Académique Documents

Professionnel Documents

Culture Documents

Monthly Report: Fixed-Income Research

Transféré par

NguyenTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Monthly Report: Fixed-Income Research

Transféré par

NguyenDroits d'auteur :

Formats disponibles

Fixed-Income Research

Monthly report February, 11th,2018

Fixed-Income Report Round-up

8,0% Bond Yields

7,0%

January/2019

6,0%

In this issue

5,0%

Round up

4,0%

Bond market 3,0%

Interest rates 2,0%

Oct-16

Oct-17

Oct-18

Apr-16

Apr-17

Apr-18

Jan-16

Jul-16

Jan-17

Jul-17

Jan-18

Jul-18

Jan-19

2Y 3Y 5Y 7Y 10Y 15Y

Source: Bloomberg, VCBS

VND 36,344 bn (+28% mom, +87% yoy) worth of bond was mobilized. VND

157,438 billion (-2,04% mom) traded on the secondary market.

Yield curve shifted downward and became steepened. According to Bloomberg

statistics, yields for 1Y, 2Y, 3Y, 5Y, 7Y, 10Y and 15Y ended January at 3.34% (-76 bps

mom), 3.478% (-73.2 bps mom), 3.608% (-68.7 bps mom), 3.84% (-71.5 bps mom), 4.2%

(-56.3 bps mom), 4.863% (-26.2 bps mom) and 5.183% (-23 bps mom) respectively.

Foreign bought VND 2,121 bn in bond market.

Le Thu Ha

+84 4 3936 6990 (ext.7182) Interbank rates were in high level almost all January due to seasonal factors.

In detail, at the end of January, interbank rate for ON-3M tenors were recorded at around

ltha_ho@vcbs.com.vn

5%. However, note that, liquidity in money market immediately benefits from news that

exchanges rates pressure cooled down.

SBV net injected VND 93,228 bn via OMO channel.

VCBS Commentary February 2019

In February, after Lunar new year, we expect that liquidity soon returned to the

system and consequently may result in a downward force in bond yields especially for the

short-ones, which are sensitive to liquidity matter.

See Disclaimer at Page 7 We believe that the stability of macroeconomics indexes were better-off notably

exchange rates and inflation. Hence, we are expecting an abundant liquidity in banking

Macroeconomic, Fixed-Income,

system in the upcoming period. It shall help to tick down interbank rate from high threshold

Financial and Corporation

Information updated at recorded from November. Meanwhile, for public investment we expect a surge in this

investment only from 2H.2019

www.vcbs.com.vn/vn/Services/AnalysisResearch

VCBS Bloomberg Page: <VCBS><go>

Research Department VCBS Page | 0

Fixed-Income Report

Bond Market

Primary Market

ST kept focused on mobilizing bonds in 10Y and 15Y.

VND 36,344 bn (+28% mom, +87% VND 36,344 bn (+28% mom, +87% yoy) worth of bond was mobilized in January from

yoy) worth of bond was mobilized. the State Treasury (ST). Therein, ST kept focused on mobilizing bonds in 10Y and 15Y. In

detail, VND 2,500 bn; VND 1,350 bn; VND 17,150 bn; VND 14,000 bn; VND 949 bn and

VND 395 bn were mobilized in 5Y, 7Y, 10Y, 15Y, 20Y and 30Y tenors, respectively.

Winning rates tended to decrease in January. The decrease level ranged from 2-30 bps this

month. This may refer that market expect a downward force in bond market in upcoming

period. Therefore, these days demand for bond was high. In January the register-offering ratio

jumped to from 1.33 times in December to 3.48 times. Therein the average Winning-to-

Offering ratio was also recorded high at 87.5%.

Meanwhile, the Vietnam Development Bank (VDB) and Vietnam Bank for Social Policies

(VBSP) did not mobilize bonds in January.

50.000 Winning Vol (VND

Primary market

GB Auction results

45.000 rates bn)

8,50% 12000

40.000

7,50% 10000

35.000

30.000 6,50% 8000

25.000 5,50% 6000

20.000

4,50% 4000

15.000

3,50% 2000

10.000

5.000 2,50% 0

0

Apr 18

Jun 18

Jan 18

Jul 18

Jan 19

Feb 18

Mar 18

Aug 18

Sep 18

Nov 18

May 18

Oct 18

Dec 18

Volume 5Y 7Y

ST VBSP VDB 10Y 15Y 20Y

30Y

Source: HNX, VCBS

From the latest updates, the annual issuance plan for 2019 was VND 200,000 bn. We will keep

updating plan for 2019 as well as Q1.2019. Note that in February, VND 12,233 bn worth of

bond will mature (~10% amount of bond mature in 2019)

Macro updates:

According to Nikkei, PMI in Vietnam reached 51.9 in January compared to 53.8 in

December. Outputs and new orders this month grew at moderate pace though they

still expand for the last 38 months. In addition GSO releases report on economic

situation with same moderate growth of manufacturing subsector. In detail, index of

industrial production (IIP) for the whole industry in January 2018 grew 7.9% over the

similar period in 2017 while the same figure last year was 22.1%. With these figures

we still anticipate that GDP growth in Q1.2019 shall vary from 6.2%-6.5%.

