Académique Documents

Professionnel Documents

Culture Documents

Corporate Gov PDF

Transféré par

Md MirazTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Corporate Gov PDF

Transféré par

Md MirazDroits d'auteur :

Formats disponibles

Corporate Governance Compliance Corporate Governance Compliance Corporate Governance Compliance Corporate Governance Compliance

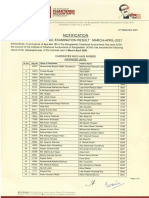

The main determinants of a company’s corporate governance In Bangladesh we have recent survey conducted by Imam that are listed by the Chittagong Stock Exchange for the term this no difficulty emerged in the study as all the information was 8.0 Findings and Analysis Table 2

system are ownership structure and legal framework. In this (2000) focused on some form of disclosure related to human from 29th March 2007 onwards. The principal objective of the straight forward regarding the compliance of the rules and in Total Appointment Board meeting

All companies included in this study made significant reports on

study we will try to focus that the practice corporate governance resource, community, and consumer disclosure. But it’s not research is to investigate into the various aspects of corporate non-compliance cases with reasons specified. attendance

governance of Bangladesh and to provide an analytical Corporate Governance. In this section, Corporate Governance

Corporate Governance Compliance: A study of the listed system among some selected top companies in Bangladesh.

There is one study concerning CSR reporting practice of some

about pure corporate governance practice. In their article

corporate social responsibility reporting practice (Abid and description. The followings are the specific objectives of this

The reports were analyzed by classifying them into five major

areas as specified by the Securities and Exchange Commission:

practices in Bangladesh have been analyzed under five

Textiles & Clothing

Pharmaceuticals & Chemicals

2

3

2

3

2

3

categories as set by the Securities and Exchange Commission

companies based on CSE-30 Index selected companies in Bangladesh (Abid & Taneem, 2007) and

another brief study on Bangladeshi CSR by Belal (1999). In this

Taneem, 2007) conclude that although number of companies

are making social disclosures, the quantity of information

study:

1. To analyze the nature of corporate governance being

1. Board of Directors mentioned above.

Cement

Engineering & Electrical

1

1

1

-

1

1

study rather than reporting practice, we focus on how strictly disclosed is very low. Sound corporate governance practice is complied by the listed companies of Bangladesh. 2. Chief Financial Officer, Head of Internal Audit and

Professor K. M. Golam Muhiuddin, FCMA*, Mohammad Nayeem Abdullah**& Sabrina Hossain*** 8.1 Board of Directors Leather & Footwear 1 1 -

the selected companies are abiding by the SEC rules and part of the corporate social responsibility. Here in this article we Company Secretary

2. To determine the quality of the compliance by the The results of this study in the area of board of directors were Paper, Printing & Packaging 1 1 1

will try to focus on regulation that is followed by listed 3. Audit Committee

Abstract: Corporate Governance is new in Bangladesh. This study makes an attempt to investigate the current practices of Corporate regulations. listed companies. Energy 1 1 1

companies. satisfactory. All 30 companies included in the survey did

Governance in Bangladesh in the listed companies in the stock market. The analysis was done in terms of the five major criteria as set by 3. To compare the different sectors of the listed 4. External/ Statutory Auditors comply with an extent. Bank 16 13 9

2.0 Corporate Governance reporting Defined 4.0 Statement of the problem

the SEC for the Corporate Governance compliance. The results thus realized are satisfactory but to improve the general quality of companies in this regard. 5. Reporting the Compliance in the Director’s Report Information Communication &

corporate governance practices in Bangladesh this study can be helpful. From the findings many firms do comply or implement the code Many writers defined corporate governance in different way. Historical experience suggests that it is very difficult for All 30 companies reported that the board’s size is as required. Technology 1 1 1

in their own way, but it should be maintained strictly in the practices, policies, regulation and procedures of the companies in businesses to operate effectively in a nation wracked by 6.0 Limitations of the study Board of Directors includes the board’s size, independent But only 14 companies out of 30 have an independent director.

Existing definitions of corporate governance fall on to a Leasing & Finance 2 1 2

Bangladesh. political or macro-economic instability. These are especially This study is on the listed 30 companies of the Chittagong Stock directors, Chairman of the Board and Chief Executive, and The 11 companies mentioned that the directors are being recruited

spectrum, with narrow views at one end and more inclusive, Miscellaneous 1 - -

damaging for capital spending, since entrepreneurs are typically Exchange that has at least 11 different sectors. This report may Director’s Report to shareholders. The Board’s size should not and will be reported in the annual report the following year.

