Académique Documents

Professionnel Documents

Culture Documents

Law and Audit Notes in Easy Format

Transféré par

Kumar SwamyTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Law and Audit Notes in Easy Format

Transféré par

Kumar SwamyDroits d'auteur :

Formats disponibles

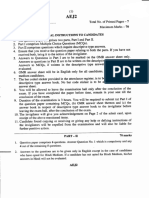

Final (New) Course

Announcement

Modifications in the scope of syllabi of select subjects

I. Exclusion of topics from the scope of syllabi of select subjects [To be effective from

November, 2019 Examination onwards]

Paper Exclusions

Paper 1: Topics excluded:

Financial

Reporting Application of existing Accounting Standards i.e., AS 15, 21,23, 25, 27 and 28

Application of Guidance Notes issued by ICAI on specified accounting aspects

Accounting for Carbon Credits and related Guidance Note

Accounting for E-commerce Business and related Guidance Note

Human Resource Reporting

Value Added Statement

Expert Advisory Committee (EAC) Opinions

The Guidance Note on accounting for expenditure on Corporate Social

Responsibility activities falling within the scope of topic 13 of Syllabus Contents

continues to be applicable

Paper 2: Topics excluded:

Strategic Indian Financial System

Financial International Financial Centre (IFC)

Management Small & Medium Enterprises

Paper 3: Chapter 14 : Special Audit Assignment topic has been excluded.

Advanced Following Engagement and Quality Control Standards excluded:

Auditing and

Professional (1) (2) (3)

Ethics S. Topics Exclusions

No of the

syllabus

1 SA 800 Special Considerations-Audits of Financial

Statements Prepared in Accordance with Special

Purpose Framework

2 SA 805 Special Considerations-Audits of Single Purpose

Financial Statements and Specific Elements,

Accounts or Items of a Financial Statement

3 SA 810 Engagements to Report on Summary Financial

Statements

4 SRE Engagements to Review Historical Financial

2400 Statements (Revised)

5 SRE Review of Interim Financial Information Chapter 7

2410 Performed by the Independent Auditor of the

Entity Excluded

6 SAE The Examination of Prospective Financial

3400 Information

7 SAE Assurance Reports on Controls At a Service

3402 Organisation

8 SAE Assurance Engagements to Report on the

3420 Compilation of Pro Forma Financial Information

Included in a Prospectus (New)

9 SRS Engagements to Perform Agreed Upon

4400 Procedures Regarding Financial Information

10 SRS Compilations Engagements (Revised)

4410

Following Guidance Notes and other publications are excluded:

1. Code of Ethics

2. Guidance Note on Independence of Auditors.

3. Guidance Note on Audit of Inventories.

4. Guidance Note on Audit of Debtors, Loans and Advances.

5. Guidance Note on Audit of Investments.

6. Guidance Note on Audit of Cash and Bank Balances.

7. Guidance Note on Audit of Liabilities.

8. Guidance Note on Audit of Revenue.

9. Guidance Note on Audit of Expenses.

10. Guidance Note on Computer Assisted Audit Techniques (CAATs).

11. Guidance Note on Audit of Payment of Dividend.

12. Guidance Note on Audit of Capital and Reserves.

13. Guidance Note on Reporting under section 143(3)(f) and (h) of the Companies

Act, 2013

14. Guidance Note on Reporting on Fraud under section 143(12) of the Companies

Act, 2013

Paper 4: Provisions/sections excluded from/retained in certain topics of the syllabus

Corporate through Study Guidelines:

and

Economic Topic Retained provisions Excluded provisions

Laws (1) (2) (3)

Winding Up Sections related to winding up by Remaining provisions

Tribunal (from sections 271-303); are excluded.

and

Sections applicable to every mode

of winding up (from sections 324-

336 and 344-347 and 352- 358) are

retained

Producer - Entire topic is excluded

Companies

Miscellaneous Sections, other than the excluded Sections 366 to 378,

Provisions sections in column (3), are retained. 396 to 404, 405, 448,

449, 451-454, 456-470

are excluded

Compounding of Adjudication and special courts are Compounding of

offences, retained. offences’ is excluded

Adjudication,

Special Courts

National Company Provisions, other than excluded Provisions dealing with

Law Tribunal and provisions in column (3), are constitution of NCLT/

Appellate Tribunal retained. NCLAT and

qualification of

chairman and NCLT/

NCLAT members, their

salary, allowances etc.,

are excluded

SEBI Act, 1992, SEBI Act, 1992 and and SEBI SEBI (ICDR)

SEBI (ICDR) (Listing Obligations and Disclosure Regulations are

Regulations, 2009 Requirement) Regulations, 2015 excluded

and SEBI (Listing are retained.

