Académique Documents

Professionnel Documents

Culture Documents

Accounting Ratios: Inancial Statements Aim at Providing F

Transféré par

Prashanth Shetty0 évaluation0% ont trouvé ce document utile (0 vote)

8 vues1 pageLeac205

Titre original

leac205

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentLeac205

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

8 vues1 pageAccounting Ratios: Inancial Statements Aim at Providing F

Transféré par

Prashanth ShettyLeac205

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

Accounting Ratios 5

F inancial statements aim at providing financial

information about a business enterprise to meet

the information needs of the decision-makers.

Financial statements prepared by a business

enterprise in the corporate sector are published and

are available to the decision-makers. These

statements provide financial data which require

analysis, comparison and interpretation for taking

decision by the external as well as internal users of

accounting information. This act is termed as

financial statement analysis. It is regarded as an

integral and important part of accounting. As

indicated in the previous chapter, the most

commonly used techniques of financial statements

analysis are comparative statements, common size

LEARNING OBJECTIVES

statements, trend analysis, accounting ratios and

After studying this chapter,

you will be able to : cash flow analysis. The first three have been

• explain the meaning, discussed in detail in the previous chapter. This

objectives and limitations chapter covers the technique of accounting ratios

of accounting ratios; for analysing the information contained in financial

• identify the various statements for assessing the solvency, efficiency and

types of ratios commonly profitability of the enterprises.

used ;

• calculate various ratios 5.1 Meaning of Accounting Ratios

to assess solvency,

liquidity, efficiency and As stated earlier, accounting ratios are an important

profitability of the firm; tool of financial statements analysis. A ratio is a

• interpret the various mathematical number calculated as a reference to

ratios calculated for relationship of two or more numbers and can be

intra-firm and inter- expressed as a fraction, proportion, percentage and

firm comparisons. a number of times. When the number is calculated

by referring to two accounting numbers derived from

Vous aimerez peut-être aussi

- Leac 205Document47 pagesLeac 205Harish Singh NegiPas encore d'évaluation

- Accounting Notes XIIDocument47 pagesAccounting Notes XIIAdarshPas encore d'évaluation

- Accounting Ratios: Inancial Statements Aim at Providing FDocument53 pagesAccounting Ratios: Inancial Statements Aim at Providing FPathan Kausar100% (1)

- Leac 205Document47 pagesLeac 205Jyoti SinghPas encore d'évaluation

- Accounting RatiosDocument42 pagesAccounting RatiosApollo Institute of Hospital AdministrationPas encore d'évaluation

- CH - 5 Accounting RatiosDocument47 pagesCH - 5 Accounting RatiosAaditi V100% (1)

- NCERT Class 12 Accountancy Accounting RatiosDocument47 pagesNCERT Class 12 Accountancy Accounting RatiosKrish Pagani100% (1)

- Accounting Ratios: Inancial Statements Aim at Providing FDocument45 pagesAccounting Ratios: Inancial Statements Aim at Providing FNIKK KICKPas encore d'évaluation

- Accounting For Managers - Block-2 PDFDocument64 pagesAccounting For Managers - Block-2 PDFHimanshu NaugainPas encore d'évaluation

- Module 3 Analysis and Interpretation of Financial StatementsDocument23 pagesModule 3 Analysis and Interpretation of Financial StatementsRonald Torres100% (1)

- Group 2Document97 pagesGroup 2SXCEcon PostGrad 2021-23100% (1)

- Pre Test: Biliran Province State UniversityDocument6 pagesPre Test: Biliran Province State Universitymichi100% (1)

- Fa Class Notes UplodedDocument252 pagesFa Class Notes UplodedDurvas Karmarkar100% (1)

- Financial & Ratio AnalysisDocument46 pagesFinancial & Ratio AnalysisParvej KhanPas encore d'évaluation

- Financial AccountingDocument252 pagesFinancial AccountingSonia Dhar100% (1)

