Académique Documents

Professionnel Documents

Culture Documents

Sunflora Vitrified - 24102017

Transféré par

graceenggint8799Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sunflora Vitrified - 24102017

Transféré par

graceenggint8799Droits d'auteur :

Formats disponibles

October 24, 2017

Sunflora Vitrified Private Limited

Summary of rated instruments

Instrument^ Rated Amount Rating Action

(Rs. crore)

Fund-based – 15.90 [ICRA]BB- (Stable); ISSUER NOT CO-OPERATING*;

Term Loan Rating moved to the ‘Issuer Not Cooperating’ category

Fund-based – 8.50 [ICRA]BB- (Stable); ISSUER NOT CO-OPERATING*;

Cash Credit Rating moved to the ‘Issuer Not Cooperating’ category

Non-fund Based – 5.50 [ICRA]A4; ISSUER NOT CO-OPERATING*; Rating moved

Bank Guarantee to the ‘Issuer Not Cooperating’ category

Unallocated 4.10 [ICRA]BB- (Stable)/[ICRA]A4; ISSUER NOT CO-

Limits OPERATING*; Rating moved to the ‘Issuer Not Cooperating’

category

Total 34.00

* Issuer did not co-operate; based on best available information.

^ Instrument details captured under Annexure-1

Rating action

ICRA has moved the ratings for the Rs. 34.00-crore bank facilities of Sunflora Vitrified Private Limited

(SVPL) to the ‘Issuer Not Cooperating’ category. The rating is now denoted as [ICRA]BB-

(Stable)/[ICRA]A4 ISSUER NOT COOPERATING.

Rationale

The rating is based on no updated information on the entity’s performance since the time it was last rated

in March, 2016. The lenders, investors and other market participants are thus, advised to exercise

appropriate caution while using this rating, as the rating does not adequately reflect the credit risk profile

of the entity. SVPL’s credit profile may have changed since the time it was last reviewed by ICRA.

However, in absence of the requisite information, ICRA is unable to take a definitive rating action.

As part of its process and in accordance with its rating agreement with SVPL, ICRA has been trying to

seek information from the entity so as to monitor its performance and had also sent repeated reminders to

the company for payment of surveillance fee that became overdue, but despite repeated requests by

ICRA, the entity’s management has remained non-cooperative. In absence of the requisite information,

and in line with SEBI’s circular no. SEBI/HO/MIRSD4/CIR/2016/119, dated November 01, 2016,

ICRA’s Rating Committee has taken a rating view based on the best available information.

Key rating drivers

Credit strengths

Extensive experience of the promoters – Incorporated in January, 2014, SVPL is into

manufacturing vitrified tiles. SVPL is promoted and managed by Mr. Biren Bhimani, along with

other directors associated with other family-owned partnership firms involved in manufacturing

ceramic wall tiles, floor tiles, ceramic clay and craft paper. The promoters have more than two

decades of experience in the ceramic tiles business, prior to SVPL.

Locational advantages by virtue of proximity to raw material sources – SVPL enjoys locational

advantage, in the form of easy availability of quality raw material, by virtue of being situated in

Morbi (Gujarat), which is a ceramic hub in India.

Credit weaknesses

Competitive business environment – The company operates in a competitive business environment

with the presence of organised players as well as unorganised tile manufacturers.

Vulnerability of profitability to any adverse fluctuations in raw material and coal prices – Raw

materials and fuel [piped natural gas (PNG) and coal] form the key inputs for the company. The

availability and pricing of both remains a concern, as an increase in the raw material and fuel cost

could increase the operating costs and impact margins.

Analytical approach:

For arriving at the ratings, ICRA has applied its rating methodologies as indicated below.

Links to applicable criteria:

Corporate Credit Rating Methodology

Policy in respect of non-cooperation by the rated entity

About the company:

Sunflora Vitrified Private Limited was incorporated in January, 2014 as a private limited company and

commenced operations in November, 2014. SVPL is a vitrified tiles manufacturer with its plant situated

at Wankaner in Morbi district, Gujarat. The company has an installed capacity to manufacture around 20

lakh boxes (around 71346 metric tonnes) of vitrified tiles per annum sized 600X600 mm.

SVPL is promoted and managed by Mr. Biren Bhimani along with other directors- Mr. Dharamshibhai

Patel, Mr. Narendrabhai Bhimani, Mr. Rameshbhai Bhimani and Mr. Jayantibhai Bhimani who have a

vast experience of around 33 years in the ceramic industry. They are also associated with other family-

owned partnership firms involved in manufacturing ceramic wall tiles, floor tiles, ceramic clay and craft

paper.

