Académique Documents

Professionnel Documents

Culture Documents

Tax Rates For The Tax Year 2019

Transféré par

Mubashir RiazTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax Rates For The Tax Year 2019

Transféré par

Mubashir RiazDroits d'auteur :

Formats disponibles

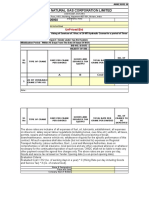

TAX

RATES FOR THE TAX YEAR 2019

TAX RATES FOR INDIVIDUALS MINIMUM TAX

Nature of Payment Section Filer Non-Filer

1. Upto Rs.400,000 0%

Individuals & AOPs [having annual turnover Rs.10 Million

or more] and Companies (Except otherwise specified) 113 1.25% of Turnover

2. Rs.400,001 to Rs.800,000 Rs. 1,000

Oil Marketing Companies, Refineries, SSGCL, SNGPL,

Rs. 2,000 PIA, Dealer or Distributors of Fertilizers & Poultry Industry 113 0.50% of Turnover

3. Rs.800,001 to Rs.1,200,000

Distributors of Pharma, Fast Moving Consumer goods,

5% of the amount Cigarettes, Petroleum Agent, Rice Mills & Flour Mills 113 0.20% of Turnover

4. Rs.1,200,001 to Rs.2,400,000 exceeding Rs.1,200,000

Motorcycles Dealers 113 0.25% of Turnover

Rs.60,000 + 10% of the amount

5. Rs.2,400,001 to Rs.4,800,000 exceeding Rs.,2,400,000 Commercial Importer (Except Cl.56B, Part IV, 2nd Sch.) 148(8) 5.0% 5.0%

Imports of edible oil & packing material by Companies

Rs.300,000 + 15% of the amount 148(8) 5.5% 8.0%

6. Exceeding Rs.4,800,000 or Industrial Undertaking)

exceeding Rs.4,800,000

Imports of edible oil & packing material (Others) 148(8) 6.0% 9.0%

TAX RATES FOR ASSOCIATIONS OF PERSONS Imports of Plastic Raw Material by Ind. Undertaking for own 148(8) 1.75% 8.0%

1. Upto Rs.400,000 0% Imports Commercial of Plastic Raw Material 148(8) 4.5% 9.0%

Imports Commercial covered under SRO.1125(I)/2011 148(8) 3.0% 4.5%

2. Rs.400,001 to Rs.1,200,000 5% Services (Companies) 153(1)(b) 8.0% 14.5%

Rs.40,000 + 10% of the amount Services (Other than Companies) 153(1)(b) 10.0% 17.5%

3. Rs.1,200,001 to Rs.2,400,000 exceeding Rs.1,200,000 Transport Services 153(1)(b) 2.0% 2.0%

Rs.160,000 + 15% of the amount Services provided to Textile, Carpets, Leather, Surgical

4. Rs.2,400,001 to Rs.3,600,000 exceeding Rs.2,400,000 & Sports goods

153(1)(b) 1.0% 1.0%

Rs.340,000 + 20% of the amount Electronics & Print Media advertising Services (Companies) 153(1)(b) 1.5% 12.0%

5. Rs.3,600,001 to Rs.4,800,000 exceeding Rs.3,600,000

Electronics & Print Media advertising Services (Others) 153(1)(b) 1.5% 15.0%

Rs.580,000 + 25% of the amount For Ind. and AOP, upto higher of Tax calculated in Upto Bill Rs.360,000 P.A

6. Rs.4,800,001 to Rs.6,000,000 exceeding Rs.4,800,000 Electricity Bill formula is minimum and above tax is adjustable.

235(4)(a) Upto Bill Rs.30,000 P.M

Rs.880,000 + 30% of the amount .

