Académique Documents

Professionnel Documents

Culture Documents

Project ODYSSIA New

Transféré par

maneshDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Project ODYSSIA New

Transféré par

maneshDroits d'auteur :

Formats disponibles

1 RAPTURE INDIA FOOTCARE Co PVT Ltd

1.1 INTRODUCTION

Finance is defined as the provision of money at the time when it is required. Every enterprise

whether big, medium or small, need finance is so indispensable today that it is rightly said it

is life blood of an enterprise with out adequate finance, no enterprise can possibly accomplish

its objectives. A financial manager is a person who is responsible in a significant way to carry

out the finance function in modern enterprise the financial manager occupied a key position .

He plays a pivotal role in planning quantum and pattern of fund requirement procuring the

desired amount of fund allocating fund so pooled among profitable out let and controlling the

uses of funds.A well designed and implemented financial management is expected to

contribute positively to the creation of a firm’s value. Dilemma in financial management is to

achieve desired tradeoff between liquidity, solvency and profitability. Management of

working capital in term of liquidity and profitability management is essential for sound

financial recital as it has a direct impact on profitability of the company.

The crucial part in managing working capital is required in maintaining its liquidity

in day to day operation to ensure its smooth running and meets its obligation .ultimate goal of

profitability can be achieved by efficient use of resources. It is concerned with maximization

of shareholders or owners wealth. It can be attained through financial performance analysis

.financial performance mean firm overall financial health over a given period of time.

financial performance analysis is the process of the determining the operating and financial

characteristics of a firm from accounting and financial statements. The goal of such analysis

Is to determine the efficiency and performance of firm’s management, as reflected in the

financial records and reports. The analyst attempted to measure the firms liquidity ,

profitability and other indicators that the business is conducted in a rational and normal way;

ensuring enough returns to the shareholders to maintain at least its markets value.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

2 RAPTURE INDIA FOOTCARE Co PVT Ltd

1.2 SIGINIFICANCE OF THE STUDY

Financial analysts often assess the firms liquidity, solvency , efficiency, profitability,

operating efficiency and financial stability in both short- term and long –term. Ratio analysis

provides relative measures of the company’s performance and can indicate clues to the

underlying financial position. For measuring financial position and financial efficiency ,

appropriate level of financial performance indicators are required with whom comparison can

be made. Generally liquid ratio, interest coverage ratio, inventory turnover ratio, return on

investment ratio and debt to net worth ratio are highly useful in determining financial

position, financial performance and ted financial stability or otherwise of such management .

In this study the odyssia foot wares is being selected to conducted a study on the

comprehensive financial performance, such as ratio analysis in term of liquidity ratio,

profitability ratio, leverage ratio and capital structure ratio.

The study of the ODYSSIA foot wares has been undertaken with certain objectives by

highlighting the unique features, functions and working as well as statutory regulations

governing of the company.

1.3 OBJECTIVE OF THE STUDY

The finance department of the odyssia foot wears foot ware company (pvt)LTD has an

important role in the continuous progress of the company. The board objective of the study

was to provide the financial performance with some new financial analysis tools so that they

could find the accuracy and different for timely decision making this important to improve

their performance and efficiency.

To obtain a true insight into financial position of the company.

To make comparative study of financial statement of different years.

To draw the correct picture of the financial operations of the company in term

of liquidity, solvency, turnover, profitability etc.

To find out the reason for unsatisfactory results.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

3 RAPTURE INDIA FOOTCARE Co PVT Ltd

1.4 LIMITATION OF THE STUDY

The ratios analysis is one of the most powerful tools of financial management. Though are

simple to calculate and easy to understand , they suffer from serious limitations.

Limitations of financial statement

Comparative study required

Problems of price level changes

Lack of adequate standard

Limited use of single ratios

Personal bias

Incomparable

1.5 scope of the study

Financial analysis in an organization is a principal and central subsystem and it operates

upon and control all other subsystems. The need for financial analysis to run the day to day

business activities cannot be over emphasized. We know that the firm should first aim at

maximizing the wealth of its shareholder earning a steady amount of profit requires

successful sale activity .the firm has to invest enough fund, in current assets for generating

the sales.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

4 RAPTURE INDIA FOOTCARE Co PVT Ltd

1.6 RESEARCH METHODOLOGY

Meaning of research

Research in common parlance refers to a search for knowledge. the advanced learner’s

dictionary of current English lays down the meaning of research as “A careful investigation

or enquiry especially through search for facts in any branch ok knowledge”.

Definition;

According to woody,” research comprises and redefining problem formulating

hypothesis or suggested solution collecting organizing and evaluating, data making,

education and researching concessions to determine whether they fit the formulating

the hypothesis”

RESEARCH DESIGN:

A research designed is programmed which guides the investigator in the process of collecting

and analyzing interpreting the observation. It is needed to facilitate the smooth sailing of the

various research operations thereby making research as efficient as possible. A research

design is the blue print of the data collections measurements and analysis of data.

Analytical research design;

The research has adopted analytical in the present study. Analytical research is use facts or

information already available, and analyze these to make a critical evaluation of the problem

DATA COLLECTION

A) PRIMARY DATA

Primary data related to the project was collected from the discussion and interaction with

the senior employees and executives in the organization from accounts and finance

department.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

5 RAPTURE INDIA FOOTCARE Co PVT Ltd

A) SECONDARY DATA

Secondary data was collected from the document, which were in printed forms like

annual report, pamphlets, reference book based on the financial management and through

websites.

TOOLS USED FOR ANALYSIS

1) Ratio analysis

2) comparative balance sheet

3) common –size balance sheet

4) Trend analysis

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

6 RAPTURE INDIA FOOTCARE Co PVT Ltd

2.1 Literature review & theoretical frame work

METCALF AND TITARD: “analysis of financial statement is a process of

evaluating the relationship between component part of a financial statement to obtain a better

understanding of a firms operation and performance.”

Myers:” financial statement analysis is largely a study of relationship among the various

financial factors in a business as disclosed by a single set of statement, and a study of the

trend of these factors as shown in a series of statements.”

Dr r. k. sahu: in his articulate ,analysis of corporate profitability a multivariate approaches

mention that among all the techniques used in financial statement analysis, ratio analysis is

most power full tool of financial analysis. but there is no international profitability ratio in

itself does not different conclusion for the same firm. So the attempt ion to measure the

composite profitability of a firm by a single indeed thereby facilitating case of comparison

and ranking.

Dr abhiman dar: in his article title” profitability of public sector bank” analyzed

Different profitability ratio and formulate a profitability ratio and decomposition model. He

expressed profitability as a ratio of operation profit to working fund.

Mrs .m. jayalekshmi: in her research , the study on the financial statement analysis of

PRICOL diagnosed the financial position and the performance of premier instrument and

control limited company with the help of liquidity and solvency ratio and suggested to reduce

the amount locked excessively in the form of current assets.

FINANCIAL RATIO ANALYSIS

Ratio analysis is the process of determining and interpreting relationship between the

item of financial statement to provide a meaningful understanding of the performance and

financial position of an enterprise. Ratio analysis is an accounting tool to presenting

accounting variables in a simple, concise, intelligible and understandable form.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

7 RAPTURE INDIA FOOTCARE Co PVT Ltd

As per the “ratio analysis is a study of relationship among various financial factors in a

business” objective of financial ratio analysis the objective of ratio analysis is to judge the

earning capacity ,financial soundness and operating efficiency of a business organization . the

use of ratio in accounting and financial management analysis help the management to know

the profitability , financial position and operating efficiency of an enterprise.

Ratio analysis is an important and age -old technique. It is powerful tool of financial analysis

. It is defined as the indicated quotient of two mathematical expression and as the relationship

between two or more things .Systematic use of ratio to interpret the financial statement so

that the strength and weakness of a firm as well as its historical performance and current

financial condition can be determined.

