Académique Documents

Professionnel Documents

Culture Documents

Vendor Master Form

Transféré par

sundarji sundararajuluTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Vendor Master Form

Transféré par

sundarji sundararajuluDroits d'auteur :

Formats disponibles

SAP VENDOR CODE TO BE ALLOTTED (For ITC Ltd.

use only)

Vendor code already allotted by ITC Limited, if available

LEGAL NAME/TRADE NAME OF THE VENDOR AS PER

PAN CARD OR as per "Form GST REG-25 / 06" (To be

mentioned on Cheque/NEFT/RTGS payment) to be

updated in ITC vendor master

TRADE NAME OF THE VENDOR AS PER "Form GST

REG-25 / 06"/ TRADE LICENCE COPY

CONSTITUTION OF THE FIRM ( Pvt. Ltd. Co. / Public Ltd.

Co. / Co-operative Society / Partnership / Limited Liability

Partnership / Proprietorship or Individual / HUF / CLUB /

TRUST / AOP / BOI )

GST REGISTRATION NO. as per "Form GST REG-25 /

# 06" & DATE if Registered

Name of the contact person & contact no.

Designation of contact person

Whether Composition scheme availed under GST Law

GST Registered ADDRESS / Communication address

CITY

CITY PIN/POSTAL CODE

DISTRICT

STATE / UNION TERRITORY WITH CODE

COUNTRY

E-MAIL ID

LANDLINE TELEPHONE NO.

MOBILE PHONE NO.

FAX NUMBER

WHETHER REGISTERED UNDER "The Micro, Small and

Medium Enterprises Development Act, 2006" OR NOT

If registered under "The Micro, Small and Medium

# Enterprises Development Act, 2006", provide

REGISTRATION NO. & DATE #

INCOME TAX PERMANENT ACCOUNT NUMBER [PAN ]

# (Please attach copy of the PAN Card / Allotment Letter

only) #

Total no of GST Registrations (pan India)

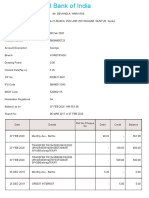

* MODE OF PAYMENT *

VENDOR BANK NAME & BRANCH

VENDOR BANK A/C NO.

OTHER INFORMATION :

Items to be supplied / nature of services to be rendered

1 by the Vendor (Provide HSN/SAC codes in separate

format)

Whether the Vendor is a manufacturer or the authorised

2

dealer of the original manufacturer

Whether there is an existing Vendor for the same

3

items / services

4 Reasons for adding a new Vendor

VENDOR'S SIGNATURE WITH NAME and SEAL SIGNATURE OF THE AUTHORISING MANAGER / HOD OF THE REQUESTING DEPARTMENT

COMMERCIAL MANAGER / FINANCE MANAGER

# Submission of self Attested Copy is mandatory.

* Duly certified bank details declaration to be provided, if the vendor opts for Direct RTGS/NEFT payment to their Bank account.

Note: (1) A declaration as to the particulars are correct must be declared by the vendor in his/her letterhead,

specifying the communicating address.

(2) Vendor updation will not be done in SAP without the necessary documents attached.

(3) For creation of "Limited" company Vendor code please attach "Certificate of Incorporation" copy Registrar of Companies;

(4) Vendor updation will not be done if GSTN certificate or a declaration of non registration under GST law is attached.

(5) For Creation of new additional vendor codes in SAP_MDO Vendor master with multiple GSTIN nos. separate signed/sealed

declaration as per SOP to be taken from the vendor in their letterhead.

ANNEXURE TO THE MAIN VENDOR ADDITION / MODIFICATION FORM

Vendor Code with Sl. No. Description of Goods/Services supplied to ITC Limited HSN/SAC Codes

ITC Limited

Vous aimerez peut-être aussi

- Vendor RegistrationFormDocument7 pagesVendor RegistrationFormeswarmohanPas encore d'évaluation

- Vendor Regn FormDocument5 pagesVendor Regn Formmkbhat17kPas encore d'évaluation

- ONGC Tender TemplateDocument88 pagesONGC Tender TemplateHitesh NayyarPas encore d'évaluation

- Vendor Registration FormDocument10 pagesVendor Registration FormGAURAV SHARMAPas encore d'évaluation

- Purchasing Manager CV Template PDFDocument2 pagesPurchasing Manager CV Template PDFsujit5584100% (1)

- Faqs Kjo RosDocument5 pagesFaqs Kjo RosarunmmsapPas encore d'évaluation

- What Is A Method Statement and Why Are They Used in Construction PDFDocument8 pagesWhat Is A Method Statement and Why Are They Used in Construction PDFKareemAdelPas encore d'évaluation