CPI in January of 2019 increased by 0.1% compared to last month, which equivalent

to an increase of 2.56% over the same period of 2017. Therein, main driver of CPI

Research Department VCBS Page | 1

Fixed-Income Report

growth was Food and beverage while transportation prevented CPI from increase this

month. We believe consumer demand is usually high at this period due to seasonal

factor of the festival seasons and it is a normal to have a high CPI level in the

remaining of Q1. Therefore, till now we do not concern much about upward pressure

on CPI.

In a recent conference of Banking Industry, SBV has stated the credit growth target of

the same figure of 2018 (~14%). With this figure, it can be indicated that SBV aimed

at a sustainable credit growth instead of a fast-growing with a view to prolong the

sustainability. Hence we still expect an active period for bond market in 1H.2019.

Exchanges rates cooled down significantly thank to timely regulating approach from

SBV. In detail, SBV successfully purchase USD 4 bn this month after raising USD

buying price at SBV Operation center by VND 500 to VND 23,200 per USD. The

gap between celling rate and exchange rates traded at commercial banks widened.

USD/VND Exchange rate

23.900

23.500

23.100

22.700

22.300

21.900

21.500

21.100

20.700

04/15 07/15 10/15 01/16 04/16 07/16 10/16 01/17 04/17 07/17 10/17 01/18 04/18 07/18 10/18 01/19

Reference exchange rate Ceiling exchange rate

Floor exchange rate VCB spot bid exchange rate

VCB spot offer exchange rate

In the latest meeting in January, FED did not raise interest rate and pledged that

future moves will be done patiently and with an eye toward how economic conditions

unfold. Meanwhile, 10Y US bond yield traded at ~2.7%- far from its peak~3.2%

recorded in November.

Secondary Market

Market was still in laggard status. Yield curve became steepened in January.

VND 157,438 billion (-2,04% mom) VND 157,438 billion (-2.04% mom) traded on the secondary market. In particular, both

traded on the secondary market. outright and repo keep decrease slightly this month recorded at VND75,609 billion (-2.05%

mom, -36.04% yoy) and VND 89,825 billion (-2.05% mom,-30.7% yoy). From Issuer’s

perspective, ST bond still dominated the market with more than 87% of outright trading value.

Research Department VCBS Page | 2

Fixed-Income Report

300

Secondary market

VND Trillion

240

180

120

60

Apr 17

Jun 17

Apr 18

Jun 18

Jan 17

Jul 17

Jan 18

Jul 18

Jan 19

Feb 17

Mar 17

Aug 17

Sep 17

Nov 17

Feb 18

Mar 18

Aug 18

Sep 18

Nov 18

May 17

Oct 17

Dec 17

May 18

Oct 18

Dec 18

Outright Repo

Source: HNX,VCBS

Yield curve shifted downward and became steepened. According to Bloomberg statistics,

yields for 1Y, 2Y, 3Y, 5Y, 7Y, 10Y and 15Y ended January at 3.34% (-76 bps mom), 3.478%

(-73.2 bps mom), 3.608% (-68.7 bps mom), 3.84% (-71.5 bps mom), 4.2% (-56.3 bps mom),

4.863% (-26.2 bps mom) and 5.183% (-23 bps mom) respectively.

Although the seasonal factor still exist in January prior to Lunar New Year. Bond yield

experienced a downward force due to some factor: (1) Pressure on exchanges rates released

with consistent regulating approach from SBV. (2) Concern on high inflation also eased thanks

to support news of lower level on crude oil price compared to the same period last year. (3)

More patient approach from FED in term of interest –lifting procedure appeared to make

market ‘s sentiment better-off .

8,0% Bond Yields

Yield Curve

6,5

7,0%

5,5 6,0%

4,5 5,0%

4,0%

3,5

3,0%

2,5

2,0%

Oct-16

Oct-17

Oct-18

Apr-16

Apr-17

Apr-18

Jan-16

Jul-16

Jan-17

Jul-17

Jan-18

Jul-18

Jan-19

1,5

1Y2Y3Y 5Y 7Y 10Y 15Y

2Y 3Y 5Y

12/28/2018 11/30/2018

1/31/2019 7Y 10Y 15Y

Source: Bloomberg, VCBS

In February, after Lunar new year, we expect that liquidity soon returned to the system and

consequently may result in a downward force in bond yields. This is also the second phase, we

mention in Annual report for fixed income. Also we drew attention to some supportive news

released right after the long break which are (1) SBV has purchased USD 4 bn so far in 2019

and (2) SBV is considering to reduce required reserve ratio for a certain amount. All of these

are expected to help strengthen liquidity in banking system. Hence, we expect a downward

force on bond yields especially for the short-ones, which are sensitive to liquidity matter.

