Académique Documents

Professionnel Documents

Culture Documents

Homework 2 Problemas de Admin de Proyectos

Transféré par

Ernesto Sesma TricioTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Homework 2 Problemas de Admin de Proyectos

Transféré par

Ernesto Sesma TricioDroits d'auteur :

Formats disponibles

earned on this investment?

2.50 At an interest rate of 12%, what is the present value of an asset that produces

$800 a year in perpetuity?

Linear Gradient Series

2.51 Kim deposits her annual bonus into a savings account that pays 7% interest

compounded annually. The size of her bonus increases by $3,000 each year, and

the initial bonus amount is $10,000. Determine how much will be in the account

immediately after the fifth deposit.

2.52 Five annual deposits in the amounts of $15,000, $14,000, $13,000, $12,000, and

$11,000 are made into a fund that pays interest at a rate of 7% compounded

annually. Determine the amount in the fund immediately after the fifth deposit.

2.53 Compute the value of P for the accompanying cash flow diagram. Assume i =

6% per year.

$700

$600

$500

$400

$300

$200

0

I 2 3 4 5 6

I

I Years

I

I

'p

2.54 What is the equal-payment series for 10 years that is equivalent to a payment

series starting with $10,000 at the end of the first year and decreasing by $1,000

each year over 10 years? Interest is 7% compounded annually.

2.55 The maintenance expense on a machine is expected to be $5,000 during the

first year and to increase $500 each year for the following ten years. What

present sum of money should be set aside now to pay for the required main-

tenance expenses over the ten-year period? (Assume 8% compound interest

CHAPTER 2 Time Value of Money

per year.)

2.56 Consider the cash flow series given in the accompanying table. What value of C

makes the deposit series equivalent to the withdrawal series at an interest rate

of 6% compounded annually?

5C

3C

2C - 1 - - ,( I

C -1- A I I

5

A -

I

I

I

I

I

I

I

0 2 3 4 I I I I I

6 7 8 9 10

Geometric-Gradient Series

2.57 Matt Christopher is a 30-year-old mechanical engineer, and his salary next year

will be $80,000. Matt expects that his salary will increase at a steady rate of 6%

per year until his retirement at age 60. If he saves 10% of his salary each year

and invest these savings at an interest rate of 8%, how much will he have at his

retirement?

2.58 Suppose that an oil well is expected to produce 12, 00,000 barrels of oil during

its first production year. However, its subsequent production (yield) is expected

to decrease by 9% over the previous year's production. The oil well has a

proven reserve of 10,500,000 barrels.

(a) Suppose that the price of oil is expected to be $120 per barrel for the next six

years. What would be the present worth of the anticipated revenue trim at

an interest rate of 10% compounded annually over the next six years?

(b) Suppose that the price of oil is expected to start at $120 per barrel during

Vous aimerez peut-être aussi

- Adidas Group Equity ValueDocument4 pagesAdidas Group Equity ValueDiaa eddin saeedPas encore d'évaluation

- Airline Pilot Career GUIDEDocument18 pagesAirline Pilot Career GUIDEDaniel LeoncePas encore d'évaluation

- Report On Economic Impact by Covid-19 (Md. Jahirul Islam MBA-09-20919004)Document4 pagesReport On Economic Impact by Covid-19 (Md. Jahirul Islam MBA-09-20919004)Mr. JahirPas encore d'évaluation

- Revised AcpDocument5 pagesRevised AcpSiddhant SharmaPas encore d'évaluation

- Exercise-Chapter 2 and 3: P Q P Q P Q A B C D FDocument4 pagesExercise-Chapter 2 and 3: P Q P Q P Q A B C D FPrum Longdy100% (4)

- Vineta PriyaDocument10 pagesVineta PriyaPriya SahniPas encore d'évaluation

- ATP For Airline PilotDocument18 pagesATP For Airline PilotSubkabox UKPas encore d'évaluation

- PFN1223 - Financial Management - Set C 2020Document14 pagesPFN1223 - Financial Management - Set C 2020alya farhanaPas encore d'évaluation

- Partnership Accounting Sample QuestionsDocument15 pagesPartnership Accounting Sample Questionspaul ndhlovuPas encore d'évaluation

- Pilot GDocument18 pagesPilot GDENISSE MACIASPas encore d'évaluation

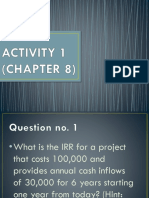

- Chapter 8 Activity 1Document21 pagesChapter 8 Activity 1Jane Hzel Lopez Militar100% (1)

