Académique Documents

Professionnel Documents

Culture Documents

Prepayment of Your ICICI Bank Loan Account:XXXXXXXXXXXX1963

Transféré par

LavSainiDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Prepayment of Your ICICI Bank Loan Account:XXXXXXXXXXXX1963

Transféré par

LavSainiDroits d'auteur :

Formats disponibles

September 18, 2018

Mr.Suraj Bhambure

545

Mumbai

Maharashtra

Pin code -400001

India

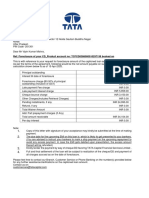

Prepayment of your ICICI Bank Loan Account :XXXXXXXXXXXX1963

Dear Mr.Suraj Bhambure,

We value your relationship with ICICI Bank.

As per your request for prepayment of your captioned ICICI Bank Loan account, please find below the

amount payable:

Principal outstanding (Rs.) : 13,18,903.00

Late payment penalty (Rs.) : 0.00

Cheque bounce charges (Rs.) : 0.00

Other charges (Rs.) : 1,50,000.00

Interest for the month (Rs.) : 0.00

Prepayment charges on outstanding Principal (Rs.) : 0.00

Interest on pending installment (Rs.) : 0.00

Pending installments (Rs.) : 47,122.00

Refunds (Rs.) : 15,45,113.00

Total Amount Payable (Rs.) : 29,088.00

Post Dated Cheque linked loan number :

Linked agreement number :

Kindly Note that:

1.Above calculation assumes that your last installment has been cleared.

2.We have taken the date of prepayment as December 10, 2018. For each day beyond this date, an

additional interest will be charged at the rate of Rs 440.00 per day.

3.If you prepay the loan after January 10, 2019, the installment for the following month will be payable.

4.On prepayment of the loan, the bank shall try to prevent payment of the subsequent month's

installment. As a precaution, we advise you to make a 'stop payment request' for your next month's

installment. In case the next month's installment is debited from your account, the amount will be

refunded, subject to clearance.

5.The above mentioned amount is valid subject to clearance of all the cheques/installments till date.

6.Prepayment charge is applicable on the outstanding amount of the facility or total interest (unexpired

period interest and outstanding interest) whichever is lower **.

7. In the event, the Applicant/s wishes to procure the Post Dated Cheques (PDCs) and / or Security Post

Dated Cheques (SPDCs) that remain unbanked at the end of the loan tenure / change of repayment

mode or details of such unbanked PDCs and / or SPDCs, the Applicant/s must make a request for the

same, within thirty days of closure of loan / change of repayment mode, failing which ICICI Bank Ltd

shall have the discretion / responsibility to destroy the unbanked PDCs including SPDCs without any

further notice and ICICI Bank Ltd shall not have the obligation to return the same to the Applicant/s.

Please note that the processing of such requests would entail charges as may be decided by ICICI

Bank Ltd from time to time.

8. As per the bank policy, if customer has done a part payment within one year of pre-payment then

prepayment charges will be applicable on amount prepaid and amount tendered towards prepayment

of loan during the last one year.

9. If you decide to prepay, please make payments of the above 'Total amount payable' through a

cheque or draft favouring ICICI Bank Ltd.

Calculation of Interest / additional interest and other charges are done on monthly basis, number of

days in a month being 30. Broken Period Pre-EMI interest is apportioned on actual number of days for

which interest is due as against 360 days in a year.

Now,stay connected by updating your mobile number and e-mail ID with us. To update your latest

contact details, please call our Customer Care.

For any clarification or more information, you may write to us at customer.care@icicibank.com from

your registered e-mail ID or call our Customer Care between 8:00 a.m. and 8:00 p.m. Alternatively, you

may visit your nearest ICICI Bank Asset Servicing Branch.

Sincerely,

ICICI Bank

This is a system-generated letter. Hence, it does not require any signature.

**GST as applicable.

Please quote your Education loan unsec number whenever you contact us.

Ahmedabad 3366 7777, Andhra Pradesh 7306 667777, Bengaluru 3366 7777, Bhopal 3366 7777,

Bhubaneshwar 3366 7777, Bihar 8102 667777, Chandigarh 3366 7777,

Chennai 3366 7777, Dehradun 3366 7777, Delhi 3366 7777, Ernakulam 3366 7777, Gujarat 8000

667777, Gurgaon 3366 7777, Haryana 9017 667777, Himachal Pradesh 9817 667777, Hyderabad 3366

7777, Jaipur 3366 7777, Karnataka 8088 667777, Kerala 9020 667777, Kolkata 3366 7777, Lucknow

3366 7777, Madhya Pradesh 9098 667777, Maharashtra 9021 667777, Mumbai 3366 7777, Orissa 9692

667777, Panji 3366 7777, Patna 3366 7777, Punjab 7307 667777, Rajasthan 7877 667777, Raipur 3366

7777, Ranchi 3366 7777, Shimla 3366 7777, Tamil Nadu 7305 667777, Uttar Pradesh 8081 667777, West

Bengal 8101 667777

Regd Off: ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara, Gujarat - 390 007. India.

