Académique Documents

Professionnel Documents

Culture Documents

Documents Required - VAT Registration

Transféré par

anjum0 évaluation0% ont trouvé ce document utile (0 vote)

115 vues1 pageThe document lists the documents and details required for VAT registration for a partnership firm. It requires 11 documents including copies of the partnership deed, PAN cards, bank statements, address and ID proofs of the partners, authorization form, photos and a resolution authorizing a partner. It also requires details of the authorized partner, commodity being traded, business commencement date, additional business locations, estimated turnover, whether CST registration is needed and the type of business.

Description originale:

Vat Registeration

Copyright

© © All Rights Reserved

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe document lists the documents and details required for VAT registration for a partnership firm. It requires 11 documents including copies of the partnership deed, PAN cards, bank statements, address and ID proofs of the partners, authorization form, photos and a resolution authorizing a partner. It also requires details of the authorized partner, commodity being traded, business commencement date, additional business locations, estimated turnover, whether CST registration is needed and the type of business.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

115 vues1 pageDocuments Required - VAT Registration

Transféré par

anjumThe document lists the documents and details required for VAT registration for a partnership firm. It requires 11 documents including copies of the partnership deed, PAN cards, bank statements, address and ID proofs of the partners, authorization form, photos and a resolution authorizing a partner. It also requires details of the authorized partner, commodity being traded, business commencement date, additional business locations, estimated turnover, whether CST registration is needed and the type of business.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

Documents and Details required for the VAT registration :

Documents Required:

1. Copy of Partnership Deed – Self Attested by authorized signatory

2. PAN Card Copy of the firm – Self Attested by authorized signatory

3. Last 3 months Bank statement – Self Attested by authorized signatory

4. Address Proof of the office (Business Premises) – Rental Agreement/Sale Deed - Self Attested by

authorized signatory

5. Route Map of the business premises – Self Attested by authorized signatory

6. Latest Original Electricity Bill of the Office (Business Premises) – Self Attested by authorized

signatory

7. ID proof of all the partners – PAN Card Copy – Self Attested

8. Address proof of all the partners – Passport/Driving License/Voter ID – anyone – Self Attested

9. Authorization in VAT Form 555 – We will fill up and give you for your signature once you provide

all the other documents.

10. Photo of all the partners – 4 copies

11. Copy of the resolution authorizing one partner to comply with the VAT registration.

12. Details of any other registration if company is having & registration document of the same.

Details Required:

1. Partner’s (Authorized Partner) – Father’s name, Mobile Number, Mail ID, Date of Birth

2. Details and description of the commodity in which company is trading and seeking for

registration.

3. Date of commencement of the business

4. Details of additional places of business if any.

5. Turnover estimated for the FY 2014-15 & FY 2015-16

6. Whether CST registration is required, if yes, details and description of the commodity in which

company seeking for CST registration.

7. Type of business, whether wholesaler, Distributor, Agency, Retailer, Auctioneer, Contractor,

Lessee, Hire Purchaser or Services?

Vous aimerez peut-être aussi

- DOCUMENTSDocument1 pageDOCUMENTStssidheeqPas encore d'évaluation

- List of Documents To Sign-Up For BillDesk Payment GatewayDocument9 pagesList of Documents To Sign-Up For BillDesk Payment GatewayBuildaBazaar E-commerce & Travel PlatformPas encore d'évaluation

- RERA Agents Individual Check ListDocument2 pagesRERA Agents Individual Check ListG N Harish Kumar YadavPas encore d'évaluation

- MVAT ACT, 2002: Who Needs To Register?Document14 pagesMVAT ACT, 2002: Who Needs To Register?CAJigarThakkarPas encore d'évaluation

- Registration of Partnership Firm in DelhiDocument7 pagesRegistration of Partnership Firm in DelhiTushar GuptaPas encore d'évaluation

- GST RegistrationDocument59 pagesGST Registrationvinayak tiwariPas encore d'évaluation

- Details Required For Incorporation of CompanyDocument1 pageDetails Required For Incorporation of CompanyLAVI TYAGIPas encore d'évaluation

- Digital Onboarding ManualDocument4 pagesDigital Onboarding ManualLoboPas encore d'évaluation