Keywords: CSE- 30, SEC, Corporate Governance, Board of Directors, Compliance. broad views placed at other. The narrow view, of corporate

unwilling to make long-term, potentially appropriable not give a true indication of the analysis, as the annual reports be less than 5 and more than 20. And the companies should This information was mentioned in the first few pages of the

Total- 30 24 21

governance is restricted to the relationship between company

investments in a country where legal rules are prone to sudden collected are of the year 2005-2006, which is the latest that have at least one tenth of the total number of the company’s Location of Information

1.0 Introduction: substitute for the market in determining the allocation of and its shareholder. The finance paradigm, expressed in agency report where the list of directors and management was

could be gathered in all the different sectors concerned for the board of directors, subject to a minimum of one, who should be List of Board of Director’s,

resources. Transactional cost economics attempts to incorporate theory is indicative of a narrow view. At the broad end of change or where taxes, inflation, or high interest rates can introduced. In three cases the independent director was

Corporate governance has become one of the most commonly study. Hence a lot of the information may not be valid any an independent director. The Chairman and the CEO must be Management & Auditors 24

human behavior in a more realistic way. In this paradigm, spectrum, corporate governance may be seen as a web of quickly eviscerate an investment’s value. (Roe, 2003). introduced as independent director, but in the other 8 cases the

used phrases in the business vocabulary. Conflict of interest is longer at the present date. separate persons, and the director’s report to shareholders must Director’s Report 12

managers and other economic agent practice bounded relationship, not only between a company and its shareholder Bangladesh has severe political crisis that affects overall rules independent director was not mentioned in the introduction but

the main problem in the auditor’s firm. Independent include fairly prepared financial statements, proper books of General Information 4

rationality and are opportunistic by nature, these results in and regulation growth and business environment. rather in either the annexure of the compliance where the

appointment of the company’s auditors by the company’s but also between a company and a broad range of stakeholder. 7.0 Research Methodology account, appropriate accounting policies, International Others 5

managers organizing transactions in their best interest. The best definition of corporate governance: The way in which companies finance themselves and the Accounting standards in the statements prepared, sound system companies claim to have an independent director or in the

shareholders is replaced by subjective appointment by company 7.1 Sample

Source: Annual reports (2005-2006)

(Williamson 1979) structure of corporate ownership within an economy are Company activities where the directors’ roles are specified and

bosses, where the auditor is all too often beholden to the of internal control, issuing company’s ability to continue as a

“Corporate governance is the system of checks and balances, considered to be principal determinants of country’s corporate As the study is confined to the listed companies only, 29 companies reported that the Chairman and the Chief

company’s senior management. (Solomon & Solomon, 2004) Stakeholder theory: a basis for stakeholder theory is that going concern, highlights and reasons specified in significant defined.

both internal and external to companies, which ensures that governance system. An insider dominated system of corporate companies which are included in the latest Chittagong Stock Executive Officer are filled by different persons. Only

companies are so large, and their impact o society so pervasive, deviations from last year, and last three years key operating and

The fall of Enron was the biggest corporate collapse ever, and companies discharge their accountability to all their HEIDELBERGCEMENT BANGLADESH LTD. has the Chairman

that they should discharge accountability to many more governance is one in which a country’s publicly listed Exchange (CSE) Selective Index (CSE -30), dated 29 March 2007 financial data.

the suffering caused by Enron’s collapse was extensive and stakeholders and act in a socially responsible way in all areas of Table 1 and the Managing Director/ CEO the same person. (Annual

sectors of the society than solely their shareholder. companies are owned and controlled by small number of major being effective for only six months onward have been chosen as

showed us that strong corporate governance needs to play to their business activity.”(Solomon & Solomon, 2004) CFO, Head of Internal Audit and Company Secretary includes Report-2005, Pg. 03). Although it is mandatory for a company if

shareholders .Insider systems are basically relationship based the sample of the study. CSE-30 comprises thirty companies Total Board’s Independent Chairman of Director’s

prevent them. First, corporate governance has become important because the mainly two issues: first that the CFO, Head of Internal Audit and listed in the CSE-30 to have the Chairman and Chief Executive

3.0 Literature review system .on the other hand the term outsider refers to the system selected by the CSE based on important criteria used as Size Directors the Board Report to

role of capital markets has grown so dramatically during the Company secretary should be appointed, and their roles, Officer as two separate individuals, this cement company, being

A number of theoretical frameworks have evolved to explain of finance and corporate governance where most large firms are benchmark of performance. These companies are quoted on and Chief Sharehol-

past decade. Second, a flood of recent academic research has One of the first influential paper on Corporate Governance was responsibilities and duties should be defined clearly. Secondly Executive ders the only cement company to be listed in the CSE-30, does not

and analyze corporate governance. For example, controlled by their managers but owned by outside Dhaka Stock Exchange (DSE) as well. The study accepts CSE-30

clearly documented the importance of effective governance in Shleifer and Vishny (1997), since it synthesized the existing the CFO and the Company Secretary of the companies should Textiles & Clothing 2 2 1 2 2 comply with the rules.

