Académique Documents

Professionnel Documents

Culture Documents

Owning A Car

Transféré par

nemo_nadal0 évaluation0% ont trouvé ce document utile (0 vote)

22 vues3 pagesThe document discusses car ownership in the Philippines and how it has transitioned from a luxury to a necessity. It explains that the rapid increase in car ownership is largely due to the many auto loan providers that make purchasing a car more affordable through competitive rates, terms, and financing packages. It provides details on what banks and financing companies typically require for a car loan, such as a 30% downpayment, loan terms of 12-48 months, interest rates, affordability guidelines, and evaluating a borrower's credit history. Insurance and loan documentation processes are also outlined. In conclusion, it states that with the ease of obtaining auto loans, car ownership is no longer considered a luxury in the Philippines but rather a necessity.

Description originale:

Owning a Car

Titre original

Owning a Car

Copyright

© © All Rights Reserved

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe document discusses car ownership in the Philippines and how it has transitioned from a luxury to a necessity. It explains that the rapid increase in car ownership is largely due to the many auto loan providers that make purchasing a car more affordable through competitive rates, terms, and financing packages. It provides details on what banks and financing companies typically require for a car loan, such as a 30% downpayment, loan terms of 12-48 months, interest rates, affordability guidelines, and evaluating a borrower's credit history. Insurance and loan documentation processes are also outlined. In conclusion, it states that with the ease of obtaining auto loans, car ownership is no longer considered a luxury in the Philippines but rather a necessity.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

22 vues3 pagesOwning A Car

Transféré par

nemo_nadalThe document discusses car ownership in the Philippines and how it has transitioned from a luxury to a necessity. It explains that the rapid increase in car ownership is largely due to the many auto loan providers that make purchasing a car more affordable through competitive rates, terms, and financing packages. It provides details on what banks and financing companies typically require for a car loan, such as a 30% downpayment, loan terms of 12-48 months, interest rates, affordability guidelines, and evaluating a borrower's credit history. Insurance and loan documentation processes are also outlined. In conclusion, it states that with the ease of obtaining auto loans, car ownership is no longer considered a luxury in the Philippines but rather a necessity.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

OWNING A CAR: LUXURY OR NECESSITY?

Phil. Star Business

By: Ven V. Martelino

(Mr. Ven Martelino is the Vice President and Head of

Consumer Lending Group for Visayas & Mindanao of Asia

United Bank)

Time was when buying a car was considered a luxury, saving

all the money one can earn to afford a vehicle that cost a

lowly five-figure level at that time. Today, in spite of the

astronomical cost of vehicles, one cannot help but be

amazed at the ever-increasing car sales that contribute to

the growing traffic problem not only in Metro Manila but in

key provincial cities as well.

To a large extent, the rapid increase in car ownership is

caused by the presence of a multitude of auto loan

providers. Banks have encroached into the once territory of

financing companies, extending credit to address an

individual's need to own a car. Competition has once again

compelled banks and financing companies to come up with

affordable rates, reasonable terms and innovative financing

packages, making the purchase of a car, a lot easier on the

pocket.

Before you take out a car loan, familiarize yourself with

some of the things that banks and financing companies

require and look for.

1. Downpayment - in general, the standard equity

requirement is 30% of the cost of unit. The higher the

downpayment the lesser the amortization will be.

2. Term - loan repayment period, which is usually from

12 to 48 months. Terms longer than this would be

more of an exception rather than a rule.

3. Rates - interest rate is expressed on an "add on" basis,

which means that total interest is added to the principal

or loanable amount and divided by the term of the loan

to arrive at the monthly amortization.

4. Affordability - monthly amortization should be no

more than 30% of combined income of the borrower

and spouse.

5. Character - borrower should exhibit satisfactory credit

history.

