Académique Documents

Professionnel Documents

Culture Documents

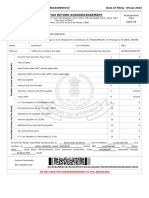

Idea Balance Sheet2017-18

Transféré par

Ilias AkhtarCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Idea Balance Sheet2017-18

Transféré par

Ilias AkhtarDroits d'auteur :

Formats disponibles

CK

Consolidated Financial Statements

Consolidated Balance Sheet as at March 31, 2018

` Mn

Particulars Notes As at As at

March 31, 2018 March 31, 2017

ASSETS

Non-current assets

Property, plant and equipment 7 244,549.33 228,442.96

Capital work-in-progress 6,512.98 13,302.99

Goodwill on consolidation 61.20 61.20

Other Intangible assets 8 552,308.61 539,128.25

Intangible assets under development 8 29,339.89 62,048.00

Financial assets

Investments accounted for using the equity method 9 16,601.12 14,784.75

Long term loans to employees 24.00 25.93

Other non-current financial assets 10 4,180.01 4,864.75

Deferred tax assets(net) (refer note 56) 12,051.57 368.97

Other non-current assets 11 17,797.36 27,693.89

Total non-current assets (A) 883,426.07 890,721.69

Current assets

Inventories 12 366.65 587.97

Financial assets

Current investments 13 56,304.30 48,997.52

Trade receivables 14 8,873.86 13,139.21

Cash and cash equivalents 15 193.15 782.46

Bank balance other than cash and cash equivalents 16 98.19 44.97

Current portion of loans to employees 20.16 20.75

Other current financial assets 17 313.74 399.09

Current tax assets (Net) 7,751.69 25.10

Other current assets 18 17,914.97 12,312.07

Total current assets (B) 91,836.71 76,309.14

Assets classified as held for sale (AHFS) (refer note 40(i)) (C) 19 10,508.87 16.11

Total Assets (A+B+C) 985,771.65 967,046.94

EQUITY AND LIABILITIES

Equity

Equity share capital 20 43,593.21 36,053.28

Other equity 21 229,031.39 211,269.16

Total equity (A) 272,624.60 247,322.44

Liabilities

Non-current liabilities

Financial liabilities

Long term borrowings 22 569,408.00 516,378.28

Other non-current financial liabilities 23 26,061.68 10,381.81

Long term provisions 24 3,107.49 3,842.29

Deferred tax liabilities (net) (refer note 56) 659.35 13,587.10

Other non-current liabilities 25 5,601.19 4,920.46

Total non-current liabilities (B) 604,837.71 549,109.94

Current liabilities

Financial liabilities

Short term borrowings 26 216.94 347.09

Trade payables (refer note 58) 35,479.09 40,776.67

Other current financial liabilities 27 43,820.06 102,560.08

Other current liabilities 28 26,597.11 26,732.08

Short term provisions 29 223.69 198.64

Total current liabilities (C) 106,336.89 170,614.56

Liabilities classified as held for sale (refer note 40(i)) (D) 1,972.45 -

Total Equity and Liabilities (A+B+C+D) 985,771.65 967,046.94

The accompanying notes are an integral part of the Financial Statements

As per our report of even date

For S.R. Batliboi & Associates LLP For and on behalf of the Board of Directors of Idea Cellular Limited

Chartered Accountants

ICAI Firm Registration No: 101049W/E300004

Prashant Singhal Arun Thiagarajan Tarjani Vakil

Partner Director Director

Membership No.: 93283 (DIN No. 00292757) (DIN No. 00009603)

Himanshu Kapania Akshaya Moondra Pankaj Kapdeo

Managing Director Whole time Director & Company Secretary

Place : Mumbai (DIN No. 03387441) Chief Financial Officer

Date : April 28, 2018 (DIN No. 02606784)