7. Exceeding Rs.6,000,001 exceeding Rs.6,000,000 FINAL DISCHARGE OF TAX

TAX RATES OF COMPANIES Nature of Payment Section Filer Non-Filer

Banking Company 35% Imports of Remeltable Steel, Potassic Fertilizer, Urea, LNG,

Cotton, Gold & Manufacturers under SRO.1125(I)/2011 148 1.0% 1.5%

Public & Private Company 29%

Persons importing Coal 148 4.0% 6.0%

Small Company 24%

Imports by Companies & Industrial Undertakings*

DEDUCTION ON INCOME FROM PROPERTY U/S 155 FOR IND. & AOP Imports of raw material, plant, machinery, equipment and parts by 148 5.5% 8.0%

Ind. Undertaking or import by large import house are adjustable

Upto Rs.200,000 NIL

Imports (Other than above) 148 6.0% 9.0%

Rs.200,001 to Rs.600,000 5.0% of the gross amount Exceeding Rs.200,000

Rs.600,001 to Rs.1,000,000 Rs.20,000 + 10.0% of the gross amount Exceeding Rs.600,000 Purchase of locally produced edible oil by manufacturer

of cooking oil or vegetable ghee or both 148A 2.0% 2.0%

Rs.1,000,001 to Rs.2,000,000 Rs.60,000 + 15.0% of the gross amount Exceeding Rs.1,000,000

Exceeding Rs.2,000,000 Rs.210,000 + 20.0% of the gross amount Exceeding Rs.2,000,000

Dividend 150 7.5% to 25.0%

Profit on debt upto Rs.500,000 (Other than Companies) 151 10.0% 10.0%

DEDUCTION ON INCOME FROM PROPERTY U/S 155 FOR COMPANIES Profit on debt exceeding Rs.500,000 (Other than Companies) 151 10.0% 17.5%

The rate of tax to be deducted shall be 15% of gross amount of rent for filers and 17.5% for non-filers. Contracts by non-residents 152(1A) 7.0% 13.0%

REDUCTION FOR SENIOR CITIZEN / DISABLED PERSON Sale of Goods (Companies) 153(1)(a) 4.0% 8.0%

50% Reduction in Tax to disabled persons having NADRA CNIC or a taxpayer having age of 60 years or

above, where regular income is upto Rs.1,000,000 from all sources, except income covered under FTR.

Sale of Goods (Other than Companies) 153(1)(a) 4.5% 9.0%

Sale of Rice, Cotton Seed Oil & Edible Oils 153(1)(a) 1.5% 1.5%

REDUCTION FOR TEACHERS & RESEARCHERS

40% Reduction in Tax for full time Teacher or Researcher employed in non-profit education or research Sale by Distributor of Fast Moving Consumer Goods (Companies) 153(1)(a) 2.0% 2.0%

institutions recognized by HEC or Employees of Government Training & Research Institutions. Sale by Distributor of Fast Moving Consumer Goods (Others) 153(1)(a) 2.5% 2.5%

CAPITAL GAIN ON DISPOSAL OF IMMOVABLE PROPERTY Local Sales & Supplies provided to Textile, Carpets,

. Irrespective of Holding Period allotment covered u/s 236C(4) 153(1)(a) 1.0% 1.0%

0.0% Leather, Surgical & Sports goods, Cigarettes and Pharma

Holding period is upto one year acquired on or after 01-07-2016 10.0% Contracts (Companies) 153(1)(c) 7.0% 14.0%

Contracts (Other than Companies) 153(1)(c) 7.5% 15.0%

Holding period is upto two years acquired on or after 01-07-2016 7.5%

Contracts (Sportspersons) 153(1)(c) 10.0% 10.0%

Holding period is upto three years acquired on or after 01-07-2016 5.0%

Services of Stitching, Dyeing, Printing, Embroidery,

Holding period is more than three years acquired on or after 01-07-2016 0.0% 153(2) 1.0% 1.0%

Washing, Sizing & Weaving to Exporters

Holding period is upto three years, if acquired before 01-07-2016 5.0%

Exports 154 1.0% 1.0%

Holding period is more than three years, if acquired before 01-07-2016 0.0%

Prize Bond (Winnings from raffle, lottery, quiz @ 20% u/s 156(2)) 156(1) 15.0% 25.0%

RATE FOR PROFIT ON DEBT - SECTION 7B Commission on Petroleum Products 156A 12.0% 17.5%

Where profit on debt does not exceed Rs.5,000,000 10% Advertising Commission 233(1) 10.0% 15.0%

Where profit on debt exceeds Rs.5,000,000 but not exceed Rs.25,000,000 12.5% Life Insurance Agent Commission upto Rs.500,000 233(1) 8.0% 16.0%

