Académique Documents

Professionnel Documents

Culture Documents

SS Bnefits - EN-05-10147 PDF

Transféré par

DanMichael Reyes0 évaluation0% ont trouvé ce document utile (0 vote)

19 vues2 pagesTitre original

SS Bnefits_EN-05-10147.pdf

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

19 vues2 pagesSS Bnefits - EN-05-10147 PDF

Transféré par

DanMichael ReyesDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

2019

When to Start Receiving Retirement Benefits

At Social Security, we’re often asked, “What’s the best The following chart shows an example of how your

age to start receiving retirement benefits?” The answer monthly benefit increases if you delay when you start

is that there’s not a single “best age” for everyone and, receiving benefits.

ultimately, it’s your choice. The most important thing

is to make an informed decision. Base your decision Monthly Benefit Amounts Differ Based on the

about when to apply for benefits on your individual Age You Decide to Start Receiving Benefits

and family circumstances. We hope the following This example assumes a benefit of $1,000

at a full retirement age of 66 and 6 months

information will help you understand how Social $1,280

1300

Security fits into your retirement decision. $1,120

$1,200

Monthly Benefit Amount

1100

$1,000 $1,040

Your decision is a personal one 900

$833

$900

$775

Would it be better for you to start getting benefits early 700

$725

with a smaller monthly amount for more years, or wait

for a larger monthly payment over a shorter timeframe? 500

The answer is personal and depends on several

factors, such as your current cash needs, your current

health, and family longevity. Also, consider if you plan

to work in retirement and if you have other sources of

retirement income. You must also study your future 0

62 63 64 65 66 and 67 68 69 70

6 months

financial needs and obligations, and calculate your

Age You Choose to Start Receiving Benefits

future Social Security benefit. We hope you’ll weigh all

the facts carefully before making the crucial decision

about when to begin receiving Social Security benefits. Let’s say you turn 62 in 2019, your full retirement age

This decision affects the monthly benefit you will is 66 and 6 months, and your monthly benefit starting

receive for the rest of your life, and may affect benefit at full retirement age is $1,000. If you start getting

protection for your survivors. benefits at age 62, we’ll reduce your monthly benefit

27.5 percent to $725 to account for the longer time you

receive benefits. This decrease is usually permanent.

Your monthly retirement benefit will be

If you choose to delay getting benefits until age 70, you

higher if you delay starting it would increase your monthly benefit to $1,280. This

Your full retirement age varies based on the year you increase is the result of delayed retirement credits you

were born. You can visit www.socialsecurity.gov/ earn for your decision to postpone receiving benefits

planners/retire/ageincrease.html to find your full past your full retirement age. The benefit at age 70 in

retirement age. We calculate your basic Social Security this example is about 76 percent more than the benefit

benefit — the amount you would receive at your full you would receive each month if you start getting

retirement age — based on your lifetime earnings. benefits at age 62 — a difference of $555 each month.

However, the actual amount you receive each month

depends on when you start receiving benefits. You Retirement may be longer than you think

can start your retirement benefit at any point from age

62 up until age 70, and your benefit will be higher the When thinking about retirement, be sure to plan for the

longer you delay starting it. This adjustment is usually long term. Many of us will live much longer than the

permanent: it sets the base for the benefits you’ll get “average” retiree, and most women live longer than

for the rest of your life. You’ll get annual cost-of-living men. About one out of every three 65-year-olds today

adjustments and, depending on your work history, may will live until at least age 90, and one out of seven

receive higher benefits if you continue to work. will live until at least age 95. Social Security benefits,

which last as long as you live, provide valuable

protection against outliving savings and other sources

of retirement income. Again, you’ll want to choose a

(over)

SocialSecurity.gov When to Start Receiving Retirement Benefits

retirement age based on your circumstances so you’ll coverage when you’re first eligible, it can be delayed,

have enough Social Security income to complement and you may have to pay a late enrollment penalty

your other sources of retirement income. for as long as you have coverage. You can find more

detailed information about Medicare on our website at

Married couples have two lives to plan for www.socialsecurity.gov/benefits/medicare.

Your spouse may be eligible for a benefit based on

your work record, and it’s important to consider Social

More resources

Security protection for widowed spouses. After all, You can estimate benefit amounts and find more

married couples at age 65 today would typically have information to help you decide when to start

at least a 50-50 chance that one member of the couple receiving retirement benefits by using our benefits

will live beyond age 90. If you are the higher earner, and planners at www.socialsecurity.gov/planners.

you delay starting your retirement benefit, it will result You can also use our Retirement Estimator at

in higher monthly benefits for the rest of your life and www.socialsecurity.gov/estimator, or create a

higher survivor protection for your spouse, if you die first. my Social Security account and get your Social Security

Statement at www.socialsecurity.gov/myaccount.

