Académique Documents

Professionnel Documents

Culture Documents

Trai Phieu 17

Transféré par

NguyenCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Trai Phieu 17

Transféré par

NguyenDroits d'auteur :

Formats disponibles

Fixed-Income Research

Annual Report 2018 January 22nd,2018

Fixed-Income Report Round-Up

8,0%

Bond yields

7,0%

Annual Report 2018 6,0%

In this issue 5,0%

4,0%

Round up 3,0%

Bond market 2,0%

01-17

02-17

03-17

04-17

05-17

06-17

07-17

08-17

09-17

10-17

11-17

12-17

01-18

02-18

03-18

04-18

05-18

06-18

07-18

08-18

09-18

10-18

Interest rates

2Y 3Y 5Y 7Y 10Y 15Y

Source: Bloomberg, VCBS

VND 192,012 bn (-1.48% yoy) was mobilized in 2018. Winning rate for 10-year

and 15-year were at high level.

Yield curve became flatten and shifted upward as price volatility of longer-term

bonds were considerable smaller than shorter-term bonds. At the end of 2018, according to

Bloomberg, 1-Y, 2-Y, 3-Y, 5-Y, 7-Y, 10-Y and 15-Y bond yields respectively was 4.1%

(+46 bps yoy); 4.21% (+31 bps yoy); 4.295% (+34.1 bps yoy); 4.555% (+19,5 bps yoy);

4,763% (+14.3 bps yoy); 5,125% (-7.9 bps yoy) and 5.413% (-27.67 bps yoy).

Foreign investors net bought VND 103 bn in 2018.

From June, interbank rate increased gradually and recorded n higher level of

average rate compared to the same period of 2017.

Le Thu Ha SBV made full use of OMO. OMO market interest rate fell 0.25% in January

+84 24 39366990 (ext. 7182) and remained stable at 4.75%.

ltha_ho@vcbs.com.vn VCBS Commentary

In 2019, we believe the average level of interbank rates will settled at higher level.

Depository rates level is forecasted to rise 50 points, while lending rates though bear

upward force, will only increase at specific segments.

We believe average issuing tenor will slightly decrease. The issuing pressure will

See Disclaimer at Page 11 be higher than 2018 and focus on the beginning of the year.

Main factors that affect secondary market in 2019 are: the liquidity of interbank

Macroeconomic, Fixed-Income,

market; the policy of SBV and the public investment disbursement.

Financial and Corporation

Information updated at VCBS forecasts the market will go through 3 periods with upward force on bond

www.vcbs.com.vn/vn/Services/AnalysisResearch yields prevails. In 1H.2019, the target of stability interest level is strongly feasible with a

number of supporting factors. Depository rates level is forecast to bear tension to rise,

mostly in later-haft of 2019.

.

VCBS Research Department Page| 0

Fixed-Income Report

BOND MARKET

Primary market

State Treasury (ST) mostly issued 10-Y and 15-Y bond. Winning rates hit bottom in 1st

Quarter then increased gradually.

VND 192,012 bn (-1.48% yoy) of

bonds was mobilized VND 192,012 bn (-1.48% yoy) worth of bonds was mobilized in 2018. In particular, VND

165,797 bn was mobilized by ST, VND 9,670 bn was mobilized by VDB and VND 16,545 bn

was mobilized by VBSP.

In regard of government bond, VND 165,797 bn was mobilized. Following the trend of 2017,

government bond auction activities in 2018 continued to record successful results.

Accordingly, the average issuance tenor of government bonds is 12.41 years (slightly

decreased compared to 13.03 years in 2017 but was still much higher than 8.7 years and 5.75

years in 2016 and 2015, respectively). Investors’ demand for government bonds still upheld.

For instance, the registered-to-offered volume of the entire market was 2,33 times, compared

to 2,79 times in 2017. Nevertheless, under the management of ST, winning-to-offering ratio

fell considerably to 56,75% compared to 73% in 2017.

Government bond auction results in 2018

VND bn %

120.000 100% Plan

Tenor Issued Complet

90% (Adjusted)

-ion

100.000

80%

5Y 31,000 12,409 40%

70%

80.000

60%

7Y 11,000 6,710 61%

60.000 50% 10Y 64,000 77,576 121%

40% 15Y 51,000 54,964 108%

40.000

30%

20Y 9,000 7,565 84%

20%

20.000

10% 30Y 9,000 6,573 73%

- 0% Total 175,000 165,797 95%

5Y 7Y 10Y 15Y 20Y 30Y

Offering volume Winning volume

Winning-to-offering ratio Issuing plan

Source: HNX, VCBS

In 2018, issuance volume for 20-Y and 30-Y decreased dramatically as the demand of banks

for these tenors became saturated, VST purposely adjusted to issue at 10-Y and 15-Y tenor.

Winning rate for 10-Y and 15-Y bond was at high level. At the end of 2018, winning rate for

10-Y, 15-Y was 5,1% (-18 bps yoy); and 5,3% (-45 bps yoy) respectively. Noteworthy, in

2018, Social Insurance of Vietnam and Deposit Insurance of Vietnam participated in auction

activities in primary market and contributed greatly in Q-2 and Q-3 when the market is quiet.

For 5-Y and 7-Y tenors, the demand was still high as the register-to-offer ratio was remain at

high level compared to other tenors.

VND 26.215 bn of government guaranteed bond was mobilized by Vietnam Development

Bank (VDB) and Vietnam Bank for Social Policies (VBS), focused mainly in the end of the

year. The spread of winning rate to government bond remained around 50-70 points.

VCBS Research Department Page| 1

Fixed-Income Report

50.000

45.000 Primary market

40.000

35.000

30.000

25.000

20.000

15.000

10.000

5.000

0

Jun 17

Jul 17

Jun 18

Jul 18

Feb 17

Apr 17

Aug 17

Sep 17

Nov 17

Jan 18

Feb 18

Apr 18

Aug 18

Sep 18

Nov 18

Mar 17

May 17

Oct 17

Mar 18

May 18

Oct 18

Dec 17

Dec 18

ST VBSP VDB

Source: HNX, VCBS

Macroeconomy outlook 2019:

GDP growth in 2019 is forecasted to be 6,6%-6,8% with stable growth drivers.

Therein, the foremost growth driver is still FDI enterprises with import and export

goods for production. Service and manufacturing segments will like to remain

positive. Consumption demand has shown better improvement, contributed greatly to

growth. GDP growth in Q1.2019 is forecast to be around 6,2%-6,5%.

