Académique Documents

Professionnel Documents

Culture Documents

Trai Phieu 14

Transféré par

NguyenCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Trai Phieu 14

Transféré par

NguyenDroits d'auteur :

Formats disponibles

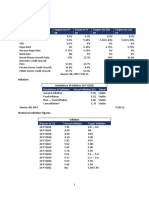

Fixed-Income Research

Weekly report December, 21st, 2018

Fixed-Income Report Round-up

High winning volume was still for 10Y and 15Y bond.

Short-term bond yields decreased this week.

Interbank settled stably at a high level.

Dec 17th- 21st/2018

Yield Curve

5.5

In this issue

Round up 5.0

Bond market

4.5

Interest rates

4.0

3.5

1Y 2Y 3Y 5Y 7Y 10Y 15Y

This week Last week Last month

Source: Bloomberg, VCBS

VND 16,010 bn was mobilized this week. VND 50,010 bn (+41% wow) was traded

on the secondary market.

Yield curve became more steepened because short-term bond yield decreased more

than long-term ones. According to Bloomberg data, 1Y, 2Y, 3Y, 5Y, 7Y, 10Y and 15Y bond

yields posted at 4.013% (-13.7 bps), 4.1% (-20.5 bps), 4.158% (-26.7 bps), 4.438% (-13 bps),

4.8% (-5 bps), 5.138% (-3 bps) and 5.4% (-1.3 bps) respectively. Also, it should be noted that

Le Thu Ha from last 2 weeks, winning rates in primary market stayed closed to yields in secondary

+84 24 3936 6990 (ext. 7182) market.

ltha_ho@vcbs.com.vn Interbank rate still settled at a high level. In details, ON – 3M rates respectively

posted at 4.417%, 4.517%, 4.617%, 4.817% and 4.9% according to Bloomberg data.

Foreign investors net bought roughly VND 762 bn this week.

SBV net injected VND 18,725.9 bn via OMO channel.

VCBS Commentary Dec 24th – 28th

We believe FED's interest rate trend is still irreversible and will have some impact on

See Disclaimer at Page 5 the market, especially in emerging markets such as Vietnam in the medium and long term.

Hence, the downward force on bond yields last week will end soon. Next week we believe

Macroeconomic, Fixed-Income,

Financial and Corporation that, bond yield shall increase slightly.

Information updated at We believe that the closer we get to the year end, the harder for interbank rates to

www.vcbs.com.vn/vn/Services/AnalysisResearch press lower in the context of no special supportive news in the market.

Research Department VCBS Page | 0

Fixed-Income Report

Bond Market

Primary Market

High volume issued in 10Y and 15Y bond.

VND 16,010 bn was mobilized this VND 16,010 bn was mobilized this week from ST and VDB. In detail, For ST-bond

week. VND 6,500 bn and 5,210 bn worth of bond issued at 10Y & 15Y. Winning rates for 10Y

and 15Y were unchanged compared to last week, settled at 5,1% and 5.3% respectively.

The registered volume to offering volume ratio for 10Y, & 15Y tenors 1.73, 1.13

respectively. Winning –to offering ratio was 90%.

Meanwhile, VDB mobilized VND 4,300 bn at 3Y, 5Y, 7Y and 10Y.

VBSP did not mobilize bond this week.

Winning rates GB Auction results Vol (VND bn)

8.50% 12000

7.50% 10000

6.50% 8000

5.50% 6000

4.50% 4000

3.50% 2000

2.50% 0

May 02- May 04

May 14- May 18

May 28- June 01

Aug 07- Aug 11

Aug 21- Aug 28

Nov 13- Nov 17

Oct 29-Nov 02

Nov 12- Nov 16

Nov 26- Nov 30

Sep 05- Sep 08

Sep 18- Sep 25

Feb 05- Feb 09

Sep 17- Sep 21

Apr 02- Apr 06

Apr 16- Apr 20

Nov 27- Dec 01

Mar 19- Mar 23

June 11 - June 15

June 25 - June 29

Aug 06 - Aug 10

Aug 20 - Aug 24

July 10- July 14

July 24- July 28

Oct 02- Oct 06

Oct 16- Oct 20

Oct 01- Oct 05

Oct 15- Oct 19

Oct 30- Nov 03

Jan 08- Jan 12

Jan 22- Jan 26

Sep 04 - Sep 09

Mar 05-Mar 09

Jul 09 - Jul 13

Jul 23 - Jul 27

Dec 11- Dec 15

Dec 25- Dec 29

Dec 10- Dec 14

Volume 5Y 7Y 10Y

15Y 20Y 30Y

Source: HNX, VCBS

Secondary Market

Short-term bond yields decreased. Liquidity increased considerably.

