Académique Documents

Professionnel Documents

Culture Documents

Reconciliation Fiscal PT Sariguna Prima Tirta - Taxation Ii

Transféré par

Yusuf RaharjaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Reconciliation Fiscal PT Sariguna Prima Tirta - Taxation Ii

Transféré par

Yusuf RaharjaDroits d'auteur :

Formats disponibles

Table of Contents

CHAPTER I (Introduction) .................................................................................................... 1

CHAPTER II (Financial Report) ........................................................................................... 5

CHAPTER III (Calculation Fiscal Reconciliation) .............................................................. 9

CHAPTER IV (Analysis) ..................................................................................................... 15

CHAPTER V (Conclution).................................................................................................... 23

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 1

INTRODUCTION

Fiscal correction aims to adjust commercial profit (i.e. profits calculated according to

the General Applicable Accounting Principles) with taxation provisions in order to obtain

fiscal profit. The Profit-Loss Calculation Report made by the company is a financial report

prepared based on General Accounting Principles. Therefore in order to be able to calculate

the amount of income tax owed, the company must make adjustments to the profit-loss

calculation report so that it complies with the provisions and regulations of the tax law. This

adjustment step is done by looking for account posts that are different treatments between

generally accepted accounting principles and the provisions of the tax law. These account

posts need fiscal correction.

The differences are as follows:

a. Permanent Difference.

Namely income and costs recognized in the calculation of net income for commercial

accounting but not recognized in the calculation of tax accounting.

b. Temporary Difference

Namely the income and costs that can be recognized today by commercial accounting

or vice versa, but cannot be recognized at once by tax accounting, usually because of

differences in recognition methods.

1. The emergence of Fiscal Corrections

Matters that make a difference between the Accounting Principles Applicable General

and the Taxation Law include:

a. Difference in Income Concepts

b. Differences in How to Measure Income

c. Difference in Cost Concept

Expenditures that can be charged as costs are all economic sacrifices in order to obtain

goods and services. Not limited to just the cost of obtaining, collecting and maintaining

income only. In short, tax-based costs are expenditures that have a direct relation to

income generation

d. Difference in Cost Measurement Method

Same as how to measure income, if there are transactions that are not fair because of a

special relationship, the transaction must be corrected.

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 2

e. Difference in the Method of Loading or Cost Allocation

f. Income is subject to final income tax.

Income that is taxed in a final manner means that the income tax has been calculated so

that it does not need to be taken into account again in calculating income tax at the end of

the year so it must be excluded from the profit-loss calculation report

2. Types of Fiscal Corrections

a. Positive Fiscal Correction

Positive Fiscal Correction is a fiscal correction that increases the amount of taxable

profit.

b. Negative Fiscal Correction

Negative Fiscal Correction is a fiscal correction that reduces taxable income

In this report, we will analyze the fiscal reconciliation for the income statement of PT

Sari Guna Primatirta Tbk for the year ended December 31, 2017. Financial report

downloaded from IDX’s database for public company financial report.

The Company is established since 1988 with the name of PT Sari Guna, and in 1989,

the Company had its name changed into PT Sariguna Primatirta until today. The Company is

part of Tanobel Food business group who produces food and beverages such as drinking

water, biscuits and powder drink. Main business activity of the Company is producer of

Bottled-Drinking Water (AMDK). The company’s vission is to be a leading national

beverage companies in Indonesia. Then the mission is To produce beverage products with

high quality, innovative, and easily obtained through the internationally certified production

process and integrated manufacturing network all over Indonesia.

The Company started commercial operation since 2003 after acquisition of AMDK or

bottled-drinking water product with brand “Anda” supplied from Arjuna mountain spring at

Pandaan. In 2004, the Company established its first Plant at Pandaan, Pasuruan and produces

AMDK with Cleo brand with marketing focus in East Java area. The Company continues its

business expansion ever since by establishing another plant and expanding marketing area

covering to Non-East Java area. Recently, the Company has 20 plants and 72 Logistic Depo

under PT Sentralsari Primasentosa (an affiliated company) located across Java, Sumatera,

Madura, Bali, Kalimantan, Lombok and Sulawesi Islands.

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 3

The Company was listed in Indonesian Stock Exchange since May 5, 2017 with ticker

code “CLEO”. The Company executed Initial Public Offering on April 26 – 28, 2017 of

450,000,000 shares with par value of Rp. 100 per shares, representing 20.45% of total issued

and fully paid-in capital after the Initial Public Offering. The public offering price was Rp.

115 per share and total proceeds acquired amount of Rp. 51,750,000,000. The shares offered

in the Initial Public Offering are entirely new shares from the Company’s portfolio and will

grant rights to the holders equaly and the same rights with other issued and fully paid-in

shares of the Company, including rights upon dividend payment, rights to vote in the GMS,

rights ton on us stocks distribution and preemptive rights according to provisions stated in the

Limited Liability Company Law.

In maintaining market share and compete with other companies, the Company

continuously maintains product quality and drives innovation and expanding lines of product

to deliver better preferences and added-value for the customers. Targeted market is

Indonesian people who require high-quality and healthy food and beverages products.

Product innovation is done through development in the product packaging aiming to provide

added-value to the customers compared to the Company’s competitors. The innovation

includesPure water, Pure Plastics, Cleo Eco Shape, 19 Litre Cleo Gallon, BPA Free.

