Académique Documents

Professionnel Documents

Culture Documents

Gfuywaiffwi

Transféré par

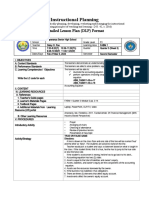

Sarah MacarimpasTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Gfuywaiffwi

Transféré par

Sarah MacarimpasDroits d'auteur :

Formats disponibles

COMMISSION ON AUDIT CIRCULAR NO.

76-26 April 6, 1976

TO : All Heads of Departments and Managing Heads of Government-owned and/or

Controlled Corporations; Chiefs of Bureaus and Offices of the National

Government; Chief Accountants; COA Regional Directors; Bureau and

Corporation Auditors; Governors, City/Municipal Mayors; Barangay Captains;

Provincial/City Auditors; and Provincial/City/Municipal/Barangay Treasurers; and

Others Concerned.

SUBJECT : Withdrawal of pre-audit and full implementation of post-audit, with certain

limitations.

1. Purpose

In line with the primary objective set forth in Section 1(a) of Presidential Decree

No. 898, dated March 3, 1976, which provides that fiscal responsibility rests directly with

the Chief or Head of the government subdivision, agency, or instrumentality, and to

eliminate interference by the auditors in purely management functions, the authority

previously granted to heads of departments and chiefs of bureaus and offices as well as

managing heads of government- owned or controlled corporations and self-governing

boards, agencies and commissions, for the continuance of pre-audit under their

respective offices or agencies as an exception to GAO Memorandum Circulars No. 531-

A and 531-B, dated February 20, 1967 and December 1, 1972, respectively, is hereby

revoked. Henceforth, the system of examination of all agency transactions shall be on

the post-audit basis, except as herein provided.

2. Responsibility of agency management

It shall be the direct responsibility of the chief or head of each department,

bureau or office, including local governments, government-owned/controlled

corporations and self-governing boards, agencies and commissions, to install and

,implement and monitor a sound system of internal control. It is, therefore, incumbent

upon agency management to institute internal safeguards or procedures particularly

those in connection with disbursements of all forms; adopt systematic voucher

processing techniques; install sound procedures for receiving and accepting deliveries of

supplies; materials and equipment; and introduce other measures as may be necessary

to prevent irregularities and strengthen existing internal control. For this purpose, the

chief or head of agency may seek the assistance of the Commission on Audit, thru the

Manpower Development and Systems Office, in the design and installation of a sound

system of internal control.

3. Transactions subject to pre-audit

The resident auditors shall:

a. Pre-audit first payment of fixed expenditures such as rentals, subscriptions to

periodicals, and other expenditures which are recurring and fixed in nature;

b. Pre-audit payment of all consumable items amounting to more than P5,000.00

such as printed forms, papers, stencils, ink, pads, gas, electricity, alcohol, water, soap,

powder, cartridges, cards, ledgers, journals, brooms, paints, brushes, motor vehicle fuel,

lubricants, tires, batteries, repair parts, nails, medical supplies, construction materials

and other expendable property normally consumed within one year after being put into

use, or converted in the process of manufacture or construction;

c. Pre-audit all refunds, including refunds of forfeited cash bonds of aliens and

temporary visitors, etc., and releases of retention fees regardless of amount;

d. Pre-audit first payment of salaries and wages of officers and employees,

either under original appointment, promotional appointment, appointment by transfer,

appointment by reinstatement and employment under labor payroll chargeable against

project funds, their last salary and those covering the commutation of all the vacation

and/or sick leave to their credit which require the submission of a clearance certificate. In

the pre-audit of labor payroll, a list of laborers, duly signed and/or approved by the

proper officials, may take the place of individual appointments. The governing provisions

of the "Requirements Applicable to Specific Classes of Disbursements", should be

followed;

e. Pre-audit vouchers and countersign checks, within the limit of their authority,

covering expenditures other than those enumerated in letter (b) involving more than

P10,000.00;

f. Pre-audit payments of back pay claims and cash advances irrespective of

amount;

g. Countersign treasury warrants;

h. Inspect deliveries of supplies, materials, and equipment within the limits of

their authority;

i. In the case of local governments, pre-audit withdrawal of bank and municipal

deposits involving more than P10,000.00; and

j. Perform such other pre-audit functions as are or may be required by law or

competent authority.

