Académique Documents

Professionnel Documents

Culture Documents

WORKING PAPER OF ADVANCE PARAS FOR DEPARTMENTAL ACCOUNTS COMMITTEE MEETING

Transféré par

kashif saeedTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

WORKING PAPER OF ADVANCE PARAS FOR DEPARTMENTAL ACCOUNTS COMMITTEE MEETING

Transféré par

kashif saeedDroits d'auteur :

Formats disponibles

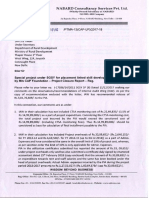

WORKING PAPER OF ADVANCE PARAS FOR DEPARTMENTAL ACCOUNTS COMMITTEE

MEETING

GOVT. POSTGRADUATE COLLEGE OF SCIENCE, FAISALABAD FOR THE PERIOD

01.07.2014 TO 30.06.2016

Period of Total Audit Observation Decisio Reply of the DDC Comments

Audit & Amount n of (Principal) Govt.

Para No. Involve last Postgraduate

D.A.C College of Science,

Meetin Fsd

g any

1 2 4 5 6

Irregular payment to Directorate

colleges Rs. 349447

As per rule 2.10 (a) 1 of PFR Vol –I same

vigilance should be exercised in respect of

expenditure incurred from Govt. revenues

as a person of ordinary prudence would

exercise in respect of expenditure of his

own money. Moreover, Rule 2.10 (b) 4,

money actually paid is under no

circumstances kept out of account a day

longer than is absolutely necessary even if

it has been paid without proper sanction.

During audit of Govt. Post Graduate

College of Science, Faisalabad for the

period 2014-16, it was observed that an

amount to the stated extent (detail

attached) was taken as loan from library

security fund of the college and paid to

Directorate colleges Faisalabad irregularly

in violation of above stated rule as

Director of colleges Fsd is separate entity

having separate budget. Audit

recommends that irregular payment

recover immediately from the concerned

under report to audit. In response to

original audit observation raised in May

2017, the management noted the

observation for compliance, however

necessary action may be taken as desired

above.

Non deposited of income tax on account

of remuneration paid to teaching staff

out of 2nd shift Rs. 181644 and less

deduction of income tax Rs. 45480.

As per section 153 of Income Tax

Ordinance 2001, every person making a

payment in full or part including a

payment by way of advance to a resident

person for the rendering of or providing of

services ; shall, at the time of making the

payment, deduct tax from the gross

amount payable (including sales tax, if

any) at the rate specified in Division III of

Part III of the first schedule – 6% in 2014-

15 and 10% in 2015-16 in all services

other than companies Taxpayers.

During audit of Govt. Post graduate

college of science, Faisalabad for the

period 2014-16, it was observed that

college management had paid an amount

of Rs. 3027400 to teaching staff as

remuneration out of 2nd shift fund but

Income tax for the year 2014-15 and

2015-16 respectively amounting to Rs.

181644 was deducted but not deposited

into Govt. Treasury. Further, it was noted

that income tax amounting to Rs. 45480

was less deducted for the year 2015-16 the

detail are as under:

Sr. Fin Tot Ta Ta Ta Ta

No. anc al x x to x x

ial Am Rat be De less

Ye oun e to ded duc ded

ar t be uct ted uct

Pai ded ed ed

d uct

ed

1 201 189 6% 113 113

4- 040 424 424 0

15 0

2 201 113 10 113 682 454

5- 700 % 700 20 80

16 0

302 227 181 454

740 124 644 80

0

Audit is of the view that weak internal

controls on Taxation resulted in non-

deduction of income tax on payment made

to service providers. Audit recommends

that the position may be clarified,

recovery affected from the concerned and

amount deposited into Govt. treasury

under report to audit. In response to

original audit observation raised in may

2017, the management noted the

observation for compliance, however

necessary action may be taken as desired

above.

Non Deduction of PST on services

rendered from security agency Rs.

129075/-

According to Sr. No.27 of second

schedule of Punjab sales Tax on Services

Act 2012, 16% sales tax on services

provided by security agency shall be

applicable.