VND 50,010 bn (+41% wow) was VND 50,010 bn (+41% wow) was traded on the secondary market. Outright and repo

traded on the secondary market. values were at VND 24,122 bn and VND 25,898 bn respectively. Regarding outright, ST-

Bond kept dominating trading volume with 97%. Remarkably, this week a large

proportion of bond trading (38%) belonged to long-term bond (>10 year) followed by

short-term bond (<5year) (36%).

Yield curve became more steepened because short-term bond yield decreased more

than long-term ones. According to Bloomberg data, 1Y, 2Y, 3Y, 5Y, 7Y, 10Y and 15Y

bond yields posted at 4.013% (-13.7 bps), 4.1% (-20.5 bps), 4.158% (-26.7 bps), 4.438% (-

13 bps), 4.8% (-5 bps), 5.138% (-3 bps) and 5.4% (-1.3 bps) respectively. Also, it should be

noted that from last 2 weeks, winning rates in primary market stayed closed to yields in

secondary market.

Research Department VCBS Page | 1

Fixed-Income Report

Yield Curve

5.5

5.0

4.5

4.0

3.5

1Y 2Y 3Y 5Y 7Y 10Y 15Y

This week Last week Last month

Source: Bloomberg, VCBS

In FOMC took place last week, FED officially hike interest rate as expected by the

majority of investors. In the meantime, for the year of 2019, FED's tightening policy is

expected to slow down from three times increase to two times adjust interest. Additionally,

FED also adjusts the slightly reduced growth prospects of the US economy. For bond

market, it seemed that the effect of this event has already been reflected and therefore can

be used as one of the reason to explain the downward force on bond yield at the end of the

week in the context of foreign exchanges rates was quite stable.

Nevertheless, we believe FED's interest rate trend is still irreversible and will have some

impact on the market, especially in emerging markets such as Vietnam in the medium and

long term. Hence, the downward force on bond yields last week will end soon. Next week

we believe that, bond yield shall increase slightly.

Foreign investors net bought roughly VND 762 bn this week. Except for tenor 10Y-

Foreign investors net bought 15Y, almost all tenors recorded a net-bought value. It seems that foreign as usual is taking

roughly VND 762 bn this week. advantage of the time when liquidity in banking system became tighter. However, it is

unlikely that foreign will soon be strongly active again in the market.

Foreign Investment in the secondary market 2018

Net position (Unit: bn.VND)

Apr 09- Apr 13

Apr 23- Apr 27

May 07- May 11

May 21- May 25

June 04- June 08

June 18- June 22

July 02- July 06

July 16- July 20

Jan 02- Jan 05

Jan 15- Jan 19

Jan 29- Feb 02

Aug 13- Aug 17

Aug 27- Aug 31

Oct 08- Oct 12

Oct 22- Oct 26

Nov 05- Nov 09

Nov 19- Nov 23

Dec 03- Dec 07

Dec 17- Dec 21

Feb 12- Feb 16

Feb 26- Mar 02

July 30- Aug 03

Sep 10- Sep 14

Sep 24- Sep 28

Mar 12- Mar 16

Mar 26- Mar 30

Source: HNX, VCBS

INTEREST RATE

Research Department VCBS Page | 2

Fixed-Income Report

Interbank Rates

Interbank rate still settled at a high

Interbank rate still settled at a high level. In details, ON – 3M rates respectively posted

level.

at 4.417%, 4.517%, 4.617%, 4.817% and 4.9% according to Bloomberg data.

Interbank rates

5.4

4.6

3.8

3.0

ON 1W 2W 1M 3M

This week Last week Last month

Source: Bloomberg, VCBS

We did not change our view that when it is closer we get to the year end, the harder for

interbank rates to press lower in the context of no special supportive news in the market.

Hence, it is unlikely that interbank rates will decrease in the last week of the year.

Open Market Operation

SBV net injected VND 18,725.9 bn

SBV net injected VND 18,725.9 bn via OMO channel. For Outrights, VND 25,960 bn

via OMO channel.

worth of 140- day SBV bills mature this week. With these outright mature, banks will take

full use of these resources to answer increasing liquidity at the end of the year due to

seasonal factor.

