Académique Documents

Professionnel Documents

Culture Documents

ABC Review Question+answer2 PDF

Transféré par

Ahmed Munawar0 évaluation0% ont trouvé ce document utile (0 vote)

126 vues2 pagesTitre original

ABC review question+answer2.pdf

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

126 vues2 pagesABC Review Question+answer2 PDF

Transféré par

Ahmed MunawarDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

w

Part / Aetivity-Based Accounting

3. Applied overhead (by product):

Deluxe: ($6.00 X 2,000) + ($1.33 X 2,000)

Regular: ($6.00 X 18,000) + ($1.33 x 43,000)

14,660

$165,190

4, Unit cost (rounded to the nearest cent):

Deluxe: ($40,000 + $14,660)/3,000

Regular: ($300,000 + $165,190)/50,000

3, Activity-Based Rates

Nabors Company produces two types of stereo units: deluxe and regular, Activity

data follow:

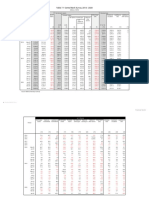

Product-Costing Data

Activity Usage Measures Deluxe Regular __Total

Units produced per year 5,000 50,000 55,000

Prime costs $39,000 $369,000 $408,000

Direct labor hours 5,000 45,000 50,000

Machine hours 10,000 90,000 100,000

Production runs 10 5 15

Number of moves 120 60 180

Activity Cost Data

(Overhead Activities)

Activity Activity Cost

Setups $ 60,000

Material handling 30,000

Power 50,000

Testing 40,000

Total ‘580,000

Required

1. Calculate the consumption ratios for each activity

2. Group activities based on the consumption ratios and activity level

3. Calculate a rate for each pooled group of activities.

4, Using the pool rates, calculate unit product costs.

Solution

1. Consumption ratios:

Overhead Activity jux gular Activity Driver

Setups 0.67" 033* Production runs

Material handling 0.67 0.33" Number of moves

Power 0.10° 0.90 Machine hours

‘Testing 0.108 0.90% Direct labor hours

10/15 (deluxe) an 5/15 (egula)

120/180 (deluxe) ad 6180 (eguls)

§10;200/100,.000 (delat) ad 90,000/200,000 (epae)

45,009/50 000 (dene) and 45 000/50,000 (cela

Chapter 4 / Activity-Based Product Costing [ 148

2, Batch-level: setups and material handling

Unitlevel: power and testing

3. _Batch-Level Pool Unit-Level Pool

Setups $60,000 Power $50,000

Material handling _30,000 “Testing 40,000

Total $90,000 Total $90,000

Runs = 15 Machine hours 100,000

Pool rate $6,000 perrun Pool rate $0.90 per

Tmachine hour

4, Unit costs; ativity-based costing

Deluxe Regular

Prime costs 8 39,000 $369,000

‘Overhead costs:

Batch-level pool

(56,000 * 10) 60,000

(56,000 x 5) 30,000

Unit level pool:

(50.90 x 10,000) 9,000

(50.90 x 90,000) 81,000

Total manufacturing costs $108,000 $480,000

Units produced =_5,000 + 50,000

Unit cost (total costs/units) £21.60 £3.60

Questions for Writing and Discussion

1. Explain why knowing the unit cost of product 9. Explain how undercosting low-volume products

or service is important and overcosting high-volume products can affect

2, What is cost measurement! Cost assignment? the competitive position of a firm.

What is the difference between the two? 10. What are non-unitlevel overhead activities? Non-

3. Explain why an actual overhead rate is rarely unit-level cost drivers? Give some examples

used for product costing. U1, What is meant by “product diversity"?

4, Describe the two-stage process associated with 12, What is an overhead consumption ratio?

plantwide overhead rates 13, Explain how departmental overhead rates can

5, Describe the two-stage process for departmental produce product costs that are more distorted

overhead rates. than those computed using a plantwide rate.

6, Explain why departmental rates might be chosen’ 14, Overhead costs are the source of product cost

cover plantwide rates. distortions. Do you agree or disagree? Explain.

7. Explain how a plantwide overhead rate, using a 15, What is activity-based product costing?

tunitlevel cost driver, can produce distorted prod- 16. What is an activity dictionary?

uct costs. In your answer, identify two major fac- 17, What is the difference between primary and sec-

tors that impair the ability of plantwide rates to ondary activities?

assign cost accurately 18, Explain how costs are assigned to activities,

8, Explain how low-volume products can be under- 19, What are unit-level activities? Batch-level activities?

costed and high-volume products overcosted if Product-level activities? Facility level activities?

only unit-level cost drivers are used to assign. 20. Explain how the number of activity rates can be

overhead costs,

reduced in an ABC system while maintaining a

reasonable level of accuracy.

