Académique Documents

Professionnel Documents

Culture Documents

MAC001 Examination Guideline S3 2018

Transféré par

josephDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MAC001 Examination Guideline S3 2018

Transféré par

josephDroits d'auteur :

Formats disponibles

Accounting Systems and Processes

MAC001

Trimester 3, 2018 Final Examination Guideline

Student Id Number Student Name

Class Day/Time: ________________

Date: UBSS to Complete

Time: UBSS to Complete

Reading Time: 10 minutes

Exam Writing Time: 2 hours

Exam Weight: 50%

This is a CLOSED BOOK Exam

The exam is 2 hours excluding10 minutes reading time.

Write your Student Name and Number at the top of this page IN THE BOX

PROVIDED

Write the DAY and TIME of your class below your name.

Begin each new question on a new page IN THE EXAM BOOKLET

PROVIDED.

Write using black or blue pen.

You may ask for extra writing booklets if you need more space.

Do NOT remove any pages from this booklet.

You may NOT take any exam papers, writing booklets, used or unused, from

the exam room.

NO MOBILE PHONES or ELECTRONIC DEVICES ARE ALLOWED to be

used whatsoever

Except for silent calculators without significant text storage capacity may be

used.

Theory: Accounting Concepts and Principles: For example 25 marks

MAC001 Accounting Systems and Processes Page 1 of 4

The accounting entity concept.

The going concern principle.

The cost principle.

The monetary principle.

Conservatism principle.

Working capital.

Full disclosure principle.

Accounting period

Accrual Accounting

Cash Accounting

Understanding Debit and credit principles in transaction, Journal entries, ledger concept and

trial balance. 6 marks

Understanding sales transaction and credit terms with journal entry 6marks

Sample Exercise: A credit sale is made on 10 July for $5000, terms 2/10, n/30. On 12 July,

$500 of goods are returned for credit. Give the journal entry on 19 July to record the receipt

of the balance due within the discount period.

Understanding Accounts receivable journal entries 10 marks

Sample Exercise:

On 30 June, George Ltd estimated that $10,000 of its receivables were likely to be

uncollectable given the debtor was in serious financial difficulty. The company recorded this

amount as an additional to Allowance for Impairment.

On 11 November, George Ltd determined that the debt was uncollectable and wrote it off.

On 12 December, the debtor unexpectedly paid the amount previously written off.

Required:

Prepare the journal entries on 30 June, 11 November and 12 December

Understanding Cost of Sales, Gross profit, expenses, and net profit 12 marks

Sample exercise practice in class.

Understanding Income statement and statement of changes in equity and balance

sheet 20 marks

Sample Exercise:

On the 1 March 2013 Patrick set up a business as an accountant. Patrick has had several

years’ experience with a large CPA firm in Sydney and when he received a large inheritance

MAC001 Accounting Systems and Processes Page 2 of 4

from a long lost relative he decided now was the time to take the risk of being his own boss.

The following transactions occurred during his first month of operation.

1. Contributed $80,000 to the accounting practice.

1. Patrick agreed to rent a large office space from his good friend Bill

3. Patrick and his girlfriend spent the morning shopping for office furniture and

equipment. He managed to negotiate credit terms for 7 days and received a discount

on the furniture and equipment. The original price of was $29,500 but the invoice

price is $25,000.

5 Purchased two computers, two printers and a modem for the business, paid $12,000

cash.

5 Paid $3000 for the first month’s rent on office space

7 Hire a personal assistance and agreed to pay $400 per week

9 Patrick completed a tax return for a desperate client and received $400 cash.

12 Paid for the office furniture and equipment

14 Paid his personal assistant $700

25 Sent an invoice to a client for services rendered of $3475

21 Paid his personal assistant $300

30 Paid utilities expenses of $900

30 Withdraw from bank $1200 for personal use

Required:

a. Prepare the following statements for March;

An Income Statement

A Statement of Changes in Equity; and

A Balance Sheet

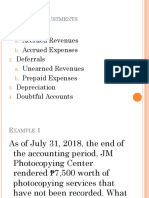

Understanding balance day adjustment entries. 21 marks

Sample Exercise:

Prepare adjusting entries for Jolly Ltd as at 30 June for the following situations:

a. The Supplies account shows a balance of $1000, but a physical count shows only

$400 if supplies.

b. The company purchased a 1-year insurance policy for $6000 on 1 may, debiting

Prepaid Insurance.

