Académique Documents

Professionnel Documents

Culture Documents

Notification

Transféré par

abbas0 évaluation0% ont trouvé ce document utile (0 vote)

13 vues4 pagespdf

Titre original

Notification (1)

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentpdf

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

13 vues4 pagesNotification

Transféré par

abbaspdf

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

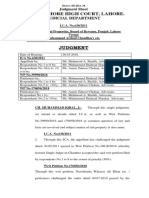

GOVERNMENT OF THE PUNJAB

EXCISE & TAXATION DEPARTMENT

Lahore dated the 30” June, 2014

No. SO.TAX(E&T)3-38/2014. In partial modification of this department's

Notification No, SO.TAX(E8T)3-38/2014, dated 26.06.2014, the Annex “A”

of the above mentioned notification |s revised and substituted with immediate

effect. Revised Annex “A” is attached herewith.

(KHALID MASOOD CHAUDHARY)

‘SECRETARY TO GOVERNMENT OF THE PUNJAB

EXCISE & TAXATION DEPARTMENT

‘No. & Date even:

‘A copy with a copy of the enclosures is forwarded for information and

necessary action to:-

1, The Secretary to Governor, Punjab.

2. The Secretary to Chief Minister, Puned

3, All Administvative Secretaries to Government of the Punjab

4. The Inspector General Police, Punjab

5, The Secretary, Punjab Assembly, Punjab

6 Al Commissioners oF the divisions in Punjab

7. The Registrar, Lahore High Cour, Lahore

8, The Accountant Genera, Punjab, Lahore

9, The Director General, Excise & Taxation, Punjab

10, The Additional Director Genera), Exelse & Taxation, Punjab

11. The Additional Secretary (GenerallStaff Officer to Chief Secretary, Punjab

12, The Assistant Secretary (Legisiation), Punjab Assemo\y

13, The Director General, Public Relations Department Punjeb

14, All District Coordination Officers in Punjad

15, All Directors, Excise & Taxation in Punjab

16. All Executive District Officers (FP) in Punjed

17, All Bxase & Taxation Officers in Punjab

18, All District Accounts Officers in Punjab

18, All District Polce Officers in Puntab

20. The PS to Minister, Excise & Tevation, Pung

21, Al Sections Officers, Excise & Taxation Department, Govt ofthe Punjab

22, ‘The Superintendent Printing Press Punjab, Lahore with the request to

publish it in the Gazette Notification

(SYED ASHIQ HUSSAIN SHAH)

‘ Depuly Secretary

(Tax Payers Factaton)

Annex “a”

as: F SPE

(REVISED 30.06.2014)

Ne, |__Type of Property Criteria for assessment

1] Ghamaa) Theatres] | Corporal rats so or ranted as the ase may Be

Arorim/mutparsose_| specie in valuation table ofthe respective local.

halls

7] Fecarics’ el | Reta aes notion forthe aly, (af reed

{menafoetring) units

eliing cottage uns

as the case may be) with following tebate for land

Upto 1 acre: Normal ates

Exceeding 1 acre upto 4 acre: 20% reduction

Exceeding § acres: 20% reduction

‘The office premises being part of such properties shall

be assassed as per commercial rates prescribed forthe

locality. Residental areas. wil be assessed 3s_per

residential rte prescrioed forthe locality, Furtier SO%

Aiscount shall be allowed io properties with seasonal

use (Cotton Ginning Factores, Rice Mils, Oil Mil, Toe

Factores etx)

Wiarrage Wally Banquet

Hall, Marriage Lawn/Event

Hall Marquee! exhibition

centres.

Self properties shall be assessed @ 175% of

‘ommercal rate of valuation tables prescribed for

locality. Rented properties shall be assessed 3s

rates preserbed for commercial rented provertis.

Properties bul as

residential properties but

used for Offices)

Educational institutions.

150% of the rates specified in the valuation table of

residential properties for te respective local.

otes/Motels/Guest

Houses & such other

Furnished properties.

Th exe of portion consisting of rooms)

boarding/lodging units usad 2s residential

‘accomadation 409% of the gross annual (365

days) rent shall be taken as GARV. The gross rent

shall be ‘worked out on average/normal charges

received per room er day.

1) The commercial area shall be assessed self or

rented as the case may be as per valuation table

prescribed for the locally

ii) While calculating covered area, _tobby/

Ketcherymosque and ancillary portion’ shall be

excuved.

