Académique Documents

Professionnel Documents

Culture Documents

Form # Form Title: Annual Income Tax Return For Individuals Earning Income PURELY From Business/Profession

Transféré par

Erika Jane Recto FanoTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Form # Form Title: Annual Income Tax Return For Individuals Earning Income PURELY From Business/Profession

Transféré par

Erika Jane Recto FanoDroits d'auteur :

Formats disponibles

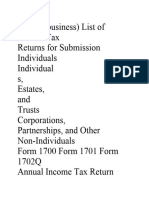

LIST OF BIR FORMS

FORM # FORM TITLE

605 Payment Form

0611-A Payment Form Covered by a Letter Notice

613 Payment Form Under Tax Compliance Verification Drive/Tax Mapping

0619-E Monthly Remittance Form for Creditable Income Taxes Withheld (Expanded)

0619-F Monthly Remittance Form for Final Income Taxes Withheld

1600 Monthly Remittance Return of Value-Added Tax and Other Percentage Taxes Withheld

1600-WP Remittance Return of Percentage Tax on Winnings and Prizes Withheld by Race Track Operators

1601C Monthly Remittance Return of Income Taxes Withheld on Compensation

1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)

1601-FQ Quarterly Remittance Return of Final Income Taxes Withheld

Quarterly Remittance Return of Final Income Taxes Withheld (On Interest Paid on Deposits and Yield on Deposit

1602Q

Substitutes/Trusts/Etc.)

Quarterly Remittance Return of Final Income Taxes Withheld on Fringe Benefits Paid to Employees other than Rank

1603Q and File

1604CF Annual Information Return of Income Taxes Withheld on Compensation and Final Withholding Taxes

Annual Information Return of Creditable Income Taxes Withheld (Expanded)/ Income Payments Exempt from

1604E

Withholding Taxes

Withholding Tax Remittance Return (For Onerous Transfer of Real Property other than Capital Asset including

1606

Taxable and Exempt)

1700 Annual Income Tax Return for Individuals Earning Purely Compensation Income

Annual Income Tax Return for Individuals Earning Income PURELY from Business/Profession (Those under the graduated

1701A income tax rates with OSD as mode of deduction OR those who opted to avail of the 8% flat income tax rate)

Annual Income Tax Return for Individuals, Estates and Trusts (Including those with both Business and Compensation

1701 Income)

1701Q Quarterly Income Tax Return for Self-employed Individuals, Estates and Trusts

1702-RT Annual Income Tax Return for Corporation, Partnership and Other Non-Individual Taxpayer Subject Only to

REGULAR Income Tax Rate

Annual Income Tax Return for Corporation, Partnership and Other Non-Individual Taxpayer EXEMPT under the Tax

1702-EX Code, as Amended, [Sec. 30 and those exempted in Sec. 27(C)] and Other Special Laws, with NO Other Taxable

Income

Annual Income Tax Return for Corporation, Partnership and Other Non-Individual with MIXED Income Subject to

1702-MX Multiple Income Tax Rates or with Income Subject to SPECIAL/PREFERENTIAL RATE

1702Q Quarterly Income Tax Return for Corporations, Partnerships and Other Non-Individual Taxpayers

1704 Improperly Accumulated Earnings Tax Return

Capital Gains Tax Return for Onerous Transfer of Real Property Classified as Capital Asset (both Taxable and

1706 Exempt)

1707 Capital Gains Tax Return for Onerous Transfer of Shares of Stocks Not Traded Through the Local Stock Exchange

Annual Capital Gains Tax Return for Onerous Transfer of Shares of Stock Not Traded Through the Local Stock

1707-A Exchange

1800 Donor's Tax Return

1801 Estate Tax Return

1900 Application to Use Loose-Leaf / Computerized Books of Accounts and/or Accounting Records

1901 Application for Registration for Self-Employed and Mixed Income Individuals, Estates/Trusts

Application for Registration For Individuals Earning Purely Compensation Income, and Non-Resident Citizens /

1902 Resident Alien Employee

1903 Application for Registration for Corporations/ Partnerships (Taxable/Non-Taxable)

Application for Registration for One-Time Taxpayer and Persons Registering under E.O. 98 (Securing a TIN to be able

1904 to transact with any Government Office)

Application for Registration Information Update for Updating / Cancellation of Registration / Cancellation of TIN /