Research Department VCBS Page | 3

Fixed-Income Report

Foreign bought VND 2,121 bn in Foreign bought VND 2,121 bn in bond market. Given the historical data into consideration, we

bond market. believe that this is the favorite time for foreign investors to build their portfolios especially the

ones who are favors short-tenor.

4.050

FI in the secondary market

Net position (Unit: bn.VND)

2.530

1.254 2.121

1.681

1.429

1.209

789 963

624

270 422

215

0

682

0 -339 -335 -222 -275

-655

-1.274 -465

Sep-17

Feb-18

Sep-18

May-17

Oct-17

Mar-18

May-18

Oct-18

Dec-17

Dec-18

Jun-17

Apr-18

Jun-18

Jul-17

Aug-17

Nov-17

Jan-18

Jul-18

Aug-18

Nov-18

Jan-19

Source: HNX, VCBS

Although, Foreign disbursed more on the last 3 months. We do not speak highly chance that

Foreign will soon be extraordinary active on the bond market taking the upward medium trend

of US bond yields into consideration.

INTEREST RATE

Interbank Rates

Interbank rates were in high level Interbank rates were in high level almost all January due to seasonal factors. In detail, at

almost all January due to seasonal the end of January, interbank rate for ON-3M tenors were recorded at around 5%. However,

factors. note that, liquidity in money market immediately benefits from news that exchanges rates

pressure cooled down. We experience this phenomenal in the middle of January. Although it

did not last long due to seasonal factor of Lunar new year.

6,0%

4,0%

2,0%

0,0%

Mar-16

Sep-16

Mar-17

Sep-17

Mar-18

Sep-18

May-16

May-17

May-18

Jan-16

Jul-16

Nov-16

Jan-17

Jul-17

Nov-17

Jan-18

Jul-18

Nov-18

Jan-19

ON 1W 2W 1M

Source: Bloomberg, VCBS

In February, we believe that the stability of macroeconomics indexes were better-off notably

exchange rates and inflation. Hence, we are expecting an abundant liquidity in banking

system in the upcoming period. It shall help to tick down interbank rate from high threshold

recorded from November. Meanwhile, for public investment we expect a surge in this

Research Department VCBS Page | 4

Fixed-Income Report

investment only from 2H.2019.

Open Market Operation

SBV net injected VND 93,228 bn via SBV took full use of OMO to minimize seasonal factors

OMO channel.

This year, SBV took full use of OMO to minimize seasonal factors. Therein, only about

VND 184,000 bn due while more than VND 280,000 worth of reverse repo was newly

offered.

Previously, there is rumor that SBV will raise OMO interest rate in Q1 of 2019. However, we

believe that this was the very last approach SBV may consider taking. Till now, we do not

foresee pressure for SBV to make it happen because liquidity shall rush back to money

market when seasonal factors washed away.

SBV-Bill Oustanding

Reverse Repo

300,0 250,0

x VND 1,000bn

x VND 1,000 bn

250,0 200,0

200,0

150,0

150,0

100,0

100,0

50,0 50,0

- -

Mar-16

Sep-16

Mar-17

Sep-17

Mar-18

Sep-18

May-16

May-17

May-18

Jul-16

Nov-16

Jan-17

Jul-17

Nov-17

Jan-18

Jul-18

Nov-18

Jan-19

Mar-16

Sep-16

Mar-17

Sep-17

Mar-18

Sep-18

May-16

May-17

May-18

Jul-16

Nov-16

Jan-17

Jul-17

Nov-17

Jan-18

Jul-18

Nov-18

Jan-19

Source: Bloomberg, VCBS

END.