It is a standard practice for car dealers to offer buyers

financing and other promotional schemes. These financing

schemes are normally "packaged" in coordination with banks

and financing companies. Some of these promotional offers

involve zero interest or low downpayment schemes. Zero

interest scheme basically means that the dealers pass on to

the bank or financing company the equivalent of the

discount they are giving their cash buyers. The bank or

financing company pays the dealer the discounted amount of

the car that the buyer/borrower wants to buy and assumes

the credit risk. For the dealers, this is no different from a

cash sale. For the bank or financing company, it is no

different from a regular car loan, since they get the

equivalent amount of interest by way of the discount.

On a selective basis, banks and financing companies may

also finance used or second-hand cars; but this requires a

higher downpayment and usually has shorter term. In

addition, a unit inspection is conducted to determine the

overall condition of the used car and its value. A car history

is likewise conducted to check and ascertain the validity of

the registration.

For the protection of the borrower and the bank's or

financing company's interest, a comprehensive car insurance

coverage is usually required with the bank or financing

company as the beneficiary or loss payee.

Mortgage is registered by the bank or financing company

with the appropriate government agency and duly annotated

in the certificate of registration with the Land Transportation

Office, all cost of which are for the account of the borrower.

One word of caution though: don't expect the bank or

financing company to take care of canceling the chattel

mortgage when you have fully paid up your car loan. What is

given to the borrower is a "release of mortgage" document,

which is needed to cancel the chattel mortgage.

Much like housing loans, the keen competition among banks

and financing companies in coming up with car loan

packages all the more makes it easier for the individual to

own a car.

And with the ease of availing credit for auto loan, owning a

car has ceased to be a LUXURY, but more of a NECESSITY

Vous aimerez peut-être aussi

- Car Loan and Finance Management NewDocument27 pagesCar Loan and Finance Management NewAman BasantwaniPas encore d'évaluation

- Group 7 F2Document37 pagesGroup 7 F2Payal SarafPas encore d'évaluation

- Dubai Islamic Bank Car IjarahDocument18 pagesDubai Islamic Bank Car IjarahBaniya KhanPas encore d'évaluation

- Nderstanding AR Inancing: U F Y CDocument4 pagesNderstanding AR Inancing: U F Y Ccalirican15Pas encore d'évaluation

- Internship ReportDocument10 pagesInternship ReportAman BasantwaniPas encore d'évaluation

- Getting A Car LoanDocument6 pagesGetting A Car LoanAnon BoletusPas encore d'évaluation

- Car Finance Islamic BankingDocument14 pagesCar Finance Islamic BankingNouman SarwarPas encore d'évaluation

- Bhavesh ProjectDocument81 pagesBhavesh Projectattalr54Pas encore d'évaluation

- Module 6B CreditDocument41 pagesModule 6B CreditLorejhen VillanuevaPas encore d'évaluation

- Auto FinanceDocument24 pagesAuto FinanceAyesha AcademicukPas encore d'évaluation

- Introduction To Car LoanDocument39 pagesIntroduction To Car Loanjaspreet singhPas encore d'évaluation

- Subject: Credit Analysis and Advances Vehicles Loan Auto Loans An Overview in Nepal: Auto Loans/hire Purchase Loans, One of The ConsumerDocument17 pagesSubject: Credit Analysis and Advances Vehicles Loan Auto Loans An Overview in Nepal: Auto Loans/hire Purchase Loans, One of The ConsumerAnkit NeupanePas encore d'évaluation

- Financial Exercise AnswerDocument15 pagesFinancial Exercise AnswerJoy ReAliza GuerreroPas encore d'évaluation

- Making Automobile and Housing Decision: Prepared byDocument37 pagesMaking Automobile and Housing Decision: Prepared byikwanudinPas encore d'évaluation

- Ep 3qtr2008 Part2 Agarwal Etal PDFDocument12 pagesEp 3qtr2008 Part2 Agarwal Etal PDFPetal Kate CornelioPas encore d'évaluation

- Vehicle Finance Financial Bubble WPDocument16 pagesVehicle Finance Financial Bubble WPAnkit SainiPas encore d'évaluation