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 4

CHAPTER II

FINANCIAL REPORT

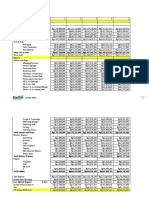

PT SARIGUNA PRIMATIRTA PT SARIGUNA

TBK PRIMATIRTA TBK

DAN ENTITAS

ANAK AND SUBSIDIARY

LAPORAN LABA RUGI DAN CONSOLIDATED STATEMENT OF

PENGHASILAN PROFIT OR LOSS AND

OTHER

KOMPREHENSIF LAIN COMPREHENSIVE

KONSOLIDASIAN INCOME

TAHUN YANG BERAKHIR

PADA TANGGAL FOR THE YEAR ENDED

31 DESEMBER 2017 DECEMBER 31, 2017

(DISAJIKAN DALAM RUPIAH, KECUALI (EXPRESSED IN RUPIAH, UNLESS

DINYATAKAN LAIN) OTHERWISE STATED)

Catata

n/

Notes 2017 2016

PENJUALAN 2n, 2o, 24, 614.677.561.20 523.932.684.97

BERSIH 29 2 2 NET SALES

BEBAN POKOK

2n, 2o, 25, (388.877.393.19 (365.613.453.82

PENJUALAN 29 5) 0) COST OF GOODS SOLD

225.800.168.00 158.319.231.15

LABA BRUTO 7 2 GROSS PROFIT

(96.992.948.421 (74.338.407.870

Beban penjualan 2o, 26 ) ) Selling expenses

General and administrative

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 5

Beban umum dan (51.481.730.201 (28.168.888.361

administrasi 2o, 27 ) ) expenses

(21.437.623.500 (16.101.190.623

Beban keuangan 2o, 28 ) ) Financing expenses

2m, 2o, 11,

Pendapatan sewa 29 5.488.353.240 4.647.331.208 Rent income

Foreign exchange

Selisih kurs - bersih 2p (155.705.090) 166.180.125 differentials - net

Laba (rugi) penjualan Gain (loss) on sale and

dan disposal

pelepasan aset tetap 12 (4.425.328.297) 1.174.815.921 of fixed assets

Lain-lain - bersih 2o, 9 5.869.054.062 2.310.913.179 Miscellaneous - net

LABA SEBELUM

BEBAN INCOME BEFORE FINAL

PAJAK FINAL

DAN TAX AND INCOME

PAJAK

PENGHASILAN 62.664.239.800 48.009.984.731 TAX EXPENSE

Pajak final 2q, 16 (321.854.545) (314.896.482) Final tax

LABA SEBELUM INCOME BEFORE

BEBAN INCOME

PAJAK

PENGHASILAN 62.342.385.255 47.695.088.249 TAX EXPENSE

MANFAAT

(BEBAN) PAJAK INCOME TAX BENEFIT

PENGHASILAN 2q, 16 (EXPENSE)

(12.747.625.750

Pajak kini ) (8.962.800.500) Current tax

Pajak tangguhan 578.971.324 530.515.236 Deferred tax

(8.432.285.264) Income Tax Expense

Beban Pajak (12.168.654.426

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 6

Penghasilan )

LABA TAHUN

BERJALAN 50.173.730.829 39.262.802.985 INCOME FOR THE YEAR

LABA (RUGI) OTHER

KOMPREHENSIF COMPREHENSIVE

LAIN INCOME (LOSS)

Pos yang Tidak Akan Item that Will Not be

Direklasifikasi Reclassified

Subsequently to Profit or

ke Laba Rugi Loss

Keuntungan (kerugian) aktuarial

atas Actuarial gain (loss) of

program imbalan

pasti 20 289.918.654 (329.408.029) defined benefit plan

Pajak penghasilan atas (keuntungan)

Income tax of actuarial

kerugian aktuarial atas program (gain)

imbalan pasti 2q, 16 (72.479.664) 82.352.007 loss of defined benefit plan

Laba (rugi)

komprehensif lain - Other comprehensive income

setelah pajak 217.438.990 (247.056.022) (loss) - net of tax

JUMLAH LABA TOTAL

KOMPREHENSIF COMPREHENSIVE

INCOME FOR THE

TAHUN BERJALAN 50.391.169.819 39.015.746.963 YEAR

Catat

an/

Notes 2017 2016

LABA TAHUN

BERJALAN YANG

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 7

DAPAT INCOME FOR THE

DIATRIBUSIKAN YEAR

KEPADA: ATTRIBUTABLE TO:

Equity Holders of

50.173.768.

Pemilik Entitas Induk 389 39.262.809.556 the Parent Company

Kepentingan Non-

Pengendali 2b (37.560) (6.571) Non-Controlling Interest

50.173.730.

JUMLAH 829 39.262.802.985 TOTAL

JUMLAH LABA TOTAL

KOMPREHENSIF COMPREHENSIVE

YANG DAPAT INCOME

DIATRIBUSIKAN ATTRIBUTABLE

KEPADA: TO:

Equity Holders of

50.391.207.

Pemilik Entitas Induk 379 39.015.753.534 the Parent Company

Kepentingan Non-

Pengendali 2b (37.560) (6.571) Non-Controlling Interest

50.391.169.

JUMLAH 819 39.015.746.963 TOTAL

Laba per Saham yang Earning per Share

Diatribusikan Attributable

kepada Pemilik to Equity Holders of

Entitas Induk 2s, 32 25 31 the Parent Company

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 8

CHAPTER III

CALCULATION OF FISCAL RECONCILIATION

COMMERCIAL NEGATIVE POSSITIVE FISCAL

INCOMETATE CORRECTIO CORRECTI INCOME

MENTS N ON STATEMENTS

INFORMATION INFO

Net Sales

Related Parties

Rp150.974.822.9

Bottle 50

Rp121.811.105.7

Gallon 09

Rp97.957.826.50

Glass 0

Rp12.292.172.65

Others 7

Manufacturing Rp15.094.762.00

services 0

Total - Related Rp398.130.689.8

Parties 16

Third Parties

Rp55.169.517.75

Bottle 1

Rp114.419.611.6

Gallon 54

Rp40.848.816.62

Glass 6

Others Rp6.108.925.355

Manufacturing

services Rp0

Total - Third Rp216.546.871.3

Parties 86

Total Net sales

Rp206.144.340.7 Rp206.144.340.7

Bottle 01 01

Rp236.230.717.3 Rp236.230.717.3

Gallon 63 63

Rp138.806.643.1 Rp138.806.643.1

Glass 26 26

Rp18.401.098.01 Rp18.401.098.01

Others 2 2

Manufacturing Rp15.094.762.00 Rp15.094.762.00

services 0 0

Rp614.677.561.2 Rp614.677.561.2

Total 02 02

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 9

COGS

Raw Materials Rp221.091.083.8 Rp221.091.083.8

used 82 82

Direct and Rp84.280.151.37 Rp84.280.151.37

indirect labor 9 9

Manufacturing

Cost :

Electricity,

water and Rp40.871.259.50 Rp40.871.259.50

telephone 2 2

Depreciation Rp20.843.295.63 Rp20.843.295.63

(Note 12) 9 9

Plants Rp11.660.116.57 Rp11.660.116.57

operational 4 4

Repairs and

maintenance Rp3.454.586.043 Rp3.454.586.043

Transportation

and fuel Rp6.112.111.212 Rp6.112.111.212

Insurance Rp656.447.889 Rp656.447.889

Others Rp2.153.141.910 Rp2.153.141.910

Cost of Rp391.122.194.0 Rp391.122.194.0

production 30 30

Finished goods

inventory

Beginning of Rp14.768.881.83 Rp14.768.881.83

year 1 1

- -

Rp17.013.682.66 Rp17.013.682.66

End of year 6 6

-

Cost of Goods Rp388.877.393.1 Rp388.877.393.