- RFPGlovesAug2019 Compressed PDFDocument112 pagesRFPGlovesAug2019 Compressed PDFKULDEEP KUMARPas encore d'évaluation

- Sample Vendor Info FormDocument2 pagesSample Vendor Info FormBabu DasPas encore d'évaluation

- Expediting of Vendor DataDocument1 pageExpediting of Vendor Datarylar999Pas encore d'évaluation

- PROJ 598 Contract and Procurement ManagementDocument2 pagesPROJ 598 Contract and Procurement ManagementAlan MarkPas encore d'évaluation

- Cost Estimation Model of Structural Steel For SuperDocument9 pagesCost Estimation Model of Structural Steel For SuperthuanPas encore d'évaluation

- Blank Vendor Evaluation FormDocument3 pagesBlank Vendor Evaluation FormGermiya K JosePas encore d'évaluation

- E-Procurnment 1Document28 pagesE-Procurnment 1smilealwplz100% (1)

- Vendor Evaluation FormDocument8 pagesVendor Evaluation FormSamrat SarkarPas encore d'évaluation

- Pre-Qualification Form FinalDocument20 pagesPre-Qualification Form FinalImran Qadir100% (2)

- The Ultimate Guide To A Truly Effective Procure-to-Pay ProcessDocument4 pagesThe Ultimate Guide To A Truly Effective Procure-to-Pay ProcessthenameisvijayPas encore d'évaluation

- Good Distribution Practices A Complete Guide - 2021 EditionD'EverandGood Distribution Practices A Complete Guide - 2021 EditionPas encore d'évaluation

- Request For Quotation RFQ 2023 BLANKDocument2 pagesRequest For Quotation RFQ 2023 BLANKGrit SioPas encore d'évaluation

- Transfertaxform Apv9t Form (072010)Document2 pagesTransfertaxform Apv9t Form (072010)Karma Pema DorjePas encore d'évaluation

- RFQ Epc Final - 01112016Document68 pagesRFQ Epc Final - 01112016TAMILPas encore d'évaluation

- ONGC Vendor Registration FormDocument9 pagesONGC Vendor Registration FormJoyal ThomasPas encore d'évaluation

- Source To Pay Procurement A Complete Guide - 2020 EditionD'EverandSource To Pay Procurement A Complete Guide - 2020 EditionPas encore d'évaluation

- Checklist of Potential Risks in The Goods and Services Procurement Process V2Document9 pagesChecklist of Potential Risks in The Goods and Services Procurement Process V2hashimhydPas encore d'évaluation

- Vendor ProfileDocument5 pagesVendor ProfileRedzuan BayudiPas encore d'évaluation

- Purchase 1Document20 pagesPurchase 1N.Usha RaoPas encore d'évaluation

- Vendor Registration FormDocument6 pagesVendor Registration FormShankar SanyalPas encore d'évaluation

- Checklist Supplier DebriefDocument2 pagesChecklist Supplier DebriefSumber UnduhPas encore d'évaluation

- Balanced ScorecardDocument36 pagesBalanced Scorecardwessam777Pas encore d'évaluation

- Roles and Responsibilities of Business Head 13-14Document24 pagesRoles and Responsibilities of Business Head 13-14Ulhas KavathekarPas encore d'évaluation

- Supplier SelectionDocument32 pagesSupplier SelectionAli RazaPas encore d'évaluation

- Assignment Cover Sheet Lecturer's Comments Form: Section A: To Be Completed by StudentDocument10 pagesAssignment Cover Sheet Lecturer's Comments Form: Section A: To Be Completed by StudentPeter ChngPas encore d'évaluation

- Is 14489 1998 PDFDocument22 pagesIs 14489 1998 PDFAditi RungtaPas encore d'évaluation

- Vendor Registration FormDocument5 pagesVendor Registration FormMaan JiiPas encore d'évaluation

- Standard Operating Procedure: ProjectsDocument1 pageStandard Operating Procedure: ProjectsShena BrittoPas encore d'évaluation

- ProjectDocument50 pagesProjectRaveen DormyPas encore d'évaluation

- SOP-Purchasing Process 2021 Rev8 - FinalDocument12 pagesSOP-Purchasing Process 2021 Rev8 - Finalsheina asuncionPas encore d'évaluation

- Vendor Rating: Reference For BusinessDocument10 pagesVendor Rating: Reference For BusinessSaikumar SelaPas encore d'évaluation

- Vendor Rating 1Document9 pagesVendor Rating 1wilsongouveiaPas encore d'évaluation

- RFQ Format Goods and ServicesDocument2 pagesRFQ Format Goods and Serviceshoxuanan9185Pas encore d'évaluation

- Fabric Stores ProceduresDocument3 pagesFabric Stores ProceduresLM MuhammadPas encore d'évaluation