The inflation rate in 2019 is forecast to be 4% - 4,5% and mainly determined by the

hypothesis that commodities may rebound to a high level. Besides, CPI may increase

strongly around moments when there are increases in public services. We should

bear in mind that the room to delay this increasing progress notably electricity,

social insurance, education, etc is not much. Accordingly, government’s

management still plays key role in regulating CPI. CPI in January is forecast to rise

0,6% mom, or 3,2% yoy.

With a small economy and high openness like Vietnam, the pressure on the

exchange rate in the context of uncertainty is what can be forecasted. However,

with a small scale, only one foreign currency supply "not too large" is enough to keep

the balance of supply and demand. In particular, VCBS believes that the new foreign

currency supply is still potential from the sale of capital to foreign strategic partners

from both the private sector and the State, in addition to the relatively stable

traditional supply from remittances or resources is emerging and has contributed an

important part in recent years as FDI disbursement. Hence, VCBS forecasts the fall of

central rate will not exceed 2,5% in 2019.

Due to the clear orientation of SBV for commercial banks to focus on improving the

credit quality instead of merely expanding credit, credit growth in 2018 is forecast to

be 14% which is lower than 2017. However credit growth in 2019 shall may be

higher than 2018 and be ~ 15%. Credit growth will concentrate mostly on financial

institutions with high asset quality and have finished dealing with bad debts. In

contrast, credit growth shall not be very positive for financial institutions which still

have difficulties to settle bad debts. Credit continues to be managed more strictly to

ensure the credit quality is focused by banks instead of the expansion in volume.

VCBS Research Department Page| 2

Fixed-Income Report

34% Credit growth

24%

14%

4%

2010 2011 2012 2013 2014 2015 2016 2017 E2018 E2019

Source: NHNN, VCBS

Secondary Market

VND 2,2 quadrillion (-2,3% yoy)

In secondary market, in the end of 2018, total value of outstanding bond loans was nearly

was traded in secondary market.

VND 1,5 quadrillion VND, equivalent to nearly 27% GDP. The most active segment was still

Average liquidity per session slightly government bond. Meanwhile, the corporate bond segment has not experienced dramatic

decrease. improvement (the outstanding loan is only equivalent to 7% GDP – still at low level compared

The most liquid bond was below 5Y. to other countries in the area).

In 2018, VND 2,2 quadrillion (-2,3% yoy) was traded on secondary market. In particular,

while the outright trading value slightly decreased, settled at VND 1 quadrillion (-12% yoy),

the repo trading value kept increase by VND 1,19 quadrillion (+7% yoy). For Outright

activities, bonds matured in less than 5 years remain the most liquid and occupied about 50%

of total trading value. The trading value per session decreased slightly to VND 8,756

bn/session due to laggard trading at the end of the year.

Outright 8.962

2.400 10.000

100% 8.756

2.100 9.000

90%

6.354

x1,000 VND bn

80% 8.000

1.800

70% 7.000

60% 1.500 6.000

VND bn

50% 1.200 3.655 5.000

3.642

40% 4.000

900

30%

3.000

20% 600 1.668

2.000

10%

300 1.000

0%

0 0

2013 2014 2015 2016 2017 2018

Total volume (left side)

> 10Y 7-10 5-7 3-5 <3 Average daily volume (right side)

Yield curve became flatten. At the end of 2018, according to Bloomberg, 1Y, 2Y, 3Y, 5Y, 7Y, 10Y and 15-Y bond yields

ended the year at 4.1% (+46 bps yoy); 4.21% (+31 bps yoy); 4.295% (+34.1 bps yoy); 4.555%

Yields for longer-term bonds

(+19.5 bps yoy); 4.763% (+14.3 bps yoy); 5.125% (-7.9 bps yoy) and 5.413% (-27.67 bps yoy)

decreased when yields for shorter –

respectively. Hence, yield curve became flatten and shifted upward. Note that price volatility

terms rose due to higher cost of

of longer-term bonds was considerable smaller than shorter-term bonds.

capital in monetary market in the

second half of the year. In particular, as the liquidity in interbank market is especially strong due to SAB deal, bond

yields on every term fell sharply. In Q2, bond market logged in unfavorable status, notably a

faster than expectation interest rate lifting from FED in the context that US economy witnessed

strong data. Meanwhile, in domestic bond market, the phenomenal drop of government bond

VCBS Research Department Page| 3

Fixed-Income Report

yields brought the government bond price level to extremely high and consequently bond yield

was vulnerable to correction pressure on any unfavorable news. This also marked the period

that yields began to rise, the market became sluggish.

Yield Curve

6,5 8,0% Bond yields

7,0%

5,5

6,0%

4,5

5,0%

3,5

4,0%

2,5 3,0%

2,0%

1,5

Jul-16

Oct-16

Jul-17

Oct-17

Jul-18

Oct-18

Jan-16

Jan-17

Jan-18

Apr-16

Apr-17

Apr-18

1Y2Y3Y 5Y 7Y 10Y 15Y

12/29/2017 6/29/2018 2Y 3Y 5Y

12/28/2018 7Y 10Y 15Y

Source: Bloomberg, VCBS compiled

Meanwhile, in second-half of 2018 classification between tenors clearly shown. Although bond

yields kept rising, upward force was mostly recorded at shorter-terms as they are more

sensitive to the volatility of monetary market. This can be explained by the fact that SBV

orientate a higher level of interbank rate with a view to minimizing arbitrage opportunities

between USD and VND. This was also one of the tools used by SBV to gradually released

rising pressure on exchange rates experienced since Q3.

2019 outlook: State Treasury Issuance plan in 2019:

The average issuance term is We estimate that the issuing plan for 2019 shall be about VND 225,000 bn.Issuing pressure

forecasted to fall slightly. Release was stronger than last year and shall focus on the first half. We think that next year

pressure is higher than 2018 and budgetary pressure will persist. However, the government has plenty of resources from

focus on the beginning of the year. different sources to balance in, especially the sources from the divestment of state capital,

large state-owned IPOs. State Treasury shall continue to try to extend the tenor of issued

Major factors affecting the secondary

government bonds by keeping more than 80% of bond issued to more than 5Y tenors.

market next year are: liquidity in the

banking market; SBV's policy and the VND

process of disbursing public Billion Bonds Matured in 2019 250

investment. 35.000

x 1,000 VNDbn

30.000 200

The market is divided into three

stages with increasing pressure on 25.000

150

the dominant yield. 20.000

15.000 100

10.000

5.000 50

0

0

Jan

Feb

Sep

Dec

Mar

May

Oct

Jun

Jul

Apr

Aug

Nov

2017 2018 2019E 2020E

ST VDB VBSP Other Bond Matured Bond issued

Source: HNX, VCBS

VCBS Research Department Page| 4

Fixed-Income Report

Major factors affecting the secondary market next year are: liquidity in the banking

market; SBV policy and disbursement of public investment. In particular, VCBS assumes:

(1) There is no serious liquidity stress on the banking system (periods affected by seasonal

factors will not last long). Credit growth policy in essence, the direction of commercial

banks to accelerate the process of dealing with bad debt.