A ratio is only comparison of the numerator with the denominator. The term

ratio refers to the numerical or quantitative relationship between two figures. Thus, ratio is

the relationship between two figures, and obtained by dividing the former by the latter. Ratios

are designed show how on numbers is related to another.

The data given in the financial statement are in absolute form, are dump, and are unable to

communicate anything . Ratios are relatives form of financial data and very useful technique

to check upon the efficiency of a firm. Some ratio indicates the trend, progress ,or downfall

of the firm.

Classification ratios

Classification of ratios

Based on financial Based on Based on

statement importance functions

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

8 RAPTURE INDIA FOOTCARE Co PVT Ltd

a) Balance sheet ratios 1) primary ratio 1liquidity ratio

2) secondary ratio 2)leverage ratio

b) Profit &loss accounts ratio 3)activity ratio

c) Composite ratio 4)profitability ratios

5)market test ratios

1) based on financial statement

Balance sheet ratios

The items used for the calculation of these ratios are taken out from the balance sheet,

eg...,current ratio, proprietary ratio, fixed assets ratio etc.

Profit and loss account ratios

These establish relationship between two items in the profit and loss account e g, ...gross

profit ratio, operating profit ratio etc.

Combined or mixed ratio

These ratios are calculated by taking out one item from the profit and loss account and other

from the balance sheet, e g......,stock turn over ratio, fixed asset turnover etc.

2) based on importance

Primary ratios

Secondary ratios are mainly used to explain the primary ratios. The success of any business

is measured by the amount of profit earned . Therefore, ratios like profit to sales, return on

capital employed etc. Are treated as primary ratio.

Secondary ratios : explain the primary ratio

3) based on functions

Liquidity ratios

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

9 RAPTURE INDIA FOOTCARE Co PVT Ltd

These ratios measures the capacity of a firm to meet its short term liability out of the short

term resource . Current ratio, quick ratio etc. Are examples

Leverage ratios

These are also called capital structure ratio . These ratios analyses the long term solvency or

financial position of a firm. Debt-equity ratio. ,proprietary in this etc are calculated in this

category .

Activity ratios

This ratio also called turn over ratios. These ratio indicate how effectively the resource are

being utilized by firm in other word, these ratio reflect the efficiency of a firm in the asset

management . Debt turn over ratio, fixed asset turnover ratio, stock turn over ratio

Profitability ratios

These ratios measures the profitability or operating efficiency of a firm,for example. gross

profit ratio, operating ratio, investment etc.

Market test ratio

This ratio are used for evaluating the shares and stock which are traded in the market .

Dividend per share....

ADVANTAGE OF THE ANALYSIS

The advantage derived by an enterprise by the use of accounting ratios are:

1) Useful in analysis of financial statement :

Bankers, investors, creditors , etc analysis balance sheet and profit and loss account by

means of ratios.

2) Useful in simplifying accounting figures:

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

10 RAPTURE INDIA FOOTCARE Co PVT Ltd

Accounting ratio simplifies summarized and systematizes a long array of accounting

figures to make them understandable . in the words of biramn and dribin, “financial ratios are

useful because they summarize briefly the results of detailed and complicated computation”.

3)Useful in judging the operating efficiency of business:

Accounting ratio are also useful for diagnose sis of the financial health of the

enterprise. This is done by evaluating liquidity , solvency , profitability etc. such a evaluation

enables management to access financial requirement and the capability of various business

units.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

11 RAPTURE INDIA FOOTCARE Co PVT Ltd

3.1 COMPANY PROFILE

Name of the company Raptur India Footcare Pvt Ltd :(ODYSSIA GROUP)

Location :Perumanna ,Kozhikode

Email :hr –odyssia @ gamil.com

General manager :Sasidharan

Year of commencement :2006

Product :Foot wears

No of workers :400

Export of product :Centralized

Purchase of raw materials :Centralized purchasing by Kozhikode unit

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

12 RAPTURE INDIA FOOTCARE Co PVT Ltd

3.2 ORGANIZATIONAL STRUCTURE

FIGURE :3.1

CHAIRMAN

MANAGING

DIRECTOR

PRODUCTION MARKETING FINANCE HUMAN

DEPARTMENT DEPARTMENT DEPARTMENT RESOURCE

DEPARTMENT

PRODUCTION MARKETING FINANCE H.R

DIRECTOR DIRECTOR MANAGER MANAGER

OPERATION MARKETING H.R EXECUTIVES

MANAGER MANAGER

PRODUCTION SUPERVISOR

MANAGER

SUPERVISOR WORKERS

WORKERS

Source: (company information)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

13 RAPTURE INDIA FOOTCARE Co PVT Ltd

3.3 INDUSTRY PROFILE

History of Footwear’s

Spanish cave drawing from more than 15000 years age shows humans with

animal skins or furs wrapped around their feet. The body of a well preserved “ice-man”

nearly 5000 years old wears leather foot coverings stuffing with straw. Shoes in some

form or another have been around for a very long time. The evolution of foot coverings

from the sandal to present day athletes shoes are marvels of engineering and continues

even today as we find new materials with which to cover our feet.

Has the shoes really changed that much though? We are in fact wearing sandals

the oldest crafted foot covering known to us. Many of the shoes we wear today can be

traced back to another era. The Cuban heels may have been named for the dance craze of

the 1920’s, but the shape can be seen long before that time. Platform soles, which are one

of the most recognizable features of footwear in 1970’s and 1990’s,were handed down to

us from the 16th century Chopin. Then, high sole were a necessity to keep the feet off the

dirty streets. Today, they are worn strictly for fashion’s sake. The pup lane with its

ridiculously long toes is not different from the wrinkle pickers worn in 1960’s.

If one can deduce, the basic shoe shapes have evolved only so much, it is

necessary to discover why this has happened. It is surely not due to a lack of imagination-

the color and materials of shoes today demonstrate that, looking at shoes from different

parts of the world, one can see undeniable similarities. While the Venetians were wearing

the “Chopin”, the Japanese balanced on high soled wooden shoes called “get”. Though the

shape is slightly different, the idea remains the same. The Venetians had no contact with

the Japanese, so it is not a case of imitation. Even the mystical Chinese practical of foot

binding has copied in our culture.

Some European women and men of the past bound their feet with tape and

squashed them into too-tight shoes. In fact, a survey from the early 1990’s reported that 88

% of women wear shoes that are too small.

As one examines footwear history, both in the west and in other parts of the

world, the similarities are apparent. Though the shoemaker of the past never would have

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

14 RAPTURE INDIA FOOTCARE Co PVT Ltd

thought to pair a sandal with platform sole, our shoe fashions of today are for the most

part, modernized adaptations of past styles.

Overview of the Indian Footwear Industry

The footwear industry is a significant segment of the leather industry in

India. India ranks second among the footwear producing countries next to china. The

industry is labour intensive and is concentrated in the small and cottage industry sectors.

While leather shoes and uppers are concentrated in large scale units, the sandals and

chappals are produced in the house hold and cottage sector. India produces more of gents

footwear while the worlds major production is in ladies footwear, in case chappals and

sandals, use of non-leather material is prevalent in the domestic market.

The major production centers India are Chennai, Ranipet, Ambur in Tamil nadu ,Mumbai

in Maharashtra, Kanpur in UP, Jalandhar in Punjab, Agra and Delhi. The Indian footwear

industry is provided with institutional infrastructure support through premier institutions’

like Central Leather Research Institute, Chennai, Footwear Design And Development

institute, Noida, National Institute of Fashion Technology, New Delhi ,etc in the areas of

technological development, design and product development and human resource

development. The availability of abundant raw material base, large domestic market and

the Opportunity to cater to world markets makes India an attractive destination for

technology and Investments.