- Auto Finance Business PlanDocument24 pagesAuto Finance Business PlansolomonPas encore d'évaluation

- Fast Facts How Much Will It Cost?: BewareDocument2 pagesFast Facts How Much Will It Cost?: BewareFlaviub23Pas encore d'évaluation

- Best Practices For Maximizing ProfitabilityDocument7 pagesBest Practices For Maximizing ProfitabilityAndrew ArmstrongPas encore d'évaluation

- Pratul C Lobo - MMS Marketing - Need Analysis of Auto Loan Customers - ICICI BankDocument51 pagesPratul C Lobo - MMS Marketing - Need Analysis of Auto Loan Customers - ICICI Bankankit0225Pas encore d'évaluation

- Final Project Thanuja Vehicle LoanDocument88 pagesFinal Project Thanuja Vehicle LoanRakeshPas encore d'évaluation

- Questionnaire Auto Loan CustomersDocument51 pagesQuestionnaire Auto Loan Customerssarvesh.bharti71% (7)

- First Time Auto Buyer: Presented by Brad CleggDocument30 pagesFirst Time Auto Buyer: Presented by Brad CleggDiki RasaptaPas encore d'évaluation

- How Interest Rates Work On Car LoansDocument3 pagesHow Interest Rates Work On Car LoansKurt Del RosarioPas encore d'évaluation

- There Are 3 Types of Car Loans Available in IndiaDocument11 pagesThere Are 3 Types of Car Loans Available in IndiaAshis Kumar MuduliPas encore d'évaluation

- FT224 The Car Buyers HandbookDocument19 pagesFT224 The Car Buyers HandbooklantolPas encore d'évaluation

- MATH +what Is Investment and LoanDocument11 pagesMATH +what Is Investment and LoanJhoana MaePas encore d'évaluation

- Growth of Consumer Financing in PakistanDocument7 pagesGrowth of Consumer Financing in Pakistannimra khaliqPas encore d'évaluation

- Business and Consumer Loan: What Is The Difference Between Bonds and Loans?Document10 pagesBusiness and Consumer Loan: What Is The Difference Between Bonds and Loans?Dandreb SardanPas encore d'évaluation

- Equity Financing Small Business AdministrationDocument8 pagesEquity Financing Small Business AdministrationrajuPas encore d'évaluation

- Consumer Credit: Submitted By: Aayush Behal Shashank Singh Manik MittalDocument61 pagesConsumer Credit: Submitted By: Aayush Behal Shashank Singh Manik Mittalmanik_mittal30% (1)

- Life of A Loan, GM FinancialDocument12 pagesLife of A Loan, GM Financialed_nycPas encore d'évaluation

- Unit 05 - Principles of Bank LendingDocument18 pagesUnit 05 - Principles of Bank LendingSayak GhoshPas encore d'évaluation

- What Do Banks Look at WhenDocument7 pagesWhat Do Banks Look at WhenlykaPas encore d'évaluation

- Personal Loan Products: New Car LoansDocument18 pagesPersonal Loan Products: New Car LoanssuvarnarathodPas encore d'évaluation

- DBRS Auto Lease Securitizations PrimerDocument21 pagesDBRS Auto Lease Securitizations PrimerPropertywizzPas encore d'évaluation

- Synopsis: Submitted in The Partial Fulfillment of Requireent For The Award of The Degree ofDocument21 pagesSynopsis: Submitted in The Partial Fulfillment of Requireent For The Award of The Degree ofsakaray mohana vidyaPas encore d'évaluation

- CFPB Examination Procedures Auto FinanceDocument54 pagesCFPB Examination Procedures Auto FinanceBrandace Hopper100% (2)

- Buying A Used CarDocument20 pagesBuying A Used Carapi-3805479Pas encore d'évaluation

- Procedures For AppraisalDocument8 pagesProcedures For AppraisalsairamPas encore d'évaluation