- Practice Sums - Sessions - 3-4Document58 pagesPractice Sums - Sessions - 3-4Vibhuti AnandPas encore d'évaluation

- PE Vs non-PE IPO ActivityDocument31 pagesPE Vs non-PE IPO ActivityMaanav VaranasiPas encore d'évaluation

- Stable Growth Vs 2 Stage Valuation TemplateDocument13 pagesStable Growth Vs 2 Stage Valuation TemplateLalit mohan PradhanPas encore d'évaluation

- 2023 Agency Analysis: People, Profits, and ProjectionsDocument15 pages2023 Agency Analysis: People, Profits, and Projectionsz09y68dhptPas encore d'évaluation

- Campus de Salvador Calendário Acadêmico 2018 / SuperiorDocument3 pagesCampus de Salvador Calendário Acadêmico 2018 / SuperiorjkdbfjsdbfjksdPas encore d'évaluation

- Green Technology & Green BondDocument12 pagesGreen Technology & Green BondSIDDHARTH DASHPas encore d'évaluation

- Advance Financial Management-IDocument5 pagesAdvance Financial Management-ImahendrabpatelPas encore d'évaluation

- Scooter India LTDDocument12 pagesScooter India LTDMukesh Patel100% (1)

- David Corredor Ramírez - 20151005129Document3 pagesDavid Corredor Ramírez - 20151005129David Corredor RamirezPas encore d'évaluation

- No.43I - , 2ol8: 1.:::So:G:C I:Apc°Huenrc, E Ptph,:C::::Aotjvdee Eesduee°Bfut5:Ot:Nc:Ent:Yv:S::: Usi D2Os:: - C!%' ( :NK) NgforDocument18 pagesNo.43I - , 2ol8: 1.:::So:G:C I:Apc°Huenrc, E Ptph,:C::::Aotjvdee Eesduee°Bfut5:Ot:Nc:Ent:Yv:S::: Usi D2Os:: - C!%' ( :NK) NgfordemrickPas encore d'évaluation

- HDFC Asset Allocator Fund of Funds - NFO LeafletDocument4 pagesHDFC Asset Allocator Fund of Funds - NFO LeafletJignesh PatelPas encore d'évaluation

- Principal Islamic Lifetime Sukuk Fund (Formerly Known As CIMB Islamic Sukuk Fund)Document2 pagesPrincipal Islamic Lifetime Sukuk Fund (Formerly Known As CIMB Islamic Sukuk Fund)MAKK Business SolutionsPas encore d'évaluation

- Ktobo Dqurobo 1592 1594 1596Document57 pagesKtobo Dqurobo 1592 1594 1596Mikhael ChangPas encore d'évaluation

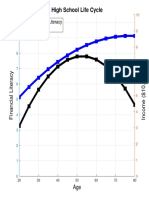

- High School Life Cycle: Financial Literacy IncomeDocument1 pageHigh School Life Cycle: Financial Literacy IncomeDaniel Lee Eisenberg JacobsPas encore d'évaluation

- Rs1,000.00 - Rs1,257.30: Bonds and Bonds ValuationDocument76 pagesRs1,000.00 - Rs1,257.30: Bonds and Bonds ValuationMomna ShahzadPas encore d'évaluation

- Man307 2017 18 Final Exam Questions SiUTDocument4 pagesMan307 2017 18 Final Exam Questions SiUTKinPas encore d'évaluation

- Cap Budg QuestionsDocument6 pagesCap Budg QuestionsSikandar AsifPas encore d'évaluation

- Comparative Analysis of Interest Rates in BankDocument12 pagesComparative Analysis of Interest Rates in BankSaikat PaulPas encore d'évaluation

- MCQS On Financial ManagementDocument3 pagesMCQS On Financial ManagementAnonymous kwi5IqtWJPas encore d'évaluation

- The Australian Economy and Financial Markets: July 2019Document33 pagesThe Australian Economy and Financial Markets: July 2019Amita SinghPas encore d'évaluation

- Fiuyg (Tnfi: Physician Aw, ,,RF"' FiDocument3 pagesFiuyg (Tnfi: Physician Aw, ,,RF"' FiMehedi Hasan MonimPas encore d'évaluation