IMPORT

In 1999, the global import of footwear (leather and non-leather) in terms of value

was around US$ 43278 million, accounting a share of 63.42% in the total global import of

leather and leather products. Out of this, import of leather footwear alone accounted for

US$ 26379 million and non-leather footwear US$ 16899 million.

EXPORT

India’s export of Leather Footwear touched US$ 331 million in 1999-2000,

recording an increase of 3.29% over the preceding year. India thus holds a share of 1.25%

in the global import of leather footwear. The major markets for Indian Leather Footwear

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

15 RAPTURE INDIA FOOTCARE Co PVT Ltd

are the U.K., the U.S.A., Germany, Italy, France and Russia. Nearly 71% of India‘s export

of Leather Footwear is to Germany, the U.S.A., the U.K and Italy.

In 1999-2000, export of leather footwear from India constituted 31% share of its

total export of leather and leather products. Nearly 33 million pairs of various types of

leather footwear were exported during the year, out of which shoes / boots constituted

90%.

The different types of leather footwear exported from India are dress shoes, casuals,

moccasins, sport shoes, horrachies, sandals, beallerinas, booties.

Present Scenario

Now-a-days footwear has become as absolute necessity rather than fashion for

civilized people. The demand for footwear is increasing day by day. Depending on the

purchasing power different classes of people use different type and quality of footwear.

The middle and lower level income group prefer low cost, durable, wear and tear resistant

footwear which can be used in all climatic condition. PU footwear emerges as the obvious

choice which satisfies the entire above requirement. The increasing popularity of PU

chappal in Kerala and other parts of the country is assuming good demand for the product

in future.

As a result of rapid economic development taking place in our country, increase

in population, increase in awareness of hygiene among the people and above all the

absolute and continuing necessity for footwear in general and PU chappal is bound to

increase considerably. PU chappal is an economic substitute for leather footwear. The

people in rural and urban area use PU chappal throughout the year, since it is suitable in

any type of terrain and weather condition.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

16 RAPTURE INDIA FOOTCARE Co PVT Ltd

COMPANY PROFILE

Opportunity Identification

Feroke is a place famous for footwear. This sector began with the PVC modeled

footwear here direct manufacturing of footwear was not done, instead the used footwear

were purchased and powdered , which was the main raw material for the footwear. In

India, Kerala is leading in the footwear industry. Initially PVC footwear entered into the

market, i.e. both upper and sole was made by PVC. Later lightweight Eva footwear

emerged. During this period, footwear was offered for the price ranging from 50 to 100.

Even though Kerala is well known for footwear, it has not tapped the entire

opportunity in a right way and none of the company has identified either a segment or a

target market nor did their focus include middle and the lower class people.

Thus ODYSSIA identified this opportunity to start a company by focusing middle class

people.

A Joint Effort – An Initiative

Footwear is a competitive sector as there are so many international brands as well

as other brands including unrecognized players focusing the low class people. The present

directors of ODYSSIA footwear wear initially independent players more specifically

competitors in the footwear industry but their brands were not much popular as the

competition was high and the customers had wide choice and highly branded products in

the market.

The independent players were the people (competitors) with the same mentality.

Thus those people with the same mentality joined together. They identified their need to

survive in the market and the importance of creating and building a brand image. Thus

“survival or existence” is the main factor that led them to unite together into a new high

quality venture with the sole motive of building a brand image and thereby widening the

market so that they can easily capture the entire market and thereby ensure their survival

and also market all their products under the license of this brand. Thus the Odyssia

branded footwear was born in the company rapture India Pvt. Ltd.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

17 RAPTURE INDIA FOOTCARE Co PVT Ltd

ODYSSIA GROUP

The company had achieved a prominent positioning the footwear market of India.

The main markets which are concentrated by the company are Kerala, Tamil Nadu and

Karnataka. The good quality and variety in models of ODYSSIA products help the

companies to face the market competition. The company has been able to maintain the

quality of the products by adopting Italian technology. The group is now looking for

further avenues in the field of footwear to stretch their hands.

ODYSSIA footwear is a renowned footwear division in south India with exclusive

Italian PU Technology dealing with a spectrum of footwear. The latest and cutting – edge

technology is based on Italian know-how and is used world – wide. The footwear is based

on high quality upper which can be used in all seasons with odorless and non fading

colors. ODYSSIA footwear is a famous footwear brand manufactured by a group of

companies

There are many associate units producing a single brand “ODYSSIA”. All the

units are situated in different parts of Calicut &Thrissur district. These units include:

Rapture India Foot care Pvt. Ltd.(Perumanna , 17alicut)

Rapture India Foot care Pvt. Ltd. (Athani , Trissur)

Rapture India Foot care Pvt. Ltd. (Olavanna,Calicut )

Soltek Polymers Pvt. Ltd.

Polytek Footwear Pvt. Ltd.

Fakco Polymers Pvt. Ltd.

Teflon Plastics Pvt. Ltd.

Hynix Elastomers Pvt. Ltd.

Navakeralam Footwear Pvt. Ltd.

During the period new bloods with technical, commercial and practical

knowledge were inducted and now the group consist of 9 working directors and

have annual group turnover of Rs 75 cores. More than 700 employees are working

in this unit.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

18 RAPTURE INDIA FOOTCARE Co PVT Ltd

RAPTURE INDIA FOOTCARE Co Pvt Ltd

Rapture India Footcare Co Pvt Ltd was commenced in the year 2006. It is one of the

associate concerns of very renowned ODYSSIA group of companies. The chairman of

Rapture India Footcare Co Pvt Ltd is Mr. Sasidaran. The company situated in Perumanna,

Calicut, Kerala. The Company has been able to achieve a landmark in the field of footwear

through the continuous researches in footwear industry. The company manufactures

“ODYSSIA” brand footwear.

All affairs and day-to-day business administration of the firm is vested in the

hands of Board of Directors. They are in charge of various activities like Production,

Finance, Marketing and human resource. The Board is assisted by qualified administrative

staffs. Rapture India Foot care Co Pvt Ltd caters to extend its markets of Kerala,

Karnataka and Tamil Nadu. The company has started with its first export to U.A.E. The

company has a good market for their products in the country and abroad.

ODYSSIA has a high brand value in the minds of the Kerala because of the

quality and the affordable price of the product. The management gives high priority to the

quality of the product. The company the quality of the product through the continuous

quality checking in each and every stages of the production process

VISION & MISSION OF THE COMPANY

Vision

“…………..To International Heights”

Mission

ODYSSIA Group introduced first time in Kerala 100% pure Italian PU technology. Foot

wear manufacturing out of the best quality material using latest technology to last longer

which gives the highest comfort to users.

ODYSSIA produces footwear items first of its kind in Kerala with Italian technology. By

the use of best raw materials and craftsmanship the company produces high quality

footwear

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

19 RAPTURE INDIA FOOTCARE Co PVT Ltd

ODYSSIA Group produced footwear at a international quality. They produce variety

model footwear at high quality. They are easy to wear in all season and are mode of the

unique comfort and satisfaction. ODYSSIA is offering value for money. They give

footwear for international quality.

The Brand Name – ODYSSIA

The name ODYSSIA was derived from a Greek word “odyssey”. Odysseus is probably

best known as the eponymous hero of the Odyssey. This epic describes his adventurous

journey as he tries to return home after the Trojan War and how he managed all the

hurdles throughout his journey which covered a decade.

Odysseus was one of the most influential Greek champions during the Trojan War. He

was one of the most trusted counselors and advisers. Odysseus is frequently viewed as a

man of the mean, renowned for his self-restraint and diplomatic skills. Odysseus was

considered the cleverest hero, and not surprisingly, he was protected by Athena, goddess

of wisdom. He often found solutions for important problems. He was amongst Helen’s

(Helen of Troy, the most beautiful woman) suitors, but to avoid war between them, he

made them all swear to respect Helens decision, and to protect whoever she chose

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

20 RAPTURE INDIA FOOTCARE Co PVT Ltd

PRODUCTION DEPARTMENT

Production department is responsible for the production of goods and services in

the organization. Production department consists of around 350 workers. They are using

the exclusive Italian PU technology for manufacturing the footwear. In production, the

capacity has increased over the years. There is a separate packing section in the production

department. More than 100 female workers are working in the production department.

