Académique Documents

Professionnel Documents

Culture Documents

Monthly Report: Fixed - Income Research

Transféré par

NguyenTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Monthly Report: Fixed - Income Research

Transféré par

NguyenDroits d'auteur :

Formats disponibles

Fixed – Income research

Monthly report May 15th, 2019

Fixed-Income Report Round-up

8.0% Bond yields

7.0%

April.2019 report

6.0%

In this issue 5.0%

Round-up 4.0%

Bond markets 3.0%

2.0%

Interest rates 01/16

04/16

07/16

10/16

01/17

04/17

07/17

10/17

01/18

04/18

07/18

10/18

01/19

04/19

2Y 3Y 5Y 7Y 10Y 15Y

Source: Bloomberg, VCBS

VND 12,576 billion (-11,90% mom) was mobilized on primary market. VND

175,690 billion (-12.34% mom) were traded on the secondary market in April 2019.

Yield curve fluctuated in a tight band. According to Bloomberg statistics, yields

Le Thu Ha

for 1Y, 2Y, 3Y, 5Y, 7Y, 10Y and 15Y end April.2019 at 3.247% (-1 bps mom), 3.485%

+84 4 3936 6990 (ext.7182) (+11.2 bps mom), 3.592% (+8.4 bps mom), 3.915% (+3.7 bps mom), 4.267% (+6.7 bps

ltha_ho@vcbs.com.vn mom), 4.797% (-2.8 bps mom), 5.152% (+0.4 bps mom), respectively.

Foreign net bought VND 48.18 billion.

Dang Khanh Linh After rebounded at the beginning of April, interbank rates became steady. In the

+84 4 3936 6990 (ext.7183) first half of April, ON tenor peaked at 4,2%; however, according to Bloomberg statistics,

yields for 1Y, 2Y, 3Y, 5Y, 7Y, 10Y and 15Y ended April 2019 at 2.84%, 3.01%, 3.27%,

ltha_ho@vcbs.com.vn 3.48% and 4.08% decreased sharply compared to the previous month.

SBV net withdrew VND 46,427 bn via OMO channel.

VCBS Commentary

In May, VCBS anticipate that bond yields are under more upward pressure but

the pressure if any shall not be overwhelmed. The expectations of market members

become significantly cautious when potential profits are not commensurate with risks and

See Disclaimer at Page 7 a higher level of capital’s costs.

Macroeconomic, Fixed-Income, The liquidity on the interbank market is expected to be stable and the average

Financial and Corporation interbank interest rates may continue to be higher than the same period last year, less likely

Information updated at to decrease sharply.

www.vcbs.com.vn/vn/Services/AnalysisResearch

Research Department VCBS Page | 0

Fixed-Income Report

BOND MARKETS

Primary Market

10Y and 15Y tenor bonds were mostly mobilized

VND 12,576 bn (-11.90% mom) VND 12,576 bn (-11.90% mom) worth of bonds were mobilized in April from the State

worth of bonds were mobilized. Treasury (ST) while winning volume focused on 10Y and 15Y tenors. In detail, VND 200 bn;

4,940 bn; 6,400 bn; 836 and 200 bn were mobilized in 5Y, 10Y, 15Y, 20Y and 30Y tenors,

respectively.

Winning rates remained in April. In detail, winning rate for 20Y decreased slightly 1 bp, while

winning rates for other tenors unchanged. Register-to-offering rate felt from 2.13 times last

month to 2.08 times this month. Winning-to-offering rate jumped from 51.91% to 67.65%.

Meanwhile, the Vietnam Development Bank (VDB) and Vietnam Bank for Social Policies

(VBSP) did not mobilize bonds this month.

50,000 Winning

rates

GB Auction results Vol (VND

Primary market 8.50% 12000

bn)

45,000

7.50% 10000

40,000

35,000 6.50% 8000

30,000 5.50% 6000

25,000 4.50% 4000

20,000 3.50% 2000

15,000 2.50% 0

May 02- May 04

May 21- May 25

Nov 26- Nov 30

Sep 24- Sep 28

Apr 08 - Apr 12

Nov 05-Nov 09

Jan 28- Feb 01

June 11 - June 15

Aug 13 - Aug 17

Mar 18- Mar 22

Oct 15- Oct 19

Sep 04 - Sep 09

Jan 07- Jan 11

Jul 02 - Jul 06

Jul 23 - Jul 27

Dec 17- Dec 21

Feb 25- Mar 01

10,000

5,000

0

Jan 18

Apr 18

Jun 18

Jul 18

Jan 19

Apr 19

Feb 18

Mar 18

Aug 18

Sep 18

Nov 18

Feb 19

Mar 19

May 18

Oct 18

Dec 18

Volume 5Y 7Y

ST VBSP VDB 10Y 15Y 20Y

Source: HNX, VCBS

State Tresury issuance plan updated:

On 24th April, State Tresury officialy released issuance plan for Q2.2019 with the total volume

of VND 80,000 bn. In our opinion, this plan is quite ambitious while the amount of matured

bonds in 2019 mostly focused on Q1.2019. The detailed plan is listed below.