Reverse Repo SBV-Bill Oustanding

300

250

x VND 1,000 bn

x VND 1,000bn

250

200

200

150

150

100 100

50 50

-

-

Sep-16

Sep-17

Sep-18

Mar-16

May-16

Mar-17

May-17

Mar-18

May-18

Jul-16

Nov-16

Jul-17

Nov-17

Jul-18

Nov-18

Jan-17

Jan-18

Mar-16

Sep-16

Mar-17

Sep-17

Mar-18

Sep-18

May-16

May-17

May-18

Jul-16

Nov-16

Jan-17

Jul-17

Nov-17

Jan-18

Jul-18

Nov-18

Source: Bloomberg, VCBS

END.

APPENDICES

Research Department VCBS Page | 3

Fixed-Income Report

Bond Auctions

Offering Registering Winning Register to Winning rate Winning/

Auction date Tenor volume volume volume Offering Ratio (%) Offering Issuer

ST bills

Government and government-backed bonds

19-Dec-18 10Y 6,500 11,249 6,500 1.73 5.1 100.00% ST

19-Dec-18 15Y 6,500 7,360 5,210 1.13 5.3 80.15% ST

18-Dec-18 3Y 1,500 2,401 1,500 1.60 5.1 100.00% VDB

18-Dec-18 7Y 3,000 1,300 1,000 0.43 5.5 33.33% VDB

18-Dec-18 10Y 2,000 1,600 1,100 0.80 5.8 55.00% VDB

18-Dec-18 15Y 2,977 - - 0.00 0 0.00% VDB

18-Dec-18 5Y 1,500 800 700 0.53 5.3 46.67% VDB

Secondary Market

Week 10-14 Dec Week 17-21 Dec

Issuer Value Value share Value Value share

Outright

11,978 82.07% 23,311 96.68%

1,819 12.46% 801 3.32%

797 5.46% - 0.00%

- 0.00% - 0.00%

Repo 14,594 100.00% 24,112 100.00%

Outright 21,411 54.85%

25,898 53.49%

Repo 17,623 45.15% 22,519 46.51%

Subtotal (3) 39,033 100.00% 48,417 100.00%

ST bills

- -

- -

Total (1)+(2)+(3) 53,627 72,529

Open Market Operation

Reverse Repo Outright (SBV Bills)

Date Due Offer Balance Outstanding Due Offer Balance Outstanding

07/30-08/03 17,000 0 (17,000) 0 6,010 48,960 42,950 101,030

08/06-08/10 0 4,096 4,096 4,096 8,500 3,400 (5,100) 90,730

08/13-08/17 4,096 12,089 7,993 12,089 10,100 700 (9,400) 81,330

08/20-08/24 12,089 18,982 6,893 18,982 700 702 2 81,332

08/27-08/31 18,982 7,702 (11,280) 7,702 6,802 1,100 (5,702) 75,630

09/03-09/07 7,702 7,349 (353) 7,349 1,100 0 (1,100) 74,530

09/10-09/14 7,349 330 (7,019) 330 2,000 4,500 2,500 77,030

09/17-09/21 330 20 (310) 20 36,400 22,830 (13,570) 63,461

09/24-09/28 20 456 436 456 10,500 25,620 15,120 78,581

10/05 -10/01 456 217 (239) 217 29,980 5,340 (24,640) 53,941

10/08 -10/12 217 0 (217) 0 22,981 4,400 (16,801) 37,140

10/15 –10/19 0 0 0 0 1,900 1,550 (350) 36,790

10/22- 10/26 0 44,345 44,345 44,345 4,280 2,000 (2,280) 34,510

10/29- 11/02 44,345 34,000 (10,346) 34,000 3,550 0 (3,550) 30,960

11/05- 11/09 34,000 52,658 18,659 52,658 2,000 0 (2,000) 28,960

11/12- 11/16 52,658 58,566 5,907 58,566 0 0 0 28,960

11/19- 11/23 58,566 63,655 5,089 63,655 0 0 0 28,960

11/26- 11/30 63,655 44,785 (18,870) 44,785 0 0 0 28,960

12/03- 12/07 44,785 68,313 23,528 68,313 0 0 0 28,960

12/10- 12/14 68,313 60,033 (8,280) 60,033 0 0 0 28,960

12/17- 12/21 60,033 52,799 (7,234) 52,799 25,960 0 (25,960) 3,000

Research Department VCBS Page | 4

Fixed-Income Report

DISCLAIMER

This report is designed to provide updated information on the fixed-income, including bonds, interest rates, some other related. The VCBS analysts

exert their best efforts to obtain the most accurate and timely information available from various sources, including information pertaining to market

prices, yields and rates. All information stated in the report has been collected and assessed as carefully as possible.