Sold 95 195

Rp225.800.168.0 Rp225.800.168.0

Gross Profit

07 07

Selling Expense

Advertising Rp29.540.630.20 Rp29.540.630.20

and promotion 5 5

Allowance

for

declining

in value of

inventorie

s

(TEMPOR

ARY

Depreciation Rp22.353.929.89 Rp145.416.5 Rp22.208.513.32 DIFFERE

(Note 12) 5 70 5 NCES)

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 10

Transportation Rp18.961.393.25 Rp18.961.393.25

and fuel 4 4

Salary, wages

and

employees’ Rp18.301.393.02 Rp18.301.393.02

benefits 9 9

Repairs and

maintenance Rp3.814.078.485 Rp3.814.078.485

Electricity,

water and

telephone Rp403.545.929 Rp403.545.929

Final

income tax

and others

(PERMA

NENT

Rp2.326.120.0 DIFFERE

Others Rp3.617.977.624 02 Rp5.944.097.626 NCES)

- -

Rp96.992.948.42 Rp99.173.651.85

Total 1 3

General and

administrative

Expense

Salary, wages

and

employees’ Rp20.900.615.72 Rp20.900.615.72

benefits 1 1

Depreciati

on

(PERMA

Depreciation Rp12.961.378. NENT

(Notes 11 and 764 Rp18.927.121.39 DIFFERE

12) Rp5.965.742.629 3 NCES)

Professional

fees Rp4.399.950.222 Rp4.399.950.222

Rent Rp3.739.458.116 Rp3.739.458.116

Rp2.798.226. Tax

Taxes Rp3.527.994.926 2 Rp729.768.708 Expense

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 11

(PERMA

NENT

DIFFERE

18 NCES)

Estimated

liabilities

for

employees

benefits

(TEMPOR

Employees’ ARY

benefits (Note Rp2.140.847. DIFFERE

20) Rp2.186.550.012 961 Rp45.702.051 NCES)

Transportation

and fuel Rp1.744.462.494 Rp1.744.462.494

Security and

cleaning Rp1.717.571.513 Rp1.717.571.513

Licenses Rp1.654.508.243 Rp1.654.508.243

Repairs and

maintenance Rp1.541.109.210 Rp1.541.109.210

Electricity,

water and

telephone Rp1.366.444.302 Rp1.366.444.302

Donation

and

representat

ion

(PERMA

NENT

Rp337.195.7 DIFFERE

Others Rp2.737.322.813 83 Rp2.400.127.030 NCES)

- -

Rp51.481.730.20 Rp59.166.839.00

Total 1 3

Financing

Expense

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 12

Rp21.023.797.76 Rp21.023.797.76

Interest loans 9 9

Allowance

for

impairmen

t of trade

receivable

s - net

Provision and (TEMPOR

bank ARY

administrative DIFFERE

charges Rp413.825.731 Rp60.800.390 Rp474.626.121 NCES)

- -

Rp21.437.623.50 Rp21.498.423.89

Total 0 0

Rent Income Rp5.488.353.240 Rp5.488.353.240

Foreign

Exchange

differentials - net -Rp155.705.090 -Rp155.705.090

Gain (loss) on

sale and disposal

of fixed assets

Rp11.733.822.99 Rp11.733.822.99

Cost 6 6

Accumulated -

Depreciation -Rp5.813.598.865 Rp5.813.598.865

Book Value Rp5.920.224.131 Rp5.920.224.131

Proceeds from

sales Rp1.494.895.834 Rp1.494.895.834

Gain (loss) on

sale and

disposal of -

fixed assets -Rp4.425.328.297 Rp4.425.328.297

Stock

issuance

costs

(PERMA

NENT

Miscellaneous - Rp2.333.128.0 DIFFERE

net Rp5.869.054.062 35 Rp3.535.926.027 NCES)

Income Before

Final Tax and

Income Tax

Expense

Income Before Final

Tax and Income Tax

Expense per

consolidated Rp62.664.239.80 Rp50.404.499.14

statements of profit 0 1

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 13

or loss and other

comprehensive

income

The share of net loss

of the associate

Loss before income

tax expense of

subsidiary Rp586.003.878 Rp586.003.878 Rp586.003.878

Income Before

Final Tax and

Income Tax Rp63.250.243.67 Rp50.990.503.01

Expense 8 9

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 14

CHAPTER IV

ANALYSIS

1. Net Sales

A portion of sales, which amounted to 64.771% and 58.121%, for the years ended

December 31, 2017 and 2016, were made to related parties (Note 29), respectively.

For the years ended December 31, 2017 and 2016, there are no sales to third parties

with total sales exceeding 10% of consolidated net sales. Bottle, Gallon, Glass. &

Others. Those elements mentioned above do not need any fiscal correction because

those are included in the deductible goods regarding the tax article based on the law.

Those things also a part of the goods available for sale, because one bottle of mineral

water consist of those elements and every cost of it will be reduce the income of its

selling.

2. Cost of Good Sold

A portion of purchases approximately 24.353% and 26.048% of the years ended

December 31, 2017 and 2016, respectively, were made from related parties (Note 29).

For the years ended December 31, 2017 and 2016, there are no purchases from third

party suppliers with total purchases exceeding 10% of consolidated net sales. Cost of

Goods Sold is no need to be corrected in fiscal correction, because it is a part of good

manufacturing process and selling, also the value added tax will be counted from the

COGS.

3. Selling Expense

a. Advertising and promotion expense

Promotion costs incurred to other parties and are the object of deduction from

Income Tax must be tax deductible in accordance with the applicable provisions.