(2) The orientation to have banks reinforce international standard for safety was unchanged

and can create a certain pressure on the whole system when the resources of commercial

banks are substantially different.

(3) The disbursement of public investment funds could be boosted again next year at the end

of Q1. However, we are not too concerned about the amount of money withdrawn by the

State Treasury (if any) with the argument that this source of funds will soon return to the

economy in various forms.

Given these assumptions, the bond market in 2019 is forecasted to be divided into 3

phases.

- Phase 1: December 2018 to the first half of Q1: cautious sentiment; liquidity in the

interbank market was under pressure due to the seasonal factors that led to the rise in

bond interest rates.

- Phase 2: from Q1 to before June, July (moment of high probability Fed will continue

to adjust the market interest rates active and active again when temporary fears are

dispelled. Bond interest rates fell but the pace fell short and rapid.

- Phase 3: Relatively long with a state of caution. Concerns have arisen over the SBV's

promulgation of circulars, regulations on safety ratios aimed at furthering

international standards, especially with Basel II in 2020. At the same time,

developments from the world market will remain unknown to the market next year,

especially the possibility of a stronger dollar. Bond interest rates are under pressure.

The market returned to cautious trading.

From the supply side, the demand for more than 2018 will not be a big pressure as the

resources mobilized in recent years are still abundant. On the demand side, bond investment

demand from insurance companies, investment funds, etc, is forecasted to continue to grow. In

2018, in addition to the 3 to 5 year maturities the market is concerned, with the maturity of

continuous increases in recent years, the transaction may witness a shift to more long terms

over 7 years - 10 years. Issue date will be maintained for more than 10 years. However, like in

2018, the issuance of 20 - year and 30 - year terms will be difficult.

Although the average inflation target for the whole year remains at 4%, we expect that the

special pressures from expected inflation may be a factor in increasing the pressure on yields.

Investment opportunities with long bonds will narrow and less when yield curve tends to be

flatter. The fluctuations will appear in the short term based on changes in the currency market.

Foreign investors slightly net- Foreign investors net-bought VND 103 bn in 2018. Buying tenors also witnessed

bought VND 103 bn in 2018. considerable change. In particular, foreigners were most active in the first 6 months. Even at

that time, foreigners were strong buyers in 30-year terms. However, for the end of the year,

foreign activity has shown signs of significant slowdown. Additionally, net-bought tenors shift

to short-term ones, which is traditionally their favorite. This can be explained at the yield level

as at the end of 2017, the relative attractiveness of the Vietnam government bond declined

significantly compared to USD investment channel. In addition, taking cost of capital into

consideration, we believe that the lower the yield, the lower the level of participation of

VCBS Research Department Page| 5

Fixed-Income Report

foreign investors in the market.

In 2019, VCBS believes there shall be a more active trading in tram of foreign activities.

However, considering the upward trend of US bond interest rate in mid-term, the increase will

be slight rather than a boost.

Foreign trading in secondary market

150

nghìn tỷ VND

93,79

100 73,15 77,19

62,44

51,85 47,34

50 22,82

-50 -10,14

-45,68 -47,24

-57,01

-68,25

-100 -77,27

-103,46

-150

2012 2013 2014 2015 2016 2017 2018

Buy Sell Net position

Source: HNX, VCBS

Interest rate

Interbank rate

Since the middle of June, interbank 2018 marked a difference from other year as no seasonal pressure showed up at the beginning

rates increased gradually and of the year thanks to phenomenal abundant liquidity. However since June, when the exchange

recorded a higher average level than rate was under upward pressure, the liquidity became less abundant and interbank rates ticked

the same period of last year. up when SBV issued 140-day Bill with high rate of 3.75%. Meanwhile, the amount ST’s time

deposit also decreased to absorb liquidity when there was negative expectation of

macroeconomic stability derived from CPI and exchange rates movement. Meanwhile,

average deposits rate increasing 30-50 points in the end of year was also a reason, which

brought seasonal liquidity earlier compared to the same period of last year. Similarly to

earlier years, fluctuations of shorter-term bond interest rates were highly sensitive to

interbank rates.

6,0%

4,0%

2,0%

0,0%

Mar-16

Sep-16

Mar-17

Sep-17

Mar-18

Sep-18

May-16

May-17

May-18

Jan-16

Jul-16

Nov-16

Jan-17

Jul-17

Nov-17

Jan-18

Jul-18

Nov-18

ON 1W 2W 1M

Source: Bloomberg, VCBS

VCBS Research Department Page| 6

Fixed-Income Report

In 2019, average interbank rates level Interbank rate will depend on the liquidity of interbank market in each period

is expected to be higher than 2018.

VCBS believe till Lunar New Year, seasonal pressure will be the main factor affecting

Seasonal pressure will appear in the interbank market liquidity. Then, the main contributing factors on monetary market in 2019

beginning of the year. include: (1) Deposit amount by State Treasury in commercial banks, (2) public investment

disbursement process and (3) the stability of exchange rate and investment inflows to

Vietnam.

In particular, VCBS believes public investment disbursement on infrastructures will be

boosted in later-half 2019 as this is an important driver to economic growth. Accordingly,

the amount of deposits by State Treasury in commercial banks will decrease dramatically.

This capital in general will not leave the system but return to the economy with higher cost.

As more and more central banks conduct tighten monetary policy or limit/gradually put a

stop to loosen monetary policy the upward trend of government bond interest rate, typically

US government bond, is irreversible. Hence, for Vietnam, although taken indirect impact,

the event that banks or financial institutions prepare for a rising cost of capital is anticipated.

All of these above factors support for the forecast in 2019 that the average cost of

capital will be higher than 2018.

Depository rates level rose 30 – 50 Depository and loan rates

points in later-half of the year,

The level of depository rates rose 30-50 points in second-half of 2019 at the terms that do

especially at the terms which did not

not have ceiling level set by SBV. According to SBV, by the end of November the VND

bear the ceiling level set by. Lending

depository rates level ranged at 0,6 – 1% for call deposit and less than 1 month. For 1-month

rates were stable.

to 6-month deposits: 4.3 – 5.5%/year, for 6-month to less than 12-month deposits: 5.3 –

SBV maintained the orientation and 6.5%/year; more than 12 months: 6.5 – 7.3%/year. USD depository rate at financial

policy to stabilize interest rate level institutions remained at 0%. We believe the adjustment on VND depository rate recently

and support growth. was due to some reasons: (1) This is the preparation of banks for the expected rising demand

of capital in regard of seasonal factors. (2) Meanwhile, this may be a preparation of financial

institution, focus on longer terms with the assumption that interbank rate will record a higher

level in next year.

