Académique Documents

Professionnel Documents

Culture Documents

BPI V BPI Employees Union-MM

Transféré par

alexDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

BPI V BPI Employees Union-MM

Transféré par

alexDroits d'auteur :

Formats disponibles

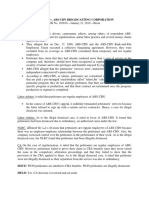

BPI v.

BPI Employees Union-Metro Manila

G.R. No. 175678

August 22, 2012

Petitioner: BANK OF THE PHILIPPINE ISLANDS

Respondent: BANK OF THE PHILIPPINE ISLANDS EMPLOYEES

UNION-METRO MANILA

Ponente: Peralta, J.

FACTS

1. Respondent Union, the SEBA of all R&F of petitioner in Metro Manila had a CBA with

petitioner which provides for loan benefits and relatively low interest rates

a. Multi-purpose loan (Php40k)

b. Real estate-secured housing loan (Php450k)

c. Car loan (Php450k)1

d. Emergency loan (Php10/15k)

2. Thereafter, petitioner issued a “no negative data bank policy”2 (No NDB policy) for the

implementation/availment of the manpower loans

a. Respondent objected

3. Grievance machinery: not resolved

4. Voluntary Arbitrator: No NDB policy, as a new condition, violates CBA

5. CA (via Rule 43): AFFIRMED VA

ISSUE: W/N the “No NDB policy” violates the CBA. YES

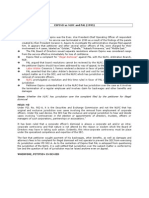

HELD

1. A CBA refers to the negotiated contract between a legitimate labor organization and the

employer concerning wages, hours of work and all other terms and conditions of

employment in a bargaining unit, including mandatory provisions for grievances and

arbitration machineries

a. As in all other contracts, there must be clear indications that the parties reached a

meeting of the minds

b. Therefore, the terms and conditions of a CBA constitute the law between the

parties

2. ITC, CBA contains no provision on the “no negative data bank policy” as a

prerequisite in the entitlement of the benefits it set forth for the employees

3. T&Cs for availment are plain and clear, all they need is proper implementation to reach

their objective

4. Although it can be said that petitioner is authorized to issue rules and regulations pertinent

to the availment and administration of the loans under the CBA, the additional rules and

regulations, however, must not impose new conditions which are not contemplated in the

CBA and should be within the realm of reasonableness

1Car loan + real-estate secured housing loan = Php450k

2As bank employees, one is expected to practice the highest standards of financial prudence

and sensitivity to basic rules of credit and management of his/her financial resources and

needs. It is for this reason that Management deemed fit that reference to the Negative Data

Bank (NDB) and other sources of financial data handling shall be made for purposes of

evaluation of manpower loans.

5. The “no negative data bank policy” is a new condition which is never contemplated

in the CBA and at some points, unreasonable to the employees because it provides

that

a. before an employee or his/her spouse can avail of the loan benefits under the CBA,

the said employee or his/her spouse must not be listed in the negative data bank,

or

b. if previously listed therein, must obtain a clearance at least one year or six months

as the case may be, prior to a loan application

6. Negotiations between an employer and a union transpire before they agree on the T&Cs

contained in the CBA

a. If the petitioner, indeed, intended to include a “no negative data bank policy” in the

CBA, it should have presented such proposal to the union during the

negotiations

b. To include such policy after the effectivity of the CBA is deceptive and goes beyond

the original agreement between the contracting parties

7. Petitioner: No NDB policy is intended to exact a high standard of conduct from its

employees

a. However, the terms and conditions of the CBA must prevail

b. Petitioner can propose the inclusion of the said policy upon the expiration of the

CBA, during the negotiations for a new CBA, but in the meantime, it has to honor

the provisions of the existing CBA

8. Art. 1702, NCC: in case of doubt, all labor legislation and all labor contracts shall

be construed in favor of the safety and decent living of the laborer

a. Any doubt or ambiguity in the contract between management and the union

members should be resolved in favor of the latter

b. No doubt, in this case, that the welfare of the laborers stands supreme

Petition DENIED.