Where profit on debt exceeds Rs.25,000,000 15% Brokerage & Commission (Other than above) 233(1) 12.0% 15.0%

TAX ON BUILDERS - SECTION 7C CNG Stations on Gas bills 234A 4.0% 6.0%

(A) Karachi, Lahore and (B) Hyderabad, Sukkur, Multan, Faisalabad, (C) Urban Areas

Islamabad Rawalpindi, Gujranwala, Sahiwal, not specified in TRANSITIONAL ADVANCE TAX - Division II Part IV of First Schedule

Peshawar, Mardan, Abbottabad, Quetta A and B Nature of Payment Section Filer Non-Filer

For commercial buildings

Cash withdrawal from bank 231A 0.3% 0.6%

Rs.210/ Sq Ft Rs.210/ Sq Ft Rs.210/ Sq Ft

For residential buildings Sale by auction 236A 10% 15%

Area in Sq.Ft Rate/ Sq.Ft Area in Sq.Ft Rate/ Sq.Ft Area in Sq.Ft Rate/ Sq.Ft Sale or transfer of Immovable property 236C 1% 2%

up to 750 Rs.20 up to 750 Rs.15 up to 750 Rs.10 Functions and gatherings Minimum Rs.20,000 or Rs.10,000 city

wise & 5% of bill whichever is higher. 236D 5% 5%

751 to 1500 Rs.40 751 to 1500 Rs.35 751 to 1500 Rs.25 Sale to distributors, dealers or wholesalers - Fertilizer 236G 0.7% 1.4%

1501 & more Rs.70 1501 & more Rs.55 1501 & more Rs.35

Sale to distributors, dealers or wholesalers - Other 236G 0.1% 0.2%

TAX ON DEVELOPERS - SECTION 7D Sale to retailers - Electronics 236H 1% 1%

(A) Karachi, Lahore and (B) Hyderabad, Sukkur, Multan, Faisalabad, (C) Urban Areas Sale to retailers - Others 236H 0.5% 1%

Islamabad Rawalpindi, Gujranwala, Sahiwal, not specified in

Peshawar, Mardan, Abbottabad, Quetta A and B On dealers, commission agents and arhatis, etc 236J

For commercial buildings Group or Class A Rs.10,000 Group or Class B Rs.7,500

Rs.210/ Sq Yd Rs.210/ Sq Yd Rs.210/ Sq Yd

Group or Class C Rs.5,000 Any other category Rs.5,000

For residential buildings

Area in Sq.Yd Rate/ Sq.Yd Area in Sq.Yd Rate/ Sq.Yd Area in Sq.Yd Rate/ Sq.Yd Purchase of immovable property upto Rs. 4(M) 236K 0% 1%*

up to 120 Rs.20 up to 120 Rs.15 up to 120 Rs.10 Purchase of immovable property exceeding Rs. 4(M) 236K 2% 4%

121 to 200 Rs.40 121 to 200 Rs.35 121 to 200 Rs.25 Banking transaction otherwise than through cash 236P - 0.6%*

201 & more Rs.70 201 & more Rs.55 201 & more Rs.35 Payment to resident for right to use machinery and equip 236Q 10% 10%

* A word of caution: Due care and caution has been taken to print this paper and if any error, mistake or mission is found to have crept in, the

information would be gladly accepted and efforts would be made to remove the same in next time. for further detail please consult the relevant Law.

Visit “www.imranghazi.com/mtba” for latest information in Tax Laws

Vous aimerez peut-être aussi

- Sustainable Space Exploration?Document11 pagesSustainable Space Exploration?Linda BillingsPas encore d'évaluation

- Agutayan IslandDocument38 pagesAgutayan IslandJunar PlagaPas encore d'évaluation

- Cost Accounting de Leon Chapter 3 SolutionsDocument9 pagesCost Accounting de Leon Chapter 3 SolutionsRommel Cabalhin0% (1)

- Tax Card 2019Document1 pageTax Card 2019Waqas AtharPas encore d'évaluation

- Summary Ty 2018Document1 pageSummary Ty 2018BADER MUNIRPas encore d'évaluation

- Tax Rates For The Tax Year 2016Document1 pageTax Rates For The Tax Year 2016Ghulam HaiderPas encore d'évaluation