1905 New Copy of TIN card / New copy of Certificate of Registration

1906 Application for Authority to Print Receipts and Invoices

1907 Application for Permit to Use Cash Register machines/Point-of-Sale Machine

2000 Documentary Stamps Tax Declaration/ Return

2000-OT Documentary Stamp Tax Declaration/Return (One Time Transactions)

2110 Application for Abatement or Cancellation of Tax, Penalties and/or Interest Under Rev. Reg. No. ______

2200-A Excise Tax Return for Alcohol Products

2200-AN Excise Tax Return for Automobiles and Non-Essential

2200-M Excise Tax Return for Mineral Products

2200-P Excise Tax Return for Petroleum Products

2200-S Excise Tax Return for Sweetened Beverages

2200-T Excise Tax Return for Tobacco Products

2304 Certificate of Income Payment Not Subject to Withholding Tax (Excluding Compensation Income)

2306 Certificate of Final Tax Withheld at Source

2307 Certificate of Creditable Tax Withheld at Source

2316 Certificate of Compensation Payment / Tax Withheld For Compensation Payment With or Without Tax Withheld

2550M Monthly Value-Added Tax Declaration

2550Q Quarterly Value-Added Tax Return

2551Q Quarterly Percentage Tax Return

Percentage Tax Return for Transactions Involving Shares of Stock Listed and Traded Through The Local Stock

2552 Exchange or Thru Initial and/or Secondary Public Offering

2553 Return of Percentage Tax Payable under Special Laws

Vous aimerez peut-être aussi

- Bir FornDocument3 pagesBir FornNavsPas encore d'évaluation

- 1040 Exam Prep: Module I: The Form 1040 FormulaD'Everand1040 Exam Prep: Module I: The Form 1040 FormulaÉvaluation : 1 sur 5 étoiles1/5 (3)

- List of BIR FORMSDocument2 pagesList of BIR FORMSLoreta Manaol VinculadoPas encore d'évaluation

- List of Bir Forms: Form NO. Form TitleDocument2 pagesList of Bir Forms: Form NO. Form TitleAiyi AtelierPas encore d'évaluation

- Bir FormsDocument2 pagesBir FormsMhyckee GuinoPas encore d'évaluation

- BIR FormsDocument2 pagesBIR FormsAiyi AtelierPas encore d'évaluation

- Bir FormsDocument3 pagesBir FormsRezel FuntilarPas encore d'évaluation

- List of Bir Forms: Form No. Form TitleDocument2 pagesList of Bir Forms: Form No. Form Titleabc360shellePas encore d'évaluation

- BIR FormsDocument6 pagesBIR FormsVanessaManaoatPas encore d'évaluation

- Form NoDocument2 pagesForm NoCarla CarreonPas encore d'évaluation

- Part 1 - Multiple Choice Theory and Problems 40 Multiple Choice Questions (1% Each)Document4 pagesPart 1 - Multiple Choice Theory and Problems 40 Multiple Choice Questions (1% Each)James Español NavasquezPas encore d'évaluation

- NGMDocument5 pagesNGMNica MariñoPas encore d'évaluation

- Withholding Tax FormsDocument1 pageWithholding Tax Formsgwynethvm03Pas encore d'évaluation

- BIR FormsDocument30 pagesBIR FormsRoma Sabrina GenoguinPas encore d'évaluation

- Bir Forms: Electronic ManualDocument11 pagesBir Forms: Electronic Manualcris lu salemPas encore d'évaluation

- Income TaxDocument19 pagesIncome TaxJustine BartolomePas encore d'évaluation

- Notes On Withholding Tax and Income Tax FilingDocument20 pagesNotes On Withholding Tax and Income Tax FilingnengPas encore d'évaluation

- List of Bir FormsDocument49 pagesList of Bir Formsblessaraynes50% (4)

- Filing of Income Tax ReturnDocument11 pagesFiling of Income Tax Returnkirko100% (1)

- TAX PAYER GUIDE MannualDocument7 pagesTAX PAYER GUIDE MannualLevi Lazareno EugenioPas encore d'évaluation

- Individual Income Tax ReturnsDocument2 pagesIndividual Income Tax ReturnsZen1Pas encore d'évaluation

- Janina Louise Caliboso Bsa 3A: Tax Reform For Acceleration and Inclusion (TRAIN) "Document3 pagesJanina Louise Caliboso Bsa 3A: Tax Reform For Acceleration and Inclusion (TRAIN) "Ja CalibosoPas encore d'évaluation