Q2.2019 Issued in Issued in %completed %completed

Tenor 2019 Plan

plan 4M.2019 M4.2019 2019 Q2.2019

5Y 40,000 10,000 4,150 0 10.4% 0%

7Y 30,000 5,000 3,550 200 11.8% 4%

10Y 70,000 26,000 36,120 4,940 51.6% 19%

15Y 78,000 30,000 34,605 6,400 44.4% 21.3%

20Y 20,000 5,000 2,585 836 12.9% 16.72%

30Y 22,000 4,000 1,035 200 4.7% 5%

Total 260,000 80,000 82,045 12,576 31.6% 15.72%

Source:MOF, VCBS Research

Research Department VCBS Page | 1

Fixed-Income Report

Macro updates:

According to Nikkei, PMI in Vietnam reached 52.5 in April compared to 51.9 in the

previous month. Therein, job increased due to new order grew at a medium pace.

Meanwhile, GSO releases report on economic situation with same moderate growth

of manufacturing subsector. In detail, index of industrial production (IIP) increased

0.6% compared to the previous month and 9.3% growth recorded same period last

year. With these figures we still anticipate that GDP growth in Q2.2019 shall vary

from 6.67%-6.85%.

CPI in April of 2019 increased by 0.31% compared to last month, which equivalent to

an increase of 2.93% over the same period of 2018. Therein, the main reason was

consumer demand grew due to price of gasoline and electricity. Howerver, the

decrease of foods and food stuff prevented CPI from climbing up strongly. In

addition, we believe that the government is still on the right track with the goal of

controlling inflation at around 4% for the whole 2019 with drastic and close

measures. CPI in May is will expected to increase 0.3%-0.5% mom.

Throughout the SBV's legislative documents in recent years, we have seen a clear and

consistent message: (1) keep credit growth at a reasonable level, focus on growth’s

quality and efficiency; (2) operate monetary policy to keep stable interest rates and

appropriate deposit rates, maintain lending rates at a reasonable level; (3) continue to

deal with bad debts in accordance with the roadmap, plans and support the operations

of credit institutions. This orientation continues to be shown in the Draft Circular

amendmet to Circular 36 regulating the safety limits and ratios in the operation of

credit institutions and foreign bank branches being consulted for market members.

However, this means that the pressure on raising charter capital for banks will

increase significantly with effects such as increasing deposit interest rate level and

capital costs for the interbank market. Accordingly, VCBS adjusted the forecasts

for the increase of deposit interest rates for 2019 to 80 points compared to that of

increasing 50 points at the end of the year as mentioned in the previous report.

After FOMC Meeting on April 30-May 1, Fed announced to keep the interest rate

unchanged of 2.25% - 2.5% and no rate cut in the near future as market expected.

This decision is considered as a suitable move in the context of stable economy and

the labor market.

The latest movement around trade tensions between the US and China tends to

negatively affect market’s sentiment. In detail, The US Customs and Border

Protection Department has just announced a tax of USD 200 billion of Chinese

goods raised from 10% to 25% (May 10th). Shortly thereafter, the Ministry of

Commerce of China also announced the retaliatory morement. Besides, US-China

trade talks ended up with no deal in Washington.

Secondary market

Market liquidity remained in April.

VND 175,690 bn (-12.34% mom) VND 175,690 bn (-12.34% mom) traded on the secondary market. Market liquidity

traded on the secondary market. decreased slightly compared to the previous month but the average trading volume remained

high at VND 9,247 bn (-3.12% mom). Therein, outright and repo value traded recorded at

VND 77,210 bn and VND 98,480 bn, respectively.

Research Department VCBS Page | 2

Fixed-Income Report

300

Secondary market

x1,000 bn

240

180

120

60

01/17

03/17

05/17

07/17

09/17

11/17

01/18

03/18

05/18

07/18

09/18

11/18

01/19

03/19

Outright Repo

Source: HNX,VCBS

Yield curve fluctuated in a tight band. According to Bloomberg statistics, yields for 1Y, 2Y,

3Y, 5Y, 7Y, 10Y and 15Y end April 2019 at 3.247% (-1 bps mom), 3.485% (+11.2 bps mom),

3.592% (+8.4 bps mom), 3.915% (+3.7 bps mom), 4.267% (+6.7 bps mom), 4.797% (-2.8 bps

mom), 5.152% (+0.4 bps mom), respectively.

