Académique Documents

Professionnel Documents

Culture Documents

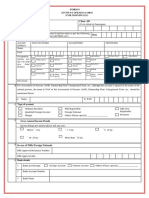

Proposal Form RinRaksha 01122017

Transféré par

Shashank ThakurCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Proposal Form RinRaksha 01122017

Transféré par

Shashank ThakurDroits d'auteur :

Formats disponibles

SBI LIFE INSURANCE COMPANY LTD.

IRDAI Registration No. 111

Registered & Corporate Office: ‘Natraj’, M.V. Road & Western Express Highway Junction,

Andheri (East), Mumbai 400 069.

Website: www.sbilife.co.in | Email: info@sbilife.co.in

Toll Free: 1800 22 9090 (Between 9 AM & 9 PM) | CIN: L99999MH2000PLC129113

SBI Life – RiNn Raksha (UIN: 111N078V03)

Proposal Form

I. Sales Channel

(To be filled in by the Sales Channel)

Source of Lead: Agency Broking Corporate Agency(SBG) Corporate Agency(CS) Corporate Agency(Alternate Channel)

Direct Others (Pls specify) ________________________________________________________________,

Name Branch

License Code No. allotted by IRDAI (for brokers)

Code No. allotted by SBI Life

II. Instructions for filling the Proposal form

1) This proposal form is to be filled by the proposed policyholder. 4) The authorised signatories must authenticate any cancellation,

2) All questions in the form have to be answered. alteration, or overwriting etc. by signing alongside.

3) Please tick () wherever applicable. 5) Please give details if ‘Others’ option is selected.

6) Please specify ‘NA’, if ‘Not Applicable’

III. Proposed Master Policyholder

a. Name of the Proposed Master Policyholder

b. Registered/ Head Office Address & Pin code

c. Mailing Address

d. Telephone number

e. Fax No.

f. E-mail address

g. Organization Category (Please submit relevant document as proof)

RBI regulated Scheduled Banks (including Co-Operative Banks) National Minority Development Financial Corporation (NMDFC)

NBFC having Certificate of Registration from RBI Small Finance Banks Regulated by RBI

National Housing Board (NHB) regulated Housing Finance Company Others, please specify:___________________________

h. PAN No: I/We do not have a PAN Card and have submitted Form 60

Note: Please provide PAN number or submit Form 60 if the annualised premium under this proposal exceeds ` .50,000/-

IV. The Scheme

a. The initial number of Members proposed

Home loan Car loan Credit Card

b. Loan Cover (type of loan covered under this scheme) Personal loan Agriculture loan Education loan

Other loans (Please Specify)_________________________

c. Is the scheme compulsory or voluntary? Compulsory Voluntary

d. If voluntary, then specify the percentage of premium

___ % by Master Policyholder ___ % by Member

payable by Master Policyholder and Member

e. Can the cover term be less than loan term? Yes No

f. Date of commencement of policy (dd/mm/yyyy)

g. Is moratorium period required? Yes No

h. Can the members choose a higher cover amount (upto 120% Yes No

of Outstanding loan amount)

V. Cover Options

Please tick () the options as required. The first two options are available only if the history of interest rates can be provided for

every claim.

Gold Option Platinum Option None

70.ver.06-12/17 MPS Page 1 of 3

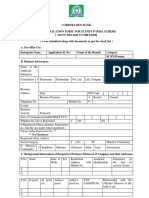

VI. Co-borrower Options

Please tick () the options as required. Please note that maximum of two co-borrowers can be covered along with the Primary Applicant.

