Académique Documents

Professionnel Documents

Culture Documents

Jurisprudence On Donation

Transféré par

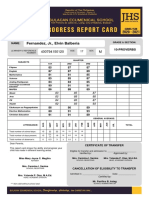

Jeff FernandezTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Jurisprudence On Donation

Transféré par

Jeff FernandezDroits d'auteur :

Formats disponibles

Jurisprudence on donation

REPUBLIC OF THE PHILIPPINES, petitioner, vs. LEON SILIM and

ILDEFONSA MANGUBAT, respondents. |||

(Republic v. Silim, G.R. No. 140487, [April 2, 2001], 408 PHIL 69-82)

Donations, according to its purpose or cause, may be categorized as: (1) pure

or simple; (2) remuneratory or compensatory; (3) conditional or modal; and (4)

onerous. A pure or simple donation is one where the underlying cause is plain

gratuity. 8 This is donation in its truest form. On the other hand, a

remuneratory or compensatory donation is one made for the purpose of

rewarding the donee for past services, which services do not amount to a

demandable debt. 9 A conditional or modal donation is one where

the donation is made in consideration of future services or where the donor

imposes certain conditions, limitations or charges upon the donee, the value

of which is inferior than that of the donation given. 10 Finally, an

onerous donation is that which imposes upon the donee a reciprocal

obligation or, to be more precise, this is the kind of donation made for a

valuable consideration, the cost of which is equal to or more than the thing

donated |||

Under the law the donation is void if there is no acceptance.

The acceptance may either be in the same document as the deed

of donation or in a separate public instrument. If the acceptance is in

a separate instrument, "the donor shall be notified thereof in an

authentic form, and his step shall be noted in both instruments.

"Title to immovable property does not pass from the

donor to the donee by virtue of a deed of donation until and

unless it has been accepted in a public instrument and the

donor duly noticed thereof. (Abellera vs. Balanag, 37

Phils. 85; Alejandro vs. Geraldez, 78 SCRA 245). If the

acceptance does not appear in the same document, it must be

made in another. Solemn words are not necessary; it is

sufficient if it shows the intention to accept, But in this case, it

is necessary that formal notice thereof be given to the donor

and the fact that due notice has been given it must be noted in

both instruments (that containing the offer to donate and that

showing acceptance). Then and only then is

the donation perfected. (11 Manresa 155-11, cited in

Vol. II, Civil Code of the Philippines by Tolentino.)."

||| Sections 745 and 749 of the New Civil Code provide:

ARTICLE 745. The donee must accept

the donation personally, or through an authorized person with a

special power for the purpose, or with a general and sufficient power;

otherwise the donation shall be void.

ARTICLE 749. In order that the donation of an immovable may

be laid, it must be made in a public document, specifying therein the

property donated and the value of the charge which the donee must

satisfy.

The acceptance may be made in the same deed of donation or

in a separate public document, but it shall not take effect unless it is

done during the lifetime of the donor.

If the acceptance is made in a separate instrument, the donor

shall be notified thereof in an authentic form, and this step shall be

noted in both instruments.

|||

RICKY Q. QUILALA, petitioner, vs. GLICERIA ALCANTARA, LEONORA

ALCANTARA, INES REYES and JOSE REYES, respondent. ||

|(Quilala v. Alcantara, G.R. No. 132681, [December 3, 2001], 422 PHIL 649-

658)

Under Article 749 of the Civil Code, the donation of an immovable must be

made in a public instrument in order to be valid, specifying therein the property

donated and the value of the charges which the donee must satisfy. As a

mode of acquiring ownership, donation results in an effective transfer of title

over the property from the donor to the donee, and is perfected from the

moment the donor knows of the acceptance by the donee, provided the donee

is not disqualified or prohibited by law from accepting the donation. Once

the donation is accepted, it is generally considered irrevocable, and the donee

becomes the absolute owner of the property. The acceptance, to be valid,

must be made during the lifetime of both the donor and the donee. It may be

made in the same deed or in a separate public document, and the donor must

know the acceptance by the donee. |||

SYNOPSIS

Catalina Quilala executed a Donation of Real Property Inter Vivos in

favor of Violeta Quilala over a parcel of land. Here in issue is the validity of the

said Deed ofDonation.