It must be stressed that all opinions, judgments, estimations and projections in this report represent independent views of the analyst at the date of

publication. Therefore, this report should be best considered a reference and indicative only. It is not an offer or advice to buy or sell or any actions

related to any assets. VCBS and/or Departments of VCBS as well as any affiliate of VCBS or affiliate that VCBS belongs to or is related to (thereafter,

VCBS), provide no warranty or undertaking of any kind in respect to the information and materials found on, or linked to the report and no obligation to

update the information after the report was released. VCBS does not bear any responsibility for the accuracy of the material posted or the information

contained therein, or for any consequences arising from its use, and does not invite or accept reliance being placed on any materials or information so

provided.

This report may not be copied, reproduced, published or redistributed for any purpose without the written permission of an authorized representative of

VCBS. Please cite sources when quoting. Copyright 2012 Vietcombank Securities Company. All rights reserved.

CONTACT INFORMATION

Tran Minh Hoang Le Thu Ha

Head of Research Senior Analyst- Economic research

tmhoang@vcbs.com.vn ltha_ho@vcbs.com.vn

VIETCOMBANK SECURITIES COMPANY

http://www.vcbs.com.vn

Ha Noi Headquarter Floor 12th & 17th, Vietcombank Tower, 198 Tran Quang Khai Street, Hoan Kiem District, Hanoi

Tel: (84-4)-39366990 ext: 140/143/144/149/150/151

Ho Chi Minh Branch Floor 1st and 7th, Green Star Building, 70 Pham Ngoc Thach Street, Ward 6, District No. 3, Ho Chi Minh City

Tel: (84-8)-3820 8116

Da Nang Branch Floor 12th, 135 Nguyen Van Linh Street, Thanh Khe District, Da Nang City

Tel: (84-511)-3888991 ext: 801/802

Nam Sai Gon Transaction Unit Lawrence Sting Building, 801 Nguyen Luong Bang Street, Phu My Hung Urban Zone, District No. 7, Ho Chi Minh City

Tel: (84-8)-54136573

Giang Vo Transaction Unit Floor 1st, Building C4 Giang Vo, Giang Vo Ward, Ba Dinh District, Hanoi

Tel: (84-4)-37265551

Can Tho Representative Office Floor 1st, Vietcombank Can Tho Building, 7 Hoa Binh Avenue, Ninh Kieu District, Can Tho City

Tel: (84-710)-3750888

Vung Tau Representative Office Floor 1st, 27 Le Loi Street, Vung Tau City, Ba Ria - Vung Tau Province

Tel: (84-64)-3513974/75/76/77/78

An Giang Representative Office Floor 7th, Vietcombank An Giang Tower, 30-32 Hai Ba Trung,, My Long Ward, Long Xuyen City, An Giang Province

Tel: (84-76)-3949843

Dong Nai Representative Office 1st & 2nd Floor, 79 Hung Dao Vuong, Ward Trung Dung, Bien Hoa City, Dong Nai Province.

Tel: (84-61)-3918815

Hai Phong Representative Office Floor 2nd, 11 Hoang Dieu Street, Minh Khai Ward, Hong Bang District, Hai Phong City

Tel: (+84-31) 382 1630

Binh Duong Representative Office Floor 3th, 516 Cach Mang Thang Tam Street, Phu Cuong Ward, Thu Dau Mot City, Binh Duong Province.

