Académique Documents

Professionnel Documents

Culture Documents

Annexure 6 - Re-Imbursemetn of Sales Tax

Transféré par

Venkataramakrishna ThubatiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Annexure 6 - Re-Imbursemetn of Sales Tax

Transféré par

Venkataramakrishna ThubatiDroits d'auteur :

Formats disponibles

73

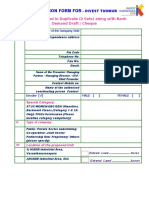

ANNEXURE: VI

(G.O. Ms. No.108 , Ind. & Com. (P&I) Dept., Dt: 14 .11.2015)

APPLICATION CUM VERIFICATION FORM FOR CLAIMING REIMBURSEMENT OF

COMMERCIAL TAX UNDER INDUSTRIAL DEVELOPMENT POLICY/SECTORAL/MSME

POLICY – 2015-2020 OF ANDHRA PRADESH

1.0. Details of Industry:

1.1. Name of the Enterprise:

1.2 Name of the Proprietor/Managing Partner / Managing Director:

1.3 TIN No. of the Enterprise/Industry/ Proprietor / Managing Partner / Managing Director:

1.4 PAN No. of the Proprietor / Managing Partner / Managing Director:

2.0. Address of the Enterprise:

2.1 Office:

2.2 Factory location:

3.0.Status:

3.1 Category : (Pl. mark)

Micro Enterprise Small Enterprise Medium Enterprise Large Industry

3.2. Constitution of the Organisation (Pl. mark)

Proprietary Partnership Pvt. Ltd. Limited Coop.

3.3. Status of the Industry: (Pl. mark)

New Industry Expansion Diversification

74

3.4 Date of Commencement of Production:

(Date of Commencement of Production is the date of First Sale Bill/Invoice)

3.5 UAM/EM Part - II/IEM/IL No:

Date:

4. Employment: Male (Nos.) Female

(Nos.)

a) Management & Staff

b) Supervisory

c) Workers

5. Fixed Capital Investment(in Rs.)

Nature of Assets New /Existing Expansion/ % of increase under

Enterprise Diversification Project Expansion/

Diversification Project

(1) (2) (3) (4)

Land

Building

Plant & Machinery

Total

(If it is a new enterprise/industry, then column (3) and (4) need not be filled and it may be strike off)

6. Line of Activity.

Line of activity Units i.e. Values in Rs.

Nos. / Tons/ Capacity

Ltrs.

New /Existing

Enterprise

Expansion/

Diversification

Project

% of increase under Expansion/ Diversification Project

Note: In respect of Expansion/Diversification projects, Enterprises involving at least 25%

enhancement on fixed capital investment and Capacity are eligible for claiming incentives

7 Sales Tax Regn. No & Date

APGST

CST

8 Installed capacity of the

existing Enterprise as certified

by the financial institution/

chartered accountant

9 Production details preceding Year Enterprises Total production

three years before expansion/

diversification project as 1

certified by the financial

institution/ chartered

2

accountant

3

75

10 Sales Tax reimbursement 1st year (20 – 20 ) Rs.

already availed by Enterprise nd

from the Date of 2 year (20 – 20 ) Rs.

Commencement of 3rd year (20 – 20 ) Rs.

Production.

4th year (20 – 20 ) Rs.

Total Rs.

11 Claim application submitted by the Enterprise/Industry for the

Year:

12 Tax paid by the Enterprise during the year as certified by

Rs.

Commercial Tax Department

13 25% Reimbursement amount claimed by the Enterprise Rs.

DECLARATION

I / We hereby confirm that to the best of our knowledge and belief, information given herein before

and other papers enclosed are true and correct in all respects. We further undertake to substantiate the

particulars about promoter(s) and other details with documentary evidence as and when called for.

I/We hereby agree that I/We shall forthwith repay the amount released to me/us under scheme, if the

amount of Reimbursement of tax are found to be disbursed in excess of the amount actually

admissible whatsoever the reason.

Station : Signature of Authorised Person

Date : with Firm /Office Seal.

