Académique Documents

Professionnel Documents

Culture Documents

Rdag Order

Transféré par

KCBD DigitalDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Rdag Order

Transféré par

KCBD DigitalDroits d'auteur :

Formats disponibles

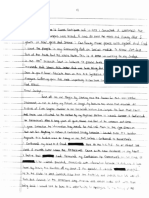

Case 18-50214-rlj11 Doc 1216 Filed 04/26/19 Entered 04/26/19 11:33:12 Page 1 of 4

The following constitutes the ruling of the court and has the force and effect therein described.

Signed April 25, 2019

United States Bankruptcy Judge

______________________________________________________________________

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE NORTHERN DISTRICT OF TEXAS

LUBBOCK DIVISION

IN RE: §

§

REAGOR-DYKES MOTORS, LP, et al.1 § Case No. 18-50214-rlj-11

§ Jointly Administered

Debtors. §

ORDER GRANTING AMENDED MOTION FOR APPROVAL OF SETTLEMENT AND

COMPROMISE WITH THE LUBBOCK COUNTY TAX ASSESSOR-COLLECTOR

UNDER BANKRUPTCY RULE 9019

On this day the Court considered the Amended Motion for Approval of Settlement and

Compromise with the Lubbock County Tax Assessor-Collector Under Bankruptcy Rule 9019 (the

“Motion”) [Docket No. 1147] filed by Reagor-Dykes Motors, LP, along with its debtor affiliates

1

The Debtors are Reagor-Dykes Motors, LP (Case No. 18-50214), Reagor-Dykes Imports, LP (Case No. 18-50215),

Reagor-Dykes Amarillo (Case No. 18-50216), Reagor-Dykes Auto Company, LP (Case No. 18-50217), Reagor-

Dykes Plainview, LP (Case No. 18-50218), Reagor-Dykes Floydada, LP (Case No. 18-50219), Reagor-Dykes

Snyder, L.P. (Case No. 18-50321), Reagor-Dykes III LLC (Case No. 18-50322), Reagor-Dykes II LLC (Case No.

18-50323) and Reagor Auto Mall I LLC (Case No. 18-50325).

ORDER GRANTING AMENDED MOTION FOR APPROVAL OF SETTLEMENT AND

COMPROMISE WITH LUBBOCK COUNTY TAX ASSESSOR-COLLECTOR

UNDER BANKRUPTCY RULE 9019 – PAGE 1

4833-0334-4015.3

Case 18-50214-rlj11 Doc 1216 Filed 04/26/19 Entered 04/26/19 11:33:12 Page 2 of 4

(“Reagor-Dykes,” or the “Debtors”), as debtors and debtors-in possession in the above-styled

and captioned case. It appearing that the Court has jurisdiction over this matter; and it appearing

that notice of the Motion as set forth therein is sufficient, and that no other or further notice need

be provided; and it further appearing that the relief requested in the Motion is in the best interests

of the Debtors and their estates and creditors; and upon all of the proceedings had before the

Court; and after due deliberation and sufficient cause appearing therefor, it is hereby

ORDERED that the Motion is GRANTED and, except as provided herein, the terms

outlined in the Motion are approved and enforceable, including that the Lubbock County Tax

Assessor-Collector’s office is authorized to waive the payment of unpaid motor-vehicle sales-tax

amounts due as a pre-condition for Texas consumers who purchased vehicles from the Reager-

Dykes Auto Group.

ORDERED that all persons in possession of certificates of titles (“Titles”) or

manufacturer’s certificates of origin (“MSOs”) for vehicles (i) sold (arguably or inarguably) by

Reagor-Dykes Auto Group and (ii) that still need to be registered for the buyer (“Vehicles”) shall

provide the Debtors with a list of all such Titles and MSOs in their possession within five (5)

days from entry of this Order. Upon receipt of a copy of (i) the retail sales contract or lease and

(ii) reasonably satisfactory proof of funding, all such persons identified in the preceding sentence

shall surrender the Titles and MSOs to the Debtors within seven (7) business days of such

receipt. The Debtors will hold the Titles and MSOs solely for consumer-registration purposes.

