Académique Documents

Professionnel Documents

Culture Documents

View your Tesla pay statement online

Transféré par

kelle brassartTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

View your Tesla pay statement online

Transféré par

kelle brassartDroits d'auteur :

Formats disponibles

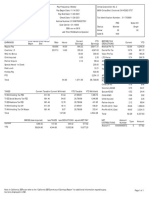

Tesla, Inc.

Pay Statement

12832 Frontrunner Blvd Period Start Date 12/17/2018

Draper, UT 84020

Period End Date 12/30/2018

510-249-3520

Pay Date 01/04/2019

Document 3296657

Net Pay $1,766.49

Pay Details

Walter Emmons Employee Number 699857 Pay TMI - Bi-Weekly Federal Income Tax S 0

219 s 6th st SSN XXX-XX-XXXX Group CA State Income Tax (Residence) S 0

Patterson, CA 95363 Job Production Associate Location NA-US-CA-Fremont-CDC CA State Income Tax (Work) S 0

USA Pay Rate $19.0000 Cost 172000 - Fremont - Model 3 -

Center Assem

Pay Frequency Biweekly

SIO G5000 - Direct Labor

Project

AX 77 - NA-US-CA-Fremont-CDC

Location

Earnings

Pay Type Week Hours Pay Rate Current YTD

Regular Pay 2nd SFT 1 40.0000 $20.9000 $836.00

Overtime 1 13.0500 $31.3502 $409.12

Paid Time Off 1 2.0000 $20.9000 $41.80

Regular Pay 2nd SFT 2 24.0000 $20.9000 $501.60 $1,337.60

Overtime 2 11.2500 $31.3502 $352.69 $761.81

Paid Time Off 2 16.0000 $20.9000 $334.40 $376.20

Holiday 2 16.0000 $19.0000 $304.00 $304.00

Group Term Life 2 $1.25 $1.25

Total Hours Paid 122.3000

Deductions

Employee Employer

Deduction Pre-Tax Current YTD Current YTD

401k Yes $277.96 $277.96 $0.00 $0.00

Dental Pretax Yes $5.00 $5.00 $0.00 $0.00

Group Term Life No $1.25 $1.25 $0.00 $0.00

Medical Pretax Yes $15.00 $15.00 $0.00 $0.00

Vision Yes $2.50 $2.50 $0.00 $0.00

Taxes

Tax Current YTD

Federal Income Tax $353.97 $353.97

Employee Medicare $40.00 $40.00

Social Security Employee Tax $171.02 $171.02

CA State Income Tax $120.10 $120.10

CA Disability Employee $27.57 $27.57

Paid Time Off Net Pay Distribution

Plan Balance Account Number Account Type Amount

Paid Time Off 12.2200 xxxxxx6463 Checking $1,766.49

Total $1,766.49

Pay Summary

Gross FIT Taxable Wages Taxes Deductions Net Pay

Current $2,780.86 $2,480.40 $712.66 $301.71 $1,766.49

YTD $2,780.86 $2,480.40 $712.66 $301.71 $1,766.49

vsn 20180423

Vous aimerez peut-être aussi

- Cheesecakefacory PDFDocument1 pageCheesecakefacory PDFTate YatesPas encore d'évaluation

- Walmart Pay Stub Online VersionDocument5 pagesWalmart Pay Stub Online VersionLily NguyenPas encore d'évaluation

- Wage Earnings StatementDocument1 pageWage Earnings StatementDiana MartinezPas encore d'évaluation

- SSPOFADVDocument1 pageSSPOFADVKaren OHarePas encore d'évaluation

- Double R Earnings Statement PaycheckDocument1 pageDouble R Earnings Statement PaycheckLadis andradePas encore d'évaluation

- StatementDocument1 pageStatementWaifubot 2.1Pas encore d'évaluation

- Keon MillerDocument4 pagesKeon MillerKeon MillerPas encore d'évaluation

- Adp Pay Stub Template 1Document1 pageAdp Pay Stub Template 1Candy ValentinePas encore d'évaluation

- Earnings Statement TitleDocument1 pageEarnings Statement TitleScott DoePas encore d'évaluation

- Full Payroll Summary: Net PayDocument2 pagesFull Payroll Summary: Net PayJuan Ignacio Ramirez JaramilloPas encore d'évaluation

- Celestine 5Document1 pageCelestine 5Nicole Caruther0% (1)

- 5419 N Sheridan RD Chicago, IL 60640-1917 773-878-7340 Restaurant Personnel IncDocument2 pages5419 N Sheridan RD Chicago, IL 60640-1917 773-878-7340 Restaurant Personnel IncLizbhet PazPas encore d'évaluation

- Gina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursDocument4 pagesGina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursGigi EggletonPas encore d'évaluation

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableMorenita ParelesPas encore d'évaluation

- Sspusadv PDFDocument1 pageSspusadv PDFKIMPas encore d'évaluation

- CheckStub 2023 05 19Document1 pageCheckStub 2023 05 19Trevor NelsonPas encore d'évaluation

