Académique Documents

Professionnel Documents

Culture Documents

Ratio Analysis: Under Armour, Inc (UA) : Liqudity Ratios

Transféré par

Maryam AhmadiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ratio Analysis: Under Armour, Inc (UA) : Liqudity Ratios

Transféré par

Maryam AhmadiDroits d'auteur :

Formats disponibles

Ratio Analysis: Under Armour, Inc (UA)

Calculation

Liqudity Ratios Formula Industry Norm Comments

2014 2013

Current Ratio Current Assets / Current Liabilities 1,549,000/421,627= 3.67 1,128,811/426,630= 2.65 2.1 Excellent

Quick Ratio Cash + AR / Current Liabilities (593,175+332,333)/421,627= 2.20 (347,489+248,329)/426,630= 1.40 0.8 Excellent

Average Collection Period AR / Daily Credit Sales 332,333/(3,084,370/360)= 38 Days 248,329/(2,332,051/360)= 38 Days 39 Days Stable But Could Improve

AR Turnover Credit Sales / AR 3,084,370/332,333= 9.28 Times 2,332,051/248,329= 9.39 Times 9.3 Times Stable But Could Improve

Inventory Turnover Cost of Good Sold / Inventory 1,572,164/536,714= 2.93 Times 1,195,381/469,006= 2.55 Times 4.8 Times Needs Improvement

Calculation

Profitability Ratios Formula Industry Norm Comments

2014 2013

ROI Operating Income / Total Assets 353,955/2,095,083= 16.89% 265,098/1,577,741= 16.80% 6.6% Excellent

Operating Profit Margin Operating Income / Sales 353,955/3,084,370= 11.48% 265,098/2,332,051= 11.37% 4.6% Excellent

Total Assets Turnover Sales / Total Assets 3,084,370/2,095,083= 1.47 Times 2,332,051/1,577,741= 1.48 Times 2.1 Times Stable, Needs Improvement

Fixed Assets Turnover Sales / Net Fixed Assets 3,084,370/305,564= 10.09 Times 2,332,051/223,952= 10.41 Times 13.4 Times Needs Improvement

Calculation

Financing Ratios Formula Industry Norm Comments

2014 2013

Debt Ratio Total Debt / Total Assets (421,627+255,250)/2,095,083= 32.31% (426,630+47,951)/1,577,741= 30.17% 58.5% Slowly Moving Up

Times Interest Earned Operating Income / Interest Expense 353,955/5,335= 66.35 Times 265,098/2,933= 90.38 Times 6.2 Times Excellent

Calculation

Return & Shareholders Ratios Formula Industry Norm Comments

2014 2013

ROE Net Income / Total Equity 208,042/(2,095,083-744,783)= 15.41% 162,330/(1,577,741-524,387)= 15.41% 18.4% Needs Improvement

P/E Stock Price/ Ending Per Share 68.88 68.88 16.74 Excellent

Maryam Ahmadi FIN 301 A

Vous aimerez peut-être aussi

- Tax Fraud Final NotesDocument5 pagesTax Fraud Final NotesMaryam AhmadiPas encore d'évaluation

- Creating Shareholder Value: A Guide For Managers And InvestorsD'EverandCreating Shareholder Value: A Guide For Managers And InvestorsÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Investment Appraisal: A Simple IntroductionD'EverandInvestment Appraisal: A Simple IntroductionÉvaluation : 4 sur 5 étoiles4/5 (6)

- Income Tax MCQ 1Document9 pagesIncome Tax MCQ 1mohammedumair100% (3)

- Comparative Study and Financial Analysis of Ginni Filaments LTDDocument61 pagesComparative Study and Financial Analysis of Ginni Filaments LTDAditi SinghPas encore d'évaluation

- Accounting CheatsheetDocument1 pageAccounting Cheatsheetalbatross868973Pas encore d'évaluation

- Risk in The BoardroomDocument2 pagesRisk in The BoardroomDwayne BranchPas encore d'évaluation

- Software Asssociates11Document13 pagesSoftware Asssociates11Arslan ShaikhPas encore d'évaluation

- Ej Philip Turner and Elnora Turner Petitioners vs. Lorenzo Shipping Corporation Respondent.Document2 pagesEj Philip Turner and Elnora Turner Petitioners vs. Lorenzo Shipping Corporation Respondent.Ej Turingan50% (2)

