Académique Documents

Professionnel Documents

Culture Documents

Schwab Individual 401 (K) : Benefits

Transféré par

James StampTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Schwab Individual 401 (K) : Benefits

Transféré par

James StampDroits d'auteur :

Formats disponibles

Schwab Individual 401(k)

You’ve worked hard to build your business. Now make sure you have a retirement plan that works for

you. An Individual 401(k) can provide you with the flexibility you need while allowing you to maximize

contributions toward your retirement.

Benefits Convenient retirement savings—Contribute to your retirement savings easily and regularly with an

Individual 401(k). Receive benefits similar to a traditional 401(k) with less administration required.

Great value—Keep your costs low and maximize your investment returns with no account opening

or maintenance fees (other account fees, fund expenses, and brokerage commissions may apply)1

on a wide choice of no-load, no-transaction-fee mutual funds.2

Tax benefits—Contributions are tax-deductible and can grow tax-deferred.

High contributions—Can be funded with a combination of salary deferrals and annual employer

profit-sharing contributions. May permit greater contributions than other types of plans, such as

a SEP or Profit-Sharing Plan, without the funding commitment required by a Personal Defined

Benefit plan.

Special catch-up provision—Individuals age 50 or older can make an additional salary deferral

catch-up contribution of $6,000 for tax years 2018 and also 2019.

Flexibility—Plan does not need to be funded annually, and the amount contributed can vary from

year to year.

100% vesting—All contributions vest immediately.

Features Convenience—Easy to establish and maintain, a Schwab Individual 401(k) can help you build your

retirement savings.

Investment choice—Select from a wide range of investments, including:

• Mutual funds—Pick from thousands of mutual funds with no loads and no transaction fees, and

take advantage of our online screening tools and carefully screened lists of funds.2

• Stocks—Along with our commitment to fast trades and dependable execution, you can rely on

Schwab’s winning combination of service, insight, and value.

• Fixed income—Access thousands of fixed income securities and explore municipal, corporate,

and government agency bonds, bond funds, and other fixed income securities.

Tools and resources—Identify stocks and mutual funds with a selection of screening tools.

Schwab Individual 401(k) 1

Contributions Maximize your contributions—Contributions to an Individual 401(k) can be higher than

contributions to other types of retirement plans. Fund your plan with:

• Annual profit-sharing contributions of up to 20% of your net self-employment income.

• Annual salary deferral of up to $18,500 for 2018 tax year and $19,000 for 2019 tax year, for

a total annual contribution of up to $55,000 for 2018 tax year and $56,000 for 2019 tax year.

If you’re age 50 or older, you can make an additional salary deferral contribution of $6,000, for

a maximum contribution of up to $61,000 for 2018 tax year and $62,000 for 2019 tax year.

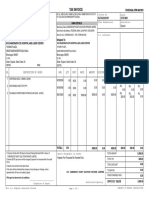

Example

SEP or Profit-Sharing Plan Individual 401(k)

$120,000 Compensation $120,000 Compensation

x 20% Max. Allowable % x 20% Max. Allowable %

of Compensation of Compensation

$24,000 Annual Contribution $24,000 Annual Profit-Sharing

Contribution

+ $19,000 2019 Salary Deferral

$43,000 Total Contribution

Individual Age 50+:

$6,000 2019 Salary Deferral

$49,000 Total Contribution

Contribution Deadline • You’ll want to fund your profit-sharing contributions by your tax-filing deadline, including any

extensions.

• In general, you must make your salary deferrals by the end of your business tax year.

Individual 401(k) Details Who is it for?

An Individual 401(k) may be best for self-employed individuals or owner-only businesses with no

employees other than a spouse (includes corporations, partnerships, and sole proprietorships).

It’s ideal for those who:

• Want to make contributions that are larger than what can typically be made to a SEP-IRA or

Profit-Sharing Plan.

• Need flexibility in the amount contributed annually.

• Want an easy-to-administer, low-cost plan.

Eligibility

• You may establish an Individual 401(k) if you are self-employed or an owner-only business and

have no employees other than your spouse.

• A partnership is eligible for an Individual 401(k) only if each partner owns at least 5% of the

business.

• A corporation is eligible for an Individual 401(k) only if it has no employees other than a sole

shareholder and his or her spouse.

• If you do not meet these criteria, Schwab can suggest other products that can meet your needs.