Each Co-borrower to be covered for Respective Share

Each Co-borrower to be covered for Entire Outstanding Loan amount

None

VII. Rider

Please tick () as required

Accidental Total and Permanent Disability Benefit (UIN: 111B023V02)

No rider

VIII. Initial Parameters – Base and Rider

Benefit Members Sum Assured (INR) Premium excluding Applicable Taxes* Premium, including

applicable taxes (INR) (INR) applicable taxes

(INR)

Death Benefit

Accidental Total

and Permanent

Disability Benefit

IX. Initial Parameters – Option

Option Members Sum Assured (INR) Premium excluding Applicable Taxes* Premium, including

(Please mention applicable taxes (INR) (INR) applicable taxes

the name of the (INR)

selected option)

________Option

________Option

* taxes include service tax/ cess/ GST and/ or any other statutory levy/ duty/ surcharge, as notified by the Central and/ or State

Government from time to time as per provisions of the prevalent tax laws.

X. Payment Details

Single Premium

a. Mode of Payment Level Premium payable for term, in years: Annual Quarterly

5 10 Half-yearly Monthly

Cheque / DD No. / UTR No. / IFSC Code / Instrument or Transaction

RTGS Code: Dated (DD/MM/YYYY)

b. Instrument Details

Bank Branch Drawn On: Amount (in INR):

XI. Declaration of the Proposed Policyholder

I/We, the undersigned, declare for and on behalf of ________________________________________________________________

_________ (Full name of the proposed master policyholder) that:

1. In agreement to the Pricing Terms / Quotation Ref. No.____________________________ dated __________________________, I/we am/are herewith submitting this proposal to

SBI Life Insurance Company Limited (referred to as ‘the Company’ or ‘SBI Life’) for issuance of a Master Policy in our favour. I/We confirm that SBI Life – RiNn Raksha scheme and the

rider (if applicable), the benefits there under, the terms and conditions thereof etc. have been explained to me/us and I/we have fully understood and agreed to abide by them.

2. I/We have obtained all the approvals and completed all the necessary procedures stipulated as per the relevant internal guidelines/ rules/ bye-laws/ statutory provisions etc.,

applicable to us, and that accordingly, I/ we am/ are duly authorized severally or jointly to sign the proposal form, furnish any particulars and carry out all matters in connection with or

incidental to the aforesaid group insurance arrangement with the Company. I / We further affirm that the Company shall not be liable in any manner whatsoever, of the consequences of

relying upon this confirmation and issuing a Master Policy in our favour.

3. I / We further declare that statements / submissions made by me / us in this proposal form (including any addendum(s) thereto and census data), all declarations, affidavits and other

statements and / or any information sought by the Company from us and relied upon by the Company to consider the issuance of the Master Policy in our favour and / or to assess the

risk on the lives to be insured under this proposal form shall form the basis of the contract of insurance between me / us and SBI Life.

4. I / We understand and agree that the Company may defer the issuance of the Master Policy to be issued in our favour till the Company duly receives, to its complete satisfaction, all the

necessary clarifications / documentation or other requirements sought by Company.

5. I / We undertake that prior to forwarding any Membership form and / or Member data to the Company for admitting any person as a member under the proposed master policy contract,

I / we shall ensure that he / she meets the applicable eligibility criteria. I / We also agree to make available to the Company such records, documents, information etc. as may be

required.

6. I / We understand and agree that the premiums and the statutory levies shall be paid in advance for all lives to be covered under the master policy contract that may be issued in our

favor.

7. I / We agree and undertake to furnish all the required details about lives to be insured / lives insured in the Company’s format of Membership Form, both in the soft copy (member data)

and the hard copy forms (membership list). I / We further agree and undertake to furnish in respect of the deceased members, the interest rate history under the loan and all requisite

documents within the stipulated time-period and in the manner laid down in the Master Policy document.

8. I / We understand and agree that the insurance cover to be provided by the Company pursuant to this proposal, shall be governed by the Master Policy contract to be issued by the

Company in our favour, and shall be further subject to the Insurance Act, 1938, any other relevant statutes, IRDAI Rules / Regulations / Guidelines etc. in force.