Thus the amount of commercial and fiscal income statement is the same, which is

Rp29.540.630.205

b. Depreciation

Due to Allowance for declining in value of inventories, there are positive

reconciliation of Rp145.416.570 .

c. Transportation and Fuel Expense

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 15

Vehicle maintenance costs, routine repairs to the company's operational vehicles

can all be charged as fees, including fuel and for pick-up vehicles for employees.

Thus the amount of commercial and fiscal income statement is the same, which is

Rp18.961.393.254

d. Salary,Wages, and Employee’s benefit

The costs of obtaining, collecting, and maintaining income include the cost of

purchasing materials, costs related to work / services including wages, etc. or

costs which are commonly referred to as daily expenses which are charged in the

year of the required expenditure. this fee can be deducted from income. Thus the

amount of commercial and fiscal income statement is the same, which is

Rp18.301.393.029

e. Repairs and Maintenance

Vehicle maintenance costs, routine repairs to the company's operational vehicles

can all be charged as fees, including fuel and for pick-up vehicles for employees.

Thus the amount of commercial and fiscal income statement is the same, which is

Rp3.814.078.485

f. Electricity Water and telephone

These account are not part of fiscal correction because every these expenses have

costs for obtaining, collecting, and maintaining income (which are objects of non-

final income tax) include: Material purchase costs, fees relating to work or

services including wages, salaries, honorariums, bonuses, gratuities and benefits

provided in the form of money, interest, rent, royalties, travel expenses, waste

treatment fees, insurance premiums, administrative fees, and taxes except for

income tax. Fees must be valid, reliable and reasonable. Thus the amount of

commercial and fiscal income statement is the same.

g. Others

Due to changes in final income tax and others, there are negative reconciliation of

Rp2.326.120.002

4. General & Adminstratif Expense

a. Salary, wages and employees’ benefits

The costs of obtaining, collecting, and maintaining income include the cost of

purchasing materials, costs related to work / services including wages, etc. or

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 16

costs which are commonly referred to as daily expenses which are charged in the

year of the required expenditure. this fee can be deducted from income. Thus the

amount of commercial and fiscal income statement is the same, which is

Rp.20.900.615.721.

b. Depreciation (Notes 11 and 12)

Based on article 11 Tax Income, depreciation is a mechanism of imposition of

expenditures whose useful lives are more than 1 (one) year related to tangible

fixed assets.

In this company, Depreciation of the asset begins when the asset is ready for

its intended use. Depreciation is computed using the straight-line method over the

estimated useful life of 20 years or at a 5% depreciation rate. Depreciation of

other property, plant and equipment is computed using the double-declining

balance method based on the estimated useful lives of the assets as follows:

Goods Year Rate Method

Machineries and plant

8 - 16 12,5% - 25%

equipment (group 2)

Double

Vehicle (Group 2) 8 25%

Declining

Office equipment (Group 1) 4-8 25% - 50%

Gallon (Group 1) 4 50%

Building and Land 20 5% Straight line

Based on fiscal tax regulation :

Group Useful Life Depreciation Rate

Straight line Double Declining

Group 1 4 Years 25% 50%

Group 2 8 years 12,5% 25%

Group 3 16 years 6,25% 12,5%

Group 4 20 years 5% 10%

Permanent 20 Years 5%

Building

Non-Permanent 10 Years 10%

Building

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 17

Based on the fiscal and commercial there are the differences of useful life. The

Machineries and plant has useful life in commercial is 8-16 years, meanwhile

Machineries and plant is categorized as group 2 in fiscal term, it should be only

for 8 years. Then for office equipment the commercial term has useful life for 4-8

years. Meanwhile the office equipment is categorized as group 1 should has

usefule life only 4 years. So it should be corrected fiscal.

For the vehicle and gallon has same useful life between commercial and fiscal.

Asset that cannot be depreciated is land, including the right to use buildings,

business use rights, rights to use for the first time. Except the value is reduced in

usage. Same with accounting.

Due to the difference in depreciation costs (especially in terms of useful life),

the depreciation cost has decreased or increased by Rp18,927,121,393. This

makes the taxable profit decrease, so the fiscal correction is called a positive fiscal

correction.

c. Professional fees

Rewards for work but no labor relations, for example: accountant honorarium,

consultant honorarium, audit fees, and other expert services. Because profesional

fees is used for in the context of business (Costs for obtaining, collecting and

maintaining income (which is a non-final PPh object). Thus the amount of

commercial and fiscal income statement is the same, which is Rp.4.399.950.222.

d. Rent

Rent expense is recognized when incurred (accrual method). Rent fees here may

be deducted from income because they are used only in the context of running a

business. Thus the amount of commercial and fiscal income statement is the same,

which is Rp.3.739.458.116.

e. Taxes

Taxes other than income tax and tax sanctions can reduce taxable income. The

type of taxes is land and building, and kind of regional tax. These tax is not

income tax and can reduce the income. In the commercial income the amount is

Rp.3.527994.926. as the decreasing amount of income it will be added from the

total amount of Land and building tax and regional tax which is

Rp.2.120.847.961.

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 18

f. Employees’ benefits (Note 20)

Employee benefits have payments to workers in connection with their work

(benefits). This employee benefit can be in the form of salary, honorarium, wages,

fees, severance pay, gratuities, benefits, and other benefits related to work.

Employee benefits that are temporary differences (temporary differences) means

that in general accounting this is recognized as a cost, but in fiscal policy in

determining the income tax payable this benefit is still not recognized as a cost. Or

vice versa. in this type, it must be included from the deduction from income

(increasing taxable income), so that the taxable profit increases, the correction is

called negative fiscal correction. In the commercial the amount is

Rp.2.186.550.012 then it will be added as the decreasing of taxable income of by

amount of Rp 2.140.847.961.

g. Transportation and Fuel

Vehicle maintenance costs, routine repairs to the company's operational vehicles

can all be charged as fees, including fuel and for pick-up vehicles for employees.