- Minimum Tax Tax Rates For Aop & Business Individuals: Nature of Payment Section Rate (ATL)Document1 pageMinimum Tax Tax Rates For Aop & Business Individuals: Nature of Payment Section Rate (ATL)Anum TariqPas encore d'évaluation

- TaxRates2021 22Document2 pagesTaxRates2021 22Amir NazirPas encore d'évaluation

- Tax Card TY 2020Document1 pageTax Card TY 2020princecharming14Pas encore d'évaluation

- Tax Rates For The Tax Year 2015Document1 pageTax Rates For The Tax Year 2015Ghulam HaiderPas encore d'évaluation

- SWHCC Tax Card - Ty 2019Document1 pageSWHCC Tax Card - Ty 2019Muhammad HaseebPas encore d'évaluation

- Tax Rates - For The Tax Year - 2019Document5 pagesTax Rates - For The Tax Year - 2019nomanjavid88Pas encore d'évaluation

- Tax Card Global Tax Consultants Tax Year 2019Document3 pagesTax Card Global Tax Consultants Tax Year 2019AqeelAhmadPas encore d'évaluation

- Tax Card For The Tax Year 2018-19: Maqbool Haroon Shahid Safdar & Co., Chartered AccountantsDocument3 pagesTax Card For The Tax Year 2018-19: Maqbool Haroon Shahid Safdar & Co., Chartered AccountantsThe MaximusPas encore d'évaluation

- ZJC Tax Rates Tables - Tax Year 2023Document11 pagesZJC Tax Rates Tables - Tax Year 2023Mux ConsultantPas encore d'évaluation

- Tax Card TY 2022Document8 pagesTax Card TY 2022princecharming14Pas encore d'évaluation

- SHCC Tax Card - Ty 2021Document1 pageSHCC Tax Card - Ty 2021Muhammad AdeelPas encore d'évaluation

- Tax Rate For Individual & Salaried: Reduction For Senior Citizen/Disabled PersonDocument2 pagesTax Rate For Individual & Salaried: Reduction For Senior Citizen/Disabled PersonFrantsForum DiscussionPas encore d'évaluation

- Income Tax Card Tax Year 2015Document3 pagesIncome Tax Card Tax Year 2015Sardar Shahid KhanPas encore d'évaluation

- Tax Rates For Tax Year 2020Document5 pagesTax Rates For Tax Year 2020Ghulam MuhiuddinPas encore d'évaluation

- Tax Rates For Individuals: Fast Moving Consumer GoodsDocument1 pageTax Rates For Individuals: Fast Moving Consumer GoodsHakim JanPas encore d'évaluation

- Tax Card For Tax Year 2020Document1 pageTax Card For Tax Year 2020zohaib shahPas encore d'évaluation

- Tax Rates Year 2024Document7 pagesTax Rates Year 2024hamidullah415161Pas encore d'évaluation

- Dexter Consultants: Updated Through Finance Act 2022Document1 pageDexter Consultants: Updated Through Finance Act 2022fahid aslamPas encore d'évaluation

- Tax Rates Card 2023 GC - 220819 - 230837Document5 pagesTax Rates Card 2023 GC - 220819 - 230837smnomanPas encore d'évaluation

- Tax Card 2012Document1 pageTax Card 2012Ch Attique WainsPas encore d'évaluation

- Tax 2020Document1 pageTax 2020Afreen MasoodPas encore d'évaluation

- Income Tax Card 2023-24 (Finance Act 2023)Document1 pageIncome Tax Card 2023-24 (Finance Act 2023)shahidPas encore d'évaluation

- Tax Card 2020-21Document2 pagesTax Card 2020-21Lahore TaxationsPas encore d'évaluation

- Tax Card For Tax Year 2021 (TSP)Document1 pageTax Card For Tax Year 2021 (TSP)Muhammad Usama SheikhPas encore d'évaluation

- Tax Card 2021Document1 pageTax Card 2021MA AttariPas encore d'évaluation

- Tax Rates 2009Document1 pageTax Rates 2009Ch Attique WainsPas encore d'évaluation

- Tax Card For Tax Year 2019Document1 pageTax Card For Tax Year 2019Kinglovefriend100% (1)

