Académique Documents

Professionnel Documents

Culture Documents

Financial Statements: Engro Pakistan

Transféré par

Usman ChDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Statements: Engro Pakistan

Transféré par

Usman ChDroits d'auteur :

Formats disponibles

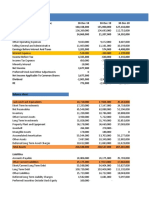

Engro Pakistan

Financial Statements

2016 2015 2014

INCOME STATEMENT Rs.(000) Rs.(000) Rs.(000)

Sales 157,208,000 181,652,000 175,958,000

Cost of Sales (121,365,000) (136,224,000) (139,742,000)

Gross Profit 35,843,000 45,429,000 36,217,000

Admin, Distribution and Marketing Expenses (15,659,000) (14,603,000) (14,789,000)

Other Expenses (2,349,000) (3,227,000) (2,543,000)

Other Income 68,838,000 5,592,000 3,719,000

Operating Profit 86,674,000 33,191,000 22,604,000

Finance Cost (6,038,000) (8,425,000) (12,344,000)

Share of Income from Joint Venture & associates 1,273,000 1,019,000 723000

Net Profit Before Taxation 81,909,000 25,785,000 10,983,000

Provision for Taxation (8,311,000) (8,516,000) (3,182,000)

Net Profit After Taxation 73,598,000 17,268,000 7,801,000

2016 2015 2014

BALANCE SHEET Rs.(000) Rs.(000) Rs.(000)

ASSETS

NON-CURRENT ASSETS

Property, Plant and Equipment 131,408,000 128,404,000 134,507,000

Long-term Investments 34,701,000 3,120,000 2,735,000

Biological Assets - 1,024,000 859000

Intangible Assets 222000 277000 296000

Others 10,405,000 4,888,000 2,399,000

Total 176,736,000 137,713,000 140,796,000

CURRENT ASSETS

Store, Spares and Loose Tools 7,148,000 7,679,000 7,547,000

Stock-in-Trade 10,704,000 14,089,000 11,567,000

Trade Debts 13,733,000 6,734,000 4,615,000

Advances, Deposits and Prepayments 1,390,000 1,508,000 1,708,000

Other Receivables 9,995 7,935,000 5,317,000

Taxes Recoverable - 2,350,000 3,253,000

Cash and Bank Balances 5,900,000 4,112,000 12,245,000

Short-term Investments 64,726,000 14,050,000 28,987,000

Others - 122000 1,052,000

Total 113,597,000 58,579,000 76,291,000

TOTAL ASSETS 290,333,000 196,292,000 217,087,000

EQUITY AND LIABILITIES

EQUITY

Share Capital 5,238,000 5,238,000 5,238,000

Share Premium 13,068,000 13,068,000 13,068,000

Unappropriated Profits 111,008,000 45,891,000 33,997,000

Reserves 4,523,000 5,044,000 4,874,000

Non-Controlling Interest 35,253,000 16,431,000 10,847,000

Total Equity 169,091,000 85,673,000 68,025,000

LIABILITIES

NON-CURRENT LIABILITIES

Borrowings 60,610,000 36,993,000 55,380,000

Derivative Financial Instruments 2000 17000 51000

Deferred Taxation 8,983,000 8,690,000 6,558,000

Others 197000 161000 198000

Total 69,791,000 45,862,000 62,187,000

CURRETN LIABILITIES

Current portion of Borrowings 12,509,000 22,589,000 17,945,000

Others 102000 98000 43000

Trade and Other Payables 31,625,000 34,051,000 53,498,000

Accrued Interest / Mark up 1,138,000 1,328,000 2,068,000

Short-term Borrowings 5,536,000 6,177,000 11,765,000

Short term finances 542000 514000 1,556,000

Total 51,451,000 64,757,000 86,875,000

TOTAL EQUITY AND LIABILITIES 290,333,000 196,292,000 217,087,000

Total Dividend (Assumption) 600,000 550,000 500,000

No. of Share (Assumption) 2,800 2,800 2,500

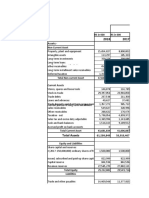

Uniliver Pakistan

Financial Statements

2016 2015 2014

INCOME STATEMENT Rs.(000) Rs.(000) Rs.(000)