Thus the amount of commercial and fiscal income statement is the same, which is

Rp1.744.462.494

h. Security and cleaning, Licences, Repairs and maintenance. Electricity, water, and

telephone

These account are not part of fiscal correction because every these expenses have

costs for obtaining, collecting, and maintaining income (which are objects of non-

final income tax) include: Material purchase costs, fees relating to work or

services including wages, salaries, honorariums, bonuses, gratuities and benefits

provided in the form of money, interest, rent, royalties, travel expenses, waste

treatment fees, insurance premiums, administrative fees, and taxes except for

income tax. Fees must be valid, reliable and reasonable. Thus the amount of

commercial and fiscal income statement is the same.

i. Other

All types and types of donations are not permitted in taxation unless donations are

officially regulated by the Government through government regulations such as

GNOT (SE-33/PJ.421/1996), PMI donations and the like. This contribution can be

categorized in this type, it must be included from the deduction from income

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 19

(increasing taxable income), so that there is a correction of the contribution, the

taxable profit decreases, the correction is called negative fiscal correction.

5. Financing Expense

a. Interest loans

According to the taxation provisions there are several categories that will occur in

the loan interest costs in calculating the entity's income tax. This category is only

used in the calculation of income tax and can be explained as follows: a) Loan

interest costs are allowed in taxation with a certain amount provided that the

average amount of bank debt is greater than the average amount of deposits held,

b) Bank loan interest fees are not allowed as a deduction expense for taxable

income if the average amount of bank debt is less than or equal to the average

number of deposits held, or c) Interest rates on bank loans can be permitted under

the following conditions: The loan funds are deposited or placed in the form of a

checking account which is subject to final income tax services, there is a

requirement for taxpayers to place certain amounts of funds in a bank in the form

of deposits based on the prevailing laws and regulations, as long as the amount of

deposits and savings is solely to fulfill this requirement, and it can be proven that

the placement of deposits or savings funds comes from additional capital and

remaining profits after being taxed.

b. Provisions and bank administrative charges

The commercial imposition of uncollectible receivables by taxpayers is the object

of fiscal reconciliation before determining taxable income. The component of

costs formed due to the establishment or allowance for reserve funds may not be

deducted from gross profit. The allowance for doubtful accounts that have not

been decided as Non-collectible Receivables may not be used as deductible costs

in calculating Taxable Income.

If viewed from the point of view of income tax, the legal basis for imposing losses

on accounts receivable as a deduction from taxable income is regulated in Article

6 paragraph (1) letter h of Law No. 36 of 2008 concerning the fourth amendment

to law number 7 of 1983 concerning income tax:

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 20

The amount of taxable income for domestic taxpayers and permanent

establishments is determined based on gross income less costs to obtain, collect

and maintain income.

The negative correction of the account is Rp60.800.390, increasing the provisions

and bank administrative charges in the fiscal income statement to Rp474.626.121.

6. Rent Income

For income received or obtained by an individual or entity from leasing land and / or

buildings in the form of land, houses, flats, apartments, condominiums, office

buildings, home offices, shops, shop houses, warehouses and industries, payable final

income tax. CLEO’s 2017 rent income in both commercial and fiscal income

statements has the amount of Rp5.488.353.240.

7. Foreign Exchange Differential

Acording to the explanation of article 4 paragraph 1 letter L "Profits obtained due to

fluctuations in foreign exchange rates are recognized based on the accounting system

adopted and carried out in accordance with the principles in accordance with the

Financial Accounting Standards applicable in Indonesia." Thus CLEO’s 2017 foreign

exchange differentials - net in the commercial income statement has the same amount

with the fiscal income statement, which is Rp155.705.090.

8. Gain (loss) on disposal fixed asset

The acquisition price for assets obtained from a sale and purchase transaction

that is not affected by a special relationship is the amount actually issued (Article 18

of Law Number 17 Year 2000). If a special relationship is affected, the acquisition

price is calculated based on the amount that should have been spent (fair market

price).

Income Tax on the difference in profit from sale of assets in the form of

houses Article 4 paragraph (2) letter d of Law Number 36 Year 2008 article 8

paragraph (1) Government Regulation Number 71 of 2008 stipulates that income from

transfer of rights to land and / or buildings subject to final tax, that is, after repayment.

Tax liability has been completed and income subject to Final income tax is not

combined with other types of income subject to non-final income tax (Non-Final

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 21

Income Tax). This type of tax can be imposed on certain types of income, transactions

or businesses.

9. Miscellaneous – net

CLEO’s 2017 miscellaneous income in the commercial income statement has

the amount of Rp5.869.054.062. Fiscal reconciliation for tax reporting is required on

this account because of permanent differences in form of allowance stock issuance

costs. The negative correction of the account is Rp2.333.128.035, deducting the

amount of miscellaneous - net in the fiscal income statement to Rp3.535.926.027.

Director General of Tax Circular Number SE18 / PJ.31 / 1989 dated 31

October 1989 item (2) which reads: "Expenditures shares, including the cost of stock

listing, appraisal advertising, underwriting, prospectus, issued in the framework of

issuing shares is fees for obtaining, collecting and maintaining income as intended in

Article 6 paragraph (1) letter b of Law Number 7 of 1983 concerning Taxes Income,

and can be deducted from gross income in accordance with the provisions in Article

11 paragraph (11) of Law Number 7 of 1983 concerning Taxes Income;

According to Article 11A paragraph (3) Income Tax Law, Stock Issuance Costs (IPO)

can be charged as a fee and taxpayers are given the freedom to choose whether the

expenditure is charged at the same time in the year it occurs expenditure or amortized;

Share issuance costs, are related costs in order to obtain, collect and maintain

income as referred to in Article 6 paragraph (1) letter b of Act Number 7 of 1983

concerning Income Tax as amended by Act Number 17 of 2000 and Article 11A

paragraph (3) which regulates: "Expenditures for establishment costs and expansion

costs of a company's capital are charged in the year of expenditure or amortized in

accordance with the provisions referred to in paragraph (2).