- Income TaxDocument292 pagesIncome TaxynnadadenipPas encore d'évaluation

- BIR Ir TAXDocument37 pagesBIR Ir TAXMarky De AsisPas encore d'évaluation

- CHAPTER 14 Regular Income Tax IndividualDocument28 pagesCHAPTER 14 Regular Income Tax IndividualAvada Kedavra100% (1)

- LAwhahahhaDocument21 pagesLAwhahahhaJeselle BagsicanPas encore d'évaluation

- EO 98 - How To Apply TINDocument7 pagesEO 98 - How To Apply TINPeterSalas100% (1)

- O o o o o o O: IndividualsDocument17 pagesO o o o o o O: IndividualsDustin GonzalezPas encore d'évaluation

- Index For Income TaxDocument20 pagesIndex For Income TaxMark Joseph BajaPas encore d'évaluation

- Registration, Taxation & Accounting Compliance of Construction IndustryDocument52 pagesRegistration, Taxation & Accounting Compliance of Construction IndustryJohn Erick FernandezPas encore d'évaluation

- Tax Returns and Tax PaymentsDocument19 pagesTax Returns and Tax PaymentsAnthonette QuiamcoPas encore d'évaluation

- Bacore 3 Course Packet 2Document15 pagesBacore 3 Course Packet 2Jenifer Borja BacayoPas encore d'évaluation

- Description: (Return To Index)Document27 pagesDescription: (Return To Index)Dura LexPas encore d'évaluation

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- BIR - Invoicing RequirementsDocument17 pagesBIR - Invoicing RequirementsCkey ArPas encore d'évaluation

- BIR Form 0605 UsesDocument4 pagesBIR Form 0605 UsesCykee Hanna Quizo LumongsodPas encore d'évaluation

- Income TaxDocument15 pagesIncome TaxJessPas encore d'évaluation

- Bir 1601fDocument3 pagesBir 1601fJuliet Jayjet Dela CruzPas encore d'évaluation

- BIR Form 1600Document39 pagesBIR Form 1600maeshach60% (5)

- Tax Advisory BIR Form Shall Be Used For VAT PDFDocument1 pageTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloPas encore d'évaluation

- EWTDocument12 pagesEWTdawngarcia1797Pas encore d'évaluation

- Income TaxationDocument13 pagesIncome TaxationKyzy LimsiacoPas encore d'évaluation

- 1601E - August 2008Document3 pages1601E - August 2008lovesresearchPas encore d'évaluation

- How Does The BIR Conduct Its Audit: By: Ms. Jorhiza Ortelano EstebanDocument13 pagesHow Does The BIR Conduct Its Audit: By: Ms. Jorhiza Ortelano EstebanRheneir MoraPas encore d'évaluation

- Individuals Required To File ITRDocument27 pagesIndividuals Required To File ITRDura LexPas encore d'évaluation

- 1601E - August 2008Document4 pages1601E - August 2008HarryPas encore d'évaluation

- Income Tax Description: IndividualsDocument13 pagesIncome Tax Description: IndividualsJAYAR MENDZPas encore d'évaluation

- 1902 For Employee'sDocument8 pages1902 For Employee'sbirtaxinfoPas encore d'évaluation

- Individuals: Income Tax DescriptionDocument17 pagesIndividuals: Income Tax DescriptionMichael Olmedo NenePas encore d'évaluation

- Guidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Document9 pagesGuidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Reynold Briones Azusano ButeresPas encore d'évaluation

- RR 3-2002Document2 pagesRR 3-2002rfylananPas encore d'évaluation

- 1st Meeting - Tax ComplianceDocument39 pages1st Meeting - Tax ComplianceViney VillasorPas encore d'évaluation

- 5.0 Intro To Income TaxDocument31 pages5.0 Intro To Income TaxAllan BacudioPas encore d'évaluation

- Form 1600Document4 pagesForm 1600KialicBetito50% (2)

- Income TaxDocument19 pagesIncome TaxKitch GamillaPas encore d'évaluation

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaPas encore d'évaluation

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasPas encore d'évaluation

- Lecture 12 Tax Law - UpdatedDocument39 pagesLecture 12 Tax Law - UpdatedAatir ImranPas encore d'évaluation

- Bir TaxDocument157 pagesBir TaxMubarrach MatabalaoPas encore d'évaluation

- Stock ResearchDocument50 pagesStock Researchvikas yadavPas encore d'évaluation

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DPas encore d'évaluation

- Turnover Ratio: Inventory Turnover Net Sales / Average Inventory 92922.3/ (3097+2729.3) /2 31.8Document5 pagesTurnover Ratio: Inventory Turnover Net Sales / Average Inventory 92922.3/ (3097+2729.3) /2 31.8rimanjoharPas encore d'évaluation