MAC001 Accounting Systems and Processes Page 3 of 4

c. On 1 June the company received $12000 from another entity which is renting a small

building from lasagne Ltd for 6 months. Lasagne Ltd credited Rent Revenue

Received in Advance.

d. Lasagne Ltd.’s accountant discovered that the company had performed services for a

client totalling $9000 but has not yet invoiced the client or recorded the transaction.

e. Lasagne Ltd pays employees $2500 per 5 day working week, and 30 June falls on a

Wednesday.

f. The company owns a van that cost $18,000 and has a useful life of 6 years (no

residual value). The company purchased the van in early April this year.

MAC001 Accounting Systems and Processes Page 4 of 4

Vous aimerez peut-être aussi

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersD'EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersÉvaluation : 2 sur 5 étoiles2/5 (4)

- Midterm Examination - Set ADocument3 pagesMidterm Examination - Set Aramirezericah84Pas encore d'évaluation

- Ca$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondD'EverandCa$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondPas encore d'évaluation

- Midterm Examination - Set CDocument2 pagesMidterm Examination - Set Cramirezericah84Pas encore d'évaluation

- Coursework 1 - BIC 0015 - V5-FinalDocument9 pagesCoursework 1 - BIC 0015 - V5-FinalFahad BashirPas encore d'évaluation

- Midterm Examination - Set BDocument3 pagesMidterm Examination - Set Bramirezericah84Pas encore d'évaluation

- Practice Questions 1 (AIS)Document8 pagesPractice Questions 1 (AIS)UroobaShiekhPas encore d'évaluation

- Assignment 1Document8 pagesAssignment 1SaidurRahamanPas encore d'évaluation

- Acct 220 Final Exam (Umuc)Document9 pagesAcct 220 Final Exam (Umuc)OmarNiemczykPas encore d'évaluation

- Accounting 1 Review QuizDocument6 pagesAccounting 1 Review QuizAikalyn MangubatPas encore d'évaluation

- Practice For Final ExamDocument7 pagesPractice For Final ExamNgọc Hân TrầnPas encore d'évaluation

- FAP Midterm (A)Document3 pagesFAP Midterm (A)musharraf anjumPas encore d'évaluation

- AC1101 Lesson 3 Discussion QuestionsDocument7 pagesAC1101 Lesson 3 Discussion QuestionsMTPas encore d'évaluation

- Lecture Notes Chapters 1-4Document32 pagesLecture Notes Chapters 1-4BlueFireOblivionPas encore d'évaluation

- Acct 220 Final Exam UmucDocument10 pagesAcct 220 Final Exam UmucOmarNiemczyk0% (2)

- INS2009 - Nguyên Lý Kế ToánDocument6 pagesINS2009 - Nguyên Lý Kế ToánHuyen NguyenPas encore d'évaluation

- Bahria University, Islamabad Campus: C. Line ManagersDocument4 pagesBahria University, Islamabad Campus: C. Line ManagersIfrah BashirPas encore d'évaluation

- Afw 1000 Final Q s1 2014Document17 pagesAfw 1000 Final Q s1 2014Mohammad RashmanPas encore d'évaluation

- Fundamentals of Accountancy, Business and Management 1Document28 pagesFundamentals of Accountancy, Business and Management 1Marlyn Lotivio40% (10)

- EOS Session 10 11Document6 pagesEOS Session 10 11Noralyn DimnatangPas encore d'évaluation

- Module 6 Rules of Debit and CreditDocument24 pagesModule 6 Rules of Debit and CreditDiana100% (2)

- NM1607R - S2 2022 (For S1 2022 Students) RESIT EXAM Question PAPERDocument9 pagesNM1607R - S2 2022 (For S1 2022 Students) RESIT EXAM Question PAPERrecovaPas encore d'évaluation

- Assignment Accounting Chapter 1Document7 pagesAssignment Accounting Chapter 1Aarya Aust100% (1)

- Accounting Principles I - Online: Chapters 3 & 4 - Exam - Part IIDocument7 pagesAccounting Principles I - Online: Chapters 3 & 4 - Exam - Part IILouie CranePas encore d'évaluation

- WorkbookDocument33 pagesWorkbookapi-295284877Pas encore d'évaluation

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Firm (Part 1)Document35 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Firm (Part 1)Ponsica Romeo50% (2)

- DK Goel Solutions Class 11 Chapter 22 DK Goel Book Available For FreeDocument1 pageDK Goel Solutions Class 11 Chapter 22 DK Goel Book Available For Freetwinkle banganiPas encore d'évaluation

- Accounting Mid TermDocument9 pagesAccounting Mid TermSaad MaqboolPas encore d'évaluation

- Instructional Planning: Detailed Lesson Plan (DLP) FormatDocument6 pagesInstructional Planning: Detailed Lesson Plan (DLP) FormatDaisy PaoPas encore d'évaluation