- Purchase MGMTDocument41 pagesPurchase MGMTrinki01Pas encore d'évaluation

- Sample Vendor Registration FormDocument3 pagesSample Vendor Registration FormJitendra BhosalePas encore d'évaluation

- Supplier Self Audit Checklist: Formulaire Référence AA-FEQ-15-Rév.03Document2 pagesSupplier Self Audit Checklist: Formulaire Référence AA-FEQ-15-Rév.03Mandy NormanPas encore d'évaluation

- Blank Vendor Profile Form - NewDocument6 pagesBlank Vendor Profile Form - Newthanhphong3005Pas encore d'évaluation

- Supplier Agreement ManagementDocument11 pagesSupplier Agreement ManagementalexbbastosPas encore d'évaluation

- Example of Using Pear FormDocument2 pagesExample of Using Pear Formjohnoo7Pas encore d'évaluation

- Request For Quotation - RFQ - PDFDocument5 pagesRequest For Quotation - RFQ - PDFavmr0% (1)

- Purchase Policy and Procedure by Puruhutjit SurjitDocument2 pagesPurchase Policy and Procedure by Puruhutjit SurjitSurjit PuruhutjitPas encore d'évaluation

- Chapter5 E&P Costs To StudentsDocument26 pagesChapter5 E&P Costs To Studentssmile100% (1)

- Supplier Questionnaire ABBDocument6 pagesSupplier Questionnaire ABBBensu KapucuPas encore d'évaluation

- Compliances Under GST & Income Tax Act-KinexinDocument3 pagesCompliances Under GST & Income Tax Act-KinexinDeepak ChauhanPas encore d'évaluation

- Certificate of OriginDocument1 pageCertificate of OriginPcelin OtrovPas encore d'évaluation

- Strategic Procurement Plan TemplateDocument9 pagesStrategic Procurement Plan TemplateMuhammad AdeelPas encore d'évaluation

- National PPP Guidelines Volume 1 Procurement Options Analysis Dec 08Document38 pagesNational PPP Guidelines Volume 1 Procurement Options Analysis Dec 08Yousuf MarzookPas encore d'évaluation

- 06 Guide To Tender EvaluationDocument9 pages06 Guide To Tender Evaluationromelramarack1858Pas encore d'évaluation

- Rental Agreement Format ChennaiDocument4 pagesRental Agreement Format Chennaisundarji sundararajuluPas encore d'évaluation

- PointsDocument1 pagePointssundarji sundararajuluPas encore d'évaluation

- Avesec ExamDocument3 pagesAvesec Examsundarji sundararajulu100% (1)

- Domestic Int 1 Int 2 Product MRP Remaining SOH Remaining SOH Remaining SOH Total StockDocument3 pagesDomestic Int 1 Int 2 Product MRP Remaining SOH Remaining SOH Remaining SOH Total Stocksundarji sundararajuluPas encore d'évaluation

- PointsDocument1 pagePointssundarji sundararajuluPas encore d'évaluation

- Sales Report Main ContentDocument2 pagesSales Report Main Contentsundarji sundararajuluPas encore d'évaluation

- Procedure For DGCA Centralised Appt & PMR FWD System PDFDocument1 pageProcedure For DGCA Centralised Appt & PMR FWD System PDFShrey AroraPas encore d'évaluation

- AATC Bangkok: StepsDocument5 pagesAATC Bangkok: Stepssundarji sundararajuluPas encore d'évaluation

- Consolidated PurchaseDocument51 pagesConsolidated Purchasesundarji sundararajuluPas encore d'évaluation

- Open Screen: Login Password 2. Products Page. Tap To Sell. No of Taps Qty 3. Check Out Page 4. Sales Report 5. Closing Report 6. Day End ReportDocument1 pageOpen Screen: Login Password 2. Products Page. Tap To Sell. No of Taps Qty 3. Check Out Page 4. Sales Report 5. Closing Report 6. Day End Reportsundarji sundararajuluPas encore d'évaluation

- Sno Product BP SP Opening Stock 1Document15 pagesSno Product BP SP Opening Stock 1sundarji sundararajuluPas encore d'évaluation

- StudyBlue Flashcard Printing of ATR 72 600 Memory ItemsDocument5 pagesStudyBlue Flashcard Printing of ATR 72 600 Memory Itemssundarji sundararajuluPas encore d'évaluation

- Atr Chklist PDFDocument2 pagesAtr Chklist PDFsundarji sundararajuluPas encore d'évaluation

- Account Statement: Msatools N No 12 O No 18 Sowrastra Nagar 1St Street Choolaimedu Ambattur ChennaiDocument2 pagesAccount Statement: Msatools N No 12 O No 18 Sowrastra Nagar 1St Street Choolaimedu Ambattur ChennaiChandru ChristurajPas encore d'évaluation

