Académique Documents

Professionnel Documents

Culture Documents

Trai Phieu 26 PDF

Transféré par

NguyenTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Trai Phieu 26 PDF

Transféré par

NguyenDroits d'auteur :

Formats disponibles

Fixed-Income Research

Weekly report March 26th, 2018

Fixed-Income Report Round-up

Only 20Y tenor was issued successfully

Bond yields increased for all tenors.

Interbank rates extended its slight downtrend.

Mar 18th – 22nd/2019

Yield Curve

In this issue

5,3

Round up

4,8

Bond market

4,3

Interest rates

3,8

3,3

2,8

1Y 2Y 3Y 5Y 7Y 10Y 15Y

This week Last week Last month

Source: Bloomberg, VCBS

VND 200 bn (-96.04%) was mobilized this week. VND 47,7941 bn (+10.41% wow)

was traded on the secondary market.

Bond yields ticked up fractionally. According to Bloomberg data, 1Y, 2Y, 3Y, 5Y,

7Y, 10Y and 15Y bond yields posted at 3.178% (+7.5 bps), 3.453% (+16.8 bps), 3.558% (+18

bps), 3.882% (+9.9 bps), 4.193% (+1 bps), 4.842% (+4.5 bps), 5.155% (+2.5 bps),

Le Thu Ha respectively.

+84 24 3936 6990 (ext. 7182) Interbank rates extended its slight downtrend. In details, ON – 3M rates respectively

ltha_ho@vcbs.com.vn posted at 3.117%, 3.217%, 3.35%, 3.483% and 4.133% according to Bloomberg data.

Foreign investors net bought roughly VND 29.78 bn this week.

SBV net withdrew VND 25,359 bn via OMO channel.

VCBS Commentary March 25th – March 29th

The Fed policy announcement minimizes the possibility of capital inflows moving

away from frontier and emerging markets, which is a positive factor for stable economy in

See Disclaimer at Page 5 Vietnam. In addition, better liquidity in money market supporting argument is better

sentiment of investors in the market, downward force will dominate bond market in the

Macroeconomic, Fixed-Income,

upcoming weeks.

Financial and Corporation

Information updated at With the positive context of economy as we mentioned above, at the present we do

www.vcbs.com.vn/vn/Services/AnalysisResearch not see any fundament changes which can push interbank rates to a high level in a long

period of time.

Research Department VCBS Page | 0

Fixed-Income Report

Bond Market

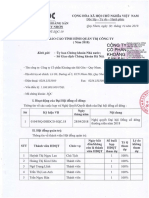

Primary Market

Only 20Y tenor bond was issued successfully

VND 200 bn (-96.04%) was VND 200 bn was mobilized this week from ST. In detail, only one tenor successfully

mobilized this week. issued out of four tenors offered (5Y, 10Y, 15Y & 20Y). VND 200 bn of bond issued at

20Y with winning rates was 5.20% (-36 bps). The registered volume to offering volume

ratio for 5Y, 10Y, 15Y & 20Y tenors were 2.10, 2.68, 2.30 and 0.40 respectively, which

showed that investors’ sentiment was conservative. The winning volume to offering

volume ratio for 20Y tenor was 40%. Besides, the auctions for 5Y, 10Y, 15Y tenor failed

indicated that the State Treasury was moderate in raising wining rates.

VBSP and VDB did not mobilize bond this week.

Winning rates GB Auction results Vol (VND bn)

8,50% 12000

7,50% 10000

6,50% 8000

5,50% 6000

4,50% 4000

3,50% 2000

2,50% 0

May 07- May 11

May 21- May 25

June 04- June 08

Nov 19- Nov 23

Jul 30 - Aug 03

Sep 10- Sep 14

Sep 24- Sep 28

Feb 18- Feb 22

Jan 29- Feb 02

Apr 09- Apr 13

Apr 23- Apr 27

Nov 05-Nov 09

Jan 28- Feb 01

Mar 12- Mar 16

Mar 26- Mar 30

June 18 - June 22

Jul 16 - Jul 20

Aug 13 - Aug 17

Aug 27 - Aug 31

Mar 04- Mar 08

Oct 08- Oct 12

Oct 22- Oct 26

Jan 02- Jan 05

Jan 15- Jan 19

Jan 02- Jan 04

Jan 14- Jan 18

Jul 02 - Jul 06

Feb 26- Mar 02

Dec 03- Dec 07

Dec 17- Dec 21

Volume 5Y 7Y 10Y 15Y 20Y 30Y

Source: HNX, VCBS

Secondary Market

Repo trading volume increased this week.