- Agency theory arises from the field of finance and economics. maximizing the value and productivity of a nation’s publicly shareholders, such as financial institutions or individual as sample because the thirty ideal companies are expected to

strands of research to that time—and was in fact named “a attend meetings of the BOD. Pharmaceuticals & 3 3 3 3 3

shareholder. reveal improved findings on Corporate Governance. A list of The Director’s Report to Shareholders has been included in the

- Transaction cost theory; arise from economics and traded firms. Third, the spread of privatization programs around Chemicals

survey of corporate governance.” the sample companies from various eleven sectors has been The company should have an audit committee as a sub- Cement 1 1 1 - 1 annual reports of 28 companies, only 6.7% companies failed to

organizational theory. the world has forced governments to improve (or create) Bangladeshi system is still bank based system, where as share

Maher and Andersson (1999) analyze the point on the basis of shown in Appendix 1. committee of the BOD. This also includes sectors like Engineering & comply with this clause, in that they did not have a separate

effective governance systems in order for the programs to be market is growing. Due to political influence on the banks, it’s

- Stakeholder theory, arise from a more social oriented shareholder versus stockholder’s models. In their opinion constitution, chairman also reporting of the audit committee to Electrical 1 1 - 1 1 report in the annual reports but rather did sign in the financial

perceived as economic and political successes. (Megginson, difficult to have sound corporate governance practice. Even The most important aspect of this study is the use of secondary

perspective on corporate governance. 2000) the BOD, authorities and also the shareholders and general Leather & Footwear 1 1 1 1 1 statements provided by the auditors. However they did report

neither model has competitive advantage. though researcher like (Charkam, 1994) has concluded in favor data. Annual reports are considered as the only means of Paper, Printing &

investors. but the format was different.

Agency theory: The ‘divorce’ of ownership and control led to The system of corporate governance presiding in any country is The works of LaPorta, Lopez-de-Silanes, Shleifer, and Vishny of insider model the tide is flowing in opposite direction. For information communication in the context of Bangladesh. Packaging 1 1 - 1 1

the notorious agency problem. First detailed theoretical the sound corporate governance practice (Megginson, 2000) Secondary data have been collected from the latest published Functions like valuation services, financial information systems Energy 1 1 - 1 1 As shown in the table below (Table 1) information relating to

determined by a wide array of internal factors including (LLSV, 1997) have had unprecedented impact. They use sample

exposition of agency problem was presented in Jensen and suggested some guidelines follows below: 1) legal reforms 2) annual reports of sample organizations. The collected data have design and implementation, book-keeping, broker-dealer Bank 16 16 7 16 14 the board of director was provided in the list of Board of

corporate ownership structure, the state of the economy, the of 49 countries and show that countries with poorer investor Information

Meckling (1976). They defined the mangers of the company as Mandate international accounting standards. 3) Promote high been classified and tabulated manually. services, actuarial services, internal audit services should not be Directors and Management list. Only the Director’s Report to

legal system, government policies, culture and history. There is protection—measured both by the character of legal rules and Communication &

the agents and the shareholders as the principal. Problem arises, standards for listing on the national stock market.4) Encourage conducted by its external auditors. Shareholders was provided in the Directors Report to the

also a host of external influences such as the extent of capital the quality of law enforcement—have smaller and less liquid 7.2 Extent of Corporate Governance Appliance Technology 1 1 - 1 1

when the agents make decisions that are not necessarily in the institutional investors to become major players in the national Shareholders and fulfilled all the set criteria. Two listed banks

inflows from abroad, the global economic climate and cross capital markets. Last but not the least, reporting of the compliance of these Leasing & Finance 2 2 1 2 2

best interests of principal. stock market.5) Establish workable, efficient bankruptcy systems The research method involved rigorous examination and only did not include the report. The independent director’s

border institutional investment. activities of the firm in the director’s report must be attached, Miscellaneous 1 1 - 1 1

LLSV (1998) document (and provide a rationale for) the fact that 6) Clarify—but limit—government’s role in corporate analysis of the annual reports under analysis to observe the recruitment was also not mentioned in many reports and these

Transaction cost theory: transaction cost theory is based on the with reasons in non-compliance. Total- 30 30 14 29 28

Political forces account for the difference in choice of corporate ownership concentration is highest in countries offering poor governance. Sometimes it’s difficult for third world country like regularity of Corporate Governance keeping in mind the Location of were gathered by personal enquiry.

fact that firms have become so large that they, in effect, The issues mentioned above are all mandatory for compliance.

governance models among various countries. Political forces--- investor protection, which is consistent with the idea that small, Bangladesh to have a sound practice in such macro economic objectives of the research. All the sections of all the 30 Information

Hence in summary of the clause 1 of the Corporate Governance

party systems, political institutions, political orientations of diversified shareholders are unlikely to be important in companies’ annual reports were carefully examined to ease the The selected companies of the CSE-30 index should comply List of Board of

instability. Director’s, & compliance it can be stated that the Pharmaceuticals and

* Professor K. M Golam Muhiuddin, FCMA , Department of Accounting & Information governments and coalitions, ideologies, and interest groups--- analysis. with the stated clauses and in cases of non-compliance, reasons

countries that fail to protect outside investors. After that in the Management 30 9 29 Chemicals & Leather and Footwear complies to the fullest

Systems, University of Chittagong, Bangladesh 5.0 Objectives of the Study should be mentioned.