- (04.07.23) Vinod Electrical & HardwareDocument1 page(04.07.23) Vinod Electrical & HardwareAbhinaz AlamPas encore d'évaluation

- 200115169Document4 pages200115169Mohd Haniff KamaruddinPas encore d'évaluation

- GR No. 173425 Full CaseDocument24 pagesGR No. 173425 Full CaseRene ValentosPas encore d'évaluation

- STFCS 2022-11-05 1667702284229Document7 pagesSTFCS 2022-11-05 1667702284229Charles GoodwinPas encore d'évaluation

- Income Tax Law and Practice: Bba - 5 Sem BBA - 301Document39 pagesIncome Tax Law and Practice: Bba - 5 Sem BBA - 301Aarti Dhanrajani HaswaniPas encore d'évaluation

- Statement 20230707130713Document8 pagesStatement 20230707130713Hitesh BossPas encore d'évaluation

- (Original For Recipient) : Sl. No Description Unit Price Discount Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Original For Recipient) : Sl. No Description Unit Price Discount Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountPriya MadanaPas encore d'évaluation

- No 3, Simpang 370-81, Kelas C Jalan Muara, Kampong Sungai Tilong Brunei Muara BC3315 Brunei DarussalamDocument2 pagesNo 3, Simpang 370-81, Kelas C Jalan Muara, Kampong Sungai Tilong Brunei Muara BC3315 Brunei DarussalamEddy MisuariPas encore d'évaluation

- Versus - Case: de C I S I 0 NDocument16 pagesVersus - Case: de C I S I 0 NRandy LorenzanaPas encore d'évaluation

- No Name T1 2022Document42 pagesNo Name T1 2022Indo -CanadianPas encore d'évaluation

- Issuer On-Behalf ServicesDocument820 pagesIssuer On-Behalf ServicesMunkhtsogt Tsogbadrakh100% (2)

- Interim Statement 10-Mar-2023 12-25-49Document2 pagesInterim Statement 10-Mar-2023 12-25-49zani arslanPas encore d'évaluation

- Fees Form 2023 2024Document2 pagesFees Form 2023 2024Kawsar AlamPas encore d'évaluation

- Unit 5 Financial Planning and Tax ManagementDocument18 pagesUnit 5 Financial Planning and Tax ManagementnoroPas encore d'évaluation

- Annex A.1.1 - Taxpayers AttestationsDocument3 pagesAnnex A.1.1 - Taxpayers AttestationssheilaPas encore d'évaluation

- Konnect K SawaalaatDocument3 pagesKonnect K SawaalaatUzer khanPas encore d'évaluation

- Accounting Ed.04 (Business & Transfer Taxes) Ma. Daria N. Labalan, Cpa, Mba TF-7:20-8:55Document3 pagesAccounting Ed.04 (Business & Transfer Taxes) Ma. Daria N. Labalan, Cpa, Mba TF-7:20-8:55Jerbert JesalvaPas encore d'évaluation

- Midterm Exam in Taxation ReviewDocument13 pagesMidterm Exam in Taxation ReviewGreggy LawPas encore d'évaluation

- LAWS20060 Taxation Law of AustraliaDocument6 pagesLAWS20060 Taxation Law of AustraliaPrashansa AryalPas encore d'évaluation

- DocumentDocument6 pagesDocumentBala RajuPas encore d'évaluation

- Original For Recipient: SHIPMENT NO: DI101642751Document1 pageOriginal For Recipient: SHIPMENT NO: DI101642751Shah BrothersPas encore d'évaluation

- Accepted Fees 1200.00 Amount in Words: One Thousand Two Hundred OnlyDocument1 pageAccepted Fees 1200.00 Amount in Words: One Thousand Two Hundred OnlySunil B. SawantPas encore d'évaluation

- Pay Roll SamDocument2 pagesPay Roll Samsamuel debebePas encore d'évaluation

- 1 Tax Rev - CIR Vs Javier 199 Scra 824Document8 pages1 Tax Rev - CIR Vs Javier 199 Scra 824LucioJr Avergonzado100% (1)

- Hotel Booking PDFDocument2 pagesHotel Booking PDFferuzbekPas encore d'évaluation

- Bank ReconciliationDocument5 pagesBank ReconciliationAngel PadillaPas encore d'évaluation

- LaborProbs PDFDocument1 pageLaborProbs PDFJuMakMat MacPas encore d'évaluation

- Batch 5 Preweek LectureDocument18 pagesBatch 5 Preweek LectureMiguel ManagoPas encore d'évaluation

- Mpassbook SB-500101010662322 1669891773717Document1 pageMpassbook SB-500101010662322 1669891773717Rama MoorthyPas encore d'évaluation