- Management Accounting - Unit1Document15 pagesManagement Accounting - Unit1anil gondPas encore d'évaluation

- Financial Statement AnalysisDocument110 pagesFinancial Statement AnalysisvidhyabalajiPas encore d'évaluation

- My ProjectDocument72 pagesMy ProjectPrashob Koodathil0% (1)

- A Study On Financial Performance For Axis BankDocument20 pagesA Study On Financial Performance For Axis BankJayaprabhu PrabhuPas encore d'évaluation

- Muh213U-Accounting I: Chapter 1: Accounting and Business EnvironmentDocument21 pagesMuh213U-Accounting I: Chapter 1: Accounting and Business EnvironmentÖmer Faruk AYDINPas encore d'évaluation

- A Study On Financial PerformanceDocument73 pagesA Study On Financial PerformanceDr Linda Mary Simon100% (2)

- Week 011 - Module Analysis and Interpretation of Financial StatementsDocument7 pagesWeek 011 - Module Analysis and Interpretation of Financial StatementsJoana Marie100% (1)

- Fma CH 1 IntroductionDocument32 pagesFma CH 1 IntroductionHabtamuPas encore d'évaluation

- Fin Statement AnalysisDocument26 pagesFin Statement AnalysisBhagaban DasPas encore d'évaluation

- 2k15-Fin. Reporting Analysis-5Document59 pages2k15-Fin. Reporting Analysis-5flamerydersPas encore d'évaluation

- Chapter 1Document8 pagesChapter 1toyibPas encore d'évaluation

- Financial Accounting & AnalysisDocument9 pagesFinancial Accounting & AnalysisPooja GoyalPas encore d'évaluation

- Class12 Accountancy2Document42 pagesClass12 Accountancy2Arunima RaiPas encore d'évaluation

- Accounting Ratios: Inancial Statements Aim at Providing FDocument47 pagesAccounting Ratios: Inancial Statements Aim at Providing Fabc100% (1)

- Chapter Three Financial Statement Analysis PDFDocument30 pagesChapter Three Financial Statement Analysis PDFsolomon takelePas encore d'évaluation

- Accounting Ratios Accounting Ratios Accounting Ratios Accounting Ratios Accounting RatiosDocument47 pagesAccounting Ratios Accounting Ratios Accounting Ratios Accounting Ratios Accounting Ratiosviswa100% (1)

- Fincial Statement AnalysisDocument41 pagesFincial Statement AnalysisAziz MoizPas encore d'évaluation

- FMPR 2 - Lesson 2Document12 pagesFMPR 2 - Lesson 2jannypagalanPas encore d'évaluation

- W2 Module 2 - Financial Statement AnalysisDocument6 pagesW2 Module 2 - Financial Statement AnalysisDanica Vetuz100% (1)

- Cost and Management Accounting I Chapter I: Fundamentals of Cost AccountingDocument19 pagesCost and Management Accounting I Chapter I: Fundamentals of Cost AccountingFear Part 2Pas encore d'évaluation

- 4.0 Financial Statement Analysis and EvaluationDocument20 pages4.0 Financial Statement Analysis and Evaluationnbp7ry76vqPas encore d'évaluation

- Cost and MGMT Accti Chapter 1 Introduction and Cost ClassificationDocument17 pagesCost and MGMT Accti Chapter 1 Introduction and Cost ClassificationMahlet AbrahaPas encore d'évaluation

- Maryland International College: Accounting and Finance For ManagersDocument26 pagesMaryland International College: Accounting and Finance For ManagersANTENEH ENDALE DILNESSAPas encore d'évaluation

- Accounts Part-II 4 PDFDocument26 pagesAccounts Part-II 4 PDFjibin samuelPas encore d'évaluation

- Accounting:: Information For Decision MakingDocument29 pagesAccounting:: Information For Decision MakingKhursheed Ahmad KhanPas encore d'évaluation

- Financial Statement AnalysisDocument27 pagesFinancial Statement AnalysisJayvee Balino100% (1)

