas encore d'évaluation

- Soal PT Buana Laporan KeuanganDocument15 pagesSoal PT Buana Laporan Keuangankakafahreza25Pas encore d'évaluation

- Kitchen Proposal: Proposed by HOME RagaDocument17 pagesKitchen Proposal: Proposed by HOME RagaChetna JoshiPas encore d'évaluation

- Bgs Institute of TechnologyDocument22 pagesBgs Institute of Technologybalakrishna krPas encore d'évaluation

- PT Finansia Multi Finance: Credit Profile Financial HighlightsDocument1 pagePT Finansia Multi Finance: Credit Profile Financial HighlightsButje MboetPas encore d'évaluation

- Capital Rationing PDFDocument12 pagesCapital Rationing PDFnagarajan sPas encore d'évaluation

- Summary Valuation Report:: Portfolio of Brookfield India Real Estate TrustDocument23 pagesSummary Valuation Report:: Portfolio of Brookfield India Real Estate TrustArvind JainPas encore d'évaluation

- Cost of CapitalDocument66 pagesCost of CapitalPriya SinghPas encore d'évaluation

- Closure FormDocument3 pagesClosure FormSriteja JosyulaPas encore d'évaluation

- Reading 21 Financial Analysis TechniquesDocument74 pagesReading 21 Financial Analysis TechniquesNeerajPas encore d'évaluation

- Practice Question Bells LTD LTDDocument2 pagesPractice Question Bells LTD LTDShaikh Hafizur RahmanPas encore d'évaluation

- Unclaimed and Unpaid Dividend Pending With The Company As On 31.03.2019Document9 pagesUnclaimed and Unpaid Dividend Pending With The Company As On 31.03.2019harsh bangurPas encore d'évaluation

- Fa9e Partiv ch12 15 PDFDocument173 pagesFa9e Partiv ch12 15 PDFAbdulaziz AlzainPas encore d'évaluation

- Forecasting FCFE FCFF and Security ValuationDocument22 pagesForecasting FCFE FCFF and Security ValuationAmruta MayekarPas encore d'évaluation

- Venu 42 ReportDocument64 pagesVenu 42 ReportSubbaRaoPas encore d'évaluation

- Cash Management WorkbookDocument10 pagesCash Management Workbookanna reham lucmanPas encore d'évaluation

- Stanford Case Study PDFDocument20 pagesStanford Case Study PDFWilliam LouchPas encore d'évaluation

- Exotic Derivatives & OptionsDocument2 pagesExotic Derivatives & OptionskurrirajeshPas encore d'évaluation

- Instruments of Credit Control in Central BankDocument8 pagesInstruments of Credit Control in Central BankAnya SinghPas encore d'évaluation

- General Accounting 1 - Indianola Pharmaceutical CompanyDocument7 pagesGeneral Accounting 1 - Indianola Pharmaceutical CompanyRheu ReyesPas encore d'évaluation

- CAREER POWER - No 09 Sbi CLRK PlrmsDocument59 pagesCAREER POWER - No 09 Sbi CLRK PlrmsrangulasivakasiPas encore d'évaluation

- Econ 121 Money and Banking Instructor: Chao WeiDocument3 pagesEcon 121 Money and Banking Instructor: Chao WeiSyed Hassan Raza JafryPas encore d'évaluation

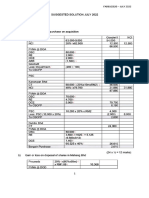

- July 22 Far620Document8 pagesJuly 22 Far620FARAH ZAFIRAH ISHAMPas encore d'évaluation

- Mondol Securities Limited: Le Meridien (6th Floor), Block#2, Plot#79/A, Airport Road, Nikunja-2, Khilkhet, Dhaka-1229Document1 pageMondol Securities Limited: Le Meridien (6th Floor), Block#2, Plot#79/A, Airport Road, Nikunja-2, Khilkhet, Dhaka-1229Istiaque AhmadPas encore d'évaluation

- The Venezuelan Enterprise Current Situation Challenges and OpportunitiesDocument74 pagesThe Venezuelan Enterprise Current Situation Challenges and OpportunitiesRuben Gonzalez CortesPas encore d'évaluation