Académique Documents

Professionnel Documents

Culture Documents

DM 2 223 The Statement of Financial Position

Transféré par

Lee SeokminDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

DM 2 223 The Statement of Financial Position

Transféré par

Lee SeokminDroits d'auteur :

Formats disponibles

DM 2 223 FINANCIAL MANAGEMENT Lecture 3

THE STATEMENT OF FINANCIAL POSITION

THE ACCOUNTING EQUATION

Assets = Liabilities + Owner’s Equity

ASSETS

The resources owned by a business.

Examples: cash, accounts receivable, inventory, supplies, land, buildings, equipment and vehicles.

LIABILITIES

The rights of creditors are the debts of the business.

Examples: accounts payable, notes payable, salaries payable and interest payable

OWNER’S EQUITY

The rights of the owners which usually represents (Investments – withdrawals ± net income/loss).

Example: share capital, withdrawals, profits/losses

T-ACCOUNTS

A graphic representation of a general ledger account. The name of the account is placed above the "T".

Debit entries are depicted to the left of the "T" and credits are shown to the right of the "T". The grand total

balance for each "T" account appears at the bottom of the account.

DETERMINING PROFIT THROUGH OPERATION

Accrual basis of accounting vs. Cash basis of accounting – accrual basis recognizes revenue when earned

and recognizes expenses when incurred

Under the expense recognition principle, expenses can be recognized either as: (1) matching; (2)

systematic allocation, or; (3) direct association.

Profit measures the performance of the company. If the revenue exceeds expenses, then it is a net

profit; otherwise, it is a net loss.

EXPENSE RECOGNITION PRINCIPLE

Expense recognition will typically follow one of three approaches, depending on the nature of the cost:

1. Associating cause and effect

Many costs are linked to the revenue they help produce. For example, a sales commission owed to an

employee is based on the amount of a sale. Therefore, commission expense should be recorded in the same

accounting period as the sale. Likewise, the cost of inventory delivered to a customer should be expensed

when the sale is recognized.

This is what is meant by associating cause and effect and is also referred to as the matching principle.

Instructor: Danica M. Almario, CPA 1

DM 2 223 FINANCIAL MANAGEMENT Lecture 3

2. Systematic and rational allocation

In the absence of a clear link between a cost and revenue item, other expense recognition schemes

must be employed. Some costs benefit many periods. Stated differently, these costs expire over time.

For example, a truck may last many years; determining how much cost is attributable to a particular year

is difficult. In such cases, accountants may use a systematic and rational allocation scheme to spread a

portion of the total cost to each period of use (in the case of a truck, through a process known as

depreciation).

3. Immediate recognition

Last, some costs cannot be linked to any production of revenue, and do not benefit future periods

either. These costs are recognized immediately.

An example would be severance pay to a fired employee, which would be expensed when the employee

is terminated.

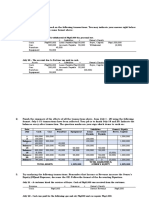

EFFECTS OF THE TRANSACTION IN THE ACCOUNTING ELEMENTS

1. Assets invested by the owner

July 1 – Paolo Reyes started a delivery service on July 1, 2013. The following transactions

occurred during the month of July. He invested PHP800,000 cash and cars amounting to PHP200,000.

Cash 800,000

Transportation vehicle 200,000

Reyes, Capital 1,000,000

2. Borrowings from the bank

July 2 – Reyes borrowed PHP100,000 cash from PNB for use in his business.

Cash 100,000

Loans Payable 100,000

3. Assets purchased for cash

July 7 – Bought tables and chairs from Orocan and paid PHP45,000 cash.

Furnitures 45,000

Cash 45,000

4. Assets purchased on account

July 15 – Various equipment were purchased on account from Fortune for PHP55,000.

Equipment 55,000

Accounts Payable 55,000

5. Cash withdrawal by the owner

July 18 – Reyes made a cash withdrawal of PHP5,000 for personal use.

Reyes, Drawing 5,000

Cash 5,000

6. Payment of liability

July 20 – The account due to Fortune was paid in cash.