In the beginning of April, bond yields robusted for almost all tenors; however, these pulled

back in the last week. The upward force may derive from interbank rates increased for

almost all tenors.

Yield curve 8.0% Bond yields

5.5

7.0%

4.5 6.0%

5.0%

3.5

4.0%

2.5 3.0%

2.0%

01/16

04/16

07/16

10/16

01/17

04/17

07/17

10/17

01/18

04/18

07/18

10/18

01/19

04/19

1.5

1Y 2Y 3Y 5Y 7Y 10Y 15Y

2/28/2019 3/29/2019 2Y 3Y 5Y

4/26/2019 7Y 10Y 15Y

Source: Bloomberg, VCBS

Bond yields decreased sharply in Q1.2019 as we expected in Annual report for fixed income

2018. In general, bond yields are unlikely to decrease further in the second phase, before

entering the uptrend when inflation risk factors may rise more in the third phase. In that

forecast scenario, bond yields are under greater upward pressure in May but the pressure if any

shall not be overwhelmed. The expectations of market members become significantly cautious

when potential profits are not commensurate with risks and a higher level of capital costs.

Despite the greater upward pressure on bond yields in May, there are some unchanged factors

for us to believe that this momentum will not be too strong: (1) In the domestic side,

macroeconomics stability is still quite good. (2) The decision of FED to keep interest rates will

reduce the possibility that investment capital flows will gradually move away from the frontier

and emerging markets. (3) Foreign direct investment robust, the number of new projects is

1,082 in April 20th with total registered capital of 5.3 billion USD, increase by 22.5% and

50.4%, respectively, over the same period in 2018.

Research Department VCBS Page | 3

Fixed-Income Report

Foreign investors net bought only Foreign investors net bought only VND 48.18 billion this month. Foreign investors extended

VND 48.18 billion this month their net bought position to six consecutive months, focused on 3Y and 10-15Y tenors.

4,050 Foreign investment in the secondary market 2018-2019

Net position (Unit: bn.VND)

2,933

2,530

1,254 2,121

1,681

1,429 1,445

1,209

789 963

624

270 422

215

-339 -335 -222 -275 48

-655

-1,274 -465

06/17

07/17

08/17

09/17

10/17

11/17

12/17

01/18

02/18

03/18

04/18

05/18

06/18

07/18

08/18

09/18

10/18

11/18

12/18

01/19

02/19

03/19

04/19

Source: HNX, VCBS

INTEREST RATE

Interbank Rates

After rebouned in the beginning of After rebouned in the beginning of April, interbank rates became steady. In the first half

April, interbank rates became steady. of the month, interbank rates increased strongly, ON tenor peaked at 4.2%. However, at the

end of April, interbank rate for ON-3M tenors were recorded at 2.84%, 3.01%, 3.27%, 3.48%

and 4.08%, decreased sharply compared to March. This indicated that liquidity returned to

the money market after abnormal demand had been met.

6.0%

4.0%

2.0%

0.0%

01/16

03/16

05/16

07/16

09/16

11/16

01/17

03/17

05/17

07/17

09/17

11/17

01/18

03/18

05/18

07/18

09/18

11/18

01/19

ON 1W 2W 1M

Source: Bloomberg, VCBS

The liquidity on the interbank market is expected to be stable, less likely to be shortfall in

May due to the supportive factors: (1) Tensional force on banking system liquidity in the

beginning of April may only be momentary and affected by the abnormal demand of some

commercial banks to ensure capital adequacy ratio. (2) The number of matured government

bonds remained at a relatively high level at VND 13,947 billion, equivalent to 11.66% of the

total matured volume in 2019, which will continue to support liquidity. (3) Public investment

from the beginning of the year to April 15 th reached VND 65.3 trillion, equaling 15.2% of the

Research Department VCBS Page | 4

Fixed-Income Report

plan. The figure increased slightly compared to 13.7% of the same period last year; however,

public disbursement is till behind the schedule. VCBS forecasts the disbursement may only

speed up from the second half of 2019. (4) No pressure on exchange rate while SBV has

bought USD 8.35 billion from the beginning of the year to April 25th, ensuring the local

currency is provided to the system. (5) Credit growth in Q1.2019 was 3.19%, lower than the

same period last year of 3.56% due to seasonal factors and policies.

The average interbank interest rate level may continue to be higher than the same period last

year, less likely to decrease sharply based on the following factors: (1) Investors are more

sensitive to the pressure of exchange rate in the context of uncertainty factors increased. (2)

The orientation to have banks reinforce international standard for safety was unchanged,

which shall create a certain pressure on the whole system when the resources of commercial

banks are substantially different.