When you are receiving retirement benefits, your

Both tools provide retirement benefit estimates based

children can also be eligible for a benefit on your work

on your actual earnings record.

record if they’re under age 18 or if they have a disability

that began before age 22. When you’re ready for benefits, you can also apply

online at www.socialsecurity.gov/applyforbenefits.

You can keep working If you want more information about how your earnings

affect your retirement benefits, read How Work

When you reach your full retirement age, you can work

Affects Your Benefits (Publication No. 05-10069).

and earn as much as you want and still get your full

This pamphlet has the current annual and monthly

Social Security benefit payment. If you’re younger than

earnings limits.

full retirement age and if your earnings exceed certain

dollar amounts, some of your benefit payments during

the year will be withheld.

Contacting Social Security

The most convenient way to contact us anytime,

This doesn’t mean you must try to limit your earnings.

anywhere is to visit www.socialsecurity.gov. There,

If we withhold some of your benefits because you

you can: apply for benefits; open a my Social Security

continue to work, we’ll pay you a higher monthly benefit

account, which you can use to review your

when you reach your full retirement age. So, if you

Social Security Statement, verify your earnings, print

work and earn more than the exempt amount, it won’t,

a benefit verification letter, change your direct deposit

on average, decrease the total value of your lifetime

information, request a replacement Medicare card, and

benefits from Social Security — and can increase them.

get a replacement SSA-1099/1042S; obtain valuable

Here is how this works: When you reach full retirement information; find publications; get answers to frequently

age, we’ll recalculate your benefit to give you credit asked questions; and much more.

for months you didn’t get a benefit because of your

If you don’t have access to the internet, we offer many

earnings. In addition, as long as you continue to work

automated services by telephone, 24 hours a day, 7

and receive benefits, we’ll check your record every

days a week. Call us toll-free at 1-800-772-1213 or at

year to see whether the extra earnings will increase

our TTY number, 1-800-325-0778, if you’re deaf or hard

your monthly benefit. You can find more information

of hearing.

about working after retirement on our website at

www.ssa.gov/planners/retire/whileworking.html. If you need to speak to a person, we can answer your

calls from 7 a.m. to 7 p.m., Monday through Friday. We

Don’t forget Medicare ask for your patience during busy periods since you

If you plan to delay receiving benefits because you’re may experience a higher than usual rate of busy signals

working, you’ll still need to sign up for Medicare three and longer hold times to speak to us. We look forward

months before reaching age 65. If you don’t enroll to serving you.

in Medicare medical insurance or prescription drug

Social Security Administration

Publication No. 05-10147 | ICN 480136 | Unit of Issue — HD (one hundred)

January 2019 (Recycle prior editions)

When to Start Receiving Retirement Benefits

Produced and published at U.S. taxpayer expense

Printed on recycled paper

Vous aimerez peut-être aussi

- Logic Pro X Film Scoring Lesson PlanDocument4 pagesLogic Pro X Film Scoring Lesson PlanDanMichael ReyesPas encore d'évaluation

- Piano Scales PDFDocument3 pagesPiano Scales PDFDanMichael ReyesPas encore d'évaluation

- Producer:Artist Agreement PDFDocument2 pagesProducer:Artist Agreement PDFDanMichael ReyesPas encore d'évaluation

- Made in Highland: 55 W. 13th Street 8th FloorDocument12 pagesMade in Highland: 55 W. 13th Street 8th FloorDanMichael ReyesPas encore d'évaluation

- Danmichael Reyes: EducationDocument3 pagesDanmichael Reyes: EducationDanMichael ReyesPas encore d'évaluation

- Taking Note UpdatedDocument2 pagesTaking Note UpdatedDanMichael ReyesPas encore d'évaluation

- If I Were A Bell Mulgrew Miller Solo Transcription PDFDocument10 pagesIf I Were A Bell Mulgrew Miller Solo Transcription PDFDanMichael ReyesPas encore d'évaluation

- Art Practice As ResearchDocument6 pagesArt Practice As ResearchDanMichael ReyesPas encore d'évaluation

- Baby Mine: Dumbo SongDocument1 pageBaby Mine: Dumbo SongDanMichael ReyesPas encore d'évaluation

- Work For Hire AgreementDocument2 pagesWork For Hire AgreementDanMichael ReyesPas encore d'évaluation

- Art of Verse & Datu Kayumanggi: Live at Pie Vol. 1Document1 pageArt of Verse & Datu Kayumanggi: Live at Pie Vol. 1DanMichael ReyesPas encore d'évaluation

- Jazz & Hip Hop Essay WW Edits+endingDocument4 pagesJazz & Hip Hop Essay WW Edits+endingDanMichael ReyesPas encore d'évaluation

- IGotRhythm 0Document1 pageIGotRhythm 0DanMichael ReyesPas encore d'évaluation

- Mademoiselle MabryDocument1 pageMademoiselle MabryDanMichael Reyes0% (1)