- Literature Review On Auto LoanDocument6 pagesLiterature Review On Auto Loansvgkjqbnd100% (1)

- Retail Banking - IcicibankDocument69 pagesRetail Banking - IcicibankKaataRanjithkumarPas encore d'évaluation

- Five Steps For CreditDocument2 pagesFive Steps For CreditjohnribarPas encore d'évaluation

- Fms AssignmentDocument6 pagesFms AssignmentGloir StoriesPas encore d'évaluation

- Consumer FinanceDocument2 pagesConsumer Financeanupam6999Pas encore d'évaluation

- Hire Purchase Sumathi AnkitaDocument18 pagesHire Purchase Sumathi Ankitasudharshanshervegar100% (1)

- PDS Vehicle Financing-I PDFDocument8 pagesPDS Vehicle Financing-I PDFakusuperPas encore d'évaluation

- Solutions For End-of-Chapter Questions and Problems: Chapter TenDocument27 pagesSolutions For End-of-Chapter Questions and Problems: Chapter TenYasser AlmishalPas encore d'évaluation

- Unit Iv Regulatory Framework & Taxation: Cross Border TransactionsDocument34 pagesUnit Iv Regulatory Framework & Taxation: Cross Border TransactionsRavi PrabuPas encore d'évaluation

- Consumer CreditDocument41 pagesConsumer CreditRup HunkPas encore d'évaluation

- Chapter 1b Retail Lending - Other ProductsDocument22 pagesChapter 1b Retail Lending - Other ProductsRishi SharmaPas encore d'évaluation

- Institute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingDocument1 pageInstitute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingSPas encore d'évaluation

- Lesson 03b Understanding MoneyDocument29 pagesLesson 03b Understanding MoneyVjion BeloPas encore d'évaluation

- Chapter 7. Consumer CreditDocument27 pagesChapter 7. Consumer CreditshitalPas encore d'évaluation

- Hinduja Leyland Finance LTDDocument42 pagesHinduja Leyland Finance LTDparamjeet99100% (6)

- Assignment 1 Medium and Long Term FinancingDocument12 pagesAssignment 1 Medium and Long Term FinancingMohit SahajpalPas encore d'évaluation

- Car Loan FinalDocument21 pagesCar Loan Finalislamkilaniya66100% (1)

- Affidavit of UndertakingDocument2 pagesAffidavit of Undertakingnemo_nadalPas encore d'évaluation

- General Purpose Loan - FillableDocument2 pagesGeneral Purpose Loan - Fillablenemo_nadalPas encore d'évaluation

- Foundlings Are Natural BornDocument3 pagesFoundlings Are Natural Bornnemo_nadalPas encore d'évaluation

- (New) NOTICE OF BORROWINGrevisedDocument1 page(New) NOTICE OF BORROWINGrevisednemo_nadalPas encore d'évaluation

- Secretary Certificate 1999Document2 pagesSecretary Certificate 1999nemo_nadalPas encore d'évaluation

- Sample Payslip KASAMBAHAY LAW PDFDocument1 pageSample Payslip KASAMBAHAY LAW PDFnemo_nadalPas encore d'évaluation

- Ra 3844Document31 pagesRa 3844nemo_nadalPas encore d'évaluation

- 7 Things You Should Never Say To Your ToddlerDocument4 pages7 Things You Should Never Say To Your Toddlernemo_nadalPas encore d'évaluation

- LEASE CONTRACT - Fillable PDFDocument2 pagesLEASE CONTRACT - Fillable PDFnemo_nadalPas encore d'évaluation

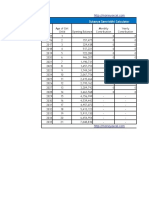

- Housing Loan Amortization Factor in MonthsDocument11 pagesHousing Loan Amortization Factor in Monthsnemo_nadalPas encore d'évaluation

- Negative Pledge Covenant PDFDocument89 pagesNegative Pledge Covenant PDFnemo_nadal0% (1)