- Management AccountingDocument108 pagesManagement AccountingBATUL ABBAS DEVASWALAPas encore d'évaluation

- Management Accounting (MA)Document114 pagesManagement Accounting (MA)Shivangi Patel100% (1)

- Sai Naik ProjectDocument78 pagesSai Naik ProjectSAIsanker DAivAMPas encore d'évaluation

- Module 1 - Accounting and BusinessDocument16 pagesModule 1 - Accounting and BusinessNiña Sharie Cardenas100% (1)

- Maryland International College: Accounting and Finance For ManagersDocument161 pagesMaryland International College: Accounting and Finance For Managershadush Gebreslasie100% (1)

- Financial Management-2Document5 pagesFinancial Management-2Shameer Babu Thonnan ThodiPas encore d'évaluation

- Project SynopsisDocument16 pagesProject SynopsisSanjeev WadheraPas encore d'évaluation

- Managerial Accounting-EXTREMEDocument3 pagesManagerial Accounting-EXTREMEAbzreil AmerolPas encore d'évaluation

- Garrisonch Chapter 14Document47 pagesGarrisonch Chapter 14nw0082student0% (1)

- Reviewer For CHAPTER 1 - Introduction To AccountingDocument5 pagesReviewer For CHAPTER 1 - Introduction To AccountingPatrick John AvilaPas encore d'évaluation

- Financial Analysis of PNBDocument73 pagesFinancial Analysis of PNBPrithviPas encore d'évaluation

- Thomson Lear Ning1267Document40 pagesThomson Lear Ning1267Sammy Ben MenahemPas encore d'évaluation

- Financial AnalysisDocument69 pagesFinancial AnalysisOlawale Oluwatoyin Bolaji100% (2)

- Financial Analysis of InfosysDocument51 pagesFinancial Analysis of InfosysRahul RajuPas encore d'évaluation

- Financial ManagementDocument8 pagesFinancial ManagementAeilin AgotoPas encore d'évaluation

- Chapter 1Document94 pagesChapter 1Siva KasiPas encore d'évaluation

- Chapter 1Document26 pagesChapter 1Robel HabtamuPas encore d'évaluation

- MaryDocument2 pagesMaryPrashanth ShettyPas encore d'évaluation

- MedicalDocument2 pagesMedicalPrashanth ShettyPas encore d'évaluation

- JavascriptDocument1 pageJavascriptPrashanth ShettyPas encore d'évaluation

- Final Chap 1 BEDocument21 pagesFinal Chap 1 BEPrashanth ShettyPas encore d'évaluation

- Book 1Document2 pagesBook 1Prashanth ShettyPas encore d'évaluation

- 2Document1 page2Prashanth ShettyPas encore d'évaluation

- ChapterDocument7 pagesChapterPrashanth ShettyPas encore d'évaluation

- ContentDocument12 pagesContentPrashanth ShettyPas encore d'évaluation

- 32115136-HR-Project 2Document1 page32115136-HR-Project 2Prashanth ShettyPas encore d'évaluation

- 32115136-HR-Project 3Document1 page32115136-HR-Project 3Prashanth ShettyPas encore d'évaluation

- 32115136-HR-Project 5Document1 page32115136-HR-Project 5Prashanth ShettyPas encore d'évaluation

- ResultsDocument29 pagesResultsPrashanth ShettyPas encore d'évaluation

- 32115136-HR-Project 1 PDFDocument1 page32115136-HR-Project 1 PDFPrashanth ShettyPas encore d'évaluation

- 32115136-HR-Project 6Document1 page32115136-HR-Project 6Prashanth ShettyPas encore d'évaluation

- ConclusionDocument1 pageConclusionPrashanth ShettyPas encore d'évaluation

- Company Application Form - Kaypee PDFDocument4 pagesCompany Application Form - Kaypee PDFPrashanth ShettyPas encore d'évaluation