• The following documents are to be furnished:

a) Certificate from concerned CTO as prescribed at Form – A.

b) Production Particulars for the last –3- years and Column No. 5 & 6 of the application duly

certified by Chartered Accountant for the first time of the claim, if it is Expansion/Diversification

Project.

c) Valid Consent for Operation (CFO) from APPCB/Acknowledgement from General Manager,

District Industries Centre concerned on pollution angle.

d) All the required document as per Check-Slip at PART – C, for the first time of the claim.

14. RECOMMENDATION OF THE INSPECTING OFFICER:

(not to be filled by the Enterprise/Industry, to be filled by inspecting Officer)

a. Amount claimed in Rs. :

b. Amount recommended in Rs. :

The claim application of the captioned Enterprise/Industry is verified as per the operational guidelines.

The Enterprise/Industry is eligible for availing incentives under IDP/MSME/Sectoral Policy 2015-20.

The Enterprise/Industry did not add or remove any Plant & Machinery and there is no change of line of

activity and capacity. Further, the Enterprise/Industry is in continuous operation, there is no break-in-

production (if so the details of the break-in-production) and I recommend the above incentives to the

captioned Enterprise/Industry.

Signature of Inspecting Officer with Name & Designation.

76

Remarks of the General Manager:

The applicant Enterprise/Industry is eligible for above incentives and the claim is in order. The

computation of capital cost has been done as per the provisions under the scheme. I recommend

for sanction of above incentives.

Signature of General Manager with Office Seal.

Note: This application form, if photo copied must be exactly as per original & it must be both sides of

the page.

S.S.RAWAT

SECRETARY TO GOVERNMENT & CIP

Vous aimerez peut-être aussi

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisD'EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisPas encore d'évaluation

- Common Application Form For Units Above 10 LakhsDocument55 pagesCommon Application Form For Units Above 10 LakhsBilla NaganathPas encore d'évaluation

- Director ReportDocument5 pagesDirector ReportkcpPas encore d'évaluation

- Tutorial 3 (1) Q1,2,4,5Document9 pagesTutorial 3 (1) Q1,2,4,5Shan JeefPas encore d'évaluation

- Application Form For: To Be Submitted in Duplicate (2 Sets) Along With Bank Demand Draft / ChequeDocument5 pagesApplication Form For: To Be Submitted in Duplicate (2 Sets) Along With Bank Demand Draft / ChequeRock RamPas encore d'évaluation

- Renewal NoticeDocument7 pagesRenewal NoticeDS SystemsPas encore d'évaluation

- Republic of The Philippines Philippine Economic Zone AuthorityDocument1 pageRepublic of The Philippines Philippine Economic Zone AuthorityJude ItutudPas encore d'évaluation

- Appform Interest Subsidy MsmeDocument5 pagesAppform Interest Subsidy MsmeKandarp TrivediPas encore d'évaluation

- AAA - Mock Exam 4Document44 pagesAAA - Mock Exam 4Myo NaingPas encore d'évaluation

- TATA PV-Dealer-Application-form PDFDocument19 pagesTATA PV-Dealer-Application-form PDFC00LE0Pas encore d'évaluation

- Cost Audit Report CRA 3 (In Excel)Document25 pagesCost Audit Report CRA 3 (In Excel)aishwarya raikar100% (1)

- Nit BD G 05 06 Eoi 2023 129Document19 pagesNit BD G 05 06 Eoi 2023 129go2ashokkumardutta2505Pas encore d'évaluation

- Application Form FormatDocument4 pagesApplication Form FormatDS SystemsPas encore d'évaluation

- Project Loan Application FormDocument34 pagesProject Loan Application FormindimusicaPas encore d'évaluation

- Annexure Sanction DetailsDocument26 pagesAnnexure Sanction DetailsdanishsamdaniPas encore d'évaluation

- Revised Application For Renewal FM-CDC-MD-02 As of 2017 Sept 15Document4 pagesRevised Application For Renewal FM-CDC-MD-02 As of 2017 Sept 15Christy SanguyuPas encore d'évaluation

- Instruction Kit For Eform Adt - 2: Page 1 of 8Document8 pagesInstruction Kit For Eform Adt - 2: Page 1 of 8maddy14350Pas encore d'évaluation

- PEZA IT Enterprise Registration ApplicationDocument10 pagesPEZA IT Enterprise Registration ApplicationNikki OcampoPas encore d'évaluation

