Académique Documents

Professionnel Documents

Culture Documents

IT Declaration Form 2019-20

Transféré par

KarunaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

IT Declaration Form 2019-20

Transféré par

KarunaDroits d'auteur :

Formats disponibles

RELIOBRIX CONSULTING PVT LTD

"INCOME TAX DECLARATION FORM" F.Y. 2019-20

All below details are MANDATORY

EMPLOYEE NAME PAN CARD NO.

EMPLOYEE ID CONTACT NUMBER

DOJ DIVISION

DEPARTMENT EMAIL ID (OFFICIAL)

REPORTING MANAGER

RESIDENTIAL ADD.

TEAM HEAD

I hereby declare that the following investment will be made by me during the financial year 2019-2020 starting from

1st of April 2019 to 31st of March 2020

PART A - Investments proposal u/s 80 C (Maximum Amount Upto Rs 150,000/-)

S.NO. Under Section 80 C Document to be furnished by Employee Amount (Rs)

1 LIC Premium Copy of Premium Payment Receipt

2 Contribution to Public Provident Fund (PPF) Copy of Challan and Passbook

3 Subscription to National Saving Certificates (NSC) VIII issue Copy of Certificate issued by Post Office

4 Tution fee for full time education in India upto a maximum of two childeren Copy of Tution Fee Receipt

5 Contribution to Unit Linked Insurance Policy (ULIP) Copy of payment receipt

6 Repayment of Housing Loan (Principal Amount) Copy of certificate issued by Housing Loan Co.

7 Contrribution to notified mutual funds - ELSS Copy of statement issued by Mutual Fund Co.

8 Premium towards Pension Plan (80CCC) Copy of Premium Payment Receipt

9 Fixed deposits for 5 years or more in a scheduled Bank FD certificate issue by Bank

TOTAL INVESTMENTS U/S 80C -

PART B - Investments proposal under Section 80D :

S.NO. Under Section 80D/80U/80DD/80DDB/80E Document to be furnished by Employee Amount (Rs)

1 80D - Premium paid towards Mediclaim Policy Premium Receipt issued by the Insurance Co.

2 80U for Handicapped self Certificate issued by physician, Surgeon, psychiatrist working in Govt

Hospital

3 80DD for Handicapped dependent Certificate issued by physician, Surgeon, psychiatrist working in Govt

Hospital

4 80DDB for self o relative for specified diseases Certificate in Form 10IA by Doctor registered with IMA with post

graduation qualification only

5 80E for Repayment of Education Loan (only Interest Payment)(for self Education) Certificate of Payment from Bank

PART C - Housing Loan

Repayment of Interest on housing loan (Max Rs. 200000/-) u/s 24(1)(b) in case of Self

1 Copy of certificate issued by Housing Loan Co.

Occupied House Property. Please refer to instructions.

Dual benefit of HRA & Housing Loan Interest can be taken only if both are

2 Address of Property for which House Loan Obtained

situated in different satelite town.

PART D - Income other than salary

1 Other income (specify if any) Rent, salary from other employer, Bank interest, Capital Gains etc..

PART E - HRA Exemption U/S 10(13A)

S.No. Address of Rented Premises Rent per month From Date To Date Total Rent

Total Rent Paid/ Payable in the year

I __________________________________________ undertake that the proposed investments/savings mentioned above will be completed and documentation in this regard will be

submitted to accounts department on or before September 30, 2019 for final computation of income tax for the year 2019-20.

In case proof of investment/payment is not provided by the date specified, income-tax may be deducted as applicable.

I Shall Idemnify Reliobrix for all cost and consequences if any information found to be incorrect.

I further declare that in case of any change in above declaration, I would inform to the company.