Meanwhile for lending rates, VND lending rates ranged mostly at 6,0 - 9,0 %/year for short-

term and 9,0 - 11% for mid and long term; USD lending rate was at 2,8 – 6,0% /year; in

particular the short-term lending rate was 2,8 – 4,7%, mid and long term lending rate was

4,5 – 6,0%. By now, the rise of depository rate from the middle of Q 3 has not created clear

pressure on lending rate. Accordingly, the rise in lending rate was only recorded locally at

high – risk segments. This movement was consistent with SBV’s orientation to stabilize

interest rate level and support growth.

VCBS Research Department Page| 7

Fixed-Income Report

Deposit rates (Unit: %)

7,50

7,00

6,50

6,00

5,50

5,00

4,50

1/2018 2/2018 3/2018 4/2018 5/2018 6/2018 8/2018 9/2018 10/2018 11/2018 12/2018

D.R (1 month) D.R (3 months) D.R (6 months) D.R (above 12 months)

Source: CEIC, VCBS

2019: The deposit rates are For the year 2019, the deposit rates are subject to some pressures:

forecasted to increase by about 50

Inflation pressure strengthened over the same period.

points while lending rates will be

stable although volatility will only be Monetary tightening trend of central banks especially FED and ECB.

stable. Credit institutions must accept a higher interest rate for maintaining a competitive

The target for stabilizing the interest advantage over deposit share (1) in the context of a bank's cost of capital (2) is

rate in the first half was feasible with expected to be higher. The liquidity in the money market was also under pressure due

some supporting factors. to the demand balance and support from the exchange rate.

The deposit interest rates are under Therefore, VCBS believes that the upward pressure on interest rates for existing deposit rates.

increasing pressure in the second half However, with the increase in mobilizing interest rates in the last 6 months of 2018, surplus in

of 2019. the next year is considered not much. As such, we expect deposit rates to increase by about

50 basis points to focus on the end of 2019, at times not subject to the control of the SBV.

Meanwhile, a ceiling of 5.5% for the term of less than 6 months is likely to remain. The

above forecasts will come with some assumptions:

Foreign currency flows into Vietnam are maintained which facilitates the State Bank

to actively regulate money supply and liquidity as necessary.

Exchange rate and foreign exchange market are stable with a reasonable discount of

VND against other countries in the region.

For lending rates, in the context of raising deposit rates is expected, the pressure on lending

rates can be explained. It should also be noted that there will be a time lag from 3 months to 6

months before upward force on deposits rates spread to lending rates. However, we believe

that the upside pressure, if any will not appear massively in all segments that will focus on the

scenario as follows: For customers with good credit history, the ability to negotiate well will

decide the rates applied to this group. We think that the bargaining power will help interest

rate stable. This coincides with the orientation of maintaining a stable and less volatile interest

rate environment to support the growth of the Government. Meanwhile, for sectors with

industries and customers with greater risk, such as real estate and consumer credit, interest

rates can tick up. With interest rates forecasted to rise more slowly than input interest rates, the

level of interest rate stability will require more steering and management roles for the operator.

VCBS Research Department Page| 8

Fixed-Income Report

Open Market Operation

SBV made full use of OMO. OMO The State Bank of Vietnam has continued to have a successful year in regulating the

rate deceased 0,25% in January then monetary market. The dynamics and decisions were made in line with seasonal factors and

stabilized at 4,75%.

market conditions during the year. OMO interest rate decreased 0,25% in Q1 then

stabilized at 4,75%. Noteworthy decision during the year was issuing Bills with tenors of 91

days, 140 days at high level of interest rates (3,75% for 140-day bills) in the first week of

August. Although just a week later, SBV stopped issuing 140-day Bills, interest levels for

issuing activities still maintained high, in particular, for 7-day term (2,75%) and 14-day term

(3%). This was one of purposely management methods by SBV using interest rate to reduce

tension on exchange rate in the last 6 months of the year .

In 2019, in the situation of unfavorable condition from worldwide, typically the medium

trend of rising US bond interest rates, there is rumor that SBV will raise OMO interest rate in

Q1 of 2019. However, we believe that it is unlikely that OMO rate will tick up again.

Reverse Repo

300,0 SBV Bills Outstanding

x VND 1,000 bn

250,0

250,0

x VND 1,000bn

200,0

200,0

150,0 150,0

100,0 100,0

50,0 50,0

- -

03/16

05/16

07/16

09/16

11/16

01/17

03/17

05/17

07/17

09/17

11/17

01/18

03/18

05/18

07/18

09/18

11/18

04/16

06/16

08/16

10/16

12/16

02/17

04/17

06/17

08/17

10/17

12/17

02/18

04/18

06/18

08/18

10/18

12/18

Source: Bloomberg, VCBS

End.

VCBS Research Department Page| 9

Fixed-Income Report

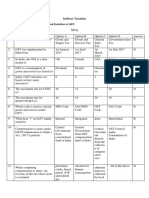

Appendices

Primary Market

Year ST VDB VBSP Others Total

2007 35,628 18,775 400 54,803

2008 19,862 26,647 1,200 47,709

2009 2,210 5,866 2,000 1,964 12,040

2010 57,727 35,457 9,000 1,376 103,560

2011 62,242 34,975 9,297 1,000 107,514

2012 134,426 36,570 17,730 4,810 193,536

2013 181,011 40,000 7,380 8,350 236,741

2014 235,397 23,243 4,702 7,100 270,442

2015 238,280 32,994 14,949 7,500 293,723

2016 281,720 21,479 13,000 500 336,000

2017 159,920 25,145 7,528 - 192,944

2018 165,797 16,545 9,670 - 192,012

Secondary Market

Year <3Y 3-7Y 7Y-15Y >15Y Repo Total Bonds outstanding

2012 82,611 61,046 18,530 - 50,289 212,476 415,195

2013 209,964 115,911 14,811 - 76,280 416,966 556,417

2014 334,009 273,209 45,382 - 247,077 899,677 691,206

2015 303,757 246,292 56,499 - 299,994 906,542 753,450

2016 433,305 444,715 113,207 - 603,520 1,594,748 930,528

2017 288,346 498,361 223,027 128,265 1,108,906 2,246,905 997,528

2018 339,529 298,250 245,431 138,922 1,190,096 2,197,136 1,086,545

*Bonds outstanding was recorded on the last day of the year

Open Market Operation

Reverse Repo Outright (SBV Bills)