- Pull, Push, Pipes: Sustainable Capital Flows For A New World OrderDocument23 pagesPull, Push, Pipes: Sustainable Capital Flows For A New World OrderHao WangPas encore d'évaluation

- Amazon Documents From NOACADocument27 pagesAmazon Documents From NOACAWKYC.comPas encore d'évaluation

- Capital Budgeting and LeasingDocument22 pagesCapital Budgeting and LeasingDeekshaPas encore d'évaluation

- Sujata: %age Turnover of ABCDocument7 pagesSujata: %age Turnover of ABCKunikaPas encore d'évaluation

- Financial Model - Mining IndustryDocument8 pagesFinancial Model - Mining IndustryAdnan AliPas encore d'évaluation

- Indonesia Strategy Stronger Growth and Stability PhaseDocument26 pagesIndonesia Strategy Stronger Growth and Stability PhaseNurcahya PriyonugrohoPas encore d'évaluation

- Agarwal and Lang-Solutions-37Document1 pageAgarwal and Lang-Solutions-37JokerTHPas encore d'évaluation

- About Simbiotic PDFDocument12 pagesAbout Simbiotic PDFRonald Gutierrez AlarcónPas encore d'évaluation

- Used Car Exports From JapanDocument9 pagesUsed Car Exports From JapanacmunarPas encore d'évaluation

- AllB - 2023 - 2024OpenEcon - AGeda - Combined UoN - AAUMScDocument84 pagesAllB - 2023 - 2024OpenEcon - AGeda - Combined UoN - AAUMScjared demissiePas encore d'évaluation

- The Private Sector Financial Balance As A Predictor of Financial CrisesDocument12 pagesThe Private Sector Financial Balance As A Predictor of Financial CrisesIsaac GoldPas encore d'évaluation

- Navin Agarwal Article Sep 2021Document5 pagesNavin Agarwal Article Sep 2021Smeet GopaniPas encore d'évaluation

- AP TA BU TIN Apprai A D: I L DGE G S L Metho SDocument11 pagesAP TA BU TIN Apprai A D: I L DGE G S L Metho SKanha SharmaPas encore d'évaluation

- July 2020 BBF20103 Introduction To Financial Management Assignment 2Document5 pagesJuly 2020 BBF20103 Introduction To Financial Management Assignment 2Muhamad SaifulPas encore d'évaluation

- Internal Rate of Return Calculating Rate of Return Rate of Return AnalysisDocument18 pagesInternal Rate of Return Calculating Rate of Return Rate of Return Analysisaini_rudinPas encore d'évaluation

- Capital BudgetingDocument9 pagesCapital BudgetingAnoop SinghPas encore d'évaluation

- Assignment 4Document24 pagesAssignment 4Agung Peradnya DewiPas encore d'évaluation

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaPas encore d'évaluation

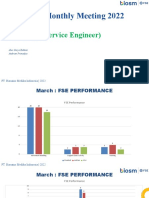

- Laporan FSE Maret 2022Document13 pagesLaporan FSE Maret 2022Andre PrimaPas encore d'évaluation

- Bwa M 03272018Document8 pagesBwa M 03272018asdf100% (1)

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunPas encore d'évaluation

- India GDPDocument1 pageIndia GDPwitedruidPas encore d'évaluation

- Deadlands Reloaded Preview PDFDocument5 pagesDeadlands Reloaded Preview PDFMaurício JacobPas encore d'évaluation

- ECON F312: Money, Banking and Financial Markets I Semester 2020-21Document23 pagesECON F312: Money, Banking and Financial Markets I Semester 2020-21AKSHIT JAINPas encore d'évaluation

- Aung Myint Mo EngineeringDocument1 pageAung Myint Mo EngineeringTOP TOPPas encore d'évaluation

- ÍmpetuDocument12 pagesÍmpetuBlas MartinezPas encore d'évaluation

- FEM PresentationDocument15 pagesFEM PresentationInnocent BhaikwaPas encore d'évaluation

- Aspects of the Dialogical Self: Extended proceedings of a symposium on the Second International Conference on the Dialogical Self (Ghent, Oct. 2002), including psycholonguistical, conversational, and educational contributionsD'EverandAspects of the Dialogical Self: Extended proceedings of a symposium on the Second International Conference on the Dialogical Self (Ghent, Oct. 2002), including psycholonguistical, conversational, and educational contributionsMarie C BertauPas encore d'évaluation

- Marine Engineering Mtech AssignmentDocument3 pagesMarine Engineering Mtech AssignmentDaniel Inemugha100% (1)