Hostels

TS0% of rates spectiod in valuaton tables for rented

‘residential properties ofthe respective locality

Hospitals

‘Commercial rate Saf or rented as the case may Be

prescribed forthe locality,

Patror Pumps/CNe

Stations/Car_—— ashy

Service Stations

Tonmercal rales sof or rented as the ease may Be.

Underground area for storage/tanks/Cenopy shall also

be accounted for as covered area,

Page 2A

‘Plaza and_mult storeved | Narimal commercial rate se or rentad as the ease may

builings (buildings with at | be. However, 10% reduction in case of 1% floor and

least 4 storeys or more first basement and further 5% reduction for each

incluging basement ) foor/oasement upto maximum of 40% shall be alowed

for fors above and below ground floor.

In case of single ownership lend shall be assessed only

‘once. However, In case of individuals and different

‘ownership lend equal to the respective portion shal

‘also be assessed in each case. Similar, In case of

mutiple use of land respective rate of the relevant

valuation tables shall be applied in pro-rata manner, It

is further aced that paid parking shall be assessed on

50% rented commercial rate of locality & free parking

_| to be excluded.

70 | Customized Parking Plazas?) 25% of the commercial rate self or rented as the case

Parking Lots ‘may be meant for the loclty.

TI [Old resdentiat Bullings |) 10% rebate for building oder than 20 years upto 30

eluding properties | years.

mentioned at serial No, 5 | il) 15% rebate for bullding alder than 30 years.

above)

i | Aovicuture Tands, [As per actual rent in cose of rented end Rs, L0O0/- per

Orchards, Nurseries kana, par annum in case of self occupation/ cuiivation.

73 | Pouity Fars, cattle sheds | 50% of the residential rate self or rented as the case

and Bhattas (Brick Kilns) | may be preserved forthe locality

77 | Transmission ‘Actual rent in case of rented properties. Sei

Communication Towers | commercial rate of valuation tables shall be applied in

‘case of company owned properties. In this case, Whole

land area shall be considered as covered aren.

TS | Gr Stations Land area & covered area including area

installaton/equipment shall be assessed on selfrented

commercial rates as the case may be.

TE | Froperties Bult & used = | Commercial rates ofthe localities seif or rented es the

‘commercial —_ properties | case may be,

(inclucing offices and.

customized educational

institutions builings)

G7 Airpori) Runway Svip/ Dry 1) Land & covered area shall be assessed as per self or

Ports/Open Yards. rented, commercial rate of the local.

ii) Runway Strip & Tad area, Dry Ports Open Yards

Including Logistic Tracks to be assessed at 25% of

les the self or rented commercial rate of te local

TB Open pkt being used for | 200% of the rate of the valuation tobie meant for the

‘commercial purposes lend area presorbed for the locality, self or rented, as

the case mey be.

75" Stadium, spats complex ||. Commercial area self or rented to be assessed as

suchlike sports stes| per commercial rate of local.

inclucing swimming pools |i, Playing fieds/areas to be assessed at residential

(ether than those being | rate of the locality elf or rented as the case may

part of any residential or

be.

Commercial. progerties)| il. Open srea/land other than the above to be

Race Courses/ venues or | assessed at residential rate rented or self as the

any ather games of sports | case may be.

sites,

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Urban Immovable Property Tax Rules, 1958Document31 pagesThe Urban Immovable Property Tax Rules, 1958abbasPas encore d'évaluation

- H.R.C. 69229 P 2018Document23 pagesH.R.C. 69229 P 2018abbasPas encore d'évaluation

- 2018LHC985Document29 pages2018LHC985abbasPas encore d'évaluation

- CHAPTER 7 Final PDFDocument108 pagesCHAPTER 7 Final PDFabbasPas encore d'évaluation

- Judgment Sheet: in The Lahore High Court Multan Bench MultanDocument15 pagesJudgment Sheet: in The Lahore High Court Multan Bench MultanabbasPas encore d'évaluation

- 2015 LHC 7326Document17 pages2015 LHC 7326abbasPas encore d'évaluation

- 197399119-Land-Record-Manual 18 PDFDocument583 pages197399119-Land-Record-Manual 18 PDFabbasPas encore d'évaluation

- This Document Outlines Steps Required For Users To Manage "Naqsha-Azari (Digitized Map) " WebsiteDocument9 pagesThis Document Outlines Steps Required For Users To Manage "Naqsha-Azari (Digitized Map) " WebsiteabbasPas encore d'évaluation

- 197399119-Land-Record-Manual 18 PDFDocument583 pages197399119-Land-Record-Manual 18 PDFabbasPas encore d'évaluation