During audit of Govt. Postgraduate

college of Science, Faisalabad for the

period 2014-16,it was observed that

payment of Rs. 214069 and Rs. 592650

was made on account of services rendered

for security agency i.e. National Police

Foundation security Services (PVT)

ltdduring financial year 2014-15 and

2015-16 respectively. But, PST @16% on

services rendered, which calculated to Rs.

129075, was less deducted on the eve of

payments released to services provider,

which is loss to the Govt.. The details are

as Under:

Sr.No. Financi Paymen 16%

al Year t made PST

to

security

1 2014-15 214069 34251

2 2015-16 592650 94824

Total 806719 129075

Audit is of the view that weak

supervisory and financial internal

controls led to less deduction of PST on

services. The Position may be clarified,

recovery effected from the parties

concerned and amount deposited into

Govt. treasury under report to audit. In

response to original audit observation

raised in May 2017, the management

note the observation for compliance,

however necessary action may be taken

as desired above.

Irregular /doubtful expenditure

incurred on pending liabilities of

previous years 2011-2012 without

obtaining sanction of competent

authority Rs. 578925/-

Para 17.18 of PFR VOL-I says that under

no circumstances may charges incurred be

allowed to stand over to be paid from the

grant of another of another year.

Furthermore, under Govt. Rules vide para-

17.17 of PFR VOL-I every DDO shall

maintain a register of liabilities in Form

PFR 27 in which he should enter all those

items of expenditure for:-

Payment is to be made by or

through an other officer.

Budget allotment or sanction of a

higher authority is to be obtained:

or

Payment would be required partly

or wholly during the next financial

years

Supporting stock register of

procurements were also not made

available to audit.

During audit of Govt. Post graduate

college of science, Fsd for the period

2014-16, it was observed that above

rules have not been followed by the

DDO concerned and an amount of

Rs.578925 had been drawn from Govt.

treasury in 2015-16 which was spent

to clear pending liabilities of previous

years 2011-12 on account of Medical

charges AO1274 (detail is enclosed),

without obtaining sanction of the

competent authority which is irregular

in the light of rules position stated

above. The absence of liability register

in form PFR-17.17 ( For each object

head) and non production of stock

register has also rendered the whole

expenditure doubtful. Therefore, a

detailed scrutiny of all payments of

previous years needs to be carried out.

The irregularity may be justified and

matter got regularized from the

competent authority under intimation

to audit, besides needful to be done

with regard to special audit. In

response to original audit observation

raised in May 2017, the management

stated that detail reply will be

submitted later on after scrutiny of

record, however necessary action may

be taken as desired above.

Loss to Govt. due to non auction of

Canteen Rs. 235334/- approximately

As per rule 4.7 (1) of PFR Vol-I, it is

primarily the responsibility of the

departmental authorities to see that all

revenue, or other debts due to Govt.,

which have to be brought to account, are

correctly and promptly assessed, realized

and credited to Government account.

During audit of Govt. Postgraduate

college of science, Faisalabad for the

period 2014-16, it was observed that a

canteen was running its business in the

premises of College. The canteen contract

was awarded amounting to Rs. 353000 per

annum (3 installments @117,667) to Mr.

Arif Riaz S/O Mushtaq Hussain

(H.NO.P-96 K Gulistan Colony, Fsd)

W.e.f July 14 to June 2015 during 2014-

15. The contractor paid first installment @

117,667) on 09-12-2014 and after that the

contractor withdraw canteen contract. It

was noticed that the college management

did not re-tender/reauction the said

canteen for the remaining period which

causes loss to Govt. amounting to Rs.

235334(117667@2) Audit was of the

view that non auction of canteen resulted

loss of Rs. 235334 approx. The position

may please be clarified, matter probed

into and loss be made good under

intimation to audit. In response to original

audit observation raised in May 2017, the

management stated that detail reply will

be submitted later on after scrutiny of

record, however necessary action may be

taken as desired above.

Un-acknowledged distribution of

magazines and whereabouts of

remaining 1260 magazines Rs. 182700/-

As per Rule 15.5 of PFR VOL-I, when

materials are issued from stock, a written

acknowledgment should be obtained from

the person to whom they are ordered to be

delivered or dispatched, or from his duly

authorized agent. During audit of Govt.