Sales 9,466,836 8,571,097 7,787,059

Cost of sales (5,264,621) (4,738,804) (4,426,989)

Gross profit 4,202,215 3,832,293 3,360,070

Distribution cost (2,238,606) (1,954,022) (1,445,978)

Administrative expenses (155,137) (154,298) (160,740)

Other operating expenses (126,587) (125,372) (127,212)

Other income 120,343 103,174 113,582

Profit from operations 1,802,228 1,701,775 1,739,722

Finance costs (34,470) (36,090) (49,793)

Profit before taxation 1,767,758 1,665,685 1,689,929

Taxation (491,669) (433,557) (518,108)

Profit after taxation 1,276,089 1,232,128 1,171,821

2016 2015 2014

BALANCE SHEET Rs.(000) Rs.(000) Rs.(000)

ASSETS

NON-CURRENT ASSETS

Property, Plant and Equipment 2,084,856 2,040,339 1,803,992

Intangible assets 81,637 81,637 81,637

Long term loans 12,302 37,749 17,855

Long term prepayment 2,605 - -

Retirement benefit - prepayment - - 1,776

Total 2,181,400 2,159,725 1,905,260

CURRENT ASSETS

Stores and spares 31,429 22,483 25,682

Stock in trade 958,171 959,276 849,057

Trade debts 301,929 209,064 204,351

Loans and advances 23,864 15,180 16,077

Trade deposits and short term prepayments 74,049 50,484 60,067

Other receivables 10,815 30,868 51,901

Taxation - payments less provision 341,659 376,961 173,843

Cash and bank balances 694,779 593,252 137,024

Sales tax refundable - - 42,690

Total 2,436,695 2,257,568 1,560,692

4,618,095 4,417,293 3,465,952

EQUITY AND LIABILITIES

EQUITY

Share capital 61,576 61,576 61,576

Reserves 1,743,342 1,617,018 721,822

Total Equity 1,804,918 1,678,594 783,398

LIABILITIES

NON-CURRENT LIABILITIES

Retirement benefits - obligation 2,452 5,691 1,369

Deferred taxation 213,242 214,953 110,870

Total 215,694 220,644 112,239

CURRETN LIABILITIES

Trade and other payables 2,424,678 2,348,513 2,518,817

Provision 57,623 37,935 21,791

Accrued interest / mark-up - 1,119 757

Taxation - provision less payments - - -

Sales tax payable 115,182 48,812 -

Short term borrowings - 81,676 28,950

Total 2,597,483 2,518,055 2,570,315

TOTAL EQUITY AND LIABILITIES 4,618,095 4,417,293 3,465,952

Total Dividend (Assumption) 400,000 375,000 350,000

No. of Share (Assumption) 1,400 1,500 1,550

Financial Ratios

Engro Pakistan

2016 2015 2014

Profitability Ratios

GP Margin 23% 25% 21%

NP Margin 52% 14% 6%

ROCE 44% 20% 11%

Liquidity Ratios

Current Ratio 221% 90% 88%

Quick Ratio 200% 69% 75%

Efficiency Ratio

Debtor Days 31.88 13.53 9.57

Creditor Days 95.11 91.24 139.73

Inventory Days 32.19 37.75 30.21

Gearing Ratios

Debt/Equity Ratio 0.41 0.54 0.91

Interest Cover Ratio 0.07 0.25 0.55

Investor Ratio

Dividend Cover 0.01 0.03 0.06

EPS 26285.00 6167.14 3120.40

UNILIVER Pakistan

2016 2015 2014

44% 45% 43%

19% 20% 22%

71% 73% 150%

94% 90% 61%

57% 52% 28%

11.64 8.90 9.58

168.10 180.89 207.67

66.43 73.89 70.00

0.12 0.13 0.14

0.02 0.02 0.03

0.31 0.30 0.30

911.49 821.42 756.01

Vous aimerez peut-être aussi

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanPas encore d'évaluation

- Standalone Kitchen Model WorkingDocument3 pagesStandalone Kitchen Model WorkingSujith psPas encore d'évaluation