- Entrepreneurship 2nd Q.exam OktcindyDocument8 pagesEntrepreneurship 2nd Q.exam OktcindyDaryl MacatbagPas encore d'évaluation

- Abm 1 Evaluation Q2 Week 1 and 2Document5 pagesAbm 1 Evaluation Q2 Week 1 and 2Christel Fermia RosimoPas encore d'évaluation

- Analyzing Business Transactions 2.docx-1Document2 pagesAnalyzing Business Transactions 2.docx-1Kristine Reyes0% (1)

- Name: - Date: - Year&Section: - Score: - Test I. True or FalseDocument5 pagesName: - Date: - Year&Section: - Score: - Test I. True or FalseJohn Arnel SevillaPas encore d'évaluation

- Topic 3 - Recording Transactions - ExerciseDocument14 pagesTopic 3 - Recording Transactions - Exercisethiennnannn45Pas encore d'évaluation

- CH 03 Alt ProbDocument8 pagesCH 03 Alt ProbMuhammad Usman25% (4)

- Recording Financial TransactionsDocument13 pagesRecording Financial Transactionssewmini.abilashi01Pas encore d'évaluation

- Abm 1-W6.M3.T1.L3Document21 pagesAbm 1-W6.M3.T1.L3mbiloloPas encore d'évaluation

- Adjusting Entries Asnwer KeyDocument19 pagesAdjusting Entries Asnwer KeyCATUGAL, LANCE ALECPas encore d'évaluation

- EOS Use of T AccountsDocument4 pagesEOS Use of T AccountsNoralyn DimnatangPas encore d'évaluation

- Tutorial 2 Journalizing PostingDocument5 pagesTutorial 2 Journalizing Postinglalala lalalaPas encore d'évaluation

- Fo A I Assignment1Document2 pagesFo A I Assignment1solomon tadesePas encore d'évaluation

- IAS Accounting Final Exam AHSAN AHMADDocument7 pagesIAS Accounting Final Exam AHSAN AHMADMehar AwaisPas encore d'évaluation

- Fundamentals of Accounting Business and Management 2: Last Name Given Name M.I. Grade & Section Score DateDocument3 pagesFundamentals of Accounting Business and Management 2: Last Name Given Name M.I. Grade & Section Score DateCherann agumboy100% (1)

- Question Chapter1 Final 1Document11 pagesQuestion Chapter1 Final 1Mạnh Đỗ ĐứcPas encore d'évaluation

- Acc 311 - Exam 1 - Form A BlankDocument12 pagesAcc 311 - Exam 1 - Form A BlankShivam GuptaPas encore d'évaluation

- AEC 54 Asynchronous Activity Accounts Payable and Purchases 102922Document4 pagesAEC 54 Asynchronous Activity Accounts Payable and Purchases 102922Jester LimPas encore d'évaluation

- Module 6 Notes ReceivablesDocument7 pagesModule 6 Notes ReceivablesMa Leobelle BiongPas encore d'évaluation

- 13 Accounting Cycle of A Service Business 2Document28 pages13 Accounting Cycle of A Service Business 2Ashley Judd Mallonga Beran60% (5)

- Accounting Textbook Solutions - 19Document19 pagesAccounting Textbook Solutions - 19acc-expertPas encore d'évaluation

- JournalizingDocument22 pagesJournalizingmaroons_01Pas encore d'évaluation

- FHBM 1214 Financial Accounting Tutorial Workbook Student Copy October 2021 TrimesterDocument68 pagesFHBM 1214 Financial Accounting Tutorial Workbook Student Copy October 2021 TrimesterZi chen AngPas encore d'évaluation

- JournalizingDocument27 pagesJournalizingMelody LiwanagPas encore d'évaluation

- AIS Manual Accounting CycleDocument1 pageAIS Manual Accounting Cyclejapvivi cecePas encore d'évaluation

- Sua de Quiz 3,4Document2 pagesSua de Quiz 3,4mymieuPas encore d'évaluation

- LUYONG - 3rd Periodical - FABM1Document4 pagesLUYONG - 3rd Periodical - FABM1Jonavi Luyong100% (2)

- AE-O-A - Quiz QuestionnaireDocument1 pageAE-O-A - Quiz QuestionnaireUSD 654Pas encore d'évaluation

- Sheet (6) Tegara English First Year Financial Accounting: GroubDocument11 pagesSheet (6) Tegara English First Year Financial Accounting: Groubmagdy kamelPas encore d'évaluation

- Adjustments Quiz 1Document5 pagesAdjustments Quiz 1Christine Mae BurgosPas encore d'évaluation