Open market operation

SBV net withdrew VND 46.427 bn SBV net withdrew VND 46.427 bn via OMO channel. Therein, only about VND 501 bn

via OMO channel. worth of reverse repo was newly offered while more than VND 1,830 bn matured last month.

In addition, SBV also used repo activities to absorb part of the resource served to build

foreign reserve recently.

Reverse Repo SBV-Bill Outstanding

180

250

x VND 1,000 bn

x VND 1,000bn

160

140 200

120

100 150

80

60 100

40

50

20

- -

03/17

05/17

07/17

09/17

11/17

01/18

03/18

05/18

07/18

09/18

11/18

01/19

02/17

04/17

06/17

08/17

10/17

12/17

02/18

04/18

06/18

08/18

10/18

12/18

02/19

Source: Bloomberg, VCBS

END.

Research Department VCBS Page | 5

Fixed-Income Report

APPENDICES

Primary Market

St Bond

VDB VBSP Volmue

Month

Issued Issued Issued Issued Issued

5Y 7Y 10Y 15Y 20Y 30Y

Volume Volume Volume Volume Volume

04/18 6,055 2.97 3.43 4.1 4.47 5.12 5.42 0 0 0 6,055

05/18 11,178 3 N/A 4.26 4.6 5.14 N/A 0 0 0 11,178

06/18 16,940 3.1 N/A 4.37 4.7 5.20 N/A 0 0 0 16,940

07/18 15,420 3.45 3,9 4.48 4.78 5.22 5.42 0 350 0 15,770

08/18 16,060 3.5 3,9 4.63 4.87 N/A N/A 0 0 0 16,080

09/18 15,700 3.5 3,9 4.8 5.07 5.22 5.42 0 5,100 0 20,800

10/18 5,366 4.2 N/A 4.95 5.2 N/A N/A 0 2,940 0 8,306

11/18 10,220 N/A N/A 5.1 5.3 N/A N/A 0 0 0 10,220

12/18 28,450 N/A N/A 5.1 5.3 N/A N/A 16,545 0 0 44,995

01/19 36,344 3.8 4.17 4.8 5.12 5.59 5.80 0 0 0 36,344

02/19 18,850 3.63 4.05 4.7 5.00 5.56 5.79 0 0 0 18,850

03/19 14,275 3.70 N/A 4.72 5.06 5.20 5.85 0 0 0 14,275

04/19 12,576 N/A 4.05 4.72 5.06 5.69 5.85 0 0 0 12,576

Secondary Market

Bonds St-bills

Total

Month Outright Repo Outright Repo

04/18 117,127 140,244 - - 257,371

05/18 83,940 104,896 - - 188,836

06/18 112,344 70,399 - - 182,733

07/18 62,423 92,597 - - 155,020

08/18 62,332 84,661 - - 146,993

09/18 68,966 81,990 - - 150,956

10/18 55,760 89,321 - - 145,081

11/18 56,834 74,806 - - 131,640

12/18 77,194 83,527 - - 160,721

01/19 75,609 81,829 - - 157,438

02/19 68,127 76,721 - - 144,848

03/19 82,809 117,631 - - 200,440

04/19 77,210 98,480 - - 175,690

Open Market Operation

Reverse Repo Outright

Month

Due Offer Balance Outstanding Due Offer Balance Outstanding

04/18 2 2 0 0 191,210 78,500 (112,630) 78,580

05/18 170 170 0 0 80,280 55,840 (24,440) 54,140

06/18 0 0 0 0 54,140 150,499 96,359 150,499

07/18 15,993 17,993 2,000 2,000 112,500 44,461 (68,039) 82,461

08/18 37,167 42,869 5,702 7,702 35,312 28,482 (6,830) 75,630

09/18 15,401 8,155 (7,246) 456 50,000 52,950 2,950 78,581

10/18 16,018 60,562 44,544 45,000 62,591 15,070 (47,521) 31,060

11/18 237,878 237,663 (215) 44,785 2,100 0 (2,100) 28,960

12/18 25,929 32,208 6,279 51,064 28,960 0 (28,960) 0

01/19 184,354 280,582 93,228 144,292 0 0 0 0

02/19 188,097 64,776 (123,321) 20,972 0 0 0 0

03/19 50,248 30,911 (19,337) 1,635 54,499 59,399 4,900 4,900

04/19 1,830 501 (1,329) 306 37,101 82,199 45,098 49,998

Research Department VCBS Page | 6

Fixed-Income Report

DISCLAIMER

This report is designed to provide updated information on the fixed-income, including bonds, interest rates, some other related. The

VCBS analysts exert their best efforts to obtain the most accurate and timely information available from various sources, including

information pertaining to market prices, yields and rates. All information stated in the report has been collected and assessed as

carefully as possible.