Schwab Individual 401(k) 2

Administration Establishment deadline—Establish plan by December 31 (or fiscal year-end).

You will need an Employer Identification Number (EIN) to establish your plan. If you don’t currently

have an EIN for your business, you may obtain one from the IRS for immediate use by applying

online at www.irs.gov.

Establishing plan—To include a full year’s compensation when calculating your contribution

amount, you should indicate the plan’s effective date of January 1 on your Schwab Individual 401(k)

Plan Adoption Agreement.

Tax filings—When your plan balance reaches $250,000 or more, you are required by law to file a

Form 5500 annually.

Loans—You may not take loans from your Schwab Individual 401(k).

Tax Advantages Contributions—Tax-deductible.

Earnings—Taxes are deferred until you start withdrawing funds.

Withdrawals—Taxable.

Distributions Tax consequences/penalties—Any earnings and contributions are taxed at the time of withdrawal.

Withdrawals made before age 59½ are subject to a 10% penalty.

Exceptions to penalty

• Penalty-free distributions may be made before age 59½ only under specific circumstances,

including termination of employment after age 55, disability, or death (distributions payable

directly to your beneficiary[ies]).

• In-service withdrawals are available only for hardship or after age 59½.

• Check your Adoption Agreement and Basic Plan Document for complete details on taking

distributions from your Individual 401(k).

Schwab Individual 401(k) 3

Next Steps Establish your plan—Review and complete the Schwab Individual 401(k) forms and

documents (as applicable), including:

• Adoption Agreement—Retain a copy of the completed document and return the original

to Schwab.

• Elective Deferral Agreement—Retain a copy for your records and provide a completed copy to

each participant to indicate the salary deferral amount.

• Basic Plan Document—Review and retain for your records.

• Plan Summary—Retain a copy for your records and provide each participant with a copy of the

completed document. Do not send to Schwab.

Open your account

• Individual 401(k) Account Application—All participants (including business owner) must

complete. Make copies for your records and return the originals to Schwab.

Contribute to account

• Contribution Transmittal Form—To make contributions to participant (including business owner)

accounts, complete and forward along with a check made payable to Charles Schwab & Co., Inc.

To request additional forms, go to Schwab.com. Completed forms can be mailed to:

Charles Schwab & Co., Inc. Charles Schwab & Co., Inc.

P.O. Box 982600 or P.O. Box 628291

El Paso, TX 79998-2600 Orlando, FL 32862-8291

For questions about the Schwab Individual 401(k) account, or for assistance in filling out the

forms, visit your local Schwab branch or call 1-800-435-4000.

How to Contact Us Call 1-800-435-4000.

Visit a Schwab branch near you.

Log in to Schwab.com.

Brokerage Products: Not FDIC-Insured • No Bank Guarantee • May Lose Value

Investors should carefully consider information contained in the prospectuses, including investment

objectives, risks, charges, and expenses. You can request a prospectus by calling Schwab at

1-800-435-4000. Please read the prospectus carefully before investing. Investment value will

fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Please refer to the Charles Schwab Pricing Guide for Individual Investors (the “Guide”) and any amendments to the

1

Guide for comprehensive details on fees.

Trades in no-load mutual funds available through the Mutual Fund OneSource ® service (including Schwab Funds®),

2

as well as certain other funds, are available without transaction fees when placed through Schwab.com or our

automated phone channels. For each of these trade orders placed through a broker, a $25 service charge applies.

Schwab reserves the right to change the funds we make available without transaction fees and to reinstate fees

on any funds. Schwab’s short-term redemption fee of $49.95 will be charged on redemption of funds purchased

through Schwab’s Mutual Fund OneSource service (and certain other funds with no transaction fee) and held for 90

days or less. Schwab reserves the right to exempt certain funds from this fee, including Schwab Funds, which may

charge a separate redemption fee, and funds that accommodate short-term trading. Funds are also subject to

management fees and expenses. Charles Schwab & Co., Inc. receives remuneration from fund companies in the

Mutual Fund OneSource program for recordkeeping and shareholder services, and other administrative services.

Schwab also may receive remuneration from transaction fee fund companies for certain administrative services.

This information is not intended to be a substitute for specific individualized tax or legal advice, and you should

consult with a qualified legal or tax advisor for further assistance.

Printed on recycled paper.

