Académique Documents

Professionnel Documents

Culture Documents

Group 1 Tax Project

Transféré par

Sheila Mae Araman0 évaluation0% ont trouvé ce document utile (0 vote)

10 vues2 pagesbnvvcvbcvb

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentbnvvcvbcvb

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

10 vues2 pagesGroup 1 Tax Project

Transféré par

Sheila Mae Aramanbnvvcvbcvb

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

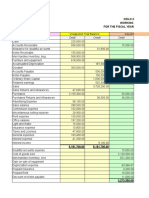

CTA CASE NO. 9305: Spouses Michael Gavin Richard L. Delos Reyes and Jennifer C.

Delos

Reyes VERSUS Commissioner of Internal Revenue

I. General Principles of Income Taxation (about Resident, Citizen, NRA-ETB, NRA-

NETB) (DEX)

In this case, the petitioners: spouses Michael Gavin Richard L. Delos Reyes and

Jennifer C. Delos Reyes are both Filipino citizens residing in the Philippines. They are

both considered as a resident citizen taxpayers of the Philippines. Their income derived

within and outside the Philippines will be taxed by the Bureau of the Internal Revenue.

II. General Principles of Income Taxation - Revenue Memorandum Circulars (SHEILA)

These are issuances that publish pertinent and applicable portions as well as

amplifications of laws, rules, regulations, and precedents issued by the BIR and other

agencies/offices.

In this case, the Revenue Memorandum Circular (RMC) No. 31-2013 issued is

valid because it is only a clarification of existing policies already in the law. It cannot be

considered void because it is within the power of the Bureau of Internal Revenue to issue

such memorandum circulars.

III. Compensation Income (KARREN)

The said petitioners are both earning a compensation income as employees of the

Asian Development Bank (ADB) and their compensation income are subject to basic

income tax using graduated rates prior to TRAIN Law since the case happened last 2013.

IV. Tax Exemptions (ALELIE)

Despite that both of them are employees of the Asian Development Bank, their

salaries are subject to income tax in the absence of a specific grant of tax exemption. It

was stated in the Article 56 of the ADB Chapter that no tax shall be levied on or in respect

of salaries and emoluments paid by the Bank to Directors, alternates, officers or

employees of the ADB but there is also a statement in the Senate Resolution No. 6 that

that ADB Chapter is subject to reservation that the Philippines retains for itself and its

political subdivision the right to tax their salaries so there were no exemptions for the

salaries of the said petitioners.

V. Powers of the Commissioner of Internal Revenue (INGRID)

The CIR plays an important role in this case because he has a power to

decide, approve and grant refund or tax credit of erroneously or excessively paid taxes.

Not Related to TAX 1: (PRINCESS)

I. Agreement between the Asian Development Bank and the Government of the

Republic of the Philippines regarding the Headquarters of the Asian Development

Bank

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Foliodete 20190519081830Document1 pageFoliodete 20190519081830Waqar Alam KhanPas encore d'évaluation

- Cpa Program Australia Taxation 2nd EditiDocument512 pagesCpa Program Australia Taxation 2nd EditiPrakash Gill100% (2)

- Ocean Carriers - Case (Final)Document18 pagesOcean Carriers - Case (Final)Namit LalPas encore d'évaluation

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearVINAY verma100% (1)

- TaxationnnnDocument12 pagesTaxationnnnRenji kleinPas encore d'évaluation

- GST Registration PDFDocument3 pagesGST Registration PDFRanjit MankuPas encore d'évaluation

- Final Details For Order #702-2405149-2985825: Shipped On December 3, 2018Document1 pageFinal Details For Order #702-2405149-2985825: Shipped On December 3, 2018Tim HubertPas encore d'évaluation

- Debit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Document6 pagesDebit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Jeane Mae BooPas encore d'évaluation

- Chemical Bonding: Lewis Dot Carbon Hydrogen OxygenDocument17 pagesChemical Bonding: Lewis Dot Carbon Hydrogen OxygenSheila Mae AramanPas encore d'évaluation

- Compounds (Noxious Compounds Produced by The Plant) Determined The Usage ofDocument25 pagesCompounds (Noxious Compounds Produced by The Plant) Determined The Usage ofSheila Mae AramanPas encore d'évaluation

- Immersing into-WPS OfficeDocument6 pagesImmersing into-WPS OfficeSheila Mae AramanPas encore d'évaluation

- Factual Recount-WPS OfficeDocument4 pagesFactual Recount-WPS OfficeSheila Mae AramanPas encore d'évaluation

- Or Bad Genes? (Book by David Raup, W.W. Norton, Co.)Document4 pagesOr Bad Genes? (Book by David Raup, W.W. Norton, Co.)Sheila Mae AramanPas encore d'évaluation

- Concept Map - CARBODocument1 pageConcept Map - CARBOSheila Mae AramanPas encore d'évaluation

- Comparing and C-WPS OfficeDocument5 pagesComparing and C-WPS OfficeSheila Mae AramanPas encore d'évaluation

- Activity Based-WPS OfficeDocument6 pagesActivity Based-WPS OfficeSheila Mae AramanPas encore d'évaluation

- Jimboy ProbabilityDocument7 pagesJimboy ProbabilitySheila Mae AramanPas encore d'évaluation

- Article Review - The Problem of Adaptation in The Study of Human BehaviorDocument1 pageArticle Review - The Problem of Adaptation in The Study of Human BehaviorSheila Mae AramanPas encore d'évaluation

- Literature Is i-WPS OfficeDocument2 pagesLiterature Is i-WPS OfficeSheila Mae AramanPas encore d'évaluation