- Innovation Voucher ProgrammeDocument13 pagesInnovation Voucher Programmechanus92Pas encore d'évaluation

- CSAS Application-FormatDocument10 pagesCSAS Application-FormatAvinash VankadaruPas encore d'évaluation

- Apply for Supplier Accreditation at Megawide ConstructionDocument5 pagesApply for Supplier Accreditation at Megawide ConstructionErwinJaysonIslaPas encore d'évaluation

- Registration for Government Purchase ProgramDocument6 pagesRegistration for Government Purchase Programauritro tarafdarPas encore d'évaluation

- Final Application Form-Ethanol Business Loan Mongu IYDocument8 pagesFinal Application Form-Ethanol Business Loan Mongu IYJosephine ChirwaPas encore d'évaluation

- Steps To Start A Small Scale IndustryDocument3 pagesSteps To Start A Small Scale Industrysajanmarian80% (5)

- Startup India Seed Fund SchemeDocument18 pagesStartup India Seed Fund Schemegaganpreetkaur031995Pas encore d'évaluation

- Battery Truck Spare Part NumbersDocument19 pagesBattery Truck Spare Part Numbersboobalan_shriPas encore d'évaluation

- AS 24 Discontinuing OperationsDocument10 pagesAS 24 Discontinuing OperationsakulamPas encore d'évaluation

- Unit 2 Procedure To Setup Entreprise ESBEDocument59 pagesUnit 2 Procedure To Setup Entreprise ESBEC V ReddyPas encore d'évaluation

- Applicability of Companies (Auditor'S Report) Order, 2020Document7 pagesApplicability of Companies (Auditor'S Report) Order, 2020GopiPas encore d'évaluation

- Yantra India Limited Recruitment 2023Document11 pagesYantra India Limited Recruitment 2023Nitish RaiPas encore d'évaluation

- Template 10 - Business CaseDocument13 pagesTemplate 10 - Business CaseNuptias UKPas encore d'évaluation

- App. Form SPRS Form 3.8.2018-1Document20 pagesApp. Form SPRS Form 3.8.2018-1Harshit BaheriaPas encore d'évaluation

- Application Form For CSR Funding From Igl NewDocument5 pagesApplication Form For CSR Funding From Igl NewPrafull ShahaPas encore d'évaluation

- r02 - Edb Rha FormDocument12 pagesr02 - Edb Rha FormSherry YangPas encore d'évaluation

- Uci 06022018Document23 pagesUci 06022018Chandan kumarPas encore d'évaluation

- Revision Notes of IT TAXDocument115 pagesRevision Notes of IT TAXVikki VigneshPas encore d'évaluation

- 1) Udyog Aadhar (MSME) - : Memorandum of Association Articles of AssociationDocument2 pages1) Udyog Aadhar (MSME) - : Memorandum of Association Articles of Associationप्रेम शिवाPas encore d'évaluation

- Income Tax Revision Notes December 2019-Executive-RevisionDocument114 pagesIncome Tax Revision Notes December 2019-Executive-RevisionMeenaa BalakrishnanPas encore d'évaluation

- PCAB Renewal Form-2019 PDFDocument24 pagesPCAB Renewal Form-2019 PDFAlan Zenith100% (5)

- boosting_business_through_r_and_d_application_for_support_v7Document8 pagesboosting_business_through_r_and_d_application_for_support_v7AbhishekPas encore d'évaluation

- CHECKLIST FOR PARTNERSHIP CONCERNDocument9 pagesCHECKLIST FOR PARTNERSHIP CONCERNm3788999Pas encore d'évaluation

- T3 Ans 1,2,4 (RA - DD)Document8 pagesT3 Ans 1,2,4 (RA - DD)MinWei1107Pas encore d'évaluation

- STP Scheme benefits of Software Technology Parks of India in BangaloreDocument25 pagesSTP Scheme benefits of Software Technology Parks of India in BangaloreJhilik PradhanPas encore d'évaluation

- Important Instruction & Fees StructureDocument3 pagesImportant Instruction & Fees StructurePeppers ChannelPas encore d'évaluation

- SOP for Early Stage Funding- Revised.51d15bea123ee299bd5fDocument5 pagesSOP for Early Stage Funding- Revised.51d15bea123ee299bd5famritacutexPas encore d'évaluation