- De La Salle University: Professional Schools, Inc. Graduate School of BusinessDocument16 pagesDe La Salle University: Professional Schools, Inc. Graduate School of BusinessDarwin Dionisio ClementePas encore d'évaluation

- 1.2.1 Financial Performance RatiosDocument135 pages1.2.1 Financial Performance RatiosGary APas encore d'évaluation

- Financial Statement Analysis and Valuation (Penman) FA2013Document5 pagesFinancial Statement Analysis and Valuation (Penman) FA2013Saurabh VashistPas encore d'évaluation

- Doing Business in IndonesiaDocument52 pagesDoing Business in IndonesiaDharmendra TripathiPas encore d'évaluation

- Compensation Manual BALDocument27 pagesCompensation Manual BALPankaj KumarPas encore d'évaluation

- Sample Business Plans - UK Guildford Dry CleaningDocument36 pagesSample Business Plans - UK Guildford Dry CleaningPalo Alto Software100% (14)

- Working With Financial StatementsDocument27 pagesWorking With Financial StatementsYannah HidalgoPas encore d'évaluation

- How Bank Makes MoneyDocument2 pagesHow Bank Makes MoneyudaykumarPas encore d'évaluation

- Statement of Cashflow: Tutor Class - 101 HUDA AULIA ARIFIN - 1406533781Document13 pagesStatement of Cashflow: Tutor Class - 101 HUDA AULIA ARIFIN - 1406533781Fiza Xiena100% (1)

- Annual Report 19-20Document116 pagesAnnual Report 19-20David haughesPas encore d'évaluation

- Income Tax Planning in India With Respect To Individual AssesseeDocument96 pagesIncome Tax Planning in India With Respect To Individual AssesseeSyed Murthza57% (7)

- 05 Ratios and Trend AnalysisDocument11 pages05 Ratios and Trend AnalysisHaris IshaqPas encore d'évaluation

- Lecture 2Document23 pagesLecture 2helmy habsyiPas encore d'évaluation

- Business School "Financial Management" BS-A&F-4A Financial Ratios Date With Day: 29 Nov, 2020 (Sunday)Document16 pagesBusiness School "Financial Management" BS-A&F-4A Financial Ratios Date With Day: 29 Nov, 2020 (Sunday)omar hashmiPas encore d'évaluation

- Analysis of Income Statement of The Allahabad BankDocument18 pagesAnalysis of Income Statement of The Allahabad BankLofidPas encore d'évaluation

- JM Fy2019Document35 pagesJM Fy2019Krishna ParikhPas encore d'évaluation

- Question No.1: (3 Marks)Document25 pagesQuestion No.1: (3 Marks)Sudha SinghPas encore d'évaluation

- 2009 10 Brand Valuation Additional InformationDocument2 pages2009 10 Brand Valuation Additional InformationAnuja BhakuniPas encore d'évaluation

- Mindtree 08 09Document3 pagesMindtree 08 09muthusubaPas encore d'évaluation

- Performance Measurement: OutlineDocument17 pagesPerformance Measurement: OutlineLưu Hồng Hạnh 4KT-20ACNPas encore d'évaluation

- University of Kelaniya: Higher Diploma in BusinessDocument17 pagesUniversity of Kelaniya: Higher Diploma in BusinessMohamed Ashraff Mohamed HakeemPas encore d'évaluation

- Ratio Comparison Yr 11 - 12Document9 pagesRatio Comparison Yr 11 - 12vivekchittoriaPas encore d'évaluation

- Cost of Capital: Sahil Kesarwani, F.Y. BAF (B), 192704Document10 pagesCost of Capital: Sahil Kesarwani, F.Y. BAF (B), 192704Rohit GadgePas encore d'évaluation

- Case StudyDocument14 pagesCase StudyViren DeshpandePas encore d'évaluation

- BA449 Chap 005Document50 pagesBA449 Chap 005mashalerahPas encore d'évaluation

- Wahyu Gunawan - Mid Exam Financial MGT - ENEMBA7Document15 pagesWahyu Gunawan - Mid Exam Financial MGT - ENEMBA7Rydo PrastariPas encore d'évaluation

- Sample Assignment UiTM Student PDFDocument319 pagesSample Assignment UiTM Student PDFZul HashimPas encore d'évaluation

- Du Pont Analysis: Components of Dupont AnalysisDocument4 pagesDu Pont Analysis: Components of Dupont AnalysisPrachi SharmaPas encore d'évaluation