** Mohammad Nayeem Abdullah, Lecturer, School of Business, Independent are the primary determinants of the degree of shareholder year 1999 -2000 they have published another two articles The reports were analyzed and where the information was not Directors’ Report 28 extent, whereas the others including the banking sector

University, Bangladesh, Email: nayeem30@yahoo.com diffusion and the relationships among managers, owners, concerning about ownership concentration and dividend This study on Corporate Governance Compliance of the listed available an interview with the concerned authority was taken This report is a study of corporate governance compliance of Others 5 complies also but the exceptions were in the employment of

*** Sabrina Hossain, Lecturer, School of Business Independent University, companies of Bangladesh is based on a sample of 30 companies

workers, and other stakeholders of the firm. (Roe, 2003) policy. so as to get the right information for the research. Apart from the CSE-30 companies, and the findings are stated below. Source: Annual reports (2005-2006) independent directors in all the cases.

Bangladesh Email: sabrinahossain@gmail.com

The Cost and Management, September-October, 2008 13 14 The Cost and Management, September-October, 2008 The Cost and Management, September-October, 2008 15 16 The Cost and Management, September-October, 2008

Corporate Governance Compliance Corporate Governance Compliance Corporate Governance Compliance Corporate Governance Compliance

8.2 Chief Financial Officer, Head of Internal Audit and Table 3 Table 4 Information about the constitution of the Audit Committee and 9.0 Conclusion Enterprises in China.) Co-sponsored by the: Organization for Economic

Company Secretary the Chairman of the Audit Committee was found in the List of Cooperation & Development Research Center of the State Council of the PRC

Total Constitution Chairman Reporting of the Report to Total Non- Non- Non- Non- Non- Non- Non- In conclusion it can be stated that although many companies of

of Audit of Audit Audit Committee Shareholders engage- engage- engage- engage- engage- engage- engage- Board of Directors, Management and Auditors or as stated in Asian Development Bank Beijing, China January 18-19, 2000.(page: 1-2)

In this area there is also satisfactory extent of compliance. 80% ment in ment in ment in ment in ment in ment in ment in

the listed ones are making satisfactory compliance with the

Committee Committee Reporting Reporting and General some annual reports in the employees’ directory. However the 15) William L. Megginson(2000) ,[Corporate governance in publicly quoted company]

of the companies reported that they have appointed a CFO, to the BOD to the Investors appraisal designing in Book- Book Actuarial Internal other code of Corporate Governance, but there are still many

or of Financial keeping dealer Services Audit services rest information regarding the reporting of the Audit Committee For presentation at the conference on:(Corporate Governance of State-Owned

Head of Internal Audit and Company Secretary. The rest 20% Authorities companies that fail to comply with the main aspects of this

Textiles & Clothing 2 1 1 2 2 2 valuation Information service was as stated in the Auditor’s Report and the various the Enterprises in China.) Co-sponsored by the: Organization for Economic

companies although have a CFO but they have not yet System governance. The reasons for this non-compliance could be

Pharmaceuticals & financial statements attached. Cooperation & Development Research Center of the State Council of the PRC

appointed an internal audit and have reported either in personal Chemicals 3 3 2 3 3 3 Textiles & attributed to the lack of statutory requirement, less awareness,

Asian Development Bank Beijing, China January 18-19, 2000.(page: 9-12)

enquiries or in notes that the internal audit recruitment is in Cement 1 1 - 1 1 1 Clothing 2 2 2 2 2 2 2 2 8.4 External/ Statutory Auditors an under developed corporate culture, and might also be the

Engineering & Pharmac- 16) William L. Megginson(2000) ,[Corporate governance in publicly quoted company]

process. All the listed 30 companies analyzed in this criterion gave very sample size. Since the study is based on only 30 listed

Electrical 1 - - 1 1 1 euticals & For presentation at the conference on:(Corporate Governance of State-Owned

Information regarding requirement to attend board meeting or Leather & Footwear 1 1 1 1 1 1 Chemicals 3 3 3 3 3 3 3 3 common results. 21 companies out of the 30 listed did mention companies in the Chittagong Stock Exchange, it actually does

Enterprises in China.) Co-sponsored by the: Organization for Economic

board meeting attendance was not disclosed in the annual

Paper, Printing & Cement 1 1 1 1 1 1 1 1 in the report about the compliance of this criterion. And the rest not portray all the companies of Bangladesh. In such

Packaging 1 - - 1 1 1 Cooperation & Development Research Center of the State Council of the PRC

reports or even in personal enquiries. 70% of the companies Engineering 9 listed companies had nothing mentioned in the report and circumstances it is advisable that not only the listed but also the

Energy 1 - 1 1 1 1 Asian Development Bank Beijing, China January 18-19, 2000.(page: 21-22)