Accounts Payable 55,000

Cash 55,000

7. Received cash for revenue earned

July 21 – A customer hired the services of Reyes. Cash of PHP15,000 was received from the

customers.

Cash 15,000

Service Revenue 15,000

Instructor: Danica M. Almario, CPA 2

DM 2 223 FINANCIAL MANAGEMENT Lecture 3

8. Paid cash for expenses incurred

July 22 – Cash was paid for the following: gas and oil, PHP500 and car repairs, PHP1,000.

Fuel and lubricant Expense 500

Repairs Expense 1,000

Cash 1,500

9. Revenue rendered on account

July 24 – Another customer hired the services of Reyes and promised to pay PHP16,000 on

July 31.

Accounts Receivable 16,000

Service Revenue 16,000

10. Paid for expenses incurred

July 25 – Paid PHP500 for telephone bill.

Telephone Expense 500

Cash 500

11. Revenue earned with a down payment, balance on account

July 27 – Another customer hired the services of Reyes. A bill was issued to them for PHP20,000,

50% of which was collected.

Cash 10,000

Accounts Receivable 10,000

Service Revenue 20,000

12. Customer’s account collected in cash

July 30 – The customer on July 24 paid 50% of his account in cash.

Cash 8,000

Accounts Receivable 8,000

13. Paid cash for expenses incurred

July 31 – Paid PHP10,000 for rental of office space, and salaries of PHP9,000.

Rent Expense 10,000

Salaries Expense 9,000

Cash 19,000

Instructor: Danica M. Almario, CPA 3

Vous aimerez peut-être aussi

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveD'EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThrivePas encore d'évaluation

- Basic Accountingch3Document87 pagesBasic Accountingch3Janine RiofloridoPas encore d'évaluation

- Basic Accountingch3 1 1Document64 pagesBasic Accountingch3 1 1Renmar CruzPas encore d'évaluation

- Course Name 9Document6 pagesCourse Name 9Revise PastralisPas encore d'évaluation

- CHAPTER 5 The Accounting EquationDocument35 pagesCHAPTER 5 The Accounting EquationKyla BallesterosPas encore d'évaluation

- Quiz Two ReviewerDocument15 pagesQuiz Two ReviewerStephanie DizonPas encore d'évaluation

- 1.3 Accounting EquationDocument6 pages1.3 Accounting EquationTvet AcnPas encore d'évaluation

- Adjustments Quiz 1Document7 pagesAdjustments Quiz 1Sheena GaborPas encore d'évaluation

- Quizbowl With Answer KeyDocument3 pagesQuizbowl With Answer Keyaccounting probPas encore d'évaluation

- Basic Accounting Reviewer Step 1 To 3Document12 pagesBasic Accounting Reviewer Step 1 To 3Mary Gleyne100% (1)

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDocument11 pagesPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoPas encore d'évaluation

- The Accounting EquationDocument23 pagesThe Accounting EquationLevi CorralPas encore d'évaluation

- FAR Quizzes and Practical ExerciseDocument23 pagesFAR Quizzes and Practical ExerciseCarla EspirituPas encore d'évaluation

- ACTIVITY 04 - Analyzing TransactionsDocument6 pagesACTIVITY 04 - Analyzing TransactionsJohn Luis Cordova CacayurinPas encore d'évaluation

- Entrepreneurship-1112 Q2 SLM WK7Document8 pagesEntrepreneurship-1112 Q2 SLM WK7April Jean Cahoy56% (9)

- Adjustments Quiz 1 - Answer KeyDocument7 pagesAdjustments Quiz 1 - Answer KeyAngelie JalandoniPas encore d'évaluation

- Accounting EquationDocument30 pagesAccounting EquationJenniferPas encore d'évaluation

- Financial WorksheetDocument6 pagesFinancial WorksheetCelyn DeañoPas encore d'évaluation

- August 20 DiscussionDocument26 pagesAugust 20 DiscussionJOSCEL SYJONGTIANPas encore d'évaluation

- Additional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TDocument4 pagesAdditional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TRenalyn Ps MewagPas encore d'évaluation

- Module-3 - (Answer) Financial-Analysis-and-ReportingDocument10 pagesModule-3 - (Answer) Financial-Analysis-and-ReportingJoanna Man LangPas encore d'évaluation