Date: Signature of the Employee

Vous aimerez peut-être aussi

- Deloitte Internship Application FormDocument3 pagesDeloitte Internship Application FormNguyen Xuan HongPas encore d'évaluation

- Business - Account Services: Minimum Average Credit BalanceDocument6 pagesBusiness - Account Services: Minimum Average Credit BalanceSameer NooraniPas encore d'évaluation

- H-1B Process FlowchartDocument1 pageH-1B Process FlowchartWilliam BaileyPas encore d'évaluation

- Case Study Chapter 2Document2 pagesCase Study Chapter 2Aries De ClaroPas encore d'évaluation

- Fifco Usa Brands Breweries Job Application FormDocument6 pagesFifco Usa Brands Breweries Job Application FormAnishaPas encore d'évaluation

- No Dues Clearance GuidelinesDocument3 pagesNo Dues Clearance GuidelinesShafina ShaikhPas encore d'évaluation

- Documents That Need To Be Submitted During TCSDocument4 pagesDocuments That Need To Be Submitted During TCSAnkur AgrawalPas encore d'évaluation

- Oil & Gas Industries: Engineering Solutions ForDocument33 pagesOil & Gas Industries: Engineering Solutions ForfemiPas encore d'évaluation

- Rws Las Resume Part2Document2 pagesRws Las Resume Part2Michelle Faith BenitezPas encore d'évaluation

- A Study On Private University Education Competitive ForcesDocument10 pagesA Study On Private University Education Competitive Forcesshaharia100% (1)

- Form No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarDocument9 pagesForm No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarHardik KalariaPas encore d'évaluation

- Salary SlipDocument1 pageSalary SlipWaqar Ahmad GuĵĵarPas encore d'évaluation

- DBS Mortgage All-In-One Application Form 2016Document3 pagesDBS Mortgage All-In-One Application Form 2016Viola HippiePas encore d'évaluation

- HashedIn - Company Profile and Job Description PDFDocument3 pagesHashedIn - Company Profile and Job Description PDFVishal SindhnoorPas encore d'évaluation

- DMCC Visa ProcessDocument30 pagesDMCC Visa ProcessMazen IsmailPas encore d'évaluation

- PERM DataDocument846 pagesPERM DataAnonymous jGfdBQmBPas encore d'évaluation

- Karan KapurDocument5 pagesKaran KapurKaran Kapur100% (1)

- CTS WAH GuidelineDocument3 pagesCTS WAH GuidelineshaannivasPas encore d'évaluation

- Computer Based Accounting in HindiDocument35 pagesComputer Based Accounting in HindisunnyPas encore d'évaluation

- Axis ASAP - KYC Offer Terms and Conditions (Clayton - Travel Bag)Document6 pagesAxis ASAP - KYC Offer Terms and Conditions (Clayton - Travel Bag)Ragul0042Pas encore d'évaluation

- Post-Employment Benefits in New York, New Jersey, and Connecticut: The Case For ReformDocument20 pagesPost-Employment Benefits in New York, New Jersey, and Connecticut: The Case For ReformManhattan InstitutePas encore d'évaluation

- Nikhil Sinha: Work Experience SkillsDocument1 pageNikhil Sinha: Work Experience SkillsNikhil SinhaPas encore d'évaluation

- Stand Up India Application Form PDFDocument5 pagesStand Up India Application Form PDFakibPas encore d'évaluation

- LIC Health Insurance ProposalDocument13 pagesLIC Health Insurance ProposalAgniPat PatPas encore d'évaluation

- MyRewards Catalogue RewardsDocument13 pagesMyRewards Catalogue Rewardspushp00100% (1)

- Presentation of Our Organization BpoDocument13 pagesPresentation of Our Organization BpoArvind singhPas encore d'évaluation

- Red BullDocument23 pagesRed BullMohona Abedeen0% (1)

- CA Firm Exam QuestionDocument13 pagesCA Firm Exam QuestionTanbir Ahsan RubelPas encore d'évaluation

- Basic Wallet Rollout - PaperDocument12 pagesBasic Wallet Rollout - PaperBatool Al-kharabshehPas encore d'évaluation

- All Bank Policy HL & LapDocument25 pagesAll Bank Policy HL & LapmadirajunaveenPas encore d'évaluation

- 6 Hah SQ6 GDocument2 pages6 Hah SQ6 GSumit Dhyani40% (5)

- Texas IBM Notice To CureDocument7 pagesTexas IBM Notice To CureMichael KrigsmanPas encore d'évaluation

- Fillable Resume TemplateDocument1 pageFillable Resume TemplatepitherstaranPas encore d'évaluation