In FY2015, the company reported a net loss of Rs. 1.28 crore on an operating income of Rs. 23.61 crore.

Key financial indicators (Audited):

Particulars FY2015

Operating Income (Rs. crore) 23.61

PAT (Rs. crore) (1.28)

OPBDIT/ OI (%) 13.61%

RoCE (%) -

Total Debt/ TNW (times) 2.25

Total Debt/ OPBDIT (times) 2.98

Interest Coverage (times) 2.06

NWC/ OI (%) 15.28%

OI: Operating Income; PAT: Profit after Tax; OPBDIT: Operating Profit before Depreciation, Interest,

Taxes and Amortisation; ROCE: PBIT/Avg (Total Debt + Tangible Net-Worth + Deferred Tax Liability -

Capital Work - in Progress);

NWC: Net Working Capital

Status of non-cooperation with previous CRA: Not applicable

Any other information: Not applicable

Rating history for last three years:

Table:

S. Instrument Current Rating Chronology of Rating History

No. (2018) for the past 3 years

Type Amount Amount Date & Date & Date & Date &

Rated Outstanding Rating Rating in Rating Rating

(Rs. (Rs crore) FY2017 in in

crore) FY2016 FY2015

October 2017 April 2016 - -

1 Term Loan Long 15.90 N.A. [ICRA]BB- [ICRA]BB- - -

Term (Stable); (Stable)

ISSUER NOT

COOPERATING*

2 Cash Credit Long 8.50 N.A. [ICRA]BB- [ICRA]BB- - -

Term (Stable); (Stable)

ISSUER NOT

COOPERATING*

3 Bank Short 5.50 N.A [ICRA]A4; [ICRA]A4 - -

Guarantee Term ISSUER NOT

COOPERATING*

4 Unallocated Long 4.10 N.A [ICRA]BB- [ICRA]BB- - -

Limits Term/ (Stable)/[ICRA]A4; (Stable)/

Short ISSUER NOT [ICRA]A4

Term COOPERATING*

* Issuer did not co-operate; based on best available information.

Complexity level of the rated instrument:

ICRA has classified various instruments based on their complexity as "Simple", "Complex" and "Highly

Complex". The classification of instruments according to their complexity levels is available on the

website www.icra.in

Annexure-1

Instrument Details

Instrument Date of Coupon Maturity Amount Rated Current Rating and

Issuance/ Rate Date (Rs. crore) Outlook

Sanction

Term Loan FY2016 - FY2021 15.90 [ICRA]BB- (Stable);

ISSUER NOT

COOPERATING*

Cash Credit - - - 8.50 [ICRA]BB- (Stable);

ISSUER NOT

COOPERATING*

Bank - - - 5.50 [ICRA]A4;

Guarantee ISSUER NOT

COOPERATING*

Unallocated - - - 4.10 [ICRA]BB-

Limits (Stable)/[ICRA]A4;

ISSUER NOT

COOPERATING*

* Issuer did not co-operate; based on best available information.

Source: Sunflora Vitrified Private Limited

Contact Details

Analyst Contacts

Subrata Ray Suprio Banerjee

+91 22 2433 1086 +91 22 6114 3443

subrata@icraindia.com supriob@icraindia.com

Sanket Thakkar Jaimin Patel

+91 79 4027 1528 +91 79 4027 1550

sanket.thakkar@icraindia.com jaimin.patel@icraindia.com

Relationship Contact

Jayanta Chatterjee

+91 80 4332 6401

jayantac@icraindia.com

About ICRA Limited:

ICRA Limited was set up in 1991 by leading financial/investment institutions, commercial banks and

financial services companies as an independent and professional investment Information and Credit

Rating Agency.

Today, ICRA and its subsidiaries together form the ICRA Group of Companies (Group ICRA). ICRA is a

Public Limited Company, with its shares listed on the Bombay Stock Exchange and the National Stock

Exchange. The international Credit Rating Agency Moody’s Investors Service is ICRA’s largest

shareholder.

For more information, visit www.icra.in

© Copyright, 2017, ICRA Limited. All Rights Reserved

Contents may be used freely with due acknowledgement to ICRA

ICRA ratings should not be treated as recommendation to buy, sell or hold the rated debt instruments. ICRA ratings are subject to

a process of surveillance, which may lead to revision in ratings. An ICRA rating is a symbolic indicator of ICRA’s current

opinion on the relative capability of the issuer concerned to timely service debts and obligations, with reference to the instrument

rated. Please visit our website www.icra.in or contact any ICRA office for the latest information on ICRA ratings outstanding.