Figure :3.2

PRODUCTION DEPARTMENT

PRODUCTION

DIRECTOR

OPERATIONS

MANAGER

PRODUCTION STORE/DISPA

MANAGER TCH

MANAGER

SUPERVISOR STORE

KEEPER

PRE-MOULDING MOULDING FINISHING PACKING

RAW FINIS

MATERIALS HED

GOO

DS

WORKERS WORKERS

Source of( company informations)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

21 RAPTURE INDIA FOOTCARE Co PVT Ltd

ODYSSIA maintains a separate Finance Department under the supervision of the

Finance Manager. He is assisted by the Accountants. The section handles all the financial

aspects of the firm. All the transactions are

handled through computerized system. The dealings are handled by tally with the latest

accounting package.

Figure :3.3

Finance Department Structure

Director

Finance manager

Accounts manager

Accountants

Stock Sales order

Source :(company information)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

22 RAPTURE INDIA FOOTCARE Co PVT Ltd

4.1 CURRENT RATIO

The ratio is mainly used to given an idea of the company’s ability to pay back its

short –term liabilities (debt and payables) with its short –term assets (cash, inventory,

receivables). The higher the current ratio, the more capable the company is of paying its

obligations. A ratio under 1 suggests that the company would be unable to pay off its

obligations if they came due at that point. While this shows the company is not in good

financial health, it does not necessarily mean that it will go bankrupt- as there are many ways

to access financing- but it is definitely not a good sign.

The current ratio can given a sense of the operating cycle or its ability to turn its

product into cash. Companies that have trouble getting paid on their receivables or have long

inventory turnover can run into liquidity problems because they are unable to alleviate their

obligation. in Because business operations differ in each industry always more useful to

compare companies within the same industry.

This ratio is similar to the acid –test ratio except that the acid test ratio does not

include inventory and prepaid as assets that can be liquidated. The components of current

ratio (current asset and current liabilities ) can be used to derive capital (difference between

current assets and liabilities ). Working capital is frequently used to derive the working

capital ratio, which is working capital as a ratio of sales.

As a conventional rule, a current ratio of 2:1 is considered as satisfactory. A very high

current ratio indicates that funds are not being used economically in the concern . similarly a

low ratio reveals that the firm may have some difficulty in meeting its debts.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

23 RAPTURE INDIA FOOTCARE Co PVT Ltd

Current assets

Current ratio=

Current liabilities

Table no:4.1

Table showing current ratio

Year Current assets Current liability Current ratio

(Rs) (Rs)

2008-2009 3457.23 5473.83 0.63

2009-2010 3636.45 4701.13 0.77

2010-2011 4006.67 4898 0.82

2011-2012 3890 5679 0.68

2012-2013 5308 7859 0.67

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

24 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figure :4.1

Source : (annual report)

Interpretation

The ideal current ratio is 2:1 which implies to meet every one rupees of current liabilities two

rupees of current assets are available. The above analysis states that the company has

indicates working capital. The company cannot meet their short-term obligation in time. A

relatively high current ratio is an indication that the firm is liquid and has the ability to pay its

current obligation in time as when they become due. But the firm current ratio for the past

five years were relatively low than the standard.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

25 RAPTURE INDIA FOOTCARE Co PVT Ltd

4.2 QUICK RATIO OR ACID TEST RATIO

Quick ratios or liquid ratio

Measure the ability of a company to use its near cash or quick assets to extinguish or retire its

current liability immediately. Quick assets include those current assets that presumably can

be quickly converted to cash at close to their book values. A company with a quick ratio of

less than I cannot current pay back its current liabilities .

Quick ratio is more rigorous test of liquidity than current ratio since it eliminates inventories

and prepaid expenses as a part of current assets. The liquid ratio gives a better picture of

firm’s capacity to meet its short –term obligation out of short –term assets.

QUICK ASSETS

QUICK RATIO =

CURRENT LIABILITIES

An ideal quick ratio often suggested is 1:1 for a concern because it is wise to keep the liquid

assets at least equal to current liabilities at all times.

A high quick ratio compared to current ratio may indicate

under stocking while a low quick ratio may indicate over stocking.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

26 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table :4.2

Quick ratio

QUICK ASSETS CURRENT Quick ratios

YEAR LIABILITY /liquid ratio

2008-2009 2439 5473.83 0.45

2009-2010 2132.24 4701.13 0.45

2010-2011 2375.08 4898 0.48

2011-2012 3024.37 5679 0.53

2012-2013 31775.45 7859 0.40

Source:( annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

27 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figure : 4.2

Source (annual report)

Interpretation

The liquid ratio represent that the firm’s liquidity position is not good. A quick ratio of 1:1 is

considered satisfactory. It indicates that quick are sufficient to pay off the short term

obligation s. but the ratio is less than the standard for the past 5 years. From 2008-2011 the

ratio shows an increased trend but the main reason is that increased both cash and sundry

debtors. Not satisfactory .

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

28 RAPTURE INDIA FOOTCARE Co PVT Ltd

4.3 ABSOLUTE LIQUIDITY RATIO

In addition to computing current and quick ratio, some analysts also compute absolute liquid

ratio to test the liquidity of the business. Absolute liquid ratio is computed by dividing the

absolute liquid assets by current liabilities.

Absolute liquid assets are equal to liquid assets minus accounts receivables(including bills

receivables). Some example of absolute liquid assets are cash , bank balance and marketable

securities etc

CASH + MARKETABLE SECURITIES

ABSOLUTE LIQUIDITY RATIO =

CURRENT LIABILITIES

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

29 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table :4.3

TABLE SHOWING ABSOLUTE LIQUID RATIO

YEAR Absolute liquidity Current liabilities Absolute liquidity

assets(Rs) (Rs) ratios

2008-2009 115.26 5473.83 0.02

2009-2010 102.49 4701.13 0.02

2010-2011 58.85 4898 0.01

2011-2012 65.69 5679 0.01

2012-2013 328.56 7859 0.04

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

30 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figure :4.3

Source(annual report)

Interpretation

The acceptable norm for this ratio is 50% or 0.5:1 or 1:2 rs.1 worth absolute liquid assets are

considered adequate to pay rs:2 worth current liabilities in time as all the creditors are not

expected to demand cash at the same time and then cash may also be realized from debtors

and inventories

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

31 RAPTURE INDIA FOOTCARE Co PVT Ltd

4.4 Gross profit ratio

The gross profit ratio play an important role in two management area. In the area of financial

management, the ratio serves as a valuable indicates of the ability to utilize effectively

outside source of fund. And shaping the pricing policy of the firm

This ratio is ascertained as follows.

Gross profit *100

Gross profit =

Net sales

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

32 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table : 4.4

Table of gross profit ratio

Gross profit Net sales Gross Profit Ratio

year

2008-2009 43.69 9390 0.47

2009-2010 -273.52 12063 -2.26

2010-2011 -249.73 10752 -2.32

2011-2012 -471.43 12911 -3.465

2012-2013 298.31 15375 1.94

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

33 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figure :4.4

Source (annual report)

Interpretation

The gross profit ratio indicates the extent to which selling price of goods per unit may decline

without resulting in losses on operation of a firm .it reflects the efficiency with which a firm

produces its products. There is no standard norm for gross profit ratio. A low g/p generally

indicates high cost of good sold due to unfavorable purchasing polices lesser sales, lower

selling prices, excessive competition , over investment in plant and machinery.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

34 RAPTURE INDIA FOOTCARE Co PVT Ltd

4.5 Analysis of profitability (profitability ratios)

1.net profit ratio

The two basic components of the net profit ratio are the net profit and sales. The net profits

are obtained after deducting income-tax and, generally, non operating expenses and incomes

are excluded from the net profit for calculating this ratio. Thus incomes such as interest on

investments outside the business, profit on sales of fixed assets and losses on sales of fixed

assets, etc excluded.