Vous aimerez peut-être aussi

- 105 BPI v. BPI Employees Union - Metro ManilaDocument2 pages105 BPI v. BPI Employees Union - Metro ManilaLiliosaEscober100% (1)

- BPI v. BPI Employees UnionDocument2 pagesBPI v. BPI Employees Unionmarites ongtengcoPas encore d'évaluation

- San Miguel Corporation Vs NLRC DigestDocument2 pagesSan Miguel Corporation Vs NLRC DigestRolan Klyde Kho YapPas encore d'évaluation

- Bañez vs. Hon. Valdevilla G.R. No. 128024 May 9, 2000 DoctrineDocument1 pageBañez vs. Hon. Valdevilla G.R. No. 128024 May 9, 2000 DoctrineMinorka Sushmita Pataunia SantoluisPas encore d'évaluation

- Rural Bank of Alaminos Vs NLRCDocument2 pagesRural Bank of Alaminos Vs NLRCpja_14100% (1)

- Best Wear vs. de Lemos DigestDocument1 pageBest Wear vs. de Lemos DigestBrian YuiPas encore d'évaluation

- La Naval Drug Corporation VDocument2 pagesLa Naval Drug Corporation VJose BautistaPas encore d'évaluation

- Stolt-Nielsen Marine Services Vs NLRCDocument2 pagesStolt-Nielsen Marine Services Vs NLRCmimisabayton50% (2)

- San Miguel Corporation Vs NLRCDocument1 pageSan Miguel Corporation Vs NLRCRolan Klyde Kho YapPas encore d'évaluation

- Mindanao Times Corporation vs. Confesor G.R. No. 183417 February 5, 2010Document2 pagesMindanao Times Corporation vs. Confesor G.R. No. 183417 February 5, 2010Iris AiePas encore d'évaluation

- Fulache v. ABS CBN (Digest)Document2 pagesFulache v. ABS CBN (Digest)Tini Guanio100% (1)

- Rural Bank of Coron Versus Annalisa CortesDocument1 pageRural Bank of Coron Versus Annalisa CortesganggingskiPas encore d'évaluation

- Liberty Union Vs Liberty CottonDocument2 pagesLiberty Union Vs Liberty Cottonrubbtuna100% (1)

- Dr. Loreche-Amit vs. Cagayan de Oro Medical CenterDocument2 pagesDr. Loreche-Amit vs. Cagayan de Oro Medical CenterMarinelle Aycee Moleta Perral50% (2)

- PNB V Cabansag DigestDocument2 pagesPNB V Cabansag DigestJeru Sagaoinit100% (2)

- LABOR RELATIONS Cases For ReviewDocument823 pagesLABOR RELATIONS Cases For ReviewCJVPas encore d'évaluation

- BPI Vs BPI EmployeesUnionDocument2 pagesBPI Vs BPI EmployeesUnionadrixuletPas encore d'évaluation

- Bernard A. Tenazas, Jaime Francisco, and Isidro Endraca v. R. Villegas Taxi TransportDocument2 pagesBernard A. Tenazas, Jaime Francisco, and Isidro Endraca v. R. Villegas Taxi TransportMJ AroPas encore d'évaluation

- BPI V BPI Employees DigestDocument2 pagesBPI V BPI Employees DigestJo-ana Desuyo100% (1)

- 02 GR 198783Document4 pages02 GR 198783Mabelle ArellanoPas encore d'évaluation

- Villa V NLRCDocument3 pagesVilla V NLRCJackie Canlas100% (1)

- Ching v. SalinasDocument4 pagesChing v. SalinasKumusta-Ako Si Torc100% (1)

- RIMANDO A. GANNAPAO Versus CIVIL SERVICE COMMISSION (CSC)Document2 pagesRIMANDO A. GANNAPAO Versus CIVIL SERVICE COMMISSION (CSC)Pim Lumauag100% (1)

- Sonza V ABSCBN Case DigestDocument4 pagesSonza V ABSCBN Case DigestAko Si Paula MonghitPas encore d'évaluation

- Nuwhrain DigestDocument2 pagesNuwhrain DigestRobertPas encore d'évaluation

- 0131 G.R. No. 74730 August 25, 1989 Caltex Vs IacDocument6 pages0131 G.R. No. 74730 August 25, 1989 Caltex Vs IacrodolfoverdidajrPas encore d'évaluation

- BPI v. BPI Employees Union-Davao, GR No. 164301, August 10, 2010Document2 pagesBPI v. BPI Employees Union-Davao, GR No. 164301, August 10, 2010Ja RuPas encore d'évaluation