- AAF014 - Deed of Conditional Sale (Installment Sale) - v02Document6 pagesAAF014 - Deed of Conditional Sale (Installment Sale) - v02maxx villa100% (2)

- LEASE CONTRACT - Fillable PDFDocument2 pagesLEASE CONTRACT - Fillable PDFnemo_nadalPas encore d'évaluation

- (New) NOTICE OF BORROWINGrevisedDocument1 page(New) NOTICE OF BORROWINGrevisednemo_nadalPas encore d'évaluation

- General Purpose Loan - FillableDocument2 pagesGeneral Purpose Loan - Fillablenemo_nadalPas encore d'évaluation

- 8990 - Addendum To MoaDocument5 pages8990 - Addendum To Moanemo_nadal100% (1)

- PFF024 - AffidavitUndertakingSingleProprietorship - V01Document2 pagesPFF024 - AffidavitUndertakingSingleProprietorship - V01nemo_nadal100% (1)

- Application For Modified General Purpose Loan: Under Res. No. 21, Series of 2014Document3 pagesApplication For Modified General Purpose Loan: Under Res. No. 21, Series of 2014nemo_nadalPas encore d'évaluation

- MOA With LGU (Housing)Document4 pagesMOA With LGU (Housing)nemo_nadal100% (2)

- Proof of Surviving Legal HeirsDocument3 pagesProof of Surviving Legal HeirsLecel Llamedo0% (1)

- PFF024 - AffidavitUndertakingSingleProprietorship - V01Document2 pagesPFF024 - AffidavitUndertakingSingleProprietorship - V01nemo_nadal100% (1)

- Application For Modified General Purpose Loan: Under Res. No. 21, Series of 2014Document3 pagesApplication For Modified General Purpose Loan: Under Res. No. 21, Series of 2014nemo_nadalPas encore d'évaluation

- Pag-Ibig Membership FlowchartDocument1 pagePag-Ibig Membership FlowchartJojo Aboyme CorcillesPas encore d'évaluation

- MOA (Provident)Document5 pagesMOA (Provident)nemo_nadalPas encore d'évaluation

- Notice of Borrowing: (Exhibit A - Loan Agreement)Document1 pageNotice of Borrowing: (Exhibit A - Loan Agreement)nemo_nadalPas encore d'évaluation

- IL14-4 Promissory NoteDocument2 pagesIL14-4 Promissory Notenemo_nadalPas encore d'évaluation

- Sample Payslip KASAMBAHAY LAW PDFDocument1 pageSample Payslip KASAMBAHAY LAW PDFnemo_nadalPas encore d'évaluation

- Revised Application Form For SPECIAL LOAN 2014Document2 pagesRevised Application Form For SPECIAL LOAN 2014nemo_nadalPas encore d'évaluation

- Affidavit of UndertakingDocument2 pagesAffidavit of Undertakingnemo_nadalPas encore d'évaluation

- Ila RemDocument4 pagesIla Remnemo_nadalPas encore d'évaluation

- Capital One BankDocument4 pagesCapital One BankAllen SIMEON86% (7)

- Atul LTDDocument27 pagesAtul LTDFast SwiftPas encore d'évaluation

- Sukanya Samriddhi Calculator VariableDocument38 pagesSukanya Samriddhi Calculator VariableRam SewakPas encore d'évaluation

- Udhari: Nasir Ali StatementDocument2 pagesUdhari: Nasir Ali StatementAshish MishraPas encore d'évaluation

- Analysis of Australian Financial SystemDocument20 pagesAnalysis of Australian Financial SystemSUMAN BERAPas encore d'évaluation

- Chapter 2: Audit of Cash and Cash Equivalents: Internal Control Over CashDocument35 pagesChapter 2: Audit of Cash and Cash Equivalents: Internal Control Over CashEmey CalbayPas encore d'évaluation