- View paystub details like earnings, taxes, deductionsDocument1 pageView paystub details like earnings, taxes, deductionsjohnathan greyPas encore d'évaluation

- Pay StubDocument1 pagePay StubLulu HuttonPas encore d'évaluation

- Get Payslip by OffsetDocument1 pageGet Payslip by OffsetDarryl WhiteheadPas encore d'évaluation

- Earnings: Our Lady of Peace Ruth MbaDocument1 pageEarnings: Our Lady of Peace Ruth MbaNanga wolosoPas encore d'évaluation

- July PAY STUB 03Document1 pageJuly PAY STUB 03enudo SolomonPas encore d'évaluation

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableMorenita Pareles100% (1)

- Payslip detailsDocument2 pagesPayslip detailsTrenika SwainPas encore d'évaluation

- PaystubDocument1 pagePaystubOrbarsPas encore d'évaluation

- Adp QUANIC MARTIN-converted (1st Try)Document12 pagesAdp QUANIC MARTIN-converted (1st Try)Quanic Martin100% (1)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableAdam MartensPas encore d'évaluation

- File 1831Document1 pageFile 183176xzv4kk5vPas encore d'évaluation

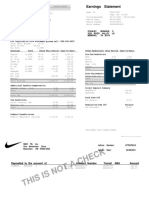

- Direct Deposit Advice This Is Not A CheckDocument1 pageDirect Deposit Advice This Is Not A CheckAlex RoofPas encore d'évaluation

- Non Negotiable - This Is Not A Check - Non NegotiableDocument1 pageNon Negotiable - This Is Not A Check - Non NegotiableAlexa PribisPas encore d'évaluation

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့Pas encore d'évaluation

- Paystub 3Document1 pagePaystub 3J RequenaPas encore d'évaluation

- Married 0: 401 14Th Street North, Kerkoven, MN 56252Document1 pageMarried 0: 401 14Th Street North, Kerkoven, MN 56252Scott DoePas encore d'évaluation

- 9:30:22Document1 page9:30:22Rosa Medina AlbarránPas encore d'évaluation

- Earnings Statement BreakdownDocument1 pageEarnings Statement BreakdownTJ JanssenPas encore d'évaluation

- WI Employee Earnings Statement May 2021Document1 pageWI Employee Earnings Statement May 2021MikkyPas encore d'évaluation

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableTJ JanssenPas encore d'évaluation

- Earnings Statement: Earnings Other Benefits and Information DepositsDocument1 pageEarnings Statement: Earnings Other Benefits and Information Depositshitta100% (1)

- Hersey K Delynn PayStubDocument1 pageHersey K Delynn PayStubSharon JonesPas encore d'évaluation

- Robert C Binson Sept 02 2022 Oct 01 2022Document1 pageRobert C Binson Sept 02 2022 Oct 01 2022Ticket Master100% (1)

- Paystub For 11-08-2019Document1 pagePaystub For 11-08-2019Roberin SegarPas encore d'évaluation

- Statement 042023 0603Document4 pagesStatement 042023 0603s8hynpcq5z0% (1)

- Earnings: Hourly Ot Sick Cctips Mealper Prempay RetailcomDocument1 pageEarnings: Hourly Ot Sick Cctips Mealper Prempay Retailcomalfredo velezPas encore d'évaluation

- Earnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Document1 pageEarnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Miquel JonesPas encore d'évaluation

- Sspofadv 4Document1 pageSspofadv 4Antoni Zelaya0% (1)

- Nieves 1Document1 pageNieves 1carterPas encore d'évaluation

- Pay Stub DetailsDocument1 pagePay Stub Detailsdtk servicePas encore d'évaluation

- DJ L Pay Stubs 2Document1 pageDJ L Pay Stubs 2jase0% (1)

- Earnings Statement: SSN: XXX-XX-2691Document1 pageEarnings Statement: SSN: XXX-XX-2691emily ambrosino0% (2)

- To 121520 Pay StubDocument1 pageTo 121520 Pay Stubsulaimon2023Pas encore d'évaluation

- Attachment 1 4Document1 pageAttachment 1 4Tabbitha CampfieldPas encore d'évaluation

- Earnings Current YTD Amount Current Units YTD Units: Town of Guttenberg 6808 Park Avenue Guttenberg, NJ 07093Document1 pageEarnings Current YTD Amount Current Units YTD Units: Town of Guttenberg 6808 Park Avenue Guttenberg, NJ 07093Alfredo MurrugarraPas encore d'évaluation

- Tinder Credit Union Bank StatementDocument3 pagesTinder Credit Union Bank Statementdudu adul100% (1)

- Macy's Earnings StatementDocument1 pageMacy's Earnings StatementLiz MatzPas encore d'évaluation

- Demetrious Dabadee 08-15-2023-3Document1 pageDemetrious Dabadee 08-15-2023-3Irfan khanPas encore d'évaluation

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableYanet AlvarezPas encore d'évaluation

- PDF DocumentDocument1 pagePDF DocumentjoelPas encore d'évaluation

- Account Summary Payment Information: New Balance $135.86Document6 pagesAccount Summary Payment Information: New Balance $135.86thinh thanhPas encore d'évaluation