- Print & BindDocument1 pagePrint & BindPrashanth ShettyPas encore d'évaluation

- Wedding Poster PDFDocument11 pagesWedding Poster PDFPrashanth ShettyPas encore d'évaluation

- Print & BindDocument1 pagePrint & BindPrashanth ShettyPas encore d'évaluation

- Sri Maruthi DigitalsDocument1 pageSri Maruthi DigitalsPrashanth ShettyPas encore d'évaluation

- Executive SummaryDocument1 pageExecutive SummaryPrashanth ShettyPas encore d'évaluation

- WDCSDSDSDDocument1 pageWDCSDSDSDPrashanth ShettyPas encore d'évaluation

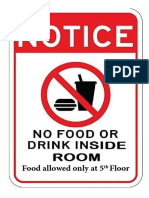

- Food Allowed Only at 5 FloorDocument1 pageFood Allowed Only at 5 FloorPrashanth ShettyPas encore d'évaluation

- Doc28 PDFDocument1 pageDoc28 PDFPrashanth ShettyPas encore d'évaluation

- Ironmaking and Steelmaking Theory and PracticeDocument494 pagesIronmaking and Steelmaking Theory and PracticeDrKinnor Chattopadhyay100% (12)

- Certificate PDFDocument1 pageCertificate PDFPrashanth ShettyPas encore d'évaluation

- Binder 1Document1 pageBinder 1Prashanth ShettyPas encore d'évaluation

- WDCSDSDSDDocument1 pageWDCSDSDSDPrashanth ShettyPas encore d'évaluation

- Software Testing Lab MannualDocument26 pagesSoftware Testing Lab MannualNayaz UddinPas encore d'évaluation

- Ironmaking and Steelmaking Theory and PracticeDocument494 pagesIronmaking and Steelmaking Theory and PracticeDrKinnor Chattopadhyay100% (12)

- 1 Math in NatureCARE - CAREEEEDocument5 pages1 Math in NatureCARE - CAREEEEEuniceCareLanajaPas encore d'évaluation

- Mixture Allegation Final VersionDocument6 pagesMixture Allegation Final VersionS.h. RonyPas encore d'évaluation

- Tea Worth of RsDocument11 pagesTea Worth of RsAnkit ShuklaPas encore d'évaluation

- STAAR Worksheet 5Document10 pagesSTAAR Worksheet 5Jisha Annie JohnPas encore d'évaluation

- Vicente Et Al., (2018)Document35 pagesVicente Et Al., (2018)Josefa CáceresPas encore d'évaluation

- Scales AssignmentDocument7 pagesScales Assignmentapi-310503032Pas encore d'évaluation

- PV Systems Servicing NC IIIDocument65 pagesPV Systems Servicing NC IIIPatrick Gregorio100% (1)

- Avg, Mix, Alligation, Ratio, Ages, Partnership BootCamp 2019Document5 pagesAvg, Mix, Alligation, Ratio, Ages, Partnership BootCamp 2019Naman sharmaPas encore d'évaluation

- EASA Module 01 Mathematics - SIMPLEDocument83 pagesEASA Module 01 Mathematics - SIMPLESenthil FlyhighPas encore d'évaluation

- Top Quantity Based Questions Free PDF For SBI Clerk Prelims - (English Version)Document14 pagesTop Quantity Based Questions Free PDF For SBI Clerk Prelims - (English Version)LBKPas encore d'évaluation

- IGCSE Maths 5080 SOW Core 2 YearsDocument18 pagesIGCSE Maths 5080 SOW Core 2 YearsYenny TigaPas encore d'évaluation

- Basic Math NotesDocument4 pagesBasic Math NotesEsenniee BanillaPas encore d'évaluation

- Engr. Besavilla - Lecture 03 - 10 Nov 2023Document15 pagesEngr. Besavilla - Lecture 03 - 10 Nov 2023Rhowelle TibayPas encore d'évaluation

- Dyuthi T0746 PDFDocument312 pagesDyuthi T0746 PDFmadhulikkaPas encore d'évaluation