It must be stressed that all opinions, judgments, estimations and projections in this report represent independent views of the analyst at

the date of publication. Therefore, this report should be best considered a reference and indicative only. It is not an offer or advice to

buy or sell or any actions related to any assets. VCBS and/or Departments of VCBS as well as any affiliate of VCBS or affiliate that

VCBS belongs to or is related to (thereafter, VCBS), provide no warranty or undertaking of any kind in respect to the information and

materials found on, or linked to the report and no obligation to update the information after the report was released. VCBS does not

bear any responsibility for the accuracy of the material posted or the information contained therein, or for any consequences arising

from its use, and does not invite or accept reliance being placed on any materials or information so provided.

This report may not be copied, reproduced, published or redistributed for any purpose without the written permission of an authorized

representative of VCBS. Please cite sources when quoting. Copyright 2012 Vietcombank Securities Company. All rights reserved.

CONTACT INFORMATION

Tran Minh Hoang Le Thu Ha Dang Khanh Linh

Head of Research Senior Analyst – Fixed income Analyst – Fixed Income

tmhoang@vcbs.com.vn ltha_ho@vcbs.com.vn dklinh@vcbs.com.vn

Research Department VCBS Page | 7

Vous aimerez peut-être aussi

- Monthly Report: Fixed-Income ResearchDocument8 pagesMonthly Report: Fixed-Income ResearchNguyenPas encore d'évaluation

- Quarterly Report: Fixed - Income ResearchDocument9 pagesQuarterly Report: Fixed - Income ResearchNguyenPas encore d'évaluation

- A452 2020 16 - GadzhiDocument17 pagesA452 2020 16 - GadzhiAdina GamaPas encore d'évaluation

- Project / Program GANTT (In Months) : Project Name Progress Start Date Finish Date Duration (Months)Document7 pagesProject / Program GANTT (In Months) : Project Name Progress Start Date Finish Date Duration (Months)Ammar BaidasPas encore d'évaluation

- CRISIL Monetary Policy Review Sliced AgainDocument6 pagesCRISIL Monetary Policy Review Sliced Againkunal kamalPas encore d'évaluation

- Politica MonetaraDocument38 pagesPolitica MonetaraAndreea CoșuţăPas encore d'évaluation

- Indonesia EconomicsDocument6 pagesIndonesia EconomicsNyoman RiyoPas encore d'évaluation

- Kotak Mahindra Bank Limited Managements Discussion and Analysis FY18Document38 pagesKotak Mahindra Bank Limited Managements Discussion and Analysis FY18ss gPas encore d'évaluation

- IIFL JuenDocument18 pagesIIFL JuenAnPas encore d'évaluation

- P Mqec 0 X T0 I WTJ TIw Z15 M HLJT Axn T2 LL Uh IVdDocument27 pagesP Mqec 0 X T0 I WTJ TIw Z15 M HLJT Axn T2 LL Uh IVdrezimoralesPas encore d'évaluation

- Rbi Bi-Monthly Monetary Policy Fy22Document2 pagesRbi Bi-Monthly Monetary Policy Fy22Shiwani singhPas encore d'évaluation

- Fund FactDocument19 pagesFund FactGatot KacaPas encore d'évaluation

- State Bank of India: Pick of The WeekDocument4 pagesState Bank of India: Pick of The WeekkevalPas encore d'évaluation

- FIN 444sec 5-Group-ReportDocument16 pagesFIN 444sec 5-Group-ReportNahida Akter JannatPas encore d'évaluation

- Are Asian LNG Spot Prices Finally Decoupling From OilDocument4 pagesAre Asian LNG Spot Prices Finally Decoupling From OilrubenpePas encore d'évaluation

- Trai Phieu 17Document12 pagesTrai Phieu 17NguyenPas encore d'évaluation

- Barentz Commodities March 2022Document11 pagesBarentz Commodities March 2022rbucholzPas encore d'évaluation

- Thematic Report: Loosening Monetary Policy of Some Central Banks in The WorldDocument7 pagesThematic Report: Loosening Monetary Policy of Some Central Banks in The WorldLong Bùi VănPas encore d'évaluation

- Pick of The Week SbiDocument4 pagesPick of The Week SbiMukesh KumarPas encore d'évaluation

- AlphaBets Investor Letter - October 2018Document5 pagesAlphaBets Investor Letter - October 2018Anish TeliPas encore d'évaluation

- Feriados: #Actividad Inicio Final Duración en DíasDocument3 pagesFeriados: #Actividad Inicio Final Duración en DíasFèlixSaulChapaApazaPas encore d'évaluation