- APPENDICES To General Guidelines - PETRONAS License Registration Applications v11.0 (10 Jun 2021) Rev 3Document12 pagesAPPENDICES To General Guidelines - PETRONAS License Registration Applications v11.0 (10 Jun 2021) Rev 3HYPERSTONE PMCPas encore d'évaluation

- Opening of Bank Account and Shops and Establishment Registration Number)Document12 pagesOpening of Bank Account and Shops and Establishment Registration Number)yashPas encore d'évaluation

- Application Form CGTMSEDocument15 pagesApplication Form CGTMSERahul Mittal67% (3)

- Application For Process Maintenance WorkersDocument6 pagesApplication For Process Maintenance WorkersJohan GunardiPas encore d'évaluation

- Accounts Manual - Part 1Document28 pagesAccounts Manual - Part 1Kiran KothariPas encore d'évaluation

- SME Smart ScoreDocument35 pagesSME Smart Scoremevrick_guyPas encore d'évaluation

- 2go Group, Inc. - Dis 2018. - DDEE3 PDFDocument184 pages2go Group, Inc. - Dis 2018. - DDEE3 PDFAlaine DoblePas encore d'évaluation

- DMD Illustrative Financial Statements for Small EntitiesDocument51 pagesDMD Illustrative Financial Statements for Small EntitiesJake Aseo Bertulfo100% (2)

- Intimation of Director Identification Number by The Company To The RegistrarDocument10 pagesIntimation of Director Identification Number by The Company To The RegistrarantopradeepPas encore d'évaluation

- ESM06-Mod02-P004-F01 - Vendor Registration Form (AED 500K Above)Document13 pagesESM06-Mod02-P004-F01 - Vendor Registration Form (AED 500K Above)syedPas encore d'évaluation

- GO (P) No 107-2016-Fin Dated 27-07-2016Document8 pagesGO (P) No 107-2016-Fin Dated 27-07-2016sunil777tvpmPas encore d'évaluation

- 5 6179095781476139217Document240 pages5 6179095781476139217Ãã Kā ShPas encore d'évaluation

- NSIC Chick ListDocument5 pagesNSIC Chick ListVRS MANPOWER AND SECURITY SERVICE PVT LTDPas encore d'évaluation

- Application Form For Retail Loans - English - 4Document6 pagesApplication Form For Retail Loans - English - 4Shreyanshi BishtPas encore d'évaluation

- 1-Composite Supply & Mixed SupplyDocument3 pages1-Composite Supply & Mixed SupplyVenkataramakrishna ThubatiPas encore d'évaluation

- A Premier On GST in IndiDocument69 pagesA Premier On GST in IndiVenkataramakrishna ThubatiPas encore d'évaluation

- Schedule IDocument6 pagesSchedule IHanu4abapPas encore d'évaluation

- Guidance Note Service TaxDocument129 pagesGuidance Note Service TaxVenkataramakrishna ThubatiPas encore d'évaluation

- Why India Needs GST ReformDocument3 pagesWhy India Needs GST ReformVenkataramakrishna ThubatiPas encore d'évaluation

- Cdcs Self Study Guide 2010Document21 pagesCdcs Self Study Guide 2010Venkataramakrishna ThubatiPas encore d'évaluation

- CDCS E-QuizDocument2 pagesCDCS E-QuizVenkataramakrishna ThubatiPas encore d'évaluation

- Letter of Credit FAQS PDFDocument38 pagesLetter of Credit FAQS PDFVenkataramakrishna Thubati100% (3)

- AP Waybill GoDocument1 pageAP Waybill GoVenkataramakrishna ThubatiPas encore d'évaluation

- C-Form Utilisation TemplateDocument1 pageC-Form Utilisation TemplateSaishankar VemuriPas encore d'évaluation

- C Forms ApplicationDocument1 pageC Forms ApplicationVenkataramakrishna ThubatiPas encore d'évaluation

- Jharkhand Govt Gazette Regarding Stipend For LawyersDocument6 pagesJharkhand Govt Gazette Regarding Stipend For LawyersLatest Laws TeamPas encore d'évaluation

- Corporate Finance Problem Set 5Document2 pagesCorporate Finance Problem Set 5MAPas encore d'évaluation