- Microsoft Corporation: Financial Analyis and ForecastDocument40 pagesMicrosoft Corporation: Financial Analyis and ForecastPrabhdeep DadyalPas encore d'évaluation

- Financial StatementsDocument14 pagesFinancial Statementsthenal kulandaianPas encore d'évaluation

- Template 2 Task 3 Calculation Worksheet - BSBFIM601Document17 pagesTemplate 2 Task 3 Calculation Worksheet - BSBFIM601Writing Experts0% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineD'EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LinePas encore d'évaluation

- Labour Equipment & MaterialDocument33 pagesLabour Equipment & MaterialSaurabh Kumar SharmaPas encore d'évaluation

- Profit & Loss Statement: O' Lites RestaurantDocument7 pagesProfit & Loss Statement: O' Lites RestaurantNoorulain AdnanPas encore d'évaluation

- Profit & Loss Statement: O' Lites GymDocument8 pagesProfit & Loss Statement: O' Lites GymNoorulain Adnan100% (5)

- Financial Management Question Bank 2019 PDFDocument384 pagesFinancial Management Question Bank 2019 PDFtsere butserePas encore d'évaluation

- Nifty Doctor Simple SystemDocument5 pagesNifty Doctor Simple SystemPratik ChhedaPas encore d'évaluation

- Question P8-1A: Cafu SADocument29 pagesQuestion P8-1A: Cafu SAMashari Saputra100% (1)

- Case Spreadsheet NewDocument6 pagesCase Spreadsheet NewUsman Ch0% (2)

- 1: Settings: Lower Oversold Opposite OversoldDocument9 pages1: Settings: Lower Oversold Opposite OversoldUsman Ch100% (1)

- Central Banking and Monetary Policy PDFDocument43 pagesCentral Banking and Monetary Policy PDFWindyee TanPas encore d'évaluation

- Application For PHD Position in - Photonics Application ParticularlyDocument2 pagesApplication For PHD Position in - Photonics Application ParticularlyUsman Ch67% (6)

- URBAN REVITALIZATION AND NEOLIBERALISMDocument50 pagesURBAN REVITALIZATION AND NEOLIBERALISMJoviecca Lawas67% (3)

- Balance Sheet: Current AssetsDocument3 pagesBalance Sheet: Current AssetsMustafa IbrahimPas encore d'évaluation

- Competitor 1 Sanofi Aventis Pakistan Limited Balance Sheets and Income Statements 2016-2020Document6 pagesCompetitor 1 Sanofi Aventis Pakistan Limited Balance Sheets and Income Statements 2016-2020Ahsan KamranPas encore d'évaluation

- Tesla Balance Sheet and Income Statement OverviewDocument26 pagesTesla Balance Sheet and Income Statement Overview崔梦炎Pas encore d'évaluation

- Research For OBUDocument14 pagesResearch For OBUM Burhan SafiPas encore d'évaluation

- Tyson Foods Income Statement Analysis 2016-2014Document13 pagesTyson Foods Income Statement Analysis 2016-2014Adil SaleemPas encore d'évaluation

- Group Project KHT Fall 20Document23 pagesGroup Project KHT Fall 20SAKIB MD SHAFIUDDINPas encore d'évaluation

- NICOL Financial Statement For The Period Ended 30 Sept 2023Document4 pagesNICOL Financial Statement For The Period Ended 30 Sept 2023Uk UkPas encore d'évaluation

- Deferred Tax Asset Retirement Benefit Assets: TotalDocument2 pagesDeferred Tax Asset Retirement Benefit Assets: TotalSrb RPas encore d'évaluation

- First Yacht ProjectDocument20 pagesFirst Yacht ProjectRaja HindustaniPas encore d'évaluation

- Cardinal - Financial StatementsDocument2 pagesCardinal - Financial StatementsCA RAKESHPas encore d'évaluation

