Académique Documents

Professionnel Documents

Culture Documents

KBE Terms and Conditions

Transféré par

Sandeep DubeyDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

KBE Terms and Conditions

Transféré par

Sandeep DubeyDroits d'auteur :

Formats disponibles

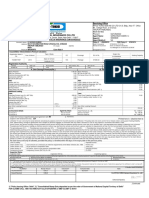

Kuch Bhi on EMI – KBE

Terms and Conditions

1. This is a special promotional offer to select card members only. The card members are selected solely at the

discretion of Standard Chartered Bank (The Bank). The Bank may or may not come out with such offers in the future

at its discretion.

2. After availing of the loan, It is deemed as your unconditional acceptance of the terms and conditions mentioned

herein and you will be bound by the same.

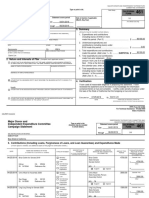

3. The EMI and the applicable GST on the interest amount of EMI, will be added to your minimum amount due every

month, and will attract penal charges in case the minimum amount due is not paid in full by the mentioned payment

due date. If the amount outstanding (including the EMI) were to exceed the credit limit, you would be liable to pay

over limit charges as applicable. Tenure confirmed at the time of applying cannot be changed. The interest is

calculated using the reducing balance method.

EMI = Principal Amount + Interest Amount

Monthly Loan Repayment = EMI + GST on Interest amount of EMI.

Effective 1-Ju17-2017, GST is 18%, subject to change and will be applicable as per Govt. regulations

4. The amount of Processing Fee and applicable GST will be billed in your monthly credit card statement, if applicable

GST is applicable on the following:

• Interest amount of EMI on a monthly basis

• Processing fees

• Pre-closure charges (If any)

5. Changes to Terms and Conditions:

a. We will inform you of any changes to terms and conditions through any of the following channels:-

i. Account statements

ii. ATMs

iii. Notice board at each branch of the Bank

iv. Internet including e-mail and website

v. Newspaper

b. Normally changes will be done with prospective effect giving notice of one month

c. Any changes in the terms and conditions will be communicated to you within 30 days of the effective date of

revision, failing which you may within 60 days of your receipt of the revised terms and conditions close your

account without any additional charges in case the revised terms and conditions are unfavourable to you.

d. If we have made a major change or a lot of minor changes in any one year, we will, at your request give you a

copy of new terms and conditions or a summary of changes

6. The Bank reserves the right to foreclose the offer and debit the entire outstanding amount if any payment is overdue.

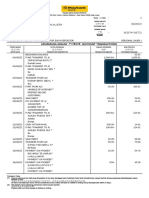

7. A separate account would be set up for this offer. The account number would reflect on your card statement and you

are requested to make your payment towards each of your accounts individually. In case you are making a payment

towards the outstanding of multiple card accounts via a single cheque/DD, then the same may be drawn in favour of

any one of your account numbers, with a clear instruction on the reverse of the cheque/DD for allocation of payment

to the respective accounts.

8. Unless explicitly specified, any loan amount that has been approved against your credit card is a part of your credit

card limit. In such a case, your credit card limit would be blocked to the extent of the outstanding principal of the

loan taken against the credit card. As and when you repay your monthly EMI/amount applicable, your available credit

limit would increase by the amount of principal paid off.

9. The ‘Available Credit Limit’ displayed in your monthly statement also factors all outstandings pertaining to balance

transfers, advances and any unpaid principal amount on your EMI loan accounts.

10. Participants will not hold Standard Chartered Bank responsible for or liable for any actions, claims, demands, losses,

damages, costs, charges which a participant might suffer, sustain, or incur by way of this scheme.

11. If your Standard Chartered Bank credit card is closed before all instalments have been charged or if your EMI

account is pre-closed, the offer amount outstanding together with the pre-closure charges (if applicable) would be

debited as one consolidated amount to your credit card. Thereafter, this will be considered to be an outstanding on

your card account and will attract financial charges (as per the T&C governing the credit card) should there be partial

/ no payment against the same.