- Advanced Accounting 6th Edition Jeter Solutions Manual PDFDocument24 pagesAdvanced Accounting 6th Edition Jeter Solutions Manual PDFHeni Fernandes FransiskaPas encore d'évaluation

- Zambian Breweries Report 2018Document8 pagesZambian Breweries Report 2018Mumbi MwansaPas encore d'évaluation

- Financial Analysis of Idea: Case Studies in Telecom BusinessDocument8 pagesFinancial Analysis of Idea: Case Studies in Telecom BusinessKrishnakant NeekhraPas encore d'évaluation

- Control: The Management Control Process: Changes From Eleventh EditionDocument25 pagesControl: The Management Control Process: Changes From Eleventh EditionAlka Narayan100% (1)

- 6-Software AssociatesDocument17 pages6-Software AssociatesgdpartthPas encore d'évaluation

- Balanced ScorecardDocument18 pagesBalanced ScorecardOnder YardasPas encore d'évaluation

- 47047bosfinal p5 cp8Document89 pages47047bosfinal p5 cp8Mitali SharmaPas encore d'évaluation

- Advanced Accounting 6th Edition Jeter Solutions ManualDocument35 pagesAdvanced Accounting 6th Edition Jeter Solutions Manuallanguor.shete0wkzrt100% (21)

- Institute of Management Development and Research (Imdr) : Pune Post Graduation Diploma in Management (PGDM)Document9 pagesInstitute of Management Development and Research (Imdr) : Pune Post Graduation Diploma in Management (PGDM)hitesh rathodPas encore d'évaluation

- Support Department Cost AllocationDocument43 pagesSupport Department Cost AllocationWahyu Mayla RosaPas encore d'évaluation

- The Fortress Resorts PLC and Marawila Resorts PLC (1201)Document21 pagesThe Fortress Resorts PLC and Marawila Resorts PLC (1201)Bajalock VirusPas encore d'évaluation

- Measuring and Evaluating Financial PerformanceDocument12 pagesMeasuring and Evaluating Financial PerformanceNishtha SisodiaPas encore d'évaluation

- Mindtree: Reference ModelDocument54 pagesMindtree: Reference ModelLiontiniPas encore d'évaluation

- Group 7 - Assignment 2Document2 pagesGroup 7 - Assignment 2diveshPas encore d'évaluation

- Renuka Foods PLC and HVA Foods PLC (1200)Document21 pagesRenuka Foods PLC and HVA Foods PLC (1200)Bajalock VirusPas encore d'évaluation

- Slide For Apprentice ConventionDocument26 pagesSlide For Apprentice ConventionamnsevenPas encore d'évaluation

- Sak Case 20.3Document14 pagesSak Case 20.3Kemala Putri AyundaPas encore d'évaluation

- BA541 Financial Management and AnalysisDocument11 pagesBA541 Financial Management and AnalysisKiran JawaidPas encore d'évaluation

- Case Study Responsibility AccountingDocument6 pagesCase Study Responsibility Accountingmonika thakur100% (1)

- Bargaining Power ASSIGNMENT - 3: I. Choice of Industry CompetitorsDocument7 pagesBargaining Power ASSIGNMENT - 3: I. Choice of Industry CompetitorssumeetkantkaulPas encore d'évaluation

- ServiceDocument132 pagesServicesherazhassannPas encore d'évaluation

- Steel Authority of India (SAIL) Ltd. - Research Center: Balance SheetDocument5 pagesSteel Authority of India (SAIL) Ltd. - Research Center: Balance SheetuttamsharmaPas encore d'évaluation

- CF Project - GP 13Document8 pagesCF Project - GP 13hjiyoPas encore d'évaluation

- Morepen Financial AnalysisDocument30 pagesMorepen Financial AnalysisSourav SPas encore d'évaluation

- ACME - Ratio AnalysisDocument1 pageACME - Ratio AnalysistashnimPas encore d'évaluation

- A Report On Financial Analysis of Next PLC 3Document11 pagesA Report On Financial Analysis of Next PLC 3Hamza AminPas encore d'évaluation

- Liquidity Ratios Liquidity RatioDocument3 pagesLiquidity Ratios Liquidity RatioAcer UlepPas encore d'évaluation

- Acma Final ReportDocument11 pagesAcma Final ReportparidhiPas encore d'évaluation

- Advanced Financial Accounting FinalDocument4 pagesAdvanced Financial Accounting Final林木田Pas encore d'évaluation

- Salalah Mills Performance 1Document15 pagesSalalah Mills Performance 1پاکیزہ مسکانPas encore d'évaluation