Notwithstanding anything herein to the contrary, this paragraph shall not apply to Titles or

MSOs that relate to Vehicles for which unpaid trade liens exist.

ORDERED that this Court will allow emergency telephonic hearings on three (3)

business days’ notice to resolve disputes over the turnover of Titles or MSOs to the Debtors as

ORDER GRANTING AMENDED MOTION FOR APPROVAL OF SETTLEMENT AND

COMPROMISE WITH LUBBOCK COUNTY TAX ASSESSOR-COLLECTOR

UNDER BANKRUPTCY RULE 9019 – PAGE 2

4833-0334-4015.3

Case 18-50214-rlj11 Doc 1216 Filed 04/26/19 Entered 04/26/19 11:33:12 Page 3 of 4

provided in this Order.

ORDERED that, notwithstanding anything to the contrary contained herein, and as part

of the process to be undertaken, the Debtors will submit, or cause to be submitted, to the

appropriate authority such paperwork or electronic information necessary to (a) transfer the

certificate of title into the new owner’s name, and (b) note any lien that has been granted by the

applicable consumer to a retail lender. Upon request, the Debtors will send to the applicable

retail lender or lessor copies of the proof of submission of the items listed in the preceding

sentence to the appropriate authority. With respect to leased vehicles for which title is to be

issued and the Debtors were the “selling” dealer, the Debtors will submit, or cause to be

submitted, to the appropriate authority such paperwork or electronic information necessary to

cause title to be issued in the name of the lessor.

ORDERED that nothing in this order shall impair, alter, or otherwise adversely affect the

liens or, in the case of leases, ownership rights, granted to the applicable retail lenders/lessors

with respect to the applicable motor vehicles to be titled through the process approved hereunder,

or the liens asserted by any unpaid trade lender.

### End of Order ###

PREPARED AND SUBMITTED BY:

ORDER GRANTING AMENDED MOTION FOR APPROVAL OF SETTLEMENT AND

COMPROMISE WITH LUBBOCK COUNTY TAX ASSESSOR-COLLECTOR

UNDER BANKRUPTCY RULE 9019 – PAGE 3

4833-0334-4015.3

Case 18-50214-rlj11 Doc 1216 Filed 04/26/19 Entered 04/26/19 11:33:12 Page 4 of 4

/s/ Marcus A. Helt

Marcus A. Helt (TX 24052187)

C. Ashley Ellis (TX 00794824)

FOLEY GARDERE

FOLEY & LARDNER LLP

2021 McKinney Avenue, Suite 1600

Dallas, TX 75201

Telephone: 214.999.3000

Facsimile: 214.999.4667

COUNSEL TO DEBTORS REAGOR-DYKES MOTORS, LP, et al.

ORDER GRANTING AMENDED MOTION FOR APPROVAL OF SETTLEMENT AND

COMPROMISE WITH LUBBOCK COUNTY TAX ASSESSOR-COLLECTOR

UNDER BANKRUPTCY RULE 9019 – PAGE 4

4833-0334-4015.3

Vous aimerez peut-être aussi

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Laz Engageent LetterDocument64 pagesLaz Engageent LetterChristoph SuterPas encore d'évaluation

- Et Al.: Debtor (Other Names, If Any, Used by The Debtor in The Last 8 Years Appear in Brackets) Address Case No. Taxid#Document2 pagesEt Al.: Debtor (Other Names, If Any, Used by The Debtor in The Last 8 Years Appear in Brackets) Address Case No. Taxid#Chapter 11 Dockets100% (1)

- Notice of Commencement of Chapter 11 Bankruptcy Case, Meeting of Creditors and Fixing of Certain DatesDocument3 pagesNotice of Commencement of Chapter 11 Bankruptcy Case, Meeting of Creditors and Fixing of Certain DatesChapter 11 DocketsPas encore d'évaluation

- Repossession DisputeDocument2 pagesRepossession Disputetpeeples67% (6)

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument22 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To J.R. Wortman Co., IncDocument18 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To J.R. Wortman Co., IncChapter 11 DocketsPas encore d'évaluation

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Armada Rubber Manufacturing CoDocument16 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Armada Rubber Manufacturing CoChapter 11 DocketsPas encore d'évaluation