VND 47,794 bn (+10.41% wow) was VND 47,794 bn (+10.41% wow) was traded on the secondary market. Outright and repo

traded on the secondary market. values were at VND 18,892 bn and VND 28,902 bn respectively. Regarding outright, ST-

Bond kept dominating trading volume with 92.10%. Remarkably, this week a large

proportion of bond trading (44.64%) belonged to short-term bond (<5year) followed by

long-term bond (>10 year) (33%).

Bond yields ticked up fractionally. According to Bloomberg data, 1Y, 2Y, 3Y, 5Y, 7Y,

10Y and 15Y bond yields posted at 3.178% (+7.5 bps), 3.453% (+16.8 bps), 3.558% (+18

bps), 3.882% (+9.9 bps), 4.193% (+1 bps), 4.842% (+4.5 bps), 5.155% (+2.5 bps),

respectively.

Research Department VCBS Page | 1

Fixed-Income Report

Yield Curve

5,3

4,8

4,3

3,8

3,3

2,8

1Y 2Y 3Y 5Y 7Y 10Y 15Y

This week Last week Last month

Source: Bloomberg, VCBS

The Federal Open Market Committee (FOMC) held the federal funds rate steady at the

conclusion of its March meeting as financial market expected. It is noticeable that FOMC’s

forward-looking projections now envision no rate increases in 2019 and a single rate hike

in 2020. The more dovish stance is a positive factor for stable economy in Vietnam,

especially exchange rate. In addition, the FED policy announcement minimizes the

possibility of capital inflows moving away from frontier and emerging markets. With the

expectation that Vietnam will continue to be the attractive country of foreign investment

flows, VCBS expects that the VND depreciation in 2019 will not exceed 2% instead of 3%

as the previous reports. Obviously, this is a positive sign for bond market in the near future.

GDP growth in the first quarter is forecasted to maintain a stable growth rate with the

expectation of 6.2%-6.5%. Besides, according to Bloomberg, SK Group has announced it

expectation to spend $1 billion to invest in Vingroup in April. This news in accordance

with abundant liquidity in money market support market’s sentiment, downward force may

dominate bond market in the upcoming weeks.

Foreign investors net bought Foreign investors net bought roughly VND 29.78 bn this week. It is recorded that

roughly VND 29.78 bn this week. foreign investors had the 10th consecutive net buying week from the beginning of the year.

Given the historical data into consideration, we believe that this is the favorite time for

foreign investors to build their portfolios.

Foreign Investment in the secondary market 2018-2019

Net position (Unit: bn.VND)

Apr 02- Apr 06

Apr 16- Apr 20

May 14- May 18

May 28- June 01

June 11- June 15

June 25- June 29

July 09- July 13

July 23- July 27

Jan 08- Jan 12

Jan 22- Jan 26

Aug 06- Aug 10

Aug 20- Aug 24

Oct 01- Oct 05

Oct 15- Oct 19

Nov 12- Nov 16

Nov 26- Nov 30

Jan 07- Jan 11

Jan 21- Jan 25

Dec 10- Dec 14

Dec 21- Dec 28

Feb 05- Feb 09

Feb 19- Feb 23

Apr 30- May 04

Sep 04- Sep 07

Sep 17- Sep 21

Feb 11- Feb 15

Mar 05- Mar 09

Mar 19- Mar 23

Oct 29- Nov 02

Feb 25- Mar 01

Mar 11- Mar 15

Source: HNX, VCBS

Research Department VCBS Page | 2

Fixed-Income Report

INTEREST RATE

Interbank Rates

Interbank rates extended its slight Interbank rates extended its slight downtrend. In details, ON – 3M rates respectively

downtrend. posted at 3.117%, 3.217%, 3.35%, 3.483% and 4.133% according to Bloomberg data. It

can be seen that interbank rates fractionally decreased in the last few weeks.

Interbank rates

4,9

4,1

3,3

2,5

ON 1W 2W 1M 3M

This week Last week Last month

Source: Bloomberg, VCBS

With the positive context of economy as we mentioned above, at the present we do not

see any fundament changes which can push interbank rates to a high level in a long

period of time.