Vous aimerez peut-être aussi

- Sharing Learning Intentions and Sharing Success CriteriaDocument19 pagesSharing Learning Intentions and Sharing Success CriteriaAhmed MunawarPas encore d'évaluation

- Active LearningDocument18 pagesActive LearningAhmed MunawarPas encore d'évaluation

- Assertive Classroom Management Strategies and Students Performance The Case of EFL ClassroomDocument12 pagesAssertive Classroom Management Strategies and Students Performance The Case of EFL Classroommilani sandamaliPas encore d'évaluation

- Teaching in A Changing SocietyDocument11 pagesTeaching in A Changing SocietyAhmed MunawarPas encore d'évaluation

- Week 1Document7 pagesWeek 1Ahmed MunawarPas encore d'évaluation

- Word Search: Count The Pictures and SubtractDocument1 pageWord Search: Count The Pictures and SubtractmamaalifandarifPas encore d'évaluation

- De BonoDocument24 pagesDe BonoAhmed MunawarPas encore d'évaluation

- Cooperative Learning PPP Week 7Document24 pagesCooperative Learning PPP Week 7Ahmed MunawarPas encore d'évaluation

- QuestioningDocument15 pagesQuestioningAhmed MunawarPas encore d'évaluation

- Supporting Trainee Teachers in Classroom ManagementDocument7 pagesSupporting Trainee Teachers in Classroom ManagementAhmed MunawarPas encore d'évaluation

- Cooperative LearningDocument16 pagesCooperative LearningAhmed MunawarPas encore d'évaluation

- Smart ObjectiveDocument17 pagesSmart ObjectiveAhmed MunawarPas encore d'évaluation

- Chapter 07 The Foreign Exchange MarketDocument32 pagesChapter 07 The Foreign Exchange MarketAhmed MunawarPas encore d'évaluation

- Jumping MathDocument1 pageJumping MathAhmed MunawarPas encore d'évaluation

- Lec 1 - The Context of Managing Public Money PDFDocument30 pagesLec 1 - The Context of Managing Public Money PDFAhmed MunawarPas encore d'évaluation

- Financial Management: Basic ConceptDocument15 pagesFinancial Management: Basic ConceptAhmed MunawarPas encore d'évaluation

- Topic 1 - Politics, Economics, and Political Economy - IntroductionDocument35 pagesTopic 1 - Politics, Economics, and Political Economy - IntroductionAhmed MunawarPas encore d'évaluation

- Assignment Brief - International Finance 2022Document6 pagesAssignment Brief - International Finance 2022Ahmed Munawar100% (1)

- Assignment: Page 1 of 4Document4 pagesAssignment: Page 1 of 4Ahmed MunawarPas encore d'évaluation

- Assessment Components For COVID-19 Situation ECO501Document2 pagesAssessment Components For COVID-19 Situation ECO501Ahmed MunawarPas encore d'évaluation

- Dive Schools - Ministry of TourismDocument25 pagesDive Schools - Ministry of TourismAhmed MunawarPas encore d'évaluation

- Forecasting Topic 6Document6 pagesForecasting Topic 6Ahmed Munawar100% (1)

- Final - Assessments For COVID - ECO213Document3 pagesFinal - Assessments For COVID - ECO213Ahmed MunawarPas encore d'évaluation

- TOUR MaldivesDocument7 pagesTOUR MaldivesAhmed MunawarPas encore d'évaluation

- MMarP Jun 2014 PDFDocument164 pagesMMarP Jun 2014 PDFAhmed MunawarPas encore d'évaluation

- ECO213 TUT 5 Demand Principles MicroeconomicsDocument2 pagesECO213 TUT 5 Demand Principles MicroeconomicsAhmed MunawarPas encore d'évaluation

- Vessels - Ministry of TourismDocument18 pagesVessels - Ministry of TourismAhmed MunawarPas encore d'évaluation

- Subject: Intermediate Microeconomics: Course: Bachelors of Economics and ManagementDocument7 pagesSubject: Intermediate Microeconomics: Course: Bachelors of Economics and ManagementAhmed MunawarPas encore d'évaluation

- Test 1 AnswersDocument6 pagesTest 1 Answersyuechan1234Pas encore d'évaluation

- Table 7.1 Central Bank Survey, 2014 - 2020: Financial SectorDocument2 pagesTable 7.1 Central Bank Survey, 2014 - 2020: Financial SectorAhmed MunawarPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)