As the Deed of Donation complied with the requirements provided

under Art. 749 of the Civil Code, the Deed is valid. The fact that the second

page of the Deed of Donation on which only the Acknowledgment appeared

was signed by the donor and one witness on the left-hand margin, and by the

donee and the other witness on the right-hand margin, the same does not

affect the validity of the instrument. The requirement that the contracting

parties and their witnesses should sign on the left-hand margin of

the instrument is merely to ensure that each and every page of

the instrument is authenticated by the parties. Further, although the donee

was not mentioned by the notary public in the Acknowledgment, the same

does not render the page a private instrument as the donee nevertheless

signed on that second page. The acceptance, which was explicitly set forth on

the first page of the notarized Deed of Donation, was, therefore, made in

a public instrument.

CIVIL LAW; MODES OF ACQUIRING OWNERSHIP; DONATION OF AN

IMMOVABLE; REQUIREMENTS. — Under Article 749 of the Civil Code,

the donation of an immovable must be made in a public instrument in order to

be valid, specifying therein the property donated and the value of the charges

which the donee must satisfy. As a mode of acquiring

ownership, donation results in an effective transfer of title over the property

from the donor to the donee, and is perfected from the moment the donor

knows of the acceptance by the donee, provided the donee is not disqualified

or prohibited by law from accepting the donation. Once the donationis

accepted, it is generally considered irrevocable, and the donee becomes the

absolute owner of the property. The acceptance, to be valid, must be made

during the lifetime of both the donor and the donee. It may be made in the

same deed or in a separate public document, and the donor must know the

acceptance by the donee. |||

TITO R. LAGAZO, petitioner, vs. COURT OF APPEALS and ALFREDO

CABANLIT, respondents. |||

(Lagazo v. Court of Appeals, G.R. No. 112796, [March 5, 1998], 350 PHIL

449-465)

CIVIL LAW; OBLIGATIONS AND CONTRACTS; DONATION;

SIMPLE DONATION DIFFERENTIATED FROM ONEROUS DONATION. —

At the outset, let us differentiate between a simple donation and an onerous

one. A simple or pure donation is one whose cause is pure liberality (no

strings attached), while onerous donation is one which is subject to burdens,

charges or future services equal to or more in value than the thing donated.

Under Article 733 of the Civil Code, donations with an onerous cause shall be

governed by the rules on contracts; hence, the formalities required for a valid

simple donation are not applicable.|||

Vous aimerez peut-être aussi

- Rules for Investigating Violations of Housing LawsDocument2 pagesRules for Investigating Violations of Housing LawsCeline-Maria JanoloPas encore d'évaluation

- Dao Heng Bank Versus Sps LaigoDocument8 pagesDao Heng Bank Versus Sps Laigoarianna0624Pas encore d'évaluation

- Prosecutors: Republic of The Philippines Regional Trial Court Zamboanga City Branch 15Document10 pagesProsecutors: Republic of The Philippines Regional Trial Court Zamboanga City Branch 15Joanne FerrerPas encore d'évaluation

- Transco v. Spouses TaglaoDocument3 pagesTransco v. Spouses TaglaoHanna BulacanPas encore d'évaluation

- Legal OpinionDocument1 pageLegal OpinionTzarlene CambalizaPas encore d'évaluation

- PLJ Volume 51 Number 1 & 2 - 05 - Pelagio T. Ricalde - Mr. Chief Justice Conception On Judicial Review P. 103-123Document21 pagesPLJ Volume 51 Number 1 & 2 - 05 - Pelagio T. Ricalde - Mr. Chief Justice Conception On Judicial Review P. 103-123Christine ErnoPas encore d'évaluation

- Aaa v. BBB Gr212448Document7 pagesAaa v. BBB Gr212448Zen JoaquinPas encore d'évaluation

- Montinola Vs VillanuevaDocument6 pagesMontinola Vs VillanuevaJay TabuzoPas encore d'évaluation

- Section 60 (B) of The LGC 1991Document5 pagesSection 60 (B) of The LGC 1991Eis Pattad MallongaPas encore d'évaluation

- Complaint - MackyDocument7 pagesComplaint - MackyFerdinand Hernandez Ramos100% (1)

- PLJ Volume 83 Number 3 - 03 - Henry Rhoel R. Aguda & Jesusa Loreto A. Arellano-Aguda - The Philippine Claim Over The Spratly Group of IslandsDocument36 pagesPLJ Volume 83 Number 3 - 03 - Henry Rhoel R. Aguda & Jesusa Loreto A. Arellano-Aguda - The Philippine Claim Over The Spratly Group of IslandsattycertfiedpublicaccountantPas encore d'évaluation