- Uj 32635+SOURCE1+SOURCE1.1Document22 pagesUj 32635+SOURCE1+SOURCE1.1sacey20.hbPas encore d'évaluation

- CH 2 Service BusinessDocument10 pagesCH 2 Service BusinessNicole AshleyPas encore d'évaluation

- Lecture Note - Week 4Document18 pagesLecture Note - Week 4josephPas encore d'évaluation

- Audit and Assurance: With AnDocument12 pagesAudit and Assurance: With AnjosephPas encore d'évaluation

- Lecture Note - Week 10Document22 pagesLecture Note - Week 10josephPas encore d'évaluation

- Quantitative Methods: Week 7Document47 pagesQuantitative Methods: Week 7josephPas encore d'évaluation

- Quantitaive Methods Week 7: With AnDocument34 pagesQuantitaive Methods Week 7: With AnjosephPas encore d'évaluation

- Quantitative Methods: Dr. Zahra SadeghinejadDocument38 pagesQuantitative Methods: Dr. Zahra SadeghinejadjosephPas encore d'évaluation

- CultureDocument4 pagesCulturejoseph100% (1)

- Case - Study Week 3 Tutorial SolutionsDocument2 pagesCase - Study Week 3 Tutorial SolutionsjosephPas encore d'évaluation

- 'Describe An Activity' Worksheet PDFDocument2 pages'Describe An Activity' Worksheet PDFjosephPas encore d'évaluation

- Hafiz AhsanDocument10 pagesHafiz AhsanjosephPas encore d'évaluation

- Hafiz AhsanDocument10 pagesHafiz AhsanjosephPas encore d'évaluation

- Suggested Answer For Corporate Laws and Secretarial Practice June 09Document23 pagesSuggested Answer For Corporate Laws and Secretarial Practice June 09tayalsirPas encore d'évaluation

- H. Muhammed Ka Parichay (Kannada)Document96 pagesH. Muhammed Ka Parichay (Kannada)Q.S.KhanPas encore d'évaluation

- Case Application 2 Who Needs A BossDocument2 pagesCase Application 2 Who Needs A BossIvan Joseph LimPas encore d'évaluation

- History of Make UpDocument15 pagesHistory of Make Upaprilann baldo100% (1)

- IAC-2012 Abstract Submission GuidelinesDocument4 pagesIAC-2012 Abstract Submission GuidelinesAngel ChicchonPas encore d'évaluation

- Duty and Power To Address Corruption PDFDocument26 pagesDuty and Power To Address Corruption PDFLau Dreyfus ArbuluPas encore d'évaluation

- Speech SynthesisDocument8 pagesSpeech Synthesispatelsam1111Pas encore d'évaluation

- Fight The Bad Feeling (Boys Over Flowers) Lyrics - T-MaxDocument7 pagesFight The Bad Feeling (Boys Over Flowers) Lyrics - T-MaxOwenPas encore d'évaluation

- 13 - Chapter 3Document22 pages13 - Chapter 3manoj varmaPas encore d'évaluation

- What Is A Target Market?Document8 pagesWhat Is A Target Market?shivaPas encore d'évaluation

- Soal Usp Bhs InggrisDocument4 pagesSoal Usp Bhs InggrisRASA RASAPas encore d'évaluation

- Software Architechture Assignment - 2023MT93112Document15 pagesSoftware Architechture Assignment - 2023MT93112Adil NasimPas encore d'évaluation

- Toad For Oracle Release Notes 2017 r2Document30 pagesToad For Oracle Release Notes 2017 r2Plate MealsPas encore d'évaluation

- Design and Construction of A GSM Based Gas Leak Alert SystemDocument6 pagesDesign and Construction of A GSM Based Gas Leak Alert SystemGibin GeorgePas encore d'évaluation

- Man B&W: Crossheaad BearingDocument66 pagesMan B&W: Crossheaad BearingRobert LuuPas encore d'évaluation

- Power Plant Economics 1 (UNIT-I)Document21 pagesPower Plant Economics 1 (UNIT-I)rahul soniPas encore d'évaluation

- Question Bank Unit 2 SepmDocument2 pagesQuestion Bank Unit 2 SepmAKASH V (RA2111003040108)Pas encore d'évaluation

- Alfamart List Store Aug2020 To June2021Document3 pagesAlfamart List Store Aug2020 To June2021Santi Leo50% (2)

- Rehab Mob Company LimitedDocument5 pagesRehab Mob Company LimitedKehkashanPas encore d'évaluation

- Young and BeautifulDocument8 pagesYoung and BeautifulDiana AdrianaPas encore d'évaluation

- High Court of KeralaDocument4 pagesHigh Court of KeralaNidheesh TpPas encore d'évaluation