Month

Due Offer Balance Outstanding Due Offer Balance Outstanding

Jan-18 3,260 42,309 39,048 41,314 167,106 197,705 30,600 47,000

Feb-18 49,780 8,466 (41,314) 0 59,000 90,600 31,600 78,600

Mar-18 31 31 0 0 84,100 196,710 112,610 191,210

Apr-18 2 2 0 0 191,210 78,500 (112,630) 78,580

May-18 170 170 0 0 80,280 55,840 (24,440) 54,140

Jun-18 0 0 0 0 54,140 150,499 96,359 150,499

Jul-18 15,993 17,993 2,000 2,000 112,500 44,461 (68,039) 82,461

Aug-18 37,167 42,869 5,702 7,702 35,312 28,482 (6,830) 75,630

Sep-18 15,401 8,155 (7,246) 456 50,000 52,950 2,950 78,581

Oct-18 16,018 60,562 44,544 45,000 62,591 15,070 (47,521) 31,060

Nov-18 237,878 237,663 (215) 44,785 2,100 0 (2,100) 28,960

Dec-18 25,929 32,208 6,279 51,064 28,960 0 (28,960) 0

Matured bond in 2019

Month ST VDB VBSP Other Total

Jan-19 19,950 9,647 502 30,099

Feb-19 12,233 2,602 300 15,135

Mar-19 30,363 360 30,723

Apr-19 10,002 260 800 11,062

May-19 13,947 190 200 14,337

Jun-19 6,000 3,351 850 10,201

Jul-19 13,000 490 600 14,090

Aug-19 6,320 1,025 3,000 10,345

Sep-19 193 350 543

Oct-19 7,752 970 1,100 9,822

Nov-19 505 100 1,500 2,105

Dec-19 5,086 5,086

Total 119,567 24,679 3,702 5,600 153,548

VCBS Research Department Page| 10

Fixed-Income Report

DISCLAIMER

This report is designed to provide updated information on the fixed-income, including bonds, interest rates, some other related. The

VCBS analysts exert their best efforts to obtain the most accurate and timely information available from various sources, including

information pertaining to market prices, yields and rates. All information stated in the report has been collected and assessed as

carefully as possible.

It must be stressed that all opinions, judgments, estimations and projections in this report represent independent views of the analyst at

the date of publication. Therefore, this report should be best considered a reference and indicative only. It is not an offer or advice to

buy or sell or any actions related to any assets. VCBS and/or Departments of VCBS as well as any affiliate of VCBS or affiliate that

VCBS belongs to or is related to (thereafter, VCBS), provide no warranty or undertaking of any kind in respect to the information and

materials found on, or linked to the report and no obligation to update the information after the report was released. VCBS does not

bear any responsibility for the accuracy of the material posted or the information contained therein, or for any consequences arising

from its use, and does not invite or accept reliance being placed on any materials or information so provided.

This report may not be copied, reproduced, published or redistributed for any purpose without the written permission of an authorized

representative of VCBS. Please cite sources when quoting. Copyright 2012 Vietcombank Securities Company. All rights reserved.

CONTACT INFORMATION

Tran Minh Hoang Le Thu Ha

Head of Research Fixed Income Analyst

tmhoang@vcbs.com.vn ltha_ho@vcbs.com.vn

VIETCOMBANK SECURITIES COMPANY

http://www.vcbs.com.vn

Ha Noi Headquarter Floor 12th & 17th, Vietcombank Tower, 198 Tran Quang Khai Street, Hoan Kiem District, Hanoi

Tel: (84-4)-39366990 ext: 140/143/144/149/150/151

Ho Chi Minh Branch Floor 1st and 7th, Green Star Building, 70 Pham Ngoc Thach Street, Ward 6, District No. 3, Ho Chi Minh City

Tel: (84-28)-3820 8116 Ext:104/106

Da Nang Branch Floor 12th, 135 Nguyen Van Linh Street, Thanh Khe District, Da Nang City Tel: (+84-236) 3888 991 ext: 801/802

Nam Sai Gon Transaction Unit Floor 3rd, V6 Tower, Plot V, Him Lam Urban Zone, 23 Nguyen Huu Tho Street, Tan Hung Ward, District No. 7, Ho Chi Minh City

Tel: (84-28)-54136573

Giang Vo Transaction Unit Floor 1st, Building C4 Giang Vo, Giang Vo Ward, Ba Dinh District, Hanoi. Tel: (+84-24) 3726 5551

Tay Ho Transaction Unit 1st & 3rd Floor, 565 Lac Long Quan Street, Tay Ho District, Hanoi. Tel: (+84-24) 2191048 (ext: 100)

Hoang Mai Transaction Unit 1st Floor Han Viet Building, 203 Minh Khai Street, Hai Ba Trung District, Hanoi. Tel: (+84-24) 3220 2345

Can Tho Representative Office Floor 1st, Vietcombank Can Tho Building, 7 Hoa Binh Avenue, Ninh Kieu District, Can Tho City . Tel: (+84-292) 3750 888

Vung Tau Representative Office Floor 1st, 27 Le Loi Street, Vung Tau City, Ba Ria - Vung Tau Province. Tel: (+84-254) 351 3974/75/76/77/78

An Giang Representative Office Floor 7th, Vietcombank An Giang Tower, 30-32 Hai Ba Trung, My Long Ward, Long Xuyen City, An Giang Province

Tel: (84-76)-3949843

Dong Nai Representative Office Floor 1st & 2nd, 79 Hung Dao Vuong, Trung Dung Ward, Bien Hoa City, Dong Nai Province. Tel: (84-61)-3918815

Hai Phong Representative Office Floor 2nd, 11 Hoang Dieu Street, Minh Khai Ward, Hong Bang District, Hai Phong City. Tel: (+84-225) 382 1630

Binh Duong Representative Office Floor 3th, 516 Cach Mang Thang Tam Street, Phu Cuong Ward, Thu Dau Mot City, Binh Duong Province.