9. I / We understand and agree that if any untrue statement is contained in the proposal form (including any addendum(s) thereto) / or any of the documents, statements information etc.

provided to the Company in connection therewith or if there has been a non-disclosure of material fact, or in case of fraud, then in any such event the Company shall have the right to, in

respect of a / all member(s) to revise the premiums / vary the benefits / treat the master policy as per the provisions of Section 45 of the Insurance Act, 1938 as amended from time to

time.

70.ver.06-12/17 MPS Page 2 of 3

10. I/ We agree that, subject to us meeting the eligibility criteria as specified in the applicable regulations,

i. Where the insured member has specifically authorised SBI Life to make payment of outstanding loan amount to us by deducting from the claim proceeds (as per the

benefits mentioned in the individual member COI); such proceeds will be payable only to the extent of the outstanding loan amount as on the date of occurence of the

insured event.

ii. The remaining claim proceeds, if any, shall be payable in the name of the insured member or his/ her nominee or beneficiary even if the cheque is sent to me/ us for

administrative convenience or through any other electronic mode of payment to the specific bank account of the insured or his/ her nominee.

iii. I/ We will be responsible for obtaining the requisite authorisation from each insured member at the time of member joining the scheme/ policy or at a later date.

iv. In the absence of such authorisation from the insured member, the entire claim proceeds will be payable to the insured member or nominee appointed by the insured

member or beneficiary as the case may be. Such claim proceeds as applicable will be paid in the name of the insured member or his/ her nominee or beneficiary even if

the cheque/ draft is sent to me/ us for administrative convenience or through any other electronic mode of payment to the specific bank account of the insured or his/

her nominee.

v. I/ We will provide the data/ information in the format prescribed by SBI Life to facilitate settlement of claim.

vi. I/ We would be subject to verification and audit by SBI Life or any agency appointed by SBI Life for verification of the data/ information that is submitted.

vii. I/ We shall get necessary audit conducted and shall submit the necessary certification from our internal/ statutory auditors, based on directions received from SBI Life,

in a timely manner.

viii. In case of an unsatisfactory audit observation, SBI Life will have the right to:

a. Recover from us the excess of claim paid over the outstanding loan amount as per the credit acount statement for all claims relevant to the observation.

b. To pay such recovered amount to the insured member or his/ her nominee/ beneficiary.

11. I/ We understand that we will facilitate the registration and settlement of the claims and that the claim form shall be duly authenticated by me/ us to the satisfaction of SBI

Life.

XII. Authorized Signatories

Signatory 1 Signatory 2

Name: Name:

Designation: Designation:

Address: Address:

Signature: Signature:

Date: (DD/MM/YYYY) Date: (DD/MM/YYYY)

XIII. Witness

Name:

Address:

Signature:

Date: (DD/MM/YYYY)

XIV. Declaration to be given if the proposed policyholder has signed in vernacular or if he is illiterate

I have explained the contents of this proposal to the proposed policyholder and ensured that the contents have been fully understood

by him / her. I have accurately recorded the proposed policyholder’s responses to the information sought in the proposal form and I

have read out the responses to her / him and she / he has confirmed that they are correct.

Signature of the Declarant Signature / thumb impression of the proposed policyholder

Name of the Declarant:

X. Declaration of the proposed policyholder

Address:

Place: Date: (DD/MM/YYYY)

XV. Section 41 of the Insurance Act, 1938; as amended from time to time

(1) No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take or renew or continue an insurance in respect of any kind of risk relating to lives or property in

India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate,

except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer.

Provided that acceptance by an insurance agent of commission in connection with a policy of life insurance taken out by himself on his own life shall not be deemed to be acceptance of a rebate of

premium within the meaning of this sub section if at the time of such acceptance the insurance agent satisfies the prescribed conditions establishing that he is a bona fide insurance agent employed by

the insurer.

(2) Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakh rupees.