- When Does A Team Rotate?Document3 pagesWhen Does A Team Rotate?Sheila Mae AramanPas encore d'évaluation

- Similarities of Philippines and ThailandDocument2 pagesSimilarities of Philippines and ThailandSheila Mae Araman100% (1)

- Concept Map - CARBODocument1 pageConcept Map - CARBOSheila Mae AramanPas encore d'évaluation

- Lessons of Covid19Document1 pageLessons of Covid19Sheila Mae AramanPas encore d'évaluation

- Cut SentencesDocument4 pagesCut SentencesSheila Mae AramanPas encore d'évaluation

- The coronavirus-WPS OfficeDocument8 pagesThe coronavirus-WPS OfficeSheila Mae AramanPas encore d'évaluation

- PrecipitationDocument1 pagePrecipitationSheila Mae AramanPas encore d'évaluation

- Cash TransferDocument2 pagesCash TransferSheila Mae AramanPas encore d'évaluation

- Impact of COVID19 To CommunityDocument3 pagesImpact of COVID19 To CommunitySheila Mae AramanPas encore d'évaluation

- MACROEVOLUTIONDocument7 pagesMACROEVOLUTIONSheila Mae AramanPas encore d'évaluation

- c19WPS OfficeDocument3 pagesc19WPS OfficeSheila Mae AramanPas encore d'évaluation

- Additional PartDocument1 pageAdditional PartSheila Mae AramanPas encore d'évaluation

- Plants (Desiccation Resistant), Marine Organisms (Fusiform Body), Cryptic Insects AllDocument23 pagesPlants (Desiccation Resistant), Marine Organisms (Fusiform Body), Cryptic Insects AllSheila Mae AramanPas encore d'évaluation

- mitosis-WPS OfficeDocument5 pagesmitosis-WPS OfficeSheila Mae AramanPas encore d'évaluation

- ) P (1-U) + Q (V) - The First Part On The Right Is Accounts For Alleles NotDocument14 pages) P (1-U) + Q (V) - The First Part On The Right Is Accounts For Alleles NotSheila Mae AramanPas encore d'évaluation

- Web DeveloperceDocument2 pagesWeb DeveloperceSheila Mae AramanPas encore d'évaluation

- Phylogenetic AnalysisDocument6 pagesPhylogenetic AnalysisSheila Mae AramanPas encore d'évaluation

- Risk management-WPS OfficeDocument6 pagesRisk management-WPS OfficeSheila Mae AramanPas encore d'évaluation

- Chapter 3Document6 pagesChapter 3Sheila Mae AramanPas encore d'évaluation

- Chapter 11Document12 pagesChapter 11Ergi CanollariPas encore d'évaluation

- DSP - ELSS - BookletDocument16 pagesDSP - ELSS - BookletPooja TripathiPas encore d'évaluation

- PAYSLIPDocument4 pagesPAYSLIPJoan SonzaPas encore d'évaluation

- Boat 235V2 Fast Charging Bluetooth Headset: Grand Total 1199.00Document1 pageBoat 235V2 Fast Charging Bluetooth Headset: Grand Total 1199.00AjayPas encore d'évaluation

- CIR Vs DLSUDocument3 pagesCIR Vs DLSUHaniya Solaiman GuroPas encore d'évaluation

- Normative Analyses of Investment Incentive in EthiopiaDocument6 pagesNormative Analyses of Investment Incentive in EthiopiaBelay MekuanintPas encore d'évaluation

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 524687300050920 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 524687300050920 Assessment Year: 2020-21asmit somPas encore d'évaluation

- Income Tax Calculation MemoDocument3 pagesIncome Tax Calculation Memoajeetpoly100% (3)

- CIR Vs LednickyDocument1 pageCIR Vs Lednickyc4382543rPas encore d'évaluation

- Chapter-3Document20 pagesChapter-3rajes wariPas encore d'évaluation

- Educational Services (PVT.) LTD.: Beaconhouse Muzaffarabad Branch NTN 22-13-0786158-3 BNRDocument1 pageEducational Services (PVT.) LTD.: Beaconhouse Muzaffarabad Branch NTN 22-13-0786158-3 BNRSyed Rizwan SaleemPas encore d'évaluation

- 1606-VAT Regs - Susana D LeeDocument2 pages1606-VAT Regs - Susana D LeeHanabishi RekkaPas encore d'évaluation

- HMRC Starter ChecklistDocument2 pagesHMRC Starter ChecklistH hPas encore d'évaluation

- Offer Letter of Iqbal MalegaonDocument5 pagesOffer Letter of Iqbal MalegaonIqbal SkPas encore d'évaluation

- VatDocument2 pagesVatFariha TarannumPas encore d'évaluation

- 1 Tax2601Document4 pages1 Tax2601sphamandla kubhekaPas encore d'évaluation

- Ais ArticleDocument6 pagesAis ArticleMohamed A FarahPas encore d'évaluation

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaPas encore d'évaluation

- Impact of Taxes On Economic Development BackgroundDocument5 pagesImpact of Taxes On Economic Development BackgroundAbdullahiPas encore d'évaluation

- Wage Type Request Form Overview 102011vs2Document2 pagesWage Type Request Form Overview 102011vs2Singh 10Pas encore d'évaluation

- Minda Kyoraku LTD - 380 - 30-12-2021Document1 pageMinda Kyoraku LTD - 380 - 30-12-2021Pragnesh PrajapatiPas encore d'évaluation

- Level IV Code 1 Project OneDocument5 pagesLevel IV Code 1 Project OneAye Tube100% (2)