& Electrical 1 1 1 1 1 1 1 1 non-listed companies should take up Corporate Governance as

reported in the annual report the board meetings held and Bank 16 7 13 16 16 16 hence through personal queries it was found that they also do

Leather & 17) William L. Megginson(2000) ,[Corporate governance in publicly quoted company]

attendance of the officials, but the rest 30% did not mention Information comply with this criterion it boosts economic growth, reduces corruption and also eases

Footwear 1 1 1 1 1 1 1 1 For presentation at the conference on:(Corporate Governance of State-Owned

Communication & the flow of funds.

anything related to the board meeting and when personally Paper, This information was found in the Compliance summary sheet

Technology 1 - - 1 1 1 Enterprises in China.) Co-sponsored by the: Organization for Economic

enquired gave no pertinent information. Leasing & Finance 2 1 1 2 2 2

Printing &

attached in the annual report either as a section or within the Cooperation & Development Research Center of the State Council of the PRC

Packaging 1 1 1 1 1 1 1 1

The required information of the criteria of Appointment of the Miscellaneous 1 - 1 1 1 1 director’s report to the shareholders. And in 30% of the cases it References Asian Development Bank Beijing, China January 18-19, 2000.(page: 23-24)

Total- 30 14 20 30 30 30 Energy 1 1 1 1 1 1 1 1

CFO, Head of Internal Audit and Company Secretary was Bank 16 16 16 16 16 16 16 16 was required to meet the officials of the companies to gather the 18) Williamson, O. (1979), "Transaction cost economics: the governance of

Location of 1) Belal , A.R (1999) “ corporate social reporting in Bangladesh “, social and

enclosed in the report in 80% of the cases. It was shown in the Information Information information. contractual relations", Journal of Law and Economics, Vol. 22 pp.233-62.

environmental accounting , vol 19 no.1 pp 8-12.

List of Board of Director’s, List of Management & List of Auditor’s Report 15 30 30 30 Communi-

List of Board of cation & 8.5 Compliance details in the Director’s Report 2) Charkam, J., 1994, “Keeping Good Company: a Study of Corporate Governance in

Auditors. The rest 6 companies in the Engineering & Electrical

sector that is eastern cables, and the others in the Banking

Director’s, Manage- Technology 1 1 1 1 1 1 1 1

The last and the fifth condition of the SEC regarding Corporate

Five. Countries”, Clarendon Press, Oxford. Appendix 1: List of companies surveyed

ment & Auditors 13 2 Leasing &

sector did not enclose this information in the report and Others 1 3 Compliance in which the directors of the company should 3) Jill Solomon & Aris Solomon. (2004). Corporate Governance and Accountability, Name of Companies Sector

Finance 2 2 2 2 2 2 2 2

Chi Chester: John Wiley & Sons.

reported in the personal enquiry that they are on the verge of Source: Annual reports (2005-2006) Miscella- report whether the company has complied with the conditions 1. Beximco textile limited Textiles & clothing

recruiting one. neous 1 1 1 1 1 1 1 1 and if not, with reasons, although being mandatory was not 4) Khan, Abid Hossain and Muzaffar, Taneem Ahmed (2007) corporate social 2. Square Textiles limited Textiles & clothing

Total- 30 30 30 30 30 30 30 30 complied by 9 companies, that is by 30% companies. Amongst responsibility reporting practices: A study on selected listed companies of 3. Square Pharmaceuticals Limited Pharmaceuticals and Chemical

Details of the Board of Meeting and the attendance were not personal enquiries they did report that they are enclosing the Location of Bangladesh. [Unpublished]

the non-compliance firms were 3 banks, namely National Bank, 4. Advanced Chemicals Industries Pharmaceuticals and Chemical

mentioned in the annual reports in 30% of the cases. Bata Shoe details in the annual report of the following year. Information 5. Beximco Pharmaceuticals Limited Pharmaceuticals and Chemical

Pubali Bank & One Bank Ltd; along with Miracle industries Ltd, 5) Khan, Abid Hossain and Muzaffar, Taneem Ahmed (2007) corporate social

Company (Bangladesh) and Usmania Glass Sheet Factory are Corporate

responsibility reporting practices: A study on selected listed companies of 6. Heidelberg Cement Bangladesh Limited Cement

8.3 Audit Committee Governance Bangladesh Online Limited, BOC Bangladesh, etc.

amongst the others with the banking sector in which such Bangladesh. [Unpublished] pp: 12-13. 7. Eastern Cables Limited Engineering and Electrical

Compliance

pertinent information was missing. This area was the most crucial study. Of the 30 listed In some cases it was mentioned under the compliance summary 8. Bata Shoe Company Leather and Footwear

Report in the 6) La Porta, Rafael, Florencio López-de-Silanes, Andrei Shleifer, and Robert W.Vishny,

companies focused for the analysis of Corporate Governance, it sheet attached in the report that this section is “not applicable”. 9. Miracle Industries Limited Paper, Printing & Packaging