All information contained herein has been obtained by ICRA from sources believed by it to be accurate and reliable, including

the rated issuer. ICRA however has not conducted any audit of the rated issuer or of the information provided by it. While

reasonable care has been taken to ensure that the information herein is true, such information is provided ‘as is’ without any

warranty of any kind, and ICRA in particular, makes no representation or warranty, express or implied, as to the accuracy,

timeliness or completeness of any such information. Also, ICRA or any of its group companies may have provided services other

than rating to the issuer rated. All information contained herein must be construed solely as statements of opinion, and ICRA

shall not be liable for any losses incurred by users from any use of this publication or its contents.

Registered Office

ICRA Limited

1105, Kailash Building, 11th Floor, 26, Kasturba Gandhi Marg, New Delhi 110001

Tel: +91-11-23357940-50, Fax: +91-11-23357014

Corporate Office

Mr. Vivek Mathur

Mobile: +91 9871221122

Email: vivek@icraindia.com

Building No. 8, 2nd Floor, Tower A, DLF Cyber City, Phase II, Gurgaon 122002

Ph: +91-124-4545310 (D), 4545300 / 4545800 (B) Fax; +91- 124-4050424

Mumbai Kolkata

Mr. L. Shivakumar Mr. Jayanta Roy

Mobile: +91 9821086490 Mobile: +91 9903394664

Email: shivakumar@icraindia.com Email: jayanta@icraindia.com

3rd Floor, Electric Mansion A-10 & 11, 3rd Floor, FMC Fortuna

Appasaheb Marathe Marg, Prabhadevi 234/3A, A.J.C. Bose Road

Mumbai—400025, Kolkata—700020

Board : +91-22-61796300; Fax: +91-22-24331390 Tel +91-33-22876617/8839 22800008/22831411,

Fax +91-33-22870728

Chennai Bangalore

Mr. Jayanta Chatterjee Mr. Jayanta Chatterjee

Mobile: +91 9845022459 Mobile: +91 9845022459

Email: jayantac@icraindia.com Email: jayantac@icraindia.com

5th Floor, Karumuttu Centre 'The Millenia'

634 Anna Salai, Nandanam Tower B, Unit No. 1004,10th Floor, Level 2 12-14, 1 & 2,

Chennai—600035 Murphy Road, Bangalore 560 008

Tel: +91-44-45964300; Fax: +91-44 24343663 Tel: +91-80-43326400; Fax: +91-80-43326409

Ahmedabad Pune

Mr. L. Shivakumar Mr. L. Shivakumar

Mobile: +91 9821086490 Mobile: +91 9821086490

Email: shivakumar@icraindia.com Email: shivakumar@icraindia.com

907 & 908 Sakar -II, Ellisbridge, 5A, 5th Floor, Symphony, S.No. 210, CTS 3202, Range

Ahmedabad- 380006 Hills Road, Shivajinagar,Pune-411 020

Tel: +91-79-26585049, 26585494, 26584924; Fax: Tel: + 91-20-25561194-25560196; Fax: +91-20-

+91-79-25569231 25561231

Hyderabad

Mr. Jayanta Chatterjee

Mobile: +91 9845022459

Email: jayantac@icraindia.com

4th Floor, Shobhan, 6-3-927/A&B. Somajiguda, Raj

Bhavan Road, Hyderabad—500083

Tel:- +91-40-40676500

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- D-045 - Engagement Letter For Compilation of Financial Forcast or ProjectionDocument3 pagesD-045 - Engagement Letter For Compilation of Financial Forcast or ProjectionLuis Enrique Altamar Ramos100% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Berlin School Final Exam - Financial Accounting and MerchandisingDocument17 pagesBerlin School Final Exam - Financial Accounting and MerchandisingNarjes DehkordiPas encore d'évaluation

- Rajpur Garments and Textiles Limited: Indian Institute of Management Ahmedabad IIMA/F&A0400Document4 pagesRajpur Garments and Textiles Limited: Indian Institute of Management Ahmedabad IIMA/F&A04002073 - Ajay Pratap Singh BhatiPas encore d'évaluation

- Prayagraj Power Generation Company Limited (PPGCL) : Proposal For Majority Stake SaleDocument16 pagesPrayagraj Power Generation Company Limited (PPGCL) : Proposal For Majority Stake Salegraceenggint8799Pas encore d'évaluation

- Repl Thermal UnitsDocument5 pagesRepl Thermal Unitsgraceenggint8799Pas encore d'évaluation