Net profit *100

Net profit ratio =

Sales

No standard has been fixed for the profit ratios. Higher the ratio the better is the firm’s

efficiency.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

35 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table : 4.5

Table showing net profit ratios

Years Net profit Sales Net profit ratios

(Rs in lakhs) in lakhs

2008-2009 28 9384.56 0.29

2009-2010 -281 12061.25 -2.33

2010-2011 -249 10747.84 -2.32

2011-2012 -471.43 12906.22 -3.65

2012-2013 238.62 15370.024 1.55

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

36 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figures : 4.5

Source (annual report

Interpretation

Net profit ratio is used to measures the overall profitability of the organization it is an index

of efficiency and profitability of the business. The net profit ratio shows an unfavorable

condition to the company. The ideal ratio must be 10% or more in every industry. The net

profit ratio of the company is not satisfactory. It indicates the company could not increase the

turn over or control its operating cost.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

37 RAPTURE INDIA FOOTCARE Co PVT Ltd

4.5 Return on total assets ratio

A ratio that measures earnings before interest and taxes(EBIT) against its total net assets.

The ratio is considered an indicators of how effectively a company is using its assets to

generate earnings before contractual obligations must be paid. The greater a company’s

earnings in proportion to its assets(and the greater the co efficiency from this calculation),

the more effectively that company is said to be using its assets.

To calculate ROTA, you must obtain the net income figure from a company’s income

statement, and then add back interest and/or taxes that were paid during the year. The

resulting number will reveal the company’s EBIT . the EBIT number should then be divided

by the company’s total net assets(total assets less depreciation and any allowance for bad

debts) to reveal the earning that company has generated for each dollar of assets on its books.

Profitability can be measured in term of relationship between net profit and total assets.

Net profit x100

Return on total assets =

Total assets

The term net profit stand for after interest and taxes.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

38 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table :4.6

Table of return on total assets

Years Net profit Total assets Return on Total

(Rs) (Rs) Assets Ratio(%)

2008-2009 28 12028.2 0.23

2009-2010 -281 11463.11 -2.45

2010-2011 -249 11460.53 -2.17

2011-2012 -471.43 11239.71 -4.19

2012-2013 298.31 12515.85 2.38

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

39 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figures : 4.6

source (annual report)

Interpretation

Return on total assets is an important ratio is measure the profitability of investment . it is

useful measure of financial resource invested infirm assets. The most efficiently the assets

used, more profitable would be the business. Here the highest ratio for return on total assets

was during the year 2012-2013 the lowest was in periods.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

40 RAPTURE INDIA FOOTCARE Co PVT Ltd

4.6 Activity ratios or turnover ratios

activity ratios sometimes referred to as operating ratios or management ratios ,measure the

efficiency with which a business uses its assets, such as inventories, account receivable, and

fixed (or capital) assets. The more commonly used operating ratios are the average collection

period, the inventory turn over the fixed assets turnover, and the total assets turnover

turnover ratio or activity ratio measure the performance or operation efficiency of an

enterprise . the ratio indicates the effective utilization of various assets by the organization.

The better management of the assets resulted to large amount sales. A proper balance

between sales and assets reflect that the assets are managed well. The various turnover ratio

used to judge the effectiveness of assets utilization are:-

1. Fixed assets turnover ratios

2. Total assets turnover ratio

Fixed assets turnover ratio

Fixed assets turnover ratio shows how well the fixed assets are being used to generate sale in

the business. In a manufacturing concern this ratio is important because sales are produced

not only by use of current assets but also by amount invested in fixed assets. This ratio

measures the efficiency of the fixed assets use.

It is calculated as follows.

Net sales

Fixed assets turn over ratio =

Fixed assets

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

41 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table : 4.7

Table of fixed assets turnover ratio

years Net sales Fixed assets Fixed assets turnover

ratios

2008-2009 9390 8558.10 1.097

2009-2010 12063 778.04 1.55

2010-2011 10752 1.49

2011-2012 12911 7181.56 1.79

2012-2013 15374 7779.97 1.98

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

42 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figure : 4.7

Source( annual report)

Interpretation

The fixed assets turn over ratio measure a company generate net sales from fixed asset

investment. Here all fixed assets to turn over ratio are above one. Sale are almost equal to

fixed assets. The highest ratio was 2.27 in the year 2012-2013 and lowest was 1.09 in2008-

2009 there was an increasing trend for the past years because of increase in sale and decrease

in fixed assets.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

43 RAPTURE INDIA FOOTCARE Co PVT Ltd

4.7 Total assets turnover ratio

Assets are used to generate sales. Total assets turnover ratio is a measure of

the overall performance or activity of the business enterprise. This ratio indicates the firm’s

ability for generating the sales per rupees of investment .This ratio aim to point out the

efficiency or inefficiency in the use of total assets.

The formula for calculating total assets turnover ratio is as follows:

Net sales

Total assets turnover ratio =

Total assets

An ideal total assets turnover ratio is 2:1 a higher ratio indicates the over trading of assets.

While low ratio indicates the assets are idle.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

44 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table : 4.8

Table of total assets turnover ratio

Years Sales Total assets Total assets turn

over ratios

2008-2009 9390 12028.2 0.78

2009-2010 12063 11463.1 1.052

2010-2011 10752 11460.53 0.94

2011-2012 12911 1239.71 1.15

2012-2013 15374 12515.85 1.23

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

45 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figure : 4.8

Source (annual report)

Interpretation

The total assets turn over ratio of the company from2008-2009 to 2012-2013 are 0.78, 1.052,

0.94,1.15,1.23 respectively . A high ratio is an indicator of over trading of total assets while a

low ratio reveals idle capacity

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

46 RAPTURE INDIA FOOTCARE Co PVT Ltd

4.8 Inventory turn over ratio:

Every firm has to maintain a certain level of inventory of finished goods as to enable to meet

the requirement of the business. Inventory turnover ratio also known as stock velocity is

normally calculated as sales/average inventory or cost of goods sold/ average inventory. It

would indicate whether inventory has been efficiently used or not. The purpose is to see

whether only the required minimum fund have been locked up in inventory.

Cost of goods sold or net sales

Inventory turn over ratio =

Average inventory

Average inventory= opening stock+ closing stock/

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

47 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table :4.9

Inventory turn over ratio

Years Net sales Average inventory Inventory turn over

ratio

2008-2009 2918776.62 6379397.15 0.457

2009-2010 6547123.11 7291287.38 0.89

2010-2011 12444217.76 9020206.23 1.37

2011-2012 15379509.78 8076545.48 1.90

2012-2013 25329002.81 8175794.30 3.09

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

48 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figure : 4.9

Source (annual report)

Interpretation

There are no rules of thumb or standard inventory turnover ratio for interpreting the inventory

turnover ratio. The norm may be different for different firms depending on the nature of

industry and business conditions. But here the inventory turnover ratio of the firm shows a

fluctuating trend. In the year 2011-2012, the inventory turnover ratio is comparatively higher

than the subsequent year which indicates efficient management of inventory.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