4. Transactions not subject to pre-audit

Except as provided for in Paragraph No. 3 all disbursements heretofore being

pre-audited by bureau, corporation, provincial and city auditors and their staff, shall be

paid directly to the creditors either by cash or check in accordance with existing

regulations without the usual pre-audit; provided, however, that accounting and auditing

rules and regulations are fully complied with by agency management, and that no

splitting of items or transactions is made for the purpose of circumventing the provisions

of this circular.

Remittances to the GSIS of life and retirement insurance premiums deducted

from the salaries of officials and employees covered by Memorandum Circular No. 541,

dated June 15, 1966, and payments of SSS benefit claims, salary loans, educational

loans and real estate loans, and purely banking transactions of government-owned

and/or controlled banking and financial institutions within the maximum amounts fixed by

existing regulations are not subject to pre-audit and shall, therefore, continue to be post-

audited.

5. Countersignature of checks

Checks covering transactions not subject to pre-audit shall no longer be

countersigned by the resident auditors. However, these checks should be countersigned

by responsible agency officials except deputized disbursing officer accountable for the

checks and personnel of the accounting unit, in accordance with existing regulations or

as provided for in corporate charters.

6. Recording, submission of vouchers and audit

Disbursing Officers shall, every fifteenth and end of the month, submit their

Reports of Disbursements and Reports of Checks Issued by Deputized Disbursing

Officers with the corresponding vouchers to the Accounting Division for recording

purposes. Thereafter, the Accounting Division shall forward the same to the resident

auditors promptly within one week after the end of the quincena period covered by the

reports for post-audit purposes. The auditors shall see to it that the reports together with

paid vouchers are submitted to their office on time and in case agency management fails

to do so, they shall require their immediate submission. Failure of the accountable

officers to submit said reports and corresponding vouchers inspite of the auditors'

request should be reported immediately to this Commission.

The auditors shall conduct supplementary audit operations, such as examination

of the cash and accounts of their respective agencies' accountable officers and such

other audit activities as required or as may be directed from time to time under existing

regulations. However, agency management may, in cases of doubt on certain financial

transactions or any particular aspect thereof, consult with the resident auditors

concerned.

7. Effectivity

The provisions of GAO Memorandum Circulars No. 531-A and 531-B, dated

February 20, 1967 and December 1, 1972, respectively, and other rules or regulations

that are inconsistent herewith are hereby amended or revoked accordingly.

This Circular shall take effect immediately.

Strict compliance herewith is hereby enjoined.

(SGD.) FRANCISCO S. TANTUICO, JR., Acting Chairman

Vous aimerez peut-être aussi

- Commission On Audit Circular No. 89-299 March 21, 1989 TODocument4 pagesCommission On Audit Circular No. 89-299 March 21, 1989 TObolPas encore d'évaluation

- COA-87-269 Defines Responsibilities of Surigao del Sur CMAUDocument5 pagesCOA-87-269 Defines Responsibilities of Surigao del Sur CMAUbernardabatayoPas encore d'évaluation

- COA Circular 86-257 Reinstitutes Selective Pre-Audit of Govt TransactionsDocument5 pagesCOA Circular 86-257 Reinstitutes Selective Pre-Audit of Govt TransactionsrbmalasaPas encore d'évaluation

- CIRCULAR NO. 95-006 Submission of DVDocument5 pagesCIRCULAR NO. 95-006 Submission of DVAr LinePas encore d'évaluation

- C89 299aDocument5 pagesC89 299aAndrew GarciaPas encore d'évaluation

- Coa Circular No. 1995-006Document3 pagesCoa Circular No. 1995-006Ar LinePas encore d'évaluation

- COA CIRCULAR NO. 82 195 October 26 1982Document4 pagesCOA CIRCULAR NO. 82 195 October 26 1982Ricardo AtanganPas encore d'évaluation

- Audit Manual PakistanDocument460 pagesAudit Manual PakistanKamran Khan100% (9)

- Commission On Audit Circular No. 81-162 July 1, 1981Document4 pagesCommission On Audit Circular No. 81-162 July 1, 1981Jennifer Marie AlmuetePas encore d'évaluation

- 1997 RRPCDocument26 pages1997 RRPCohmymesotesPas encore d'évaluation

- Makati Revenue CodeDocument12 pagesMakati Revenue CodeMica de GuzmanPas encore d'évaluation

- C92-375 - Closing and Opening of Books of Accounts Due To Merging, Conso, & TransferDocument8 pagesC92-375 - Closing and Opening of Books of Accounts Due To Merging, Conso, & TransferHoven MacasinagPas encore d'évaluation