- Scott River Hydraulic Habitat ModelingDocument14 pagesScott River Hydraulic Habitat ModelingseemsaamPas encore d'évaluation

- Тема 3. THE IMPORTANCE OF SCIENCEDocument6 pagesТема 3. THE IMPORTANCE OF SCIENCEАлександр ХмельницкийPas encore d'évaluation

- Flushing of An Indwelling Catheter and Bladder Washouts KnowbotsDocument5 pagesFlushing of An Indwelling Catheter and Bladder Washouts KnowbotsTanaman PeternakanPas encore d'évaluation

- The Effects of MagnetiteDocument23 pagesThe Effects of MagnetiteavisenicPas encore d'évaluation

- Ebook - Atmel Avr AssemblerDocument20 pagesEbook - Atmel Avr AssemblerelfrichPas encore d'évaluation

- Questionnaire Survey About Life Quality of Students in Can Tho CityDocument6 pagesQuestionnaire Survey About Life Quality of Students in Can Tho CityTrọng TrầnPas encore d'évaluation

- Land Colonization of PlantsDocument57 pagesLand Colonization of PlantsSUDHA GUPTAPas encore d'évaluation

- Tunisia Tax Guide - 2019 - 0Document10 pagesTunisia Tax Guide - 2019 - 0Sofiene CharfiPas encore d'évaluation

- Reading ComprehensionDocument3 pagesReading ComprehensionMaribel OrtizPas encore d'évaluation

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesD'EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesÉvaluation : 4.5 sur 5 étoiles4.5/5 (99)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderD'EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderÉvaluation : 4.5 sur 5 étoiles4.5/5 (62)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurD'Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (15)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeD'EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeÉvaluation : 4.5 sur 5 étoiles4.5/5 (91)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryD'EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryÉvaluation : 4 sur 5 étoiles4/5 (26)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizD'EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizÉvaluation : 4.5 sur 5 étoiles4.5/5 (112)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsD'EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsÉvaluation : 5 sur 5 étoiles5/5 (48)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- Having It All: Achieving Your Life's Goals and DreamsD'EverandHaving It All: Achieving Your Life's Goals and DreamsÉvaluation : 4.5 sur 5 étoiles4.5/5 (65)

- Getting to Yes: How to Negotiate Agreement Without Giving InD'EverandGetting to Yes: How to Negotiate Agreement Without Giving InÉvaluation : 4 sur 5 étoiles4/5 (652)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorD'EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorÉvaluation : 4.5 sur 5 étoiles4.5/5 (132)

- The Master Key System: 28 Parts, Questions and AnswersD'EverandThe Master Key System: 28 Parts, Questions and AnswersÉvaluation : 5 sur 5 étoiles5/5 (62)

- When the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachD'EverandWhen the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachÉvaluation : 3.5 sur 5 étoiles3.5/5 (6)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureD'EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (100)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessD'EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessÉvaluation : 4.5 sur 5 étoiles4.5/5 (407)

- Every Tool's a Hammer: Life Is What You Make ItD'EverandEvery Tool's a Hammer: Life Is What You Make ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (249)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedD'EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedÉvaluation : 4.5 sur 5 étoiles4.5/5 (38)

- Expert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceD'EverandExpert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceÉvaluation : 5 sur 5 étoiles5/5 (365)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelD'EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelÉvaluation : 5 sur 5 étoiles5/5 (52)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyD'EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyÉvaluation : 5 sur 5 étoiles5/5 (22)

- Your Next Five Moves: Master the Art of Business StrategyD'EverandYour Next Five Moves: Master the Art of Business StrategyÉvaluation : 5 sur 5 étoiles5/5 (806)

- Be Fearless: 5 Principles for a Life of Breakthroughs and PurposeD'EverandBe Fearless: 5 Principles for a Life of Breakthroughs and PurposeÉvaluation : 4 sur 5 étoiles4/5 (49)

- Transformed: Moving to the Product Operating ModelD'EverandTransformed: Moving to the Product Operating ModelÉvaluation : 4 sur 5 étoiles4/5 (1)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andD'EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andÉvaluation : 4.5 sur 5 étoiles4.5/5 (709)

- Built to Serve: Find Your Purpose and Become the Leader You Were Born to BeD'EverandBuilt to Serve: Find Your Purpose and Become the Leader You Were Born to BeÉvaluation : 5 sur 5 étoiles5/5 (25)

- Summary of The 33 Strategies of War by Robert GreeneD'EverandSummary of The 33 Strategies of War by Robert GreeneÉvaluation : 3.5 sur 5 étoiles3.5/5 (20)