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 22

CHAPTER V

CONCLUSION

RECONCILIATION FISCAL PT SARIGUNA PRIMA TIRTA – TAXATION II 23

Vous aimerez peut-être aussi

- Bookkeeping Video Training: (Handout)Document22 pagesBookkeeping Video Training: (Handout)Yusuf RaharjaPas encore d'évaluation

- Level I of CFA Program 5 Mock Exam December 2020 Revision 2Document45 pagesLevel I of CFA Program 5 Mock Exam December 2020 Revision 2JasonPas encore d'évaluation

- Business Law and Regulations - CorporationDocument15 pagesBusiness Law and Regulations - CorporationMargie RosetPas encore d'évaluation

- Retail FormulaDocument5 pagesRetail FormulavipinvermaseptPas encore d'évaluation

- MODULE 2 Business FinanceDocument16 pagesMODULE 2 Business FinanceWinshei CaguladaPas encore d'évaluation

- PEN KY Olicy: Need For Open Skies PolicyDocument5 pagesPEN KY Olicy: Need For Open Skies PolicyDebonair Shekhar100% (1)

- Cooperatives (Republic Act No. 9520 A.k, A. Philippine Cooperative Code of 2008)Document14 pagesCooperatives (Republic Act No. 9520 A.k, A. Philippine Cooperative Code of 2008)xinfamousxPas encore d'évaluation

- Annual Report 2017-18Document190 pagesAnnual Report 2017-1823321gauravPas encore d'évaluation

- ZVI AFS 2022 As of 03-30-2023Document16 pagesZVI AFS 2022 As of 03-30-2023Mike SyPas encore d'évaluation

- Rammar Farm Supply Financial StatementsDocument17 pagesRammar Farm Supply Financial StatementsMa Teresa B. CerezoPas encore d'évaluation

- Tubo FSDocument7 pagesTubo FSdemonjoePas encore d'évaluation

- PT Garudafood Putra Putri Jaya TBK - Q3 - 30.09.2019Document96 pagesPT Garudafood Putra Putri Jaya TBK - Q3 - 30.09.2019We Luph NPas encore d'évaluation

- Ciputra Development Interim Financial ReportDocument219 pagesCiputra Development Interim Financial ReportTyas AnandaPas encore d'évaluation

- ZVI AFS 2022 As of 03-21-2023Document18 pagesZVI AFS 2022 As of 03-21-2023Mike SyPas encore d'évaluation

- Ciputra Development - Billingual - 31 - Des - 2020Document251 pagesCiputra Development - Billingual - 31 - Des - 2020Dillart SpacePas encore d'évaluation

- Annual Report 18-19Document338 pagesAnnual Report 18-19sairaj bhatkarPas encore d'évaluation

- Verotel Merchant Services B.V. v. Rizal Commercial Bank 2021Document90 pagesVerotel Merchant Services B.V. v. Rizal Commercial Bank 2021hyenadogPas encore d'évaluation

- BSIS ePA 313 - Preparation of Statement of Changes in EquityDocument6 pagesBSIS ePA 313 - Preparation of Statement of Changes in EquityKen ChanPas encore d'évaluation

- Laporan Keuangan Triwulan 2 Tengah Tahun Good PDFDocument96 pagesLaporan Keuangan Triwulan 2 Tengah Tahun Good PDFputri meilia arifahPas encore d'évaluation

- Consolidated Financial Statement 2019 q4 25 Feb 2020 PDFDocument83 pagesConsolidated Financial Statement 2019 q4 25 Feb 2020 PDFOtta Muhammad TarregaPas encore d'évaluation

- Annual Report SummaryDocument2 pagesAnnual Report SummaryYOGESH AGRAWALPas encore d'évaluation

- Good Hope PLC: Annual ReportDocument11 pagesGood Hope PLC: Annual ReporthvalolaPas encore d'évaluation

- LK Calk Sep 2018Document158 pagesLK Calk Sep 2018Mutiara Karimah AnyarPas encore d'évaluation

- Ctra 3M2019Document177 pagesCtra 3M2019Taufik HidayatPas encore d'évaluation

- Annual 12 04 2018 16 40 33 PDFDocument136 pagesAnnual 12 04 2018 16 40 33 PDFIchsan FadhilPas encore d'évaluation

- KEJUDocument90 pagesKEJUDina sofianaPas encore d'évaluation

- VITP Private Limited-FSDocument71 pagesVITP Private Limited-FSnarayanvarmaPas encore d'évaluation

- Hexindo-Adiperkasa Bilingual 31 Maret 2020 ReleasedDocument104 pagesHexindo-Adiperkasa Bilingual 31 Maret 2020 ReleasedRYZA IVAN DIRGANTARAPas encore d'évaluation

- FinolexDocument171 pagesFinolexAkash Nil ChatterjeePas encore d'évaluation

- TCS and Infosys - Financial AnalysisDocument10 pagesTCS and Infosys - Financial AnalysisGhritachi PaulPas encore d'évaluation

- Perusahaan Umum (Perum) Bulog Dan Entitas Anak/: and Its SubsidiariesDocument104 pagesPerusahaan Umum (Perum) Bulog Dan Entitas Anak/: and Its SubsidiariesAryaPas encore d'évaluation

- 2016-03-31 00 - 00 - 00 - AA1 - Diro - Note PDFDocument25 pages2016-03-31 00 - 00 - 00 - AA1 - Diro - Note PDFkirtan patelPas encore d'évaluation

- TSPC Q1 2021 FSDocument79 pagesTSPC Q1 2021 FSPanama TreasurePas encore d'évaluation

- NIPPON INDOSARI 2018 FINANCIAL REPORTDocument105 pagesNIPPON INDOSARI 2018 FINANCIAL REPORTvalkenaiPas encore d'évaluation

- Annual Report FY2020Document424 pagesAnnual Report FY2020SAGAR KASERAPas encore d'évaluation

- PT Tifico Fiber Indonesia Tbk 2019 Financial StatementsDocument83 pagesPT Tifico Fiber Indonesia Tbk 2019 Financial Statementsrosida ibrahimPas encore d'évaluation

- Amc Annual Report - 2018 - 19Document149 pagesAmc Annual Report - 2018 - 19ujjwalgoldPas encore d'évaluation

- TFCO LapKeu2020 - NewDocument107 pagesTFCO LapKeu2020 - Newmuniya altezaPas encore d'évaluation

- COA Audit Report on Municipality of Datu Piang for 2018Document46 pagesCOA Audit Report on Municipality of Datu Piang for 2018Hazel Ommayah Tomawis-MangansakanPas encore d'évaluation

