Académique Documents

Professionnel Documents

Culture Documents

Mock Test Q1 PDF

Transféré par

Manasa Suresh0 évaluation0% ont trouvé ce document utile (0 vote)

84 vues4 pagesTitre original

Mock test Q1.pdf

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

84 vues4 pagesMock Test Q1 PDF

Transféré par

Manasa SureshDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

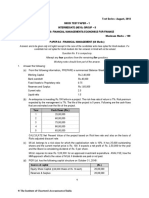

Test Series: March 2019

MOCK TEST PAPER –1

FINAL (NEW) COURSE: GROUP – I

PAPER – 2 : STRATEGIC FINANCIAL MANAGEMENT

Question No. 1 is compulsory. Attempt any four questions from the remaining five questions. Working notes

should form part of the answer.

Time Allowed – 3 Hours Maximum Marks – 100

1. (a) A Mutual Fund is holding the following assets in Rs. Crores :

Investments in diversified equity shares 90.00

Cash and Bank Balances 10.00

100.00

The Beta of the portfolio is 1.1. The index future is selling at 4300 level. The Fund Manager

apprehends that the index will fall at the most by 10%. Calculate the number of index futures he

should short for perfect hedging. One index future consists of 50 units.

Evaluate your answer assuming the Fund Manager's apprehension will materialize. (7 Marks)

(b) EFD Ltd. is an export business house. The company prepares invoice in customers' currency. Its

debtors of US$. 10,000,000 is due on April 1, 2015.

Market information as at January 1, 2015 is:

Exchange rates US$/INR Currency Futures US$/INR

Spot 0.016667 Contract size: Rs. 24,816,975

1-month forward 0.016529 1-month 0.016519

3-months forward 0.016129 3-month 0.016118

Initial Margin Interest rates in India

1-Month Rs. 17,500 6.5%

3-Months Rs. 22,500 7%

On April 1, 2015 the spot rate US$/INR is 0.016136 and currency future rate is 0.016134.

Recommend as to which of the following methods would be most advantageous to EFD Ltd.

(i) Using forward contract

(ii) Using currency futures

(iii) Not hedging the currency risk (7 Marks)

(c) Explain some of the innovative ways to finance a startup. (6 Marks)

2. (a) TM Fincorp has bought a 6 x 9 Rs. 100 crore Forward Rate Agreement (FRA) at 5.25%. On fixing

date reference rate i.e. MIBOR turns out be as follows:

Period Rate (%)

3 months 5.50

6 months 5.70

9 months 5.85

You are required to calculate:

(i) Profit/Loss to TM Fincorp. in terms of basis points.

1

© The Institute of Chartered Accountants of India

(ii) The settlement amount.

(Assume 360 days in a year) (8 Marks)

(b) The risk-free rate of return Rf is 9 percent. The expected rate of return on the market portfolio Rm

is 13 percent. The expected rate of growth for the dividend of Platinum Ltd. is 7 percent. The last

dividend paid on the equity stock of firm A was Rs. 2.00. The beta of Platinum Ltd. equity stock

is 1.2.

(i) Calculate the equilibrium price of the equity stock of Platinum Ltd.?

(ii) Also, calculate the equilibrium price when

• The inflation premium increases by 2 percent?

• The expected growth rate increases by 3 percent?

• The beta of Platinum Ltd. equity rises to 1.3? (8 Marks)

(c) Describe the characteristics of financial instruments. (4 Marks)

3. (a) On January 1, 2013 an investor have a portfolio of 5 shares as given below:

Security Price No. of Shares Beta

A 349.30 5,000 1.15

B 480.50 7,000 0.40

C 593.52 8,000 0.90

D 734.70 10,000 0.95

E 824.85 2,000 0.85

The cost of capital to the investor is 10.5% per annum.

You are required to calculate:

(i) The beta of his portfolio.

(ii) The theoretical value of the NIFTY futures for February 2013.