- All Number in Thousands)Document7 pagesAll Number in Thousands)Lauren LoshPas encore d'évaluation

- FinancialDocument18 pagesFinancialMohammad UmmerPas encore d'évaluation

- P&L and Balance Sheet Analysis of Global Green and Red CompaniesDocument134 pagesP&L and Balance Sheet Analysis of Global Green and Red Companiesraveendiran kanagarajanPas encore d'évaluation

- Morgan Stanley ProjectDocument24 pagesMorgan Stanley ProjectGoodangel Blessing0% (1)

- Is BSDocument4 pagesIs BSAlamesuPas encore d'évaluation

- I Fitness Venture StandaloneDocument15 pagesI Fitness Venture StandaloneThe keyboard PlayerPas encore d'évaluation

- Day 1 To Day 4Document186 pagesDay 1 To Day 4Sameer PadhyPas encore d'évaluation

- Fruit Bread Bakery Financials Over 5 YearsDocument13 pagesFruit Bread Bakery Financials Over 5 YearsMary Chris Saldon BalladaresPas encore d'évaluation

- Standard-Ceramic-Limited NewDocument10 pagesStandard-Ceramic-Limited NewTahmid ShovonPas encore d'évaluation

- Rafhan Maize Products Company LTDDocument10 pagesRafhan Maize Products Company LTDALI SHER HaidriPas encore d'évaluation

- FSA ProjectDocument59 pagesFSA ProjectIslam AbdelshafyPas encore d'évaluation

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisAlina Binte EjazPas encore d'évaluation

- Tesla 2018 Production ForecastDocument61 pagesTesla 2018 Production ForecastAYUSH SHARMAPas encore d'évaluation

- Income Statement: 2013-2014 (Year) 2014-2015 (Year) 2015-2016 (Year)Document3 pagesIncome Statement: 2013-2014 (Year) 2014-2015 (Year) 2015-2016 (Year)Rifat Ibna LokmanPas encore d'évaluation

- Ali Asghar Report ..Document7 pagesAli Asghar Report ..Ali AzgarPas encore d'évaluation

- Statements Projected Profit & LossDocument6 pagesStatements Projected Profit & LossApril Joy ObedozaPas encore d'évaluation

- New Microsoft Excel WorksheetDocument10 pagesNew Microsoft Excel WorksheetakbarPas encore d'évaluation

- FM Assignment 1.1Document36 pagesFM Assignment 1.1Zee ArainPas encore d'évaluation

- Excel TopgloveDocument21 pagesExcel Topglovearil azharPas encore d'évaluation

- Financial Statement of YAKULT Philippines CorpDocument5 pagesFinancial Statement of YAKULT Philippines CorpMonii OhPas encore d'évaluation

- PAKISTAN AND UAE FORECAST PROJECTIONSDocument3 pagesPAKISTAN AND UAE FORECAST PROJECTIONSSyeda Nida AliPas encore d'évaluation

- Infosys Balance Sheet and Cash Flow AnalysisDocument44 pagesInfosys Balance Sheet and Cash Flow AnalysisAnanthkrishnanPas encore d'évaluation

- RMG Sales Forecast - QueenieDocument31 pagesRMG Sales Forecast - QueenieQueenie Amor AstilloPas encore d'évaluation

- Galadari PDFDocument7 pagesGaladari PDFRDPas encore d'évaluation

- Donam Corporate FinanceDocument9 pagesDonam Corporate FinanceMAGOMU DAN DAVIDPas encore d'évaluation

- Company Financial StatementsDocument3 pagesCompany Financial StatementsNarasimha Jammigumpula0% (1)

- Workpaper Advanced Accounting 2Document2 pagesWorkpaper Advanced Accounting 2gabiPas encore d'évaluation

- Crescent Textile Mills LTD AnalysisDocument23 pagesCrescent Textile Mills LTD AnalysisMuhammad Noman MehboobPas encore d'évaluation

- Home Depot Final DCFDocument120 pagesHome Depot Final DCFapi-515120297Pas encore d'évaluation