- Solar Project Telengana - 10MWpDocument2 pagesSolar Project Telengana - 10MWpgraceenggint8799Pas encore d'évaluation

- Chitra Fucked by A TailorDocument10 pagesChitra Fucked by A Tailorshahulcit0% (1)

- Police LawsDocument21 pagesPolice LawsMohd Usmaan KhanPas encore d'évaluation

- December Issue - 2019Document82 pagesDecember Issue - 2019graceenggint8799Pas encore d'évaluation

- A&E-Company Profile PDFDocument9 pagesA&E-Company Profile PDFgraceenggint8799Pas encore d'évaluation

- IPCL - Corporate Presentation - Updated On 07.02.2017Document34 pagesIPCL - Corporate Presentation - Updated On 07.02.2017graceenggint8799Pas encore d'évaluation

- 1 Successful ComplementationDocument15 pages1 Successful ComplementationmohantyomPas encore d'évaluation

- About ASSETS AND EQUIPMENTS INC. Formed On January 2014 Is A Mumbai Based Sole ProprietorshipDocument7 pagesAbout ASSETS AND EQUIPMENTS INC. Formed On January 2014 Is A Mumbai Based Sole Proprietorshipgraceenggint8799Pas encore d'évaluation

- Municipal Solid Waste Management Manual: Step-Wise GuidanceDocument604 pagesMunicipal Solid Waste Management Manual: Step-Wise Guidancenimm196267% (3)

- Flyer - Waste To Energy Waste Management in India - Enincon PDFDocument8 pagesFlyer - Waste To Energy Waste Management in India - Enincon PDFgraceenggint8799Pas encore d'évaluation

- KGKGKDocument26 pagesKGKGKgraceenggint8799Pas encore d'évaluation

- Seed 8 Beware of THIS Aasuric CultureDocument213 pagesSeed 8 Beware of THIS Aasuric Culturegraceenggint8799Pas encore d'évaluation

- Getting Started With OneDrive PDFDocument1 pageGetting Started With OneDrive PDFmegaPas encore d'évaluation

- Assam Electricity Regulatory CommissionDocument14 pagesAssam Electricity Regulatory Commissiongraceenggint8799Pas encore d'évaluation

- Power Purchase AgreementDocument23 pagesPower Purchase Agreementgraceenggint8799Pas encore d'évaluation

- BJP Membership Application FormDocument1 pageBJP Membership Application Formgraceenggint8799Pas encore d'évaluation

- FloatingSolarPanelsInstallation in ArizonaDocument60 pagesFloatingSolarPanelsInstallation in ArizonaKozmoz EvrenPas encore d'évaluation

- SJVN Limited: (A Joint Venture of Govt. of India & Govt. of Himachal Pradesh)Document20 pagesSJVN Limited: (A Joint Venture of Govt. of India & Govt. of Himachal Pradesh)graceenggint8799Pas encore d'évaluation

- 2 Smart Cities ReportDocument54 pages2 Smart Cities ReportAnshuman Patil MagarPas encore d'évaluation

- Assam Electricity Regulatory CommissionDocument14 pagesAssam Electricity Regulatory Commissiongraceenggint8799Pas encore d'évaluation

- Bakhtar Bastan Solar Wind CompanyDocument3 pagesBakhtar Bastan Solar Wind Companygraceenggint8799Pas encore d'évaluation

- Central Electricity Board: Ceb 2015 SSDG Net-Metering Scheme Application FormDocument4 pagesCentral Electricity Board: Ceb 2015 SSDG Net-Metering Scheme Application Formgraceenggint8799Pas encore d'évaluation

- Revision of Tariff For Grid Interactive Megawatt Scale Solar Power Plants For FY18Document16 pagesRevision of Tariff For Grid Interactive Megawatt Scale Solar Power Plants For FY18graceenggint8799Pas encore d'évaluation

- 2016 EIF Presentation Session1 AFG PDFDocument9 pages2016 EIF Presentation Session1 AFG PDFgraceenggint8799Pas encore d'évaluation

- SJVN Limited: (A Joint Venture of Govt. of India & Govt. of Himachal Pradesh)Document20 pagesSJVN Limited: (A Joint Venture of Govt. of India & Govt. of Himachal Pradesh)graceenggint8799Pas encore d'évaluation

- 20 RFP - Urozgan Solar 1 MW (MEW REN 20 URO) 3fc9e788 f7cd 4f40 B84a 2aed9cec2ce8Document84 pages20 RFP - Urozgan Solar 1 MW (MEW REN 20 URO) 3fc9e788 f7cd 4f40 B84a 2aed9cec2ce8graceenggint8799Pas encore d'évaluation