(iii) The number of contracts of NIFTY the investor needs to sell to get a full hedge until

February for his portfolio if the current value of NIFTY is 5900 and NIFTY futures have a

minimum trade lot requirement of 200 units. Assume that the futures are trading at their fair

value.

(iv) The number of future contracts the investor should trade if he desires to reduce the beta of

his portfolios to 0.6.

No. of days in a year be treated as 365.

Given: In (1.105) = 0.0998 and e(0.015858) = 1.01598 (8 Marks)

(b) The following information is available with respect of Krishna Ltd.

Year Krishna Ltd. Dividend Average Dividend Return on

Average share price per Share Market Index Yield Govt. bonds

Rs. Rs.

2012 245 20 2013 4% 7%

2013 253 22 2130 5% 6%

2014 310 25 2350 6% 6%

2015 330 30 2580 7% 6%

Calculate the Beta Value of the Krishna Ltd. at the end of 2015 and State your observation.

(8 Marks)

© The Institute of Chartered Accountants of India

(c) Describe the concept of ‘Evaluation of Technical Analysis’. (4 Marks)

4. (a) Orange purchased 200 units of Oxygen Mutual Fund at Rs. 45 per unit on 31 st December, 2009.

In 2010, he received Rs. 1.00 as dividend per unit and a capital gains distribution of Rs. 2 per

unit.

Required:

(i) Calculate the return for the period of one year assuming that the NAV as on 31 st December

2010 was Rs. 48 per unit.

(ii) Calculate the return for the period of one year assuming that the NAV as on 31 st December

2010 was Rs. 48 per unit and all dividends and capital gains distributions have been

reinvested at an average price of Rs. 46.00 per unit. Ignore taxation. (8 Marks)

(b) On April 3, 2016, a Bank quotes the following:

Spot exchange Rate (US $ 1) INR 66.2525 INR 67.5945

2 months’ swap points 70 90

3 months’ swap points 160 186

In a spot transaction, delivery is made after two days.

Assume spot date as April 5, 2016.

Assume 1 swap point = 0.0001,

Calculate:

(i) swap points for 2 months and 15 days. (For June 20, 2016),

(ii) foreign exchange rate for June 20, 2016, and

(iii) the annual rate of premium/discount of US$ on INR, on an average rate. (8 Marks)

(c) Explain the pricing of the securitized Instruments.

OR

Describe the concept of ‘Stripped Securities’. (4 Marks)

5. (a) You have following quotes from Bank A and Bank B:

Bank A Bank B

SPOT USD/CHF 1.4650/55 USD/CHF 1.4653/60

3 months 5/10

6 months 10/15

SPOT GBP/USD 1.7645/60 GBP/USD 1.7640/50

3 months 25/20

6 months 35/25

Calculate:

(i) How much minimum CHF amount you have to pay for 1 Million GBP spot?

(ii) Considering the quotes from Bank A only, for GBP/CHF what are the Implied Swap points

for Spot over 3 months? (8 Marks)

(b) Delta Ltd.’s current financial year’s income statement reports its net income as Rs. 15,00,000.

Delta’s marginal tax rate is 40% and its interest expense for the year was Rs. 15,00,000. The

company has Rs. 1,00,00,000 of invested capital, of which 60% is debt. In addition, Delta Ltd.

tries to maintain a Weighted Average Cost of Capital (WACC) of 12.6%.

(i) Calculate the operating income or EBIT earned by Delta Ltd. in the current year.

© The Institute of Chartered Accountants of India

(ii) Calculate the Delta Ltd.’s Economic Value Added (EVA) for the current year?

(iii) Delta Ltd. has 2,50,000 equity shares outstanding. According to the EVA you calculated in

(ii), Evaluate how much can Delta pay in dividend per share before the value of the

company would start to decrease? If Delta does not pay any dividends, Evaluate what would

you expect to happen to the value of the company? (8 Marks)

(c) State the Benefits available to Micro, Small or Medium enterprises. (4 Marks)

6. (a) The Nishan Ltd. has 35,000 shares of equity stock outstanding with a book value of Rs.20 per

share. It owes debt Rs. 15,00,000 at an interest rate of 12%. Selected financial results are as

follows.