12. Nothing contained herein shall prejudice or affect the terms and conditions of the Card Member agreement. The

terms of this agreement shall be in addition to and not in derogation of the terms contained in the Bank’s Card

Member Rules and Regulations.

13. In case of card renewal / upgrade , if the new card is out for delivery and undelivered which leads to deactivation

/cancellation , the EMI account will be closed and the client will be liable to pay the complete outstanding as per the

statement with the pre-closure and associated charges

14. In the event you do not agree to the details of the offer, rate of interest, applicable charges, or the terms and

conditions herein, you are required to call the Bank’s help line and cancel the offer within 15 days from the date of

set up of offer, failing which you shall have deemed to have accepted the offer and the terms and conditions herein

and be liable to pay interest on the amount disbursed from the date of the set up of offer. If the request for closure is

made after 15 days of the conversion, processing fee (PF) charged at the time of booking shall not be refunded back.

15. To pre-close your EMI account, please call the helpline numbers.

Standard Chartered Bank is committed to making your Banking with us a pleasant experience and values your

feedback:

Visit Us: www.sc.com/in

Write to Us: card.services@sc.com

You can write to us for any further queries at Customer Care Unit, Standard Chartered Bank, Post Box No. 8888,

Chennai 600 001.

SMS us: SMS "Service" to 9980033333 and we will provide assistance to you within 24 hours. The Bank assures to

pay `100, on failure of establishing contact within 24 hours*.

(*Terms and Conditions apply) In case of unresolved grievances email us at: head.service@sc.com

Phone Banking Numbers:

• Ahmedabad, Bangalore, Chennai, Delhi, Hyderabad, 66014444

Kolkata, Mumbai, Pune 39404444

• Allahabad, Amritsar, Bhopal, Bhubaneshwar, Chandigarh, Cochin/Ernakulam, 6601444

Coimbatore, Indore, Jaipur, Jalandhar, Kanpur, Lucknow, Ludhiana, 3940444

Nagpur, Patna, Rajkot, Surat, Vadodara

Gurgaon, Noida 011 – 66014444 / 011 - 39404444

• Jalgaon, Guwahati, Cuttack, Mysore, Thiruvananthpuram, Vishakhapatnam 1800 345 1000

• Siliguri 1800 345 5000

sc.com/in

Vous aimerez peut-être aussi

- You Have Opened This PDF in Preview Mode and Will Not Have Full FunctionalityDocument6 pagesYou Have Opened This PDF in Preview Mode and Will Not Have Full FunctionalitymooPas encore d'évaluation

- Allard, Sebastien: SubscriberDocument3 pagesAllard, Sebastien: SubscriberDanielle YoderPas encore d'évaluation

- Accenture Payments Innovation FindingsDocument16 pagesAccenture Payments Innovation FindingsГлеб Коэн100% (1)

- Simple ReceiptDocument4 pagesSimple Receiptbarakasake300Pas encore d'évaluation

- Cigna Global GOP ProviderDocument2 pagesCigna Global GOP ProviderRoyer HyacinthePas encore d'évaluation

- Global Universal Banking: Investment PortalDocument6 pagesGlobal Universal Banking: Investment Portaledwin100% (1)

- Healthcare - Gov/sbc-Glossary: Important Questions Answers Why This MattersDocument9 pagesHealthcare - Gov/sbc-Glossary: Important Questions Answers Why This Mattersapi-252555369Pas encore d'évaluation

- Tax Invoice: Charge DetailsDocument3 pagesTax Invoice: Charge DetailsRohit SharmaPas encore d'évaluation

- What This Health Plan CoversDocument10 pagesWhat This Health Plan CoversQFQEWFWQEFwqPas encore d'évaluation

- Marriott - CC Auth Form - EnglishDocument1 pageMarriott - CC Auth Form - EnglishjTPas encore d'évaluation

- Statement of Fact: What You Have Told UsDocument4 pagesStatement of Fact: What You Have Told UsRhys HarryPas encore d'évaluation