- Gov. Acc. Chapter 5Document38 pagesGov. Acc. Chapter 5Thea Marie GuiljonPas encore d'évaluation

- Guidelines for Writing Off Dormant AccountsDocument7 pagesGuidelines for Writing Off Dormant AccountsHaryeth CamsolPas encore d'évaluation

- Requirements (Cash Advance)Document60 pagesRequirements (Cash Advance)Rosemarie Guinayen Perez-MalagueñaPas encore d'évaluation

- 10-Casiguran Aurora09 Part2-Findings and RecommendationsDocument7 pages10-Casiguran Aurora09 Part2-Findings and RecommendationsKasiguruhan AuroraPas encore d'évaluation

- Audit Manual CompleteDocument484 pagesAudit Manual CompleteHassan GullPas encore d'évaluation

- DOF Local Finance Circular 03-93Document4 pagesDOF Local Finance Circular 03-93Peggy SalazarPas encore d'évaluation

- COMMISSION ON AUDIT CIRCULAR NO. 92-385 October 1, 1992 SubjectDocument4 pagesCOMMISSION ON AUDIT CIRCULAR NO. 92-385 October 1, 1992 SubjectJoanna Sarah T. DivaPas encore d'évaluation

- Audit Manual 1Document274 pagesAudit Manual 1Humayoun Ahmad Farooqi100% (2)

- 2009 RevRules of Procedures of COA PDFDocument23 pages2009 RevRules of Procedures of COA PDFVoxDeiVoxPas encore d'évaluation

- Audit Manual 0Document458 pagesAudit Manual 0Faisal JahangirPas encore d'évaluation

- Coa Circular 97-002 (Cash Advance)Document9 pagesCoa Circular 97-002 (Cash Advance)Abajoy Albinio100% (2)

- Settlement of Accounts GuideDocument155 pagesSettlement of Accounts GuideRonnie Balleras Pagal100% (1)

- Commission On Audit Circular 2012-004Document3 pagesCommission On Audit Circular 2012-004Che Poblete CardenasPas encore d'évaluation

- Accounting For Disbursement and Related TransactionsDocument12 pagesAccounting For Disbursement and Related TransactionsHinataPas encore d'évaluation

- Coa Memorandum-Cem 6,26Document3 pagesCoa Memorandum-Cem 6,26Allyssa GabaldonPas encore d'évaluation

- Government Accounting 2018 Questions AnswersDocument158 pagesGovernment Accounting 2018 Questions AnswersElea Morata100% (1)

- Revised COA Rules of ProcedureDocument19 pagesRevised COA Rules of ProcedureDiazPas encore d'évaluation

- General ProvisionDocument22 pagesGeneral ProvisionAnna LynPas encore d'évaluation

- Eo 285-1987Document4 pagesEo 285-1987ChealsenPas encore d'évaluation

- Circular 97-002 - Utilization of Cash Advances.Document13 pagesCircular 97-002 - Utilization of Cash Advances.JOHAYNIEPas encore d'évaluation

- Government Accounting 2018 Questions AnswersDocument196 pagesGovernment Accounting 2018 Questions AnswersIvan Romero33% (3)

- Reviewer For OADDocument6 pagesReviewer For OADJJ RicoPas encore d'évaluation

- PW A CODE AppendicesDocument93 pagesPW A CODE AppendiceshdfcPas encore d'évaluation

- Core Text Module 3Document8 pagesCore Text Module 3apple_doctoleroPas encore d'évaluation

- COA Presentation - RRSADocument155 pagesCOA Presentation - RRSAKristina Dacayo-GarciaPas encore d'évaluation

- Accounting and Budgeting Policies for Local Government UnitsDocument34 pagesAccounting and Budgeting Policies for Local Government UnitsRachel Sanculi LustinaPas encore d'évaluation

- Rrsa Coa - C2009-006Document5 pagesRrsa Coa - C2009-006rbv005Pas encore d'évaluation

- Div Acctt-DAO &MSOa&eVol-IDocument19 pagesDiv Acctt-DAO &MSOa&eVol-IShivam SinghPas encore d'évaluation

- COA Rules of ProcedureDocument31 pagesCOA Rules of ProcedureRaoul Jann BalanquitPas encore d'évaluation

- COA Cir 94-013, 12-13-94Document4 pagesCOA Cir 94-013, 12-13-94Misc EllaneousPas encore d'évaluation