- Quarter Life Crisis BassDocument2 pagesQuarter Life Crisis BassDanMichael ReyesPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Calander of Events 18 3 2020-21Document67 pagesCalander of Events 18 3 2020-21Ekta Tractor Agency KhetasaraiPas encore d'évaluation

- TCW Act #4 EdoraDocument5 pagesTCW Act #4 EdoraMon RamPas encore d'évaluation

- BS 6206-1981 PDFDocument24 pagesBS 6206-1981 PDFwepverro100% (2)

- Request BADACODocument1 pageRequest BADACOJoseph HernandezPas encore d'évaluation

- The Possibility of Making An Umbrella and Raincoat in A Plastic WrapperDocument15 pagesThe Possibility of Making An Umbrella and Raincoat in A Plastic WrapperMadelline B. TamayoPas encore d'évaluation

- BAIN REPORT Global Private Equity Report 2017Document76 pagesBAIN REPORT Global Private Equity Report 2017baashii4Pas encore d'évaluation

- InvoiceDocument2 pagesInvoiceiworldvashicmPas encore d'évaluation

- Production Planning & Control: The Management of OperationsDocument8 pagesProduction Planning & Control: The Management of OperationsMarco Antonio CuetoPas encore d'évaluation

- Regional Policy in EU - 2007Document65 pagesRegional Policy in EU - 2007sebascianPas encore d'évaluation

- Measure of Eco WelfareDocument7 pagesMeasure of Eco WelfareRUDRESH SINGHPas encore d'évaluation

- Nike Pestle AnalysisDocument10 pagesNike Pestle AnalysisAchal GoyalPas encore d'évaluation

- Fiscal Deficit UPSCDocument3 pagesFiscal Deficit UPSCSubbareddyPas encore d'évaluation

- Zubair Agriculture TaxDocument3 pagesZubair Agriculture Taxmunag786Pas encore d'évaluation

- Acknowledgement: MANISHA SIKKA - I Would Also Like To Express My Thanks To My Guide in ThisDocument78 pagesAcknowledgement: MANISHA SIKKA - I Would Also Like To Express My Thanks To My Guide in ThisKuldeep BatraPas encore d'évaluation

- (Dilg Memorandum Circular No. 2014-81) For The 2nd Quarter of C.Y. 2019 Region: HUC: BarangayDocument3 pages(Dilg Memorandum Circular No. 2014-81) For The 2nd Quarter of C.Y. 2019 Region: HUC: BarangayYuri VillanuevaPas encore d'évaluation

- DuPont Analysis On JNJDocument7 pagesDuPont Analysis On JNJviettuan91Pas encore d'évaluation

- Paul Romer: Ideas, Nonrivalry, and Endogenous GrowthDocument4 pagesPaul Romer: Ideas, Nonrivalry, and Endogenous GrowthJuan Pablo ÁlvarezPas encore d'évaluation

- Presentation On " ": Human Resource Practices OF BRAC BANKDocument14 pagesPresentation On " ": Human Resource Practices OF BRAC BANKTanvir KaziPas encore d'évaluation

- Democratic Developmental StateDocument4 pagesDemocratic Developmental StateAndres OlayaPas encore d'évaluation

- Strategic Planning For The Oil and Gas IDocument17 pagesStrategic Planning For The Oil and Gas ISR Rao50% (2)

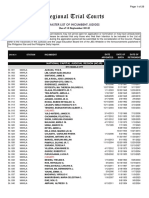

- Regional Trial Courts: Master List of Incumbent JudgesDocument26 pagesRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaPas encore d'évaluation

- BiogasForSanitation LesothoDocument20 pagesBiogasForSanitation LesothomangooooPas encore d'évaluation

- HQ01 - General Principles of TaxationDocument14 pagesHQ01 - General Principles of TaxationJimmyChao100% (1)

- Latihan Soal PT CahayaDocument20 pagesLatihan Soal PT CahayaAisyah Sakinah PutriPas encore d'évaluation

- Evolution of Taxation in The PhilippinesDocument16 pagesEvolution of Taxation in The Philippineshadji montanoPas encore d'évaluation

- Application Form For Subscriber Registration: Tier I & Tier II AccountDocument9 pagesApplication Form For Subscriber Registration: Tier I & Tier II AccountSimranjeet SinghPas encore d'évaluation

- Asiawide Franchise Consultant (AFC)Document8 pagesAsiawide Franchise Consultant (AFC)strawberryktPas encore d'évaluation

- Patent Trolling in IndiaDocument3 pagesPatent Trolling in IndiaM VridhiPas encore d'évaluation

- CMACGM Service Description ReportDocument58 pagesCMACGM Service Description ReportMarius MoraruPas encore d'évaluation

- Trade Confirmation: Pt. Danareksa SekuritasDocument1 pageTrade Confirmation: Pt. Danareksa SekuritashendricPas encore d'évaluation