- L&S Resources criminal case for bounced checksDocument4 pagesL&S Resources criminal case for bounced checksJosef MacanasPas encore d'évaluation

- Associate Justice Marvic Leonen's SpeechDocument6 pagesAssociate Justice Marvic Leonen's SpeechChristopher Martin GunsatPas encore d'évaluation

- Comelec Res NR 10197-GunbanDocument1 pageComelec Res NR 10197-Gunbanchina100% (1)

- 2012 SALES Outline Villanueva PDFDocument62 pages2012 SALES Outline Villanueva PDFGarsha HalePas encore d'évaluation

- Presidential Decree No. 1866 Codifying Laws on Illegal FirearmsDocument5 pagesPresidential Decree No. 1866 Codifying Laws on Illegal FirearmsCharshii100% (1)

- Philippines Terminal CaseDocument6 pagesPhilippines Terminal CaseJaneKarlaCansanaPas encore d'évaluation

- COA Decision on NEA Employees' Rice Allowance ClaimDocument264 pagesCOA Decision on NEA Employees' Rice Allowance ClaimnchlrysPas encore d'évaluation

- Hague Service Convention GuideDocument0 pageHague Service Convention Guidelito77Pas encore d'évaluation

- Toyota Shaw vs Court of Appeals - Contract of Sale RequirementsDocument12 pagesToyota Shaw vs Court of Appeals - Contract of Sale RequirementskookPas encore d'évaluation

- CAOIBES, JR., Et Al. vs. CAOIBES-PANTOJA Case DigestDocument1 pageCAOIBES, JR., Et Al. vs. CAOIBES-PANTOJA Case Digestamareia yapPas encore d'évaluation

- Sec 45 LGCDocument6 pagesSec 45 LGCWelbert SamaritaPas encore d'évaluation

- Query: A Question Arises On Whether This Provision Has Been Impliedly Repealed by RA 8552Document3 pagesQuery: A Question Arises On Whether This Provision Has Been Impliedly Repealed by RA 8552JC HilarioPas encore d'évaluation

- Non-Receipt of A Written Notice of Dishonour of Checks: The Case of People vs. Manalo For B.P. Blg. 22Document6 pagesNon-Receipt of A Written Notice of Dishonour of Checks: The Case of People vs. Manalo For B.P. Blg. 22Judge Eliza B. Yu100% (4)

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument3 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledsofiaqueenPas encore d'évaluation

- Compiled Digest PFR - Rev.1Document38 pagesCompiled Digest PFR - Rev.1Song Ong100% (1)

- 195 PEOPLE v. RECTODocument4 pages195 PEOPLE v. RECTOav783Pas encore d'évaluation

- Law 4 Sale of Goods NotesDocument23 pagesLaw 4 Sale of Goods NotesFatePas encore d'évaluation

- Administrative Order No. 22 (Appeals To Office of The President)Document6 pagesAdministrative Order No. 22 (Appeals To Office of The President)macel0308100% (1)

- UPL by AIDocument2 pagesUPL by AIHannah Keziah Dela CernaPas encore d'évaluation

- Rape Cases PDFDocument12 pagesRape Cases PDFAudrin Agapito G. de AsisPas encore d'évaluation

- Revenue Regulations on Philippine Stock Transaction TaxesDocument7 pagesRevenue Regulations on Philippine Stock Transaction TaxesKrstn RsslliniPas encore d'évaluation

- Strengthening The Constitutional Right To Self-Organization, Amending ProvisionsDocument13 pagesStrengthening The Constitutional Right To Self-Organization, Amending ProvisionsAsisclo CastanedaPas encore d'évaluation

- Special Power of Attorney: AcknowledgmentDocument3 pagesSpecial Power of Attorney: AcknowledgmentLhuz AniPas encore d'évaluation

- Electoral Reforms Law RA 6646Document12 pagesElectoral Reforms Law RA 6646tagabantayPas encore d'évaluation

- Contempt, Forum ShoppingDocument59 pagesContempt, Forum ShoppingbbyshePas encore d'évaluation

- Labor Law Review NOTES for Midterms 2015-2016Document15 pagesLabor Law Review NOTES for Midterms 2015-2016MichaelPas encore d'évaluation