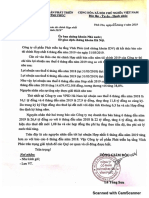

Open Market Operation

SBV net withdrew VND 25,359 bn

SBV net withdrew VND 25,359 bn via OMO channel. The outstanding of reverse repo

via OMO channel.

continued to decrease this week. In addition, SBV continued to issue T-Bills to absorb

part of the resources served to build foreign reserve recently. This net withdrawing trend

has continued for six consecutive weeks, indicating a better liquidity. Till now, we still

believe that with more favorable condition, it is unlikely that SBV will raise rate.

Reverse Repo SBV-Bill Oustanding

180 250

x VND 1,000 bn

x VND 1,000bn

160

140 200

120

150

100

80 100

60

40 50

20

- -

Feb-17

Feb-18

Feb-19

Oct-17

Dec-17

Oct-18

Dec-18

Apr-17

Jun-17

Apr-18

Jun-18

Aug-17

Aug-18

Mar-17

Sep-17

Mar-18

Sep-18

May-17

May-18

Jul-17

Nov-17

Jan-18

Jul-18

Nov-18

Jan-19

Source: Bloomberg, VCBS

END.

Research Department VCBS Page | 3

Fixed-Income Report

APPENDICES

Bond Auctions

Offering Registering Winning Register to Winning rate Winning/

Auction date Tenor volume volume volume Offering Ratio (%) Offering Issuer

ST bills

Government and government-backed bonds

20-Mar-19 5Y 1,000 2,101 - 2.10 0 0.00% ST

20-Mar-19 10Y 2,000 5,350 - 2.68 0 0.00% ST

20-Mar-19 15Y 2,000 4,600 - 2.30 0 0.00% ST

20-Mar-19 20Y 500 200 200 0.40 5.2 40.00% ST

Secondary Market

Week 11 Mar – 15 Mar Week 18 Mar – 22 Mar

Issuer Value Value share Value Value share

Outright

ST 16,154 88.20% 17,399 92.10%

VDB 1,499 8.18% 683 3.62%

VBSP 662 3.62% 810 4.29%

Others - 0.00% - 0.00%

Subtotal (1) 18,315 100.00% 18,892 100.00%

Repo

Repo 24,759 49.93% 28,902 53.45%

Reserve Repo 24,832 50.07% 25,168 46.55%

Subtotal (2) 49,591 100.00% 54,070 100.00%

ST bills

Outright

Repo

Subtotal (3)

Total (1)+(2)+(3) 72,371 67,906

Open Market Operation

Reverse Repo Outright (SBV Bills)

Date Due Offer Balance Outstanding Due Offer Balance Outstanding

10/15 –10/19 0 0 0 0 1,900 1,550 (350) 36,790

10/22- 10/26 0 44,345 44,345 44,345 4,280 2,000 (2,280) 34,510

10/29- 11/02 44,345 34,000 (10,346) 34,000 3,550 0 (3,550) 30,960

11/05- 11/09 34,000 52,658 18,659 52,658 2,000 0 (2,000) 28,960

11/12- 11/16 52,658 58,566 5,907 58,566 0 0 0 28,960

11/19- 11/23 58,566 63,655 5,089 63,655 0 0 0 28,960

11/26- 11/30 63,655 44,785 (18,870) 44,785 0 0 0 28,960

12/03- 12/07 44,785 68,313 23,528 68,313 0 0 0 28,960

12/10- 12/14 68,313 60,033 (8,280) 60,033 0 0 0 28,960

12/17- 12/21 60,033 52,799 (7,234) 52,799 25,960 0 (25,960) 3,000

12/24- 12/28 52,799 51,064 (1,735) 51,064 3,000 0 (3,000) 0

01/02- 01/05 29,048 30,640 6,574 57,638 0 0 0 0

01/07- 01/11 52,656 47,823 (4,803) 52,835 0 0 0 0

01/14- 01/18 47,853 52,815 4,962 52,815 0 0 0 0

01/21 - 01/25 52,814.9 100335.8 47,520.9 100,335.8 0 0 0 0

01/28 – 02/01 0 52,284 52,284 152,619 0 0 0 0

02/11 - 02/15 32,035 13,796.10 (18,239) 134,380 0 0 0 0

02/18 - 02/22 134,380 28,681 (105,699) 28,681 0 0 0 0

02/25 - 03/01 28,681 18,971 (9,709) 18,972 0 0 0 0

03/04 - 03/08 18971 13961 (5010) 13,961 0 0 0 0

03/11 – 03/15 13,961 7,587 (6,374) 7,588 0 17,000 17,000 17,000

03/18 - 03/22 7,587 2,728 (4,859) 2,728 17,000 37,500 20,500 37,500

Research Department VCBS Page | 4

Fixed-Income Report

DISCLAIMER

This report is designed to provide updated information on the fixed-income, including bonds, interest rates, some other related. The VCBS analysts