Tel: (+84-650) 3855 771

Research Department VCBS Page | 5

Vous aimerez peut-être aussi

- Coffee Can Investing - The Low Risk Road To Stupendous WealthDocument364 pagesCoffee Can Investing - The Low Risk Road To Stupendous WealthKristen Ravali100% (38)

- ST Small Account Secrets Report FINALDocument33 pagesST Small Account Secrets Report FINALReginald RinggoldPas encore d'évaluation

- Master Technical AnalysisDocument7 pagesMaster Technical AnalysissatishdinakarPas encore d'évaluation

- Silver Jewelry Report: Prepared For The Silver InstituteDocument31 pagesSilver Jewelry Report: Prepared For The Silver InstituteKareena JainPas encore d'évaluation

- Maple Tree Accessory ShopDocument6 pagesMaple Tree Accessory ShopJasper Andrew Adjarani80% (5)

- Managing Business Marketing ChannelsDocument22 pagesManaging Business Marketing ChannelsYashashvi RastogiPas encore d'évaluation

- (Premium Liability) : Lecture AidDocument24 pages(Premium Liability) : Lecture Aidmabel fernandezPas encore d'évaluation

- First Solar: CFRA's Accounting Quality ConcernsDocument2 pagesFirst Solar: CFRA's Accounting Quality ConcernsAnuj KhannaPas encore d'évaluation

- Philip Kotler Waldemar Pfoertsch Oct. 2006Document20 pagesPhilip Kotler Waldemar Pfoertsch Oct. 2006Gazal Atul SharmaPas encore d'évaluation

- FinMan Module 2 Financial Markets & InstitutionsDocument13 pagesFinMan Module 2 Financial Markets & Institutionserickson hernanPas encore d'évaluation

- Financial Soundness Indicators for Financial Sector Stability in BangladeshD'EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshPas encore d'évaluation

- Trai Phieu 15Document6 pagesTrai Phieu 15NguyenPas encore d'évaluation

- Trai Phieu 21Document6 pagesTrai Phieu 21NguyenPas encore d'évaluation

- Trai Phieu 18Document6 pagesTrai Phieu 18NguyenPas encore d'évaluation

- Trai Phieu 25Document7 pagesTrai Phieu 25NguyenPas encore d'évaluation

- Trai Phieu 2Document7 pagesTrai Phieu 2NguyenPas encore d'évaluation

- Trai Phieu 7Document6 pagesTrai Phieu 7NguyenPas encore d'évaluation

- Weekly Report: Fixed-Income ResearchDocument7 pagesWeekly Report: Fixed-Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 6Document6 pagesTrai Phieu 6NguyenPas encore d'évaluation

- Solid, Stable and Consistent: BOC Hong Kong (Holdings) LimitedDocument4 pagesSolid, Stable and Consistent: BOC Hong Kong (Holdings) LimitedRalph SuarezPas encore d'évaluation

- UBL FMR February 2022 4Document27 pagesUBL FMR February 2022 4kaka shipaiPas encore d'évaluation

- LIC Housing Ltd. - InitiatingDocument7 pagesLIC Housing Ltd. - InitiatingAnantharaman RamasamyPas encore d'évaluation

- Macroeconomic Analysis: Key Bangladesh Economic Targets and IndicatorsDocument6 pagesMacroeconomic Analysis: Key Bangladesh Economic Targets and IndicatorsShaikh Saifullah KhalidPas encore d'évaluation

- HTTPS:/WWW - Pnbmetlife.com/documents/met Invest - ULIP - Aug18 - tcm47-66816 PDFDocument33 pagesHTTPS:/WWW - Pnbmetlife.com/documents/met Invest - ULIP - Aug18 - tcm47-66816 PDFAbhinav VermaPas encore d'évaluation

- Shriram City Union Finance Ltd. - 204 - QuarterUpdateDocument12 pagesShriram City Union Finance Ltd. - 204 - QuarterUpdateSaran BaskarPas encore d'évaluation

- Earnings Update Q1FY22Document15 pagesEarnings Update Q1FY22sai mohanPas encore d'évaluation

- Banking Sector 210202Document15 pagesBanking Sector 210202Brian StanleyPas encore d'évaluation

- Ubl FMR April 2021 - Compressed 3Document28 pagesUbl FMR April 2021 - Compressed 3Hassan AliPas encore d'évaluation

- VCB - Jul 8 2014 by HSC PDFDocument6 pagesVCB - Jul 8 2014 by HSC PDFlehoangthuchienPas encore d'évaluation

- ICRA - Mutual Fund Screener - June 2021Document29 pagesICRA - Mutual Fund Screener - June 2021Dhanush KodiPas encore d'évaluation

- Recent Challenges in Monetary Policy Design in India: Mridul SaggarDocument38 pagesRecent Challenges in Monetary Policy Design in India: Mridul SaggarbafnajayeshPas encore d'évaluation