- Donation CasesDocument6 pagesDonation CasessalpanditaPas encore d'évaluation

- Bar Question On Criminal Law 2004 Murder and SpiDocument1 pageBar Question On Criminal Law 2004 Murder and SpiAnonymous lbOiXWCp100% (1)

- 2011 Bar Examination Questionnaire For Remedial LawDocument28 pages2011 Bar Examination Questionnaire For Remedial LawYsabel ReyesPas encore d'évaluation

- Usufruct CasesDocument24 pagesUsufruct CasesMay AnascoPas encore d'évaluation

- Rule on Children Charged Under the Dangerous Drugs ActDocument32 pagesRule on Children Charged Under the Dangerous Drugs ActDbee Dvee100% (1)

- Crimes Committed by Public Officers-Part 1Document26 pagesCrimes Committed by Public Officers-Part 1Marites Barrios Taran100% (1)

- R.A 10591 Full TextDocument70 pagesR.A 10591 Full TextKriska Herrero TumamakPas encore d'évaluation

- Bolos VDocument3 pagesBolos VAnonymous NqaBAyPas encore d'évaluation

- Jocelyn Sy Limkaichong CaseDocument9 pagesJocelyn Sy Limkaichong Casefamigo451Pas encore d'évaluation

- To Mr. Mark San JuanDocument2 pagesTo Mr. Mark San JuanPol David G. InfantePas encore d'évaluation

- Senga Sales SyllabusDocument2 pagesSenga Sales SyllabusPochoy Mallari0% (1)

- Non-Joinder of Indispensable Parties Is Not A Ground For The Dismissal of An ActionDocument2 pagesNon-Joinder of Indispensable Parties Is Not A Ground For The Dismissal of An ActionSarah Jane-Shae O. SemblantePas encore d'évaluation

- Buy Sale Agreement 123ZDocument5 pagesBuy Sale Agreement 123ZcefuneslpezPas encore d'évaluation

- Our Mendicant Foreign PolicyDocument6 pagesOur Mendicant Foreign PolicyEspino EmmanuelPas encore d'évaluation

- 1997 Rules of Civil Procedure SummaryDocument307 pages1997 Rules of Civil Procedure SummaryLeogen TomultoPas encore d'évaluation

- Spa AchaDocument1 pageSpa AchaPrudente SollerPas encore d'évaluation

- Torts Cases For May 16 (26-30)Document18 pagesTorts Cases For May 16 (26-30)Rosalyn BahiaPas encore d'évaluation

- Facie To Have Been Issued For A Valuable Consideration and Every Person WhoseDocument5 pagesFacie To Have Been Issued For A Valuable Consideration and Every Person WhoseRina Lynne BaricuatroPas encore d'évaluation

- Dimaano 10 LegalOpinionDocument3 pagesDimaano 10 LegalOpinionJoielyn Dy DimaanoPas encore d'évaluation

- War crimes and crimes against humanity in the Rome Statute of the International Criminal CourtD'EverandWar crimes and crimes against humanity in the Rome Statute of the International Criminal CourtPas encore d'évaluation

- DonationDocument2 pagesDonationWreigh ParisPas encore d'évaluation

- How To Create Sponsored Facebook Post and How To Boost Facebook AdvertisementDocument5 pagesHow To Create Sponsored Facebook Post and How To Boost Facebook AdvertisementJeff FernandezPas encore d'évaluation

- Distribution of An Unregistered Product - Possible Violations CommittedDocument6 pagesDistribution of An Unregistered Product - Possible Violations CommittedJeff FernandezPas encore d'évaluation

- Flowchart - FOI Request FormDocument1 pageFlowchart - FOI Request FormJeff FernandezPas encore d'évaluation

- Economies: The Economic Impact of Lockdowns: A Persistent Inoperability Input-Output ApproachDocument14 pagesEconomies: The Economic Impact of Lockdowns: A Persistent Inoperability Input-Output ApproachFrancis Joseph Maano ReyesPas encore d'évaluation

- Quality Manual City Legal DepartmentDocument78 pagesQuality Manual City Legal DepartmentJeff FernandezPas encore d'évaluation

- Distribution of An Unregistered Product - Possible Violations CommittedDocument6 pagesDistribution of An Unregistered Product - Possible Violations CommittedJeff FernandezPas encore d'évaluation

- Revised Katarungang Pambarangay LawDocument1 pageRevised Katarungang Pambarangay LawJeff FernandezPas encore d'évaluation