- Documents Required RegistrationDocument8 pagesDocuments Required RegistrationFinance & Health ExpressPas encore d'évaluation

- Require DocumentDocument1 pageRequire Documentschetan013Pas encore d'évaluation

- ChecklistDocument1 pageChecklistEstella consultancyPas encore d'évaluation

- Checklist For Incorporation of Private CompanyDocument2 pagesChecklist For Incorporation of Private Companysandeep62Pas encore d'évaluation

- Real Estate Marketing Agent Registration Form: Important InstructionsDocument7 pagesReal Estate Marketing Agent Registration Form: Important InstructionsAshok KumarPas encore d'évaluation

- PMS AgreementDocument41 pagesPMS AgreementSandeep BorsePas encore d'évaluation

- GOODDDDocument12 pagesGOODDDPeeyush JainPas encore d'évaluation

- KYC Documents For EntitiesDocument2 pagesKYC Documents For EntitiesParikshit YadavPas encore d'évaluation

- De-Mat and Trading Account Opening Procedure (Back Office Working)Document11 pagesDe-Mat and Trading Account Opening Procedure (Back Office Working)Swapnil MorePas encore d'évaluation

- Firm Registration: Preparation of FileDocument2 pagesFirm Registration: Preparation of FilezeshanPas encore d'évaluation

- Section 8 Check ListDocument1 pageSection 8 Check ListG N Harish Kumar YadavPas encore d'évaluation

- Emigrate 2Document2 pagesEmigrate 2tssidheeqPas encore d'évaluation

- GST Reg ChecklistDocument35 pagesGST Reg ChecklistShaik MastanvaliPas encore d'évaluation

- Bir Tax Clearance LetterDocument1 pageBir Tax Clearance LetterMay Ann MeramPas encore d'évaluation

- Documents Required To Be Produced Along With The Housing Loan ApplicationDocument5 pagesDocuments Required To Be Produced Along With The Housing Loan ApplicationGajendra AudichyaPas encore d'évaluation

- Real Estate Documentation and RegistrationDocument4 pagesReal Estate Documentation and RegistrationMa Cecile Candida Yabao-Rueda100% (3)

- Procedure For Issueof Duplicate Share CertificateDocument5 pagesProcedure For Issueof Duplicate Share CertificateKrunalPas encore d'évaluation

- Value Added Tax (VAT) Form For RegistrationDocument3 pagesValue Added Tax (VAT) Form For RegistrationHeena VermaPas encore d'évaluation

- Limited Liability PartnershipDocument12 pagesLimited Liability PartnershipananthkalviPas encore d'évaluation

- Word - ISS Application For Authorized Persons - BSE - 01-JULY-2015Document35 pagesWord - ISS Application For Authorized Persons - BSE - 01-JULY-2015meera nPas encore d'évaluation

- All in One Statutory Forms & Order Form of OPCDocument23 pagesAll in One Statutory Forms & Order Form of OPCraajverma1000mPas encore d'évaluation

- Non Face To Face Form With AMB Declaration PDFDocument10 pagesNon Face To Face Form With AMB Declaration PDFrohit.godhani9724Pas encore d'évaluation

- PreSchool SALE AgreementDocument4 pagesPreSchool SALE AgreementBalasubramanian ManivasagamPas encore d'évaluation

- NEW ACCOUNT - OPENING - FORM - IndiaDocument2 pagesNEW ACCOUNT - OPENING - FORM - IndiaDeepak PanghalPas encore d'évaluation

- Bank Procedure and FormalitiesDocument59 pagesBank Procedure and Formalitiesrakesh19865Pas encore d'évaluation

- Iec Document ListDocument3 pagesIec Document ListTax ProffessionalPas encore d'évaluation

- Document Required For Sales Tax RegistrationDocument2 pagesDocument Required For Sales Tax RegistrationAlok JhaPas encore d'évaluation

- Non Individual - KYC Application FormDocument4 pagesNon Individual - KYC Application Formlaxmans20Pas encore d'évaluation

- Trade LicenseDocument2 pagesTrade LicenseBadri KathaPas encore d'évaluation

- What Are The List of Documents Required For GST Registration?Document16 pagesWhat Are The List of Documents Required For GST Registration?Dhiraj Ranjan RayPas encore d'évaluation