156 Vodafone Idea Limited (formerly Idea Cellular Limited)

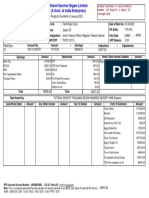

CK

Consolidated Financial Statements

Consolidated Statement of Profit and Loss for the year ended March 31, 2018

` Mn

Particulars Notes For the year ended For the year ended

March 31, 2018 March 31, 2017

INCOME

Service revenue 282,419.89 355,298.44

Sale of Trading Goods 51.28 228.11

Other operating income 30 318.22 230.82

Revenue from operations 282,789.39 355,757.37

Other income 31 3,529.30 3,069.35

TOTAL INCOME 286,318.69 358,826.72

OPERATING EXPENDITURE

Cost of Trading Goods 72.58 279.19

Employee benefit expenses 32 15,430.43 17,976.45

Network expenses and IT outsourcing cost 33 97,333.64 101,817.03

License fees and spectrum usage charges 34 28,667.17 40,514.83

Roaming and access charges 35 35,357.85 42,754.44

Subscriber acquisition and servicing expenditure 36 27,942.25 30,282.23

Advertisement, business promotion expenditure and content cost 37 8,147.50 9,412.50

Other expenses 38 9,362.43 10,284.10

222,313.85 253,320.77

PROFIT BEFORE FINANCE COSTS, DEPRECIATION, AMORTISATION, SHARE

OF PROFIT/(LOSS) OF JOINT VENTURE AND ASSOCIATES AND TAX 64,004.84 105,505.95

Fair value (gain) / loss on Compulsorily Convertible Preference Shares (CCPS) - 290.15

Finance costs 39 48,129.69 39,794.37

Depreciation 7 50,629.75 49,913.76

Amortisation 8 33,461.21 28,358.28

LOSS BEFORE TAX AND SHARE OF PROFIT / (LOSS) OF

JOINT VENTURE AND ASSOCIATE (68,215.81) (12,850.61)

Add: Share in Profits of Joint Venture 3,457.88 4,302.93

Add: Share in Loss of Associate (234.35) (84.67)

LOSS BEFORE TAX (64,992.28) (8,632.35)

Tax expense:

- Current tax 55 1,233.90 990.09

- Deferred tax 55 (24,544.58) (5,625.48)

LOSS AFTER TAX (41,681.60) (3,996.96)

OTHER COMPREHENSIVE INCOME / (LOSS)

Items not to be reclassified to profit or loss in subsequent periods:

Re-measurement gains/ (losses) of defined benefit plans 52 441.41 (56.82)

Income tax effect 55 (151.81) 19.30

Group’s share in other comprehensive income of joint venture (6.92) (5.82)

and associate (net of taxes)

Other comprehensive income / (loss) for the year, net of tax 282.68 (43.34)

TOTAL COMPREHENSIVE LOSS FOR THE YEAR (41,398.92) (4,040.30)

Earnings per equity share of ` 10 each: 57

Basic (`) (11.36) (1.23)

Diluted (`) (11.36) (1.23)

The accompanying notes are an integral part of the Financial Statements

As per our report of even date

For S.R. Batliboi & Associates LLP For and on behalf of the Board of Directors of Idea Cellular Limited

Chartered Accountants

ICAI Firm Registration No: 101049W/E300004

Prashant Singhal Arun Thiagarajan Tarjani Vakil

Partner Director Director

Membership No.: 93283 (DIN No. 00292757) (DIN No. 00009603)

Himanshu Kapania Akshaya Moondra Pankaj Kapdeo

Managing Director Whole time Director & Company Secretary

Place : Mumbai (DIN No. 03387441) Chief Financial Officer

Date : April 28, 2018 (DIN No. 02606784)

Annual Report 2017-18 157

Vous aimerez peut-être aussi

- HR Compliance ChecklistDocument5 pagesHR Compliance ChecklistPragat Naik100% (2)

- Salary SlipDocument2 pagesSalary Slipprnali.vflPas encore d'évaluation

- G. L. Bajaj Institute of Technology & Management: Fee ReceiptDocument1 pageG. L. Bajaj Institute of Technology & Management: Fee ReceiptmaniastuntPas encore d'évaluation

- PayU - Sales DeckDocument25 pagesPayU - Sales Deckarjun prajapatPas encore d'évaluation