Postgraduate college of Science, Fsd for

the period 2014-16, it was observed that

college magazine (Kawish 2015) were

printed for Rs461970. The details are as

Under:

Sr.N B.N Fir NO. Rate Am

o. O. m of ount

& Na Mag

date me azin

e

1 134 Uni 270 145 391

&15 que 0 500

.4.1 Publ

5 ishe

rs

Cho

wk

urdu

Baz

ar

Lhr

Following Lapses were noticed:

Stock entry of the magazine were

not entered in the stock register.

The 2700 nos. of magazines were

printed out of which 2000 received

by the distributed person out of

which 1440 were shown

distributed whereabouts of

remaining 1260 magazines among

the students were un

acknowledged as the as the

acknowleged of the recipents were

not available on reocord.

In the absence of the acknowledgements

of the recipients, the receipt of the

magazine by rightful person could not be

authenticated. Audit recommends that the

department should strengthen its internal

controls and investigate the matter to fix

the responsibility regarding lapse. In

response to original audit observation

raised in May 2017, the management

stated that detail reply will be submitted

later on after scrutiny of record, however

necessary action may be taken as desired.

Non-return of library books –Rs.52900

As per library rules mentioned in the

Prospectus of the college, books can be

retained for 14 days for study by the

students and required to get re-issued after

this period. In case of non-return of books

within due date, a fine of Re.1 per day

will be charged. In case of loss of a book,

price of the new book or four times of the

price of purchase will be charged.

During audit of Government Postgraduate

college of Science, Fsd for the period

2014-16, it was observed that books

detailed in the statement annexed had

been issued to the students but the same

were not returned to Library within due

date. Neither books or cost thereof nor

fine were recovered which causes loss to

Govt. due to non-receipt back books.

Audit recommends that all overdue books

may be collected and fine be recovered

from the defaulters under report to audit.

In response to original audit observation

raised in May 2017, the management

noted the observation for compliance,

however necessary action may be taken as

desired above.

Non deposit of Income tax on account

of remuneration Rs. 50554/-

As per section 153 of Income Tax

ordinance 2001, every person making a

payment in full or part including a

payment by way of advance to a resident

person for the rendering of or providing of

services; shall, at the time of making the

payment, deduct tax from the gross

amount payable (including sales tax, if

any) at the rate specified in Division III of

Part III of the First Schedule – 6% in

2014-15 and 10% in 2015-16 in all

services other than companies Taxpayers.

During audit of Govt. Post graduate

college of science, fsd for the period

2014-16 it was observed that college

management had paid an amount of

Rs.612737 to principal and coordinator as

remuneration out of 2nd shift fund but

Income tax for the period 2014-15 and

2015-16 amounting to Rs. 50554 was

deducted but not deposited into Govt.

Treasury. Audit is of the view that weak

internal controls on Taxation resulted in

Non-deduction of income tax on payment

made to services providers. Audit

recommends that position may be

clarified, recovery affected from the

concerned and amount deposited into

Govt. treasury under report to audit. In

response to original audit observation

raised in may 2017, the management

noted the observation for compliance,

however necessary action may be taken as

desired above.

Loss of Government due to Income tax

not recovered from Canteen contractor

Rs. 39000/- Recovery thereof

According to section 36-A of Income Tax

Ordinance (1) Any person making sale by

public auction 2[or auction by a tender],

of any property or goods 3[(including

property or goods confiscated or

attached)] either belonging to or not

belonging to the Govt. local Government,

any authority a company, a foreign

association declared to be a company

under sub-clause (vi) of clause (b) of sub-

section (2) of section 80, or a foreign

contractor or a consultant or a consortium

or Collector of customs or Commissioner

of 4[Inland Revenue] or any other

authority, shall collect advance tax,

computed on the basis of sale price of

such property and at the rate specified in

Division VIII of Part IV of the First

Schedule, from the person to whom such

property or goods are being sold.

Explanation. – For the purposes of this

section, sale of any property includes the

awarding of any lease to any person,

including a lease of the right to collect

tolls, fees or other levies, by whatever

name called.]-1 [Division VIII Advance

tax at the time of sales by auction.

The rate of collection of tax under section

236A shall be 2[10]% of the gross sale

price of any property or goods sold by

auction.]