- Docket Ref. No. 331 Hearing Date: September 25, 2008 at 2:00 P.M. Objection Deadline: September 18, 2008 at 4:00 P.MDocument6 pagesDocket Ref. No. 331 Hearing Date: September 25, 2008 at 2:00 P.M. Objection Deadline: September 18, 2008 at 4:00 P.MChapter 11 DocketsPas encore d'évaluation

- Debtors' Motion For Entry of Interim and Final OrdersDocument88 pagesDebtors' Motion For Entry of Interim and Final OrdersPhiladelphiaMagazine100% (1)

- Settlement For Carvana Signed by All 1 DMID1 5rttass7aDocument8 pagesSettlement For Carvana Signed by All 1 DMID1 5rttass7aMichael JamesPas encore d'évaluation

- Panay Railways, Inc. vs. HEVA Management and Development Corporation, 664 SCRA 1, January 25, 2012Document10 pagesPanay Railways, Inc. vs. HEVA Management and Development Corporation, 664 SCRA 1, January 25, 2012j0d3Pas encore d'évaluation

- 05-55927-swr Doc 10184 Filed 11/07/08 Entered 11/07/08 18:13:21 Page 1 of 7Document7 pages05-55927-swr Doc 10184 Filed 11/07/08 Entered 11/07/08 18:13:21 Page 1 of 7Chapter 11 DocketsPas encore d'évaluation

- 12 Asia International Auctioneers Vs Parayno Case DigestDocument1 page12 Asia International Auctioneers Vs Parayno Case DigestAnonymous MikI28PkJc100% (1)

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solo Products Co., LLCDocument18 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solo Products Co., LLCChapter 11 DocketsPas encore d'évaluation

- LBP Vs EscandorDocument5 pagesLBP Vs EscandorSugar Fructose GalactosePas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument26 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument41 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- G.R. No. 162267. July 4, 2008. Pci Leasing and Finance, Inc., Petitioner, vs. Ucpb General INSURANCE CO., INC., RespondentDocument10 pagesG.R. No. 162267. July 4, 2008. Pci Leasing and Finance, Inc., Petitioner, vs. Ucpb General INSURANCE CO., INC., RespondentulticonPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- RDAG Doc 779 1.3.19 MUSA Request To CompelDocument6 pagesRDAG Doc 779 1.3.19 MUSA Request To CompelKCBD DigitalPas encore d'évaluation

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solvay Engineered Polymers, IncDocument18 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solvay Engineered Polymers, IncChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument25 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument22 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Ex Parte Motion For Order Shortening Notice Period andDocument22 pagesEx Parte Motion For Order Shortening Notice Period andChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Southern District of New York::::::: Case No. 11-22866 (RDD)Document4 pagesUnited States Bankruptcy Court Southern District of New York::::::: Case No. 11-22866 (RDD)Chapter 11 DocketsPas encore d'évaluation

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Nyx, IncorporatedDocument18 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Nyx, IncorporatedChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Southern District of New YorkDocument10 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument134 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Unique Fabricating, IncDocument18 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Unique Fabricating, IncChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- 01 Country Bankers Insurance Corporation vs. LagmanDocument11 pages01 Country Bankers Insurance Corporation vs. LagmanAiren Jamirah Realista PatarlasPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument33 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Order Terminating FTX Naming Rts Agmt (Signed Jan 11 2023)Document11 pagesOrder Terminating FTX Naming Rts Agmt (Signed Jan 11 2023)David DworkPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Ashland Chemical, IncDocument16 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Ashland Chemical, IncChapter 11 DocketsPas encore d'évaluation

- Lheman BrotherDocument935 pagesLheman BrotherBabasab Patil (Karrisatte)Pas encore d'évaluation

- Williams v. Hagood, 98 U.S. 72 (1878)Document4 pagesWilliams v. Hagood, 98 U.S. 72 (1878)Scribd Government DocsPas encore d'évaluation

- PCI Leasing and Finance, Inc. vs. UCPB GeneralDocument15 pagesPCI Leasing and Finance, Inc. vs. UCPB GeneralHyacinthPas encore d'évaluation