- Macro Economics and Economic Development of PakistanDocument3 pagesMacro Economics and Economic Development of PakistanWaqas AyubPas encore d'évaluation

- National Open University of Nigeria: Prepared byDocument17 pagesNational Open University of Nigeria: Prepared byMAVERICK MONROEPas encore d'évaluation

- 1.25 Suku Bunga, Diskonto, Imbalan (Persen Per Tahun)Document2 pages1.25 Suku Bunga, Diskonto, Imbalan (Persen Per Tahun)Izzuddin AbdurrahmanPas encore d'évaluation

- Kareen Leon, Cpa Page No: - 1 - General JournalDocument4 pagesKareen Leon, Cpa Page No: - 1 - General JournalTayaban Van Gih100% (2)

- Dianne FeinsteinDocument5 pagesDianne Feinsteinapi-311780148Pas encore d'évaluation

- Syllabus - Wills and SuccessionDocument14 pagesSyllabus - Wills and SuccessionJImlan Sahipa IsmaelPas encore d'évaluation

- Gram Yojana (Gram Priya) 10 Years Rural Postal Life Insurance Age at Entry Yrs Annual Rs Halfyearly Rs Quarterly Rs Monthly Age at Entry YrsDocument2 pagesGram Yojana (Gram Priya) 10 Years Rural Postal Life Insurance Age at Entry Yrs Annual Rs Halfyearly Rs Quarterly Rs Monthly Age at Entry YrsPriya Ranjan KumarPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Anita GaourPas encore d'évaluation

- Accounting 1 ReviewerDocument3 pagesAccounting 1 ReviewerCortez, Charish BSAIS 1210 - BULACANPas encore d'évaluation

- How George Soros Made $8 BillionDocument2 pagesHow George Soros Made $8 BillionAnanda rizky syifa nabilahPas encore d'évaluation

- Acquisition Analysis and RecommendationsDocument49 pagesAcquisition Analysis and RecommendationsAnkitSawhneyPas encore d'évaluation

- CVPA ANALYSIS AND BEP CALCULATIONSDocument38 pagesCVPA ANALYSIS AND BEP CALCULATIONSLouie De La TorrePas encore d'évaluation

- Breaking The Time Barrier PDFDocument70 pagesBreaking The Time Barrier PDFCalypso LearnerPas encore d'évaluation

- CBSE Class 12 Economics Sample Paper (For 2014)Document19 pagesCBSE Class 12 Economics Sample Paper (For 2014)cbsesamplepaperPas encore d'évaluation

- I 1065Document55 pagesI 1065Monique ScottPas encore d'évaluation

- 227 - Unrebutted Facts Regarding The IRSDocument5 pages227 - Unrebutted Facts Regarding The IRSDavid E Robinson100% (1)

- Investment Analyst Cevian Capital 2017Document1 pageInvestment Analyst Cevian Capital 2017Miguel Couto RamosPas encore d'évaluation

- Region I - TIP DAR ProgramDocument761 pagesRegion I - TIP DAR ProgramDavid ThomasPas encore d'évaluation

- Britannia IndsDocument16 pagesBritannia IndsbysqqqdxPas encore d'évaluation

- 2122 s3 Bafs Notes STDocument3 pages2122 s3 Bafs Notes STKiu YipPas encore d'évaluation

- A122 Exercises QDocument30 pagesA122 Exercises QBryan Jackson100% (1)

- Finance ProblemsDocument5 pagesFinance Problemsstannis69420Pas encore d'évaluation

- MCQ Banking, Finance and Economy TestDocument7 pagesMCQ Banking, Finance and Economy Testarun xornorPas encore d'évaluation

- IPP Report PakistanDocument296 pagesIPP Report PakistanALI100% (1)

- Transfer PricingDocument12 pagesTransfer PricingMark Lorenz100% (1)

- Home Activity 3Document6 pagesHome Activity 3Don LopezPas encore d'évaluation

- Inventory Trading SampleDocument28 pagesInventory Trading SampleRonald Victor Galarza Hermitaño0% (1)

- Construction Budget: Project InformationDocument2 pagesConstruction Budget: Project InformationAlexandruDanielPas encore d'évaluation