- Genpact Vs InfosysDocument3 pagesGenpact Vs InfosysNidhi MishraPas encore d'évaluation

- Introduction To BPODocument35 pagesIntroduction To BPOFider GracianPas encore d'évaluation

- Employee Self Verification FormDocument6 pagesEmployee Self Verification Formdharsan321Pas encore d'évaluation

- Company Profile FormatDocument17 pagesCompany Profile Formatmysorabh3533Pas encore d'évaluation

- Oracle HSA Setup GuideDocument16 pagesOracle HSA Setup Guideleninapps33Pas encore d'évaluation

- Performance Guide For ISP 18: About InternshalaDocument3 pagesPerformance Guide For ISP 18: About InternshalaSameer SheikhPas encore d'évaluation

- Accenture India Employee Tax TrackingDocument4 pagesAccenture India Employee Tax TrackingSiva ThotaPas encore d'évaluation

- Partnership: AdmissionDocument7 pagesPartnership: AdmissionSweta SinghPas encore d'évaluation

- Income Tax Refund RTI ApplicationDocument3 pagesIncome Tax Refund RTI Applicationcharul.shukla100% (2)

- Software Product Development Talent Pool Assessment - Buenos AiresDocument12 pagesSoftware Product Development Talent Pool Assessment - Buenos AiresTalent NeuronPas encore d'évaluation

- Walmart Global Tech India - Software Engineer LLDocument3 pagesWalmart Global Tech India - Software Engineer LLShbPas encore d'évaluation

- Tcs KycDocument2 pagesTcs KycDominicPas encore d'évaluation

- AX 2012 Fixed Asset Set Up BlogDocument7 pagesAX 2012 Fixed Asset Set Up BlogSrini Vasan100% (1)

- Payroll Setup ChecklistDocument4 pagesPayroll Setup ChecklistcaliechPas encore d'évaluation

- Proposal For Business AssociatesDocument15 pagesProposal For Business Associatesmohammedakbar88Pas encore d'évaluation

- RBIDocument2 pagesRBIAshish RanjanPas encore d'évaluation

- PAYFORT Mobile-SDK Android Integration Guide V 1.1.1Document23 pagesPAYFORT Mobile-SDK Android Integration Guide V 1.1.1Sharu KhanPas encore d'évaluation

- Profs MCQ!Document22 pagesProfs MCQ!kaksdvoPas encore d'évaluation

- General Accounting and Auditing Test QnsDocument11 pagesGeneral Accounting and Auditing Test QnsVrinda BPas encore d'évaluation

- BPO - SWIFT PresentationDocument23 pagesBPO - SWIFT PresentationmuhammadanasmustafaPas encore d'évaluation

- ApplicationForm PDFDocument6 pagesApplicationForm PDFanuPas encore d'évaluation

- Debit authority letter for salary payment servicesDocument1 pageDebit authority letter for salary payment servicestaraivan100% (2)

- A Small Briefing On CSI PayrollDocument6 pagesA Small Briefing On CSI PayrollAjay PandeyPas encore d'évaluation

- 3 Trends That Will Define The Future of The Business Analyst RoleDocument22 pages3 Trends That Will Define The Future of The Business Analyst RoleBunnyPas encore d'évaluation

- Investment Declaration Form FY 2019-20 v2Document5 pagesInvestment Declaration Form FY 2019-20 v2Rehan ElectronicsPas encore d'évaluation

- Investment proof submission guidelinesDocument40 pagesInvestment proof submission guidelinesSundar PabbareddyPas encore d'évaluation

- 5+ Yers Exp in Java, J2ee (Pradeep)Document2 pages5+ Yers Exp in Java, J2ee (Pradeep)KarunaPas encore d'évaluation

- 0606 01 Imprest Cash PolicyDocument4 pages0606 01 Imprest Cash PolicyKarunaPas encore d'évaluation

- Karnataka LWF Rates Amendment 6 April 2017Document1 pageKarnataka LWF Rates Amendment 6 April 2017KarunaPas encore d'évaluation

- Withdrawals From The EPF AccountDocument2 pagesWithdrawals From The EPF AccountKarunaPas encore d'évaluation