- Reynaldo Lozano v. Hon. Eliezer de Los SantosDocument2 pagesReynaldo Lozano v. Hon. Eliezer de Los SantosbearzhugPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument3 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Here Is Why He FiledDocument83 pagesHere Is Why He FileddiannedawnPas encore d'évaluation

- United States v. The Motorlease Corporation, 334 F.2d 617, 2d Cir. (1964)Document4 pagesUnited States v. The Motorlease Corporation, 334 F.2d 617, 2d Cir. (1964)Scribd Government DocsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument22 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- RCBC vs. AlfaDocument6 pagesRCBC vs. AlfaAlecsandra ChuPas encore d'évaluation

- 4.7.14 Macomb County ObjectionDocument12 pages4.7.14 Macomb County ObjectionWDET 101.9 FMPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument22 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Order Granting Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Armada Rubber Manufacturing CoDocument3 pagesOrder Granting Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Armada Rubber Manufacturing CoChapter 11 DocketsPas encore d'évaluation

- Ex Parte Motion For Order Shortening Notice Period and Scheduling An Expedited Hearing (TheDocument10 pagesEx Parte Motion For Order Shortening Notice Period and Scheduling An Expedited Hearing (TheChapter 11 DocketsPas encore d'évaluation

- Bankruptcy Dismissal For Lone Ranger Holdings The Dwight Jory CompanyDocument5 pagesBankruptcy Dismissal For Lone Ranger Holdings The Dwight Jory CompanybelievethingsPas encore d'évaluation

- United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesUnited States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Dacey V Mt. EverstDocument9 pagesDacey V Mt. EverstacelaerdenPas encore d'évaluation

- Objection To Interim Order Approving Customer Agreement Among The Debtors, Their Principal Customers and Jpmorgan Chase Bank, N.A. and Related ReliefDocument30 pagesObjection To Interim Order Approving Customer Agreement Among The Debtors, Their Principal Customers and Jpmorgan Chase Bank, N.A. and Related ReliefChapter 11 DocketsPas encore d'évaluation

- Manuel Luis C. Gonzales vs. GJH Land, Inc., Gr. No. 202664, November 10, 2015Document50 pagesManuel Luis C. Gonzales vs. GJH Land, Inc., Gr. No. 202664, November 10, 2015Jerry SerapionPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument23 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Chapter 13 Bankruptcy in the Western District of TennesseeD'EverandChapter 13 Bankruptcy in the Western District of TennesseePas encore d'évaluation

- 2022 Maui Invitational BracketDocument1 page2022 Maui Invitational BracketKOLD News 13Pas encore d'évaluation

- Lubbock ISD LawsuitDocument17 pagesLubbock ISD LawsuitKCBD DigitalPas encore d'évaluation

- Lubbock SPHC PIT ReportDocument16 pagesLubbock SPHC PIT ReportKCBD DigitalPas encore d'évaluation

- 2022 Online Sponsor PacketDocument4 pages2022 Online Sponsor PacketKCBD DigitalPas encore d'évaluation

- Midland Christian Educators File Civil Rights Lawsuit Against City of Midland, Police DepartmentDocument36 pagesMidland Christian Educators File Civil Rights Lawsuit Against City of Midland, Police DepartmentMidland Reporter-Telegram100% (1)

- EO-GA-40 Prohibiting Vaccine Mandates Legislative Action IMAGE 10-11-2021Document3 pagesEO-GA-40 Prohibiting Vaccine Mandates Legislative Action IMAGE 10-11-2021Mark SchnyderPas encore d'évaluation

- Defendant's Trial BriefDocument7 pagesDefendant's Trial BriefKCBD DigitalPas encore d'évaluation

- Lubbock Disparity Report Version 2Document132 pagesLubbock Disparity Report Version 2KCBD Digital100% (1)

- EO-GA-32 Continued Response To COVID-19 IMAGE 10-07-2020Document7 pagesEO-GA-32 Continued Response To COVID-19 IMAGE 10-07-2020Jakob RodriguezPas encore d'évaluation

- Grape Growers' Original PetitionDocument39 pagesGrape Growers' Original PetitionKCBD DigitalPas encore d'évaluation