- COA Rules of ProcedureDocument20 pagesCOA Rules of ProcedureGerald MesinaPas encore d'évaluation

- Commission On Audit Circular No. 91-359 July 18, 1991 TODocument1 pageCommission On Audit Circular No. 91-359 July 18, 1991 TObolPas encore d'évaluation

- Commission On Audit Circular No. 91-359 July 18, 1991 TODocument1 pageCommission On Audit Circular No. 91-359 July 18, 1991 TObolPas encore d'évaluation

- Chapter 1 - Nature and Scope of NGAS Questions & Answers:: 2018 EditionDocument117 pagesChapter 1 - Nature and Scope of NGAS Questions & Answers:: 2018 EditionAira ArinasPas encore d'évaluation

- COA RulesDocument22 pagesCOA RulesNoraiza Mae Keith TalbinPas encore d'évaluation

- Audit Reports and Financial StatementsDocument7 pagesAudit Reports and Financial StatementsMa. Hazel Donita Diaz100% (1)

- Written ReportDocument6 pagesWritten ReportRosela Mae BaracaoPas encore d'évaluation

- Remedies On COA DisallowanceDocument20 pagesRemedies On COA DisallowanceIan dela Cruz Encarnacion100% (2)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4D'EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Pas encore d'évaluation

- 1040 Exam Prep Module XI: Circular 230 and AMTD'Everand1040 Exam Prep Module XI: Circular 230 and AMTÉvaluation : 1 sur 5 étoiles1/5 (1)

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23D'EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Pas encore d'évaluation

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018D'EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Pas encore d'évaluation

- Textbook of Urgent Care Management: Chapter 13, Financial ManagementD'EverandTextbook of Urgent Care Management: Chapter 13, Financial ManagementPas encore d'évaluation

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18D'EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18Pas encore d'évaluation

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24D'EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24Pas encore d'évaluation

- Course Specs Mar Law BSMT CHEDDocument63 pagesCourse Specs Mar Law BSMT CHEDjutester100% (1)

- Labor Law Exam Answers 2010Document2 pagesLabor Law Exam Answers 2010jutesterPas encore d'évaluation

- 2015 Bar Questions For Political LawDocument10 pages2015 Bar Questions For Political LawAnonymous nYvtSgoQPas encore d'évaluation

- Criminal Law Book I ReviewDocument31 pagesCriminal Law Book I ReviewjutesterPas encore d'évaluation

- New rules on legitimate contracting under DO 174-17Document3 pagesNew rules on legitimate contracting under DO 174-17jutesterPas encore d'évaluation

- Philippine Labor Law Bar Exam QuestionsDocument10 pagesPhilippine Labor Law Bar Exam QuestionsTheBeloved Catherine KayPas encore d'évaluation

- Oblicon Legal NotesDocument24 pagesOblicon Legal NotesDazzle DutertePas encore d'évaluation

- Civil Law Legal BriefsDocument6 pagesCivil Law Legal BriefsEJ Sor Pis CalPas encore d'évaluation

- COA Circular on Court Decision Regarding Backpay ClaimsDocument4 pagesCOA Circular on Court Decision Regarding Backpay ClaimsjutesterPas encore d'évaluation

- Right to Self-OrganizationDocument8 pagesRight to Self-OrganizationjutesterPas encore d'évaluation

- Authority To ProsecuteDocument1 pageAuthority To Prosecutejutester100% (1)

- AOI Template SECDocument15 pagesAOI Template SECEdison Flores0% (1)

- CIVIL LAW Conflicts of Law Case DigestsDocument37 pagesCIVIL LAW Conflicts of Law Case DigestsjutesterPas encore d'évaluation

- Case DigestsDocument13 pagesCase DigestsjutesterPas encore d'évaluation

- NLRC Ruling Challenged in CADocument56 pagesNLRC Ruling Challenged in CAWendell Leigh Oasan96% (54)

- FAQs in TaxationDocument3 pagesFAQs in TaxationjutesterPas encore d'évaluation

- Cigars 101Document5 pagesCigars 101jutesterPas encore d'évaluation

- Country Profile Serbia enDocument16 pagesCountry Profile Serbia enKatarina VujovićPas encore d'évaluation

- UPS, Inc. Strategy FormulationDocument16 pagesUPS, Inc. Strategy FormulationSusan Arrand100% (1)