- BFL Standalone Financials - June 2022Document5 pagesBFL Standalone Financials - June 2022SomPas encore d'évaluation

- Balance Sheet: Particulars 2018 2019Document9 pagesBalance Sheet: Particulars 2018 2019Manjusha JuluriPas encore d'évaluation

- TVS Income StatementDocument9 pagesTVS Income StatementBobPas encore d'évaluation

- Financial StatementsDocument14 pagesFinancial Statementsthenal kulandaianPas encore d'évaluation

- Wa0000.Document23 pagesWa0000.srm finservPas encore d'évaluation

- Financial StatementDocument6 pagesFinancial StatementCeddie UnggayPas encore d'évaluation

- Bauwerk LTD.: This Is A Computer Generated Statement and Does Not Require Any SignatureDocument23 pagesBauwerk LTD.: This Is A Computer Generated Statement and Does Not Require Any SignatureSadid ShahzadPas encore d'évaluation

- Feb2023 - Salary Slip PDFDocument1 pageFeb2023 - Salary Slip PDFOM SHARMAPas encore d'évaluation

- Payslip July 2019 CP Payslip 024612 PDFDocument2 pagesPayslip July 2019 CP Payslip 024612 PDFhari bcaPas encore d'évaluation

- Appointment - Letter GaganDocument10 pagesAppointment - Letter GaganAjay choudharyPas encore d'évaluation

- Salary Slip For The Month - Mar 2019: Earnings Amt. (INR) Deductions Amt. (INR)Document1 pageSalary Slip For The Month - Mar 2019: Earnings Amt. (INR) Deductions Amt. (INR)Shivpratap Singh RajawatPas encore d'évaluation

- Payslip: Madhya Pradesh Madhya Kshetra Vidyut Vitran Company LTDDocument2 pagesPayslip: Madhya Pradesh Madhya Kshetra Vidyut Vitran Company LTDRavi SahuPas encore d'évaluation

- PrivateDocument1 pagePrivateapi-3745021Pas encore d'évaluation

- Prasant Kumar Dakua: Pay Slip - February 2019Document1 pagePrasant Kumar Dakua: Pay Slip - February 2019biki222Pas encore d'évaluation

- Promotion Letter - 1Document2 pagesPromotion Letter - 1RaviArryanPas encore d'évaluation

- Appraisal LetterDocument2 pagesAppraisal LetterAparna KalePas encore d'évaluation

- SsssDocument2 pagesSsssRafiqul Islam SaimonPas encore d'évaluation

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauPas encore d'évaluation

- FormDocument1 pageFormKANHAIYA KUMARPas encore d'évaluation

- TEMPLATE - Letter of PromotionDocument1 pageTEMPLATE - Letter of PromotionUsman MajeedPas encore d'évaluation

- H925 Payslip Gabriel Feb 2015 PDFDocument1 pageH925 Payslip Gabriel Feb 2015 PDFAnonymous ALI6GKILPas encore d'évaluation

- April Pay SlipDocument1 pageApril Pay SlipBandari GoverdhanPas encore d'évaluation

- Oct PayslipDocument1 pageOct PayslipPandu RjPas encore d'évaluation

- IncrementDocument1 pageIncrementDeepak SinghPas encore d'évaluation

- Admin 48131116Document1 pageAdmin 48131116Manpreet KambojPas encore d'évaluation

- UnknownDocument1 pageUnknownrahulagarwal33Pas encore d'évaluation

- Payslip For The Month of Nov 2022Document1 pagePayslip For The Month of Nov 2022Natural HealthCare IdeasPas encore d'évaluation

- May Pay SlipDocument1 pageMay Pay SlipAnkit100% (1)

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANEPas encore d'évaluation

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriPas encore d'évaluation

- UnknownDocument1 pageUnknownsaravananbsnlslm3866Pas encore d'évaluation

- G. L. Bajaj Institute of Technology & Management: Fee ReceiptDocument2 pagesG. L. Bajaj Institute of Technology & Management: Fee Receiptamirqureshi6281Pas encore d'évaluation