- Feriados: #Actividad Inicio Final Duración en DíasDocument3 pagesFeriados: #Actividad Inicio Final Duración en DíasjhairPas encore d'évaluation

- Feriados: #Actividad Inicio Final Duración en DíasDocument3 pagesFeriados: #Actividad Inicio Final Duración en DíasjaiderPas encore d'évaluation

- Feriados: #Actividad Inicio Final Duración en DíasDocument3 pagesFeriados: #Actividad Inicio Final Duración en DíasYharly ChaiñaPas encore d'évaluation

- Optimal Group, Inc.: Company BackgroundDocument10 pagesOptimal Group, Inc.: Company BackgroundMeester KewpiePas encore d'évaluation

- Resumo BTG Pactual PDFDocument206 pagesResumo BTG Pactual PDFJulio Cesar Gusmão CarvalhoPas encore d'évaluation

- Indian HospitalsDocument8 pagesIndian Hospitalsakumar4uPas encore d'évaluation

- Ejemplo Ghantt Forma 2Document3 pagesEjemplo Ghantt Forma 2Javier HuescaPas encore d'évaluation

- Feriados: #Actividad Inicio Final Duración en DíasDocument3 pagesFeriados: #Actividad Inicio Final Duración en DíasCarlos Ivan BeltranPas encore d'évaluation

- Kantar Worldpanel - FMCG Monitor August 2017 - ENDocument9 pagesKantar Worldpanel - FMCG Monitor August 2017 - ENtinadang12796Pas encore d'évaluation

- Dataxu Q2 2019 Industry Benchmark Reports 1Document27 pagesDataxu Q2 2019 Industry Benchmark Reports 1saptoPas encore d'évaluation

- Chapter 1 PDFDocument18 pagesChapter 1 PDFiqra waseemPas encore d'évaluation

- Pier 11944-Eb30aDocument5 pagesPier 11944-Eb30aMayra Raviela SoteloPas encore d'évaluation

- The Stock Market in MayDocument2 pagesThe Stock Market in MayJohn Paul GroomPas encore d'évaluation

- Laporan Fit To Work (FTW) 2018 NEWDocument117 pagesLaporan Fit To Work (FTW) 2018 NEWaris cahyonoPas encore d'évaluation

- IRC DesignDocument16 pagesIRC Designshubhanshu chaurasiyaPas encore d'évaluation

- HDFC Equity Fund: Comprehesive Fund Review & RatingDocument11 pagesHDFC Equity Fund: Comprehesive Fund Review & Ratingmayank007Pas encore d'évaluation

- Monthly Market MonitorDocument44 pagesMonthly Market MonitortomPas encore d'évaluation

- Heat Index Register: Project Name: BSP - 9047 ELEMENT 1.3fDocument2 pagesHeat Index Register: Project Name: BSP - 9047 ELEMENT 1.3fShafie ZubierPas encore d'évaluation

- World BankDocument11 pagesWorld BankChatis HerabutPas encore d'évaluation

- Economic Review Jul-Mar 2019Document7 pagesEconomic Review Jul-Mar 2019FaisalPas encore d'évaluation

- 2695 KuraSushi 20211020 Initiation EngDocument29 pages2695 KuraSushi 20211020 Initiation EngCheng DipooPas encore d'évaluation

- Working-Schedule, During Holiday & Lebaran 1439H/Y2018Document2 pagesWorking-Schedule, During Holiday & Lebaran 1439H/Y2018Ade Yoga PrasetyaPas encore d'évaluation

- Result Review: Margins Contract As Opex NormalisesDocument10 pagesResult Review: Margins Contract As Opex NormalisesSriHariKalyanBPas encore d'évaluation

- Result Review: Margins Contract As Opex NormalisesDocument10 pagesResult Review: Margins Contract As Opex NormalisesSriHariKalyanBPas encore d'évaluation

- Q3 2017 Education Sector Overview: P, V & C, LLCDocument9 pagesQ3 2017 Education Sector Overview: P, V & C, LLCAnonymous Feglbx5Pas encore d'évaluation

- Local Situation Covid19 enDocument8 pagesLocal Situation Covid19 enErik ChanPas encore d'évaluation

- Profit From Horse RacingDocument5 pagesProfit From Horse RacingTheActuary50% (4)

- Multiyear October 2017Document1 pageMultiyear October 2017api-285158260Pas encore d'évaluation

- Parte 2Document34 pagesParte 2Odla Sedlej OcopihcPas encore d'évaluation

- ImfDocument19 pagesImfOsama RiazPas encore d'évaluation

- Infosys Q3FY20 ResultsDocument11 pagesInfosys Q3FY20 Resultsbobby singhPas encore d'évaluation