CIN:L65190GJ1994PLC021012. PAN No: AAACI1195H

Corp Off: ICICI Bank Towers, Bandra Kurla Complex, Mumbai - 400051. India. Website:

www.icicibank.com

You can access your loan details through ICICI Bank iMobile app. To download, SMS iMobile to

5676766.

Vous aimerez peut-être aussi

- Goldman Sachs Risk Management: November 17 2010 Presented By: Ken Forsyth Jeremy Poon Jamie MacdonaldDocument109 pagesGoldman Sachs Risk Management: November 17 2010 Presented By: Ken Forsyth Jeremy Poon Jamie MacdonaldPol BernardinoPas encore d'évaluation

- Ratankumar Singha PDFDocument2 pagesRatankumar Singha PDFRatan Kumar SinghaPas encore d'évaluation

- E Sign DocDocument26 pagesE Sign DocShaik ShabanaPas encore d'évaluation

- Img PDFDocument2 pagesImg PDFlalit chhabraPas encore d'évaluation

- Welcome LetterDocument3 pagesWelcome LetterDeepak DevasiPas encore d'évaluation

- Welcome LetterDocument4 pagesWelcome LetterChetan ChoudharyPas encore d'évaluation

- Welcome Letter PDFDocument2 pagesWelcome Letter PDFNirmalya Sen100% (1)

- Yamamoto Vs NishinoDocument3 pagesYamamoto Vs NishinoTricia SandovalPas encore d'évaluation

- 'Foreclosure - Simulation - Report' LXW-M05619-200138877 PDFDocument1 page'Foreclosure - Simulation - Report' LXW-M05619-200138877 PDFshree dev kenal100% (1)

- Welcome LetterDocument4 pagesWelcome LettershannuPas encore d'évaluation

- Duplicate: 1 of Page No: File No: / 1 / 2Document2 pagesDuplicate: 1 of Page No: File No: / 1 / 2Anand AdkarPas encore d'évaluation

- Repayment Receipt CRED3F5D7AID4000032Document1 pageRepayment Receipt CRED3F5D7AID4000032SivaPas encore d'évaluation

- ICICI Bank Car Loans Primary DetailsDocument11 pagesICICI Bank Car Loans Primary DetailsAastha PandeyPas encore d'évaluation

- Certificate of InterestDocument1 pageCertificate of InterestMantu Kumar100% (1)

- HDFC Loan EMI Bill Payments - Billdesk122019 PDFDocument1 pageHDFC Loan EMI Bill Payments - Billdesk122019 PDFPrasadPas encore d'évaluation

- Jaka Investment Vs CIR - CDDocument2 pagesJaka Investment Vs CIR - CDNolas Jay100% (1)

- HL Sanction LetterDocument4 pagesHL Sanction LetterAarib ZaidiPas encore d'évaluation

- Satya Noc PDFDocument1 pageSatya Noc PDFpulapa umamaheswara raoPas encore d'évaluation

- Piramal SOAREPORT02023 07 01 11 31 000Document3 pagesPiramal SOAREPORT02023 07 01 11 31 000Om PrakashPas encore d'évaluation

- Annexure - 1: Mode of RepaymentDocument2 pagesAnnexure - 1: Mode of RepaymentRohit chavanPas encore d'évaluation

- Gold Loan-33000-NOCDocument1 pageGold Loan-33000-NOCDipra DasPas encore d'évaluation

- Fullerton Loan PDFDocument3 pagesFullerton Loan PDFSURANA1973Pas encore d'évaluation

- Sept. 2021 INSET Notice and Minutes of MeetingDocument8 pagesSept. 2021 INSET Notice and Minutes of MeetingSonny MatiasPas encore d'évaluation

- PLCHE001297Document1 pagePLCHE001297spselvamailPas encore d'évaluation

- Aditya Birla Foreclosure LetterDocument1 pageAditya Birla Foreclosure LetterShuvabrata Ganai100% (2)

- No Objection CertificateDocument1 pageNo Objection CertificateArjun GowdaPas encore d'évaluation

- Sriram Transport PDFDocument1 pageSriram Transport PDFPraveen KumarPas encore d'évaluation

- No Objection CertificateDocument1 pageNo Objection CertificateSenthil KumarPas encore d'évaluation