- Rodriguez ConfessionDocument3 pagesRodriguez ConfessionKCBD DigitalPas encore d'évaluation

- 1611 Roosevelt Leprino AgmtDocument45 pages1611 Roosevelt Leprino AgmtKCBD DigitalPas encore d'évaluation

- AG Texas Probable Cause Affidavit OpinionDocument5 pagesAG Texas Probable Cause Affidavit OpinionKCBD DigitalPas encore d'évaluation

- Vote HomemadeDocument1 pageVote HomemadeKCBD DigitalPas encore d'évaluation

- Planned Parenthood Files Lawsuit Against City of Lubbock On Abortion OrdinanceDocument15 pagesPlanned Parenthood Files Lawsuit Against City of Lubbock On Abortion OrdinanceKCBD DigitalPas encore d'évaluation

- Scannable Document On Aug 13, 2019 at 3-42-28 PMDocument2 pagesScannable Document On Aug 13, 2019 at 3-42-28 PMKCBD DigitalPas encore d'évaluation

- Texas Tech's School of Theatre and Dance Multiple Racism Reports and Call To ActionDocument5 pagesTexas Tech's School of Theatre and Dance Multiple Racism Reports and Call To ActionBradley BurtPas encore d'évaluation

- Ordinance Abolishing Abortion Within City Limits (Lubbock) PDFDocument9 pagesOrdinance Abolishing Abortion Within City Limits (Lubbock) PDFKCBD DigitalPas encore d'évaluation

- Texas COVID VisitationDocument58 pagesTexas COVID VisitationKCBD DigitalPas encore d'évaluation

- Texas Tech 2020 Football Schedule PDFDocument1 pageTexas Tech 2020 Football Schedule PDFKCBD Digital100% (1)

- Carlos Rodriquez's Confession Letter RedactedDocument3 pagesCarlos Rodriquez's Confession Letter RedactedKCBD Digital0% (1)

- Ordinance Abolishing Abortion Within City Limits (Lubbock) PDFDocument9 pagesOrdinance Abolishing Abortion Within City Limits (Lubbock) PDFKCBD DigitalPas encore d'évaluation

- 2019-05-07 Motion To Dismiss - OrtizDocument118 pages2019-05-07 Motion To Dismiss - OrtizKCBD DigitalPas encore d'évaluation

- Dixon Vs StateDocument61 pagesDixon Vs StateKCBD DigitalPas encore d'évaluation

- Dixon Vs StateDocument61 pagesDixon Vs StateKCBD DigitalPas encore d'évaluation

- Marching Band Physical Exam FAQDocument2 pagesMarching Band Physical Exam FAQKCBD DigitalPas encore d'évaluation

- 2019-05-07 Defs' MTN To Dismiss - GravesDocument79 pages2019-05-07 Defs' MTN To Dismiss - GravesKCBD DigitalPas encore d'évaluation

- Ford Motor Credit Amended Proposed JudgmentDocument3 pagesFord Motor Credit Amended Proposed JudgmentKCBD DigitalPas encore d'évaluation

- Subject To Motion To Transfer Venue, Defendant Bart Reagor'S Amended Original Answer - Page 1Document4 pagesSubject To Motion To Transfer Venue, Defendant Bart Reagor'S Amended Original Answer - Page 1KCBD DigitalPas encore d'évaluation

- List of Intl DelegatesDocument3 pagesList of Intl DelegatesAhsan Mohiuddin100% (1)

- Correctional Administration Q ADocument62 pagesCorrectional Administration Q AAngel King Relatives100% (1)

- Settlement, OAG v. RattnerDocument35 pagesSettlement, OAG v. RattnerLaura NahmiasPas encore d'évaluation

- Legal MemorandumDocument4 pagesLegal Memorandumblocker6Pas encore d'évaluation

- Virgines Calvo Doing Business Under The Name and Style Transorient Container Terminal Services, Inc Vs UCPB General Insurance Co.Document5 pagesVirgines Calvo Doing Business Under The Name and Style Transorient Container Terminal Services, Inc Vs UCPB General Insurance Co.Athina Maricar CabasePas encore d'évaluation