Income and Cash Flow Capital

EBIT Rs. 80,000 Debt Rs. 1,500,000

Interest 1,80,000 Equity 7,00,000

EBT (Rs. 1,00,000) Rs. 2,200,000

Tax 0

EAT (Rs. 1,00,000)

Depreciation Rs. 50,000

Principal repayment (Rs. 75,000)

Cash Flow (Rs. 1,25,000)

Evaluate and Restructure the financial line items shown assuming a composition in which

creditors agree to convert two thirds of their debt into equity at book value. Assume Nishan will

pay tax at a rate of 15% on income after the restructuring, and that principal repayments are

reduced proportionately with debt. Demonstrate as to who will control the company and by how

big a margin after the restructuring? (8 Marks)

(b) Mr. Abhishek is interested in investing Rs. 2,00,000 for which he is considering following three

alternatives:

(i) Invest Rs. 2,00,000 in Mutual Fund X (MFX)

(ii) Invest Rs. 2,00,000 in Mutual Fund Y (MFY)

(iii) Invest Rs. 1,20,000 in Mutual Fund X (MFX) and Rs. 80,000 in Mutual Fund Y (MFY)

Average annual return earned by MFX and MFY is 15% and 14% respectively. Risk free rate of

return is 10% and market rate of return is 12%.

Covariance of returns of MFX, MFY and market portfolio Mix are as follow:

MFX MFY Mix

MFX 4.800 4.300 3.370

MFY 4.300 4.250 2.800

Mix 3.370 2.800 3.100

You are required to calculate:

(i) variance of return from MFX, MFY and market return,

(ii) portfolio return, beta, portfolio variance and portfolio standard deviation,

(iii) expected return, systematic risk and unsystematic risk; and

(iv) Sharpe ratio, Treynor ratio and Alpha of MFX, MFY and Portfolio Mix. (12 Marks)

© The Institute of Chartered Accountants of India

Vous aimerez peut-être aussi

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosD'EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosPas encore d'évaluation

- SFM QuesDocument5 pagesSFM QuesAstha GoplaniPas encore d'évaluation

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument15 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answerritz meshPas encore d'évaluation

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportD'EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportPas encore d'évaluation

- MTP 1 May 21 QDocument4 pagesMTP 1 May 21 QSampath KumarPas encore d'évaluation

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument17 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidPas encore d'évaluation

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerCA Dipesh JainPas encore d'évaluation

- 44956mtpbosicai Final QP p2Document7 pages44956mtpbosicai Final QP p2Shubham SurekaPas encore d'évaluation

- 70067bos56011 Final p2qDocument6 pages70067bos56011 Final p2qVipul JainPas encore d'évaluation

- SFM Q 2Document5 pagesSFM Q 2riyaPas encore d'évaluation

- Practical Questions: Derivatives Analysis and Valuation 7Document24 pagesPractical Questions: Derivatives Analysis and Valuation 7RITZ BROWNPas encore d'évaluation

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidPas encore d'évaluation

- FFTFMDocument5 pagesFFTFMKaran NewatiaPas encore d'évaluation

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswercdPas encore d'évaluation

- MTP 1 Nov 18 QDocument6 pagesMTP 1 Nov 18 QSampath KumarPas encore d'évaluation

- TEST Paper 1 Full TestDocument9 pagesTEST Paper 1 Full Testjohny SahaPas encore d'évaluation

- Ca Inter May 2023 ImpDocument23 pagesCa Inter May 2023 ImpAlok TiwariPas encore d'évaluation

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerAyushi GuptaPas encore d'évaluation