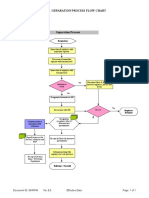

- Exit or Separation Process Flow ChartDocument1 pageExit or Separation Process Flow ChartKarunaPas encore d'évaluation

- 5+ Yers Exp in Java, J2ee (Pradeep)Document5 pages5+ Yers Exp in Java, J2ee (Pradeep)KarunaPas encore d'évaluation

- 5+ Yers Exp in Java, J2ee (Pradeep)Document5 pages5+ Yers Exp in Java, J2ee (Pradeep)KarunaPas encore d'évaluation

- 53 Retainer Ship AgreementDocument3 pages53 Retainer Ship AgreementAlpesh ThakkarPas encore d'évaluation

- 15 ExitpolicyDocument5 pages15 ExitpolicyKaran JoshiPas encore d'évaluation

- 5+ Yers Exp in Java, J2ee (Pradeep)Document5 pages5+ Yers Exp in Java, J2ee (Pradeep)KarunaPas encore d'évaluation

- 5 Methods of Training EvaluationDocument5 pages5 Methods of Training EvaluationKarunaPas encore d'évaluation

- 01 Mobile GuidelinesDocument4 pages01 Mobile GuidelinesBharath BhushanPas encore d'évaluation

- 5 Methods of Training EvaluationDocument4 pages5 Methods of Training EvaluationKarunaPas encore d'évaluation

- 15 ExitpolicyDocument5 pages15 ExitpolicyKaran JoshiPas encore d'évaluation

- Employment Verification Letter for Abhijeet RanjanDocument1 pageEmployment Verification Letter for Abhijeet RanjanKarunaPas encore d'évaluation

- Structured OJT ProcessDocument4 pagesStructured OJT ProcessgptothPas encore d'évaluation

- Article IDocument2 pagesArticle IKarunaPas encore d'évaluation

- Exit or Separation Process Flow ChartDocument2 pagesExit or Separation Process Flow ChartKarunaPas encore d'évaluation

- Five Brilliant Motivational Stories.....Document4 pagesFive Brilliant Motivational Stories.....Deepak MahajanPas encore d'évaluation

- AO Advertisement Correted 27.10 0Document22 pagesAO Advertisement Correted 27.10 0Rick GangulyPas encore d'évaluation

- 3rd Dec HR Club MeetingDocument2 pages3rd Dec HR Club MeetingKarunaPas encore d'évaluation

- To Whomsoever It May Concern: AE/ADM/HR/SAL/10/12/01 10 December, 2011Document1 pageTo Whomsoever It May Concern: AE/ADM/HR/SAL/10/12/01 10 December, 2011KarunaPas encore d'évaluation

- Harshit Goel: Address: C46/A Bhagwatam New South Ganesh Nagar, New Delhi 110092 Mobile: 8181047047,9599214585 E-MailDocument2 pagesHarshit Goel: Address: C46/A Bhagwatam New South Ganesh Nagar, New Delhi 110092 Mobile: 8181047047,9599214585 E-MailKarunaPas encore d'évaluation

- ECR Annexure IDocument1 pageECR Annexure IKarunaPas encore d'évaluation

- Health With Life: ConnectingDocument1 pageHealth With Life: ConnectingKarunaPas encore d'évaluation

- AnjaliBajpai (8 0)Document3 pagesAnjaliBajpai (8 0)KarunaPas encore d'évaluation

- AvinashKumarMistry (6 0)Document3 pagesAvinashKumarMistry (6 0)KarunaPas encore d'évaluation

- Anthony Lawrence: BUSINESSWORLD (ABP GROUP) (Dec 2000 - Present)Document2 pagesAnthony Lawrence: BUSINESSWORLD (ABP GROUP) (Dec 2000 - Present)KarunaPas encore d'évaluation

- Baishaki Mukherjee: ObjectiveDocument3 pagesBaishaki Mukherjee: ObjectiveKarunaPas encore d'évaluation

- HANDLING | BE DESCHI PROFILEDocument37 pagesHANDLING | BE DESCHI PROFILECarlos ContrerasPas encore d'évaluation