The required information of this criterion was available in 70% annual report 21 21 21 21 21 21 21 1997, Legal determinants of external finance, Journal of Finance 52, 1131-1150.

was found that only 67% of the companies did have an Audit Others 9 9 9 9 9 9 9 10. BOC Bangladesh Limited Energy

of the cases. 40% listed firms has this information in the Table 5 7) La Porta, Rafael, Florencio López-de-Silanes, Andrei Shleifer, and Robert W. Vishny,

Committee as a sub-committee of the Board of Directors. The 11. Arab Bangladesh Bank Bank

Director’s Report, 13% in the General information pages and experience in accounting or finance. All the companies that did 1998, Law and finance, Journal of Political Economy 106, 1113-1150.

rest listed companies did not comply with this section because Total In the annexure of the report it 12. National Bank Limited Bank

the rest 17% in other areas including personal enquiries. comply with this section do have a Chairman for the 8) La Porta, Rafael, Florencio López-de-Silanes, Andrei Shleifer, and Robert W. 13. The City Bank Limited Bank

of the reasons stated below. has been mentioned

Surprisingly Usmania Glass Sheet factory being the only glass Committee. However the cement sector, engineering and Textiles & Clothing 2 2 Vishny, 1999a, The quality of government, Journal of Law, Economics, and 14. Pubali Bank Limited Bank

sheet to be listed in the CSE-30 had no information in the In order to comply with the Audit Committee Constitution the electrical sector, paper, printing and packaging sector, IC&T Organization 15, 222-279. 15. Islami Bank Bangladesh Limited Bank

Pharmaceuticals & 3 1

annual report regarding either the appointment of the CFO, committee must have at least three members, and one of sectors are the ones that did not comply, and out of 16 banks 9) La Porta, Rafael, Florencio López-de-Silanes, Andrei Shleifer, and Robert W. 16. Prime Bank Limited Bank

Chemicals Cement 1 1

Head on Internal Audit and Company Secretary or the board mandatory members at least has to be an independent director. listed in the CSE-30, 13 reportedly has a Chairman fulfilling this Vishny, 1999b, Investor protection: Origins, consequences, reform, working 17. Dhaka Bank Bank

Engineering & Electrical 1 -

As only 14 companies out of 30 that are listed have an criterion. paper (MIT, Cambridge, MA). 18. Southeast Bank Limited Bank

meetings held and the attendance record. However in the Leather & Footwear 1 1

independent director, this clause was not fully complied with. 19. Mutual Trust Bank Limited Bank

Having an Audit Committee must also report to the Board of Paper, Printing & Packaging 1 - 10) La Porta, Rafael, Florencio López-de-Silanes, and Andrei Shleifer, 1999a,

20. One Bank LImited Bank

Although many of the listed company did have the other two Directors and the Authorities and also to the Shareholders and corporate ownership around the world, Journal of Finance 54, 471-517.

Energy 1 - 21. Bank Asia Limited Bank

CFO, Head of Internal Audit and Company Secretary members right in many cases, but still having no independent the General Investors. Fortunately in the survey it was found 11) Mark J. Roe. (2003). Political Determinants of Corporate Governance: Political

Bank 16 13 22. Mercantile Bank Limited Bank

director does not fully satisfy this clause. And in such that although 20 listed companies do have an Audit Committee Context, Corporate Impact, and New York: Oxford University Press. 9 (Page2-3).

includes mainly two issues: first that the CFO, Head of Information Communication 23. Uttara Bank Limited Bank

circumstances it was found that the banks were amongst the as a sub-committee of the Board of Directors, the rest 10

& Technology 1 - 12) Michael C. Jensen and William H. Meckling (1976)” Theory of the Firm: 24. Eastern Bank Limited Bank

Internal Audit and Company secretary should be main ones that failed to comply. Only 7 banks out of the 16 companies listed also has an audit committee but not in terms

Leasing & Finance 2 2 Managerial Behavior, Agency Costs and Ownership Structure”, Journal of 25. Export Import Bank of Bangladesh Limited Bank

appointed, and their roles, responsibilities and duties listed banks did comply, (rest failed in the term of having an of the Corporate Governance SEC regulations. Hence all 30 Financial Economics, October, 1976, V. 3, No. 4, pp. 305-360.

Miscellaneous 1 1 26. Jamuna Bank Limited Bank

listed companies did have information to be passed to the

should be defined clearly. Secondly the CFO and the independent director). Total- 30 21 13) Imam, S. (2000) Corporate Social Performance reporting in Bangladesh, 27. Bangladesh Online Limited ICT

shareholders and board of directors in the form of Auditors

Location of Information managerial auditing journal, vol .15 no.3, pp133-41. 28. Uttara Finance and Investment Limited Leasing and Finance

Company Secretary of the companies should attend Fortunately for the country it was found that 20 listed Report. Hence all the annual reports studied of the 30 listed

Annexure 21 29. First Lease International Limited Leasing and Finance

meetings of the BOD. companies do have a Chairman of the Audit Committee that has companies did have the Auditor’s Report attached to give 14) William L. Megginson(2000) ,[Corporate governance in publicly quoted company]