Tel: (+84-274) 3855 771

VCBS Research Department Page| 11

Vous aimerez peut-être aussi

- One Bold Move a Day: Meaningful Actions Women Can Take to Fulfill Their Leadership and Career PotentialD'EverandOne Bold Move a Day: Meaningful Actions Women Can Take to Fulfill Their Leadership and Career PotentialPas encore d'évaluation

- DART India Chart Book - May 19Document10 pagesDART India Chart Book - May 19Aman GuptaPas encore d'évaluation

- Pick of The Week SbiDocument4 pagesPick of The Week SbiMukesh KumarPas encore d'évaluation

- Project / Program GANTT (In Months) : Project Name Progress Start Date Finish Date Duration (Months)Document7 pagesProject / Program GANTT (In Months) : Project Name Progress Start Date Finish Date Duration (Months)Ammar BaidasPas encore d'évaluation

- Tool Room NUMBER PART: C1029831: DesingDocument4 pagesTool Room NUMBER PART: C1029831: Desingmis2hijosPas encore d'évaluation

- QT Fund Monthly FactsheetDocument4 pagesQT Fund Monthly FactsheetKevinPas encore d'évaluation

- Pick of The Week Ongc LTDDocument4 pagesPick of The Week Ongc LTDAnkit JagetiaPas encore d'évaluation

- Sample Flight ScheduleDocument1 pageSample Flight ScheduleShahriar Ali SifatPas encore d'évaluation

- Tim Carmona To Rcbc-Ipc For RiseDocument5 pagesTim Carmona To Rcbc-Ipc For RiseAlfredo Osana QuejadasPas encore d'évaluation

- Cronograma Gantt2Document45 pagesCronograma Gantt2Valter Gil JrPas encore d'évaluation

- PDF To WordDocument26 pagesPDF To WordPrerit SinghalPas encore d'évaluation

- Rancangan Pengajaran Dan Pembelajaran Perlaksanaan Program Kod Kursus Ht-012-2:2012 Food Preparation and ProductionDocument1 pageRancangan Pengajaran Dan Pembelajaran Perlaksanaan Program Kod Kursus Ht-012-2:2012 Food Preparation and ProductionNurul Nasuha RazalliPas encore d'évaluation

- Source: Philippine Statistics AuthorityDocument4 pagesSource: Philippine Statistics AuthorityJohn Paul CristobalPas encore d'évaluation

- Monthly Report: Fixed - Income ResearchDocument8 pagesMonthly Report: Fixed - Income ResearchNguyenPas encore d'évaluation

- Spark Strategy - Why Household Savings Have Been Falling in India - Apr'19 - Spark CapitalDocument9 pagesSpark Strategy - Why Household Savings Have Been Falling in India - Apr'19 - Spark CapitalMadhuchanda DeyPas encore d'évaluation

- Kotak Mahindra Bank Limited Managements Discussion and Analysis FY18Document38 pagesKotak Mahindra Bank Limited Managements Discussion and Analysis FY18ss gPas encore d'évaluation

- Sunday: Pelaksanaan Pembangunan Jalan Kabupaten (Program APBD-Dinas Perhubungan)Document1 pageSunday: Pelaksanaan Pembangunan Jalan Kabupaten (Program APBD-Dinas Perhubungan)Andi Anugrah Reski Astri100% (1)

- Design, Supply, Installation, Testing Commissioning of Natural Gas Booster Compressor Station For 747 MW (Gross) CCPP GudduDocument1 pageDesign, Supply, Installation, Testing Commissioning of Natural Gas Booster Compressor Station For 747 MW (Gross) CCPP GudduHassan EjazPas encore d'évaluation

- D2. Make A Gantt Chart On How You Have Managed & Organized Your Activity During Completion of Your Assignments of This UnitDocument2 pagesD2. Make A Gantt Chart On How You Have Managed & Organized Your Activity During Completion of Your Assignments of This UnitRohidPas encore d'évaluation

- Benchmark - July 2019 - Cobalt - Forecast - ReportDocument58 pagesBenchmark - July 2019 - Cobalt - Forecast - ReportÁlvaro OrdóñezPas encore d'évaluation

- Tractor TripDocument1 pageTractor Triptrishila tandelPas encore d'évaluation

- Pick of The Week JK PaperDocument4 pagesPick of The Week JK PaperKamal AgarwalPas encore d'évaluation

- Monthly Report: Fixed-Income ResearchDocument8 pagesMonthly Report: Fixed-Income ResearchNguyenPas encore d'évaluation

- Liquid Assets Bank Size and Bank Profitability For BUKU 1, BUKU 2, BUKU 3 and BUKU 4 in IndonesiaDocument12 pagesLiquid Assets Bank Size and Bank Profitability For BUKU 1, BUKU 2, BUKU 3 and BUKU 4 in IndonesiaaijbmPas encore d'évaluation

- Event Update: Please Refer To Disclaimer On The Next PageDocument2 pagesEvent Update: Please Refer To Disclaimer On The Next PageDhruv GandhiPas encore d'évaluation

- Skipper - 1QFY18 Result Update - 060917Document5 pagesSkipper - 1QFY18 Result Update - 060917amankumar sahuPas encore d'évaluation

- Understanding Seasonality in Cannabis Sales: Headset Cannabis Market ReportsDocument15 pagesUnderstanding Seasonality in Cannabis Sales: Headset Cannabis Market ReportsHAS UYARPas encore d'évaluation

- Frenos Disco BL - m525 - 02Document1 pageFrenos Disco BL - m525 - 02CbaPas encore d'évaluation

- Darkmoon Firekeeper Weapons (Ink Efficient, For Fancier Methods of Reinforcement and Enhancing 3D Detail by Hand)Document11 pagesDarkmoon Firekeeper Weapons (Ink Efficient, For Fancier Methods of Reinforcement and Enhancing 3D Detail by Hand)cesarignaPas encore d'évaluation

- Darkmoon Firekeeper Weapons (Untextured)Document11 pagesDarkmoon Firekeeper Weapons (Untextured)cesarignaPas encore d'évaluation

- Laporan Fit To Work (FTW) 2018 NEWDocument117 pagesLaporan Fit To Work (FTW) 2018 NEWaris cahyonoPas encore d'évaluation

- Proscenio 01-04-22 - Arqui 02-04-22Document9 pagesProscenio 01-04-22 - Arqui 02-04-22SebastianGomezPas encore d'évaluation

- Project Planner: Start Date Today DateDocument3 pagesProject Planner: Start Date Today DateBiswajet Routh100% (1)

- Excel Project PlannerDocument3 pagesExcel Project PlannerNgoc Quang NguyenPas encore d'évaluation

- Project Planner: Start Date Today DateDocument3 pagesProject Planner: Start Date Today DatePLACALYPas encore d'évaluation

- Project Planner: Start Date Today DateDocument3 pagesProject Planner: Start Date Today DateEl Hadji Mandella NdiayePas encore d'évaluation