- Cost of Covid-19 VaccinesDocument1 pageCost of Covid-19 VaccinesJeff FernandezPas encore d'évaluation

- Revised Katarungang Pambarangay LawDocument1 pageRevised Katarungang Pambarangay LawJeff FernandezPas encore d'évaluation

- Revised Katarungang Pambarangay LawDocument1 pageRevised Katarungang Pambarangay LawJeff FernandezPas encore d'évaluation

- Revised Katarungang Pambarangay LawDocument1 pageRevised Katarungang Pambarangay LawJeff FernandezPas encore d'évaluation

- ORIENTATION ON THE LEGAL ISSUANCES RE RELOCATION OF ISFsDocument1 pageORIENTATION ON THE LEGAL ISSUANCES RE RELOCATION OF ISFsJeff FernandezPas encore d'évaluation

- Part-Time Work GuidelinesDocument13 pagesPart-Time Work GuidelinesJeff FernandezPas encore d'évaluation

- PDRF Guidebookv1.2 (Oct2020)Document57 pagesPDRF Guidebookv1.2 (Oct2020)Jeff Fernandez100% (2)

- The Role of Transnational Cooperation in Cybersecurity Law EnforcementDocument10 pagesThe Role of Transnational Cooperation in Cybersecurity Law EnforcementJeff FernandezPas encore d'évaluation

- Part-Time Work GuidelinesDocument13 pagesPart-Time Work GuidelinesJeff FernandezPas encore d'évaluation

- Quezon City Disaster Risk Reduction and Managerent Office: Dr"Bu'Id Nt8C.,%Ez9On88 Tzy2!P #%#D.#,Y#I#%## #QueroncnyDocument49 pagesQuezon City Disaster Risk Reduction and Managerent Office: Dr"Bu'Id Nt8C.,%Ez9On88 Tzy2!P #%#D.#,Y#I#%## #QueroncnyJeff FernandezPas encore d'évaluation

- Student Documents Online 161896738597391582Document1 pageStudent Documents Online 161896738597391582Jeff FernandezPas encore d'évaluation

- PDRF Guidebookv1.2 (Oct2020)Document57 pagesPDRF Guidebookv1.2 (Oct2020)Jeff Fernandez100% (2)

- EUROLINK - Oct 19, 2020Document1 pageEUROLINK - Oct 19, 2020Jeff FernandezPas encore d'évaluation

- 2016 Revised POEA Rules and Regulations For Land BasedDocument71 pages2016 Revised POEA Rules and Regulations For Land BasedCindy Grace Manuel AgbisitPas encore d'évaluation

- EUROLINK - April 30, 2021Document1 pageEUROLINK - April 30, 2021Jeff FernandezPas encore d'évaluation

- Authority To PracticeDocument2 pagesAuthority To Practiceanthony singzon86% (7)

- Student Documents Online 161896738597391582Document1 pageStudent Documents Online 161896738597391582Jeff FernandezPas encore d'évaluation

- Aplikasyon para Sa Awtoridad Na Makapagtrabaho o Makapagpatuloy NG Propesyon Sa Labas NG DSWDDocument3 pagesAplikasyon para Sa Awtoridad Na Makapagtrabaho o Makapagpatuloy NG Propesyon Sa Labas NG DSWDJeff FernandezPas encore d'évaluation

- Deed of Sale of Motor VehicleDocument2 pagesDeed of Sale of Motor VehicleJeff FernandezPas encore d'évaluation

- 2016 Revised POEA Rules and Regulations For Land BasedDocument71 pages2016 Revised POEA Rules and Regulations For Land BasedCindy Grace Manuel AgbisitPas encore d'évaluation

- Part-Time Work GuidelinesDocument13 pagesPart-Time Work GuidelinesJeff FernandezPas encore d'évaluation

- Deed of ConveyanceDocument1 pageDeed of Conveyancethatbeachgirl xxPas encore d'évaluation

- Student Documents Online 161896738597391582Document1 pageStudent Documents Online 161896738597391582Jeff FernandezPas encore d'évaluation

- ACT NO. 496 "The Land Registration Act. "Document1 pageACT NO. 496 "The Land Registration Act. "Emil Bautista100% (3)

- Supreme Court Ruling on Illegal Possession of Firearms CaseDocument15 pagesSupreme Court Ruling on Illegal Possession of Firearms CaseNoel Gillamac0% (1)