- China Petroleum & Chemical Corp. Balance Sheet BreakdownDocument25 pagesChina Petroleum & Chemical Corp. Balance Sheet BreakdownALEX ZAMORAPas encore d'évaluation

- Ats Consolidated (Atsc), Inc. Fiscal Fitness Analysis (Draft)Document6 pagesAts Consolidated (Atsc), Inc. Fiscal Fitness Analysis (Draft)Marilou CagampangPas encore d'évaluation

- Bursa Q3 2015 FinalDocument16 pagesBursa Q3 2015 FinalFakhrul Azman NawiPas encore d'évaluation

- Maple Leaf Balance Sheet AnalysisDocument12 pagesMaple Leaf Balance Sheet Analysis01290101002675Pas encore d'évaluation

- UploadDocument83 pagesUploadAli BMSPas encore d'évaluation

- Excel File SuzukiDocument18 pagesExcel File SuzukiMahnoor AfzalPas encore d'évaluation

- Draft ADocument16 pagesDraft ABiplob K. SannyasiPas encore d'évaluation

- Pronatural Food Corp. Financial Statement AnalysisDocument29 pagesPronatural Food Corp. Financial Statement AnalysisZejkeara ImperialPas encore d'évaluation

- National Foods Balance Sheet: 2013 2014 Assets Non-Current AssetsDocument8 pagesNational Foods Balance Sheet: 2013 2014 Assets Non-Current Assetsbakhoo12Pas encore d'évaluation

- Financial Statement Analysis UnsolvedDocument3 pagesFinancial Statement Analysis Unsolvedavani singhPas encore d'évaluation

- TeslaDocument5 pagesTeslaRajib ChatterjeePas encore d'évaluation

- Abott LabDocument6 pagesAbott LabRizwan Sikandar 6149-FMS/BBA/F20Pas encore d'évaluation

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisUrooj FatimaPas encore d'évaluation

- GJGJGHJGGJDocument3 pagesGJGJGHJGGJUsman ChPas encore d'évaluation

- BBBBBBBDocument4 pagesBBBBBBBUsman ChPas encore d'évaluation

- BBBBBBBDocument4 pagesBBBBBBBUsman ChPas encore d'évaluation

- Experienced Finance Professional Seeking New OpportunityDocument3 pagesExperienced Finance Professional Seeking New OpportunityUsman ChPas encore d'évaluation

- AaaaaDocument2 pagesAaaaaUsman ChPas encore d'évaluation

- CCCCCDocument2 pagesCCCCCUsman ChPas encore d'évaluation

- BBBBBDocument1 pageBBBBBUsman ChPas encore d'évaluation

- Experienced Finance Professional Seeking New OpportunityDocument3 pagesExperienced Finance Professional Seeking New OpportunityUsman ChPas encore d'évaluation

- Strategy 1.3Document2 pagesStrategy 1.3Usman ChPas encore d'évaluation

- Pakistani Accountant Seeks UAE OpportunityDocument2 pagesPakistani Accountant Seeks UAE OpportunityUsman ChPas encore d'évaluation

- TBLDocument1 pageTBLUsman ChPas encore d'évaluation

- Advanced Financial Management (AFM) : Syllabus and Study GuideDocument20 pagesAdvanced Financial Management (AFM) : Syllabus and Study GuideSunnyPas encore d'évaluation

- Experienced Finance Professional Seeking New OpportunityDocument3 pagesExperienced Finance Professional Seeking New OpportunityUsman ChPas encore d'évaluation

- Experienced Finance Professional Seeking New OpportunityDocument3 pagesExperienced Finance Professional Seeking New OpportunityUsman ChPas encore d'évaluation

- TBLDocument1 pageTBLUsman ChPas encore d'évaluation

- TBLDocument1 pageTBLUsman ChPas encore d'évaluation

- L ExampleDocument4 pagesL ExampleUsman ChPas encore d'évaluation

- Experienced Finance Professional Seeking New OpportunityDocument3 pagesExperienced Finance Professional Seeking New OpportunityUsman ChPas encore d'évaluation

- Experienced Finance Professional Seeking New OpportunityDocument3 pagesExperienced Finance Professional Seeking New OpportunityUsman ChPas encore d'évaluation