- Tax Rates 2010Document1 pageTax Rates 2010Ch Attique WainsPas encore d'évaluation

- Tax Rate Card For Tax Year 2023 24Document10 pagesTax Rate Card For Tax Year 2023 24srismailPas encore d'évaluation

- Tax Card 2024 (Updated)Document2 pagesTax Card 2024 (Updated)Mansoor AhmadPas encore d'évaluation

- RLA Rate Card 2020 2021Document13 pagesRLA Rate Card 2020 2021Muhammad EjazPas encore d'évaluation

- Setting Up Msmes in India - v1.0Document8 pagesSetting Up Msmes in India - v1.0HHP13579Pas encore d'évaluation

- 2019 Tax Card PakistanDocument9 pages2019 Tax Card PakistanRaja Hamza rasgPas encore d'évaluation

- WHT Tax Card - 2024Document1 pageWHT Tax Card - 2024shahid100% (1)

- TaxRateCard 2022-23Document7 pagesTaxRateCard 2022-23Anas KhanPas encore d'évaluation

- 4/25/2016 21st MCMC 1Document19 pages4/25/2016 21st MCMC 1ShaniPas encore d'évaluation

- Taxation (CHN) - Dec 2020 FinalDocument3 pagesTaxation (CHN) - Dec 2020 FinalALEX TRANPas encore d'évaluation

- Khilji Co Rate Card 2021 22Document14 pagesKhilji Co Rate Card 2021 22Khalid ButtPas encore d'évaluation

- WHT Rate Card 2018-19Document2 pagesWHT Rate Card 2018-19taqi1122Pas encore d'évaluation

- Tax Rates 2021Document6 pagesTax Rates 2021Muazam memonPas encore d'évaluation

- (Year) : Amendments Vide Finance Act, 2010 On "Direct Tax"Document16 pages(Year) : Amendments Vide Finance Act, 2010 On "Direct Tax"peyala_sudhirPas encore d'évaluation

- Tax Rates For The Tax Year 2020: Amar AssociatesDocument2 pagesTax Rates For The Tax Year 2020: Amar AssociatesZeeshanPas encore d'évaluation

- Income Tax WHT Rates Card 2016-17Document8 pagesIncome Tax WHT Rates Card 2016-17Sami SattiPas encore d'évaluation

- Taxation (Pakistan) : Tuesday 3 December 2013Document13 pagesTaxation (Pakistan) : Tuesday 3 December 2013Mashhood AhmedPas encore d'évaluation

- ACCA F6 Taxation Solved Past PapersDocument235 pagesACCA F6 Taxation Solved Past Paperssaiporg100% (1)

- KCO-Rate-Card 2021Document13 pagesKCO-Rate-Card 2021Aqib SheikhPas encore d'évaluation

- Moore Shekha Mufti Withholding Chart Pro Tax Year 2023 RevisedDocument14 pagesMoore Shekha Mufti Withholding Chart Pro Tax Year 2023 RevisedNouman KhanPas encore d'évaluation

- WHT Tax CardDocument2 pagesWHT Tax CardAsim JavedPas encore d'évaluation

- Rates of Income TaxDocument9 pagesRates of Income TaxAiza KhanPas encore d'évaluation

- Withholding Tax Rates (Income Tax Ordinance, 2001) For Tax Year 2016Document4 pagesWithholding Tax Rates (Income Tax Ordinance, 2001) For Tax Year 2016Shahid SiddiquePas encore d'évaluation

- Tax Card 2013-14Document1 pageTax Card 2013-14Mudassir Ijaz100% (4)

- Budget Analysis 2011Document30 pagesBudget Analysis 2011Vandana SharmaPas encore d'évaluation

- Test 5 (QP)Document4 pagesTest 5 (QP)iamneonkingPas encore d'évaluation

- Budget Highlights & Comments 2018-19-Deloittepk-NoexpDocument2 pagesBudget Highlights & Comments 2018-19-Deloittepk-NoexpAhmed RazaPas encore d'évaluation

- Soaps & Detergents World Summary: Market Values & Financials by CountryD'EverandSoaps & Detergents World Summary: Market Values & Financials by CountryPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionPas encore d'évaluation