- CIR V Toledo (2015)Document2 pagesCIR V Toledo (2015)Anonymous bOncqbp8yiPas encore d'évaluation

- Chanakya National Law University, PatnaDocument16 pagesChanakya National Law University, PatnaKaustub PrakashPas encore d'évaluation

- The Law On MarriageDocument284 pagesThe Law On Marriagemeowiskulet100% (2)

- 2016 Ballb (B)Document36 pages2016 Ballb (B)Vicky D0% (1)

- Introduction To The IDDRSDocument772 pagesIntroduction To The IDDRSccentroamérica100% (1)

- Let's - Go - 4 - Final 2.0Document4 pagesLet's - Go - 4 - Final 2.0mophasmas00Pas encore d'évaluation

- PTA Vs Philippine GolfDocument2 pagesPTA Vs Philippine Golfrm2803Pas encore d'évaluation

- (G.R. No. 102772. October 30, 1996.) PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, v. ROGELIO DEOPANTE y CARILLO, Accused-AppellantDocument8 pages(G.R. No. 102772. October 30, 1996.) PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, v. ROGELIO DEOPANTE y CARILLO, Accused-AppellantJoy NavalesPas encore d'évaluation

- Chapter 11 Path To Modernization - HssliveDocument7 pagesChapter 11 Path To Modernization - Hssliveanujdubey0183% (6)

- Indian JudiciaryDocument6 pagesIndian JudiciaryAdiba A. 130Pas encore d'évaluation

- Jonathan Fenby Will China Dominate The 21st Centur PDFDocument4 pagesJonathan Fenby Will China Dominate The 21st Centur PDFjoeboots78Pas encore d'évaluation

- Moot MemorialDocument18 pagesMoot MemorialHarshit Chordia100% (1)

- Thayer Strategic Implications of President Biden's Visit To VietnamDocument3 pagesThayer Strategic Implications of President Biden's Visit To VietnamCarlyle Alan Thayer100% (1)

- "Captain America: The First Avenger" Article (Interview With Star Chris Evans, Director Joe Johnston and Screenwriters Stephen McFeely and Christopher Markus)Document4 pages"Captain America: The First Avenger" Article (Interview With Star Chris Evans, Director Joe Johnston and Screenwriters Stephen McFeely and Christopher Markus)Frank Lovece100% (1)

- The Seventh Day Adventists - Sunday Study in CultsDocument30 pagesThe Seventh Day Adventists - Sunday Study in CultssirjsslutPas encore d'évaluation

- Dreadful MutilationsDocument2 pagesDreadful Mutilationsstquinn864443Pas encore d'évaluation

- Case Study - Pharma IndustryDocument2 pagesCase Study - Pharma IndustryMazbahul IslamPas encore d'évaluation

- Miriam Makeba (A Hero)Document18 pagesMiriam Makeba (A Hero)TimothyPas encore d'évaluation

- "When Reality Strikes" (Grade 9)Document4 pages"When Reality Strikes" (Grade 9)Jeffrey De ChavezPas encore d'évaluation

- Password Reset B2+ CST 4BDocument1 pagePassword Reset B2+ CST 4BSebastian GrabskiPas encore d'évaluation

- Cyber Law Course OutlineDocument4 pagesCyber Law Course OutlineYashwanth KalepuPas encore d'évaluation

- Violence Against MenDocument2 pagesViolence Against MenPriya GuptaPas encore d'évaluation

- Criminal Law Assignment 2Document13 pagesCriminal Law Assignment 2Ideaholic Creative LabPas encore d'évaluation

- USCIS Policy Memo Perez-Olano Settlement AgreementDocument7 pagesUSCIS Policy Memo Perez-Olano Settlement AgreementValeria GomezPas encore d'évaluation

- ISLAMIC CODE OF ETHICS: CORE OF ISLAMIC LIFEDocument2 pagesISLAMIC CODE OF ETHICS: CORE OF ISLAMIC LIFEZohaib KhanPas encore d'évaluation

- Holiday List - 2020Document3 pagesHoliday List - 2020nitin369Pas encore d'évaluation

- Revised Reading List Term 2 2011-2Document25 pagesRevised Reading List Term 2 2011-2Victor SilvaPas encore d'évaluation

- Right To Freedom of Religion With Respect To Anti-Conversion LawsDocument11 pagesRight To Freedom of Religion With Respect To Anti-Conversion LawsAditya SantoshPas encore d'évaluation