- BSNL Balance SheetDocument15 pagesBSNL Balance SheetAbhishek AgarwalPas encore d'évaluation

- Murali Krishna Chollangi Payslip Nov 2022.PdfmDocument1 pageMurali Krishna Chollangi Payslip Nov 2022.Pdfmanuteck1Pas encore d'évaluation

- Madan PayslipDocument1 pageMadan PayslipBADI APPALARAJUPas encore d'évaluation

- Scrip Code: 500295 Scrip Code: VEDL: Sensitivity: Internal (C3)Document2 pagesScrip Code: 500295 Scrip Code: VEDL: Sensitivity: Internal (C3)Vijai PrakashPas encore d'évaluation

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document3 pagesItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Mohammad AliPas encore d'évaluation

- Web Payslip 266675 202304Document2 pagesWeb Payslip 266675 202304prabhat.finnproPas encore d'évaluation

- Rahul Gangarekar - Offer LetterDocument2 pagesRahul Gangarekar - Offer Letterrahul gangarekarPas encore d'évaluation

- CT13529 Payslip Feb2024Document1 pageCT13529 Payslip Feb2024Vikash SinghPas encore d'évaluation

- HikeDocument1 pageHikeB RameshPas encore d'évaluation

- Revised Offer Letter - ResolveTechDocument2 pagesRevised Offer Letter - ResolveTechsayali kadPas encore d'évaluation

- BSNLDocument1 pageBSNLRaj MasterPas encore d'évaluation

- PAY SLIP For The Month of Feb/2019 (From 01/02/2019 To 28/02/2019)Document3 pagesPAY SLIP For The Month of Feb/2019 (From 01/02/2019 To 28/02/2019)Mithilesh AgarwalPas encore d'évaluation

- Pay Statement: June 2019 Aspin Pharma Pvt. LTDDocument1 pagePay Statement: June 2019 Aspin Pharma Pvt. LTDAman AnsariPas encore d'évaluation

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountEkta Upadhyay 48Pas encore d'évaluation

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AMithlesh SharmaPas encore d'évaluation

- DIVAKAR - M - May 2021 - PayslipDocument1 pageDIVAKAR - M - May 2021 - PayslippandiyanPas encore d'évaluation

- Salary Slip S5Document1 pageSalary Slip S5M.B TrickPas encore d'évaluation

- Aeries Technology Group Private Limited: Full and Final Settlement - December 2018Document3 pagesAeries Technology Group Private Limited: Full and Final Settlement - December 2018तेजस्विनी रंजनPas encore d'évaluation

- July Month Salary SlipDocument1 pageJuly Month Salary SlipThakur Paras ChauhanPas encore d'évaluation

- Form 16 - FY 20 - 21 - FY 2020 - 2021Document9 pagesForm 16 - FY 20 - 21 - FY 2020 - 2021Amit GautamPas encore d'évaluation

- Javed JuneDocument1 pageJaved JuneVikas JangidPas encore d'évaluation

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaPas encore d'évaluation

- OctDocument1 pageOctRamPrasadPas encore d'évaluation

- BSC 3rd SemesterDocument3 pagesBSC 3rd Semestervikashyadav51209Pas encore d'évaluation

- D. J. Sanghvi College of Engineering, Mumbai-56Document4 pagesD. J. Sanghvi College of Engineering, Mumbai-56shubham nikatPas encore d'évaluation

- BCL Ar 2022-23Document1 pageBCL Ar 2022-23pgp39356Pas encore d'évaluation

- (Please Write The Name That Appears On Your Card) : PNB Credit Card Rewards Redemption FormDocument1 page(Please Write The Name That Appears On Your Card) : PNB Credit Card Rewards Redemption FormJane PulmaPas encore d'évaluation

- Amadeus Training Catalogue PDFDocument88 pagesAmadeus Training Catalogue PDFDeyae SerroukhPas encore d'évaluation

- IFRS Metodo Del Derivado HipoteticoDocument12 pagesIFRS Metodo Del Derivado HipoteticoEdgar Ramon Guillen VallejoPas encore d'évaluation

