Académique Documents

Professionnel Documents

Culture Documents

12 Suspense Accounts Notes

Transféré par

Aejaz MohamedCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

12 Suspense Accounts Notes

Transféré par

Aejaz MohamedDroits d'auteur :

Formats disponibles

Suspense accounts

Ideally every transaction a business enters in their books should involve a Debit in

one account and a Credit in another for the amount involved. If this does not happen

our accounts will be wrong at the end of the year. The errors fall into 3 categories:

1. One or both entries left out of the accounts.

2. One entry on the wrong side of an account.

3. The wrong amount entered in an account

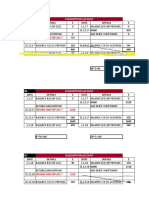

For Example, look at a Sales Day Book. It records all sales on credit to our varied

customers (ignoring VAT):

Customer Amount This should result in four entries in the books

Mr A 20 a debit in Mr A a/c of 20

a debit in Mrs D a/c 30

Mrs D 30 a debit in Mrs Z a/c of 60

Mrs Z 60 and a credit in sales of 110

You can see, with so many entries there is great potential for mistakes to be made. The

Leaving Cert questions tell you that the mistakes have been made and you have to fix

them. The strategy for fixing them is threefold:

1. First decide what ideally should have happened

2. Then show what actually did happen

3. And then change it so that the actual looks like the ideal.

The hardest part is deciding what should have happened, you do this by using the

BookKeeping Key

DEBIT CREDIT

Balance Sheet Asset Liability

Profit and Loss Expense Income

How this works is: every account is either an Asset, Liability, Expense or Income.

First we chose what type of account you are dealing with. Eg Sales is an income,

Capital is a Liability, Machinery is an Asset. We then look at which column it appears

in. If it appears in a column in the key under the Debit heading, then a Debit entry will

increase the account and the opposite, a Credit, will reduce it.

Once you know what you should have done, then you can plus or minus the entries

actually made with what should have happened to fix the error.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Balance of Payment & Balance of TradeDocument11 pagesBalance of Payment & Balance of TradeAejaz MohamedPas encore d'évaluation

- Balance of Payments: Presented by Shamroze SajidDocument18 pagesBalance of Payments: Presented by Shamroze SajidAejaz MohamedPas encore d'évaluation

- Commerce Revision Questions. PDF For FORM 4 and 5 2021Document20 pagesCommerce Revision Questions. PDF For FORM 4 and 5 2021Aejaz Mohamed100% (2)

- Term 1 - Commerce F4 SOW 2021-2022Document6 pagesTerm 1 - Commerce F4 SOW 2021-2022Aejaz MohamedPas encore d'évaluation

- Form 4 Paper 1 2020 Batch Term 3 19.3.21Document10 pagesForm 4 Paper 1 2020 Batch Term 3 19.3.21Aejaz MohamedPas encore d'évaluation

- Chapter - 9 Internal Trade: Material Downloaded From SUPERCOP 1/10Document10 pagesChapter - 9 Internal Trade: Material Downloaded From SUPERCOP 1/10Aejaz MohamedPas encore d'évaluation

- Commerce Revision Questions. PDF For FORM 4 AND 5 2021Document20 pagesCommerce Revision Questions. PDF For FORM 4 AND 5 2021Aejaz MohamedPas encore d'évaluation

- Chapter - 10 International BusinessDocument7 pagesChapter - 10 International BusinessAejaz MohamedPas encore d'évaluation

- Chapter - 2 Forms of Business Organisation: Meaning of Sole ProprietorshipDocument10 pagesChapter - 2 Forms of Business Organisation: Meaning of Sole ProprietorshipAejaz MohamedPas encore d'évaluation

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsAejaz Mohamed81% (21)

- Commerce 3rd Term Exam Form 3 2020Document9 pagesCommerce 3rd Term Exam Form 3 2020Aejaz MohamedPas encore d'évaluation

- Answer Key Accounting Paper 2 Term 3 Form 4Document8 pagesAnswer Key Accounting Paper 2 Term 3 Form 4Aejaz MohamedPas encore d'évaluation

- Commerce 3rd Term Exam 2020 Form 3 Answer KeyDocument9 pagesCommerce 3rd Term Exam 2020 Form 3 Answer KeyAejaz MohamedPas encore d'évaluation

- Answer Key Accounting Paper 2 Term 3 Form 4Document8 pagesAnswer Key Accounting Paper 2 Term 3 Form 4Aejaz MohamedPas encore d'évaluation

- Clubs and Societies Questions 2020 BatchDocument13 pagesClubs and Societies Questions 2020 BatchAejaz MohamedPas encore d'évaluation

- Excel 2016 Basic Quick RefeDocument3 pagesExcel 2016 Basic Quick RefeAejaz MohamedPas encore d'évaluation

- Chapter 6 Types of Leverages-1Document23 pagesChapter 6 Types of Leverages-1Aejaz MohamedPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)