- SFM Q MTP 2 Final May22Document6 pagesSFM Q MTP 2 Final May22Divya AggarwalPas encore d'évaluation

- Corporate Financial ManagementDocument3 pagesCorporate Financial ManagementRamu KhandalePas encore d'évaluation

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerKuperajahPas encore d'évaluation

- SFM N RTP, MTP, EXAMDocument204 pagesSFM N RTP, MTP, EXAMKuperajahPas encore d'évaluation

- Financial ManagementDocument4 pagesFinancial ManagementsimranPas encore d'évaluation

- Nov 10Document7 pagesNov 10chandreshPas encore d'évaluation

- Mock Test Q2 PDFDocument5 pagesMock Test Q2 PDFManasa SureshPas encore d'évaluation

- Q.P. Code: 62202: Managerial AccountingDocument6 pagesQ.P. Code: 62202: Managerial Accountinganshul bhutangePas encore d'évaluation

- 4 Financial Management Questions Nov Dec 2019 PL PDFDocument5 pages4 Financial Management Questions Nov Dec 2019 PL PDFShahriar ShihabPas encore d'évaluation

- MTP 1 May 18 QDocument4 pagesMTP 1 May 18 QSampath KumarPas encore d'évaluation

- SFM QDocument4 pagesSFM QriyaPas encore d'évaluation

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayPas encore d'évaluation

- MTP Oct. 2018 FM and Eco QuestionDocument6 pagesMTP Oct. 2018 FM and Eco QuestionAisha MalhotraPas encore d'évaluation

- Sep23 Ques-1Document5 pagesSep23 Ques-1absankey770Pas encore d'évaluation

- Paper - 2: Strategic Financial Management: (5 Marks) Security A K S PDocument24 pagesPaper - 2: Strategic Financial Management: (5 Marks) Security A K S PSaurabh GholapPas encore d'évaluation

- Financial ManagementDocument3 pagesFinancial ManagementMRRYNIMAVATPas encore d'évaluation

- SFM RTP Nov 22Document16 pagesSFM RTP Nov 22Accounts PrimesoftPas encore d'évaluation

- ICAI - Question BankDocument6 pagesICAI - Question Bankkunal mittalPas encore d'évaluation

- Mba Summer 2019Document4 pagesMba Summer 2019Dhruvi PatelPas encore d'évaluation

- SFMDocument29 pagesSFMShrinivas PrabhunePas encore d'évaluation

- Financial Treasury and Forex Management: NoteDocument7 pagesFinancial Treasury and Forex Management: Notesks0865Pas encore d'évaluation

- 8) FM EcoDocument19 pages8) FM EcoKrushna MatePas encore d'évaluation

- CA Final Paper 2Document32 pagesCA Final Paper 2MM_AKSIPas encore d'évaluation

- MQP - MBA - Sem2 - Financial Management (DMBA202) PDFDocument4 pagesMQP - MBA - Sem2 - Financial Management (DMBA202) PDFsanjeev misraPas encore d'évaluation

- Oct19 Ques-1Document5 pagesOct19 Ques-1absankey770Pas encore d'évaluation

- Test Series: August, 2016 Mock Test Paper - 1 Final Course: Group - I Paper - 2: Strategic Financial ManagementDocument40 pagesTest Series: August, 2016 Mock Test Paper - 1 Final Course: Group - I Paper - 2: Strategic Financial ManagementMuhamed Muhsin PPas encore d'évaluation

- 0432 Fourth Semester 5 Years B.B.A. LL.B. Examination, December 2012 Financial ManagementDocument4 pages0432 Fourth Semester 5 Years B.B.A. LL.B. Examination, December 2012 Financial ManagementsimranPas encore d'évaluation

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityReniePas encore d'évaluation

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthPas encore d'évaluation

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilPas encore d'évaluation

- SFM Old MTP Dec 21Document6 pagesSFM Old MTP Dec 21Kanchana SubbaramPas encore d'évaluation