- MCQ Adjusting EntriesDocument7 pagesMCQ Adjusting EntriesMara Clara100% (1)

- Las 6Document4 pagesLas 6Venus Abarico Banque-AbenionPas encore d'évaluation

- The Accounting EquationDocument26 pagesThe Accounting EquationNicole Ann RosetePas encore d'évaluation

- Unit 3 - Adjusting EntriesDocument37 pagesUnit 3 - Adjusting EntriesJayvee TasanePas encore d'évaluation

- Tutorial 2 Journalizing PostingDocument5 pagesTutorial 2 Journalizing Postinglalala lalalaPas encore d'évaluation

- Module 3. Activity Sheet The Accounting EquationDocument4 pagesModule 3. Activity Sheet The Accounting Equationmarejoymanabat3Pas encore d'évaluation

- Analyzing Transactions To Start A BusinessDocument22 pagesAnalyzing Transactions To Start A BusinessPaula MabulukPas encore d'évaluation

- Compilation Notes On Journal Ledger and Trial Balance - Part 2Document8 pagesCompilation Notes On Journal Ledger and Trial Balance - Part 2Andra FleurPas encore d'évaluation

- Accounting 1 Review QuizDocument6 pagesAccounting 1 Review QuizAikalyn MangubatPas encore d'évaluation

- Adjusting Entries: Problem 1Document9 pagesAdjusting Entries: Problem 1Wholehearted LayoutsPas encore d'évaluation

- 24-Month Note Due To BDODocument3 pages24-Month Note Due To BDOEliza CruzPas encore d'évaluation

- Accounting Equation: Prepared By: Ms. Jocelyn F. Española, LPTDocument34 pagesAccounting Equation: Prepared By: Ms. Jocelyn F. Española, LPTLove JcwPas encore d'évaluation

- Fundamentals AnswerDocument12 pagesFundamentals AnswerRienalyn Dumlao Duldulao-DaligconPas encore d'évaluation

- Requirements in Fundamentals of AccountingDocument7 pagesRequirements in Fundamentals of AccountingMoises Macaranas JrPas encore d'évaluation

- Quiz BowlDocument2 pagesQuiz Bowlaccounting probPas encore d'évaluation

- Problems in AccountingDocument4 pagesProblems in AccountingRaul Soriano CabantingPas encore d'évaluation

- Chapter 1 FOA-Introduction To AcctgDocument25 pagesChapter 1 FOA-Introduction To AcctgBardenas JoybiePas encore d'évaluation

- Midterm 2nd 3rd Meeting RevisedDocument6 pagesMidterm 2nd 3rd Meeting RevisedChristopher CristobalPas encore d'évaluation

- Accounting EquationDocument21 pagesAccounting Equationvillanuevadimple91Pas encore d'évaluation

- Ganibo - Fabm Accounting EquationDocument6 pagesGanibo - Fabm Accounting EquationShereen Mallorca GaniboPas encore d'évaluation

- 17 Lecture 1 Bookkeeping and AccountingDocument11 pages17 Lecture 1 Bookkeeping and AccountingCrisceldette ApostolPas encore d'évaluation

- Review of The Accounting Process PDFDocument3 pagesReview of The Accounting Process PDFShiela Marie Sta AnaPas encore d'évaluation

- Assignment QuestionsDocument13 pagesAssignment QuestionsAiman KhanPas encore d'évaluation

- Course Name 6Document6 pagesCourse Name 6Revise PastralisPas encore d'évaluation

- Accounting Battaglia 1 Question and AnswersDocument7 pagesAccounting Battaglia 1 Question and AnswersRina RaymundoPas encore d'évaluation

- Accounting 3Document3 pagesAccounting 3hahaniPas encore d'évaluation

- Adjustments Quiz 1Document6 pagesAdjustments Quiz 1Christine Mae BurgosPas encore d'évaluation

- Enclosure 1. Teacher-Made Learner's Home Task (Week 6) : 1. Official Receipt or Cash ReceiptDocument5 pagesEnclosure 1. Teacher-Made Learner's Home Task (Week 6) : 1. Official Receipt or Cash ReceiptKim FloresPas encore d'évaluation