49 RAPTURE INDIA FOOTCARE Co PVT Ltd

4.9 Proprietary ratio or equity ratio

the proprietary ratio represent the proportion of shareholders funds in the total assets used in

the business. This ratio indicated to which the assets of the company can be lost without

affecting the interest of creditors of the company. This ratio reveals the long term future

solvency of the company. This ratio is worked as follows:

shareholders funds

Proprietary ratio =

Total assets

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

50 RAPTURE INDIA FOOTCARE Co PVT Ltd

table : 4.10

Table of proprietary ratio

Years Shareholders’ funds Total assets Proprietary

ratio

2008-2009 2131.19 12028.2 0.18

2009-2010 2131.19 .11463.1 0.19

2010-2011 2131.19 11460.53 0.19

2011-2012 2131.19 11239.71 0.19

2012-2013 2131.19 12515.85 0.17

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

51 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figure :4.10

Source (annual report)

Interpretation

The proprietary ratio is computed for the purpose of knowing how much fund have been

provided by the shareholders towards the total assets. Generally a ratio 0.5:1 above is

considered ideal. A higher ratio indicates that the firm is less dependence on creditors for wo

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

52 RAPTURE INDIA FOOTCARE Co PVT Ltd

4.10 WORKING CAPITAL TURNOVER RATIO :

This ratio reflects the turnover of the firm’s net working capital in the course of the year. It is

a good measures of over-trading and under trading . the higher is the ratio, the lower is the

investment in working capital and the greater are the profits. However, a very high turnover

of working capital is sign of over trading and may put the concern in to financial difficulties.

Net sales

Working capital turn over ratio=

Net working capital

Table no: 4.11

Table showing working capital turn over ratio: (in lakhs)

Year Net sales Net working capital Working capital

turn over ratio

2008-2009 9390 -2016.60 -4.65

2009-2010 12063 -1064.68 -11.33

2010-2011 10752 -891.36 -12.06

2011-2012 12911 -1789 -7.21

2012-2013 15374 -2551 -6.02

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

53 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figure : 4.11

Source (annual report)

Interpretation

The standard or ideal working capital turnover ratio is7 or 8 .higher ratio the better working

capital but the higher the ratio indicates over trading. Low ratio indicates under trading w/c

turn over ratio show inefficient use of working capital in the firm.. net w/c is negative for the

five year2009-2010 and2010-2011 showing inefficient use of working capital.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

54 RAPTURE INDIA FOOTCARE Co PVT Ltd

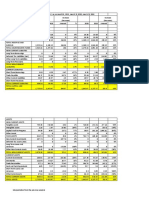

Table : 4.12

COMPARATIVE BALANCE SHEET

For the year ending 31st march 2008-2009

particulars 2008 2009 Increase/ %increase/

(In lakhs) (In Lakhs) decrease decrease

assets

Fixed assets(net) 9406.43 8558.10 -848.33 -9.02%

Capital working in 1.16 10.57 9.41 811.20%

progress

investment 2.30 2.30 - -

Current assets and 3717.33 3457.23 -260.1 -6.10%

loans& advance

Profit& loss account 813 785.33 -27.67 -3.40%

Total assets 13940.22 12813.53 -1126.69 -8.08%

Liabilities

Share capital 21211.19 2131.19

Secured loan 6225.70 4836.46 -1389.24 -22.31%

Unsecured loan - 372.05 372.05 -

Current liabilities 5583.33 5473.83 -109.5 -1.96%

&provision

Total liabilities 13940.22 12813.53 -1126.69 -8.08%

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

55 RAPTURE INDIA FOOTCARE Co PVT Ltd

INTERPRETATION

The fixed assets are decrease by 0.55%. the decrease in these assets has been used mainly for

production activities .profit and loss account shows a debit increase by 35.84% the company

not having profit.

There is no changes in share capital i..e.. no additional fund has been raised .the current

liabilities is increased by 15.95% the company cannot properly meet its creditors . there is no

reserve surplus. The company has no profitability.

The current assets of the company have decrease to;116.27 in lakhs in the year 2010 the

current liabilities are also increased to Rs:781.27 company has not satisfactory

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

56 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table :4.13

COMPARATIVE BALANCE SHEET

For the year ending 31st march 2009-2010

Particulars 2009 2010 Increases / %increase

( in lakhs ) ( in lakhs ) Increase Decrease

Assets

Fixed assets 8558.10 7783.04 -775.06 -9.056%

Capital work in 10.57 41.32 30.75 290.92%

progress

Investment 2.30 2.30 - -

Current assets and 3457.23 3636.45 179.22 5.18%

loans & advance

Profits &loss a/c 785.33 1065.88 280.55 35.72%

Total assets 12813.53 12528.99 -284.54 -2.22%

Liabilities

Share capital 2131.19 2131.9

Secured loan 4836.46 5267.23 430.77 8.90%

Unsecured loan 372.05 429.44 57.39 15.42%

Current liabilities 5473.83 4701.13 -772.7 -14.12%

&provision

Total liabilities 12813.53 12528.99 -284.54 -2.22%

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

57 RAPTURE INDIA FOOTCARE Co PVT Ltd

INTERPRETATION

The current assets of the company increased to Rs:179.22 and current liabilities has

decreased to Rs:772.7 lakhss. The liquidity position of the company is satisfactory.

The fixed asset of the company is decreased by Rs:775.06 lakhs and long term loans

are increase by Rs:430.77 Lakhs. This shows that company use loans to maintain

working capital.

There is no change in share capital i…e..no additional fund has been raised .

There is no reserve and surplus. The company has no profitability.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

58 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table :4.14

COMPARATIVE BALANCE SHHET

For the year ending 31st march 2010--2011

Particulars 2010 2011 Increases / %increase

( in lakhs ) ( in lakhs ) Increase Decrease

Assets

Fixed assets 7783.04 7221.63 -561.41 --7.26%

Capital work in 41.32 229.93 188.61 456.46%

progress

Investment 2.3 2.3 - -

Current assets and 36.36.45 4006.67 370.22 10.18%

loans & advance

Profits &loss a/c 1065.88 1315.05 249.17 23.38%

Total assets 12528.99 12528.99 246.59 1.96%

Liabilities

Share capital 2131.19 2131.19

Secured loan 5267.23 5248.91 -18.32 -0.34

Unsecured loan 429.44 497.45 68.01 15.83%

Current liabilities 4701.13 4898.03 196.9 4.18

&provision

Total liabilities 12528.99 12775.88 246.59 1.96%

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

59 RAPTURE INDIA FOOTCARE Co PVT Ltd

INTERPRETATION

The increased to current assets of the company have increased to Rs:370.22 in the year 2010

the current liabilities are also increase 1.96.9 . the capital position company is satisfactory.

There is no money is kept as reserve and surplus.

There is no change in share capital no additional fund been raised.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

60 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table : 4.15

COMPARATIVE BALANCE SHHET

For the year ending 31st march 2011-2012

Particulars 2011 2012 Increases / %increase

( in lakhs ) ( in lakhs ) Increase Decrease

Assets

Fixed assets 7221.63 7181.56 -40.07 --0.55%

Capital work in 229.93 165.45 -64.48 -28.04%

progress

Investment 2.3 2.3 - -

Current assets and 4006.67 3890.4 -1167.27 -2.90%

loans & advance

Profits &loss a/c 1315.05 11786.48 471.43 35.84%

Total assets 12775.58 13026.19 250.61 1.96%

Liabilities

Share capital 2131.9 2131.19

Secured loan 5248.91 4638.74 -610.17 -11.62%

Unsecured loan 497.45 576.96 79.51 15.98%

Current liabilities 4898.03 5679.3 781.27 15.9%

&provision

Total liabilities 12775.58 13026.19 250.61 1.96%

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

61 RAPTURE INDIA FOOTCARE Co PVT Ltd

INTERPRETATION

The fixed assets are decrease by 0.55%. the decrease in these assets has been used mainly for

production activities .profit and loss account shows a debit increase by 35.84% the company

not having profit.