- Action: Civil Case CFI Rizal, Makati Was Filed by Ernesto Medina and Jose G. Ong Against Cosme de Aboitiz and Pepsi-Cola BottlingDocument2 pagesAction: Civil Case CFI Rizal, Makati Was Filed by Ernesto Medina and Jose G. Ong Against Cosme de Aboitiz and Pepsi-Cola BottlingJim ParedesPas encore d'évaluation

- Soco Vs Mercantile CorpDocument2 pagesSoco Vs Mercantile CorpChiara JaynePas encore d'évaluation

- Elisco-Elirol Labor Union Vs NorielDocument3 pagesElisco-Elirol Labor Union Vs NorieltengloyPas encore d'évaluation

- Sanyo vs. Canizares Digest & FulltextDocument9 pagesSanyo vs. Canizares Digest & FulltextBernie Cabang PringasePas encore d'évaluation

- Case ListDocument5 pagesCase ListItzah C KretPas encore d'évaluation

- Amit V Cagayan de Oro Med CenterDocument1 pageAmit V Cagayan de Oro Med CenterAndrewPas encore d'évaluation

- Espino Vs NLRC and PalDocument1 pageEspino Vs NLRC and Palmaanyag6685Pas encore d'évaluation

- MECO vs. Meralco WorkersDocument2 pagesMECO vs. Meralco Workershellostudents123Pas encore d'évaluation

- SSK Parts V SSK CamasDocument1 pageSSK Parts V SSK CamasKat Jolejole100% (1)

- Eagle Ridge Golf Country Club Vs CA & Ereu, 2010Document6 pagesEagle Ridge Golf Country Club Vs CA & Ereu, 2010sarah abutazilPas encore d'évaluation

- 30 - G R - No - 208535-DigestDocument2 pages30 - G R - No - 208535-DigestNaomi InotPas encore d'évaluation

- 19 Alilem Credit V BandiolaDocument2 pages19 Alilem Credit V BandiolaDaphne Dianne MendozaPas encore d'évaluation

- 4 Pepsi Cola V MartinezDocument2 pages4 Pepsi Cola V MartinezChristiane Marie Bajada100% (1)

- FEU V TrajanoDocument1 pageFEU V TrajanoPeperonii0% (2)

- 01 Gabriel vs. Sec of LaborDocument2 pages01 Gabriel vs. Sec of LaborcagrnsPas encore d'évaluation

- EPacific Vs CabansayDocument2 pagesEPacific Vs CabansayStephanie Valentine100% (1)

- Capitol Medical Center Vs MerisDocument2 pagesCapitol Medical Center Vs MerisLaurence Brian M. HagutinPas encore d'évaluation

- Title: Veloso V China Airlines GR No.: 104302Document3 pagesTitle: Veloso V China Airlines GR No.: 104302Rochelle Joy SolisPas encore d'évaluation

- Philippine Journalist Vs Journal EMPLOYEES UNION (G.R. NO. 192601 JUNE 3, 2013)Document1 pagePhilippine Journalist Vs Journal EMPLOYEES UNION (G.R. NO. 192601 JUNE 3, 2013)RobertPas encore d'évaluation

- Ust Vs Samahang Manggagawa NG UstDocument2 pagesUst Vs Samahang Manggagawa NG UstkaiaceegeesPas encore d'évaluation

- PCI AUTOMATION CENTER, INC. vs. NLRCDocument3 pagesPCI AUTOMATION CENTER, INC. vs. NLRCJomarco SantosPas encore d'évaluation

- ABS-CBN v. World Interactive Network Systems (WINS) : G .R. NO - 169332 FEBRU A RY 11, 2008Document9 pagesABS-CBN v. World Interactive Network Systems (WINS) : G .R. NO - 169332 FEBRU A RY 11, 2008Jerahmeel CuevasPas encore d'évaluation

- Sanyo v. Canizares (Labor II)Document2 pagesSanyo v. Canizares (Labor II)philippinoyPas encore d'évaluation

- METROLAB INDUSTRIES INC. vs. HON. MA. NIEVES ROLDAN-CONFESOR AND METROLAB INDUSTRIES EMPLOYEES ASSOCIATION - DigestDocument1 pageMETROLAB INDUSTRIES INC. vs. HON. MA. NIEVES ROLDAN-CONFESOR AND METROLAB INDUSTRIES EMPLOYEES ASSOCIATION - DigestRoxanne Peña100% (1)