- Companies From Deal CurryDocument5 pagesCompanies From Deal CurryHemantPas encore d'évaluation

- APCMA - Members & Non-MembersDocument7 pagesAPCMA - Members & Non-MembersazkhanPas encore d'évaluation

- Proposal Letter of B 2 B Redeifined Angel (2) (1) 3 (New)Document3 pagesProposal Letter of B 2 B Redeifined Angel (2) (1) 3 (New)Hardy TomPas encore d'évaluation

- Analysis of Mutual Fund PerformanceDocument7 pagesAnalysis of Mutual Fund PerformanceMahaveer ChoudharyPas encore d'évaluation

- ....Document60 pages....Ankit MaldePas encore d'évaluation

- Secretary of Finance vs. Lazatin GR No. 210588Document14 pagesSecretary of Finance vs. Lazatin GR No. 210588Gwen Alistaer CanalePas encore d'évaluation

- IFB Washing Machines Marketing Analysis: N V Jagadeesh Kumar TDocument10 pagesIFB Washing Machines Marketing Analysis: N V Jagadeesh Kumar TomprakashPas encore d'évaluation

- Regional Acceptance Ach Draft Form-OneDocument2 pagesRegional Acceptance Ach Draft Form-Onejohnlove720% (1)

- Dragonpay Payment InstructionDocument1 pageDragonpay Payment Instructionkenneth molinaPas encore d'évaluation

- Chevron Attestation PDFDocument2 pagesChevron Attestation PDFedgarmerchanPas encore d'évaluation

- President's Report by Roberta HoeyDocument5 pagesPresident's Report by Roberta HoeyAltrusa International of Montrose COPas encore d'évaluation

- PPP Force MajeureDocument7 pagesPPP Force MajeureJasonafarrellPas encore d'évaluation

- Keegan02 The Global Economic EnvironmentDocument17 pagesKeegan02 The Global Economic Environmentaekram faisalPas encore d'évaluation

- Emissions TradingDocument22 pagesEmissions Tradingasofos100% (1)

- Revised approval for 132/33kV substation in ElchuruDocument2 pagesRevised approval for 132/33kV substation in ElchuruHareesh KumarPas encore d'évaluation

- (Topic 6) Decision TreeDocument2 pages(Topic 6) Decision TreePusat Tuisyen MahajayaPas encore d'évaluation

- HNIDocument5 pagesHNIAmrita MishraPas encore d'évaluation

- International-Organisation List NotesDocument62 pagesInternational-Organisation List NotesVINOD KUMARPas encore d'évaluation

- MTNL Mumbai PlansDocument3 pagesMTNL Mumbai PlansTravel HelpdeskPas encore d'évaluation

- PerdiscoDocument10 pagesPerdiscogarytrollingtonPas encore d'évaluation

- Commercial Transactions ProjectDocument25 pagesCommercial Transactions ProjectNishtha ojhaPas encore d'évaluation

- OCI DiscussionDocument6 pagesOCI DiscussionMichelle VinoyaPas encore d'évaluation

- RA 7183 FirecrackersDocument2 pagesRA 7183 FirecrackersKathreen Lavapie100% (1)

- Visa Cashless Cities ReportDocument68 pagesVisa Cashless Cities ReportmikePas encore d'évaluation

- BSOP330 Week 3 Lab Assignments Chapter 13 Problems 13.3 13.5 13.9 13.21 - 536935Document6 pagesBSOP330 Week 3 Lab Assignments Chapter 13 Problems 13.3 13.5 13.9 13.21 - 536935Javier Salas ZavaletaPas encore d'évaluation

- Membership ListDocument17 pagesMembership ListFinmark Business GroupPas encore d'évaluation

- Budget Deficit: Some Facts and InformationDocument3 pagesBudget Deficit: Some Facts and InformationTanvir Ahmed SyedPas encore d'évaluation

- CH 15 CDocument1 pageCH 15 CstillnotbeaPas encore d'évaluation

- Chairing A Meeting British English TeacherDocument7 pagesChairing A Meeting British English TeacherJimena AbdoPas encore d'évaluation