- San Juan City Executive Summary 2022Document7 pagesSan Juan City Executive Summary 2022MAYON NAGAPas encore d'évaluation

- 2Q 2020 GLVA Galva+Technologies+TbkDocument66 pages2Q 2020 GLVA Galva+Technologies+TbkAank KurniaPas encore d'évaluation

- FINANCIAL STATEMENT ANALYSIS FinalDocument34 pagesFINANCIAL STATEMENT ANALYSIS FinalMica R.Pas encore d'évaluation

- 620-Laporan Keuangan 2018 AuditedDocument150 pages620-Laporan Keuangan 2018 AuditedDimas AdiputrantoPas encore d'évaluation

- Laporan Keuangan PT Elang Mahkota Teknologi TBK 30 PDFDocument143 pagesLaporan Keuangan PT Elang Mahkota Teknologi TBK 30 PDFRAHUL YADATAMAPas encore d'évaluation

- Consolidated Financial Statement Q4 2020Document79 pagesConsolidated Financial Statement Q4 2020Edo AgusPas encore d'évaluation

- Laporan Keuangan Per 31 December 2018Document128 pagesLaporan Keuangan Per 31 December 2018nuraini mahiraPas encore d'évaluation

- Marakaj Gasoline Station Financial Statements 2020-2019Document20 pagesMarakaj Gasoline Station Financial Statements 2020-2019Ma Teresa B. CerezoPas encore d'évaluation

- Food Terminal Inc. Executive Summary 2021Document4 pagesFood Terminal Inc. Executive Summary 2021Robien Ray InfantePas encore d'évaluation

- PT Baramulti Suksessarana Tbk Interim Financial Statements June 2022Document111 pagesPT Baramulti Suksessarana Tbk Interim Financial Statements June 2022Novita HasyyatiPas encore d'évaluation

- Annual ReportDocument99 pagesAnnual ReportDedy SunPas encore d'évaluation

- PPPC REP COA Audit-Report-FY2018Document7 pagesPPPC REP COA Audit-Report-FY2018Bbk GamingPas encore d'évaluation

- 2018 - COA Annual Audited ReportDocument299 pages2018 - COA Annual Audited Reportvomawew647Pas encore d'évaluation

- IFRS SOLVED QUESTIONSDocument14 pagesIFRS SOLVED QUESTIONSSharan ReddyPas encore d'évaluation

- Financial Statement of Analysis Horizontal and VerticalDocument7 pagesFinancial Statement of Analysis Horizontal and VerticalALYSSA MARIE NAVARRAPas encore d'évaluation

- Kotak Mahindra Life Insurance Company LimitedDocument208 pagesKotak Mahindra Life Insurance Company Limitedgulatisrishti15Pas encore d'évaluation

- Dvla 2019Document111 pagesDvla 2019MichaelPas encore d'évaluation

- 5 FinDocument35 pages5 FinMansour HamjaPas encore d'évaluation

- Glainier Industríal CorporationDocument43 pagesGlainier Industríal CorporationGraceila CalopePas encore d'évaluation

- Indonesian Financial Statements TranslationDocument48 pagesIndonesian Financial Statements TranslationJeri HorisonPas encore d'évaluation

- PT Darya-Varia Laboratoria Tbk Laporan Keuangan 2020Document113 pagesPT Darya-Varia Laboratoria Tbk Laporan Keuangan 2020Kec MeuraxaPas encore d'évaluation

- Arwana Citramulia TBK - Billingual - 31 - Des - 2020Document118 pagesArwana Citramulia TBK - Billingual - 31 - Des - 2020Akbar Rianiri BakriPas encore d'évaluation

- TSPC Q1 2022 FSDocument79 pagesTSPC Q1 2022 FSPanama TreasurePas encore d'évaluation

- BVG India - Annual Report 2020-21Document32 pagesBVG India - Annual Report 2020-21Shubham RautPas encore d'évaluation

- Statement of Comprehensive IncomeDocument2 pagesStatement of Comprehensive IncomeRandom AcPas encore d'évaluation

- 01 TC2018 Audit Report ADocument114 pages01 TC2018 Audit Report AJerwin Cases TiamsonPas encore d'évaluation

- Guide to Strategic Management Accounting for ManagerrsD'EverandGuide to Strategic Management Accounting for ManagerrsPas encore d'évaluation

- Top 10 Accounting Interview QuestionsDocument13 pagesTop 10 Accounting Interview QuestionsYusuf RaharjaPas encore d'évaluation

- MarketingDocument2 pagesMarketingYusuf RaharjaPas encore d'évaluation

- The Jakarta PostDocument12 pagesThe Jakarta PostYusuf RaharjaPas encore d'évaluation

- Analisis Kinerja Fundamental Dan Persepsi Pasar PT Astra Agro Lestari, TBKDocument19 pagesAnalisis Kinerja Fundamental Dan Persepsi Pasar PT Astra Agro Lestari, TBKYusuf RaharjaPas encore d'évaluation

- Investment SummaryDocument3 pagesInvestment SummaryYusuf RaharjaPas encore d'évaluation

- KontanDocument22 pagesKontanYusuf RaharjaPas encore d'évaluation

- Statistics For Business and Economics: Random Variables & Probability DistributionsDocument117 pagesStatistics For Business and Economics: Random Variables & Probability DistributionsfarhanPas encore d'évaluation

- Calculate Future Value of AnnuityDocument32 pagesCalculate Future Value of AnnuityYusuf RaharjaPas encore d'évaluation

- Session 3, BUS, Descriptive Stat, Exploring Data-Var Analysis, SincihDocument109 pagesSession 3, BUS, Descriptive Stat, Exploring Data-Var Analysis, SincihLili GuloPas encore d'évaluation

- AccountingFundamentalsCoursePresentation 200607 222026 PDFDocument69 pagesAccountingFundamentalsCoursePresentation 200607 222026 PDFXee Shaun Ali BhatPas encore d'évaluation

- Mathematics of Business Functions and GraphsDocument55 pagesMathematics of Business Functions and GraphsGio VanniPas encore d'évaluation

- Statistics For Business and Economics: Inferences Based On A Single Sample: Estimation With Confidence IntervalsDocument56 pagesStatistics For Business and Economics: Inferences Based On A Single Sample: Estimation With Confidence IntervalsYusuf RaharjaPas encore d'évaluation