exert their best efforts to obtain the most accurate and timely information available from various sources, including information pertaining to market

prices, yields and rates. All information stated in the report has been collected and assessed as carefully as possible.

It must be stressed that all opinions, judgments, estimations and projections in this report represent independent views of the analyst at the date of

publication. Therefore, this report should be best considered a reference and indicative only. It is not an offer or advice to buy or sell or any actions

related to any assets. VCBS and/or Departments of VCBS as well as any affiliate of VCBS or affiliate that VCBS belongs to or is related to (thereafter,

VCBS), provide no warranty or undertaking of any kind in respect to the information and materials found on, or linked to the report and no obligation to

update the information after the report was released. VCBS does not bear any responsibility for the accuracy of the material posted or the information

contained therein, or for any consequences arising from its use, and does not invite or accept reliance being placed on any materials or information so

provided.

This report may not be copied, reproduced, published or redistributed for any purpose without the written permission of an authorized representative of

VCBS. Please cite sources when quoting. Copyright 2012 Vietcombank Securities Company. All rights reserved.

CONTACT INFORMATION

Tran Minh Hoang Le Thu Ha

Head of Research Senior Analyst- Economic research

tmhoang@vcbs.com.vn ltha_ho@vcbs.com.vn

VIETCOMBANK SECURITIES COMPANY

http://www.vcbs.com.vn

th th

Ha Noi Headquarter Floor 12 & 17 , Vietcombank Tower, 198 Tran Quang Khai Street, Hoan Kiem District, Hanoi

Tel: (84-4)-39366990 ext: 140/143/144/149/150/151

Ho Chi Minh Branch Floor 1st and 7th, Green Star Building, 70 Pham Ngoc Thach Street, Ward 6, District No. 3, Ho Chi Minh City

Tel: (84-28)-3820 8116 Ext:104/106

Da Nang Branch Floor 12th, 135 Nguyen Van Linh Street, Thanh Khe District, Da Nang City. Tel: (+84-236) 3888 991 ext: 801/802

Nam Sai Gon Transaction Unit Floor 3rd, V6 Tower, Plot V, Him Lam Urban Zone, 23 Nguyen Huu Tho Street, Tan Hung Ward, District No. 7, Ho Chi Minh City

Tel: (84-28)-54136573

Giang Vo Transaction Unit Floor 1st, Building C4 Giang Vo, Giang Vo Ward, Ba Dinh District, Hanoi. Tel: (+84-24) 3726 5551

Tay Ho Transaction Unit 1st & 3rd Floor, 565 Lac Long Quan Street, Tay Ho District, Hanoi. Tel: (+84-24) 2191048 (ext: 100)

Hoang Mai Transaction Unit 1st Floor Han Viet Building, 203 Minh Khai Street, Hai Ba Trung District, Hanoi. Tel: (+84-24) 3220 2345

Can Tho Representative Office Floor 1st, Vietcombank Can Tho Building, 7 Hoa Binh Avenue, Ninh Kieu District, Can Tho City.Tel: (+84-292) 3750 888

Vung Tau Representative Office Floor 1st, 27 Le Loi Street, Vung Tau City, Ba Ria - Vung Tau Province. Tel: (+84-254) 351 3974/75/76/77/78

An Giang Representative Office Floor 7th, Vietcombank An Giang Tower, 30-32 Hai Ba Trung, My Long Ward, Long Xuyen City, An Giang Province

Tel: (84-76)-3949843

Dong Nai Representative Office Floor 1st & 2nd, 79 Hung Dao Vuong, Trung Dung Ward, Bien Hoa City, Dong Nai Province. Tel: (84-61)-3918815

Hai Phong Representative Office Floor 2nd, 11 Hoang Dieu Street, Minh Khai Ward, Hong Bang District, Hai Phong City. Tel: (+84-225) 382 1630

Binh Duong Representative Office Floor 3th, 516 Cach Mang Thang Tam Street, Phu Cuong Ward, Thu Dau Mot City, Binh Duong Province.