- Question PaperDocument3 pagesQuestion PaperAmbrishPas encore d'évaluation

- Question No.1 Is Compulsory. Answer Any Questions From The Remaining Six Questions Working Notes Should Form Part of The Answers (MARKS 100)Document6 pagesQuestion No.1 Is Compulsory. Answer Any Questions From The Remaining Six Questions Working Notes Should Form Part of The Answers (MARKS 100)rahul26665323Pas encore d'évaluation

- Assignment MF0001: (2 Credits) Set 1Document9 pagesAssignment MF0001: (2 Credits) Set 1470*Pas encore d'évaluation

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManPas encore d'évaluation

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilPas encore d'évaluation

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikPas encore d'évaluation

- 4201 (Previous Year Questions)Document13 pages4201 (Previous Year Questions)Tanjid MahadyPas encore d'évaluation

- Investment Banking - 02092021Document4 pagesInvestment Banking - 02092021rishabh jainPas encore d'évaluation

- Accs June 16Document8 pagesAccs June 16manasPas encore d'évaluation

- Ca Final Strategic Financial Management Full Test 1 May 2022 Test Paper 1644507041Document12 pagesCa Final Strategic Financial Management Full Test 1 May 2022 Test Paper 1644507041itaxkgcPas encore d'évaluation

- P6-Corporation TaxDocument16 pagesP6-Corporation TaxAnonymous rePT5rCrPas encore d'évaluation

- EO 179 On The Coco Levy FundsDocument5 pagesEO 179 On The Coco Levy FundsImperator FuriosaPas encore d'évaluation

- Tugas 3 CH 7 Dan 8 Up Date1Document5 pagesTugas 3 CH 7 Dan 8 Up Date1Bayu SilvatikaPas encore d'évaluation

- Indonesianpockettaxbook2009 PDFDocument104 pagesIndonesianpockettaxbook2009 PDFP Amalia Salabah CitraPas encore d'évaluation

- John Keells Holdings PLC (JKH) - Q3 FY 16 - BUYDocument10 pagesJohn Keells Holdings PLC (JKH) - Q3 FY 16 - BUYSudheera IndrajithPas encore d'évaluation

- Bond Stock ValuationDocument38 pagesBond Stock ValuationRichard Artajo RoxasPas encore d'évaluation

- Accounting Group Assignment 1 (Updated)Document22 pagesAccounting Group Assignment 1 (Updated)Dylan Rabin PereiraPas encore d'évaluation

- $845.07 Thus, The Price of The Bond Is $845.07Document16 pages$845.07 Thus, The Price of The Bond Is $845.07Vani Prince TyagiPas encore d'évaluation

- This Study Resource Was: 1. in The Audit of The Heats Corporation's Financial Statements at December 31, 2005, TheDocument5 pagesThis Study Resource Was: 1. in The Audit of The Heats Corporation's Financial Statements at December 31, 2005, TheIvy BautistaPas encore d'évaluation

- Fundamentals of Financial Accounting 4th Edition Phillips Solutions ManualDocument43 pagesFundamentals of Financial Accounting 4th Edition Phillips Solutions ManualGregoryGreenjptqd100% (14)

- Center For Review and Special Studies - : Accounting For Shareholders' Equity (Study Notes)Document10 pagesCenter For Review and Special Studies - : Accounting For Shareholders' Equity (Study Notes)Yvonne DuyaoPas encore d'évaluation

- Wiley CFA Society Mock Exam 2020 Level I Morning QuestionsDocument36 pagesWiley CFA Society Mock Exam 2020 Level I Morning QuestionsThaamier MisbachPas encore d'évaluation

- A V Thomas & Co LTD 2006Document10 pagesA V Thomas & Co LTD 2006Anantha LakshmiPas encore d'évaluation

- 1914 Co-Operative SocDocument34 pages1914 Co-Operative SocPriyal ShahPas encore d'évaluation