- An Analysis of Annual Ratio of TCS FinalDocument106 pagesAn Analysis of Annual Ratio of TCS FinalChandan Srivastava100% (1)

- Grade 5 K-12 2nd Quarter Periodical Test With Answer Keys & TOS MATHDocument7 pagesGrade 5 K-12 2nd Quarter Periodical Test With Answer Keys & TOS MATHmichael g. casinillo88% (123)

- Problems On Ratios and ProportionsDocument13 pagesProblems On Ratios and ProportionsJenson DonPas encore d'évaluation

- Diagnostic Test Math 5Document6 pagesDiagnostic Test Math 5Jennifer SantosPas encore d'évaluation

- DLL Mathematics 5 q2 w9Document8 pagesDLL Mathematics 5 q2 w9Riza GustePas encore d'évaluation

- Ratios and ProportionsDocument23 pagesRatios and ProportionsLeonen AngelynPas encore d'évaluation

- DLL - Math 6 - Q2 - W1Document5 pagesDLL - Math 6 - Q2 - W1France Kenneth SantosPas encore d'évaluation

- GeometryDocument62 pagesGeometryRamana ReddyPas encore d'évaluation

- L&T Infotech Test Pattern and Important Questions Pattern of Written Exam: Section No. of QuestionsDocument8 pagesL&T Infotech Test Pattern and Important Questions Pattern of Written Exam: Section No. of QuestionsPrathap Gowda PrathuPas encore d'évaluation

- Nr420301 Jet Propulsion and Rocket EngineeringDocument2 pagesNr420301 Jet Propulsion and Rocket Engineeringgeddam06108825Pas encore d'évaluation

- Math6 Q2 Mod1 Fractions and Ratio v6Document21 pagesMath6 Q2 Mod1 Fractions and Ratio v6Rene Jr BulakhaPas encore d'évaluation

- MDT06DDD PDFDocument3 pagesMDT06DDD PDFPaola CruzPas encore d'évaluation

- Questionnaire For Teacher Respondents ResearchersDocument5 pagesQuestionnaire For Teacher Respondents Researchersthelma olipasPas encore d'évaluation

- Homework 9.1 Ratios and ProportionsDocument10 pagesHomework 9.1 Ratios and ProportionsAliRazaPas encore d'évaluation

- Concrete Design MixDocument4 pagesConcrete Design Mixsubhashchandra chandruPas encore d'évaluation

- Word ProblemsDocument16 pagesWord ProblemsSona Ghulam MohammadPas encore d'évaluation

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (13)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyD'EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsD'EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)D'EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Getting to Yes: How to Negotiate Agreement Without Giving InD'EverandGetting to Yes: How to Negotiate Agreement Without Giving InÉvaluation : 4 sur 5 étoiles4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantD'EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantÉvaluation : 4.5 sur 5 étoiles4.5/5 (146)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyD'EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyÉvaluation : 4.5 sur 5 étoiles4.5/5 (37)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceD'EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidencePas encore d'évaluation

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditD'EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditÉvaluation : 5 sur 5 étoiles5/5 (1)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)D'EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)D'EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Évaluation : 4.5 sur 5 étoiles4.5/5 (24)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageD'EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageÉvaluation : 4.5 sur 5 étoiles4.5/5 (109)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)D'EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Évaluation : 4 sur 5 étoiles4/5 (33)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineD'EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlinePas encore d'évaluation

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!D'EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Évaluation : 4.5 sur 5 étoiles4.5/5 (14)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelD'Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelPas encore d'évaluation

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesD'EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesÉvaluation : 5 sur 5 étoiles5/5 (4)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?D'EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Évaluation : 5 sur 5 étoiles5/5 (1)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeD'EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeÉvaluation : 4 sur 5 étoiles4/5 (21)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- Financial Accounting For Dummies: 2nd EditionD'EverandFinancial Accounting For Dummies: 2nd EditionÉvaluation : 5 sur 5 étoiles5/5 (10)

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsD'EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)