Tel: (+84-274) 3855 771

Research Department VCBS Page | 5

Vous aimerez peut-être aussi

- Trai Phieu 17Document12 pagesTrai Phieu 17NguyenPas encore d'évaluation

- Trai Phieu 5 PDFDocument6 pagesTrai Phieu 5 PDFNguyenPas encore d'évaluation

- Trai Phieu 14Document6 pagesTrai Phieu 14NguyenPas encore d'évaluation

- Trai Phieu 15Document6 pagesTrai Phieu 15NguyenPas encore d'évaluation

- Trai Phieu 6Document6 pagesTrai Phieu 6NguyenPas encore d'évaluation

- Trai Phieu 27 PDFDocument6 pagesTrai Phieu 27 PDFNguyenPas encore d'évaluation

- Quarterly Report: Fixed - Income ResearchDocument9 pagesQuarterly Report: Fixed - Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 18Document6 pagesTrai Phieu 18NguyenPas encore d'évaluation

- Monthly Report: Fixed-Income ResearchDocument8 pagesMonthly Report: Fixed-Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 29 PDFDocument8 pagesTrai Phieu 29 PDFNguyenPas encore d'évaluation

- Trai Phieu 22Document6 pagesTrai Phieu 22NguyenPas encore d'évaluation

- Trai Phieu 7Document6 pagesTrai Phieu 7NguyenPas encore d'évaluation

- Trai Phieu 21Document6 pagesTrai Phieu 21NguyenPas encore d'évaluation

- Trai Phieu 25Document7 pagesTrai Phieu 25NguyenPas encore d'évaluation

- Weekly Report: Fixed-Income ResearchDocument7 pagesWeekly Report: Fixed-Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 2Document7 pagesTrai Phieu 2NguyenPas encore d'évaluation

- Macroeconomic Research April 2019: by A Member of VIETCOMBANKDocument14 pagesMacroeconomic Research April 2019: by A Member of VIETCOMBANKNguyenPas encore d'évaluation

- Trai Phieu 9 PDFDocument6 pagesTrai Phieu 9 PDFNguyenPas encore d'évaluation

- Monthly Report: Fixed - Income ResearchDocument8 pagesMonthly Report: Fixed - Income ResearchNguyenPas encore d'évaluation

- Macroeconomics Research: Quarterly ReportDocument11 pagesMacroeconomics Research: Quarterly ReportNguyenPas encore d'évaluation

- Trai Phieu 5 PDFDocument6 pagesTrai Phieu 5 PDFNguyenPas encore d'évaluation

- Trai Phieu 9 PDFDocument6 pagesTrai Phieu 9 PDFNguyenPas encore d'évaluation

- MEF Baocaoquantri 2018Document3 pagesMEF Baocaoquantri 2018NguyenPas encore d'évaluation

- SDE Baocaoquantri 2018Document2 pagesSDE Baocaoquantri 2018NguyenPas encore d'évaluation

- Công Ty C PH N Khoáng S N Sài Gòn Quy NH NDocument5 pagesCông Ty C PH N Khoáng S N Sài Gòn Quy NH NNguyenPas encore d'évaluation

- Tổng Công Ty Cổ Phần Y Tế DanamecoDocument14 pagesTổng Công Ty Cổ Phần Y Tế DanamecoNguyenPas encore d'évaluation

- KTS Baocaotaichinh Q3 2019Document31 pagesKTS Baocaotaichinh Q3 2019NguyenPas encore d'évaluation

- IDV Giaitrinh KQKD 6T 2019 Soatxet HopnhatDocument1 pageIDV Giaitrinh KQKD 6T 2019 Soatxet HopnhatNguyenPas encore d'évaluation

- SLS Baocaotaichinh Q3 2019 PDFDocument25 pagesSLS Baocaotaichinh Q3 2019 PDFNguyenPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Liberalisation Privatisation and GlobalisationDocument13 pagesLiberalisation Privatisation and Globalisationakp200522Pas encore d'évaluation

- Real Estate - Property in DubaiDocument1 pageReal Estate - Property in DubaiqazatsamiaPas encore d'évaluation