©2019 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. IAN (1215-AHEH) SLS30720-15 (01/19)

00223989

Vous aimerez peut-être aussi

- Website Redesign Proposal for BigCoDocument5 pagesWebsite Redesign Proposal for BigCoJames Stamp100% (2)

- Trumpet Studio Course Packet PDFDocument50 pagesTrumpet Studio Course Packet PDFAnonymous Zvl4mzF100% (5)

- Statement 31-JUL-20 AC 33211541Document6 pagesStatement 31-JUL-20 AC 33211541meu pau67% (3)

- Meracle - Executive SummaryDocument2 pagesMeracle - Executive SummaryColina QuyenColin TranPas encore d'évaluation

- GraphPad Dose Response Ebook PDFDocument12 pagesGraphPad Dose Response Ebook PDFAngeronaPas encore d'évaluation

- Slides - Pharmacokinetics - PharmacologyDocument43 pagesSlides - Pharmacokinetics - PharmacologyAli Veer Ali VeerPas encore d'évaluation

- A Four Year Syllabus For Applied TrumpetDocument10 pagesA Four Year Syllabus For Applied TrumpetAnonymous 4pGFWz54JPas encore d'évaluation

- Jerry Hey & Larry Hall Extended Adam Routine For TrumpetDocument6 pagesJerry Hey & Larry Hall Extended Adam Routine For TrumpetJames Stamp100% (1)

- A Four Year Syllabus For Applied TrumpetDocument10 pagesA Four Year Syllabus For Applied TrumpetAnonymous 4pGFWz54JPas encore d'évaluation

- Comeback Trumpeters GuideDocument126 pagesComeback Trumpeters GuideLeo100% (5)

- Gmail - APEC Schools - S202103135 - SY21 Assessment of FeesDocument2 pagesGmail - APEC Schools - S202103135 - SY21 Assessment of FeesMerry Chris Anne AdonaPas encore d'évaluation

- Bill To Be AttachedDocument1 pageBill To Be AttachedSumedha SawniPas encore d'évaluation

- Ella Lyman Cabot Trust Application for Project FundingDocument2 pagesElla Lyman Cabot Trust Application for Project FundingAdeyemi Oluwaseun JohnPas encore d'évaluation

- E.Types of Retirement Plans-1Document13 pagesE.Types of Retirement Plans-1Madhu dollyPas encore d'évaluation

- IRS Fringe Benefits GuideDocument118 pagesIRS Fringe Benefits GuideRandall TalcottPas encore d'évaluation

- A Chemical Spread Sheet in Microsoft ExcelDocument7 pagesA Chemical Spread Sheet in Microsoft ExcelKvts Pavan KumarPas encore d'évaluation

- Scaffold Hunter Facilitating Drug Discovery by VisualDocument17 pagesScaffold Hunter Facilitating Drug Discovery by VisualPatrick Comassetto FührPas encore d'évaluation

- Geneious R7: A Bioinformatics Platform For BiologistsDocument1 pageGeneious R7: A Bioinformatics Platform For BiologistsMelissa PentecostPas encore d'évaluation

- 01-2011 Benefit Guide-Active 10.20.10Document53 pages01-2011 Benefit Guide-Active 10.20.10stevestoPas encore d'évaluation

- Oracle HSA Setup GuideDocument16 pagesOracle HSA Setup Guideleninapps33Pas encore d'évaluation

- BAH - Total Rewards 2015 PDFDocument4 pagesBAH - Total Rewards 2015 PDFAnonymous NpRKutejMJPas encore d'évaluation

- Commvault Licensing GuideDocument20 pagesCommvault Licensing GuideFawad MirzaPas encore d'évaluation

- Implement Telemedicine to Increase Patient Access and Market ShareDocument14 pagesImplement Telemedicine to Increase Patient Access and Market ShareNaomi SargeantPas encore d'évaluation

- MistyWest Capabilities Statement Feb 2022Document34 pagesMistyWest Capabilities Statement Feb 2022nikita kankiyaPas encore d'évaluation

- Day-2 - June 01 (EDA + Visual Analytics)Document74 pagesDay-2 - June 01 (EDA + Visual Analytics)Mahander OadPas encore d'évaluation

- Informatica Ready Partner Program Brochure 2948Document4 pagesInformatica Ready Partner Program Brochure 2948Gregory FoxPas encore d'évaluation

- Partner Playbook: Data Protection PortfolioDocument34 pagesPartner Playbook: Data Protection Portfoliokarlosm84Pas encore d'évaluation