- 2016 EIF Presentation Session1 AFG PDFDocument9 pages2016 EIF Presentation Session1 AFG PDFgraceenggint8799Pas encore d'évaluation

- Presentation of GERES in Afghanistan: 1. Greenhouses and VerandasDocument5 pagesPresentation of GERES in Afghanistan: 1. Greenhouses and Verandasgraceenggint8799Pas encore d'évaluation

- Business Combi CH 6 de JesusDocument9 pagesBusiness Combi CH 6 de JesusMerel Rose FloresPas encore d'évaluation

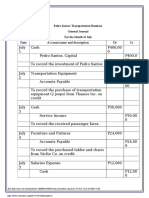

- Pedro Santos' Transportation Business General Journal For The Month of JulyDocument8 pagesPedro Santos' Transportation Business General Journal For The Month of Julyლ itsmooncakes ́ლPas encore d'évaluation

- Financial Engineering and Security DesignDocument12 pagesFinancial Engineering and Security DesignMagnus BytingsvikPas encore d'évaluation

- A Project Report On TaxationDocument71 pagesA Project Report On TaxationHveeeePas encore d'évaluation

- Risk and Return FundamentalsDocument60 pagesRisk and Return FundamentalsasmaPas encore d'évaluation

- Registration flow and documentsDocument22 pagesRegistration flow and documentsmdzainiPas encore d'évaluation

- Mobile Money International Sdn Bhd Company ProfileDocument1 pageMobile Money International Sdn Bhd Company ProfileLee Chee SoonPas encore d'évaluation

- Gacer, Ann Mariellene L. (Assignment No.2) TaxDocument6 pagesGacer, Ann Mariellene L. (Assignment No.2) TaxAnn Mariellene Gacer50% (2)

- CBSE XII Accountancy Most Important QuestionsDocument15 pagesCBSE XII Accountancy Most Important QuestionsgauravPas encore d'évaluation

- 04 Stock Trading Basics Online Trading Platzi Mario ValleDocument31 pages04 Stock Trading Basics Online Trading Platzi Mario Vallejuan velezPas encore d'évaluation

- Closing Your Savings Account FormDocument1 pageClosing Your Savings Account FormtafseerahmedPas encore d'évaluation

- Template Excel Pengantar AkuntansiiDocument15 pagesTemplate Excel Pengantar AkuntansiiKim SeokjinPas encore d'évaluation

- SATURDAYDocument20 pagesSATURDAYkristine bandaviaPas encore d'évaluation

- Chapter - 9: General Financial Rules 2017Document40 pagesChapter - 9: General Financial Rules 2017PatrickPas encore d'évaluation

- Bangladesh's Leading Mobile Banking ServicesDocument12 pagesBangladesh's Leading Mobile Banking ServicesTaymur Hasan MunnaPas encore d'évaluation

- BBA607 - Role of International Financial InstitutionsDocument11 pagesBBA607 - Role of International Financial InstitutionsSimanta KalitaPas encore d'évaluation

- SIP PPT RavirajsinhDocument21 pagesSIP PPT RavirajsinhJadeja AjayrajsinhPas encore d'évaluation

- VALUATION TABLE TITLESDocument8 pagesVALUATION TABLE TITLESAndre Mikhail ObierezPas encore d'évaluation

- ConsiderDocument284 pagesConsiderGhulam NabiPas encore d'évaluation

- L5M4 New PaperDocument9 pagesL5M4 New PaperibraokelloPas encore d'évaluation

- Biz Cafe Operations Excel - Assignment - UIDDocument3 pagesBiz Cafe Operations Excel - Assignment - UIDJenna AgeebPas encore d'évaluation

- Power of Attorney (General)Document3 pagesPower of Attorney (General)champakPas encore d'évaluation

- Death ClaimDocument29 pagesDeath Claimparikshit purohitPas encore d'évaluation

- Exhibits and Student TemplateDocument7 pagesExhibits and Student Templatesatish.evPas encore d'évaluation

- 822 Taxation XI PDFDocument181 pages822 Taxation XI PDFPiyush GargPas encore d'évaluation

- Income Tax CalculatorDocument5 pagesIncome Tax CalculatorTanmay DeshpandePas encore d'évaluation

- Transfer Tax Quiz QuestionsDocument5 pagesTransfer Tax Quiz QuestionsKyasiah Mae AragonesPas encore d'évaluation