- Naftu Vs Maldecowu-UlfwpDocument3 pagesNaftu Vs Maldecowu-UlfwpRe YaPas encore d'évaluation

- Art 263-264 Chris Garments CaseDocument2 pagesArt 263-264 Chris Garments CaseKwakwakPas encore d'évaluation

- Santiago v. C.F. Sharp Crew (Digest)Document3 pagesSantiago v. C.F. Sharp Crew (Digest)Eumir SongcuyaPas encore d'évaluation

- 06 MC ENGINEERING v. NLRC (FERRER) PDFDocument2 pages06 MC ENGINEERING v. NLRC (FERRER) PDFTon RiveraPas encore d'évaluation

- 8 Oreshoot Mining Co. Vs ArellanoDocument3 pages8 Oreshoot Mining Co. Vs ArellanoChristiane Marie BajadaPas encore d'évaluation

- Group 5 Digest CompilationDocument8 pagesGroup 5 Digest Compilationbrida athenaPas encore d'évaluation

- Domondon Vs NLRCDocument1 pageDomondon Vs NLRCpja_14Pas encore d'évaluation

- J. Peralta: Bpi V. Bpi Employees Union-Metro ManilaDocument3 pagesJ. Peralta: Bpi V. Bpi Employees Union-Metro ManilaCamille BritanicoPas encore d'évaluation

- 105 BPI V BPI Employees Union Metro ManilaDocument2 pages105 BPI V BPI Employees Union Metro ManilaalexPas encore d'évaluation

- HAMDAN V. RUMSFELD (548 U.S. 557) - 2006 Facts: Petitioner Salim Hamdan, A Citizen of Yemen, Was TheDocument1 pageHAMDAN V. RUMSFELD (548 U.S. 557) - 2006 Facts: Petitioner Salim Hamdan, A Citizen of Yemen, Was ThealexPas encore d'évaluation

- Leyla Sahin vs. TurkeyDocument1 pageLeyla Sahin vs. TurkeyalexPas encore d'évaluation

- LockerbieDocument2 pagesLockerbiealexPas encore d'évaluation

- Yamashita vs. StyerDocument2 pagesYamashita vs. StyeralexPas encore d'évaluation

- Bachrach V Talisay SilayDocument1 pageBachrach V Talisay SilayalexPas encore d'évaluation

- Perpetua For Each. Jumamoy Was Ordered To Indemnify The Heirs of TheDocument2 pagesPerpetua For Each. Jumamoy Was Ordered To Indemnify The Heirs of ThealexPas encore d'évaluation

- National Power Corporation Vs City of Cabanatuan: Diciembre 5, 2013Document2 pagesNational Power Corporation Vs City of Cabanatuan: Diciembre 5, 2013alexPas encore d'évaluation

- 105 BPI V BPI Employees Union Metro ManilaDocument2 pages105 BPI V BPI Employees Union Metro ManilaalexPas encore d'évaluation

- Qatar v. Bahrain 2001 PDFDocument84 pagesQatar v. Bahrain 2001 PDFalexPas encore d'évaluation

- 01-Introduction To Medical Jurisprudence Jan-May 2019 UP PDFDocument4 pages01-Introduction To Medical Jurisprudence Jan-May 2019 UP PDFalexPas encore d'évaluation

- Viii. Unfair Labor Practice A. in GeneralDocument5 pagesViii. Unfair Labor Practice A. in GeneralalexPas encore d'évaluation

- Udhr Preamble Icescr Article 2: The Right To Organise (Entry Into Force: 04 Jul 1950)Document10 pagesUdhr Preamble Icescr Article 2: The Right To Organise (Entry Into Force: 04 Jul 1950)alexPas encore d'évaluation

- Blondeau V NanoDocument1 pageBlondeau V NanoalexPas encore d'évaluation

- People V de LeonDocument6 pagesPeople V de LeonalexPas encore d'évaluation

- The Market Mechanism: SA. Quimbo 27 January 2015Document14 pagesThe Market Mechanism: SA. Quimbo 27 January 2015alexPas encore d'évaluation