- 04 17 2022 Paystub - 1Document1 page04 17 2022 Paystub - 1Destiny SmithPas encore d'évaluation

- Account Number Statement Period: ActivityDocument2 pagesAccount Number Statement Period: ActivityAshley KingPas encore d'évaluation

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeD'EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadePas encore d'évaluation

- Committee Types and Roles: Valerie HeitshusenDocument4 pagesCommittee Types and Roles: Valerie HeitshusenChristine Aev OlasaPas encore d'évaluation

- Impact of Macroeconomic Policies To The Unemployment Situation in The PhilippinesDocument7 pagesImpact of Macroeconomic Policies To The Unemployment Situation in The Philippineskenah suzzane angPas encore d'évaluation

- Answers For Test-secEDocument4 pagesAnswers For Test-secEAbhishek Sharda100% (1)

- Security Rmc39 07Document2 pagesSecurity Rmc39 07Printet08Pas encore d'évaluation

- FHBM1024 Microeconomics and Macroeconomics: Welcome ToDocument39 pagesFHBM1024 Microeconomics and Macroeconomics: Welcome ToAllen FoureverPas encore d'évaluation

- Lec-14A - Chapter 34 - The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument50 pagesLec-14A - Chapter 34 - The Influence of Monetary and Fiscal Policy On Aggregate DemandMsKhan0078Pas encore d'évaluation

- Article CritiqueDocument2 pagesArticle CritiqueDennielkyle Dominguez80% (5)

- Vat3 FormDocument2 pagesVat3 FormMacharia MainaPas encore d'évaluation

- Inflation: Amity Business SchoolDocument15 pagesInflation: Amity Business Schoolkeerthika12311Pas encore d'évaluation

- Impact of Reforms on Indian LabourDocument18 pagesImpact of Reforms on Indian LabourAnirban ChakrabortyPas encore d'évaluation

- BSP Primer - Exchange RateDocument14 pagesBSP Primer - Exchange RateCarlo Bryan CortezPas encore d'évaluation

- Charles Dallara Speech To The Hellenic Bank AssociationDocument11 pagesCharles Dallara Speech To The Hellenic Bank AssociationCEInquiryPas encore d'évaluation

- Inequality in Income DistributionDocument12 pagesInequality in Income DistributionIsham TanejaPas encore d'évaluation

- FULL CONVERTIBILITY OF INDIAN RUPEEDocument18 pagesFULL CONVERTIBILITY OF INDIAN RUPEEankur jaiswalPas encore d'évaluation

- Ijmra 13524 PDFDocument12 pagesIjmra 13524 PDFAhmadPas encore d'évaluation

- Display of Details For Tariff or DescriptionDocument2 pagesDisplay of Details For Tariff or DescriptionZankar R ParikhPas encore d'évaluation

- 2020 Specimen Paper 1Document10 pages2020 Specimen Paper 1mohdportmanPas encore d'évaluation

- FII Inflows Impacted by Inflation, Exchange RatesDocument10 pagesFII Inflows Impacted by Inflation, Exchange RateshajashaikPas encore d'évaluation

- Return Note - BRH12188307Document1 pageReturn Note - BRH12188307JamesPas encore d'évaluation

- Fiscal PolicyDocument24 pagesFiscal Policyરહીમ હુદ્દાPas encore d'évaluation

- Taylor J.B., Woodford M.-Handbook of Macroeconomics, Part 2-North Holland (1999)Document539 pagesTaylor J.B., Woodford M.-Handbook of Macroeconomics, Part 2-North Holland (1999)Raphael BacchiPas encore d'évaluation

- De minimis regimes overviewDocument3 pagesDe minimis regimes overviewMiguel Angel JaramilloPas encore d'évaluation

- Political Economy - by CSD in SrilankaDocument35 pagesPolitical Economy - by CSD in SrilankaSampath SamarakoonPas encore d'évaluation

- Microeconomics Chapter 6 SummaryDocument1 pageMicroeconomics Chapter 6 SummaryLanphuong Bui0% (1)

- Introduction To International Business Chapter 2Document65 pagesIntroduction To International Business Chapter 2Mohd Haffiszul Bin Mohd SaidPas encore d'évaluation

- Economic Calendar - Top 5 Things To Watch This Week: 10-Year Three-MonthDocument2 pagesEconomic Calendar - Top 5 Things To Watch This Week: 10-Year Three-MonthNazish KhanPas encore d'évaluation

- ImfDocument19 pagesImfDeepesh Singh100% (1)

- IBT Midterms ReviewerDocument7 pagesIBT Midterms ReviewerJhonica CabungcalPas encore d'évaluation

- Chapter 5-Trading Internationally: True/FalseDocument15 pagesChapter 5-Trading Internationally: True/FalseShae WillaimsPas encore d'évaluation

- Understanding Macroeconomics and its RelevanceDocument7 pagesUnderstanding Macroeconomics and its RelevanceSubrat RathPas encore d'évaluation