- Chapter 3 - ProbabilityDocument61 pagesChapter 3 - ProbabilityVeronicaPas encore d'évaluation

- Statistics For Business and Economics: Statistics, Data, & Statistical ThinkingDocument14 pagesStatistics For Business and Economics: Statistics, Data, & Statistical ThinkingYusuf RaharjaPas encore d'évaluation

- Ifrs 15Document78 pagesIfrs 15KunalArunPawarPas encore d'évaluation

- Chapter 2 Math of BusinessDocument30 pagesChapter 2 Math of BusinessYusuf RaharjaPas encore d'évaluation

- CH14 PPTDocument37 pagesCH14 PPTfame charity porioPas encore d'évaluation

- Why Earnings Don't Matter for Digital CompaniesDocument7 pagesWhy Earnings Don't Matter for Digital CompaniesYusuf RaharjaPas encore d'évaluation

- Application Linear FunctionDocument25 pagesApplication Linear FunctionYusuf RaharjaPas encore d'évaluation

- 7.3 Projected Profit Loss: IncomeDocument10 pages7.3 Projected Profit Loss: IncomeYusuf RaharjaPas encore d'évaluation

- Fixed Income Final No. 2Document10 pagesFixed Income Final No. 2Yusuf RaharjaPas encore d'évaluation

- Arens Chapter06Document42 pagesArens Chapter06indahmuliasariPas encore d'évaluation

- Dividend Policy and The Earned Contributed CapitalDocument28 pagesDividend Policy and The Earned Contributed CapitalPratiwi SidaurukPas encore d'évaluation

- English Final Project (Finished)Document15 pagesEnglish Final Project (Finished)Yusuf RaharjaPas encore d'évaluation

- Accounting ReportDocument3 pagesAccounting ReportYusuf RaharjaPas encore d'évaluation

- Summary - PSAK 53Document8 pagesSummary - PSAK 53Yusuf RaharjaPas encore d'évaluation

- Accounting For Typical Transactions in The Football IndustryDocument44 pagesAccounting For Typical Transactions in The Football IndustryYusuf RaharjaPas encore d'évaluation

- SA 501 - Group3Document31 pagesSA 501 - Group3Yusuf RaharjaPas encore d'évaluation

- 04 Atlassian 3 Statement Model CompletedDocument18 pages04 Atlassian 3 Statement Model CompletedYusuf RaharjaPas encore d'évaluation

- Merit List Spring 2021Document6 pagesMerit List Spring 2021Rezwan SiamPas encore d'évaluation

- Eight Simple Steps For New Product DevelopmentDocument5 pagesEight Simple Steps For New Product DevelopmenthazemPas encore d'évaluation

- Logistic Industry Employee PersonalityDocument10 pagesLogistic Industry Employee Personalityjoel herdianPas encore d'évaluation

- Invitation To Attend COSH Seminar WorkshopDocument1 pageInvitation To Attend COSH Seminar WorkshopOliver Sumbrana100% (1)

- Lesson 1 Analyzing Recording TransactionsDocument6 pagesLesson 1 Analyzing Recording TransactionsklipordPas encore d'évaluation

- Analysis: StrengthDocument4 pagesAnalysis: Strengthchill itPas encore d'évaluation

- Carta de La Junta Sobre La AEEDocument3 pagesCarta de La Junta Sobre La AEEEl Nuevo DíaPas encore d'évaluation

- Who Are Managers and What Do They DoDocument11 pagesWho Are Managers and What Do They DoMa'am KC Lat PerezPas encore d'évaluation

- COBIT 2019 Design Toolkit With Description - Group X.XLSX - DF2Document8 pagesCOBIT 2019 Design Toolkit With Description - Group X.XLSX - DF2Aulia NisaPas encore d'évaluation

- Research Paper ITL401Document16 pagesResearch Paper ITL401Horksrun SamrongPas encore d'évaluation

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAryan JaiswalPas encore d'évaluation

- Distribution Channel in Wagh Bakri TeaDocument5 pagesDistribution Channel in Wagh Bakri TeaJuned RajaPas encore d'évaluation

- 1687503543sapm 2018-19Document230 pages1687503543sapm 2018-19Arun P PrasadPas encore d'évaluation

- John Maynard KeynesDocument28 pagesJohn Maynard KeynesReymar Lorente UyPas encore d'évaluation

- Discussion Papers in EconomicsDocument41 pagesDiscussion Papers in EconomicsdebasishPas encore d'évaluation

- Act1110 Quiz No. 1 Legal Structures QuestionnaireDocument9 pagesAct1110 Quiz No. 1 Legal Structures QuestionnaireKhloe Nicole AquinoPas encore d'évaluation

- Executive SummaryDocument3 pagesExecutive SummaryKanchan TripathiPas encore d'évaluation

- Investors/ Analyst's Presentation (Company Update)Document38 pagesInvestors/ Analyst's Presentation (Company Update)Shyam SunderPas encore d'évaluation

- The Funding Cost of Chinese Local Government DebtDocument48 pagesThe Funding Cost of Chinese Local Government Debt袁浩森Pas encore d'évaluation

- Business Exit Strategy - 1Document2 pagesBusiness Exit Strategy - 1SUBRATA MODAKPas encore d'évaluation

- Topic1 Understanding Financial StatementsDocument15 pagesTopic1 Understanding Financial StatementsA cPas encore d'évaluation

- Tutorial On Chap 9 & 10 Hrm648Document4 pagesTutorial On Chap 9 & 10 Hrm648Aina AmnaniPas encore d'évaluation

- BBA (Gen) 3rd Semester Result (Regular & Reappear) Dec 2019 PDFDocument878 pagesBBA (Gen) 3rd Semester Result (Regular & Reappear) Dec 2019 PDFSahaj MehtaPas encore d'évaluation

- Mobile Services: Your Account Summary This Month'S ChargesDocument8 pagesMobile Services: Your Account Summary This Month'S ChargesVenkatram PailaPas encore d'évaluation

- Vegi Sree Vijetha (1226113156)Document6 pagesVegi Sree Vijetha (1226113156)Pradeep ChintadaPas encore d'évaluation