- DLP Fundamentals of Accounting 1 - Q3 - W3Document5 pagesDLP Fundamentals of Accounting 1 - Q3 - W3Daisy PaoPas encore d'évaluation

- Multinational E-CommerceDocument60 pagesMultinational E-CommerceLong KimQuyPas encore d'évaluation

- CSR Practices of Indian Public Sector BanksDocument6 pagesCSR Practices of Indian Public Sector BankssharadiitianPas encore d'évaluation

- School Improvement Plan - Enabling MechanismsdocxDocument4 pagesSchool Improvement Plan - Enabling MechanismsdocxKilangi Integrated SchoolPas encore d'évaluation

- Analysis of Financial Statements Project: GUL AHMAD Textile MillsDocument32 pagesAnalysis of Financial Statements Project: GUL AHMAD Textile MillsHanzala AsifPas encore d'évaluation

- NikeDocument33 pagesNikeRocking Heartbroker DebPas encore d'évaluation

- Management Discussion & Analysis highlights key developments in Indian economy, housing finance industry and company's progressDocument136 pagesManagement Discussion & Analysis highlights key developments in Indian economy, housing finance industry and company's progressVritika JainPas encore d'évaluation

- Central Bank of SudanDocument12 pagesCentral Bank of SudanYasmin AhmedPas encore d'évaluation

- Crowdfunding 101Document37 pagesCrowdfunding 101haddanPas encore d'évaluation

- 11 - PSS (SBL Specimen 1 Sept 3023 Preseen) - Answer by Sir Hasan Dossani (Full Drafting)Document12 pages11 - PSS (SBL Specimen 1 Sept 3023 Preseen) - Answer by Sir Hasan Dossani (Full Drafting)abdullahdap9691Pas encore d'évaluation

- CH IndiaPost - Final Project ReportDocument14 pagesCH IndiaPost - Final Project ReportKANIKA GORAYAPas encore d'évaluation

- Ch20 SolutionsDocument19 pagesCh20 SolutionsAlexir Thatayaone NdoviePas encore d'évaluation

- Government of Karnataka's Chief Minister's Self-Employment Program DetailsDocument4 pagesGovernment of Karnataka's Chief Minister's Self-Employment Program DetailsHajaratali AGPas encore d'évaluation

- The Concept of Relationship Marketing: Lesson 2.1Document66 pagesThe Concept of Relationship Marketing: Lesson 2.1Love the Vibe0% (1)

- Options Exposed PlayBookDocument118 pagesOptions Exposed PlayBookMartin Jp100% (4)

- Risk and Return 2Document2 pagesRisk and Return 2Nitya BhakriPas encore d'évaluation

- Republic Act No 10607Document7 pagesRepublic Act No 10607Romel TorresPas encore d'évaluation

- Setting The Right Price at The Right TimeDocument5 pagesSetting The Right Price at The Right TimeTung NgoPas encore d'évaluation

- Apple Production Facilities ShiftDocument2 pagesApple Production Facilities ShiftSamarth GargPas encore d'évaluation

- Gsip For 15 YrsDocument3 pagesGsip For 15 YrsJoni SanchezPas encore d'évaluation

- High Low Method and Overhead RatesDocument5 pagesHigh Low Method and Overhead RatesHafizah Mardiah0% (1)

- Financial Accessibility of Women Entrepreneurs: (W S R T W P W E)Document5 pagesFinancial Accessibility of Women Entrepreneurs: (W S R T W P W E)Vivi OktaviaPas encore d'évaluation

- Uganda National Fertilizer Policy April23-2016Document33 pagesUganda National Fertilizer Policy April23-2016Elvis100% (1)

- Assocham Logistics SectorDocument4 pagesAssocham Logistics SectorSarat GudlaPas encore d'évaluation

- Information Systems, Organizations, and Strategy: Chapter 3-Key Terms, Review Questions and Discussion QuestionsDocument4 pagesInformation Systems, Organizations, and Strategy: Chapter 3-Key Terms, Review Questions and Discussion QuestionsPeter BensonPas encore d'évaluation

- Downsizing Best PracticesDocument26 pagesDownsizing Best PracticescorfrancescaPas encore d'évaluation

- Customer Experience Department: Daily Incentive Program "Mcrewards"Document4 pagesCustomer Experience Department: Daily Incentive Program "Mcrewards"Cedie Gonzaga AlbaPas encore d'évaluation

- Bank StatementDocument1 pageBank StatementLatoya WilsonPas encore d'évaluation