There is no changes in share capital i..e.. no additional fund has been raised .the current

liabilities is increased by 15.95% the company cannot properly meet its creditors . there is no

reserve surplus. The company has no profitability.

The current assets of the company have decrease to;116.27 in lakhs in the year 2010 the

current liabilities are also increased to Rs:781.27 company has not satisfactory .

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

62 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table : 4.16

COMPARATIVE BALANCE SHEET

For the year ending 31st march 2012-2013

Particulars 2012 2013 Increases / %increase

( in lakhs ) ( in lakhs ) Increase Decrease

Assets

Fixed assets 7181.56 6776.97 401.59 5.59.5%

Capital work in 165.45 122.05 -43.5 -26.23%

progress

Investment 2.3 2.3 - -

Current assets and 3890.4 7159.5 3268.98 84.02%

loans & advance

Profits &loss a/c 1786.48 1547.8 -238.62 -13.35%

Total assets 13026.19 14063.% 1037.51 7.96%

Liabilities

Share capital 2131.19 2131.19

Secured loan 4638.74 3396 --1247.2 -26.79%

Unsecured loan 576.96 3638.51 3061.55 530.63%

Current liabilities 5679.3 4898 -781.3 -13.76

&provision

Total liabilities 13026.19 14063.7 1037.51 7.96%

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

63 RAPTURE INDIA FOOTCARE Co PVT Ltd

INTERPRETATION

The fixed assets are decreased by 5.59% the decrease in the assets has been used

mainly for production activities.

There is no change in share capital

The current assets of the company increased to84.02% and current liabilities has

decreased to 13.76% the liquidity position of the company is satisfactory.

There is no money kept as reserves and surplus.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

64 RAPTURE INDIA FOOTCARE Co PVT Ltd

4.11 Common size balance sheet

A statement in which all item are expressed as a percentage of bas figure useful

for purpose of analysis trend and changing relationship among financial

statement.

Advantages

To establish a relationship

To present the change in various item in relation to total assets or total

liabilities.

Common base comparison

Vertical common size analysis involves stating all balance sheet item as a

percentage of total assets. It useful in comparing current balance sheet.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

65 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table :4.17

COMMON SIZE BALANCE SHEET

For the year ending 31st march 2008-2009

particulars 2008 % 2009 in %

lakhs

In lakhs

assets

Fixed assets(net) 9406.43 67.48% 8558.10 66.79%

Capital working in 1.16 0.08% 10.57 0.09%

progress

investment 2.30 0.02% 2.30 0.02%

Current assets and 3717.33 26.67% 3457.23 26.98%

loans& advance

Profit& loss account 813 5.83% 785.33 6.13%

Total assets 13940.22 100% 12813.53 100%

Liabilities

Share capital 21211.19 15.28% 2113.19 16.63%

Secured loan 6225.70 44.66% 4836.46 37.74%

Unsecured loan - 372.05 2.90%

Current liabilities 5583.33 40.05% 5473.83 42.71%

&provision

Total liabilities 13940.22 100% 12813.53 100%

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

66 RAPTURE INDIA FOOTCARE Co PVT Ltd

Interpretation

From the above common size balance sheet we can that share capital of the company is

decreasing trend both secured loan were increasing trend and unsecured loan in decreasing

trend . the fixed asset decreased from 67.48% to 66.79%it is because of the depreciation of

fixed assets. In case of current asset were increased by 0.31% and the current liability also

shows increasing trend but the current asset is less than liability.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

67 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table : 4.18

COMMON SIZE BALANCE SHEET

For the year ending 31st march 2009-2010

particulars 2010 % 2009 in %

lakhs

in lakhs

assets

Fixed assets(net) 7783.04 62.12% 8558.10 66.79%

Capital working in 41.32 0.33% 10.57 0.09%

progress

investment 2.30 0.02% 2.30 0.02%

Current assets and 3636.3 29.027% 3457.23 26.98%

loans& advance

Profit& loss account 1065.88 8.51% 785.33 6.13%

Total assets 12528.99 100% 12813.53 100%

Liabilities

Share capital 2131.19 17.018% 2113.19 16.63%

Secured loan 5267.23 42.04% 4836.46 37.74%

Unsecured loan 429.44 3.42 372.05 2.90%

Current liabilities 4701.13 37.25% 5473.83 42.71%

&provision

Total liabilities 12528.99 100% 12813.53 100%

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

68 RAPTURE INDIA FOOTCARE Co PVT Ltd

interpretation

In 2008 the share capital is 16.63% and in 2009 the share capital is increased by 17.01% both

secured loan and unsecured loan shows an increased trend. There is no reserve and surplus in

both years. The percentage of fixed assets has decreased from 66.79%to 62.% that indicates

there is a sale of fixed assets. Taking total assets 100 the current assets show as increasing

trend the current liabilities shown decreasing trend.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

69 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table : 4.19

Common size balance sheet

For the year ending 31st march 2010-2011

particulars 2010 % 2011 %

assets

Fixed assets(net) 7783.04 62.12% 7221.63 56.53%

Capital working in 41.32 0.33% 229.93 1.8%

progress

investment 2.30 0.02% 2.3 0.02%

Current assets and 3636.3 29.027% 4006.67 31.36%

loans& advance

Profit& loss account 1065.88 8.51% 1315.03 9.51%

Total assets 12528.99 100% 12775.58 100%

Liabilities

Share capital 2131.19 17.018% 2113.19 16.68%

Secured loan 5267.23 42.04% 5248.9 41.08%

Unsecured loan 429.44 3.42 497.45 3.9%

Current liabilities 4701.13 37.25% 4898.03 38.34%

&provision

Total liabilities 12528.99 100% 12775.58 100%

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

70 RAPTURE INDIA FOOTCARE Co PVT Ltd

Interpretation

The percentage of fixed assets has decreased from 62% to 56% that indicates

there is a sale of fixed assets. Both secured loans show a decreasing trend and

unsecured loan showing increasing trend. In 2010 the current assets is 29.02

and in 2011 it is increase from 31.36 it is because of the increasing of sundry

debtors and also increase of inventory, cash bank balance.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

71 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table : 4.20

Common size balance sheet

For the year ending 31st march 2011-2012

particulars 2011 % 2012 %

assets

Fixed assets(net) 7221.63 62.12% 7181.56 56.53%

Capital working in 229.93 0.33% 165.45 1.8%

progress

investment 2.3 0.02% 2.3 0.02%

Current assets and 4006.67 29.027% 3890.4 31.36%

loans& advance

Profit& loss account 1315.03 8.51% 1786.48 9.51%

Total assets 12775.58 100% 13026.19 100%

Liabilities

Share capital 2131.19 17.018% 2113.19 16.68%

Secured loan 5248.9 42.04% 4638.74 35.61.%

Unsecured loan 497.44 3.42 576.96 4..43%

Current liabilities 4898.03 37.25% 5679.3 43.6%

&provision

Total liabilities 12775.58 100% 13026.19 100%

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

72 RAPTURE INDIA FOOTCARE Co PVT Ltd

Interpretation

In2011 the share capital is 16.68% and in 2012 the share capital is decreased by 16.36% there

is no reserve and surplus in both years. From the above common size balance sheet we can

see that share capital of the company is decrease trend both secured loan were decrease trend

and unsecured loan in increasing trend. The percentage of fixed assets has decreased from