- t2 Past Paper PoiletDocument15 pagest2 Past Paper Poiletburaque100% (1)

- Experienced Finance Professional Seeking New OpportunityDocument3 pagesExperienced Finance Professional Seeking New OpportunityUsman ChPas encore d'évaluation

- John Maynard KeynesDocument28 pagesJohn Maynard KeynesReymar Lorente UyPas encore d'évaluation

- Bandai Namco Holdings Financial ReportDocument1 pageBandai Namco Holdings Financial ReportHans Surya Candra DiwiryaPas encore d'évaluation

- Securities and Exchange Board of India Final Order: WTM/AB/IVD/ID4/14459/2021-22Document91 pagesSecurities and Exchange Board of India Final Order: WTM/AB/IVD/ID4/14459/2021-22Pratim MajumderPas encore d'évaluation

- Feasibility Draft of Yellow Corn in Salug Valley (3!18!19)Document13 pagesFeasibility Draft of Yellow Corn in Salug Valley (3!18!19)Joseph Hachero TimbancayaPas encore d'évaluation

- Agricultural FinanceDocument22 pagesAgricultural Financeamit100% (3)

- Flash Memory Income Statements and Balance Sheets 2007-2009Document14 pagesFlash Memory Income Statements and Balance Sheets 2007-2009Pranav TatavarthiPas encore d'évaluation

- Alternative DevelopmentDocument13 pagesAlternative Developmentemana710% (1)

- Chapter 2 Macro SolutionDocument12 pagesChapter 2 Macro Solutionsaurabhsaurs100% (1)

- CW QuizDocument3 pagesCW QuizLorene bby100% (1)

- 1687503543sapm 2018-19Document230 pages1687503543sapm 2018-19Arun P PrasadPas encore d'évaluation

- OWNERISSUE110106IDocument16 pagesOWNERISSUE110106ISamPas encore d'évaluation

- Green Marketing: Boost Profits While Protecting the PlanetDocument8 pagesGreen Marketing: Boost Profits While Protecting the Planetvongai dearPas encore d'évaluation

- Panukalang ProyektoDocument10 pagesPanukalang ProyektoIsidro Jungco Remegio Jr.Pas encore d'évaluation

- Final Exam Spr2011Document5 pagesFinal Exam Spr2011Austin Holmes50% (4)

- Summer internship report on ICA Pidilite JVDocument11 pagesSummer internship report on ICA Pidilite JVArnab Das100% (1)

- Marketing Research: Methodological Foundations, 9e: by Churchill and IacobucciDocument21 pagesMarketing Research: Methodological Foundations, 9e: by Churchill and IacobucciYazan GhanemPas encore d'évaluation

- Medical Devices Market in India 2023 - Part-IDocument52 pagesMedical Devices Market in India 2023 - Part-IAdarsh ChamariaPas encore d'évaluation

- Burger King KFC McDonaldsDocument6 pagesBurger King KFC McDonaldsAnh TranPas encore d'évaluation

- ACTBAS1 - Lesson 2 (Statement of Financial Position)Document47 pagesACTBAS1 - Lesson 2 (Statement of Financial Position)AyniNuydaPas encore d'évaluation

- ON Dry Fish Business: Submitted byDocument6 pagesON Dry Fish Business: Submitted byKartik DebnathPas encore d'évaluation

- Commission Fines Ajinomoto Cheil and Daesang in Food Flavour Enhancers Nucleotides CartelDocument1 pageCommission Fines Ajinomoto Cheil and Daesang in Food Flavour Enhancers Nucleotides CartelRohit JangidPas encore d'évaluation

- Accounting Textbook Solutions - 68Document19 pagesAccounting Textbook Solutions - 68acc-expertPas encore d'évaluation

- Customer Satisfaction Towards Honda Two Wheeler: Presented By: Somil Modi (20152002) BBA-MBA 2015Document9 pagesCustomer Satisfaction Towards Honda Two Wheeler: Presented By: Somil Modi (20152002) BBA-MBA 2015Inayat BaktooPas encore d'évaluation