Research Department VCBS Page | 5

Fixed-Income Report

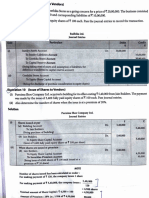

APPENDICES

Primary Market

ST Bond

VDB VBSP Other

Month

Issued Issued Issued Issued Issued

5Y 7Y 10Y 15Y 20Y 30Y

Volume Volume Volume Volume Volume

Jan-18 19,365 4.3 4.35 4.38 4.5 5.2 5.4 0 0 0 19,365

Feb-18 10,015 3.05 3.4 4.2 4.4 N/A N/A 0 0 0 10,015

Mar-18 11,028 2.97 3.43 N/A 4.4 5.1 5.42 0 0 0 11,028

Apr-18 6,055 2.97 3.43 4.1 4.47 5.12 5.42 0 0 0 6,055

May-18 11,178 3 N/A 4.26 4.6 5.14 N/A 0 0 0 11,178

Jun-18 16,940 3.1 N/A 4.37 4.7 5.2 N/A 0 0 0 16,940

Jul-18 15,420 3.45 3.9 4.48 4.78 5.22 5.42 0 350 0 15,770

Aug-18 16,060 3.5 3.9 4.63 4.87 N/A N/A 0 0 0 16,080

Sep-18 15,700 3.5 3.9 4.8 5.07 5.22 5.42 0 5,100 0 20,800

Oct-18 5,366 4.2 N/A 4.95 5.2 N/A N/A 0 2,940 0 8,306

Nov-18 10,220 N/A N/A 5.1 5.3 N/A N/A 0 0 0 10,220

Dec-18 28,450 N/A N/A 5.1 5.3 N/A N/A 16,545 0 0 44,995

Jan-19 36,344 3.8 4.17 4.8 5.12 5.59 5.8 0 0 0 36,344

Secondary Market

Bonds ST-bills

Total

Month Outright Repo Outright Repo

Jan-18 118,223 118,127 - - 236,350

Feb-18 73,893 100,365 - - 174,285

Mar-18 118,614 149,163 - - 267,777

Apr-18 117,127 140,244 - - 257,371

May-18 83,940 104,896 - - 188,836

Jun-18 112,344 70,399 - - 182,733

Jul-18 62,423 92,597 - - 155,020

Aug-18 62,332 84,661 - - 146,993

Sep-18 68,966 81,990 - - 150,956

Oct-18 55,760 89,321 - - 145,081

Nov-18 56,834 74,806 - - 131,640

Dec-18 77,194 83,527 - - 160,721

Jan-19 75,609 81,829 - - 157,438

Open Market Operation

Reverse Repo Outright (SBV Bills)

Month

Due Offer Balance Outstanding Due Offer Balance Outstanding

Jan-18 3,260 42,309 39,048 41,314 167,106 197,705 30,600 47,000

Feb-18 49,780 8,466 (41,314) 0 59,000 90,600 31,600 78,600

Mar-18 31 31 0 0 84,100 196,710 112,610 191,210

Apr-18 2 2 0 0 191,210 78,500 (112,630) 78,580

May-18 170 170 0 0 80,280 55,840 (24,440) 54,140

Jun-18 0 0 0 0 54,140 150,499 96,359 150,499

Jul-18 15,993 17,993 2,000 2,000 112,500 44,461 (68,039) 82,461

Aug-18 37,167 42,869 5,702 7,702 35,312 28,482 (6,830) 75,630

Sep-18 15,401 8,155 (7,246) 456 50,000 52,950 2,950 78,581

Oct-18 16,018 60,562 44,544 45,000 62,591 15,070 (47,521) 31,060

Nov-18 237,878 237,663 (215) 44,785 2,100 0 (2,100) 28,960

Dec-18 25,929 32,208 6,279 51,064 28,960 0 (28,960) 0

Jan-19 184,354 280,582 93,228 144,292 0 0 0 0

Research Department VCBS Page | 6

Fixed-Income Report

DISCLAIMER

This report is designed to provide updated information on the fixed-income, including bonds, interest rates, some other related. The

VCBS analysts exert their best efforts to obtain the most accurate and timely information available from various sources, including

information pertaining to market prices, yields and rates. All information stated in the report has been collected and assessed as

carefully as possible.

It must be stressed that all opinions, judgments, estimations and projections in this report represent independent views of the analyst at

the date of publication. Therefore, this report should be best considered a reference and indicative only. It is not an offer or advice to

buy or sell or any actions related to any assets. VCBS and/or Departments of VCBS as well as any affiliate of VCBS or affiliate that

VCBS belongs to or is related to (thereafter, VCBS), provide no warranty or undertaking of any kind in respect to the information and

materials found on, or linked to the report and no obligation to update the information after the report was released. VCBS does not

bear any responsibility for the accuracy of the material posted or the information contained therein, or for any consequences arising

from its use, and does not invite or accept reliance being placed on any materials or information so provided.

This report may not be copied, reproduced, published or redistributed for any purpose without the written permission of an authorized

representative of VCBS. Please cite sources when quoting. Copyright 2012 Vietcombank Securities Company. All rights reserved.