- Project Planner: Start Date Today DateDocument3 pagesProject Planner: Start Date Today DateOmaru NimagaPas encore d'évaluation

- Excel Project PlannerDocument3 pagesExcel Project PlannerXei PongPas encore d'évaluation

- Project Planner: Start Date Today DateDocument3 pagesProject Planner: Start Date Today DateAmandaPas encore d'évaluation

- Q3 2017 Education Sector Overview: P, V & C, LLCDocument9 pagesQ3 2017 Education Sector Overview: P, V & C, LLCAnonymous Feglbx5Pas encore d'évaluation

- Roof Deck Mezzanine Floor Plan 1 Helipad Floor Plan 2: Scale A 1:250M 15 Scale A 1:250M 15Document1 pageRoof Deck Mezzanine Floor Plan 1 Helipad Floor Plan 2: Scale A 1:250M 15 Scale A 1:250M 15Stephany JulaoPas encore d'évaluation

- Balance Activities: Duratio N (Days) Date Start Date EndDocument2 pagesBalance Activities: Duratio N (Days) Date Start Date EndshubhendrasahaPas encore d'évaluation

- Animal Gato Golden PDFDocument61 pagesAnimal Gato Golden PDFCharlye VasquezPas encore d'évaluation

- Netra Early Warnings Signals Through Charts Feb 2023Document16 pagesNetra Early Warnings Signals Through Charts Feb 2023jeevan gangavarapuPas encore d'évaluation

- Third Year B.SC Nursing Master PlanDocument1 pageThird Year B.SC Nursing Master PlanDinesh JoyPas encore d'évaluation

- Edelweiss Professional Investor Research Diwali Picks 2019 FundamentalDocument7 pagesEdelweiss Professional Investor Research Diwali Picks 2019 FundamentalSandip DasPas encore d'évaluation

- Dog 400 MMDocument12 pagesDog 400 MMLuisPas encore d'évaluation

- GU 20 XX Yy - U Bolt Guía Con TPIDocument1 pageGU 20 XX Yy - U Bolt Guía Con TPIJesús JiménezPas encore d'évaluation

- Sales AnalysisDocument1 pageSales AnalysisThorayaPas encore d'évaluation

- Lettice and Lovage PDFDocument1 pageLettice and Lovage PDFapi-2452366370% (2)

- Source: Philippine Statistics AuthorityDocument4 pagesSource: Philippine Statistics AuthorityToastPas encore d'évaluation

- гылро схема 130Document1 pageгылро схема 130АлександрPas encore d'évaluation

- Perational Alendar: January February MarchDocument1 pagePerational Alendar: January February MarchJahangir KhanPas encore d'évaluation

- Centercourt 100levelDocument1 pageCentercourt 100levelg_sandy_reddy2482Pas encore d'évaluation

- RFP - Icba Grid-Connected Solar PV System Project - 0Document11 pagesRFP - Icba Grid-Connected Solar PV System Project - 0Ahmed HussainPas encore d'évaluation

- Less Policing More Murders: US HOMICIDES (1996-2020)Document2 pagesLess Policing More Murders: US HOMICIDES (1996-2020)Paul BedardPas encore d'évaluation

- Quarterly Report: Fixed - Income ResearchDocument9 pagesQuarterly Report: Fixed - Income ResearchNguyenPas encore d'évaluation

- RINU FINAL MSTR 2019 BatchDocument9 pagesRINU FINAL MSTR 2019 BatchDelphy VarghesePas encore d'évaluation

- State Bank of India: Pick of The WeekDocument4 pagesState Bank of India: Pick of The WeekkevalPas encore d'évaluation

- Rbi Bi-Monthly Monetary Policy Fy22Document2 pagesRbi Bi-Monthly Monetary Policy Fy22Shiwani singhPas encore d'évaluation

- Trai Phieu 15Document6 pagesTrai Phieu 15NguyenPas encore d'évaluation

- Trai Phieu 18Document6 pagesTrai Phieu 18NguyenPas encore d'évaluation

- Monthly Report: Fixed-Income ResearchDocument8 pagesMonthly Report: Fixed-Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 14Document6 pagesTrai Phieu 14NguyenPas encore d'évaluation

- Quarterly Report: Fixed - Income ResearchDocument9 pagesQuarterly Report: Fixed - Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 21Document6 pagesTrai Phieu 21NguyenPas encore d'évaluation

- Trai Phieu 25Document7 pagesTrai Phieu 25NguyenPas encore d'évaluation

- Monthly Report: Fixed - Income ResearchDocument8 pagesMonthly Report: Fixed - Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 7Document6 pagesTrai Phieu 7NguyenPas encore d'évaluation

- Trai Phieu 2Document7 pagesTrai Phieu 2NguyenPas encore d'évaluation

- Volunteers in Arts and Culture Organizations in Canada in 2007Document26 pagesVolunteers in Arts and Culture Organizations in Canada in 2007NguyenPas encore d'évaluation

- Weekly Report: Fixed-Income ResearchDocument7 pagesWeekly Report: Fixed-Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 6Document6 pagesTrai Phieu 6NguyenPas encore d'évaluation

- MEF Baocaoquantri 2018Document3 pagesMEF Baocaoquantri 2018NguyenPas encore d'évaluation

- Macroeconomic Research April 2019: by A Member of VIETCOMBANKDocument14 pagesMacroeconomic Research April 2019: by A Member of VIETCOMBANKNguyenPas encore d'évaluation

- 2018-04-23 The New Yorker PDFDocument92 pages2018-04-23 The New Yorker PDFNguyen100% (2)

- SLS Baocaotaichinh Q3 2019 PDFDocument25 pagesSLS Baocaotaichinh Q3 2019 PDFNguyenPas encore d'évaluation

- Công Ty C PH N Khoáng S N Sài Gòn Quy NH NDocument5 pagesCông Ty C PH N Khoáng S N Sài Gòn Quy NH NNguyenPas encore d'évaluation

- Tổng Công Ty Cổ Phần Y Tế DanamecoDocument14 pagesTổng Công Ty Cổ Phần Y Tế DanamecoNguyenPas encore d'évaluation

- STIBET Applicationform U Ko-LaDocument3 pagesSTIBET Applicationform U Ko-LaNguyenPas encore d'évaluation

- Tong Hop 100 Topics Cho Ielts Speaking by Ngocbach PDFDocument160 pagesTong Hop 100 Topics Cho Ielts Speaking by Ngocbach PDFNguyenPas encore d'évaluation

- Energy From The Desert Ed-5 2015 LR PDFDocument171 pagesEnergy From The Desert Ed-5 2015 LR PDFNguyenPas encore d'évaluation