XVI. Extract of Section 45 of the Insurance Act, 1938; as amended from time to time

No policy of life insurance shall be called in question on any ground whatsoever after the expiry of three years from the date of the policy. A policy of life insurance may be called in question at any time within

three years from the date of the policy, on the ground of fraud or on the ground that any statement of or suppression of a fact material to the expectancy of the life of the insured was incorrectly made in the

proposal or other document on the basis of which the policy was issued or revived or rider issued. The insurer shall have to communicate in writing to the insured or the legal representatives or nominees or

assignees of the insured, the grounds and materials on which such decision is based.

No insurer shall repudiate a life insurance policy on the ground of fraud if the insured can prove that the mis-statement or suppression of a material fact was true to the best of his knowledge and belief or that

there was no deliberate intention to suppress the fact or that such mis-statement or suppression are within the knowledge of the insurer. In case of fraud, the onus of disproving lies upon the beneficiaries, in

case the policyholder is not alive.

In case of repudiation of the policy on the ground of misstatement or suppression of a material fact, and not on the grounds of fraud, the premiums collected on the policy till the date of repudiation shall be paid.

Nothing in this section shall prevent the insurer from calling for proof of age at any time if he is entitled to do so, and no policy shall be deemed to be called in question merely because the terms of the policy are

adjusted on subsequent proof that the age of the life insured was incorrectly stated in the proposal.

For complete details of the section and the definition of ‘date of policy’, please refer Section 45 of the Insurance Act, 1938, as amended from time to time.

70.ver.06-12/17 MPS Page 3 of 3

Vous aimerez peut-être aussi

- Sampoorn Suraksha - Master Proposal Form - NEE - 22422Document4 pagesSampoorn Suraksha - Master Proposal Form - NEE - 22422ANIL TIWARIPas encore d'évaluation

- SBI+Life+-+Group+Micro+Shield+-+SP Master+Proposal+Form 09022023Document4 pagesSBI+Life+-+Group+Micro+Shield+-+SP Master+Proposal+Form 09022023arceroxPas encore d'évaluation

- Shifting FormDocument5 pagesShifting FormSambaraju SunkariPas encore d'évaluation

- Common Application Format For MSME Loans - IBA ApprovedDocument5 pagesCommon Application Format For MSME Loans - IBA ApprovedPriya KalraPas encore d'évaluation

- MC CMD Ed Others: Annexure Sanctioning AuthorityDocument26 pagesMC CMD Ed Others: Annexure Sanctioning AuthoritydanishsamdaniPas encore d'évaluation

- Loan Mout TION FORMDocument6 pagesLoan Mout TION FORMSantosh Kumar GuptaPas encore d'évaluation

- Loan Applicatinaniagsloauwvjwon FormDocument6 pagesLoan Applicatinaniagsloauwvjwon FormSantosh Kumar GuptaPas encore d'évaluation

- SIDBI Loan ApplicationDocument12 pagesSIDBI Loan ApplicationakshayaPas encore d'évaluation

- Annexure A Application For MSME Loan Upto Rs.100 LakhDocument6 pagesAnnexure A Application For MSME Loan Upto Rs.100 LakhChayan MajumdarPas encore d'évaluation

- Customer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsDocument17 pagesCustomer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsKavya NageshPas encore d'évaluation

- Annexure - Common Loan Application Form With Formats I, II and III-EnglishDocument12 pagesAnnexure - Common Loan Application Form With Formats I, II and III-EnglishThe LoanWalaPas encore d'évaluation

- Common Loan Appln Upto Rs 2 CroreDocument7 pagesCommon Loan Appln Upto Rs 2 CroreAashish DabhadePas encore d'évaluation

- Application Form For MsmesDocument8 pagesApplication Form For MsmesNitin PaliwalPas encore d'évaluation

- Msme Application FormDocument7 pagesMsme Application FormPabitra Kumar PrustyPas encore d'évaluation

- Annexure - Common Loan Application Form With Formats I, II and III-EnglishDocument12 pagesAnnexure - Common Loan Application Form With Formats I, II and III-EnglishPratyush DasPas encore d'évaluation