During audit of Govt. postgraduate

college of science, Fsd for the period

2014-16, it was observed that the canteen

contract was awarded amounting to

Rs.390000 per annum to Mr. Abdul

Hameed w.e.f July 15 to June 2016 but

advance income tax @10% amounting to

Rs. 39000 was not deducted recovered

from the contractor to be deposited into

Govt. treasury. Audit feels that weak

supervisory and financial internal controls

have resulted into non recovery of

advance tax which is loss to the

government. Therefore, the matter may

please be looked into recovery effected

from the contractor concerned at the

earliest and amount deposited into Govt.

treasury without any further delay.

In response to original audit observation

raised in may 2017, the management

noted the observation for compliance,

however necessary action may be taken as

desire above.

Recovery of Rs. 20187/ irregularly

drawn from computer account and paid

audit recovery payable by the computer

contracting firm.

As per notification Govt. of the Punjab,

Higher Education Department dated:

16.05.2016, the expenditure shall be made

keeping in view the financial propeiety,

transparency and financial Rules &

procedures. During audit of Govt.

Postgraduate college of Science, Fsd for

the period 2014-16, it was observed that

an amount of Rs. 20187/- was drawn for

the from the computer fund for depositing

Income tax in compliance of Audit Para

No.06 of the AIR (Audit & Inspection

Report) for the financial year 2012-14

titled “Loss to revenue due to non

recovery of income tax at source- Rs.

20187”. Following irregularities were

noticed:

The payment of income tax recovery

pointed out by audit was to be recovered

from the computer contracting firm on

account of service rendered but the

Income tax on such payment was not

deducted at source at the time of payment

in that years as pointed out by audit.

Instead of recovery from defaulter, the

college management was drawn the

amount from computer fund and deposited

into treasury which was disgusting and

irregular. The matter is serious nature

which need to be clarified:

Audit therefore requires that

1. Amount pointed out by audit may be

recovered from concerned firm and

deposited back into computer account

under intimation to audit.

2. Responsibility for this irregular draw

may be fixed along with the disciplinary

action.

In response to original audit observation

raised in May 2017, the management

stated that detail reply will be submitted

later on after scrutiny of record, however

necessary action may be taken as desired

above.

Non auction of unserviceable items of

store

Rule 4.1 of PFR volume-I provides that

the department controlling officers should

accordingly see that all sums due to

government are regularly received and

checked against demands, and that they

are paid into the treasury and rule 2.33 of

PFR vol-I states that every Govt. servant

should realize fully and clearly that he

will be held personally responsible for any

loss sustained by Govt. through fraud or

negligence on his part. During audit of

Govt. Postgraduate college of science,

Faisalabad for the period 2014-16, it was

observed that a large number of store

articles were found lying in the store in

the college premises which need to be

auctioned. Audit recommends that

unserviceable items of store may be

auctioned and realized amount be

deposited into Govt. treasury under report

to audit. In response to original audit

observation raised in May 2017, the

management stated that compliance will

be made soon, however necessary action

may be taken as desired above.

Vous aimerez peut-être aussi

- SDSSU-Tandag ES2011Document4 pagesSDSSU-Tandag ES2011Chard BhotonzPas encore d'évaluation

- 08-Looc2012 Part2-Findings and RecommendationsDocument10 pages08-Looc2012 Part2-Findings and RecommendationsMiss_AccountantPas encore d'évaluation

- NIFA Report 2018-20Document26 pagesNIFA Report 2018-20zaka khanPas encore d'évaluation

- Criteria For Non - TeachingDocument5 pagesCriteria For Non - TeachingMayur ThombrePas encore d'évaluation

- ENGG UG SSS FeesDocument28 pagesENGG UG SSS FeesPramod SURYATALEPas encore d'évaluation

- Over and Under Deduction of Salaries and ContributionsDocument3 pagesOver and Under Deduction of Salaries and ContributionsArlea AsenciPas encore d'évaluation

- 1449293287189medical Dental Guidelines 2016-17 To 2018-19 PDFDocument4 pages1449293287189medical Dental Guidelines 2016-17 To 2018-19 PDFVenkata Nagaraj MummadisettyPas encore d'évaluation

- Circular-2019 E7 0Document36 pagesCircular-2019 E7 0Cag ExamsPas encore d'évaluation