- Schrödinger Life Sciences 2013 Major New Features & EnhancementsDocument10 pagesSchrödinger Life Sciences 2013 Major New Features & Enhancementsthamizh555Pas encore d'évaluation

- Bioinformatics CompaniesDocument18 pagesBioinformatics Companiesmy.dear.sirPas encore d'évaluation

- The Complete HSA GuidebookDocument229 pagesThe Complete HSA GuidebookMichelle LumPas encore d'évaluation

- Visual Discovery Tools: Market Segmentation and Product PositioningDocument30 pagesVisual Discovery Tools: Market Segmentation and Product PositioningGetafixPas encore d'évaluation

- Employee Compensation and BenefitsDocument28 pagesEmployee Compensation and BenefitsToqeer AhmedPas encore d'évaluation

- 2021 Benefits Summary - ReadDocument12 pages2021 Benefits Summary - Readapi-544195419Pas encore d'évaluation

- Thingworx Extension Development User Guide PDFDocument93 pagesThingworx Extension Development User Guide PDFRonaldMartinezPas encore d'évaluation

- Advance AI & ML Certification ProgramDocument29 pagesAdvance AI & ML Certification ProgramRoshan ShaikPas encore d'évaluation

- The Spoken Tutorial (IIT Bombay)Document9 pagesThe Spoken Tutorial (IIT Bombay)Raj BathijaPas encore d'évaluation

- Guidelines For Industrial Placement ReportDocument11 pagesGuidelines For Industrial Placement ReportElaine LaLaPas encore d'évaluation

- Sample Relocation Cover Letter TemplateDocument9 pagesSample Relocation Cover Letter Templatebcrqy80d100% (1)

- Integrating b2b Service With Field ServiceDocument82 pagesIntegrating b2b Service With Field ServiceRaghavendra KamurthiPas encore d'évaluation

- A Winning Resume Kit ResumeCoachDocument14 pagesA Winning Resume Kit ResumeCoachsohail2006Pas encore d'évaluation

- Enterprise Fixed Asset Management SolutionDocument18 pagesEnterprise Fixed Asset Management SolutionsandeepPas encore d'évaluation

- Research And Development Tax Credit A Complete Guide - 2021 EditionD'EverandResearch And Development Tax Credit A Complete Guide - 2021 EditionPas encore d'évaluation

- Optum solutions help health plans address cost quality and revenueDocument12 pagesOptum solutions help health plans address cost quality and revenueantonettereynoldsPas encore d'évaluation

- KISS PrincipleDocument3 pagesKISS PrincipleAlyDedenPas encore d'évaluation

- Thesis On Recuirtment and SelectionDocument70 pagesThesis On Recuirtment and SelectionWehvaria RainaPas encore d'évaluation

- Equity Incentive PlanDocument3 pagesEquity Incentive PlanRocketLawyer100% (2)

- Mind Mapping Introduction Speller 2008Document32 pagesMind Mapping Introduction Speller 2008shaileshvc100% (1)

- ONAP Orchestration Architecture Use Cases WP Feb 2018Document11 pagesONAP Orchestration Architecture Use Cases WP Feb 2018radhia saidanePas encore d'évaluation

- NewJoinersBrochureOverviewDocument46 pagesNewJoinersBrochureOverviewKrishPas encore d'évaluation

- Unit Title Work With Others Unit Code Unit DescriptorDocument27 pagesUnit Title Work With Others Unit Code Unit DescriptorOliver SyPas encore d'évaluation

- VMware Vsphere With Operations Management Launch Playbook PDFDocument11 pagesVMware Vsphere With Operations Management Launch Playbook PDFCarlos Eduardo Chavez MorenoPas encore d'évaluation

- Denmark WP Process Document (AutoRecovered)Document11 pagesDenmark WP Process Document (AutoRecovered)Amarnath ReddyPas encore d'évaluation

- RMN - Epsilon 52229 EN 3Document16 pagesRMN - Epsilon 52229 EN 3Kim HoldenPas encore d'évaluation

- Deloitte USI Consulting JD Consultant - Lateral - Tech Strategy - AI&DS VDRAFTDocument2 pagesDeloitte USI Consulting JD Consultant - Lateral - Tech Strategy - AI&DS VDRAFThaikyutradersPas encore d'évaluation

- How To Write A Business Plan 1Document16 pagesHow To Write A Business Plan 1Cindy JauculanPas encore d'évaluation