- BDL Refutes Mistakes in Policy Paper on Lebanon Financial CrisisDocument5 pagesBDL Refutes Mistakes in Policy Paper on Lebanon Financial CrisisNaeem ShreimPas encore d'évaluation

- Downgrading Estimates On Higher Provisions Maintain BUY: Bank of The Philippine IslandsDocument8 pagesDowngrading Estimates On Higher Provisions Maintain BUY: Bank of The Philippine IslandsJPas encore d'évaluation

- Time Value of Money: Professor XXX Course Name/numberDocument34 pagesTime Value of Money: Professor XXX Course Name/numbersumuewuPas encore d'évaluation

- Lov 20200826Document6 pagesLov 20200826JPas encore d'évaluation

- IEQ Oct 2017 PresentationDocument32 pagesIEQ Oct 2017 PresentationnotagoodpasswordoliverPas encore d'évaluation

- HDFC Bank: Performance HighlightsDocument4 pagesHDFC Bank: Performance HighlightsAditi TyagiPas encore d'évaluation

- Bank Central Asia TBK: Loan Restructuring To Suppress NIMDocument6 pagesBank Central Asia TBK: Loan Restructuring To Suppress NIMValentinus AdelioPas encore d'évaluation

- Banking Basics: Classification, Advances, NPAs, Deposits & Basel 3 NormsDocument26 pagesBanking Basics: Classification, Advances, NPAs, Deposits & Basel 3 NormsDev DugarPas encore d'évaluation

- Axis Bank Q1FY11 Result Update Shows Strong GrowthDocument6 pagesAxis Bank Q1FY11 Result Update Shows Strong GrowthSukesh KothariPas encore d'évaluation

- SPP Capital Market Update June 2023Document10 pagesSPP Capital Market Update June 2023Jake RosePas encore d'évaluation

- 4Q21 Greater Philadelphia Industrial MarketDocument5 pages4Q21 Greater Philadelphia Industrial MarketKevin ParkerPas encore d'évaluation

- equitas-small-finance-bank--company-updateDocument10 pagesequitas-small-finance-bank--company-updatefinal bossuPas encore d'évaluation

- 4QFY16 Income Declines 21.1%: Share DataDocument5 pages4QFY16 Income Declines 21.1%: Share DataJajahinaPas encore d'évaluation

- $1M Today 12.5 15.5% 20 YearsDocument4 pages$1M Today 12.5 15.5% 20 Yearsanna_meenaPas encore d'évaluation

- Handsome (020000) 20060217Document4 pagesHandsome (020000) 20060217Imad ElharrakPas encore d'évaluation

- 1Q16 Net Income Up 17.7% To Php1.4Bil, in Line With EstimatesDocument3 pages1Q16 Net Income Up 17.7% To Php1.4Bil, in Line With EstimatesmariaroxannePas encore d'évaluation

- Bank Central Asia TBK: 9M20 Review: Solid Capital and PPOPDocument7 pagesBank Central Asia TBK: 9M20 Review: Solid Capital and PPOPHamba AllahPas encore d'évaluation

- Reverse DCFDocument9 pagesReverse DCFjenkisanPas encore d'évaluation

- Union Budget DiscussionDocument17 pagesUnion Budget DiscussionrishabhPas encore d'évaluation

- What Does The Fund Invest In?: Sun Life Grepa Growth PLUS FundDocument1 pageWhat Does The Fund Invest In?: Sun Life Grepa Growth PLUS FundBee ThreeallPas encore d'évaluation

- RBL Bank - 4QFY19 - HDFC Sec-201904191845245959765Document12 pagesRBL Bank - 4QFY19 - HDFC Sec-201904191845245959765SachinPas encore d'évaluation

- Dabur Q3FY11 ResultDocument17 pagesDabur Q3FY11 ResultjackjariPas encore d'évaluation

- Axis Bank - LKP - 29.10.2020 PDFDocument12 pagesAxis Bank - LKP - 29.10.2020 PDFVimal SharmaPas encore d'évaluation

- Treasury Focus Oct09Document11 pagesTreasury Focus Oct09hussainmhPas encore d'évaluation

- Varma Capitals - Modeling TestDocument6 pagesVarma Capitals - Modeling TestSuper FreakPas encore d'évaluation

- Vinati Organics LTD: Growth To Pick-Up..Document5 pagesVinati Organics LTD: Growth To Pick-Up..Bhaveek OstwalPas encore d'évaluation