- Financial Statement Analysis of Habib BankDocument87 pagesFinancial Statement Analysis of Habib Bankhelperforeu56% (9)

- Offshore Finance.Document34 pagesOffshore Finance.Karan Asrani100% (1)

- Trust Receipts Law PD 115Document57 pagesTrust Receipts Law PD 115Venice SantibañezPas encore d'évaluation

- 201272163237draft Prospectus - Jointeca Education Solutions Limited - FinalDocument220 pages201272163237draft Prospectus - Jointeca Education Solutions Limited - FinalNimalanPas encore d'évaluation

- 1 - 1st September 2007 (010907)Document4 pages1 - 1st September 2007 (010907)Chaanakya_cuimPas encore d'évaluation

- AXIS BANK-Wealth ManagementDocument155 pagesAXIS BANK-Wealth Managementakanungo91% (11)

- Risk Management in BanksDocument32 pagesRisk Management in Banksanon_595315274100% (1)

- T AccountsDocument4 pagesT AccountsMaks MaksPas encore d'évaluation

- Project Report of Share KhanDocument111 pagesProject Report of Share Khanchintan782% (11)

- TIFDDocument1 pageTIFDAtulPas encore d'évaluation

- The Vishakhapatnam Co-Operative Bank LTD.: On-Line Examination - Recruitment of Probationary Officers (Asst. Managers)Document5 pagesThe Vishakhapatnam Co-Operative Bank LTD.: On-Line Examination - Recruitment of Probationary Officers (Asst. Managers)AnushaPas encore d'évaluation

- PHN6WKI7 UPI Error and Response Codes V 2 3 1Document38 pagesPHN6WKI7 UPI Error and Response Codes V 2 3 1nikhil0000Pas encore d'évaluation

- Easy Creative Financing Techniques With Quick ClosesDocument3 pagesEasy Creative Financing Techniques With Quick Closesmel fellerPas encore d'évaluation

- IST 2021 Fee ChallanDocument1 pageIST 2021 Fee ChallanMuhammadPas encore d'évaluation

- Bataan Branch: Olytechnic Niversity of The Hilippines Office of The Vice President For Branches and Satellite CampusesDocument7 pagesBataan Branch: Olytechnic Niversity of The Hilippines Office of The Vice President For Branches and Satellite CampusesKim EllaPas encore d'évaluation

- Holder in Due Course CasesDocument9 pagesHolder in Due Course CasesGela Bea BarriosPas encore d'évaluation

- Application Format For Sub Agent (E SBTR)Document2 pagesApplication Format For Sub Agent (E SBTR)Rafikul RahemanPas encore d'évaluation

- 489 FDocument18 pages489 Fasgharkhankakar100% (2)

- 123Document5 pages123Bede Ramulfo Juntilla SedanoPas encore d'évaluation

- Chapter 5Document30 pagesChapter 5Jyoti Prakash BarikPas encore d'évaluation

- Basic Accounting Concepts and Case StudiesDocument114 pagesBasic Accounting Concepts and Case Studiesgajiniece429Pas encore d'évaluation

- Questions and Answers About Direct PLUS Loans For Graduate and Professional StudentsDocument2 pagesQuestions and Answers About Direct PLUS Loans For Graduate and Professional Studentsistuff28Pas encore d'évaluation

- Lakpue Drug, Inc., La G.R. No. 166379 Croesus Pharma, Inc., Tropical Biological Phils., INC. (All Known As LAKPUE GROUP of Companies) And/Or Enrique Castillo, JR.Document7 pagesLakpue Drug, Inc., La G.R. No. 166379 Croesus Pharma, Inc., Tropical Biological Phils., INC. (All Known As LAKPUE GROUP of Companies) And/Or Enrique Castillo, JR.Dom Robinson BaggayanPas encore d'évaluation

- Industrial Finance Corp. v. TobiasDocument1 pageIndustrial Finance Corp. v. TobiasJennilyn TugelidaPas encore d'évaluation