- The Periodic Table of Loyalty MarketingDocument10 pagesThe Periodic Table of Loyalty MarketingLorena Tacury100% (1)

- 2023 Ad Spend OutlookDocument28 pages2023 Ad Spend OutlookNguyễn Châu Bảo NgọcPas encore d'évaluation

- Your Business Insights Partner Using Data ScienceDocument17 pagesYour Business Insights Partner Using Data ScienceharigopaldasaPas encore d'évaluation

- Social Media Training NewDocument18 pagesSocial Media Training NewmarhadyPas encore d'évaluation

- Product Demo TemplateDocument9 pagesProduct Demo Templateconnectadasgupta100% (1)

- Rc018 010d Core DotnetDocument6 pagesRc018 010d Core DotnetBala SubraPas encore d'évaluation

- Code of Conduct - Hellofresh: Core Values and Corporate CultureDocument6 pagesCode of Conduct - Hellofresh: Core Values and Corporate CultureMadi100% (1)

- Plugins Zotero DocumentationDocument7 pagesPlugins Zotero Documentationarchivo_lcPas encore d'évaluation

- Gartner and Data PipelinesDocument11 pagesGartner and Data Pipelinesdgloyn_cox100% (1)

- CRM FullDocument150 pagesCRM FullTanya JunejaPas encore d'évaluation

- Resume Sample Financial ManagementDocument2 pagesResume Sample Financial ManagementSitiSyawaliaPas encore d'évaluation

- Business Models Explained: Razor Blade, Freemium & MoreDocument57 pagesBusiness Models Explained: Razor Blade, Freemium & MoreYash UpadhyayPas encore d'évaluation

- InfoSys D2 Assignment Lbla545Document12 pagesInfoSys D2 Assignment Lbla545lbla545Pas encore d'évaluation

- Medicare HMO PPO Pharmacy Directory enDocument287 pagesMedicare HMO PPO Pharmacy Directory enUlyssesm90100% (1)

- Automated Configuration and Provisioning A Clear and Concise ReferenceD'EverandAutomated Configuration and Provisioning A Clear and Concise ReferenceÉvaluation : 5 sur 5 étoiles5/5 (1)

- The University of British Columbia School of Music: Requirements For Undergraduate Trumpet AuditionDocument4 pagesThe University of British Columbia School of Music: Requirements For Undergraduate Trumpet AuditionDumi DumDumPas encore d'évaluation

- Cash Features Disclosure Statement: January 2019Document32 pagesCash Features Disclosure Statement: January 2019James StampPas encore d'évaluation

- Trumpet CompendiumDocument29 pagesTrumpet CompendiumJames Stamp100% (3)

- Arban Checklist TrumpetDocument1 pageArban Checklist TrumpetJames StampPas encore d'évaluation

- Trumpet MethodsDocument64 pagesTrumpet MethodsJames Stamp100% (5)

- Applied Trumpet Lesson Syllabus: Ourse UtcomesDocument7 pagesApplied Trumpet Lesson Syllabus: Ourse UtcomesJames StampPas encore d'évaluation

- Green Glue Outperforms Mass Loaded VinylDocument4 pagesGreen Glue Outperforms Mass Loaded VinylJames StampPas encore d'évaluation

- Recital ChecklistDocument1 pageRecital ChecklistJames StampPas encore d'évaluation

- Williams Strength Building RoutineDocument1 pageWilliams Strength Building RoutineJames Stamp100% (4)

- Trumpet CompendiumDocument29 pagesTrumpet CompendiumJames Stamp100% (3)

- Shook Maximizing Daily PracticeDocument4 pagesShook Maximizing Daily PracticeJames Stamp100% (2)

- International Trumpet GuildDocument3 pagesInternational Trumpet GuildJames StampPas encore d'évaluation

- Arban Checklist TrumpetDocument1 pageArban Checklist TrumpetJames StampPas encore d'évaluation

- International Trumpet GuildDocument1 pageInternational Trumpet GuildJames StampPas encore d'évaluation

- International Trumpet GuildDocument5 pagesInternational Trumpet GuildJames StampPas encore d'évaluation

- MTSU Undergraduate Audition Requirements TrumpetDocument1 pageMTSU Undergraduate Audition Requirements TrumpetJames StampPas encore d'évaluation

- Six American Master Trumpet TeachersDocument158 pagesSix American Master Trumpet TeachersJames Stamp86% (7)