- Role of The Investment Corporation of Bangladesh ICB in Development of Capital Market in BangladeshDocument45 pagesRole of The Investment Corporation of Bangladesh ICB in Development of Capital Market in BangladeshAuishee BaruaPas encore d'évaluation

- Business Law Assignment Submitted By:-: Syeda Maham Waseem (170156)Document7 pagesBusiness Law Assignment Submitted By:-: Syeda Maham Waseem (170156)Maham WasimPas encore d'évaluation

- 2017 Za + ZB (Ec) Ac1025Document53 pages2017 Za + ZB (Ec) Ac1025전민건Pas encore d'évaluation

- 123 Karl DittmanDocument12 pages123 Karl DittmanRajkiran Goshkonda50% (2)

- IA2 CH15A PROBLEMS (Vhinson)Document5 pagesIA2 CH15A PROBLEMS (Vhinson)sophomorefilesPas encore d'évaluation

- Part2 Revenue Regulations 2018Document194 pagesPart2 Revenue Regulations 2018April CaringalPas encore d'évaluation

- Symbiosis Law School, Pune: A F M I A - 1Document11 pagesSymbiosis Law School, Pune: A F M I A - 1pranjalPas encore d'évaluation

- Position PaperDocument12 pagesPosition PaperDeepti TripathiPas encore d'évaluation

- Cost Chapter 1 Second Part PDFDocument13 pagesCost Chapter 1 Second Part PDFMax Dela TorrePas encore d'évaluation

- What Is Community Tax?: Speaker: Valerie A. OngDocument25 pagesWhat Is Community Tax?: Speaker: Valerie A. Ongmarz busaPas encore d'évaluation

- Model Question PapersDocument14 pagesModel Question PaperscrpfdotnewsPas encore d'évaluation

- Eco2a - Economic DevelopmentDocument6 pagesEco2a - Economic Developmentmhar lonPas encore d'évaluation

- Pre 4 - Audit of The Gas, Petroleum, and Oil Sectors (Powerpoint)Document59 pagesPre 4 - Audit of The Gas, Petroleum, and Oil Sectors (Powerpoint)nefael lanciolaPas encore d'évaluation

- Chapter 2 Acctg 101Document4 pagesChapter 2 Acctg 101ana angelesPas encore d'évaluation

- Journalizing TransactionsDocument5 pagesJournalizing TransactionsSatvik Bisht100% (1)

- Tax Rates AS2024-25Document9 pagesTax Rates AS2024-25DRK FrOsTeRPas encore d'évaluation

- Shouq AlmutairiDocument8 pagesShouq AlmutairiSeu4EduPas encore d'évaluation

- H05. Statement of Changes in EquityDocument3 pagesH05. Statement of Changes in EquityMaryrose SumulongPas encore d'évaluation

- Interim 中 期 報 告: Stock Code: 0788 0788Document45 pagesInterim 中 期 報 告: Stock Code: 0788 0788mailimailiPas encore d'évaluation

- Startup Valuation - Applying The Discoun... D in Six Easy Steps - EY - NetherlandsDocument14 pagesStartup Valuation - Applying The Discoun... D in Six Easy Steps - EY - NetherlandsRodrigo Langenhin Vásquez VarelaPas encore d'évaluation

- Cq1 Topics Far2901 To 2926 PDF FreeDocument9 pagesCq1 Topics Far2901 To 2926 PDF FreeKlomoPas encore d'évaluation

- DCF Valuation Procter Gamble 1 - 1712693877056Document8 pagesDCF Valuation Procter Gamble 1 - 1712693877056Yo TuPas encore d'évaluation

- The Following Are Several Transactions of Ardery Company That OccurredDocument1 pageThe Following Are Several Transactions of Ardery Company That OccurredTaimur TechnologistPas encore d'évaluation

- Ratio Analysis Cheat SheetDocument2 pagesRatio Analysis Cheat SheetcinkayunramPas encore d'évaluation

- Financial Forecasting For Strategic GrowthDocument32 pagesFinancial Forecasting For Strategic GrowthSarah G100% (1)

- Max Life Insurance Launches Savings Advantage PlanDocument3 pagesMax Life Insurance Launches Savings Advantage PlanVarshik FlashPas encore d'évaluation

- Parcial Balotario 2Document91 pagesParcial Balotario 2Carla ArechePas encore d'évaluation