- Nations Trust Bank Sri LankaDocument3 pagesNations Trust Bank Sri Lankaudita7208100% (1)

- Local Situation Covid19 enDocument10 pagesLocal Situation Covid19 enDEFPas encore d'évaluation

- Commodities February 2024Document13 pagesCommodities February 2024Ofer SoreqPas encore d'évaluation

- Covid-19, Textile Sector and Herding in Pakistani Stock MarketDocument5 pagesCovid-19, Textile Sector and Herding in Pakistani Stock MarketIAEME PublicationPas encore d'évaluation

- Project Gantt ChartDocument1 pageProject Gantt Chartdaniel.cabasa2577Pas encore d'évaluation

- Cross Asset: Technical VistaDocument18 pagesCross Asset: Technical VistaanisdangasPas encore d'évaluation

- Urbana 2018-19 Academic Calendar V3Document3 pagesUrbana 2018-19 Academic Calendar V3Muhammad AsadPas encore d'évaluation

- Trai Phieu 14Document6 pagesTrai Phieu 14NguyenPas encore d'évaluation

- Trai Phieu 18Document6 pagesTrai Phieu 18NguyenPas encore d'évaluation

- Trai Phieu 17Document12 pagesTrai Phieu 17NguyenPas encore d'évaluation

- Trai Phieu 15Document6 pagesTrai Phieu 15NguyenPas encore d'évaluation

- Weekly Report: Fixed-Income ResearchDocument7 pagesWeekly Report: Fixed-Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 25Document7 pagesTrai Phieu 25NguyenPas encore d'évaluation

- Trai Phieu 21Document6 pagesTrai Phieu 21NguyenPas encore d'évaluation

- Trai Phieu 27 PDFDocument6 pagesTrai Phieu 27 PDFNguyenPas encore d'évaluation

- Trai Phieu 26 PDFDocument6 pagesTrai Phieu 26 PDFNguyenPas encore d'évaluation

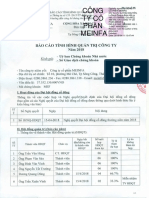

- SDE Baocaoquantri 2018Document2 pagesSDE Baocaoquantri 2018NguyenPas encore d'évaluation

- Trai Phieu 22Document6 pagesTrai Phieu 22NguyenPas encore d'évaluation

- Trai Phieu 29 PDFDocument8 pagesTrai Phieu 29 PDFNguyenPas encore d'évaluation

- Macroeconomic Research April 2019: by A Member of VIETCOMBANKDocument14 pagesMacroeconomic Research April 2019: by A Member of VIETCOMBANKNguyenPas encore d'évaluation

- Trai Phieu 5 PDFDocument6 pagesTrai Phieu 5 PDFNguyenPas encore d'évaluation

- Trai Phieu 2Document7 pagesTrai Phieu 2NguyenPas encore d'évaluation

- Trai Phieu 9 PDFDocument6 pagesTrai Phieu 9 PDFNguyenPas encore d'évaluation

- Trai Phieu 7Document6 pagesTrai Phieu 7NguyenPas encore d'évaluation

- Trai Phieu 6Document6 pagesTrai Phieu 6NguyenPas encore d'évaluation

- Macroeconomics Research: Quarterly ReportDocument11 pagesMacroeconomics Research: Quarterly ReportNguyenPas encore d'évaluation

- MEF Baocaoquantri 2018Document3 pagesMEF Baocaoquantri 2018NguyenPas encore d'évaluation

- Trai Phieu 9 PDFDocument6 pagesTrai Phieu 9 PDFNguyenPas encore d'évaluation

- Trai Phieu 5 PDFDocument6 pagesTrai Phieu 5 PDFNguyenPas encore d'évaluation

- Công Ty C PH N Khoáng S N Sài Gòn Quy NH NDocument5 pagesCông Ty C PH N Khoáng S N Sài Gòn Quy NH NNguyenPas encore d'évaluation

- Tổng Công Ty Cổ Phần Y Tế DanamecoDocument14 pagesTổng Công Ty Cổ Phần Y Tế DanamecoNguyenPas encore d'évaluation

- KTS Baocaotaichinh Q3 2019Document31 pagesKTS Baocaotaichinh Q3 2019NguyenPas encore d'évaluation

- IDV Giaitrinh KQKD 6T 2019 Soatxet HopnhatDocument1 pageIDV Giaitrinh KQKD 6T 2019 Soatxet HopnhatNguyenPas encore d'évaluation

- SLS Baocaotaichinh Q3 2019 PDFDocument25 pagesSLS Baocaotaichinh Q3 2019 PDFNguyenPas encore d'évaluation