Obligations and

Disclosure

Requirement)

Regulations, 2015

The Foreign The FEMA, 1999 along with the The remaining Rules

Exchange following Rules/Regulations - and Regulations are

Management Act, Fem (Permissible Capital excluded.

1999 Account Transactions)

Regulations, 2000

Fem (Current Account

Transactions) Rules, 2000

FEM (Export of Goods &

Services) Regulations, 2015

The Securitization Relevant definitions covered in Remaining provisions

and the Study Material are excluded

Reconstruction of management of asset by the

Financial Assets bank and the financial

and Enforcement institutions

of Security

Interest Act, 2002

Insolvency & The Corporate and Insolvency Remaining provisions

Bankruptcy Code, resolution process i.e. upto section (i.e. from section 60

2016 59 onwards) are excluded.

Paper 6A : Topic “Quantitative Analysis” excluded

Risk

Management

Paper 6B : Topic “Banking Management” excluded

Financial

Services

and Capital

Markets

Paper 6D : Topic “World Trade Organization (WTO) ” excluded

Economic

Laws

Paper 8: The following topics have been excluded from the syllabus of Part II: Customs &

Indirect Tax FTP1

Laws

Warehousing

Demand and Recovery

Provisions relating to prohibited goods, notified goods, specified goods, illegal

importation/exportation of goods

Searches, seizure and arrest; Offences; Penalties; Confiscation and

Prosecution

Appeals and Revision; Advance Rulings; Settlement Commission

Officers of Customs; Appointment of customs ports, airports etc.

Provisions relating to coastal goods and vessels carrying coastal goods

Other provisions

II. Inclusions within the scope of syllabi of select subjects [To be effective from May, 2020

Examination onwards]

Paper Inclusions

Paper 4: Corporate Legislation Topics Added

and Economic Laws

The Foreign Exchange Overseas Direct Investment

Management Act, 1999 Import of Goods and Services

External Commercial Borrowing Policy

Paper 6A: Risk Topic “Evaluation of Risk Management Strategies” included

Management

Paper 6B: Financial Topics “Leasing and Factoring” included

Services and Capital

Markets

1

These exclusions are relevant for Final (Old) Paper 8: Indirect Tax Laws also.

Vous aimerez peut-être aussi

- Other Laws - Chart PDFDocument34 pagesOther Laws - Chart PDFBharathPas encore d'évaluation

- CA FINAL Audit Revision: Summary Charts Cover All TopicsDocument151 pagesCA FINAL Audit Revision: Summary Charts Cover All TopicsKumar SwamyPas encore d'évaluation

- Activity Based Costing Suits Melody's Piano and Keyboard DivisionsDocument16 pagesActivity Based Costing Suits Melody's Piano and Keyboard DivisionsKumar SwamyPas encore d'évaluation

- Appointment & Remuneration of Managerial PersonnelDocument24 pagesAppointment & Remuneration of Managerial Personnelnaga jaganPas encore d'évaluation

- 51082bos40777 cp6 PDFDocument19 pages51082bos40777 cp6 PDFKumar SwamyPas encore d'évaluation

- Appeals Chart by Darshan Khare 1.PDF 1Document1 pageAppeals Chart by Darshan Khare 1.PDF 1Kumar SwamyPas encore d'évaluation

- Chapter 5: Acquisition, Development and Implementation Ofinformtion SystemsDocument1 pageChapter 5: Acquisition, Development and Implementation Ofinformtion SystemsKumar SwamyPas encore d'évaluation