30. Usmania Glass Sheet Factory Limited Miscellaneous

a professional qualification or knowledge, understanding and information to the concerned stakeholders. Source: Annual reports (2005-2006) For presentation at the conference on:(Corporate Governance of State-Owned

18 The Cost and Management, September-October, 2008 The Cost and Management, September-October, 2008 19 20 The Cost and Management, September-October, 2008

Th e C o s t a n d M a n a g e m e n t, S e p te m b e r -O cto b e r , 2 0 0 8 17

Vous aimerez peut-être aussi

- Tax Compliances Day 4Document15 pagesTax Compliances Day 4Md MirazPas encore d'évaluation

- 3 Business Finance Questions Nov Dec 2019 CLDocument2 pages3 Business Finance Questions Nov Dec 2019 CLMd Miraz0% (1)

- 3 Business Finance Questions Nov Dec 2019 CLDocument2 pages3 Business Finance Questions Nov Dec 2019 CLMd Miraz0% (1)

- Advanced Level 2021Document2 pagesAdvanced Level 2021Md MirazPas encore d'évaluation

- Prohibition of Beneficial Owners Trade Rule 1995Document6 pagesProhibition of Beneficial Owners Trade Rule 1995Reefat HasanPas encore d'évaluation

- Evaluating Performance - Chapter 12Document10 pagesEvaluating Performance - Chapter 12Md MirazPas encore d'évaluation

- Tax Compliances Day 4Document15 pagesTax Compliances Day 4Md MirazPas encore d'évaluation

- ICAB Dhaka Mock Exam Schedule March 2021Document1 pageICAB Dhaka Mock Exam Schedule March 2021Md MirazPas encore d'évaluation

- VAT Mock Exam Time 2 Hours Marks 60: Prepared by Snehasish Barua, FCADocument3 pagesVAT Mock Exam Time 2 Hours Marks 60: Prepared by Snehasish Barua, FCAMd MirazPas encore d'évaluation

- Microsoft Word Shortcut Keys PDFDocument5 pagesMicrosoft Word Shortcut Keys PDFMd MirazPas encore d'évaluation

- Projects SolutionsDocument81 pagesProjects SolutionsMd Miraz100% (1)

- Previous LiteratureDocument1 pagePrevious LiteratureMd MirazPas encore d'évaluation

- U V J Ucyj E Wë: Mycörvzš¿X Evsjv 'K Mikvi Cöv - WGK WK V Awa'ßiDocument28 pagesU V J Ucyj E Wë: Mycörvzš¿X Evsjv 'K Mikvi Cöv - WGK WK V Awa'ßiMd MirazPas encore d'évaluation

- IFRS Seminar: IAS 39 Financial Instruments Recognition and Measurement OverviewDocument43 pagesIFRS Seminar: IAS 39 Financial Instruments Recognition and Measurement OverviewVher Ducay100% (1)

- NunDocument33 pagesNunMd MirazPas encore d'évaluation

- AIS09Document45 pagesAIS09Azhar UddinPas encore d'évaluation

- Previous LiteratureDocument1 pagePrevious LiteratureMd MirazPas encore d'évaluation

- Smart Box On The GoDocument52 pagesSmart Box On The GoNaimul Haque NayeemPas encore d'évaluation

- #Love - Pixel - B - Hash Tags - Deskgram PDFDocument10 pages#Love - Pixel - B - Hash Tags - Deskgram PDFMd MirazPas encore d'évaluation

- Business Plan On Fruits and Vegetable Supply ChainDocument27 pagesBusiness Plan On Fruits and Vegetable Supply ChainKishan Tank85% (165)

- Capiatal Budgeting Analysis 12.8Document4 pagesCapiatal Budgeting Analysis 12.8Md MirazPas encore d'évaluation

- Capiatal Budgeting Analysis 12.8Document4 pagesCapiatal Budgeting Analysis 12.8Md MirazPas encore d'évaluation

- Case Study - Bax Container Limited: Superior TechnologyDocument18 pagesCase Study - Bax Container Limited: Superior TechnologyMd MirazPas encore d'évaluation

- Previous LiteratureDocument1 pagePrevious LiteratureMd MirazPas encore d'évaluation

- Parmalatfinalpresentation 170717010056Document15 pagesParmalatfinalpresentation 170717010056Md MirazPas encore d'évaluation

- Jamil Sir Presentation SamplingDocument47 pagesJamil Sir Presentation SamplingMd MirazPas encore d'évaluation

- Instructions !!!Document1 pageInstructions !!!Al EnePas encore d'évaluation

- Basic Ali 2009 PDFDocument101 pagesBasic Ali 2009 PDFMd MirazPas encore d'évaluation

- Mohammad Al-Amin RashidDocument64 pagesMohammad Al-Amin RashidMd MirazPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Strategic Management Consolidated Assignment-2 - 10th February 22Document25 pagesStrategic Management Consolidated Assignment-2 - 10th February 22Mani Bhushan SinghPas encore d'évaluation