- Chapter 9Document11 pagesChapter 9shaikha alneyadiPas encore d'évaluation

- Timesheet GOPA CLMDocument1 pageTimesheet GOPA CLMKhaled ShekoPas encore d'évaluation

- Final Term Paper (Imrul Hasan)Document82 pagesFinal Term Paper (Imrul Hasan)Sharif Md RezaPas encore d'évaluation

- c2 Mgt420 Yong SlideDocument40 pagesc2 Mgt420 Yong SlideNurul SakinahPas encore d'évaluation

- DH 1217Document12 pagesDH 1217The Delphos HeraldPas encore d'évaluation

- Draft National Building Maintenance Policy October 2011Document47 pagesDraft National Building Maintenance Policy October 2011Ir An100% (4)

- Job Application Letter Sample NgoDocument8 pagesJob Application Letter Sample Ngos1telylawyn3100% (1)

- Participatory and Non-Particpatory Management: Prepared by Sreedivya. V.S & Anuja.F. LawrenceDocument15 pagesParticipatory and Non-Particpatory Management: Prepared by Sreedivya. V.S & Anuja.F. LawrenceSREE DIVYAPas encore d'évaluation

- 2020.01.27 ICS Social Complete Handbook For Factories V2Document46 pages2020.01.27 ICS Social Complete Handbook For Factories V2Jucy NguyenPas encore d'évaluation

- Department of Labor: Ncentral07Document70 pagesDepartment of Labor: Ncentral07USA_DepartmentOfLaborPas encore d'évaluation

- Answer With Counterclaim - Final For PrintingDocument11 pagesAnswer With Counterclaim - Final For PrintingPatrick PenachosPas encore d'évaluation

- Guide For Working in TeamsDocument3 pagesGuide For Working in TeamspigilantePas encore d'évaluation

- S1386 SCAs SingletonDocument3 pagesS1386 SCAs SingletonICNJPas encore d'évaluation

- Axiom Medical Releases "Workers' Comp: Minimize The Impact" White PaperDocument2 pagesAxiom Medical Releases "Workers' Comp: Minimize The Impact" White PaperPR.comPas encore d'évaluation

- Scientific QuestionDocument7 pagesScientific QuestionSanket PatelPas encore d'évaluation

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument1 pageW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceMegan AndreaPas encore d'évaluation

- MS 108 - Unit 9Document26 pagesMS 108 - Unit 9kamrulislamaustralia92Pas encore d'évaluation

- Payslip 815431 2022-01Document1 pagePayslip 815431 2022-01Lokesh PutturPas encore d'évaluation

- Inflation and Unemployment in Nigeria: An ARDL - ApproachDocument6 pagesInflation and Unemployment in Nigeria: An ARDL - ApproachPremier PublishersPas encore d'évaluation

- PHP 50,000/month PHP 30,000/month Yes PHP 2,000: - ConformeDocument1 pagePHP 50,000/month PHP 30,000/month Yes PHP 2,000: - ConformeluckyPas encore d'évaluation

- Exemple CV Filetype PDFDocument2 pagesExemple CV Filetype PDFNancyPas encore d'évaluation

- IR Unit VDocument23 pagesIR Unit Vyogitha reddyPas encore d'évaluation

- Peoplesoft Training Base Benefits: Fewer Clients, More AttentionDocument136 pagesPeoplesoft Training Base Benefits: Fewer Clients, More AttentionManoPas encore d'évaluation

- Management Theory and PracticeDocument5 pagesManagement Theory and PracticeGEORGINA PAULlPas encore d'évaluation

- Industrial Disputes Act 1947Document2 pagesIndustrial Disputes Act 1947Jithin Krishnan100% (1)

- TCSDocument43 pagesTCScapsam1Pas encore d'évaluation

- Recruitment Selection Process Methods and StepsDocument13 pagesRecruitment Selection Process Methods and StepsVinoth RajaPas encore d'évaluation

- Motivating PeopleDocument4 pagesMotivating Peoplesweetgirl11Pas encore d'évaluation

- 11 Task Performance - ARG CCPDocument2 pages11 Task Performance - ARG CCPVenoMyyy 28Pas encore d'évaluation

- Impact of Emotional Intelligence On Employees PerformanceDocument24 pagesImpact of Emotional Intelligence On Employees Performancedanamaria13100% (2)