- Film Analysis-Inside JobDocument2 pagesFilm Analysis-Inside JobXytusPas encore d'évaluation

- Global Finance3Document11 pagesGlobal Finance3kbogdanoviccPas encore d'évaluation

- A - Area Code ListDocument2 pagesA - Area Code ListMahakaal Digital PointPas encore d'évaluation

- Swot Analysis of The Manufacturing and Service IndustryDocument15 pagesSwot Analysis of The Manufacturing and Service Industrypramita160775% (8)

- Cortland County Gutchess Lumber Sports ParkDocument14 pagesCortland County Gutchess Lumber Sports ParkNewsChannel 9Pas encore d'évaluation

- CH - 01 Introduction, Overview and Evolution of GST - MCQDocument5 pagesCH - 01 Introduction, Overview and Evolution of GST - MCQSanket MhetrePas encore d'évaluation

- WACC EthiopiaDocument4 pagesWACC EthiopiaPandS BoiPas encore d'évaluation

- Acct Statement - XX6419 - 08112022Document26 pagesAcct Statement - XX6419 - 08112022AartiPas encore d'évaluation

- Advantages and Disadvantages of Fdi For IndiaDocument4 pagesAdvantages and Disadvantages of Fdi For IndiaYagnesh AcharyaPas encore d'évaluation

- Brochure-Study On UPDocument3 pagesBrochure-Study On UPANSHUL GUPTAPas encore d'évaluation

- No Power Plant Capacity Location Year CODDocument3 pagesNo Power Plant Capacity Location Year CODSudi ArtoPas encore d'évaluation

- PJSC "Centrenergo" Soe "CC "Krasnolymanska" JSC UMCC": MiningDocument2 pagesPJSC "Centrenergo" Soe "CC "Krasnolymanska" JSC UMCC": MiningVlad KremerPas encore d'évaluation

- Pricing Strategy For Tractor in BiharDocument20 pagesPricing Strategy For Tractor in BiharManthan KulkarniPas encore d'évaluation

- Vijay L Kelkar CommitteeDocument1 pageVijay L Kelkar CommitteeAmogh DikshitPas encore d'évaluation

- NR #2421B, 05.31.2011, Cooperatives Banking ActDocument1 pageNR #2421B, 05.31.2011, Cooperatives Banking Actpribhor2Pas encore d'évaluation

- Corruption in Banking Sector of BangladeshDocument3 pagesCorruption in Banking Sector of BangladeshMezbaul Haider Shawon50% (4)

- Econmark Outlook 2019 January 2019 PDFDocument107 pagesEconmark Outlook 2019 January 2019 PDFAkhmad BayhaqiPas encore d'évaluation

- A. The Number of Units of Output That A Worker Can Produce in One HourDocument6 pagesA. The Number of Units of Output That A Worker Can Produce in One HouraaaaPas encore d'évaluation

- Taxation 2022 AdvancedDocument3 pagesTaxation 2022 AdvancedNeil CorpuzPas encore d'évaluation

- Central Bank Foreign Reserves: Haukur C. Benediktsson and Sturla PálssonDocument8 pagesCentral Bank Foreign Reserves: Haukur C. Benediktsson and Sturla Pálssonelarabel abellarePas encore d'évaluation

- Canara Revecco ManufacturingDocument7 pagesCanara Revecco ManufacturingRanjan Sharma100% (1)

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZAPas encore d'évaluation

- Europe Economics OverviewDocument4 pagesEurope Economics Overviewapi-291877361Pas encore d'évaluation

- AP EC CH 6 QuestionsDocument2 pagesAP EC CH 6 QuestionsSAVONNA HARPERPas encore d'évaluation

- FKCHR21000013552626077712117306005Document2 pagesFKCHR21000013552626077712117306005Dr. Bhoopendra FoujdarPas encore d'évaluation

- Spending Guide For A Family of SixDocument1 pageSpending Guide For A Family of Sixapi-3711938100% (1)

- Pospap-Republic of IndiaDocument2 pagesPospap-Republic of IndiaRahma WidyaPas encore d'évaluation

- Impact of Recession IndiaDocument32 pagesImpact of Recession IndiaAvishek KarmakarPas encore d'évaluation

- Assessment of Government Influence On Exchange RatesDocument1 pageAssessment of Government Influence On Exchange Ratestrilocksp SinghPas encore d'évaluation

- Preferential Trade Area: Economic IntegrationDocument4 pagesPreferential Trade Area: Economic IntegrationПолина УстиноваPas encore d'évaluation

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPas encore d'évaluation

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceD'EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceÉvaluation : 4 sur 5 étoiles4/5 (1)

- Corporate Finance Formulas: A Simple IntroductionD'EverandCorporate Finance Formulas: A Simple IntroductionÉvaluation : 4 sur 5 étoiles4/5 (8)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamD'EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamPas encore d'évaluation

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 5 sur 5 étoiles5/5 (2)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthD'EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthÉvaluation : 4 sur 5 étoiles4/5 (20)

- Creating Shareholder Value: A Guide For Managers And InvestorsD'EverandCreating Shareholder Value: A Guide For Managers And InvestorsÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- The Value of a Whale: On the Illusions of Green CapitalismD'EverandThe Value of a Whale: On the Illusions of Green CapitalismÉvaluation : 5 sur 5 étoiles5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsD'EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsÉvaluation : 4.5 sur 5 étoiles4.5/5 (21)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingD'EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- Product-Led Growth: How to Build a Product That Sells ItselfD'EverandProduct-Led Growth: How to Build a Product That Sells ItselfÉvaluation : 5 sur 5 étoiles5/5 (1)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyD'EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyÉvaluation : 3 sur 5 étoiles3/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistD'EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistÉvaluation : 4.5 sur 5 étoiles4.5/5 (73)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successD'EverandReady, Set, Growth hack:: A beginners guide to growth hacking successÉvaluation : 4.5 sur 5 étoiles4.5/5 (93)

- The Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressD'EverandThe Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressPas encore d'évaluation

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistD'EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistÉvaluation : 4 sur 5 étoiles4/5 (32)

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- Mind over Money: The Psychology of Money and How to Use It BetterD'EverandMind over Money: The Psychology of Money and How to Use It BetterÉvaluation : 4 sur 5 étoiles4/5 (24)

- Financial Leadership for Nonprofit Executives: Guiding Your Organization to Long-Term SuccessD'EverandFinancial Leadership for Nonprofit Executives: Guiding Your Organization to Long-Term SuccessÉvaluation : 4 sur 5 étoiles4/5 (2)