- http:// rgiclservices.reliancegeneral.co.in/ PDFDownload/ViewPDF.aspx? PolicyNo=1104262348016357 &| PolicyNo:1104262348016357 | CustName:RAJESH HARISHCHANDRA MHASHELKAR | Prod:2348 | RSD:19-Jul-2016 | RED:18-Jul-2017Document2 pageshttp:// rgiclservices.reliancegeneral.co.in/ PDFDownload/ViewPDF.aspx? PolicyNo=1104262348016357 &| PolicyNo:1104262348016357 | CustName:RAJESH HARISHCHANDRA MHASHELKAR | Prod:2348 | RSD:19-Jul-2016 | RED:18-Jul-2017RGILPas encore d'évaluation

- Invoice 141Document1 pageInvoice 141franshadiPas encore d'évaluation

- Alvarado, Sandra E: SubscriberDocument3 pagesAlvarado, Sandra E: SubscriberJohn LarbiePas encore d'évaluation

- Dni HinoDocument3 pagesDni Hinomht1Pas encore d'évaluation

- Customer Application FormDocument2 pagesCustomer Application FormBoopathi KalaiPas encore d'évaluation

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument2 pagesIffco-Tokio General Insurance Co - LTD: Servicing OfficeRANGITHPas encore d'évaluation

- Basic Own DamageDocument3 pagesBasic Own DamageHarsh PriyaPas encore d'évaluation

- To Renew SMS, REN To 9222211100Document10 pagesTo Renew SMS, REN To 9222211100Lakshmi SrivastwaPas encore d'évaluation

- MACN-A018 - Universal Affidavit of Termination of All CORPORATEas El, Tara NovaDocument3 pagesMACN-A018 - Universal Affidavit of Termination of All CORPORATEas El, Tara NovaTara Nova ElPas encore d'évaluation

- SVB USA Benefit SummaryDocument2 pagesSVB USA Benefit SummarycvsamsPas encore d'évaluation

- Asf Shaikh TAX NEW2014Document1 pageAsf Shaikh TAX NEW2014Asifshaikh7566Pas encore d'évaluation

- Blue Shield of California Major Donor and Independent Expenditure Committee Campaign StatementDocument6 pagesBlue Shield of California Major Donor and Independent Expenditure Committee Campaign StatementWAKESHEEP Marie RNPas encore d'évaluation

- Robinhood: Account Summary Portfolio AllocationDocument3 pagesRobinhood: Account Summary Portfolio Allocationkrushnavadan5666Pas encore d'évaluation

- Invoice 1434857Document1 pageInvoice 1434857mieayamjamurPas encore d'évaluation

- 1TechnicalBid T6 PDFDocument340 pages1TechnicalBid T6 PDFKanha GargPas encore d'évaluation

- Electronic Record and Signature DisclosureDocument4 pagesElectronic Record and Signature DisclosureVhince BaltoresPas encore d'évaluation

- MBBsavings - 162674 016721 - 2022 09 30 PDFDocument3 pagesMBBsavings - 162674 016721 - 2022 09 30 PDFAdeela fazlinPas encore d'évaluation

- Model Engineer 4677 PDFDocument60 pagesModel Engineer 4677 PDFMartijn HinfelaarPas encore d'évaluation

- Application Form For CSWIP 10 Year Re-CertificationDocument7 pagesApplication Form For CSWIP 10 Year Re-Certificationchandana kumar0% (1)

- Summer Internship ProjectDocument51 pagesSummer Internship ProjectMahesh SatapathyPas encore d'évaluation

- Two Wheeler Insurance CertificateDocument1 pageTwo Wheeler Insurance CertificatesareenckPas encore d'évaluation

- BPI Autodebit Arrangement FormDocument1 pageBPI Autodebit Arrangement FormKane Arvin ChingPas encore d'évaluation

- Application for Authorization to Debit AccountDocument1 pageApplication for Authorization to Debit AccountPatrick PoculanPas encore d'évaluation

- Fact Find Sample - Multiple EntitiesDocument28 pagesFact Find Sample - Multiple Entitiesapi-239405473Pas encore d'évaluation