- Court of Tax Appeals First Division: Republic of The Philippines Quezon CityDocument2 pagesCourt of Tax Appeals First Division: Republic of The Philippines Quezon CityPaulPas encore d'évaluation

- BioplasticDocument5 pagesBioplasticclaire bernadaPas encore d'évaluation

- Ethiopia Profile Enhanced Final 7th October 2021Document6 pagesEthiopia Profile Enhanced Final 7th October 2021sarra TPIPas encore d'évaluation

- Chapter 8Document52 pagesChapter 8EffePas encore d'évaluation

- Indian MFTrackerDocument1 597 pagesIndian MFTrackerAnkur Mittal100% (1)

- Simple GST Invoice Format in ExcelDocument2 pagesSimple GST Invoice Format in ExcelsadnPas encore d'évaluation

- Application of Memebership Namrata DubeyDocument2 pagesApplication of Memebership Namrata DubeyBHOOMI REALTY AND CONSULTANCY - ADMINPas encore d'évaluation

- Assignment 1Document13 pagesAssignment 1Muhammad Asim Hafeez ThindPas encore d'évaluation

- Brian Ghilliotti: BES 218: Entrepreneurial Studies: Week 3Document3 pagesBrian Ghilliotti: BES 218: Entrepreneurial Studies: Week 3Brian GhilliottiPas encore d'évaluation

- 托福阅读功能目的题1 0Document59 pages托福阅读功能目的题1 0jessehuang922Pas encore d'évaluation

- AP Macro 2008 Audit VersionDocument24 pagesAP Macro 2008 Audit Versionvi ViPas encore d'évaluation

- GLOBANT S.A. Globs of Exaggerated Growth and Accounting ShenanigansDocument26 pagesGLOBANT S.A. Globs of Exaggerated Growth and Accounting ShenanigansWarren TrumpPas encore d'évaluation

- Annexure V Bidder Response SheetDocument2 pagesAnnexure V Bidder Response SheetAshishPas encore d'évaluation

- 2019 Apr 20 Dms Aiu MasterDocument25 pages2019 Apr 20 Dms Aiu MasterIrsyad ArifiantoPas encore d'évaluation

- Lecture 3 Profit Maximisation and Competitive SupplyDocument36 pagesLecture 3 Profit Maximisation and Competitive SupplycubanninjaPas encore d'évaluation

- Understanding Culture, Society and Politics - Government ProgramsDocument27 pagesUnderstanding Culture, Society and Politics - Government ProgramsFrancis Osias SilaoPas encore d'évaluation

- February-14 Rural Development SchemesDocument52 pagesFebruary-14 Rural Development SchemesAnonymous gVledD7eUGPas encore d'évaluation

- "Training and Action Research of Rural Development Academy (RDA), Bogra, Bangladesh." by Sheikh Md. RaselDocument101 pages"Training and Action Research of Rural Development Academy (RDA), Bogra, Bangladesh." by Sheikh Md. RaselRasel89% (9)

- Ayushman Bharat NewDocument21 pagesAyushman Bharat NewburhanPas encore d'évaluation

- PROVA DE INGLÊS Anpad 2009 JunDocument6 pagesPROVA DE INGLÊS Anpad 2009 JunDavi Zorkot100% (1)

- Poverty Alleviation Programmes in IndiaDocument4 pagesPoverty Alleviation Programmes in IndiaDEEPAK GROVERPas encore d'évaluation

- Artifact5 Position PaperDocument2 pagesArtifact5 Position Paperapi-377169218Pas encore d'évaluation

- Process of Environmental Clerance and The Involve inDocument9 pagesProcess of Environmental Clerance and The Involve inCharchil SainiPas encore d'évaluation

- Black and Gold Gala - On WebDocument1 pageBlack and Gold Gala - On Webapi-670861250Pas encore d'évaluation

- UAS MS NathanaelCahya 115190307Document2 pagesUAS MS NathanaelCahya 115190307Nathanael CahyaPas encore d'évaluation

- Garuda Indonesia Vs Others, Winning The Price WarDocument16 pagesGaruda Indonesia Vs Others, Winning The Price Waryandhie570% (1)

- Abre Viation SDocument62 pagesAbre Viation SAlinaPas encore d'évaluation