- Haugen 1996Document39 pagesHaugen 1996Roland Adi NugrahaPas encore d'évaluation

- Cooperative BookkeepingDocument41 pagesCooperative Bookkeepingjaydeeado50% (4)

- Moody's Investor DayDocument44 pagesMoody's Investor Daymaxbg91Pas encore d'évaluation

- SMChap 003Document23 pagesSMChap 003testbank100% (1)

- 12 Accountancy sp08Document15 pages12 Accountancy sp08sneha muralidharanPas encore d'évaluation

- Capital Market Regulatory Insight - P.S.rao & AssociatesDocument43 pagesCapital Market Regulatory Insight - P.S.rao & AssociatesSharath Srinivas Budugunte100% (1)

- By: Vinit Mishra SirDocument109 pagesBy: Vinit Mishra SirgimPas encore d'évaluation

- Solution Manual INTACC3 SUMMERDocument25 pagesSolution Manual INTACC3 SUMMERRaven SiaPas encore d'évaluation

- Return On EquityDocument6 pagesReturn On EquitySharathPas encore d'évaluation

- Balance Sheet of HDFC BankDocument5 pagesBalance Sheet of HDFC BankSonica RajputPas encore d'évaluation

- Finman 3 EwanDocument7 pagesFinman 3 EwanNorman Christopher LopezPas encore d'évaluation

- BW OffshoreDocument65 pagesBW Offshorethebigy1n100% (1)

- Videocon - Working CapitalDocument68 pagesVideocon - Working Capitalswati_arora100% (1)

- Chapter One 1.1.: Background of The StudyDocument14 pagesChapter One 1.1.: Background of The StudyRajesh YadavPas encore d'évaluation

- UM-PT01-MQF-BR006-S00 MAKLUMAT KURSUS UNTUK SEMESTER PENGGAL SEMASA (Adjusted COVID19)Document4 pagesUM-PT01-MQF-BR006-S00 MAKLUMAT KURSUS UNTUK SEMESTER PENGGAL SEMASA (Adjusted COVID19)Wong Yong Sheng WongPas encore d'évaluation

- GSFM7514 Assignment Master Budget QuestionsDocument3 pagesGSFM7514 Assignment Master Budget Questionsnoorfazirah9196Pas encore d'évaluation

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- Creating Shareholder Value: A Guide For Managers And InvestorsD'EverandCreating Shareholder Value: A Guide For Managers And InvestorsÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingD'EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthD'EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthÉvaluation : 4 sur 5 étoiles4/5 (20)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelD'Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelPas encore d'évaluation

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursD'EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 4.5 sur 5 étoiles4.5/5 (18)

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamD'EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamPas encore d'évaluation

- Mind over Money: The Psychology of Money and How to Use It BetterD'EverandMind over Money: The Psychology of Money and How to Use It BetterÉvaluation : 4 sur 5 étoiles4/5 (24)

- Financial Risk Management: A Simple IntroductionD'EverandFinancial Risk Management: A Simple IntroductionÉvaluation : 4.5 sur 5 étoiles4.5/5 (7)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsD'EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsD'EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsPas encore d'évaluation

- Product-Led Growth: How to Build a Product That Sells ItselfD'EverandProduct-Led Growth: How to Build a Product That Sells ItselfÉvaluation : 5 sur 5 étoiles5/5 (1)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)D'EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Évaluation : 4 sur 5 étoiles4/5 (5)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistD'EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistÉvaluation : 4 sur 5 étoiles4/5 (32)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursD'EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursÉvaluation : 4.5 sur 5 étoiles4.5/5 (34)

- How to Measure Anything: Finding the Value of Intangibles in BusinessD'EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessÉvaluation : 3.5 sur 5 étoiles3.5/5 (4)

- Valley Girls: Lessons From Female Founders in the Silicon Valley and BeyondD'EverandValley Girls: Lessons From Female Founders in the Silicon Valley and BeyondPas encore d'évaluation