- 6.6 (Par. 2) Bengzon v. Drilon, 208 SCRA 133Document1 page6.6 (Par. 2) Bengzon v. Drilon, 208 SCRA 133TricksterPas encore d'évaluation

- Eo Tanod BrigadeDocument7 pagesEo Tanod Brigadegines miagaoPas encore d'évaluation

- Patnanungan, QuezonDocument3 pagesPatnanungan, QuezonSunStar Philippine NewsPas encore d'évaluation

- AOI and BLDocument3 pagesAOI and BLJoseph C. NegrilloPas encore d'évaluation

- Minutes of A MeetingDocument2 pagesMinutes of A MeetingSyed Mujtaba HassanPas encore d'évaluation

- Aa1000852 PDFDocument5 pagesAa1000852 PDFMithun KumarPas encore d'évaluation

- Aman Saxena Letter PetitionDocument2 pagesAman Saxena Letter PetitionBar & BenchPas encore d'évaluation

- Benefits of A Will PDFDocument3 pagesBenefits of A Will PDFTerrence PenaPas encore d'évaluation

- Admin 1-4 CasesDocument98 pagesAdmin 1-4 CasesKayee KatPas encore d'évaluation

- Policy Alternative AssignmentDocument11 pagesPolicy Alternative Assignmentapi-246825887Pas encore d'évaluation

- Quo Warranto: Court. - The Solicitor General or A Public Prosecutor May, With The Permission of The Court in WhichDocument2 pagesQuo Warranto: Court. - The Solicitor General or A Public Prosecutor May, With The Permission of The Court in Whichanalou agustin villezaPas encore d'évaluation

- Sample Production Contract: DateDocument4 pagesSample Production Contract: DatePrashanthPas encore d'évaluation

- Judicial Affidavit Rule: A.M. NO. 12-8-8-SCDocument11 pagesJudicial Affidavit Rule: A.M. NO. 12-8-8-SCMae AnnPas encore d'évaluation

- Petition 7 of 2018 2Document32 pagesPetition 7 of 2018 2Salimah Nadiah GunnerettePas encore d'évaluation

- PNP Formal ChargeDocument2 pagesPNP Formal ChargeVedprilJacky TVPas encore d'évaluation

- Disciplinary Action and Preventive SuspensionDocument29 pagesDisciplinary Action and Preventive SuspensionMar Jan GuyPas encore d'évaluation

- Saqina Homework 1Document7 pagesSaqina Homework 1Shaqina Qanidya PPas encore d'évaluation

- Recruitment of Insurance Medical Officers (IMO) Grade-II (Allopathic)Document4 pagesRecruitment of Insurance Medical Officers (IMO) Grade-II (Allopathic)Ashish BakliwalPas encore d'évaluation

- How To Start CSS - PMS Essay Writing - (By - Saeed Wazir)Document8 pagesHow To Start CSS - PMS Essay Writing - (By - Saeed Wazir)Shazi KhanPas encore d'évaluation

- Continental Legal History: SeriesDocument10 pagesContinental Legal History: SeriesNejira AjkunicPas encore d'évaluation

- Cambodias Family Trees MedDocument96 pagesCambodias Family Trees MedModelice100% (2)

- In The Court of The 5 Additional Chief Metroplitan Magistrate at BangaloreDocument5 pagesIn The Court of The 5 Additional Chief Metroplitan Magistrate at BangaloreShekar Lakshmana SastryPas encore d'évaluation

- U.S.-Taiwan Relations: Prospects For Security and Economic TiesDocument42 pagesU.S.-Taiwan Relations: Prospects For Security and Economic TiesThe Wilson CenterPas encore d'évaluation

- Abalos v. Macatangay, JR., (G.R. No. 155043 September 30, 2004)Document18 pagesAbalos v. Macatangay, JR., (G.R. No. 155043 September 30, 2004)Leizl A. VillapandoPas encore d'évaluation

- The Meaning of The Expression "Legal Proceedings" and Its Judicial InterpretationDocument29 pagesThe Meaning of The Expression "Legal Proceedings" and Its Judicial InterpretationaRCHITPas encore d'évaluation