- Annexure: ( Not Mandatory)Document12 pagesAnnexure: ( Not Mandatory)PAWAN JAINPas encore d'évaluation

- K Fintech - Intersector - Shifting-Form - ISS-1 - 1.2Document3 pagesK Fintech - Intersector - Shifting-Form - ISS-1 - 1.2aaaaPas encore d'évaluation

- Provisional Acknowledgement: WWW - Pnbindia.inDocument7 pagesProvisional Acknowledgement: WWW - Pnbindia.inNANDINI KHANNAPas encore d'évaluation

- YG598666Document19 pagesYG598666AkashPas encore d'évaluation

- File 1Document3 pagesFile 1nakul chandra SahuPas encore d'évaluation

- Form CHG-1 - 28 - 01 - 2023 - 28 - 01 - 2023Document10 pagesForm CHG-1 - 28 - 01 - 2023 - 28 - 01 - 2023technowireinPas encore d'évaluation

- With Logo - Policy Document LIC S Bima RatnaDocument16 pagesWith Logo - Policy Document LIC S Bima RatnaSUSHIL KUMAR PANDEYPas encore d'évaluation

- Basic Loan Application For SME Loans: Affix Photographs of Applicant/Co-obligant /guarantorDocument13 pagesBasic Loan Application For SME Loans: Affix Photographs of Applicant/Co-obligant /guarantorDamoooPas encore d'évaluation

- Form ISS Inter Sector Shifting - Ver 2.0Document3 pagesForm ISS Inter Sector Shifting - Ver 2.0Sathyanarayanan MuralikrishnanPas encore d'évaluation

- Customer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsDocument16 pagesCustomer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsPanchu SwainPas encore d'évaluation

- Form CHG-1 - 25 - 11 - 2022 - 25 - 11 - 2022Document10 pagesForm CHG-1 - 25 - 11 - 2022 - 25 - 11 - 2022technowireinPas encore d'évaluation

- Sample Policy Document LIC S Dhan SanchayDocument19 pagesSample Policy Document LIC S Dhan SanchayChandra ShekarPas encore d'évaluation

- Stand Up India Application Form PDFDocument5 pagesStand Up India Application Form PDFakibPas encore d'évaluation

- SIDBI Trader Finance Scheme Loan Application Form: A. Business InformationDocument15 pagesSIDBI Trader Finance Scheme Loan Application Form: A. Business InformationJaveed TajiPas encore d'évaluation

- Elan PRO FRM Vendor Registration Form 14012018Document1 pageElan PRO FRM Vendor Registration Form 14012018Ammar BeidesPas encore d'évaluation

- EBG Services - Annexure For EBGDocument3 pagesEBG Services - Annexure For EBGSabyasachi Naik (Zico)Pas encore d'évaluation

- Atmanirbar Bharat ApplicationDocument6 pagesAtmanirbar Bharat Applicationbijay kumarPas encore d'évaluation

- Details To Be Provided For Lodging ClaimsDocument6 pagesDetails To Be Provided For Lodging ClaimsNavjeet GillPas encore d'évaluation

- Aa3350679 PDFDocument9 pagesAa3350679 PDFPrachi KaushikePas encore d'évaluation

- DocsDocument2 pagesDocsMohsin ShaikhPas encore d'évaluation

- E-Term Policy DocumentDocument23 pagesE-Term Policy DocumentpraveenPas encore d'évaluation

- MGFP Endowment TNCDocument33 pagesMGFP Endowment TNCsarthakPas encore d'évaluation

- DHFL Sanction LetterDocument6 pagesDHFL Sanction LetterRamesh Kulkarni75% (4)

- Business LoanDocument6 pagesBusiness Loansandeep Kumar Dubey100% (1)

- You Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?Document23 pagesYou Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?gkPas encore d'évaluation

- Jeevan Labh PDFDocument17 pagesJeevan Labh PDFIshdeep SinglaPas encore d'évaluation