- 4' - FDM - ExamplesDocument24 pages4' - FDM - ExamplesHasnain MurtazaPas encore d'évaluation

- Site Surveying and Levelling John ClansyDocument36 pagesSite Surveying and Levelling John ClansyJohn William TolentinoPas encore d'évaluation

- Sec 93Document1 pageSec 93roufixPas encore d'évaluation

- Reconciliation and OpenModelicaDocument25 pagesReconciliation and OpenModelicaferdi66Pas encore d'évaluation

- 15 Famous Greek Mathematicians and Their ContributionsDocument16 pages15 Famous Greek Mathematicians and Their ContributionsMallari MarjoriePas encore d'évaluation

- Find The Positive Root of The Equation Correct To Five Decimal PlacesDocument5 pagesFind The Positive Root of The Equation Correct To Five Decimal PlacesPramod GowdaPas encore d'évaluation

- Maths Introduction Igcse Extended 3 YrsDocument9 pagesMaths Introduction Igcse Extended 3 YrsYenny TigaPas encore d'évaluation

- אלגוריתמים- הרצאה 7 - Single Source Shortest Path ProblemDocument5 pagesאלגוריתמים- הרצאה 7 - Single Source Shortest Path ProblemRonPas encore d'évaluation

- Syllogism Made EasyDocument20 pagesSyllogism Made EasympvetriveluPas encore d'évaluation

- System Dynamics For Engineering Students Concepts and Applications 2Nd Edition Nicolae Lobontiu Full ChapterDocument61 pagesSystem Dynamics For Engineering Students Concepts and Applications 2Nd Edition Nicolae Lobontiu Full Chapterbarbara.fitzpatrick934100% (6)

- I 1691Document32 pagesI 1691Juan Carlos Montes CastillaPas encore d'évaluation

- Zero To InfinityDocument181 pagesZero To InfinityAnup SaravanPas encore d'évaluation

- Surveying II O18 R15 3012Document3 pagesSurveying II O18 R15 3012Sufaira ShahadiyaPas encore d'évaluation

- PreviewpdfDocument27 pagesPreviewpdfJoaquin Sanchez JSPas encore d'évaluation

- STPM Maths T Assignment Introduction ExampleDocument2 pagesSTPM Maths T Assignment Introduction ExampleLing YiPas encore d'évaluation

- Systems of Numbers and Conversion: AlgebraDocument51 pagesSystems of Numbers and Conversion: AlgebraFelicia BarnPas encore d'évaluation

- Finite Element Programming With MATLABDocument58 pagesFinite Element Programming With MATLABbharathjoda100% (8)

- Multiple Choice RotationDocument20 pagesMultiple Choice RotationJohnathan BrownPas encore d'évaluation

- !!!destiny MatrixDocument107 pages!!!destiny Matrixjuancorraliza0% (2)

- GUIA de BibliometrixDocument62 pagesGUIA de BibliometrixrobinsonortizsierraPas encore d'évaluation

- Computer Aided Design of Electrical ApparatusDocument12 pagesComputer Aided Design of Electrical Apparatusraj selvarajPas encore d'évaluation

- MTAP Math ChallengeDocument5 pagesMTAP Math ChallengeHaron Abedin100% (1)

- The Effects of Design, Manufacturing Processes, and Operations Management On The Assembly of Aircraft Composite StructureDocument104 pagesThe Effects of Design, Manufacturing Processes, and Operations Management On The Assembly of Aircraft Composite StructureLinda Ayu Kusuma WardaniPas encore d'évaluation

- Malaysia Education Blueprint 2013-2025Document292 pagesMalaysia Education Blueprint 2013-2025HaziraAzlyPas encore d'évaluation

- 5135 Rover Ruckus Engineering NotebookDocument164 pages5135 Rover Ruckus Engineering Notebookapi-502004424Pas encore d'évaluation

- (ASTM International) Manual On Presentation of DataDocument116 pages(ASTM International) Manual On Presentation of DataJuan Ros100% (1)

- ADA104915 HEC BeardDocument17 pagesADA104915 HEC BeardVageesha Shantha Veerabhadra SwamyPas encore d'évaluation

- Atmospheric Thermodynamics 2Nd Edition Craig Bohren Full ChapterDocument67 pagesAtmospheric Thermodynamics 2Nd Edition Craig Bohren Full Chapterwilliam.belliveau809100% (7)