- CosDocument5 pagesCosWerner van LoonPas encore d'évaluation

- Obillos, Jr. vs. Cir - 139 Scra 436Document4 pagesObillos, Jr. vs. Cir - 139 Scra 436Ygh E SargePas encore d'évaluation

- Alcan Pakaging Starpack Corporation vs. The City Treasurer of Manila PDFDocument3 pagesAlcan Pakaging Starpack Corporation vs. The City Treasurer of Manila PDFJuralexPas encore d'évaluation

- Citi rent cashbackDocument3 pagesCiti rent cashbackdwarakanath4Pas encore d'évaluation

- Account Activity: Transaction Date Post Date Transaction Reference No. Description Debit Credit BalanceDocument1 pageAccount Activity: Transaction Date Post Date Transaction Reference No. Description Debit Credit BalanceAtiq_2909Pas encore d'évaluation

- Cost Breakup of Indian Ride Sharing CabsDocument3 pagesCost Breakup of Indian Ride Sharing CabsNNS RohitPas encore d'évaluation

- BLTST119ExOr NY PDFDocument1 pageBLTST119ExOr NY PDFmoresubscriptionsPas encore d'évaluation

- Phonepe Startup Project (Entrepreneur)Document9 pagesPhonepe Startup Project (Entrepreneur)Aŋoop KrīşħŋặPas encore d'évaluation

- Request Form Bank of Baroda PDFDocument2 pagesRequest Form Bank of Baroda PDFSwetha ElangoPas encore d'évaluation

- VAT Guide For VendorsDocument106 pagesVAT Guide For VendorsUrvashi KhedooPas encore d'évaluation

- Class AssignmentDocument3 pagesClass AssignmentZen JoaquinPas encore d'évaluation

- First Data Annual Report 2011Document178 pagesFirst Data Annual Report 2011SteveMastersPas encore d'évaluation

- HDFC Bank Statement Summary for M/S. VIASTAR IMPEX PVT LTDDocument5 pagesHDFC Bank Statement Summary for M/S. VIASTAR IMPEX PVT LTDFIERY TrackPas encore d'évaluation

- Final C.A. – D.T- MCQ’s on Profits and Gains from Business or Profession & Assessment of Various EntitiesDocument130 pagesFinal C.A. – D.T- MCQ’s on Profits and Gains from Business or Profession & Assessment of Various Entitiesanand vishwakarmaPas encore d'évaluation

- Waleed Mohammed Elhasan Elmubarak: 2072020: 0233120720200001: Saving Plus:: 31-01-2022Document8 pagesWaleed Mohammed Elhasan Elmubarak: 2072020: 0233120720200001: Saving Plus:: 31-01-2022knoor33Pas encore d'évaluation

- Calculate Income from Salaries Including Entertainment Allowance and House Rent AllowanceDocument3 pagesCalculate Income from Salaries Including Entertainment Allowance and House Rent AllowanceSiva SankariPas encore d'évaluation

- Carmelino Pansacola v. CIRDocument2 pagesCarmelino Pansacola v. CIRVince MontealtoPas encore d'évaluation

- Challan of Cash Paid in To Challan NoDocument2 pagesChallan of Cash Paid in To Challan NoWnc WestridgePas encore d'évaluation

- Taxation and Auditing: An OverviewDocument3 pagesTaxation and Auditing: An Overviewsubash pandeyPas encore d'évaluation

- Ram BillDocument1 pageRam BillHarish Babu N KPas encore d'évaluation

- GermanDocument28 pagesGermanVaibhavi SinghPas encore d'évaluation

- CHAPTER 3: Financial Documents in The International PaymentDocument33 pagesCHAPTER 3: Financial Documents in The International PaymentVũ Cao Kỳ DuyênPas encore d'évaluation

- MedicalimDocument1 pageMedicalimsaurabhPas encore d'évaluation

- SSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077Document29 pagesSSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077samPas encore d'évaluation

- INCOME TAX Imp - SectionsDocument7 pagesINCOME TAX Imp - SectionsDeepak Singh100% (1)

- Tax Invoice: Caregroup Sight Solution Private LimitedDocument1 pageTax Invoice: Caregroup Sight Solution Private LimitedtejasPas encore d'évaluation

- For Any Transactional Queries Related To Donations Please ContactDocument1 pageFor Any Transactional Queries Related To Donations Please ContactChristo JeniferPas encore d'évaluation