- Accounting Grade 12 Test 1 Self-Study (Lockdown Period)Document5 pagesAccounting Grade 12 Test 1 Self-Study (Lockdown Period)pleasuremaome06Pas encore d'évaluation

- Accounting P1 Nov 2022 MG EngDocument11 pagesAccounting P1 Nov 2022 MG Engmthethwathando422Pas encore d'évaluation

- Q1 2023 Earnings Presentation - FINALDocument10 pagesQ1 2023 Earnings Presentation - FINALChinnakannan EPas encore d'évaluation

- Hikkaduwa Beach Resorts PLC and Waskaduwa Beach Resorts PLCDocument17 pagesHikkaduwa Beach Resorts PLC and Waskaduwa Beach Resorts PLCreshadPas encore d'évaluation

- Liquidity Ratio Industr Y: Company 2.26 0.77Document2 pagesLiquidity Ratio Industr Y: Company 2.26 0.77MasTer PanDaPas encore d'évaluation

- Mary Kay Cosmetics IncDocument16 pagesMary Kay Cosmetics IncMaryam AhmadiPas encore d'évaluation

- Organized CrimeDocument10 pagesOrganized CrimeMaryam AhmadiPas encore d'évaluation

- Costco Disclosure NotesDocument3 pagesCostco Disclosure NotesMaryam AhmadiPas encore d'évaluation

- Capstone Sources UsedDocument2 pagesCapstone Sources UsedMaryam AhmadiPas encore d'évaluation

- Article Name AuthorDocument3 pagesArticle Name AuthorMaryam AhmadiPas encore d'évaluation

- Fund Factsheets - IndividualDocument57 pagesFund Factsheets - IndividualRam KumarPas encore d'évaluation

- Stanton Industries SolutionDocument2 pagesStanton Industries SolutionBusi LutaPas encore d'évaluation

- Financial Management MDocument3 pagesFinancial Management MYaj CruzadaPas encore d'évaluation

- Review of LiteratureDocument7 pagesReview of LiteratureAshish KumarPas encore d'évaluation

- EXIM BankDocument79 pagesEXIM BankMishkaCDedhia0% (2)

- Acctg.222 Exam - Questionnaire FINALDocument7 pagesAcctg.222 Exam - Questionnaire FINALAnonymous dbNSSxXPBPas encore d'évaluation

- U - S - History Great Depression Causes DBQDocument10 pagesU - S - History Great Depression Causes DBQAbdirahman JamaPas encore d'évaluation

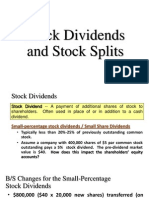

- Stock Dividends and Stock SplitsDocument18 pagesStock Dividends and Stock SplitsPaul Dexter Go100% (1)

- Jago Gra Hak JagoDocument6 pagesJago Gra Hak JagoNeeraj KumarPas encore d'évaluation

- Customer Satisfaction - HDFC LifeDocument49 pagesCustomer Satisfaction - HDFC Liferaj0% (1)

- CFMP Module 2 Equities - English (Auto-Generated)Document26 pagesCFMP Module 2 Equities - English (Auto-Generated)Nak HusderPas encore d'évaluation

- Chapter 2Document3 pagesChapter 2AyylmaoPas encore d'évaluation

- 4 - Cash Flow EstimationDocument11 pages4 - Cash Flow Estimationdestinyrocks88Pas encore d'évaluation

- RCBC: Issuance of Long Term Negotiable CDsDocument3 pagesRCBC: Issuance of Long Term Negotiable CDsBusinessWorldPas encore d'évaluation

- Tax Reform For Acceleration and Inclusion ActDocument6 pagesTax Reform For Acceleration and Inclusion ActRoiven Dela Rosa TrinidadPas encore d'évaluation

- If That Is "Murderball," I Asked Myself, What Is Football?Document6 pagesIf That Is "Murderball," I Asked Myself, What Is Football?John M. PhillipsPas encore d'évaluation

- Essar Steel-Defaulting On Debt RepaymentDocument9 pagesEssar Steel-Defaulting On Debt RepaymentSudani Ankit100% (1)

- News of The Day: Attention To Our Distinguished SubscribersDocument13 pagesNews of The Day: Attention To Our Distinguished Subscriberssmiley346Pas encore d'évaluation

- Funds Flow Statement ProjectDocument99 pagesFunds Flow Statement Projecttulasinad12333% (3)