- 11 September, 2023 The Manager State Bank of India Jagtial 7-6-248, ASHOK NAGAR, JAGTIAL, Telangana 505327Document1 page11 September, 2023 The Manager State Bank of India Jagtial 7-6-248, ASHOK NAGAR, JAGTIAL, Telangana 505327For InsurancePas encore d'évaluation

- Week 13 - Local Government (Ra 7160) and DecentralizationDocument4 pagesWeek 13 - Local Government (Ra 7160) and DecentralizationElaina JoyPas encore d'évaluation

- It's A System Generated Document Doesn't Require Any Seal or SignatureDocument1 pageIt's A System Generated Document Doesn't Require Any Seal or SignatureClor Ltd100% (1)

- No Objetion Certificate (NOC) - 002138377: Download NowDocument6 pagesNo Objetion Certificate (NOC) - 002138377: Download NowSolar ShopePas encore d'évaluation

- NOC LatterDocument1 pageNOC Lattermailme.rajeshparalPas encore d'évaluation

- Loan Noc 8abecftDocument1 pageLoan Noc 8abecftRahul KalmekhPas encore d'évaluation

- No Objection Certificate PDFDocument1 pageNo Objection Certificate PDFpropvisor real estate100% (1)

- Noc Letter ILOS16714943Document1 pageNoc Letter ILOS16714943Jay SharmaPas encore d'évaluation

- Ofltr 4311063 181103114418718 1 3Document3 pagesOfltr 4311063 181103114418718 1 3폴로 쥰 차Pas encore d'évaluation

- 10 Overseas Bank Vs CA & Tapia PDFDocument10 pages10 Overseas Bank Vs CA & Tapia PDFNicoleAngeliquePas encore d'évaluation

- Payu Fin NocDocument1 pagePayu Fin NocRmillionsque Finserve50% (2)

- Primal Finance NocDocument1 pagePrimal Finance Nocchethanchriss81Pas encore d'évaluation

- No Objection Certificate PDFDocument1 pageNo Objection Certificate PDFPankaj ChouhanPas encore d'évaluation

- No Objetion Certificate (NOC) - 171527283Document1 pageNo Objetion Certificate (NOC) - 171527283sk.iliyas riyasPas encore d'évaluation

- Noc Documents 2023-08-23Document1 pageNoc Documents 2023-08-23Naresh SoniPas encore d'évaluation

- NOC DocumentDocument1 pageNOC DocumentVidhya MandalPas encore d'évaluation

- IBL Noc LETTERDocument2 pagesIBL Noc LETTERrshyamsolanki1488Pas encore d'évaluation

- PDFDocument3 pagesPDFaru76767650% (2)

- Loan Closure LetterDocument1 pageLoan Closure LetterKiran SNPas encore d'évaluation

- Cash Bean - Pay Day Loan - 190812020137600271 PDFDocument3 pagesCash Bean - Pay Day Loan - 190812020137600271 PDFmanojPas encore d'évaluation

- Pre CloseStatementDocument2 pagesPre CloseStatementMadhu BalaPas encore d'évaluation

- ChikuDocument19 pagesChikudurga kaliPas encore d'évaluation

- CRM ForeClosureDocument2 pagesCRM ForeClosureAnish PandeyPas encore d'évaluation

- Customer Request Form: - For Internal UseDocument1 pageCustomer Request Form: - For Internal UseFARHAT TYAGIPas encore d'évaluation

- Monthly Pay SlipDocument1 pageMonthly Pay SlipPraveen SharmaPas encore d'évaluation

- Ref: Foreclosure of Your CD - Product Account No: TCFCD0386000010297199 Booked OnDocument2 pagesRef: Foreclosure of Your CD - Product Account No: TCFCD0386000010297199 Booked Onvipin mishra100% (2)

- Noc Letter ILOS711679868476BHPIDocument1 pageNoc Letter ILOS711679868476BHPIBijayPas encore d'évaluation

- Noc - 112023Document1 pageNoc - 112023ajaysasidharan2211Pas encore d'évaluation

- UBI Small Business Loan Closure LetterDocument1 pageUBI Small Business Loan Closure Letterviveksinghaug14Pas encore d'évaluation

- Confirmation Letter Reliance Infratel PVT - LTDDocument1 pageConfirmation Letter Reliance Infratel PVT - LTDjatin chauhanPas encore d'évaluation

- Munar8257 - Welcome LetterDocument3 pagesMunar8257 - Welcome LetterYash DaymaPas encore d'évaluation

- Loan Sanction-Letter With kfs4330739025633689315Document4 pagesLoan Sanction-Letter With kfs4330739025633689315Sapan MishraPas encore d'évaluation