- Freeman PDFDocument27 pagesFreeman PDFJaqueline FonsecaPas encore d'évaluation

- Automobile Insurance - FAQ - Team-BHPDocument12 pagesAutomobile Insurance - FAQ - Team-BHPkrishnakumariramPas encore d'évaluation

- ch01Document25 pagesch01khalidhamdanPas encore d'évaluation

- Corporate Law and Corporate GovernanceDocument27 pagesCorporate Law and Corporate GovernanceNooria YaqubPas encore d'évaluation

- Emerging Markets Review: Wanli Li, Jingting Zhou, Ziqiao Yan, He Zhang TDocument25 pagesEmerging Markets Review: Wanli Li, Jingting Zhou, Ziqiao Yan, He Zhang TDessy ParamitaPas encore d'évaluation

- Life Insurance Premium Payment CalcDocument4 pagesLife Insurance Premium Payment Calcクマー ヴィーンPas encore d'évaluation

- Corporation Bank ProjectDocument65 pagesCorporation Bank ProjectAjay MasseyPas encore d'évaluation

- Glaucus Research - West China Cement - HK 2233 - Strong Sell August 8 2012Document52 pagesGlaucus Research - West China Cement - HK 2233 - Strong Sell August 8 2012mistervigilantePas encore d'évaluation

- 01&02 - GE05 - Fundamentals of Ethics, Corporate Governance and Business Law - A. Ethics and Business (15%)Document14 pages01&02 - GE05 - Fundamentals of Ethics, Corporate Governance and Business Law - A. Ethics and Business (15%)adnan.shajon40% (5)

- Principles of Corporate Governance ExplainedDocument18 pagesPrinciples of Corporate Governance ExplainedSarthak MishraPas encore d'évaluation

- DSNLU Corporate Law I Project Analysis of Minority Shareholder RightsDocument8 pagesDSNLU Corporate Law I Project Analysis of Minority Shareholder RightsBatmanPas encore d'évaluation

- Corporate GovernanceDocument46 pagesCorporate Governance9897856218Pas encore d'évaluation

- 4 Hoi and RobinDocument7 pages4 Hoi and RobinelizabetaangelovaPas encore d'évaluation

- Walt Disney - FinalDocument17 pagesWalt Disney - FinalJennifer NesterPas encore d'évaluation

- Activities/ Assessment:: Sky's The Limit: The China Sky Saga Discussion QuestionsDocument2 pagesActivities/ Assessment:: Sky's The Limit: The China Sky Saga Discussion QuestionsANH NGUYEN DANG QUEPas encore d'évaluation

- Premium for Good Corporate GovernanceDocument5 pagesPremium for Good Corporate GovernancelaloasisPas encore d'évaluation

- As 8003-2003 Corporate Governance - Corporate Social ResponsibilityDocument7 pagesAs 8003-2003 Corporate Governance - Corporate Social ResponsibilitySAI Global - APAC0% (1)

- Building upon our strengthsDocument65 pagesBuilding upon our strengthsgeopan88Pas encore d'évaluation

- Audit Mnager With Big 4 and Fortune 500 ExpertiseDocument2 pagesAudit Mnager With Big 4 and Fortune 500 Expertiseapi-77562463Pas encore d'évaluation

- Kier Ar 2023 Final PDFDocument248 pagesKier Ar 2023 Final PDFrab.nawaz1625Pas encore d'évaluation

- Dynamic Diversified Differentiated BankDocument29 pagesDynamic Diversified Differentiated BankAlaina LongPas encore d'évaluation

- MfrsDocument12 pagesMfrsiskandar027Pas encore d'évaluation

- Chapter 11 Governance & Social ResponsibilityDocument17 pagesChapter 11 Governance & Social ResponsibilityNoob HackerPas encore d'évaluation

- Global Compact Principles As An Effective Tool For Implementing Green HRM-A Study of Selected Indian CorporateDocument7 pagesGlobal Compact Principles As An Effective Tool For Implementing Green HRM-A Study of Selected Indian CorporateMahadharma RakshitaPas encore d'évaluation

- Annual Report 2019 Kattali Textile LTD PDFDocument78 pagesAnnual Report 2019 Kattali Textile LTD PDFRabib Ahmed100% (1)

- Emerging Markets PartnershipDocument20 pagesEmerging Markets PartnershipVikas Gupta67% (3)

- ESG Practices and Corporate Financial PerformanceDocument9 pagesESG Practices and Corporate Financial PerformanceNishanthi udagamaPas encore d'évaluation

- ADMM 2017 Artistic Denim Mills Limited - Text.markedDocument78 pagesADMM 2017 Artistic Denim Mills Limited - Text.markedMuqaddas KhalidPas encore d'évaluation

- Beams12ge Im12Document4 pagesBeams12ge Im12ElaPas encore d'évaluation