- 1 ST Weekly Report 2019Document3 pages1 ST Weekly Report 2019Tuan Tran QuangPas encore d'évaluation

- Quiz: Lab. Modeling Finance Saturday, 22 June 2019: QuestionsDocument2 pagesQuiz: Lab. Modeling Finance Saturday, 22 June 2019: QuestionsWilliam SuryadharmaPas encore d'évaluation

- Recerse DCF Calculation Yellow Manual InputDocument6 pagesRecerse DCF Calculation Yellow Manual InputErvin Khouw100% (1)

- Five Key QuestionsDocument12 pagesFive Key QuestionsInternational Business TimesPas encore d'évaluation

- Outlook Asia Pacific Reits Past Present and FutureDocument4 pagesOutlook Asia Pacific Reits Past Present and FutureBe UPas encore d'évaluation

- A Review Post Global Credit Crisis: Indian NBFC SectorDocument6 pagesA Review Post Global Credit Crisis: Indian NBFC SectorsauravPas encore d'évaluation

- Avendus Wealth ManagementDocument23 pagesAvendus Wealth ManagementAbhishek NoriPas encore d'évaluation

- India Listed Pharma Healthcare May23Document6 pagesIndia Listed Pharma Healthcare May23Vansh AggarwalPas encore d'évaluation

- Bank Negara Indonesia's Infrastructure Loan Growth Boosts Net ProfitDocument5 pagesBank Negara Indonesia's Infrastructure Loan Growth Boosts Net ProfitAnonymous XoUqrqyuPas encore d'évaluation

- Monthly Investment Recommendations August 2023Document18 pagesMonthly Investment Recommendations August 2023mark.muitaPas encore d'évaluation

- Weekly Economic & Financial Commentary 15julyDocument13 pagesWeekly Economic & Financial Commentary 15julyErick Abraham MarlissaPas encore d'évaluation

- South Indian Bank: Strong Results Upgrade To BUYDocument5 pagesSouth Indian Bank: Strong Results Upgrade To BUYVinod KumarPas encore d'évaluation

- DDW 20201105 PDFDocument1 pageDDW 20201105 PDFVimal SharmaPas encore d'évaluation

- Monthly Report: Fixed-Income ResearchDocument8 pagesMonthly Report: Fixed-Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 17Document12 pagesTrai Phieu 17NguyenPas encore d'évaluation

- Trai Phieu 22Document6 pagesTrai Phieu 22NguyenPas encore d'évaluation

- Quarterly Report: Fixed - Income ResearchDocument9 pagesQuarterly Report: Fixed - Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 26 PDFDocument6 pagesTrai Phieu 26 PDFNguyenPas encore d'évaluation

- Trai Phieu 6Document6 pagesTrai Phieu 6NguyenPas encore d'évaluation

- Trai Phieu 29 PDFDocument8 pagesTrai Phieu 29 PDFNguyenPas encore d'évaluation

- Trai Phieu 5 PDFDocument6 pagesTrai Phieu 5 PDFNguyenPas encore d'évaluation

- Weekly Report: Fixed-Income ResearchDocument7 pagesWeekly Report: Fixed-Income ResearchNguyenPas encore d'évaluation

- Trai Phieu 27 PDFDocument6 pagesTrai Phieu 27 PDFNguyenPas encore d'évaluation

- Macroeconomic Research April 2019: by A Member of VIETCOMBANKDocument14 pagesMacroeconomic Research April 2019: by A Member of VIETCOMBANKNguyenPas encore d'évaluation

- Trai Phieu 5 PDFDocument6 pagesTrai Phieu 5 PDFNguyenPas encore d'évaluation

- Trai Phieu 7Document6 pagesTrai Phieu 7NguyenPas encore d'évaluation

- Tổng Công Ty Cổ Phần Y Tế DanamecoDocument14 pagesTổng Công Ty Cổ Phần Y Tế DanamecoNguyenPas encore d'évaluation

- Trai Phieu 9 PDFDocument6 pagesTrai Phieu 9 PDFNguyenPas encore d'évaluation

- Trai Phieu 9 PDFDocument6 pagesTrai Phieu 9 PDFNguyenPas encore d'évaluation

- SLS Baocaotaichinh Q3 2019 PDFDocument25 pagesSLS Baocaotaichinh Q3 2019 PDFNguyenPas encore d'évaluation