- Audit Report Sindh Agriculture University Tandojam, SindhDocument63 pagesAudit Report Sindh Agriculture University Tandojam, Sindhsadaf_183100% (1)

- PSB Promotion GuidelinesDocument24 pagesPSB Promotion GuidelinesPranav RaiPas encore d'évaluation

- Aphermc Guidelines 2020-23 PDFDocument9 pagesAphermc Guidelines 2020-23 PDFSantoshHsotnasPas encore d'évaluation

- Group B de Pu 13052014Document3 pagesGroup B de Pu 13052014Dok MiPas encore d'évaluation

- Guest FacultyDocument6 pagesGuest FacultyDILIP KUMAR REDDYPas encore d'évaluation

- Step Increment AOMDocument3 pagesStep Increment AOMArlea AsenciPas encore d'évaluation

- IAW-response + AnnexureDocument8 pagesIAW-response + AnnexureJatin KalraPas encore d'évaluation

- Budget Circular No. 2022 4 Dated December 20 2022Document7 pagesBudget Circular No. 2022 4 Dated December 20 2022Antipolo City BudgetPas encore d'évaluation

- Amendments in CA Final Direct Tax For May 2015Document127 pagesAmendments in CA Final Direct Tax For May 2015sourabh singlaPas encore d'évaluation

- Statement On Impact of Audit Qualifications For The Period Ended March 31, 2015 (Company Update)Document5 pagesStatement On Impact of Audit Qualifications For The Period Ended March 31, 2015 (Company Update)Shyam SunderPas encore d'évaluation

- DO 56, S. 2016 - Guidelines On The Grant of Performance-Based Bonus For The Department of Education Employees and Officials For Fiscal Year 2015Document48 pagesDO 56, S. 2016 - Guidelines On The Grant of Performance-Based Bonus For The Department of Education Employees and Officials For Fiscal Year 2015Deped Tambayan100% (6)

- Philippine Health Insurance Corporation: Call Center: (02) 8441-7442 Trunkline: (02) 8441-7444Document14 pagesPhilippine Health Insurance Corporation: Call Center: (02) 8441-7442 Trunkline: (02) 8441-7444Jerick Mangiduyos LapurgaPas encore d'évaluation

- Abbottabad Audit 2013Document39 pagesAbbottabad Audit 2013Lila GulPas encore d'évaluation

- PSU Executive Summary Highlights Key Audit FindingsDocument6 pagesPSU Executive Summary Highlights Key Audit Findingsjaymark camachoPas encore d'évaluation

- Ugc Arrears ProceedingsDocument3 pagesUgc Arrears ProceedingsdrgmraoPas encore d'évaluation

- Guidelines for Payment of Pay Revision ArrearsDocument124 pagesGuidelines for Payment of Pay Revision Arrearsmyscbd75% (4)

- CAMPA Advert enDocument6 pagesCAMPA Advert enYogesh DagarPas encore d'évaluation

- 02-PSU2016 Transmittal Letter To Board Of-RegentsDocument2 pages02-PSU2016 Transmittal Letter To Board Of-Regentsjaymark camachoPas encore d'évaluation

- ITAT-No Income Tax On Adjustment of Excess Salary RecoverdDocument3 pagesITAT-No Income Tax On Adjustment of Excess Salary RecoverdManok KumarPas encore d'évaluation

- Government of Andhra PradeshDocument4 pagesGovernment of Andhra PradeshVenkatadurgaprasad GopamPas encore d'évaluation

- Advanced Tax Laws Question Paper 2021-2022Document4 pagesAdvanced Tax Laws Question Paper 2021-2022sorien panditPas encore d'évaluation

- Finance Department Notification-2004 (205-258)Document54 pagesFinance Department Notification-2004 (205-258)Humayoun Ahmad Farooqi67% (6)

- Constitutional Petition Leave To AppeaDocument10 pagesConstitutional Petition Leave To AppeaOwais AhmedPas encore d'évaluation

- Prospectus PDFDocument129 pagesProspectus PDFMANSHADPas encore d'évaluation

- Deputation Non Faculty AdvertisementDocument7 pagesDeputation Non Faculty AdvertisementAlokMishraPas encore d'évaluation