CONTACT INFORMATION

Tran Minh Hoang Le Thu Ha

Head of Research Fixed income Analyst

tmhoang@vcbs.com.vn ltha_ho@vcbs.com.vn

VIETCOMBANK SECURITIES COMPANY

http://www.vcbs.com.vn

Ha Noi Headquarter Floor 12th & 17th, Vietcombank Tower, 198 Tran Quang Khai Street, Hoan Kiem District, Hanoi Tel: (84-4)-39366990 ext:

140/143/144/149/150/151

Ho Chi Minh Branch Floor 1st and 7th, Green Star Building, 70 Pham Ngoc Thach Street, Ward 6, District No. 3, Ho Chi Minh City

Tel: (84-28)-3820 8116 Ext:104/106

Da Nang Branch Floor 12th, 135 Nguyen Van Linh Street, Thanh Khe District, Da Nang City Tel: (+84-236) 3888 991 ext: 801/802

Nam Sai Gon Transaction Unit Floor 3rd, V6 Tower, Plot V, Him Lam Urban Zone, 23 Nguyen Huu Tho Street, Tan Hung Ward, District No. 7, Ho Chi Minh City

Tel: (84-28)-54136573

Giang Vo Transaction Unit Floor 1st, Building C4 Giang Vo, Giang Vo Ward, Ba Dinh District, Hanoi. Tel: (+84-24) 3726 5551

Tay Ho Transaction Unit 1st & 3rd Floor, 565 Lac Long Quan Street, Tay Ho District, Hanoi. Tel: (+84-24) 2191048 (ext: 100)

Hoang Mai Transaction Unit 1st Floor Han Viet Building, 203 Minh Khai Street, Hai Ba Trung District, Hanoi. Tel: (+84-24) 3220 2345

Can Tho Representative Office Floor 1st, Vietcombank Can Tho Building, 7 Hoa Binh Avenue, Ninh Kieu District, Can Tho City. Tel: (+84-292) 3750 888

Vung Tau Representative Office Floor 1st, 27 Le Loi Street, Vung Tau City, Ba Ria - Vung Tau Province Tel: (+84-254) 351 3974/75/76/77/78.

An Giang Representative Office Floor 7th, Vietcombank An Giang Tower, 30-32 Hai Ba Trung, My Long Ward, Long Xuyen City, An Giang Province

Tel: (84-76)-3949843

Dong Nai Representative Office Floor 1st & 2nd, 79 Hung Dao Vuong, Trung Dung Ward, Bien Hoa City, Dong Nai Province Tel: (84-61)-3918815

Hai Phong Representative Office Floor 2nd, 11 Hoang Dieu Street, Minh Khai Ward, Hong Bang District, Hai Phong City. Tel: (+84-225) 382 1630

Binh Duong Representative Office Floor 3th, 516 Cach Mang Thang Tam Street, Phu Cuong Ward, Thu Dau Mot City, Binh Duong Province.

Tel: (+84-274) 3855 771

Research Department VCBS Page | 7

Vous aimerez peut-être aussi

- Royal Bank of Canada PDFDocument1 pageRoyal Bank of Canada PDFempower93 empower93100% (1)

- Asahi Case SolutionDocument1 pageAsahi Case SolutionAmit BiswalPas encore d'évaluation

- Matatu Sacco Software Features PDFDocument4 pagesMatatu Sacco Software Features PDFdavid544150% (2)

- Quarterly Report: Fixed - Income ResearchDocument9 pagesQuarterly Report: Fixed - Income ResearchNguyenPas encore d'évaluation

- State Bank of India: Pick of The WeekDocument4 pagesState Bank of India: Pick of The WeekkevalPas encore d'évaluation

- Pick of The Week SbiDocument4 pagesPick of The Week SbiMukesh KumarPas encore d'évaluation

- Understanding Seasonality in Cannabis Sales: Headset Cannabis Market ReportsDocument15 pagesUnderstanding Seasonality in Cannabis Sales: Headset Cannabis Market ReportsHAS UYARPas encore d'évaluation

- CRISIL Monetary Policy Review Sliced AgainDocument6 pagesCRISIL Monetary Policy Review Sliced Againkunal kamalPas encore d'évaluation

- Pick of The Week Ongc LTDDocument4 pagesPick of The Week Ongc LTDAnkit JagetiaPas encore d'évaluation

- Liquid Assets Bank Size and Bank Profitability For BUKU 1, BUKU 2, BUKU 3 and BUKU 4 in IndonesiaDocument12 pagesLiquid Assets Bank Size and Bank Profitability For BUKU 1, BUKU 2, BUKU 3 and BUKU 4 in IndonesiaaijbmPas encore d'évaluation

- Kotak Mahindra Bank Limited Managements Discussion and Analysis FY18Document38 pagesKotak Mahindra Bank Limited Managements Discussion and Analysis FY18ss gPas encore d'évaluation

- Monthly Report: Fixed - Income ResearchDocument8 pagesMonthly Report: Fixed - Income ResearchNguyenPas encore d'évaluation

- Chapter 1 PDFDocument18 pagesChapter 1 PDFiqra waseemPas encore d'évaluation

- Economy - July-19 CPI Anticipated at 10.71%YoY Breaching A 7-Year High - June 30, 2019Document3 pagesEconomy - July-19 CPI Anticipated at 10.71%YoY Breaching A 7-Year High - June 30, 2019SidrahAKPas encore d'évaluation

- Event Update: Please Refer To Disclaimer On The Next PageDocument2 pagesEvent Update: Please Refer To Disclaimer On The Next PageDhruv GandhiPas encore d'évaluation