56.53% to 55.13%.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

73 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table :4.21

COMMON SIZE BALANCE SHEET

For the year ending 31st march 2012-2013

particulars 2012 % 2013 %

In lakhs in lakhs

assets

Fixed assets(net) 7181.56 56.53% 6779.97 48.2

Capital working in 165.45 1.8% 122.05 0.8%

progress

investment 2.3 0.02% 2.3 0.02%

Current assets and 3890.4 31.36% 7159.38 50.9%

loans& advance

Profit& loss account 1786.48 9.51% 1547.86 1.11%

Total assets 13026.19 100% 14063.70 100%

Liabilities

Share capital 2113.19 16.68% 2131.9 15.15%

Secured loan 4638.9 35.61% 3396 24.15%

Unsecured loan 576.96 4.43% 3638.51 25.87%

Current liabilities 5679.3 43.6% 4898 34.83%

&provision

Total liabilities 13026.19 100% 14063.7 100%

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

74 RAPTURE INDIA FOOTCARE Co PVT Ltd

Interpretation

From the above common size balance sheet we can see that share capital of the company is

decrease trend both secured loan were decreasing trend and unsecured loan in trend is

increasing. There is no reserve surplus in both years. The fixed assets decreased from55.13%

to48.2% it indicates that there is a sale of fixed assets.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

75 RAPTURE INDIA FOOTCARE Co PVT Ltd

4.12 Trend analysis

Comparing past data over a period of time with a base year is called trend analysis. This

method determine the direction upwards or down words and involves the computation of the

percentage relationship the cash statement. Item bears to the same item in base years. The

information for a numbers of years is taken up and one year, generally the first year as taken

as base year. The figure of base year taken as 100 and trend ratios for other years calculated

on the basis of base year the analyst is able to see the trend of figures, whether upward or

downward. The trend percentage is generally computed for major items in the statement

Sales

Table : 4.22

Table of trend percentage of sales (in lakhs)

Years Sales Trend%

2008-2009 10856.67 100%

2009-2010 13538.5 124.70%

2010-2011 11622.24 107.05%

2011-2012 14184.15 130.65%

2012-2013 16956.11 156.18%

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

76 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figure : 4. 12

Source(annual report)

Interpretation

In this analysis year 2007-2008 taken as base year while comparing with it, in 2009-2010

sales increase to 124.70 from 100% where as in 2010-2011 sales was 107.5% showing a

decrease from that of2010 while looking in to 2011-2012 the sales again increase to 130.65

sales showing a good trend in 2013 that 156.18% .

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

77 RAPTURE INDIA FOOTCARE Co PVT Ltd

Table : 4.23

TREND ANALYSIS ON PROFIT

Table of trend percentage profit

Years Profit Trend%

2008-2009 28 100

2009-2010 -281 -1003.57

2010-2011 -249 -889.28

2011-2012 -471.43 -1683.67

2012-2013 298.31 1065.39

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

78 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figure : 4. 13

Source (annual report)

Interpretation

In this analysis year 2008-2009 taken as base year while comparing with it in 2009-2010

from profit decreased to 1003.57% from100% where as in 2010-2011 was -888.28%

showing again deceasing trend.1683.67% profit showing a good trend.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

79 RAPTURE INDIA FOOTCARE Co PVT Ltd

TREND ANALYSIS ON PURCHASE:

Table of trend percentage of purchase

Table : 4.24

Purchase

Years Trend%

2008-2009 1268 100

2009-2010 2043 161.12

2010-2011 1603 126.42

2011-2012 1933 152.45

2012-2013 2586 203.94

Source (annual report)

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

80 RAPTURE INDIA FOOTCARE Co PVT Ltd

Figure :4.14

Source (annual report)

Interpretation

While considering purchase which shows the trend increase in 2010- at 161.12 diminish it to

126.42% then show a slight increase in 152.45% a huge change occur in the year 2013 that

of 203.94%.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

81 RAPTURE INDIA FOOTCARE Co PVT Ltd

5.1 FINDINGS

1)The company shows a fluctuating trend for the current ratio and the ideal ratio is 2:1

Average current ratio of the company0.72 for the last five year showing that the liquidity

position of the company not be the satisfaction level.

2)The company’s liquidity ratio for the last five year is fluctuating . the ideal ratio is 1:1 for

the last year shows that company is not maintaining a satisfactory liquidity position.

3) The gross profit ratio indicates the extent to which selling price of goods per unit may

decline without resulting in losses on operation of a firm .it reflects the efficiency with which

a firm produces its products. There is no standard norm for gross profit ratio. A low g/p

generally indicates high cost of good sold due to unfavorable purchasing polices lesser sales,

lower selling prices, excessive competition , over investment in plant and machinery.

4)Proprietary ratio showed as decreasing trend which indicate that the long term solvency

position was liquidating against the interest of creditors.

5)Return on total asset ratio is not be satisfactory position in the study period

6) In this analysis year 2008-2009 taken as base year while comparing with it in 2009-2010

from profit decreased to 1003.57% from100% where as in 2010-2011 was -888.28%

showing again deceasing trend.1683.67% profit showing a good trend

7) The fixed assets turn over ratio measure a company generate net sales from fixed asset

investment. Here all fixed assets to turn over ratio are above one. Sale are almost equal to

fixed assets. The highest ratio was 2.27 in the year 2012-2013 and lowest was 1.09 in2008-

2009 there was an increasing trend for the past years because of increase in sale and decrease

in fixed assets.

8)In this analysis year 2007-2008 taken as base year while comparing with it, in 2009-2010

sales increase to 124.70 from 100% where as in 2010-2011 sales was 107.5% showing a

decrease from that of2010 while looking in to 2011-2012 the sales again increase to 130.65

sales showing a good trend in 2013 that 156.18%

Comparative balance sheet 2008-2009 details are following

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

82 RAPTURE INDIA FOOTCARE Co PVT Ltd

The fixed assets are decrease by 0.55%. the decrease in these assets has been used mainly for

production activities .profit and loss account shows a debit increase by 35.84% the company

not having profit.

There is no changes in share capital i..e.. no additional fund has been raised .the current

liabilities is increased by 15.95% the company cannot properly meet its creditors . there is no

reserve surplus. The company has no profitability.

The current assets of the company have decrease to;116.27 in lakhs in the year 2010 the

current liabilities are also increased to Rs:781.27 company has not satisfactory

Comparative balance sheet 2009-2010

The current assets of the company increased to Rs:179.22 and current liabilities has

decreased to Rs:772.7 lakhss. The liquidity position of the company is satisfactory.

The fixed asset of the company is decreased by Rs:775.06 lakhs and long term loans

are increase by Rs:430.77 Lakhs. This shows that company use loans to maintain

working capital.

There is no change in share capital i…e..no additional fund has been raised .

There is no reserve and surplus. The company has no profitability.

From the above common size balance sheet we can see that share capital of the company is

decrease trend both secured loan were decreasing trend and unsecured loan in trend is

increasing. There is no reserve surplus in both years. The fixed assets decreased from55.13%

to48.2% it indicates that there is a sale of fixed assets in 2012-2013

In2011 the share capital is 16.68% and in 2012 the share capital is decreased by 16.36% there

is no reserve and surplus in both years. From the above common size balance sheet we can

see that share capital of the company is decrease trend both secured loan were decrease trend

and unsecured loan in increasing trend. The percentage of fixed assets has decreased from

56.53% to 55.13%.

JAI BHARATH SCHOOL OF MANAGEMENT STUDIES, PERUMBAVOOR

83 RAPTURE INDIA FOOTCARE Co PVT Ltd

5.2 Suggestions:

1) Expenses should controlled by improving the earning of the company.

2) the company should try to minimize investment in inventories.

3) the company should try to reduce the current liabilities for achieving good liquidity

position.

4) the current liabilities can be maintained with the help of issue additional share. This

will increase the cash position, current assets and long term capital. This will never affect

current liabilities.

5) the company shows a negative working capital for the last year so the company should

maintain adequate current asset to meet its day to day operation.

6) the balance land property available can be utilize for leasing because lease rent is one

of the source for increasing current asset.

7) liquidity position of the company is not satisfactory, so the company should ,make

necessary step to maintain an adequate liquidity position.

8)in order to manage debtors more efficiency, establish clear credit practices as a matter

of the company policy and make sure that these practices are clearly understood by staff,