- Final Policy Doc - LIC S Jeevan Labh PDFDocument17 pagesFinal Policy Doc - LIC S Jeevan Labh PDFAakritiVermaPas encore d'évaluation

- NPS Registation Form - V1.3Document7 pagesNPS Registation Form - V1.3Narendar KumarPas encore d'évaluation

- Certificate of Insurance - Indiafirst Life Group Loan Protect PlanDocument10 pagesCertificate of Insurance - Indiafirst Life Group Loan Protect PlanChandrahas KumarPas encore d'évaluation

- Jai Jawan Salary Plus AccDocument4 pagesJai Jawan Salary Plus AccLakshmi NarasaiahPas encore d'évaluation

- Policy Document - LIC S Bima Jyoti 03 03 2021Document17 pagesPolicy Document - LIC S Bima Jyoti 03 03 2021Anime worldPas encore d'évaluation

- Agent's/ Intermediary's /POSP-LI's Code Agent's/ Intermediary's/POSP-LI's Name Agent's/Intermediary's/POSP - LI's Mobile Number/ Landline NumberDocument17 pagesAgent's/ Intermediary's /POSP-LI's Code Agent's/ Intermediary's/POSP-LI's Name Agent's/Intermediary's/POSP - LI's Mobile Number/ Landline NumberCHITRAKAR (ØÑkäR)Pas encore d'évaluation

- Final Policy Doc - LIC S Jeevan UmangDocument20 pagesFinal Policy Doc - LIC S Jeevan UmangdemoPas encore d'évaluation

- Rinn Raksha - 111N078V01 - Term and Conditions - Website UploadDocument19 pagesRinn Raksha - 111N078V01 - Term and Conditions - Website UploadMonojit SahaPas encore d'évaluation

- Loan Term Sheet - 22 - 51 - 14Document14 pagesLoan Term Sheet - 22 - 51 - 14rushikeshovhal9697Pas encore d'évaluation

- 05 Circular - ForM 9 - Account Opening Form (Individual)Document4 pages05 Circular - ForM 9 - Account Opening Form (Individual)Sneha bagwePas encore d'évaluation

- Reporting of Loan Agreement Details Under Foreign Exchange Management Act, 1999Document7 pagesReporting of Loan Agreement Details Under Foreign Exchange Management Act, 1999Pankaj Kumar SaoPas encore d'évaluation

- Common Application For MSME LoanDocument6 pagesCommon Application For MSME LoanSanthoshPas encore d'évaluation

- Union Bank of India Application-Form-For-msmes2Document8 pagesUnion Bank of India Application-Form-For-msmes2SHUBHAM GHARATPas encore d'évaluation

- Draft Proposal 904374689Document19 pagesDraft Proposal 904374689SIDDHESH WADEKARPas encore d'évaluation

- Above 10 Lakh To 100 Lakh) : Udyog Aadhar Registration No.Document5 pagesAbove 10 Lakh To 100 Lakh) : Udyog Aadhar Registration No.poonamPas encore d'évaluation

- Discovery Fund Premium ReceiptsDocument1 pageDiscovery Fund Premium ReceiptsKartikPas encore d'évaluation

- युनाइटेड बक ऑफ इंडया United Bank of India: United Demat Account Opening FormDocument12 pagesयुनाइटेड बक ऑफ इंडया United Bank of India: United Demat Account Opening Formjay meskaPas encore d'évaluation

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyD'EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyPas encore d'évaluation

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)D'EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- Petroleum DemandDocument7 pagesPetroleum DemandWon JangPas encore d'évaluation

- Summer Internship Report (MBA)Document35 pagesSummer Internship Report (MBA)ShivamPas encore d'évaluation

- Financial Accounting 1 Syllabus Template 1Document6 pagesFinancial Accounting 1 Syllabus Template 1Bernard DomasianPas encore d'évaluation