- Spark Strategy - Why Household Savings Have Been Falling in India - Apr'19 - Spark CapitalDocument9 pagesSpark Strategy - Why Household Savings Have Been Falling in India - Apr'19 - Spark CapitalMadhuchanda DeyPas encore d'évaluation

- Tracking Financial ConditionsDocument14 pagesTracking Financial ConditionsSathishPas encore d'évaluation

- Ukraine & MKT Implications 250222Document4 pagesUkraine & MKT Implications 250222sandadilaxma reddyPas encore d'évaluation

- The Coming Collapse of Inflation and How To Benefit From It July 2022Document29 pagesThe Coming Collapse of Inflation and How To Benefit From It July 2022Dinesh RupaniPas encore d'évaluation

- Parte 2Document34 pagesParte 2Odla Sedlej OcopihcPas encore d'évaluation

- Pick of The Week JK PaperDocument4 pagesPick of The Week JK PaperKamal AgarwalPas encore d'évaluation

- Edelweiss Professional Investor Research Diwali Picks 2019 FundamentalDocument7 pagesEdelweiss Professional Investor Research Diwali Picks 2019 FundamentalSandip DasPas encore d'évaluation

- Result Review: Margins Contract As Opex NormalisesDocument10 pagesResult Review: Margins Contract As Opex NormalisesSriHariKalyanBPas encore d'évaluation

- Result Review: Margins Contract As Opex NormalisesDocument10 pagesResult Review: Margins Contract As Opex NormalisesSriHariKalyanBPas encore d'évaluation

- QT Fund Monthly FactsheetDocument4 pagesQT Fund Monthly FactsheetKevinPas encore d'évaluation

- Rbi Bi-Monthly Monetary Policy Fy22Document2 pagesRbi Bi-Monthly Monetary Policy Fy22Shiwani singhPas encore d'évaluation

- Initiating Coverage: Power Tillers To Steer Growth - Initiate With BUYDocument18 pagesInitiating Coverage: Power Tillers To Steer Growth - Initiate With BUYsarvo_44Pas encore d'évaluation

- Torrent Downloaded From ExtraTorrent - CCDocument6 pagesTorrent Downloaded From ExtraTorrent - CCAhmed Ali HefnawyPas encore d'évaluation

- Monthly Economic Turkey Aug17Document17 pagesMonthly Economic Turkey Aug17erdPas encore d'évaluation

- KPI DataDocument58 pagesKPI DataIlham Husnul Abid SyamsuddinPas encore d'évaluation

- What Is SofrDocument9 pagesWhat Is SofrShaPas encore d'évaluation

- HDFC Equity Fund: Comprehesive Fund Review & RatingDocument11 pagesHDFC Equity Fund: Comprehesive Fund Review & Ratingmayank007Pas encore d'évaluation

- Fund FactDocument19 pagesFund FactGatot KacaPas encore d'évaluation

- Monetary Policy Mar-21-3Document1 pageMonetary Policy Mar-21-3kalimPas encore d'évaluation

- UTI Aggressive Hybrid Fund (Formerly UTI Hybrid Equity Fund)Document29 pagesUTI Aggressive Hybrid Fund (Formerly UTI Hybrid Equity Fund)Rinku MishraPas encore d'évaluation

- World BankDocument11 pagesWorld BankChatis HerabutPas encore d'évaluation

- 2019-02 Monthly Housing Market OutlookDocument28 pages2019-02 Monthly Housing Market OutlookC.A.R. Research & Economics0% (1)

- Dolat Capital Modi Era S Century An AnalysisDocument21 pagesDolat Capital Modi Era S Century An AnalysisRohan ShahPas encore d'évaluation

- Infosys Q3FY20 ResultsDocument11 pagesInfosys Q3FY20 Resultsbobby singhPas encore d'évaluation

- InflationDocument42 pagesInflationTwinkle MehtaPas encore d'évaluation

- Final Consumer Price IndexDocument2 pagesFinal Consumer Price IndexyyPas encore d'évaluation

- 2021-02 Monthly Housing Market OutlookDocument29 pages2021-02 Monthly Housing Market OutlookC.A.R. Research & EconomicsPas encore d'évaluation

- RFP - Icba Grid-Connected Solar PV System Project - 0Document11 pagesRFP - Icba Grid-Connected Solar PV System Project - 0Ahmed HussainPas encore d'évaluation

- Costs of Tyre SectorDocument9 pagesCosts of Tyre SectorabdullahPas encore d'évaluation

- Economy: IndiaDocument8 pagesEconomy: IndiaRavichandra BPas encore d'évaluation

- Company Update: L&T Makes Formal Move To Acquire MindtreeDocument8 pagesCompany Update: L&T Makes Formal Move To Acquire Mindtreeswapnil tyagiPas encore d'évaluation