- Blue Shield CA Employee Enrollment Template v20160101Document8 pagesBlue Shield CA Employee Enrollment Template v20160101Anonymous RLktVcPas encore d'évaluation

- Receipt PDFDocument2 pagesReceipt PDFPramod ChavanPas encore d'évaluation

- Pran Application PDFDocument5 pagesPran Application PDFChandra Sekhar BasamPas encore d'évaluation

- BPI Expresslink Automatic Debit FormDocument1 pageBPI Expresslink Automatic Debit FormJohnrod AbrazaldoPas encore d'évaluation

- Ankit ChaudharyDocument3 pagesAnkit ChaudharyheartheckerPas encore d'évaluation

- Romblon - ProvDocument2 pagesRomblon - ProvirenePas encore d'évaluation

- PDFDocument2 pagesPDFAjay vermaPas encore d'évaluation

- Credit Card Application For Principal CardholderDocument1 pageCredit Card Application For Principal CardholderLoay RashadPas encore d'évaluation

- Od 110281678571962000Document1 pageOd 110281678571962000Pranav SinghPas encore d'évaluation

- OHRA Application FormDocument4 pagesOHRA Application FormwangchanghuiPas encore d'évaluation

- Automobile Insurance - FAQ - Team-BHPDocument12 pagesAutomobile Insurance - FAQ - Team-BHPkrishnakumariramPas encore d'évaluation

- Angel Broking Pvt. Ltd. Angel Commodities Broking Pvt. LTDDocument2 pagesAngel Broking Pvt. Ltd. Angel Commodities Broking Pvt. LTDManishSankrityayanPas encore d'évaluation

- Retail Invoice Bill for Asus Zenfone 4Document2 pagesRetail Invoice Bill for Asus Zenfone 4Vasanth SreePas encore d'évaluation

- License Application SummaryDocument9 pagesLicense Application SummaryWesley James ViejoPas encore d'évaluation

- DWS NEWS RELEASE - Unemployment Insurance Claims Report (1.7)Document2 pagesDWS NEWS RELEASE - Unemployment Insurance Claims Report (1.7)Jennifer WeaverPas encore d'évaluation

- Disclosure StatementDocument3 pagesDisclosure StatementWhoPas encore d'évaluation

- Invoice 16584 PDFDocument1 pageInvoice 16584 PDFfranshadiPas encore d'évaluation

- This Is Only A Summary.: Important Questions Answers Why This MattersDocument10 pagesThis Is Only A Summary.: Important Questions Answers Why This MattersAnonymous D47ZzQZDtPas encore d'évaluation

- License Internet PDFDocument1 pageLicense Internet PDFTanner YeaPas encore d'évaluation

- Dental BS Delta 1500 PPO Benefit Summary 2018Document4 pagesDental BS Delta 1500 PPO Benefit Summary 2018deepchaitanyaPas encore d'évaluation

- CignaDocument7 pagesCignaUNKNOWN LSAPas encore d'évaluation

- GPDocument3 pagesGPHarshitPas encore d'évaluation

- PDFDocument2 pagesPDFpatluPas encore d'évaluation

- Customer PDFDocument1 pageCustomer PDFErwinPas encore d'évaluation

- Nursys e Notify Report: NINA M WALSH (NCSBN ID: 20526130)Document2 pagesNursys e Notify Report: NINA M WALSH (NCSBN ID: 20526130)Nina Michelle WalshPas encore d'évaluation

- Military Out of State Vehicle Registration Forms For FloridaDocument17 pagesMilitary Out of State Vehicle Registration Forms For Floridapnguin1979Pas encore d'évaluation

- Obtain PA Antique, Classic or Collectible PlateDocument2 pagesObtain PA Antique, Classic or Collectible PlateNick RosatiPas encore d'évaluation

- FWD Life Insurance Corp.: Expresslink Automatic Debit ArrangementDocument1 pageFWD Life Insurance Corp.: Expresslink Automatic Debit ArrangementMatteo Messina DenaroPas encore d'évaluation