- Shivaji University Finance Officer RecruitmentDocument3 pagesShivaji University Finance Officer RecruitmentIshita KadamPas encore d'évaluation

- Private Engineering Colleges Guidelines 2022 2025 TAFRCDocument11 pagesPrivate Engineering Colleges Guidelines 2022 2025 TAFRCXymer UnknownPas encore d'évaluation

- Admin Volume ThirdDocument114 pagesAdmin Volume ThirdRealPas encore d'évaluation

- PDFDocument2 pagesPDFRehan KhanPas encore d'évaluation

- Finance Depatment Notifications-2002 (55-164)Document96 pagesFinance Depatment Notifications-2002 (55-164)Humayoun Ahmad Farooqi100% (1)

- G o No 3Document1 pageG o No 3api-142567765Pas encore d'évaluation

- Kvs Transfer GuidelinesDocument15 pagesKvs Transfer GuidelinesDrMamta SinghPas encore d'évaluation

- Chapter 2 Financial Reporting in Panchayat Raj Institutions Karnataka Report No 5 of 2017 On LBDocument7 pagesChapter 2 Financial Reporting in Panchayat Raj Institutions Karnataka Report No 5 of 2017 On LBMAHESH KALBURGIPas encore d'évaluation

- Budgetory ControlDocument44 pagesBudgetory ControlManish RajakPas encore d'évaluation

- Arrears PRC Cir - Memo.dt13!6!2018Document7 pagesArrears PRC Cir - Memo.dt13!6!2018Praveen BabuPas encore d'évaluation

- Pgm2017 ProsDocument76 pagesPgm2017 ProsAnto PaulPas encore d'évaluation

- India: No.30/0/2018 Government The Director General Central Public Works DepartmentDocument53 pagesIndia: No.30/0/2018 Government The Director General Central Public Works DepartmentChief Engineer Western Zone-3Pas encore d'évaluation

- 2013fin MS176Document3 pages2013fin MS176nmsusarla999Pas encore d'évaluation

- Revised Procedure For Operation 27122018Document21 pagesRevised Procedure For Operation 27122018Shoutook JohnPas encore d'évaluation

- Ad-Hoc Bonus 2023-2024Document2 pagesAd-Hoc Bonus 2023-2024Aditya NandiPas encore d'évaluation

- MFDAC DEA D.G.Khan 2021-22Document98 pagesMFDAC DEA D.G.Khan 2021-22kashafkhanmaqsoodPas encore d'évaluation

- Government of Andhra PradeshDocument16 pagesGovernment of Andhra PradeshPraveena VemulapalliPas encore d'évaluation

- 15052014fin MS105 PDFDocument16 pages15052014fin MS105 PDFPraveena VemulapalliPas encore d'évaluation

- Madras High Court Ruling on MACP Scheme BenefitsDocument13 pagesMadras High Court Ruling on MACP Scheme BenefitsSambasivam GanesanPas encore d'évaluation

- Chapter 4 - Accounting For DisbursementsDocument12 pagesChapter 4 - Accounting For DisbursementsErika Villanueva Magallanes0% (1)

- Advt For The Post of Officer AdminDocument5 pagesAdvt For The Post of Officer AdminAbhinav GuptaPas encore d'évaluation

- F Rules 7085 30102017Document4 pagesF Rules 7085 30102017manmohanPas encore d'évaluation

- Draft Inspection Report on Accounts of HeadmistressDocument6 pagesDraft Inspection Report on Accounts of HeadmistressSandyCorpPas encore d'évaluation

- Case Studies in Not-for-Profit Accounting and AuditingD'EverandCase Studies in Not-for-Profit Accounting and AuditingPas encore d'évaluation

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018D'EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Pas encore d'évaluation

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesD'EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesPas encore d'évaluation

- DATABASE Kawasan Industri PolugadungDocument20 pagesDATABASE Kawasan Industri PolugadungRina Rachman100% (1)

- Module Combustion Engineering-1-2Document13 pagesModule Combustion Engineering-1-2Julie Ann D. GaboPas encore d'évaluation

- Student Boarding House Quality in Term of Health DDocument11 pagesStudent Boarding House Quality in Term of Health DPauline Valerie PacturanPas encore d'évaluation