- Kemenkeu BPPK 20200720 Online Seminar Chatib BasriDocument14 pagesKemenkeu BPPK 20200720 Online Seminar Chatib BasriClara LilaPas encore d'évaluation

- November 2021 Uk Economy Property Market UpdateDocument7 pagesNovember 2021 Uk Economy Property Market Update344clothingPas encore d'évaluation

- Result Review: Margin Miss But Resilient Outlook in Tough EnvironmentDocument10 pagesResult Review: Margin Miss But Resilient Outlook in Tough EnvironmentYagyaaGoyalPas encore d'évaluation

- Economic Research - IndiaCPIIIP June - Centrum 12072023Document5 pagesEconomic Research - IndiaCPIIIP June - Centrum 12072023OIC TestPas encore d'évaluation

- Benchmark - July 2019 - Cobalt - Forecast - ReportDocument58 pagesBenchmark - July 2019 - Cobalt - Forecast - ReportÁlvaro OrdóñezPas encore d'évaluation

- Apollo Credit Market Outlook Jul23Document157 pagesApollo Credit Market Outlook Jul23supPas encore d'évaluation

- Market Review - Outer London (North West) - January 2019Document2 pagesMarket Review - Outer London (North West) - January 2019Marina QattanPas encore d'évaluation

- Menap PP en Reo1118Document21 pagesMenap PP en Reo1118Ангелина ВасильченкоPas encore d'évaluation

- Indonesia EconomicsDocument6 pagesIndonesia EconomicsNyoman RiyoPas encore d'évaluation

- SFMRDocument6 pagesSFMRAli RazaPas encore d'évaluation

- HeroMotoCorp Reduce BoBCaps 20200814 PDFDocument11 pagesHeroMotoCorp Reduce BoBCaps 20200814 PDFKiran KudtarkarPas encore d'évaluation

- Update On IDFC Arbitrage FundDocument6 pagesUpdate On IDFC Arbitrage FundGPas encore d'évaluation

- Economic Review Jul-Mar 2019Document7 pagesEconomic Review Jul-Mar 2019FaisalPas encore d'évaluation

- 2019-09 Monthly Housing Market OutlookDocument44 pages2019-09 Monthly Housing Market OutlookC.A.R. Research & EconomicsPas encore d'évaluation

- Executive Summary IEF Nov2020Document6 pagesExecutive Summary IEF Nov2020fredy coronelPas encore d'évaluation

- 2019-10 Monthly Housing Market OutlookDocument44 pages2019-10 Monthly Housing Market OutlookC.A.R. Research & EconomicsPas encore d'évaluation

- Trai Phieu 15Document6 pagesTrai Phieu 15NguyenPas encore d'évaluation

- Trai Phieu 17Document12 pagesTrai Phieu 17NguyenPas encore d'évaluation

- Trai Phieu 18Document6 pagesTrai Phieu 18NguyenPas encore d'évaluation

- Trai Phieu 14Document6 pagesTrai Phieu 14NguyenPas encore d'évaluation

- Trai Phieu 21Document6 pagesTrai Phieu 21NguyenPas encore d'évaluation

- Trai Phieu 25Document7 pagesTrai Phieu 25NguyenPas encore d'évaluation

- Monthly Report: Fixed - Income ResearchDocument8 pagesMonthly Report: Fixed - Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 7Document6 pagesTrai Phieu 7NguyenPas encore d'évaluation

- Trai Phieu 2Document7 pagesTrai Phieu 2NguyenPas encore d'évaluation

- Volunteers in Arts and Culture Organizations in Canada in 2007Document26 pagesVolunteers in Arts and Culture Organizations in Canada in 2007NguyenPas encore d'évaluation

- Weekly Report: Fixed-Income ResearchDocument7 pagesWeekly Report: Fixed-Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 6Document6 pagesTrai Phieu 6NguyenPas encore d'évaluation

- MEF Baocaoquantri 2018Document3 pagesMEF Baocaoquantri 2018NguyenPas encore d'évaluation

- Macroeconomic Research April 2019: by A Member of VIETCOMBANKDocument14 pagesMacroeconomic Research April 2019: by A Member of VIETCOMBANKNguyenPas encore d'évaluation

- 2018-04-23 The New Yorker PDFDocument92 pages2018-04-23 The New Yorker PDFNguyen100% (2)

- SLS Baocaotaichinh Q3 2019 PDFDocument25 pagesSLS Baocaotaichinh Q3 2019 PDFNguyenPas encore d'évaluation

- Công Ty C PH N Khoáng S N Sài Gòn Quy NH NDocument5 pagesCông Ty C PH N Khoáng S N Sài Gòn Quy NH NNguyenPas encore d'évaluation

- Tổng Công Ty Cổ Phần Y Tế DanamecoDocument14 pagesTổng Công Ty Cổ Phần Y Tế DanamecoNguyenPas encore d'évaluation