- FDNACCT Quiz-2 Answer-Key Set-ADocument4 pagesFDNACCT Quiz-2 Answer-Key Set-APia DigaPas encore d'évaluation

- Fundamentals of Accounting Part 2Document20 pagesFundamentals of Accounting Part 2MICHAEL DIPUTADO100% (1)

- 2 Accounting Entries - DR - CR - AdjustmentsDocument6 pages2 Accounting Entries - DR - CR - AdjustmentsI am AchiPas encore d'évaluation

- 5533 Financial AccountingDocument11 pages5533 Financial AccountingJamshaid MannanPas encore d'évaluation

- Chapter 1 Acctg Equation JournalizingDocument4 pagesChapter 1 Acctg Equation JournalizingNicole Marie Pontay BajadePas encore d'évaluation

- 3 Adjusting Entries HandoutsDocument10 pages3 Adjusting Entries HandoutsJuan Dela CruzPas encore d'évaluation

- Lesson 1 - Acctg+Document8 pagesLesson 1 - Acctg+CARLA JAYNE MAGMOYAOPas encore d'évaluation

- Community College of Gingoog CityDocument2 pagesCommunity College of Gingoog CityJeffrey Lois Sereño MaestradoPas encore d'évaluation

- I. Multiple Choice:: Mindanao Mission AcademyDocument3 pagesI. Multiple Choice:: Mindanao Mission AcademyHLeigh Nietes-GabutanPas encore d'évaluation

- Summary of Richard A. Lambert's Financial Literacy for ManagersD'EverandSummary of Richard A. Lambert's Financial Literacy for ManagersPas encore d'évaluation

- DM 2 223 The Basic Financial StatementsDocument4 pagesDM 2 223 The Basic Financial StatementsLee SeokminPas encore d'évaluation

- DM223Document3 pagesDM223Lee SeokminPas encore d'évaluation

- DM223Document3 pagesDM223Lee SeokminPas encore d'évaluation

- Introduction To AccountingDocument6 pagesIntroduction To AccountingLee SeokminPas encore d'évaluation

- Ifrs in Depth Expected Credit LossesDocument26 pagesIfrs in Depth Expected Credit LossesMagPas encore d'évaluation

- DM 223Document7 pagesDM 223Lee SeokminPas encore d'évaluation

- Demystifying Expected Credit LossDocument40 pagesDemystifying Expected Credit LossV Prasanna Shrinivas100% (1)

- Tax Update 1.31.18 PDFDocument25 pagesTax Update 1.31.18 PDFLee SeokminPas encore d'évaluation

- Tax Advisory BIR Form Shall Be Used For VAT PDFDocument1 pageTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloPas encore d'évaluation

- Tax Advisory - Withholding TaxesDocument1 pageTax Advisory - Withholding TaxesRalph AñesPas encore d'évaluation

- RR No. 11-2018Document47 pagesRR No. 11-2018Micah Adduru - RoblesPas encore d'évaluation

- Tax Advisory On Withholding Tax - 2.6.18Document1 pageTax Advisory On Withholding Tax - 2.6.18Gil Pino100% (1)

- Crime Data Analysis 1Document2 pagesCrime Data Analysis 1kenny larosePas encore d'évaluation

- Acute Renal Failure in The Intensive Care Unit: Steven D. Weisbord, M.D., M.Sc. and Paul M. Palevsky, M.DDocument12 pagesAcute Renal Failure in The Intensive Care Unit: Steven D. Weisbord, M.D., M.Sc. and Paul M. Palevsky, M.Dkerm6991Pas encore d'évaluation

- 10 2005 Dec QDocument6 pages10 2005 Dec Qspinster40% (1)

- READING 4 UNIT 8 Crime-Nurse Jorge MonarDocument3 pagesREADING 4 UNIT 8 Crime-Nurse Jorge MonarJORGE ALEXANDER MONAR BARRAGANPas encore d'évaluation