- City Profil Addis AbabaDocument33 pagesCity Profil Addis AbabaEyuale TPas encore d'évaluation

- Autox - December 2019 PDFDocument162 pagesAutox - December 2019 PDFtae talPas encore d'évaluation

- Resume Assignment v5 - Ps 4963 - Cloninger Ps t00111877Document1 pageResume Assignment v5 - Ps 4963 - Cloninger Ps t00111877api-666151731Pas encore d'évaluation

- Topic: Fea For Fatigue Life Assessment of Valve Component Subjected To Internal Pressure Loading. (Through Software)Document27 pagesTopic: Fea For Fatigue Life Assessment of Valve Component Subjected To Internal Pressure Loading. (Through Software)tallat0316557Pas encore d'évaluation

- Nfa2xsy TDocument2 pagesNfa2xsy Terni.ainy93Pas encore d'évaluation

- GREEN Manual - 2021Document157 pagesGREEN Manual - 2021Bon Ber Amad Orofeo100% (2)

- Material Safety Data Sheet "Cut Back Bitumen": Section 1: Product and Company IdentificationDocument4 pagesMaterial Safety Data Sheet "Cut Back Bitumen": Section 1: Product and Company IdentificationPecel LelePas encore d'évaluation

- Banking Sector Project ReportDocument83 pagesBanking Sector Project ReportHarshal FusePas encore d'évaluation

- 72-76 kW 310SK/310SK TC Compact Track Loader SpecsDocument10 pages72-76 kW 310SK/310SK TC Compact Track Loader SpecsPerrote Caruso PerritoPas encore d'évaluation

- Opposition To Motion For InjunctionDocument29 pagesOpposition To Motion For InjunctionBasseemPas encore d'évaluation

- RLE Journal CoverDocument2 pagesRLE Journal Coverrchellee689Pas encore d'évaluation

- Intro To HCI and UsabilityDocument25 pagesIntro To HCI and UsabilityHasnain AhmadPas encore d'évaluation

- Mid-Term Test RemedialDocument2 pagesMid-Term Test RemedialgaliihputrobachtiarzenPas encore d'évaluation

- Defences of Illegality in England, Canada and the USDocument11 pagesDefences of Illegality in England, Canada and the USBetteDavisEyes00Pas encore d'évaluation

- 2390A Series Spectrum AnalyzersDocument6 pages2390A Series Spectrum AnalyzersElizabeth FaulknerPas encore d'évaluation

- CMC Internship ReportDocument62 pagesCMC Internship ReportDipendra Singh50% (2)

- Ans: DDocument10 pagesAns: DVishal FernandesPas encore d'évaluation

- Soap Making BooksDocument17 pagesSoap Making BooksAntingero0% (2)

- User Manual - User Manual - Original and Genuine Veronica® 1W PLL (1WPLLM)Document39 pagesUser Manual - User Manual - Original and Genuine Veronica® 1W PLL (1WPLLM)Carlos Evangelista SalcedoPas encore d'évaluation

- Drilling and Demolition: Hilti. Outperform. OutlastDocument48 pagesDrilling and Demolition: Hilti. Outperform. OutlastVinicius CoimbraPas encore d'évaluation

- Wind Energy Potential in BangladeshDocument10 pagesWind Energy Potential in BangladeshAJER JOURNALPas encore d'évaluation

- الصراع التنظيمي وأثره...Document25 pagesالصراع التنظيمي وأثره...mohmod moohPas encore d'évaluation

- Catalogue: See Colour in A Whole New LightDocument17 pagesCatalogue: See Colour in A Whole New LightManuel AguilarPas encore d'évaluation

- Over 20 free and paid Pathfinder 2E character sheet optionsDocument1 pageOver 20 free and paid Pathfinder 2E character sheet optionsravardieresudPas encore d'évaluation

- Google Inc 2014Document19 pagesGoogle Inc 2014Archit PateriaPas encore d'évaluation

- Form-Q - Application For Quarry PermitDocument1 pageForm-Q - Application For Quarry PermitDebasish PradhanPas encore d'évaluation

- Eastman 2389 TDSDocument14 pagesEastman 2389 TDSSkySupplyUSAPas encore d'évaluation