- STIBET Applicationform U Ko-LaDocument3 pagesSTIBET Applicationform U Ko-LaNguyenPas encore d'évaluation

- Tong Hop 100 Topics Cho Ielts Speaking by Ngocbach PDFDocument160 pagesTong Hop 100 Topics Cho Ielts Speaking by Ngocbach PDFNguyenPas encore d'évaluation

- Energy From The Desert Ed-5 2015 LR PDFDocument171 pagesEnergy From The Desert Ed-5 2015 LR PDFNguyenPas encore d'évaluation

- Issue of Shares Question Part 1Document2 pagesIssue of Shares Question Part 1Madhvi Gaur.Pas encore d'évaluation

- Personal Finance Canadian Canadian 5th Edition Kapoor Test BankDocument25 pagesPersonal Finance Canadian Canadian 5th Edition Kapoor Test BankMollyMoralescowyxefb100% (43)

- 00000785-CURRENT ACCOUNT - I-4129-Feb-19Document2 pages00000785-CURRENT ACCOUNT - I-4129-Feb-19AUTO online VTOPas encore d'évaluation

- Financial Services Provided by Sumeru Securities Private LimitedDocument32 pagesFinancial Services Provided by Sumeru Securities Private Limitedsagar timilsinaPas encore d'évaluation

- Deutsche Bank India Country Fact SheetDocument3 pagesDeutsche Bank India Country Fact SheetNandan Aurangabadkar0% (1)

- Business Environment: © Oxford University Press 2014. All Rights ReservedDocument18 pagesBusiness Environment: © Oxford University Press 2014. All Rights Reservedamit dipankarPas encore d'évaluation

- BiiiimplmoniwbDocument34 pagesBiiiimplmoniwbShruti DubeyPas encore d'évaluation

- Final Settlement PageDocument6 pagesFinal Settlement Pagemohammad zubairPas encore d'évaluation

- PLDT AcoDocument1 pagePLDT AcoWesPas encore d'évaluation

- Madoff Statements of Financial Condition For Fiscal Years Ended 10/31/02 To 10/31/07Document4 pagesMadoff Statements of Financial Condition For Fiscal Years Ended 10/31/02 To 10/31/07jpeppard100% (2)

- United States Court of Appeals, Tenth CircuitDocument9 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsPas encore d'évaluation

- Receivables Management: "Any Fool Can Lend Money, But It TakesDocument37 pagesReceivables Management: "Any Fool Can Lend Money, But It Takesjai262418Pas encore d'évaluation

- Legaspi V PeopleDocument3 pagesLegaspi V PeoplenilesrevillaPas encore d'évaluation

- Business Finance ReviewerDocument3 pagesBusiness Finance ReviewerEmelita abagatPas encore d'évaluation

- Thesis: The Influence of Hedge Funds On Share PricesDocument63 pagesThesis: The Influence of Hedge Funds On Share Pricesbenkedav100% (7)

- Ec 1745 Fall 2008 Problem Set 1Document2 pagesEc 1745 Fall 2008 Problem Set 1tarun singhPas encore d'évaluation

- Pool Management For Islamic BanksDocument27 pagesPool Management For Islamic Bankssjawaidiqbal83% (6)

- BDO Credit CardDocument5 pagesBDO Credit CardAldrin SorianoPas encore d'évaluation

- Blank Finance Budgets and Net WorthDocument24 pagesBlank Finance Budgets and Net WorthAdam100% (6)

- NSDL Case StudyDocument3 pagesNSDL Case StudyDeepshikha Goel100% (1)

- Driver Clearance For Grab - PDF - 20230928 - 140406 - 0000Document1 pageDriver Clearance For Grab - PDF - 20230928 - 140406 - 0000jzeb.gonzales18Pas encore d'évaluation

- Bosnia and Herzegovina Financial Sector ReportDocument21 pagesBosnia and Herzegovina Financial Sector ReportNirmalPas encore d'évaluation

- PT Sinar MotorDocument67 pagesPT Sinar MotorHesti RisqyasariPas encore d'évaluation

- Assignment of ContractDocument2 pagesAssignment of Contractapi-355836870Pas encore d'évaluation

- PRESS RELEASE - Suspension of Payments On Selected External Debts of The Government of Ghana - For IMMEDIATE RELEASEDocument2 pagesPRESS RELEASE - Suspension of Payments On Selected External Debts of The Government of Ghana - For IMMEDIATE RELEASEKMPas encore d'évaluation

- Craig Hayward - 2021 - 1065 - K1 3Document6 pagesCraig Hayward - 2021 - 1065 - K1 3Craig HaywardPas encore d'évaluation

- BBL Cheque Book Authorization LetterDocument1 pageBBL Cheque Book Authorization Letterkazi shahriar mannan Maruf100% (1)