- Marcos-Araneta v. CADocument3 pagesMarcos-Araneta v. CAJenny Mary DagunPas encore d'évaluation

- CA Inter FM SM A MTP 2 May 2024 Castudynotes ComDocument19 pagesCA Inter FM SM A MTP 2 May 2024 Castudynotes ComsanjanavijjapuPas encore d'évaluation

- Field of EconomicsDocument5 pagesField of EconomicsVinod JoshiPas encore d'évaluation

- SME Retailer Internationalisation: Case Study Evidence From British RetailersDocument29 pagesSME Retailer Internationalisation: Case Study Evidence From British RetailersReel M. A. MahmoudPas encore d'évaluation

- Advance Test Schedule CS Executive Dec-23Document22 pagesAdvance Test Schedule CS Executive Dec-23Gungun ChetaniPas encore d'évaluation

- Novartis Case QuestionsDocument3 pagesNovartis Case QuestionshinderPas encore d'évaluation

- Trade Directory 2012 KleinDocument364 pagesTrade Directory 2012 Kleinqqlang100% (4)

- What Have WE Learned So FarDocument4 pagesWhat Have WE Learned So FarKrystel Erika Tarre100% (1)

- Executive SummaryDocument59 pagesExecutive SummaryJoana ViudezPas encore d'évaluation

- What Is Return On Equity - ROE?Document12 pagesWhat Is Return On Equity - ROE?Christine DavidPas encore d'évaluation

- Financial ManagementDocument8 pagesFinancial Managementmandeep_kaur20Pas encore d'évaluation

- Historical Financial Analysis - CA Rajiv SinghDocument78 pagesHistorical Financial Analysis - CA Rajiv Singhవిజయ్ పి100% (1)

- Shui Fabrics CaseDocument2 pagesShui Fabrics Casepriam gabriel d salidaga100% (3)

- An Overview of Basel III: An Evolving Framework For BanksDocument17 pagesAn Overview of Basel III: An Evolving Framework For BanksNikunj NagarPas encore d'évaluation

- SHAREHOLDERSDocument6 pagesSHAREHOLDERSJoana MariePas encore d'évaluation

- General Insurance Corporation of India DRHPDocument524 pagesGeneral Insurance Corporation of India DRHPAshok YadavPas encore d'évaluation

- FPA Entrance Test 60 Menit (Answer)Document10 pagesFPA Entrance Test 60 Menit (Answer)Andri GintingPas encore d'évaluation

- Procurement Mapping - Understanding Procurement TypesDocument8 pagesProcurement Mapping - Understanding Procurement Typeszahoor80Pas encore d'évaluation

- A Study On Cooperative Banks in India With Special Reference ToDocument9 pagesA Study On Cooperative Banks in India With Special Reference ToAllen AlfredPas encore d'évaluation

- Annual Report HuaweiDocument208 pagesAnnual Report HuaweiWael SalemPas encore d'évaluation

- Prudential BSN Takaful Berhad Investment-Linked Plan IllustrationDocument19 pagesPrudential BSN Takaful Berhad Investment-Linked Plan IllustrationimansarahPas encore d'évaluation

- Omar EffendiDocument10 pagesOmar EffendiWael FayezPas encore d'évaluation

- ANSWER - GB550 Financial Management Unit 1Document9 pagesANSWER - GB550 Financial Management Unit 1LAWRENCE KING'OLAPas encore d'évaluation

- Sweet Poison DayamaniDocument20 pagesSweet Poison DayamaniwillyindiaPas encore d'évaluation

- A Study On Financial Performance Analysis of ACCDocument5 pagesA Study On Financial Performance Analysis of ACCpramodPas encore d'évaluation

- Annual Report 2018 2019Document272 pagesAnnual Report 2018 2019Nishita AkterPas encore d'évaluation

- Break Even AnalysisDocument2 pagesBreak Even AnalysisChandramouli Kolavasi100% (1)