- Pdf&rendition 1 10Document1 pagePdf&rendition 1 10rangaswamy8194Pas encore d'évaluation

- Yes Bank ARDocument359 pagesYes Bank ARNihal YnPas encore d'évaluation

- N O C Format For Society - HFCDocument1 pageN O C Format For Society - HFCManushi ShahPas encore d'évaluation

- Cars24 Experiance LetterDocument1 pageCars24 Experiance Lettersanju151989Pas encore d'évaluation

- WarningLetter SF0048437 PDFDocument2 pagesWarningLetter SF0048437 PDFAsish Kumar PratapPas encore d'évaluation

- 2023 20 11 10 51 50 Pre ClosestatementDocument2 pages2023 20 11 10 51 50 Pre ClosestatementMohit pathakPas encore d'évaluation

- Psalm 51 (Part 1)Document5 pagesPsalm 51 (Part 1)Virgil GillPas encore d'évaluation

- Policy ScheduleDocument6 pagesPolicy ScheduleAkshay SakharkarPas encore d'évaluation

- National Law Institute University, Bhopal: Enforceability of Share Transfer RestrictionsDocument13 pagesNational Law Institute University, Bhopal: Enforceability of Share Transfer RestrictionsDeepak KaneriyaPas encore d'évaluation

- Cfa Blank ContractDocument4 pagesCfa Blank Contractconcepcion riveraPas encore d'évaluation

- LION OIL COMPANY v. NATIONAL UNION FIRE INSURANCE COMPANY OF PITTSBURGH, PA Et Al ComplaintDocument22 pagesLION OIL COMPANY v. NATIONAL UNION FIRE INSURANCE COMPANY OF PITTSBURGH, PA Et Al ComplaintACELitigationWatchPas encore d'évaluation

- Program Registration Forms Sea-BasedDocument28 pagesProgram Registration Forms Sea-BasedCharina Marie CaduaPas encore d'évaluation

- Full Download Technical Communication 12th Edition Markel Test BankDocument35 pagesFull Download Technical Communication 12th Edition Markel Test Bankchac49cjones100% (22)

- Control Scheme For Acb Transformer Incomer Module Type-DaetDocument86 pagesControl Scheme For Acb Transformer Incomer Module Type-DaetAVIJIT MITRAPas encore d'évaluation

- HORTATORYDocument3 pagesHORTATORYaidaPas encore d'évaluation

- Candidate Profile - Apprenticeship Training PortalDocument3 pagesCandidate Profile - Apprenticeship Training PortalTasmay EnterprisesPas encore d'évaluation

- Voodoo The History of A Racial Slur 1St Edition Boaz All ChapterDocument65 pagesVoodoo The History of A Racial Slur 1St Edition Boaz All Chaptertiffany.richardson295100% (3)

- Aditoriyama Land LawDocument28 pagesAditoriyama Land LawAditya Pratap SinghPas encore d'évaluation

- Duroosu L-Lugatuti L-Arabiyyah English KeyDocument61 pagesDuroosu L-Lugatuti L-Arabiyyah English KeyAsid MahmoodPas encore d'évaluation

- Media and Information Literacy: Quarter 1 - Module 7Document8 pagesMedia and Information Literacy: Quarter 1 - Module 7Louie RamosPas encore d'évaluation

- Omnibus CSC - 02232018 GUIDEDocument1 pageOmnibus CSC - 02232018 GUIDETegnap NehjPas encore d'évaluation

- Unit 15Document4 pagesUnit 15Oktawia TwardziakPas encore d'évaluation

- Digest - Arigo Vs SwiftDocument2 pagesDigest - Arigo Vs SwiftPing KyPas encore d'évaluation

- Eou FTZ EpzDocument18 pagesEou FTZ EpzNaveen Kumar0% (1)

- Empanelment Application Form 2016Document4 pagesEmpanelment Application Form 2016venkatPas encore d'évaluation

- नवोदय िव ालय सिमित Navodaya Vidyalaya Samiti: Registration No. 25140400531Document3 pagesनवोदय िव ालय सिमित Navodaya Vidyalaya Samiti: Registration No. 25140400531PintuPas encore d'évaluation

- Assignment - 2 Cash Flow Analysis: Submitted by Group - 8Document13 pagesAssignment - 2 Cash Flow Analysis: Submitted by Group - 8dheeraj_rai005Pas encore d'évaluation

- Allahabad Address 1930Document7 pagesAllahabad Address 1930Abdul mutaal AsadPas encore d'évaluation

- Jay Scott Lawsuit 2Document25 pagesJay Scott Lawsuit 2NewsTeam20Pas encore d'évaluation

- AptitudeDocument2 pagesAptitudedodaf78186Pas encore d'évaluation