- Nitno 13Document3 pagesNitno 13Next Move HRPas encore d'évaluation

- 1 PBDocument16 pages1 PBdavidPas encore d'évaluation

- Certificate of Creditable Tax Withheld at Source: Sharp (Phils) CorporationDocument17 pagesCertificate of Creditable Tax Withheld at Source: Sharp (Phils) CorporationromnickPas encore d'évaluation

- Transfer PricingDocument41 pagesTransfer PricingJudy Ann AcruzPas encore d'évaluation

- Reading 1Document3 pagesReading 1Jvc CawiliPas encore d'évaluation

- Introduction To Econometrics - Stock & Watson - CH 13 SlidesDocument38 pagesIntroduction To Econometrics - Stock & Watson - CH 13 SlidesAntonio AlvinoPas encore d'évaluation

- Billing InvoicesDocument1 pageBilling InvoicesPewnoy GamingPas encore d'évaluation

- Econimic Policies of ChinaDocument3 pagesEconimic Policies of Chinawake up PhilippinesPas encore d'évaluation

- Inland and Maritime Trade in Medieval IndiaDocument11 pagesInland and Maritime Trade in Medieval IndiaUjjwal SharmaPas encore d'évaluation

- MQ Tech FY2022 Q3Document12 pagesMQ Tech FY2022 Q3zul hakifPas encore d'évaluation

- Comprehensive Guide to Candlestick PatternsDocument9 pagesComprehensive Guide to Candlestick Patternsamitkumarjha2014100% (1)

- Bright Ideas Catalogue INDIADocument130 pagesBright Ideas Catalogue INDIAKiran KumarPas encore d'évaluation

- 1form 16 Novopay PDFDocument2 pages1form 16 Novopay PDFTirupathi Rao TellaputtaPas encore d'évaluation

- 7189 1 2 ReadingDocument6 pages7189 1 2 ReadingalwardsocialPas encore d'évaluation

- Arwana Citramulia TBK - 30 - 06 - 2021 - ReleasedDocument85 pagesArwana Citramulia TBK - 30 - 06 - 2021 - ReleasedM Fany AFPas encore d'évaluation

- Toilet Vip 1 DormiDocument42 pagesToilet Vip 1 Dormimuhamad ega alfianaPas encore d'évaluation

- UPVC Windows Quotation ProjectDocument3 pagesUPVC Windows Quotation ProjectsathishPas encore d'évaluation

- Account Statement 040823 030923Document9 pagesAccount Statement 040823 030923Ashwani PanditPas encore d'évaluation

- Chapter 05: Absorption Costing and Variable CostingDocument169 pagesChapter 05: Absorption Costing and Variable CostingNgan Tran Ngoc ThuyPas encore d'évaluation

- Formula Sheet Final ExamDocument3 pagesFormula Sheet Final Examaaa yyyPas encore d'évaluation

- Retirement of Partner PPT 13.01.21 A.hannan AccountacyDocument15 pagesRetirement of Partner PPT 13.01.21 A.hannan AccountacyVishal GoelPas encore d'évaluation

- Use of Auxiliary Information For Estimating Population Mean in Systematic Sampling Under Non-ResponseDocument13 pagesUse of Auxiliary Information For Estimating Population Mean in Systematic Sampling Under Non-ResponseScience DirectPas encore d'évaluation

- Happy Hours Apparels Aug 20, 2021Document2 pagesHappy Hours Apparels Aug 20, 2021Noman AwanPas encore d'évaluation

- Unit 8 - Lesson 4 - Business CycleDocument18 pagesUnit 8 - Lesson 4 - Business Cycleapi-260512563Pas encore d'évaluation

- 1824 000 PI SPC 0003 - 7 - IFP - CleanedDocument22 pages1824 000 PI SPC 0003 - 7 - IFP - CleanedJudith HidalgoPas encore d'évaluation

- (20495331 - Review of Keynesian Economics) The Economics of Negative Interest RatesDocument2 pages(20495331 - Review of Keynesian Economics) The Economics of Negative Interest RatesElita Luisa Coromoto Rincón CastilloPas encore d'évaluation

- FlipcardmixterDocument2 pagesFlipcardmixterUmesh PatelPas encore d'évaluation

- Module 8 QuizDocument29 pagesModule 8 QuizNamastePas encore d'évaluation