- Input Data For Incometax Fillling FY 2014-15 AY 2015-16Document3 pagesInput Data For Incometax Fillling FY 2014-15 AY 2015-16satishktPas encore d'évaluation

- Business Credit Application 01Document3 pagesBusiness Credit Application 01raj dosPas encore d'évaluation

- Holiday Homework: AccountancyDocument11 pagesHoliday Homework: AccountancydivyaPas encore d'évaluation

- Conversion of Firm Into CompanyDocument6 pagesConversion of Firm Into Companyvijay_masapathri7135Pas encore d'évaluation

- Deed of Partnership: 1. Business ActivityDocument4 pagesDeed of Partnership: 1. Business Activitypeenaz parveen100% (1)

- Ptec Registration Checklist PDFDocument2 pagesPtec Registration Checklist PDFNetaji BhosalePas encore d'évaluation

- Become Direct Marketing Agent For A Mutually Beneficial RelationshipDocument11 pagesBecome Direct Marketing Agent For A Mutually Beneficial RelationshipBhanu TezzPas encore d'évaluation

- Remiser Form BseDocument12 pagesRemiser Form BseMohammed Naushad SPas encore d'évaluation

- Firm RegistrationDocument1 pageFirm Registrationkhan jeePas encore d'évaluation

- Firm RegistrationDocument1 pageFirm Registrationkhan jeePas encore d'évaluation

- Ali Raza Law Assigment 3Document3 pagesAli Raza Law Assigment 3tahleel bashiPas encore d'évaluation

- Guidelines For RemisiersDocument15 pagesGuidelines For Remisierssantosh.pw4230Pas encore d'évaluation

- Procedure For VAT Registration SimpleDocument3 pagesProcedure For VAT Registration SimpleVikas KumarPas encore d'évaluation

- Grammar Friends 1 SBDocument2 pagesGrammar Friends 1 SBsgourisPas encore d'évaluation

- Mandatory - ItemsDocument1 pageMandatory - ItemsNaveen HegdePas encore d'évaluation

- Application of Advocate.Document3 pagesApplication of Advocate.VijayrajPas encore d'évaluation

- Vat 05Document3 pagesVat 05Hirojit GhoshPas encore d'évaluation

- Maharashtra Vat ActDocument21 pagesMaharashtra Vat ActaatifbmsPas encore d'évaluation

- VAT FormDocument8 pagesVAT FormSonila JainPas encore d'évaluation

- Modified Vendor Registration Form PDFDocument3 pagesModified Vendor Registration Form PDFAnonymous cKGCdi100% (1)

- FinancialDocument2 pagesFinancialMosaab AklPas encore d'évaluation

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsD'EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsPas encore d'évaluation

- Apj Abdul Kalam Patna Working FileDocument12 pagesApj Abdul Kalam Patna Working FileanjumPas encore d'évaluation

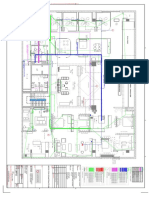

- Second Floor Numbering LAYOUT B1-E-26F02Document1 pageSecond Floor Numbering LAYOUT B1-E-26F02anjumPas encore d'évaluation

- Karnataka School and College RuralDocument30 pagesKarnataka School and College RuralanjumPas encore d'évaluation

- B1-E-21f02 Power & Raceway Layout B1-E-26f02Document1 pageB1-E-21f02 Power & Raceway Layout B1-E-26f02anjumPas encore d'évaluation

- Dinga Dinga Ding Ding DuuuuDocument1 pageDinga Dinga Ding Ding DuuuuanjumPas encore d'évaluation

- Msme CertificateDocument1 pageMsme CertificateanjumPas encore d'évaluation

- Dell Pricelist Jan'20 MilsestoneDocument3 pagesDell Pricelist Jan'20 MilsestoneanjumPas encore d'évaluation

- XXXXX UL PriceDocument1 pageXXXXX UL PriceanjumPas encore d'évaluation

- Nayeem Ahmed: in The Name of Allah, The Most Beneficent, The MercifulDocument2 pagesNayeem Ahmed: in The Name of Allah, The Most Beneficent, The MercifulanjumPas encore d'évaluation

- Nayeem Ahmed: NikahDocument2 pagesNayeem Ahmed: NikahanjumPas encore d'évaluation