- SDE Baocaoquantri 2018Document2 pagesSDE Baocaoquantri 2018NguyenPas encore d'évaluation

- Monthly Report: Fixed - Income ResearchDocument8 pagesMonthly Report: Fixed - Income ResearchNguyenPas encore d'évaluation

- Macroeconomics Research: Quarterly ReportDocument11 pagesMacroeconomics Research: Quarterly ReportNguyenPas encore d'évaluation

- MEF Baocaoquantri 2018Document3 pagesMEF Baocaoquantri 2018NguyenPas encore d'évaluation

- Công Ty C PH N Khoáng S N Sài Gòn Quy NH NDocument5 pagesCông Ty C PH N Khoáng S N Sài Gòn Quy NH NNguyenPas encore d'évaluation

- IDV Giaitrinh KQKD 6T 2019 Soatxet HopnhatDocument1 pageIDV Giaitrinh KQKD 6T 2019 Soatxet HopnhatNguyenPas encore d'évaluation

- KTS Baocaotaichinh Q3 2019Document31 pagesKTS Baocaotaichinh Q3 2019NguyenPas encore d'évaluation

- PREPARING A MARKETING PLANDocument6 pagesPREPARING A MARKETING PLANjunaidi_karmanPas encore d'évaluation

- Merchandise Category: Vinay H NDocument22 pagesMerchandise Category: Vinay H Nvinayhn07100% (2)

- Chapter 10 Futures Arbitrate Strategies Test BankDocument6 pagesChapter 10 Futures Arbitrate Strategies Test BankJocelyn TanPas encore d'évaluation

- A Study On Consumers Satisfaction Towards Himalaya Products With Special Reference To Dharapuram TownDocument2 pagesA Study On Consumers Satisfaction Towards Himalaya Products With Special Reference To Dharapuram Townsangeetha100% (1)

- Ace Case Study SolutionsDocument4 pagesAce Case Study SolutionsGunjan joshiPas encore d'évaluation

- FEU Intermediate Accounting 2 Activity 04 NCA Held for SaleDocument3 pagesFEU Intermediate Accounting 2 Activity 04 NCA Held for SaleEstiloPas encore d'évaluation

- IndonesiaStrategy-WhereToBePositioned20180913Document38 pagesIndonesiaStrategy-WhereToBePositioned20180913Andy WidyasayogoPas encore d'évaluation

- Invitation To Bid: General GuidelinesDocument24 pagesInvitation To Bid: General GuidelinesGregoria ReyesPas encore d'évaluation

- How Loyalty Programs Differ Across Top Indian RetailersDocument29 pagesHow Loyalty Programs Differ Across Top Indian Retailersnitesh kumarPas encore d'évaluation

- Role of MarketingDocument3 pagesRole of MarketingYogesh GodgePas encore d'évaluation

- Resume Marketing Professional Less Than 40 CharactersDocument3 pagesResume Marketing Professional Less Than 40 CharactersShraddha SanghviPas encore d'évaluation

- MA542785 AOF SignedDocument96 pagesMA542785 AOF SignedriyashahahahahahaPas encore d'évaluation

- Net Income Calculation for Multiple ProblemsDocument3 pagesNet Income Calculation for Multiple ProblemsChris Tian FlorendoPas encore d'évaluation

- Snacko India Leveraging Trade Promotion For Competitive AdvantageDocument4 pagesSnacko India Leveraging Trade Promotion For Competitive Advantagearshad kamalPas encore d'évaluation

- Home TextilesDocument8 pagesHome TextilesJammu NavaniPas encore d'évaluation

- Key Learnings From Managerial Economics - Tushar BallabhDocument2 pagesKey Learnings From Managerial Economics - Tushar BallabhTushar BallabhPas encore d'évaluation

- Latihan AFLDocument15 pagesLatihan AFLNyamo SuendroPas encore d'évaluation

- Phan 2 3 4 Summ IntroDocument3 pagesPhan 2 3 4 Summ IntroNguyễn Hoàng ĐiệpPas encore d'évaluation

- Market Efficiency and Empirical Evidence: EMH TestsDocument86 pagesMarket Efficiency and Empirical Evidence: EMH TestsVaidyanathan RavichandranPas encore d'évaluation

- Crafting The Neoliberal StateDocument15 pagesCrafting The Neoliberal StateAsanijPas encore d'évaluation