- Providers - Blue Shield Promise Health Plan PDFDocument3 pagesProviders - Blue Shield Promise Health Plan PDFMohamed ElmallahPas encore d'évaluation

- City of Fort St. John - 2022 Annual Tax Sale ReportDocument5 pagesCity of Fort St. John - 2022 Annual Tax Sale ReportAlaskaHighwayNewsPas encore d'évaluation

- Sip & Micro Sip PDC Form - 29.04.2013Document4 pagesSip & Micro Sip PDC Form - 29.04.2013Aayush ShahPas encore d'évaluation

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooPas encore d'évaluation

- Smart Choice Super Employer AigDocument85 pagesSmart Choice Super Employer AigrkPas encore d'évaluation

- Sample StatementDocument1 pageSample StatementMurali TPas encore d'évaluation

- Kuch Bhi On EMI - KBE 3 Months Offer Terms and ConditionsDocument1 pageKuch Bhi On EMI - KBE 3 Months Offer Terms and Conditionsdevpal78Pas encore d'évaluation

- Standard Chartered EMI offer termsDocument2 pagesStandard Chartered EMI offer termsSanam PandeyPas encore d'évaluation

- Individual Account Opening Form - March 24 - 2021Document13 pagesIndividual Account Opening Form - March 24 - 2021Ewang Chris EjabiPas encore d'évaluation

- (0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FDocument1 page(0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FAngad MundraPas encore d'évaluation

- Daftar Akun RenataDocument3 pagesDaftar Akun RenataFitriRahmanPas encore d'évaluation

- UPSC CMS Exam 2020 NotificationDocument26 pagesUPSC CMS Exam 2020 NotificationSana ZaidiPas encore d'évaluation

- Bank Frauds and Role of RBI - Taxguru - inDocument3 pagesBank Frauds and Role of RBI - Taxguru - inSamarth jhunjhunwalaPas encore d'évaluation

- DeathWish - A NovelDocument28 pagesDeathWish - A NovelA MAITRA100% (1)

- Account Usage and Recharge Statement From 01-Jul-2023 To 30-Jul-2023Document7 pagesAccount Usage and Recharge Statement From 01-Jul-2023 To 30-Jul-2023vinukhote363Pas encore d'évaluation

- Epayments Import Template Adjustable Oct-21Document14 pagesEpayments Import Template Adjustable Oct-21WasimPas encore d'évaluation

- New Technological Innovations in The Banking SectorDocument5 pagesNew Technological Innovations in The Banking SectorlapogkPas encore d'évaluation

- Conclusions and Suggestions.: Chapter No. 07Document35 pagesConclusions and Suggestions.: Chapter No. 07SarinPas encore d'évaluation

- Internship ReportDocument55 pagesInternship Reportreshmamaharjan11Pas encore d'évaluation

- Account Opening Form Personal enDocument3 pagesAccount Opening Form Personal enUveish UzairPas encore d'évaluation

- Kalinga Institute of Industrial Technology, Deemed To Be University, BhubaneswarDocument10 pagesKalinga Institute of Industrial Technology, Deemed To Be University, BhubaneswarVikas RanjanPas encore d'évaluation

- RBL Mitc FinalDocument40 pagesRBL Mitc Finalsamarth guptaPas encore d'évaluation

- SBI NEFT Other Account Transfer 7Document2 pagesSBI NEFT Other Account Transfer 7Dharmendra SinghPas encore d'évaluation

- Rahel MulugetaDocument67 pagesRahel Mulugetamty100% (1)

- Muhammad Yousuf: Account StatementDocument5 pagesMuhammad Yousuf: Account StatementYOUSUFPas encore d'évaluation

- Fee Information Document Name of The Account Provider: Account Name: DateDocument8 pagesFee Information Document Name of The Account Provider: Account Name: DateGomes dos SantosPas encore d'évaluation

- Nibl InformationsDocument50 pagesNibl InformationsPraveen MandalPas encore d'évaluation