- Vyshnavikambar@Yahoo Com 193481Document3 pagesVyshnavikambar@Yahoo Com 193481sudhirreddy1982Pas encore d'évaluation

- Railways PresentationDocument33 pagesRailways PresentationshambhoiPas encore d'évaluation

- Management AccountingDocument304 pagesManagement AccountingRomi Anton100% (2)

- Cost Accounting Concept and DefinitionDocument10 pagesCost Accounting Concept and DefinitionRifa AzeemPas encore d'évaluation

- Circular 25 2019Document168 pagesCircular 25 2019jonnydeep1970virgilio.itPas encore d'évaluation

- Data Cleaning With SSISDocument25 pagesData Cleaning With SSISFreeInformation4ALLPas encore d'évaluation

- ICT Sector - Annual Monitoring Report PDFDocument46 pagesICT Sector - Annual Monitoring Report PDFWirePas encore d'évaluation

- Sip Project ReportDocument45 pagesSip Project ReportRachit KharePas encore d'évaluation

- LTE World Summit 2014 Brochure PDFDocument16 pagesLTE World Summit 2014 Brochure PDFMoussa Karim AlioPas encore d'évaluation

- Purpose of AuditDocument5 pagesPurpose of Auditannisa radiPas encore d'évaluation

- Chapter 1 MGMT481 - Summer 2021Document23 pagesChapter 1 MGMT481 - Summer 2021Jelan AlanoPas encore d'évaluation

- Bam 040 Demand and Supply PT.2Document14 pagesBam 040 Demand and Supply PT.2Vkyla BataoelPas encore d'évaluation

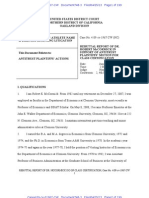

- REBUTTAL REPORT OF DR. ROBERT McCORMICK IN SUPPORT OF ANTITRUST PLAINTIFFS' MOTION FOR CLASS CERTIFICATIONDocument199 pagesREBUTTAL REPORT OF DR. ROBERT McCORMICK IN SUPPORT OF ANTITRUST PLAINTIFFS' MOTION FOR CLASS CERTIFICATIONInsideSportsLawPas encore d'évaluation

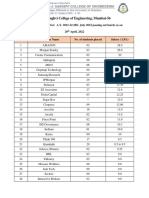

- Banglore Institute of TechnologyDocument5 pagesBanglore Institute of TechnologyAdmission DetailsPas encore d'évaluation

- TDS Alcomer 7199Document2 pagesTDS Alcomer 7199PrototypePas encore d'évaluation

- Tender Opportunity - Kagita Mikam (Shannonville) CustodianDocument2 pagesTender Opportunity - Kagita Mikam (Shannonville) CustodianKagitaMikamPas encore d'évaluation

- Unit 2 Consumer BehaviourDocument14 pagesUnit 2 Consumer Behaviournileshstat5Pas encore d'évaluation

- Huimfisllfia: 18 July - August 2006 Aba Bank MarkehngDocument8 pagesHuimfisllfia: 18 July - August 2006 Aba Bank MarkehngGhumonto SafiurPas encore d'évaluation

- Customer Relationship Management About HundaiDocument76 pagesCustomer Relationship Management About HundaiZulfiquarAhmed50% (4)

- Petronas CobeDocument54 pagesPetronas CobeRifqiPas encore d'évaluation

- Sample General Service ContractDocument4 pagesSample General Service Contractjohn_lagaPas encore d'évaluation

- Industrial Training ReportDocument7 pagesIndustrial Training ReportMT RAPas encore d'évaluation

- Integrating COBIT 5 With COSO PDFDocument59 pagesIntegrating COBIT 5 With COSO PDFHenry Omar Espinal VasquezPas encore d'évaluation

- Joselito Resumae UpdatedDocument8 pagesJoselito Resumae Updatedjoselito ruantoPas encore d'évaluation

- Acc 106 Account ReceivablesDocument40 pagesAcc 106 Account ReceivablesAmirah NordinPas encore d'évaluation