- ANZ - Green Field ProjectDocument38 pagesANZ - Green Field ProjectEfficient WritersPas encore d'évaluation

- Ch14 Krugman 10eDocument38 pagesCh14 Krugman 10eRiçard HoxhaPas encore d'évaluation

- Risk PremiumDocument29 pagesRisk PremiumNabilah Usman100% (1)

- Active Bond Management StrategiesDocument15 pagesActive Bond Management StrategiesNeeraj BhartiPas encore d'évaluation

- Ch7 HW AnswersDocument31 pagesCh7 HW Answerscourtdubs78% (9)

- Busfin 7 Sources and Uses of Short Term and Long Term FundsDocument5 pagesBusfin 7 Sources and Uses of Short Term and Long Term FundsRenz Abad50% (2)

- MBA Mortgage Market StabilizationDocument5 pagesMBA Mortgage Market StabilizationJohn MechemPas encore d'évaluation

- Presentaion Risk MGT in Banking RBS 7.12.2016Document26 pagesPresentaion Risk MGT in Banking RBS 7.12.2016Farhan IslamPas encore d'évaluation

- Cash and Cash EquivalentsDocument4 pagesCash and Cash EquivalentsSheila Mae AramanPas encore d'évaluation

- Key Performance Indicators Drive Best Practices For General ContractorsDocument9 pagesKey Performance Indicators Drive Best Practices For General ContractorsMarcus Skookumchuck VanniniPas encore d'évaluation

- Study Notes The Building Blocks of Risk ManagementDocument19 pagesStudy Notes The Building Blocks of Risk Managementalok kundaliaPas encore d'évaluation

- Protiviti Risk ModelDocument20 pagesProtiviti Risk ModelRiz DeenPas encore d'évaluation

- LIC Mutual FundDocument127 pagesLIC Mutual FundShikha PradhanPas encore d'évaluation

- Short Term Alpha Signals SSRN-id4115411Document27 pagesShort Term Alpha Signals SSRN-id4115411Pranab PattanaikPas encore d'évaluation

- INSTRUCTION: Make Sure Your Mobile Phone Is in Silent Mode and Place It at The Front Together With Bags & BooksDocument2 pagesINSTRUCTION: Make Sure Your Mobile Phone Is in Silent Mode and Place It at The Front Together With Bags & BooksSUPPLYOFFICE EVSUBCPas encore d'évaluation

- Final Ratio AnalysisDocument40 pagesFinal Ratio AnalysisShruti PatilPas encore d'évaluation

- Fundamental Analysis OfwiproDocument35 pagesFundamental Analysis OfwiproLavina Chandalia100% (3)

- Lesson 1 BANKING - Banking and Financial InstitutionDocument4 pagesLesson 1 BANKING - Banking and Financial InstitutionAngela MagtibayPas encore d'évaluation

- Unit-4 Liquidity DecisionsDocument35 pagesUnit-4 Liquidity DecisionsGrubber grubPas encore d'évaluation

- Chap 001Document33 pagesChap 001zhentang89Pas encore d'évaluation

- FINANCIAL-MARKETS Prelims RevDocument13 pagesFINANCIAL-MARKETS Prelims RevJasmine TamayoPas encore d'évaluation

- A Project Report On Comparative Analysis Ulip Vs Mutual Funds - NetworthDocument72 pagesA Project Report On Comparative Analysis Ulip Vs Mutual Funds - NetworthNagireddy Kalluri80% (5)

- Final Ipo in IndiaDocument81 pagesFinal Ipo in IndiaSumit YadavPas encore d'évaluation

- Introduction To Investment and SecuritiesDocument9 pagesIntroduction To Investment and SecuritiesAbcPas encore d'évaluation

- Agricultural Bank of ChinaDocument288 pagesAgricultural Bank of ChinaDomen SolinaPas encore d'évaluation

- Business, Accounting and Financial Studies Paper 1Document13 pagesBusiness, Accounting and Financial Studies Paper 1wileyPas encore d'évaluation

- Determinants of Sovereign Bond Spreads in Emerging Markets: Local Fundamentals and Global Factors vs. Ever-Changing MisalignmentsDocument42 pagesDeterminants of Sovereign Bond Spreads in Emerging Markets: Local Fundamentals and Global Factors vs. Ever-Changing MisalignmentsjonPas encore d'évaluation

- BCG ReportDocument10 pagesBCG ReportGirinath Deshpande100% (1)

- Term Paper On Square Pharmaceuticals LTDDocument28 pagesTerm Paper On Square Pharmaceuticals LTDMd NayeemPas encore d'évaluation

- Sap Cash FlowDocument17 pagesSap Cash FlowAlok Samataray0% (2)