- NCLT Law PDFDocument1 pageNCLT Law PDFKumar SwamyPas encore d'évaluation

- Law and Audit Notes in Easy FormatDocument43 pagesLaw and Audit Notes in Easy FormatKumar SwamyPas encore d'évaluation

- Ca Final - MAY 2019: Abc Analysis Indirect TaxationDocument2 pagesCa Final - MAY 2019: Abc Analysis Indirect TaxationKumar SwamyPas encore d'évaluation

- How To Memorize Theory Subjects For CA Students by CA Ammit AggarwalDocument5 pagesHow To Memorize Theory Subjects For CA Students by CA Ammit AggarwalKumar SwamyPas encore d'évaluation

- 138 Summary Indas Vs AsDocument32 pages138 Summary Indas Vs AsKumar SwamyPas encore d'évaluation

- ABC Analysis FR Old M19 2 PDFDocument2 pagesABC Analysis FR Old M19 2 PDFKumar SwamyPas encore d'évaluation

- Audit Faster CoeDocument70 pagesAudit Faster CoeKumar SwamyPas encore d'évaluation

- As 20 Earning Per Share Full NotesDocument37 pagesAs 20 Earning Per Share Full NotesKumar SwamyPas encore d'évaluation

- Transportation Problem SolverDocument24 pagesTransportation Problem SolverKumar SwamyPas encore d'évaluation

- Auditing Paper May 2019 Old SyllabusDocument7 pagesAuditing Paper May 2019 Old SyllabusKumar SwamyPas encore d'évaluation

- Ca Final IscaDocument130 pagesCa Final IscaKumar SwamyPas encore d'évaluation

- 422 - Summary by Harsh Gupta - Part 1Document9 pages422 - Summary by Harsh Gupta - Part 1Kumar Swamy0% (2)

- Accounting Standard - 20 Earning Per Share Full NotesDocument16 pagesAccounting Standard - 20 Earning Per Share Full NotesKumar SwamyPas encore d'évaluation

- Companies (Auditors' Report) Order, 2015 (CARO) : Requirements of Sec 143 Requirements of CARODocument28 pagesCompanies (Auditors' Report) Order, 2015 (CARO) : Requirements of Sec 143 Requirements of CAROCA Rishabh DaiyaPas encore d'évaluation

- 2 Sec 164 167 Disqualification VacationDocument7 pages2 Sec 164 167 Disqualification VacationKumar SwamyPas encore d'évaluation

- Allied Law SectionsDocument18 pagesAllied Law SectionsKumar SwamyPas encore d'évaluation

- Accounting Standard 18 - Related Party Disclosures PDFDocument9 pagesAccounting Standard 18 - Related Party Disclosures PDFKumar SwamyPas encore d'évaluation

- Accounting Standard 18 - Related Party DisclosuresDocument3 pagesAccounting Standard 18 - Related Party DisclosuresKumar SwamyPas encore d'évaluation

- Allied Law Competation ActDocument26 pagesAllied Law Competation ActKumar SwamyPas encore d'évaluation

- Direct Tax Amendments May Nov 19 New by CA Siddartha SuranaDocument17 pagesDirect Tax Amendments May Nov 19 New by CA Siddartha SuranaKumar SwamyPas encore d'évaluation

- AMA May 2019Document15 pagesAMA May 2019Kumar SwamyPas encore d'évaluation

- 201 SFM Past Exam Analysis For Nov 2018Document1 page201 SFM Past Exam Analysis For Nov 2018Kumar SwamyPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 5 Time Inc Vs ReyesDocument16 pages5 Time Inc Vs ReyesKrisia OrensePas encore d'évaluation

- Protecting banks and depositorsDocument3 pagesProtecting banks and depositorsSur ReyPas encore d'évaluation

- Insurance offer letter summaryDocument8 pagesInsurance offer letter summaryDivya SinghPas encore d'évaluation

- Duties of Bailee: Dip Jyoti ChakrabortyDocument6 pagesDuties of Bailee: Dip Jyoti ChakrabortyAmandeep MalikPas encore d'évaluation

- Valueandethicsofpublicresponsibility REPORTFINALDocument18 pagesValueandethicsofpublicresponsibility REPORTFINALarchieveda100% (1)