- Sustainable Development at British Petroleum: Presented by Amardeep Kulshrestha 09BS0000172 Section-EDocument20 pagesSustainable Development at British Petroleum: Presented by Amardeep Kulshrestha 09BS0000172 Section-EAmar KulshresthaPas encore d'évaluation

- DEIR Appendix LDocument224 pagesDEIR Appendix LL. A. PatersonPas encore d'évaluation

- Nta855 C400 D6 PDFDocument110 pagesNta855 C400 D6 PDFIsmael Grünhäuser100% (4)

- Tamilnadu Shop and Establishment ActDocument6 pagesTamilnadu Shop and Establishment ActShiny VargheesPas encore d'évaluation

- Entitlement Cure SampleDocument34 pagesEntitlement Cure SampleZondervan100% (1)

- Art of Facing InterviewsDocument15 pagesArt of Facing Interviewskrish_cvr2937100% (2)

- Valve Material SpecificationDocument397 pagesValve Material Specificationkaruna34680% (5)

- Long Term Effects of Surgically Assisted Rapid Maxillary Expansion Without Performing Osteotomy of The Pterygoid PlatesDocument4 pagesLong Term Effects of Surgically Assisted Rapid Maxillary Expansion Without Performing Osteotomy of The Pterygoid PlatesAngélica Valenzuela AndrighiPas encore d'évaluation

- Feature: SFP Optical Module 1 .25G Double Optical Fiber 20kmDocument2 pagesFeature: SFP Optical Module 1 .25G Double Optical Fiber 20kmDaniel Eduardo RodriguezPas encore d'évaluation

- NORSOK M-630 Edition 6 Draft For HearingDocument146 pagesNORSOK M-630 Edition 6 Draft For Hearingcaod1712100% (1)

- Lichens - Naturally Scottish (Gilbert 2004) PDFDocument46 pagesLichens - Naturally Scottish (Gilbert 2004) PDF18Delta100% (1)

- Electrical Data: PD2310 ApplicationsDocument1 pageElectrical Data: PD2310 ApplicationsKSPas encore d'évaluation

- ZX110to330 ELEC E PDFDocument1 pageZX110to330 ELEC E PDFYadi100% (1)

- 001 RuminatingpacketDocument12 pages001 Ruminatingpacketكسلان اكتب اسميPas encore d'évaluation

- Basic Electrical Engineering NotesDocument25 pagesBasic Electrical Engineering NotesAnas AnsariPas encore d'évaluation

- 2020 ROTH IRA 229664667 Form 5498Document2 pages2020 ROTH IRA 229664667 Form 5498hk100% (1)

- Epo-Fix Plus: High-Performance Epoxy Chemical AnchorDocument3 pagesEpo-Fix Plus: High-Performance Epoxy Chemical Anchormilivoj ilibasicPas encore d'évaluation

- Intro To Psychological AssessmentDocument7 pagesIntro To Psychological AssessmentKian La100% (1)

- Sanctuary Policy PomonaDocument3 pagesSanctuary Policy PomonaGabriel EliasPas encore d'évaluation

- Lab Manual PDFDocument68 pagesLab Manual PDFSantino AwetPas encore d'évaluation

- Project Management A Technicians Guide Staples TOCDocument5 pagesProject Management A Technicians Guide Staples TOCAnonymous NwnJNO0% (3)

- Offender TypologiesDocument8 pagesOffender TypologiesSahil AnsariPas encore d'évaluation

- Flusarc 36: Gas-Insulated SwitchgearDocument76 pagesFlusarc 36: Gas-Insulated SwitchgearJoey Real CabalidaPas encore d'évaluation

- G103 Remov Waste Dust Extraction UnitDocument2 pagesG103 Remov Waste Dust Extraction UnitJoseCRomeroPas encore d'évaluation

- Gender, Slum Poverty and Climate Change in Flooded River Lines in Metro ManilaDocument53 pagesGender, Slum Poverty and Climate Change in Flooded River Lines in Metro ManilaADBGADPas encore d'évaluation

- Principles of Health Management: Mokhlis Al Adham Pharmacist, MPHDocument26 pagesPrinciples of Health Management: Mokhlis Al Adham Pharmacist, MPHYantoPas encore d'évaluation