- PHILCONSA vs. ENRIQUEZ examines constitutionality of presidential vetoesDocument3 pagesPHILCONSA vs. ENRIQUEZ examines constitutionality of presidential vetoesSwitzel SambriaPas encore d'évaluation

- United States v. Robyn Dipietro, 936 F.2d 6, 1st Cir. (1991)Document11 pagesUnited States v. Robyn Dipietro, 936 F.2d 6, 1st Cir. (1991)Scribd Government DocsPas encore d'évaluation

- How To Speak Clearly Speaking and Pronounciation For Clear SpeeDocument2 pagesHow To Speak Clearly Speaking and Pronounciation For Clear SpeeAkshay GoelPas encore d'évaluation

- CONSTITUTIONAL LAW CASE DIGESTSDocument564 pagesCONSTITUTIONAL LAW CASE DIGESTSJotham FunclaraPas encore d'évaluation

- Montejo Vs COMELECDocument3 pagesMontejo Vs COMELECJuris MendozaPas encore d'évaluation

- Ellorimo - Digest-Heirs of Cabal Vs Sps CabalDocument4 pagesEllorimo - Digest-Heirs of Cabal Vs Sps CabalReghEllorimoPas encore d'évaluation

- CASTILLO vs. CRUZ, G.R. No. 182165Document1 pageCASTILLO vs. CRUZ, G.R. No. 182165Anonymous NqaBAy100% (1)

- 04 Practice & Regulation of The ProfessionDocument7 pages04 Practice & Regulation of The Professionrandomlungs121223Pas encore d'évaluation

- DistillationDocument10 pagesDistillationLiz BargolaPas encore d'évaluation

- James G. Ong v. CA, 310 Scra 1 (1999)Document5 pagesJames G. Ong v. CA, 310 Scra 1 (1999)Fides DamascoPas encore d'évaluation

- Difference Between Ejusdem Generis and Noscitur A SociisDocument1 pageDifference Between Ejusdem Generis and Noscitur A SociisTEJASV SINGHPas encore d'évaluation

- Oil Price Stabilization Fund RulingDocument6 pagesOil Price Stabilization Fund Rulingabakada_kaye100% (1)

- Champagne v. Marshal, 1st Cir. (2004)Document7 pagesChampagne v. Marshal, 1st Cir. (2004)Scribd Government DocsPas encore d'évaluation

- UGANDA Computer Misuse Act No. 2 of 2011Document24 pagesUGANDA Computer Misuse Act No. 2 of 2011Gregory KagoohaPas encore d'évaluation

- DeJean v. Grosz, 10th Cir. (2016)Document12 pagesDeJean v. Grosz, 10th Cir. (2016)Scribd Government DocsPas encore d'évaluation

- Greenwich Ballistics v. Jamison InternationalDocument10 pagesGreenwich Ballistics v. Jamison InternationalPriorSmartPas encore d'évaluation

- 2009 Banking LawDocument29 pages2009 Banking LawAnge Buenaventura Salazar100% (1)

- Constitutional Validity of Minimum Wages ActDocument23 pagesConstitutional Validity of Minimum Wages ActNitish Kumar NaveenPas encore d'évaluation

- Good Governance & Indian ConstitutionDocument55 pagesGood Governance & Indian ConstitutionTarun Verma100% (3)

- NCR Guidelines Withdrawal From Debt ReviewDocument7 pagesNCR Guidelines Withdrawal From Debt Reviewapi-200738055Pas encore d'évaluation

- SAMPLE Motion To Expunge With Motion To ResolveDocument5 pagesSAMPLE Motion To Expunge With Motion To ResolveKarenliambrycejego RagragioPas encore d'évaluation

- Civpro NotesDocument33 pagesCivpro NotesBuen LibetarioPas encore d'évaluation

- P0012 - Bomba de Injecciòn MAMDocument4 pagesP0012 - Bomba de Injecciòn MAMMIGUEL PEÑAPas encore d'évaluation

- CD - 6. BAPCI Vs ObiasDocument3 pagesCD - 6. BAPCI Vs ObiasMykaPas encore d'évaluation